If a trader is just starting his journey in the securities market, it will not be easy for him to understand the new specifics of work for him. To help you quickly filter out securities according to the given parameters, special programs have been developed – stock screeners (Stock Screener). They allow you to select securities in the background according to specified criteria. Such programs will be useful not only for beginners, but also for professional brokers and traders.

What is a stock screener, what is the purpose of the application

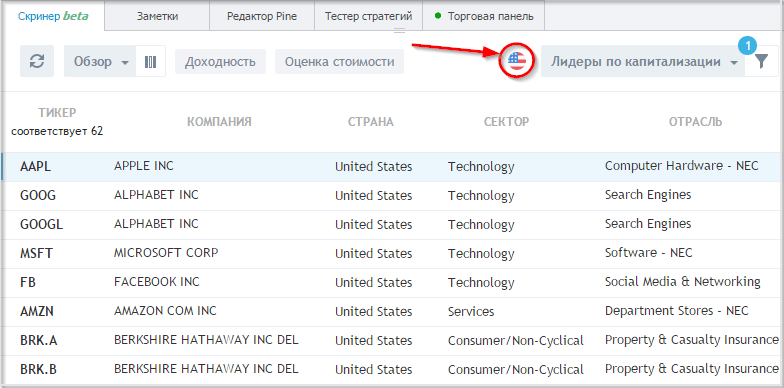

In order to better understand what a stock screener is, we can take a regular store as an example. Let’s say a person comes to a retail outlet to buy cookies. He walks into a store and sees 50 different kinds of cookies on the shelves. Each of them has its own characteristics, advantages and disadvantages. However, you need to buy cream cookies with filling, and no more than 70 rubles per kilogram. If you start manually sorting through all the products of the store, the buyer will spend a lot of time that can be used for more useful things. As a result, the buyer approaches the seller. He tells him the criteria for the desired product and asks for help with the choice. The seller knows the products of his store very well, so he can easily find the right cookie in half a minute. If a trader searched for it on his own, he would spend 20-30 minutes on the same operation. Screeners work on the same principle. In fact, this is not even a program, but a service that has several dozen filters built into it. Here, the investor/trader is required to tell the screener the parameters of the securities they want to view. The program analyzes the request, sorts through the database of stocks that meet the specified requirements and displays them through the St. Petersburg Stock Exchange Stock Screener interface at https://finbull.ru/stock/:

The screener does not relieve the investor or trader of the need to understand the securities market and the affairs of a particular company, this tool only filters out shares according to certain parameters, and whether they are set correctly based on the real state of affairs is the responsibility of the protein mind.

How does the screener work?

