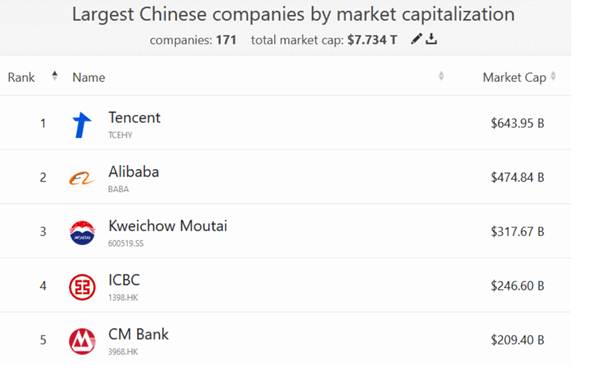

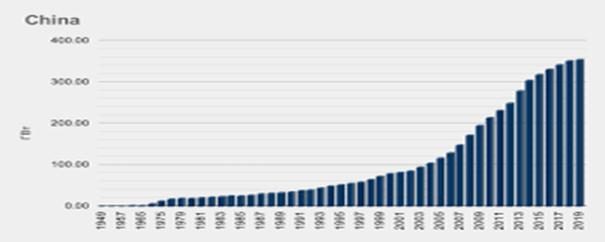

Today, China is one of the largest and fastest growing economies in the world. There are many large corporations in China, and these are not only high-tech giants. The total capitalization of the 170 largest Chinese companies today has exceeded $7.5 trillion. Therefore, the acquisition of their shares is undoubtedly of interest for the

diversification of the investment portfolio .

- Share structure of the Chinese stock market

- First echelon

- Chinese blue chips

- Second echelon

- third tier

- List of blue chip stocks of the Chinese stock market

- Several blue-chip Chinese companies

- How to buy Chinese blue chips

- on Russian stock exchanges

- Through foreign brokers

- Through direct investment in China

- Through collective investment in Chinese securities

- Benefits and risks of investing in blue chips in the Chinese market

- How Much Should You Invest in Chinese Blue Chips?

- Benefits of investing in China’s blue chips

- Cons of investment

- Does it make sense to buy Chinese “blue chips”

Share structure of the Chinese stock market

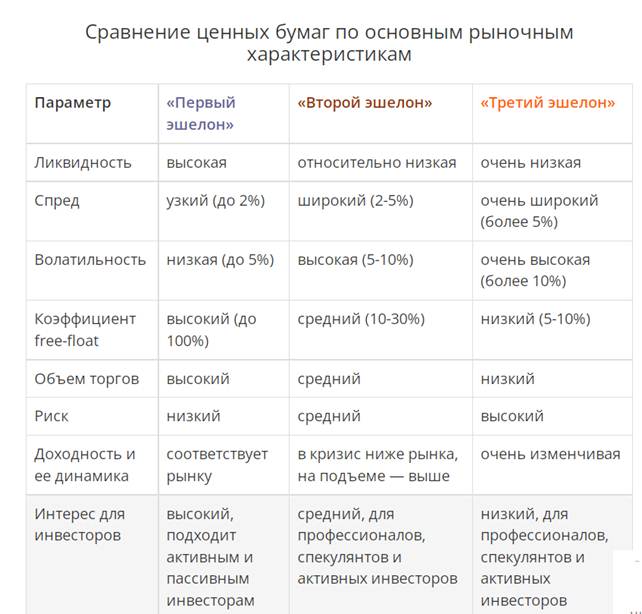

Shares of the Chinese, like any other, the stock market are divided into three echelons.

First echelon

The first tier includes stocks with the highest degree of liquidity. Companies that have issued shares are highly stable, practically insensitive to small changes in the market. They have a very high, about 90%, free-float ratio and a narrow spread. This is China’s blue chips.

Free-float – the percentage of shares freely traded on the market to the total number of shares of the company.

Spread is an indicator of the difference between the price of buying and selling shares at a single point in time.

According to the Hang Seng Index (HSI) (Hong Kong Stock Exchange Index). The list of blue chips in China includes such giants as Geely Automobile, Galaxy Entertainment Group, Lenovo and others.

Chinese blue chips

However, the main Chinese blue chip index is the SSE 50 Index. It includes 50 companies that are the largest in China, with the highest level of capitalization, and their shares show the best performance in terms of reliability and liquidity. This list includes banking, industrial and trading corporations well-known in the world market, including, such as – Bank of China, Orient Securities; Bank of Beijing; PetroChina (the world’s first corporation to reach the $1 trillion capitalization level); China National Nuclear Power and others.

