Nafolodoncogo ni suguyaw : danfara, minɛn sugandili, waridon tilennen lakika, wariko portfolio, hakilinata, waridonminɛn sugandili. Gɛlɛya waatiw la minnu bɛ to ka kɛ, mɔgɔ gansanw bɛ wariko gɛlɛya ni u nafa dɔgɔyali sɔrɔ, ka sɔrɔ sɔrɔyɔrɔ damadɔw bɔnɛ u la, ani ka warimaralenw ko teliya la, ni u bɛ yen. Wa mɔgɔ minnu b’u ka sɔrɔ dilan ni hakili ye ka bɔ sɔrɔyɔrɔ caman na, olu bɛ u dɔw ka zeru kɛ. Baarakɛlaw bɛ sugu kɔlɔsi tuma bɛɛ, ani kɛrɛnkɛrɛnnenya la, gɛlɛya waati la, ka to ka sugu kɔlɔsi ani ka fɛn caman kɛ, ka wari bilacogo ɲuman ni sɔrɔ lajɛcogo ɲumanw fɔ ani k’u sugandi ka da sɛgɛsɛgɛliba dɔ kan.

- Essence ani mechanisms, wari bilali wajibiyalenw

- Nafolodon suguyaw danfaralenw

- Nafolodoncogo suguyaw

- Nafolodoncogo suguyaw ni u cogoyaw minnu bɛ sɔrɔ ɲɔgɔn fɛ

- Banki wari bilalenw

- Ka mara

- Bondw (Bonw).

- Immobilier ka fɛnw

- Mutuel ka nafolosɔrɔsiraw

- Nafolo minnu bɛ jago kɛ ni fɛnw falenfalenni ye

- Kriptowariw

- Sanu

- Intérêt faralen ɲɔgɔn kan

- warijɛ wari

- Waati min bɛ kɛ ka wari bila

- Nafolodonni kuntaalajan

- Nafolodonni waati cɛmancɛ la

- Nafolodonniw waati kunkurunnin kɔnɔ

Essence ani mechanisms, wari bilali wajibiyalenw

Investissement b jate wari, lakana, nafolo, nafolo ani josariyaw w r w ye jago ni jagofɛnw na walasa ka sɔrɔ walima jate sɔrɔ. Nafolodonni kuntilenna ye :

- Sara walima pensiyɔn filanan dabɔli, sɔrɔ faralen ni sɔrɔ jɔnjɔn ɲɛnamaya, denbaya ani taama kama.

- Ka sɔrɔ ni bolomafaraw lakana ka bɔ nafolosɔrɔbaliya ni wariko faratiw la.

- Wari maracogo ɲuman walasa ka kapitali da ani ka taa wariko hɔrɔnya cogo la.

Jamanadenw ka bi sɔrɔ hakɛ bɛ jira foto in na:

- Sosiyete minnu bɛ se ka da u kan, olu ka jatew ni u ka bonw. Aksidan sugu la.

- Immobilier ka fɛnw.

- Nɛgɛ nafamaw. Fɔlɔ, sanu.

- Kriptowariw.

- Jagokɛlaw ka wari bilali.

- Aw ye wari bila aw ka kalan na : ka sekow ni sekow sɔrɔ minnu bɛ sɔrɔ sɔrɔ.

- Exchange ani stock jago.

Nafolodonni ye nafolodonniw ni nafolomafɛnw ye minnu bɛna dɛmɛ ka nafolo lakana ani ka sɔrɔ wɛrɛw sɔrɔ. O kɔfɛ, gɛlɛya bɛ kɛ nafolo ye ani sababu ye ka dɛmɛ don sɔrɔ ni jatebɔ la. Fɛɛrɛ min bɛ kɛ ka i ka nafolo caya, gɛlɛya tɛ. A nafa ka bon dɔrɔn i bɛ se ka wari bila cogo min na ani yɔrɔ min na ka ɲɛ, nka a nafa ka bon fana i bɛ se ka i ka waribon mara cogo ɲuman na.

Investissement capital ye fɛnw, hakili ani wariko fɛɛrɛw ye. Klasik kɔrɔ la, kapitali ye nafolomafɛnw bɛɛ ye, hali fɛn dilanni fɛɛrɛw. Nafolodon faamuyali la, fɛnw dilanni fɛɛrɛw ye waridonminɛnw ye.