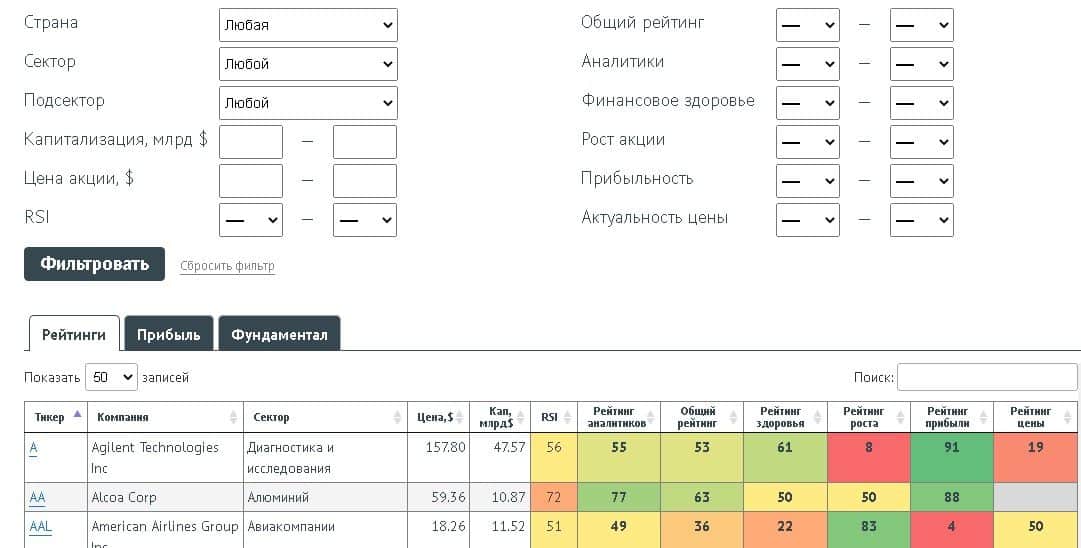

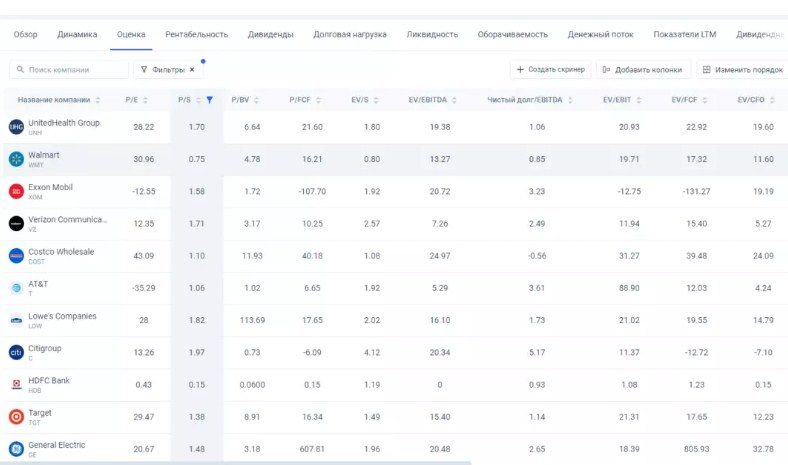

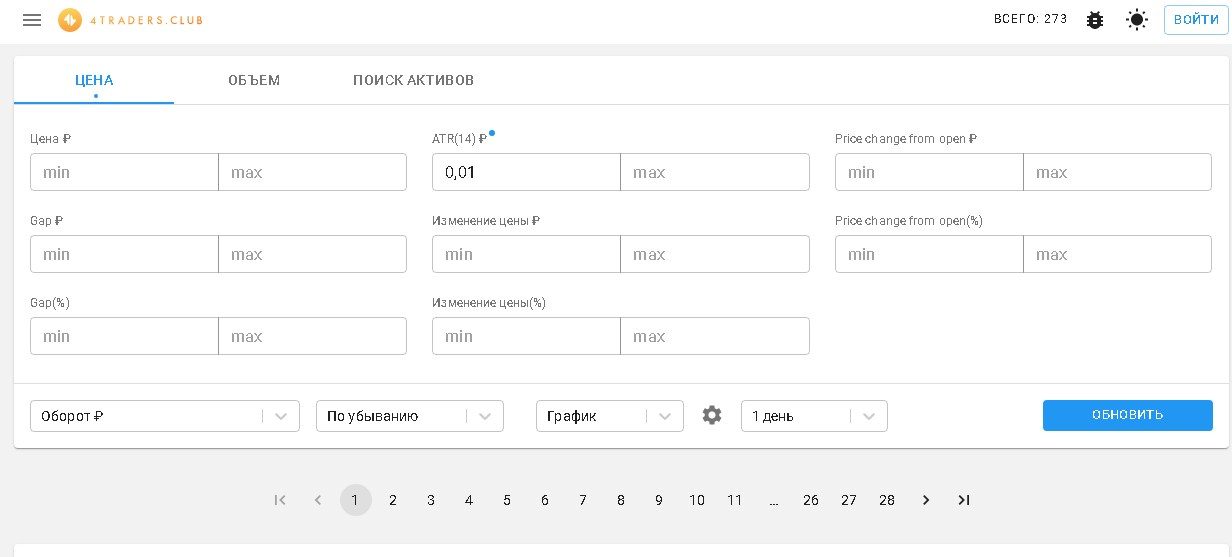

The stock screener allows you to conduct a primary analysis of stocks using multiples and ratios. Each screener has built-in filters in its software shell. The trader either fills them in manually or selects the parameters from the values offered by the service. Analyzing the entered data, the screener makes a selection of securities that fit the specified criteria. The trader here can set various parameters. It can be:

- fundamental characteristics;

- P/E, P/BV, P/S, P/FCF, EV/EBITDA, E/P multiples, Graham, DuPont, Altman and other estimates;

- the number of shares in circulation;

- securities with great potential according to analysts’ forecasts;

- various criteria for accounting or financial reporting.