Second echelon

These are shares of fairly large companies that have, although less than in the first echelon, but a fairly high degree of liquidity. Second tier stocks are average in terms of free-float ratio, sales volume, risks and returns. The spread for such stocks is much wider than for blue chips.

third tier

Shares of third-tier companies have a very low level of liquidity, have the lowest cost and free-float ratio. The trading volume for these shares is small. They carry high risks and a very wide spread. Three echelons of Chinese stocks:

List of blue chip stocks of the Chinese stock market

In September 2021, China published a list of the 500 largest corporations in the state. According to the list published jointly by the China Enterprise Directors Association and the China Enterprise Confederation. The combined income of these enterprises amounted to 89.83 trillion JPY (13.9 trillion dollars). and showed an increase in profitability of 4.43%, respectively, when compared with the same period of the previous year. The profit received by these enterprises in 2020 amounted to a record 4.07 trillion JPY (an increase of 4.59%). The level of operating income required for inclusion in the list also rose, it amounted to 39.24 billion JPY, which is 3.28 billion JPY more than in the previous period. Companies whose revenue grew by more than JPY 100 billion exceeded 200 (actually 222 companies) and 8 of them exceeded the JPY 1 trillion threshold.

| Position in the Chinese market | Company name | Dislocation | Yield in millions of $ | Place according to FORTUNE GLOBAL 500 |

| one | State Grid | Beijing | 386618 | 2 |

| 2 | China National Petroleum | Beijing | 283958 | four |

| 3 | Sinopec Group | Beijing | 283728 | 5 |

| four | China State Construction Engineering | Beijing | 234425 | 13 |

| 5 | Ping An Insurance | Shenzhen | 191509 | 16 |

| 6 | Industrial & Commercial Bank of China | Beijing | 182794 | twenty |

| 7 | China Construction Bank | Beijing | 172000 | 25 |

| eight | Agricultural Bank of China | Beijing | 153885 | 29 |

Several blue-chip Chinese companies

These companies are the most promising for investments, as well as for working with their shares on the stock markets. They have a high level of capitalization, and bring consistently high income. Their shares are attractive for long-term investment. So for example:

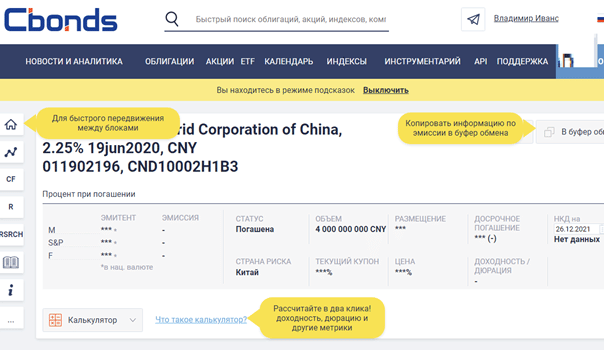

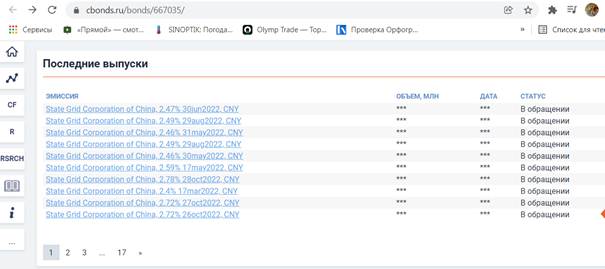

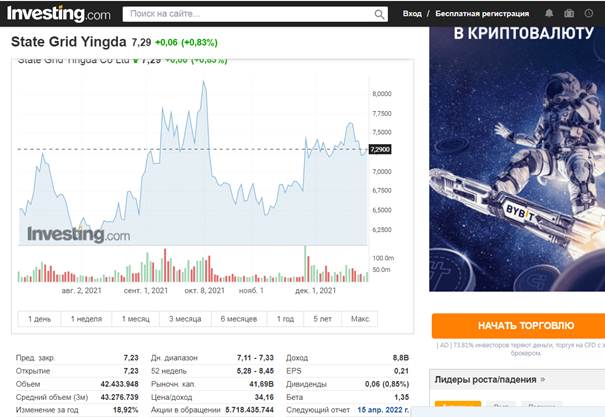

State Grid is a Chinese state-owned company, the world’s largest enterprise that builds nuclear power plants in many countries of the world and distributes electricity throughout the PRC. In addition, through its subsidiaries, it actively invests in the development of power grids and the construction of new facilities abroad (Brazil, the Philippines, etc.)

