Blue chips of the Russian stock market as of 2022.

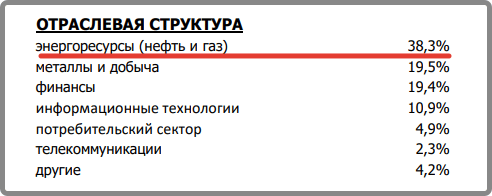

blue chipsname the shares of the most stable companies in the country. They are also called first-tier stocks. According to statistics, when investing in them, there is the least risk of losing investments. It is one thing to own shares of Sberbank, and quite another for the unknown Let’s Go, whose license can be taken away at any moment. Russian blue chips are leaders in the industry, and many of them are state-controlled in Russia. The state is the main shareholder of Gazprom – more than 50% of the shares. Dividends are an important line of the budget, so investors have no doubt that if problems arise, the state will provide financial support. Many of the blue chips are strategic companies in the country. Gazprom is a gas export monopoly. Polyus is a leader in gold mining. The emergence of a worthy competitor is unlikely – to enter this market you need a lot of capital.

The term “blue chips” comes from poker and is rather arbitrary. There are no clear criteria by which a company is classified as a blue chip company in Russia. But the main criteria can be identified.

Benefits of first tier stocks

What are the advantages of Russian blue chips

Liquidity

The higher the liquidity of the share, the easier it is to sell the existing assets of a large volume. It also depends on liquidity how close to the market price a transaction will be made. Russian blue chips have the best liquidity – they are traded daily by hundreds of traders. So the daily turnover of Sberbank or Gazprom is tens of billions of rubles.

Reliability

An investor who has first-tier shares (Russian blue chips) can be confident in his investment. These companies have a stable business, higher credit ratings, less leverage and more resources. That is why investments in these shares are advised to beginners.

Dividends

Most blue chip companies in Russia pay dividends. These are sustainable companies that can share part of the profits with shareholders. A large share of the budget of some regions is dividends. State-owned companies in Russia must pay at least half of their profits in the form of dividends.

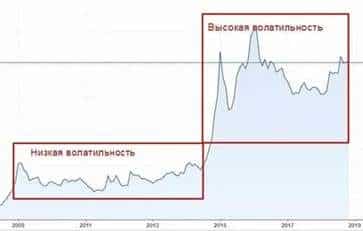

volatility of 20% per day or more. Blue chips have lower volatility.

List of blue chips in the Russian stock market for 2022

By changing the quotes of the largest companies in the country, they draw a conclusion about the economic situation as a whole.

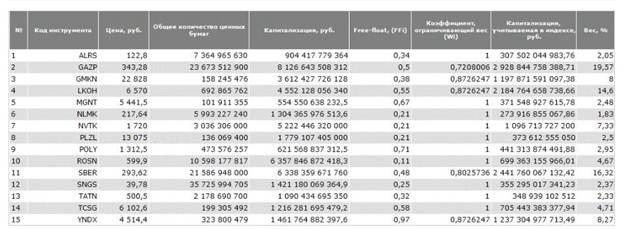

The Moscow Exchange calculates the

MOEXBC blue chip index . The current list of blue chips is published on the official website of the Moscow Exchange. The MOEXBC index is not available for trading, it is a market indicator.

- Polyus Gold is the leader of the gold mining industry in Russia. Over 10 years, shares have risen in price by 1307%, with an average annual dividend yield of 4.66%.

- TCS Group is a financial group of companies, the main asset is Tinkoff Bank. In addition, Tinkoff Insurance and Tinkoff Investments are included . Growth over 3 years 566%, average annual dividend yield 0.91%.

- Yandex is the development of a search engine, in addition, Yandex offers taxi services, food delivery, an electronic payment system, etc. Growth over 10 years is 416%, the company does not pay dividends, preferring to invest profits in development.

- Novatek is the leader in gas production in Russia. Growth over 10 years 375%, average annual dividend yield 2.4%

- MMC Norilsk Nickel is the largest miner of non-ferrous metals, palladium and nickel. Growth over 10 years 324%, average annual dividend yield 9.09%.

- Sberbank – the main bank of Russia, has a branch in almost any city in the country. The main block of shares belongs to the state. Growth over 10 years 365%, average annual dividend yield 6.43%

- Lukoil is the largest oil producing company in Russia. Engaged in the extraction and processing of oil and gas. Growth over 10 years 332%, average dividend yield 6.3%.

- Polymetal is the largest miner of precious metals in Russia. Growth over 10 years 319%, average dividend yield 4.29%.

- Tatneft is the largest oil producing company. Growth over 10 years 262%, average dividend yield 8.04%.

- NLMK is the largest Russian metallurgical company. Growth over 10 years 250%, average dividend yield 10.9%.

- Rosneft is the largest oil company in the Russian Federation. Growth over 10 years 199%, average dividend yield 3.55%.

- Magnit is the largest chain of grocery, cosmetics and household goods stores. Growth over 10 years 125%, average dividend yield 5.5%.

- Gazprom is a monopoly in gas exports. The main block of shares belongs to the state. Growth over 10 years 114%, average dividend yield 6.66%.

- MTS is the largest mobile operator. Growth over 10 years 73.4%, average dividend yield 11%.

- Surgutneftegaz is a joint stock company uniting oil producing enterprises in Russia. Growth over 10 years 47.1%, average dividend yield 1.89%.

Blue chips of the Russian stock market – where to invest: https://youtu.be/emCE4DldKW8

Investments in blue chips of Russian companies

Profit from investments in Russian blue chips is made up of annual dividends, and some companies pay dividends even more often – once a quarter and depending on the growth in market value. The multiple growth of quotes is a long process, it can take years. But stable dividends provide cash flow even when quotes fall. Companies will not pay dividends only in the event of a severe crisis that hit the country as a whole.

In the wake of the coronavirus turmoil, many companies have announced dividend cuts and some have been forced to not pay dividends in 2020.

Buying blue-chip stocks is most profitable during panic sales. After the economic situation improves, blue chips are growing faster than second-tier stocks. And the drop in quotes is not so significant. The amount of dividends is a fixed value approved by the Board of Shareholders. It depends on the profit of the company, not on the share price. When quotes fall, the dividend yield rises, which slows down further decline. On a rebound, an investor can earn 20-30% of the portfolio in a short time or leave profitably bought shares in the expectation of further growth. Depending on the investor’s capital, there are several strategies for investing in Russian blue chips:

- It is possible to purchase an ETF , such as a DIVD ETF, that includes the most stable, dividend-paying companies. This method is suitable for investors with small capital, less than 50 thousand rubles. [caption id="attachment_12042" align="aligncenter" width="800"]

- Assemble a portfolio of blue chips on your own . In this case, it is necessary to purchase 15 shares in equal shares. Based on the value of the most expensive share of MMC Norilsk Nickel, the minimum investment amount is 350,000 rubles. If you do not include Norilsk Nickel and buy only the remaining 14 shares, the minimum amount is reduced to 85 thousand rubles. You can buy the entire portfolio at the same time or buy additional shares from the list evenly once a month or once a quarter.

- An investor may not buy a portfolio of stocks, but invest in a specific stock or several stocks . So some people who worked in the Tatneft company and saw the business from the inside bought shares every month for many years.