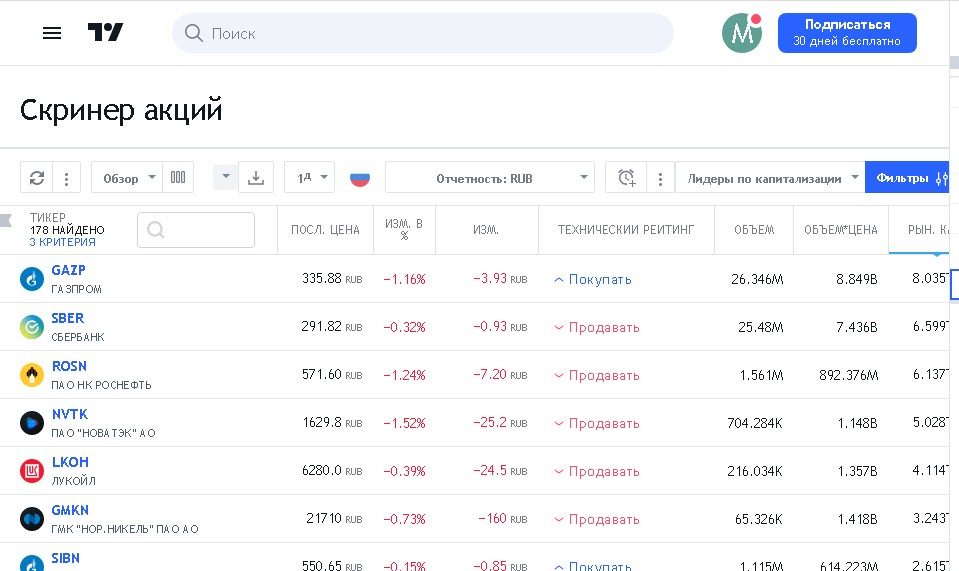

Moscow Exchange :

However, screeners also have disadvantages. They will not suit those people who do not understand anything about multipliers and financial indicators. They can even be dangerous if not used properly.

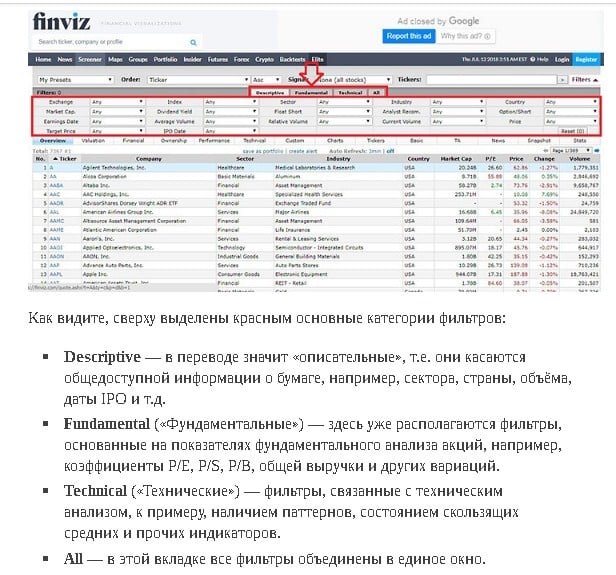

For the program to be useful, the investor must at least at the initial level understand the specifics of the market, and know exactly what he wants to find with the help of the screener. Otherwise, the trader will simply go through options that will not bring him any benefit. Most of the screeners have an English interface. To use the program effectively, you need to understand this language at least at a conversational level. Services for automatic translation of pages are not suitable here. The fact is that during background translation, the meaning of the text is often lost or distorted. If this factor is not taken into account, this can lead the trader to sad consequences, up to the loss of his securities and capital. [caption id="attachment_11969" align="aligncenter" width="678"]

How to use the screener

The interface of most existing screeners has the following sections:

- description of the company;

- dividends;

- multipliers;

- financial statements;

- financial ratios;

- liquidity.