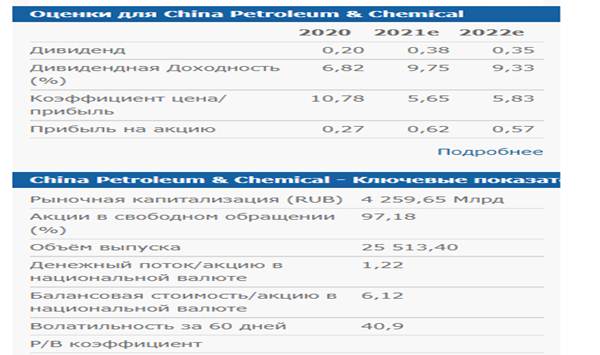

China National Petroleum– the largest oil and gas company in China, which is completely state-owned and occupies a practically monopoly position in the domestic market. It includes a number of subsidiaries (PetroChina, Kunlun Energy, etc.). As of 2019, its total assets amounted to 2.732 trillion JPY, and the number of employees reaches almost 500 thousand people. The stock price of China National Petroleum today is:

How to buy Chinese blue chips

The stability and profitability of China’s blue-chip securities make them attractive investment targets. You can buy these papers.

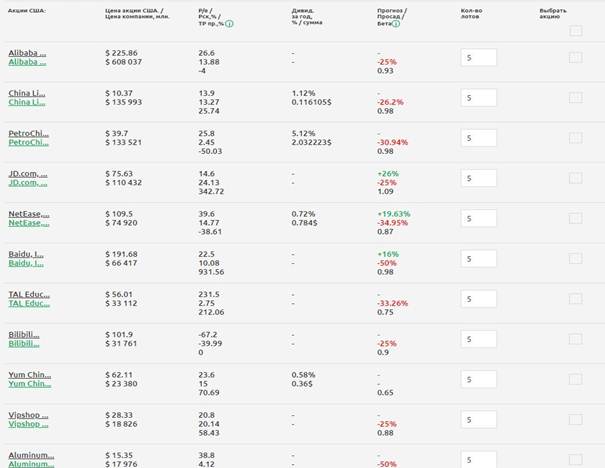

on Russian stock exchanges

Some positions of Chinese securities are quite accessible on the Russian stock market. These are not only shares, but also

depositary receipts (ADRs). They freely circulate on the St. Petersburg Stock Exchange and are quoted in US dollars. On the stock exchange of St. Petersburg you can buy:

- Alibaba Group Holding Limited (BABA);

- Aluminum Corporation of China Li (ACH);

- Baidu Inc. (BIDU);

- China Eastern Airlines Corporati (CEA);

- China Life Insurance Company Lim. (LFC);

- China Southern Airlines Company (ZNH);

- Hello Group Inc. (MOMO);

- Huaneng Power International Inc. (HNP);

- Huazhu Group Limited (HTHT);

- com, inc. (JD);

- JOYY Inc. (YY);

- NetEase Inc. (NTES);

- PetroChina Company Limited (PTR);

- Sinopec Shanghai Petrochemical (SHI);

- com Limited (SOHU);

- TAL Education Group (TAL);

- Vipshop Holdings Limited (VIPS);

- Weibo Corporation (WB);

- China Mobile (Hong Kong) Ltd. (CHL);

- China Telecom Corporation Limite (CHA)

And others, today it is about 30 positions. On the Moscow Exchange, the quotation is made in rubles and is presented in the following main options:

- Alibaba Group Holding Limited (BABA-RM)

- Baidu Inc. (BIDU-RM)

- PetroChina Company Limited (PTR-RM)

- com, inc. (JD-RM)

- Li Auto Inc. (LI-RM)

- NIO Inc. (NIO-RM)

- TAL Education Group (TAL-RM)

- Vipshop Holdings Limited (VIPS-RM)

However, the number of options continues to steadily increase. For most traders who are just starting out in the stock market, this may be enough. It is not difficult to start working with them, it is quite enough to open

an individual investment account (exchange account). Given that the shares were listed on the Russian Stock Exchange, they are subject to the entire list of tax benefits that apply to the acquisition of shares of domestic companies.