Walasa ka kapitali maracogo ɲuman sɔrɔ, wariko kalanko koɲɛ ka gɛlɛn. Ka nafolodonni nafa dɔn, k’a sɔrɔ u m’u faamuya ka ɲɛ, mɔgɔ caman bɛ don nanbarako ni piramidi fɛɛrɛw la, yɔrɔ min na daɲɛ koloma ye « waridon » ye tuma bɛɛ. San kɔnɔna na, Irisikaw ye wari miliyari 13,5 “di” wariko nanbarakɛlaw ma. Sisan cogoya min bɛ wariko la, o bɛ tulon kɛ kalanjɛ ni wariko cogoyaw sɛgɛsɛgɛli nafa la. San tan caman kɔnɔ, fɛɛrɛ min bɛ senna, n’o ye ka « sigi dɔrɔmɛ ni ɛrɔ kan », o ye baara dabila, o waridon ninnu nafa dɔgɔyara siɲɛ caman kalo fila kɔnɔ. A tɛ i n’a fɔ jamanakuntigi Biden, n’o ye dɔrɔmɛ kelen sɔngɔ fɔ rubɛ kɛmɛ fila ye, Ameriki warimara miliyarikɛ Ray Dalio bɛ warijɛ nɔgɔ wele, wa a t’a fɔ ko warimaralenw ka mara warijɛ la, kɛrɛnkɛrɛnnenya la, gɛlɛya waatiw la. https://barokunw.opexflow.com/jago-kalan/ray-dalio.

Nafolodon suguyaw danfaralenw

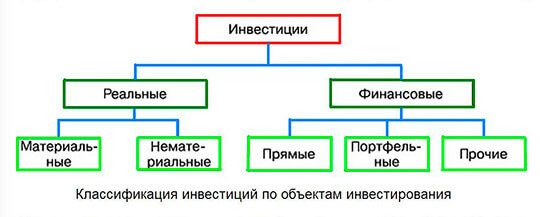

Investissement suguyaw ka danfara teoritiki caman bɛ yen. Ka kɛɲɛ ni nafolodonfɛnw suguya ye, olu ye :

- Nafolomafɛnw ni nafolomafɛnw bilali tilennen kuntaalajan lakikaw , waribon basigilen ni baarakɛta cogo la, ka fara hakililata kan. O cogo de la, baarakɛda minnu ka nafolo basigilenw bɛ dabɔ. U kun ye ka sɛnɛfɛnw yiriwa, k’u ɲɛ ka taa a fɛ ani k’u kuraya ni tɔnɔ bilalenw ye.

- Nafolosɔrɔsiraw ka bolomafaraw bɛ na ni sɔrɔ sɔrɔli tilennen ye. Olu ye wari bilali ye siniɲɛsigi ni lakanafɛnw cogo la, aksidanw, bonw ani juruw wajibiyalenw cogo la. Fana wari bilali jago la, wariko porozɛw ani jagokɛyɔrɔw la. Sɔrɔ min bɛ bɔ o waridonfɛnw na, o bɛ kɛ ni jatebɔfɛnw ye minnu bɛ kɛ tuma bɛɛ ani sɔngɔ jiginni n’u feereli kɛra.

- Speculative – wari bilali wariw ni nɛgɛ nafama suguyaw la.

- Nafolodonna ka sendon tilennen fɛn sugandili la, ka bolomafara di a ka kapitali yamaruyalen na, ani ka sendon nafolodonfɛn ɲɛnabɔli la.

- Sendonni tilennen nafolodonniw na cɛmancɛlamɔgɔw fɛ – waridonnafolo, dilanbagaw, wariko ladilikɛlaw.

Nafama ye nafolodonniw danfara ye ka kɛɲɛ ni nafolodonni sariyaw ye :

- Nafolodonni kuntaalajan minnu bɛ tɛmɛ san duuru kan.

- Depositi minnu bɛ kɛ waati cɛmancɛ la, olu bɛ daminɛ san kelen na ka se san duuru ma.

- Nafolodonni waati kunkurunnin kɔnɔ , waati min tɛ san kelen bɔ.

Nafolodoncogo jiralan nafama wɛrɛ ye u ka sɔrɔ hakɛ ye :

- Nafolodonniw jate nafa ka bon kosɛbɛ, sɔrɔ min bɛ sɔrɔ o la, o bɛ tɛmɛ waridon sugu la nafa hakɛ danmadɔ kan.

- Nafa hakɛ danmadɔ ye wari bilalenw ye minnu bɛ se ka suma ni wari bilalenw nafa danma ye sugu la.