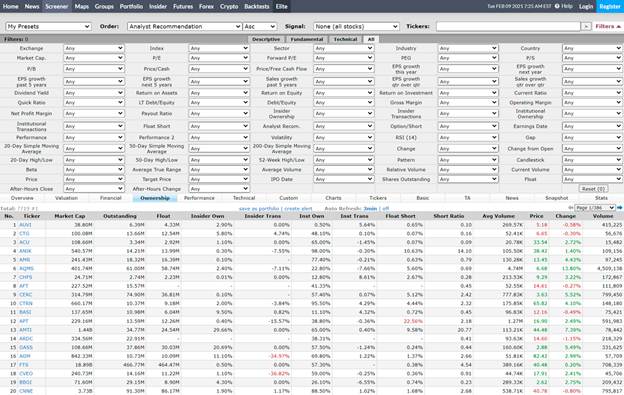

Each section has a number of subsections. For example, in the “Description of the company” you can find information about the exchange where the shares are sold, the industry of activity and data on whether the security falls into the indices. A trader can independently configure filters for sections and subsections. This can be done both manually and using templates. In the first case, it is necessary to prescribe specific filter values or choose them among the proposed options.

broker itself, because many of them are equipped with their own screeners. To set up filters in this case, you will need to select “Euro” as the currency, and “IT industry” in the company’s characteristics.

- First, stocks are selected based on the P/E Ratio criterion. This indicates that the securities are undervalued. By enabling this filter on the skinner, the trader narrows his choice from 3-4 thousand to 100-200 shares.

- Next, the P/BV filter is turned on. It is recommended to set it to a value greater than 1, but less than some other specific number. Accordingly, the output will be options for securities that are sold above their book value, but, nevertheless, do not exceed this indicator by much.

- The companies are then compared in terms of ROA and ROE. Thanks to this, the trader can understand how effectively the company uses the investors’ money.

- After performing all these actions, 5-10 options remain on the screener screen. They are monitored manually, choosing the most promising of them.

Thus, the screener cannot completely replace the mind and understanding of the investment market. It only helps to filter out unnecessary information. Fundamental analysis of stocks in the Russian market, analysis through 4 screeners, how to evaluate data correctly: https://youtu.be/GVzeqKjhTk8

Overview of popular stock screeners for the Russian market

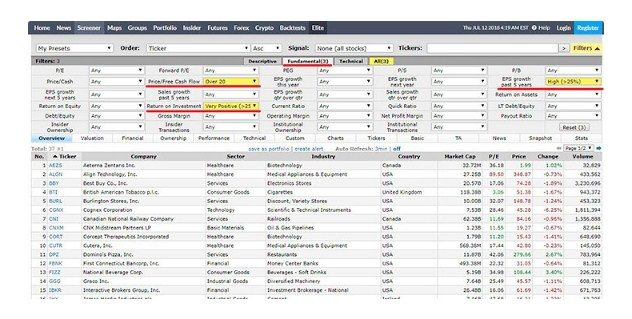

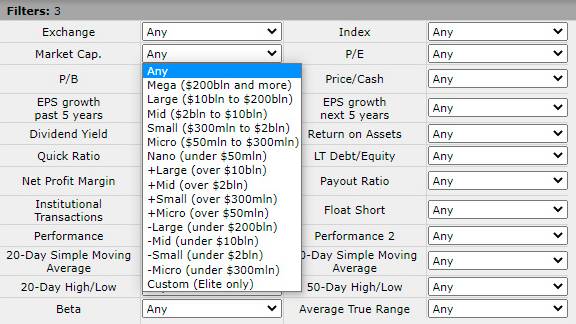

Finvis

This is one of the simplest and most famous screeners among traders. You don’t need to register here. Having entered the service, you can immediately set the value of the filters and start searching for securities. The selection will be updated automatically. Despite the fact that there is only an English version of the screener, it has a simple and intuitive interface. Even those who do not speak English can understand it. The service has three large groups of filters:

- Descriptive – description.

- Fundamental – fundamental characteristics.

- Technical – technical analysis.