Through foreign brokers

Investors who want to work with a wider variety of Chinese blue chips than the domestic market can offer can open accounts with overseas brokers. The largest number of shares of Chinese “blue chips” in 2021 were traded on US exchanges (New York Stock Exchange, NASDAQ, and others). In order to start trading Chinese shares on these exchanges, you should contact the appropriate brokers, such as:

- Charles Schwab,

- E*Trade,

- Interactive Brokers,

- TD Ameritrade, and others.

Through direct investment in China

Direct investments directly in China will turn out to be the most profitable and expedient, this will allow you to use the minimum commission, but the amounts that will be invested will be quite large, and this is unlikely to be suitable for novice investors.

Through collective investment in Chinese securities

Another way to gain exposure to Chinese stocks is through the acquisition of ΕTF. By investing in ΕTF, an investor does not buy individual shares, but immediately buys a block of shares in various Chinese companies. Thus, investing funds not in a specific company, but in the entire stock market of China. ΕTF can be purchased on the Moscow Exchange. These include, AKCH, the operator of OOO MC Alfa-Capital and FXCN, the operator of FinEx Funds plc.

Benefits and risks of investing in blue chips in the Chinese market

In recent decades, China has developed with amazing intensity, and today it is rightfully considered the second (after the United States) economy in the world. But at the same time, there is no consensus among investors about the stability of its economy. This is due to the political system prevailing in the country. In addition, the United States opposes the excessively active external expansion of Chinese companies. Therefore, in forecasts for 2022, the opinion that the growth of the Chinese economy will slow down sharply prevails more and more. This cannot but affect the value and profitability of Chinese blue chips. And naturally increases the risks of long-term investments.

How Much Should You Invest in Chinese Blue Chips?

In such an ambiguous situation, when buying shares of Chinese companies, moderation must be observed. There is no certainty that a bright tomorrow awaits all companies in this country. But one should not disregard the fact that the Chinese economy has far from exhausted its potential and has all the prerequisites for continued rapid growth. Therefore, the best solution would be to invest in Chinese blue chips 6-12% of your investment portfolio. This allows you to minimize your risks and at the same time earn on investments.

Benefits of investing in China’s blue chips

The undoubted advantages of investing in Chinese securities include:

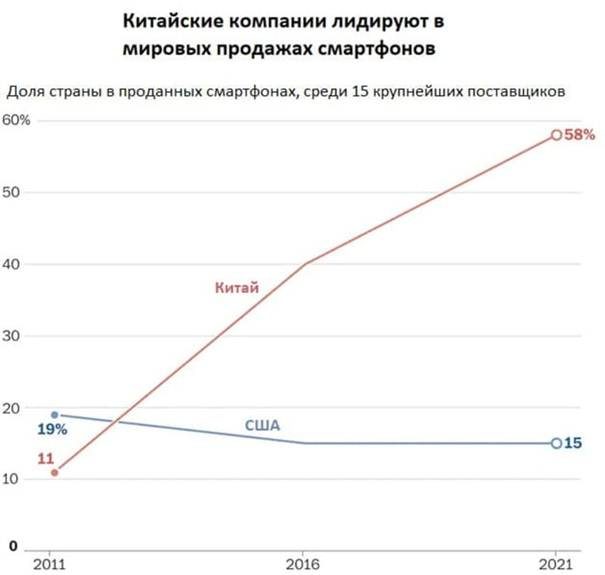

- high GDP growth rate (on average more than 8% per year) for a number of years;

- a high share of high-tech production in the country’s economy;

- high competitiveness of Chinese goods in the foreign market;

- low cost of labor and the presence of a huge number of able-bodied population;

- tight control by the authorities, which significantly reduces the possibility of manipulation and deception of investors.

Cons of investment

But along with the advantages, investing in China also has a number of disadvantages:

- the uncertainty created by the political system;

- the possibility of a “trade war” from the US and the EU;

- the risk of imposing sanctions;

- inaccuracy of the data provided.

Does it make sense to buy Chinese “blue chips”

Undoubtedly, it is advisable to buy shares of Chinese companies. Some share of stocks, the most interesting Chinese companies, should be present in investment portfolios as an asset for potential growth. But using Chinese blue-chip stocks to generate passive income is hardly worthwhile.