- Nafolosɔrɔ minnu bɛ sɔrɔ dɔgɔya , olu ye waridonw ye minnu bɛ na ni sɔrɔ ye sugu jukɔrɔ.

- Nafolo minnu tɛ tɔnɔ ɲini, ni tɔnɔ bolodalen tɛ, olu dɔw ye sigida, sigida ani dɛmɛn porogaramuw ye.

Nafolodonni ɲɛfɔli nafama min bɛ kɛ waridonna fɛ, o ye k’a tila ka kɛɲɛ ni wariko farati hakɛ min bɛ a la:

- Risk -free investment ni sɔrɔ garanti 100%. Olu dɔw ye wari bilalenw ye jamana ka bankiw kɔnɔ ani gɔfɛrɛnaman ka bonw.

- Faratiba ka nafolodonniw ye minnu ka bɔnɛ farati ka dɔgɔ ni suguya hakɛ danmadɔ ye .

- Farati cɛmancɛ waridonw ye fɛnw ye minnu bɛ se ka suma ni farati tɔw ye sugu la.

- Faratiba bɛ nafolodonni minnu na, olu ye fɛnw ye minnu ka farati hakɛ ye suguya farati hakɛ cayalenba ye. Olu dɔw ye wari bilali ye porozɛw la minnu bɛ kɛ ni hakilinata ye, ni sɔrɔ ka ca ni tɔw bɛɛ ye.

Nafolodonni jogo min nafa ka bon o cogo kelen na, o ye a ka wariko ye:

- Investissement min ka ca kosɛbɛ , minɛnw bɛ yen minnu bɛ se ka wuli nɔgɔya la ani teliya la ka kɛ wari ye k’a sɔrɔ bɔnɛ ma bɔ sugu sɔngɔ la.

- Investissement liquide moyenne bɛ tali kɛ fɛnw na minnu bɛ se ka wuli ka bɔ tile 30 la ka taa kalo wɔɔrɔ la, k’a sɔrɔ bɔnɛba ma kɛ u sɔngɔ la.

- Investissement min ka dɔgɔn, o bɛ se ka wuli ka kɛ wari ye, min tɛ kalo wɔɔrɔ bɔ. A ka c’a la, o fɛnw ye fɛnw ye minnu tɛ dɔn kosɛbɛ walima minnu ma ban.

- Investissement illiquide ye min tɛ se ka wuli a yɛrɛ ma, nka a bɛ kɛ fɛn kelen dɔ dɔrɔn de ye.

Ka kɛɲɛ ni nafolo bilalenw baaracogo ye, wari bilalen bɛ se ka kɛ :

- Nafolodon fɔlɔ ye nafolodonni kura ye.

- Segin -ka-bɔnye ye nafolodonni ye min bɛ segin-ka-bɔ, nafolo min bɛ sɔrɔ waridon fɔlɔ sɔrɔ la. Ni wari bilali kokura seko la, waridonnaw bɛ se ka dɔ fara u ka sɔrɔ kan siɲɛ caman waati kunkurunnin kɔnɔ.

- Investissement (nafolodonni) ye nafolodonniw bɔli ye minnu bilala sen kan ka kɔrɔ, k’a sɔrɔ u ma baara kɛ n’u ye kokura.

Ka kɛɲɛ ni fɛntigiya cogoya ye, waridonw ye mɔgɔ kelen ta ye ka bɔ tɔnw ni mɔgɔ kelen-kelen bɛɛ la, ani jamana, ka fara o cogoya fila ɲagaminen kan. O cogo kelenw bɛ se ka kɛ jamana wɛrɛw ta ye, wa jamana damadɔ ka waridonw bɛ wele ko jɛ-ka-baara. Investissement suguya wɛrɛ bɛ yen – annuité, sɔrɔ min bɛ sɔrɔ o la, o bɛ boloda waati kelenw kɔnɔ. Misaliw ye asiransi ni pensiyɔn nafolo ye. O danfara fanba bɛ kɛ daɲɛw ni jogoɲumanya kama ni waridonna ka bolofara jateminɛni ye – waridonna ka minɛnw ni waridon suguyaw kulu min bɛ sɔrɔko siratigɛw walima jagokɛyɔrɔw danfaralenw ɲɛfɔ.