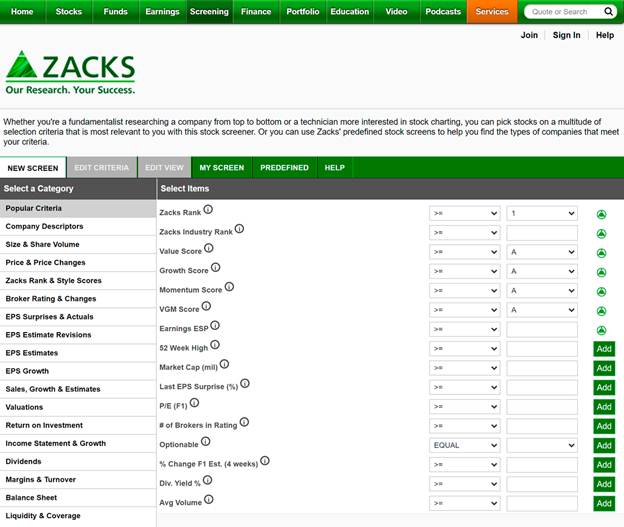

zaks

There are practically no technical analysis filters here. But there are accounting criteria. Thanks to the screener, you can collect characteristics from 18 sections. This allows you to compile your own program. Each of them has another 5 to 15 subsections. Those. a set of settings here allows you to effectively search for securities according to the specified parameters. Of the minuses, it can be noted that not all filters will be available in the free version. For example, it will not be possible to search for companies by rating or growth potential. However, this can be done manually.

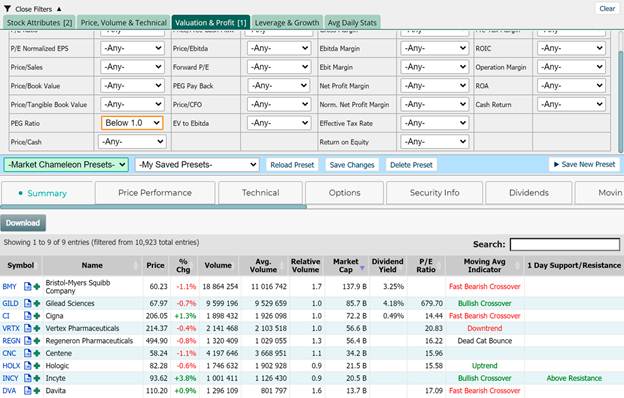

Screener from “Markethameleon”

They are easy and convenient to use. As soon as a trader starts filling in the parameter fields, companies matching the already entered criteria immediately appear at the bottom of the screen. The screener comes with detailed instructions for its use, as well as a training video. The only thing is that they are all in English. The free version will not save search results. It will also be impossible to fill in some fields. The latter are mainly related to technical analysis.

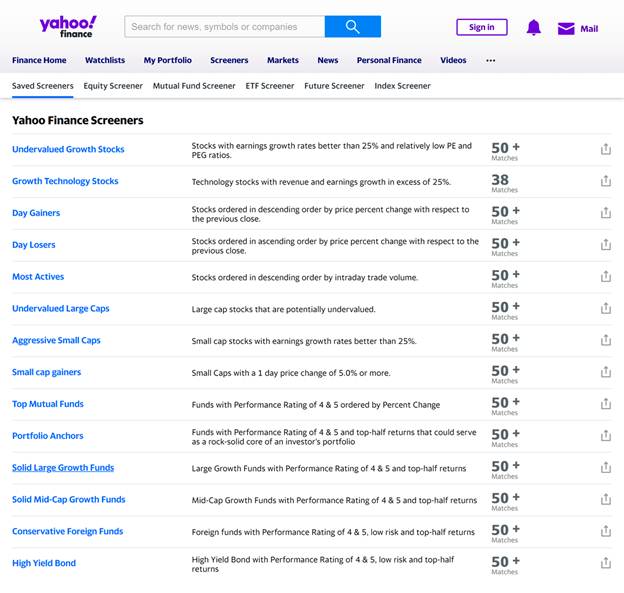

Yahoo screener

It comes with ready-made search criteria for securities. You can edit the template at any time if you wish. In any case, the trader will have to fill in some of the fields himself. For beginners who are not familiar with the market, this may seem complicated. Correction of some important parameters, for example, the same growth rates and profitability, will be available only after purchasing the paid version.

Screener Comparison

| Stock Screener Name | Is it suitable for beginners? | Autocomplete fields | Availability of additional input options |

| Finvis | + | + | + |

| zaks | + | – | – |

| Screener from “Markethameleon” | – | + | + |

| Yahoo screener | – | + | – |

A stock screener is a trader’s assistant. But it’s just a helper. He will not be able to complete the work. The program only searches for securities according to the specified parameters. How competently the criteria are set depends on the skills of the trader himself.