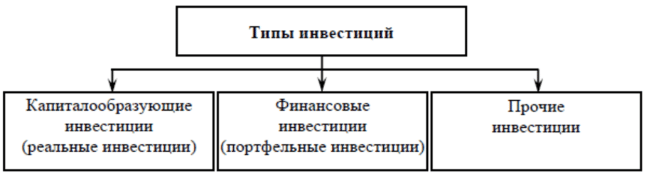

Nafolodoncogo suguyaw

Foroko minnu bɛ yen, olu ye waridon suguyaw jiracogo wɛrɛw ye. Misali la, u bɛ nafolodonni nafaw n’a ŋaniyaw jira:

- Jagokɛyɔrɔw bɛ jate wari bilalenw ye walasa ka tɔnɔ caman sɔrɔ, ni sigidako ni fan wɛrɛw tɛ.

- Sosiyete ka nafolodonniw tɛ jago ye.

- Nafolodonni minnu bɛ tali kɛ ɲɔgɔn na, olu bɛ tugu waridonnaw ka laɲiniw na minnu bɛ kɛ ni fɛɛrɛw ye.

Investissement capital suguya minnu bɛ kɛ ka fɛnw don, olu fana bɛ jate:

- Wari jiracogo sɛbɛn in na banki ka wari bilalenw ni warimarayɔrɔw la.

- Fɛnɲɛnɛma sɛbɛnw kɔnɔ, nafolo suguya minnu tɛ se ka wuli ani minnu tɛ se ka wuli.

- Nafolo ni hakililata cogoyaw :

1 .- Hakilila josariyaw sɛbɛnnikɛlaw, dɔnniya, patɔrɔnw ka josariyaw.

- Hakɛ min bɛ mɔgɔ la ka baara kɛ ni nafolo sɔrɔlenw ye – ji, dugukolo, gazi ani petoroli, minɛnw.

- Nafolosɔrɔko josariyaw sɛbɛn .

Forobaciyɛnko suguya dɔw bɛ yen:

- Ka juruw ni impositi laɲiniw di minnu bɛ kɛ ka ɲɛ.

- Gofɛrɛnaman ka baarakɛnafolo bilali siratigɛ la.

- Nafolodoncogo minnu bɛ bɔ jamana ka tɔnw na.

- Jamana walima bolomafaraw ka bolomafaraw cogoya ye annuité ani rent ye.

O de kosɔn, wariko suguyaw bɛ waridon suguyaw ɲɛfɔ ka ɲɛ jiracogo kɛrɛnkɛrɛnnenw na.

Nafolodoncogo suguyaw ni u cogoyaw minnu bɛ sɔrɔ ɲɔgɔn fɛ

Nafolodon suguya caman bɛ yen, wa suguya kelen-kelen bɛɛ la, a ka kan ka nafolodonfɛnw sugandi minnu bɛ se ka da u kan. A ka kan ka wari bila, ka kɛ ni wari bilali seko ye, ka ladilikɛlaw kɛ baarakɛlaw ye, ani ka taama kɛ sisan kow la. O waati kelen na, a nafa ka bon ka bolomafaraw caman kɛ portfolio suguya caman na, bawo wari bilalen suguya caman nafa bɛ Changé waati kɔnɔ.

Misaliw ye nafolodonni minnu nafa ka bon kosɛbɛ sanw danfaralenw na:

- 2001 – nafa caman sɔrɔli bonw ni dugukolow bilali la .

- 2014 – sanu ni Ameriki ka bolomafaraw seginni.

- 2020 – nafa caman sɔrɔla Bitcoin na ani boon kura kɔnɔ .

Banki wari bilalenw

O wari bilali suguw bɛ kɛ Risi bankiw kɔnɔ, farati tɛ minnu na, ni jamana ka garanti bɛ o wari bilalen na. Nka wari bilalen hakɛ tɛ waribonbonni dafa tuma bɛɛ. O ye wari maracogo ye min bɛ se ka da a kan. Deposits terme minnu bɛ nɔ bɔ kosɛbɛ.

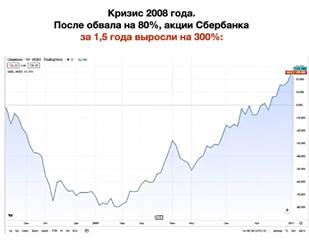

Ka mara

Sisan, a ye wariko suguya dɔ ye min bɛ nafa sɔrɔ tuma bɛɛ, nka a ka dɔnniya ka bon. Aw ka kan ka tɔnw ka bolomafaraw sugandi minnu bɛ se ka da u kan, minnu ka bonya bɛ se 30% ma san kɔnɔ walima ka tɛmɛ o kan. OZON ye bonya 100% sɔrɔ san fila kɔnɔ. Polyus Gold ka jatebɔsɛbɛnw, Yandex ka jatebɔsɛbɛnw, Apple ka jatebɔsɛbɛnw ye tɔnɔba sɔrɔ. Wa jamana wɛrɛw ka jatew ta fan fɛ, brokerage jatew minnu tun bɛ boursew kan, olu tun bɛ jɔ waati dɔ kɔnɔ. A ka kan ka to an hakili la ko gɛlɛya ye sababu ye, wa wari bilali ye baarakɛminɛn ye min bɛ kɛ ka wari mara ani ka dɔ fara a kan. Nin ye misali ye Sberbank ka jateminεw bonya kan san 2008 gɛlɛya kɔnɔ:

Bondw (Bonw).

Bon minnu bɛ bɔ bɔbaga belebelew la minnu bɛ se ka da u kan, olu sara ka ca, nka u bɛ na ni farati ye. A lakananen don ka tɛmɛ gɔfɛrɛnaman ka bonda kan. Farati tɛ u la, nka u ka sɔrɔ man bon. Bonw kɔnɔ, waritigi bɛ kɛ jurudonna ye sosiyete walima jamana dɔ la waati dɔ kɔnɔ ani porogaramu dɔ kɔnɔ. Olu ye wariko kuntaalajanw ye, waati laban na, wari bilalen hakɛ ni tɔnɔ min bɛ sɔrɔ wari bilalen na, o bɛ segin. Nin ye dɛmɛ ye min bɛ se ka da a kan, nka a bɛ sɔrɔ nafolosɔrɔbaliya datugucogo la.

Immobilier ka fɛnw

A dalen b’a la ko a ka kan ka wari bila yan sɔrɔ yiriwali sabatili waatiw la, bawo dugukoloko bɛ bin wariko la gɛlɛyaw waatiw la. O kɛra san 2008 la. Nka san 2001 ni 2020 la, dɔ farala a kan kosɛbɛ wari bilalenw sɔrɔli la Irisi jamana na.

Mutuel ka nafolosɔrɔsiraw

Mutual funds bɛ pools of participants lajɛ passive investments la securities suguya caman na, a nafa ka bon ka sugandili ɲuman kɛ ani ka investments kɔlɔsi, ka jateminɛ kɛ suguya taabolo la. Jateminεw bε sεbεn k’a bε bεn kɛmɛsarada la. https://articles.opexflow.com/investissement/birzhevye-paevye-investissementnye-fondy.htm Bamako, Mali

Nafolo minnu bɛ jago kɛ ni fɛnw falenfalenni ye

O ETFw bɛnnen don daminɛbagaw ma ani u bɛ waridon bolodalenw di minnu bɛ suguya indisew jateminɛ. Olu ye wariko ye min bɛ kɛ waati kunkurunnin kɔnɔ, faratiba bɛ min na, ni nafa caman bɛ se ka sɔrɔ ni sɔngɔw bɛ wuli tile bɛɛ kɔnɔ. Aw bɛ se ka dɔ bɔ farati la ni aw ye index (index) caman sugandi.

Kriptowariw

O wariko kuntaala surunw bɛ faratiba lase u ma ni nafa caman ye. Wari bilali kripto dɔrɔmɛw la, o bɛ na ni wari bilalen sɔrɔli ye 15%. A ka kan k’an hakili to a la ko san laban ninnu na, Bitcoin cayara ni 200% ye san kɔnɔ. Jamana dɔw la, terminal dɔw bɛ yen minnu bɛ kɛ ka kriptowariw tigɛli kɛ warijɛ ye. Kripto jago la, waridonnaw bɛ se ka sɔrɔ fo 10% tile kɔnɔ.

Sanu

Aw bɛ se ka bulon san, walima aw bɛ se ka ETF sanu san. Sanu nafa bonya bɛ danfara don san o san, nka a ye waridon sabatilenw dɔ ye min bɛ kɛ nafolo marali lakananen tariku kɔnɔ. Sanu bɛ se ka kɛ tuma bɛɛ, a tɛ nafa caman di, nka a ye asiransi garanti ye.

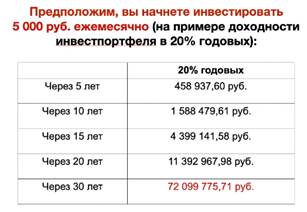

Intérêt faralen ɲɔgɔn kan

A ka c’a la, u bɛ wele ko gundo min bɛ kɛ sababu ye ka nafolo sɔrɔ joona. Tɔnɔ faralen ye wari bilalen kɔfɛ nafa ye min bɛ sɔrɔ wari bilalen fɔlɔ la. Bankiw ka daɲɛ ye “capitalisation” ye o ko la. Cogo wɛrɛ la, o bɛ wele ko tɔnɔ nafama ani tɔnɔ jɛlen, walima tɔnɔ min bɛ sɔrɔ tɔnɔ kan, ka fara nafa sɔrɔta hakɛ kan, ka jateminɛ kɛ wariko seginni na ani ka jateminɛ kɛ kapitalizasiyɔn na. A nafa ka bon ka tɔnɔ faralen jate waati dɔw la, a kana bɔ wari hakɛ fɔlɔ la, nka ka bɔ warimaralenw na waati dɔ kɔnɔ. A y’a jira ko sɔrɔ min bɛ sɔrɔ, o bɛ fara a hakɛ fɔlɔ kan, wa a bɛ sɔrɔ wɛrɛ fana sɔrɔ. Misali dɔ jiralen bɛ foto in na:

warijɛ wari

Waati jan kɔnɔ, o tun ye fɛɛrɛ ye min bɛ kɛ sababu ye ka maganw mara ani ka nafa sɔrɔ. Sisan nin fɛɛrɛ in ye bɔnɛ faratiba sɔrɔ. Nka tulon dɔ tora ni wari falenfalen ye boursew kan, ani fana ni faratiba ye. Ray Dalio ko:

Waati min bɛ kɛ ka wari bila

Ni waridon waatiw tɛ kelen ye, waridon hakɛw tɛ kelen ye, ani nafa sɔrɔli hakɛw tɛ kelen ye:

| Ayi. | Jateminɛ kɛcogo sariya | Nafolodonni kuntaalajan | Nafolodonni waati cɛmancɛ la | Nafolodonni waati kunkurunnin kɔnɔ |

| kelen | Sarali min bɛ kɛ | K’a ta san 1 la ka se san 5 ma walima ka tɛmɛ o kan | Fɔ ka se san kelen ma | Tile ni kalow |

| 2 ye | Nivo de rénaissance (sɛnɛfɛnw sɔrɔcogo). | Hakɛlama | Hakɛlama | Jamanjan |

| 3 ye | Farati | Minimum ye | Hakɛlama | Jamanjan |

| naani | Donni dakun | Mako bɛ kapitaliba la | Hakɛlama | Fitinin |

| 5 ye | pros | Daŋaniya ni sabatili | Daŋaniya ni sabatili danfaralen | Sɔrɔ caman ni teliya |

| 6 ye | Minus (Minɛw). | Kuntaala jan ni don dakun, sɔrɔ hakɛ danmadɔ | Sarali dɔɔnin dɔɔnin | Faratibaw bɛ yen |

Nafolodonni kuntaalajan

O waridon suguw dabɔra waati janw kama, ni waridon porogaramuw bɛ se san 25 ma. Olu dɔw ye:

- Baara kɛli ni tɔnw ka tɔnw ka tɔnw ni bonw ye minnu bɛ se ka da u kan. Ka brokerage jatebɔsɛbɛn dɔ da wuli.

- Nafolodonni minnu bɛ kɛ fɛn dilanni na.

- Sow jɔli, sow sɔrɔli ka feere kokura ani ka u jate.

- Masinw ni minɛnw sɔrɔli.

- Sanu min bɛ kɛ ka a mara.

- Bijoux, warijɛw.

- Investissement yɛrɛ ka kalan.

Nafolodonni waati cɛmancɛ la

O wari bilalenw misali dɔ ye banki wari bilalenw ye, wari bilalenw sanu na, wari falenfalen nafolo ani ɲɔgɔndɛmɛ nafolo.

Nafolodonniw waati kunkurunnin kɔnɔ

Olu ye waridon ye MFIw la, ɲɔgɔndɛmɛ nafolo, wari falenfalen pakew, kriptowari ani jamana kɔkan wariko jago. Nafolodoncogo ni cogoya caman bɛ yen, wa u kelen-kelen bɛɛ bɛ baara kɛ ka ɲɛ cogoya dɔw la. Walasa k’u baara cogo ɲuman na, a ka kan ka nafolodon kalan yiriwa, ka nafolodonna ka bolofara camanba dege ni waridoncogo n’a nafaw ye minnu tɛ kelen ye, ani ka nafolodoncogo ɲɛnabɔli waleya. O waati kelen na, ka wariko bolodacogo kuntaalajan jira min bɛ se san 10-25 ma.