Blue chips is a common term for stock market participants. Means a large, stable company that has been growing for 5-25 years, showing good financial results and paying dividends. Securities of this type are called shares of the first echelon.

Background of the term

The phrase “blue chips” came to the exchange world from the world of casinos, namely, from poker. Each chip in this game has its own meaning depending on the color. Whites are considered the cheapest and cost no more than one dollar. Reds have a higher price – five dollars each. Blue chips are considered the most expensive, they have the highest value among all the others. On the territory of the financial exchange, the concept of blue chips is commonplace. These are special types of companies that have established themselves as stable and highly capitalized. Such firms are leading in the industry they occupy, their services and goods are considered to be predominant, and without their goods the normal functioning of the economy is impossible. During a market crash, blue chip companies exit with the least losses due to their stability. Blue chip companies often have their own brand, but it’s so popular that it’s becoming a household name. https://articles.opexflow.com/akcii/golubye-fishki-fondovogo-rynka.htm

How do companies achieve blue chip status?

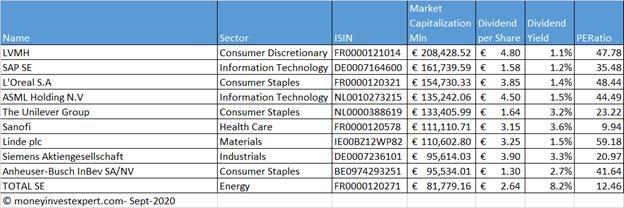

Among those companies that have established themselves as steadily growing companies, there are several that are not yet considered blue chips, but they are quite a bit short of this title. Often these are companies that create new technologies, like Facebook, which has 1.84 billion daily active users. This indicator makes the social network one of the most famous in the world. In addition, the corporation has reached a capitalization of $1.05 trillion. All that does not give the company the title of “blue chips” is its relative youth and refusal to pay dividends. Facebook did not exist until 2004, so many investors who have gone through fire, water and crises do not recognize the company as a leader and stable, and Mark Zuckerberg refused to pay dividends, due to the desire to develop the company. Top 10 Blue Chip Europe from the MSCI Europe Index:

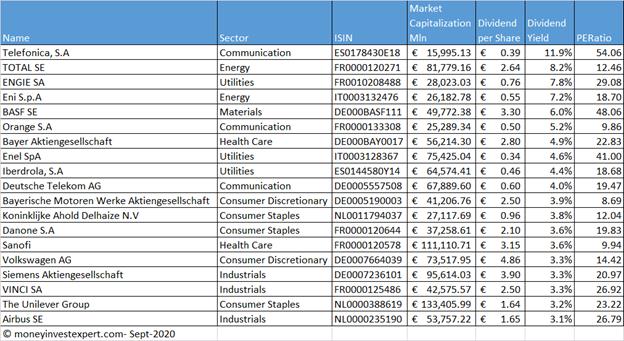

EURO Stoxx 50 – Eurozone blue chip index

To find reliable companies, there is a list with the best companies:

- High market capitalization (selection takes place automatically).

- Located in the European Union.

The index is rebalanced annually in early September. The largest companies in the index:

- ASML Holding NV is a Dutch company operating in the field of semiconductor equipment. It is the largest manufacturer of equipment for the micro electrical industry. The company’s products are used in many countries around the world. The capitalization of the company is more than 350 billion dollars.

- LVMH Moët Hennessy Louis Vuitton is a multinational French company that owns well-known brands for the production of wealth and luxury: clothes, accessories, perfumes and classics of elite alcohol. It has several divisions around the world. Among the brands of the company are such brands as: Dior, Louis Vuitton, Givenchy, Guerlain, Moet e Chandon and Hennessy.

- Linde plc is an international chemical corporation founded in Germany, moved to Ireland in 2018 and established its headquarters in the UK. It is the largest producer of industrial and medical gases. The company has over 4,000 completed projects and 1,000 registered patents. Liquid hydrogen cylinders from this company are found in many industrial shops.

- SAP SE is a German company that provides software to organizations. They create automated systems for such activities as: trade, finance, accounting, production, personnel management and much more.

- Sanofi SA is a French pharmaceutical company operating worldwide, a leader among such companies. Among their work, the following divisions can be distinguished: the development of vaccines against various viruses and other diseases, drugs for the treatment of diabetes and the cardiovascular system, veterinary products and general medicines.

- Siemens AG is a German corporation operating in the field of electronics and electrical engineering. This is not just a single company, but a conglomerate of different enterprises. Their services include: electrical engineering, power equipment, transport, medical equipment, lighting and electronics.

- Total SE is a French international company engaged in the production and sale of oil, ranked 4th in the list of the largest oil producing companies. This corporation has its branches in many countries of the world. One of the key ones is the branch in Russia. They mine black gold in the country thanks to a production sharing agreement. In addition, the company is a sponsor of many sporting events.

- L’Oréal SA is a French corporation engaged in the production and sale of cosmetics. The company has united several small but well-known brands under its wing: Loreal, Maybelline New York, Garnier, Giorgio Armani and Lancome.

- Unilever NV is an English company engaged in the production of food products and household chemicals. In Russia, hygiene products under this brand are the most popular.

- Allianz SE is the largest German insurance corporation providing services all over the world and is included in the list of systemically important companies in the global economy. The company’s activities include banking and insurance. The number of clients is growing every day, by 2021 Allianz SE serves more than 88 million people.

How to find blue chips in Europe?

An alternative way to search for European blue chips is to use special stock screeners:

- https://ru.tradingview.com/screener/ – there is a setting in the screener – capitalization leaders, it remains to select the country of interest.

- https://finviz.com/screener.ashx – there are many settings in the screener: dividend payments, country, exchange, etc.

- https://finance.yahoo.com/screener/new/ – a simple screener in which you need to specify a high capitalization and country.

How to buy popular European stock market blue chips

The principle of buying European blue chips is the same for all brokers. The difference lies in the arrangement of personal accounts and mobile applications. Before buying shares, you will need to exchange rubles for euros in the broker’s personal account.

Important: The number of European shares available for purchase depends on the specific broker.

After receiving the currency, you can go to the shares tab and in the filters specify the currency of the purchase of the euro or European shares. You can also buy shares in Europe with the help of funds from brokers and managers. For example: FinEx offers clients German shares of leading companies, the cost of a share is 29 rubles. Or an exchange-traded fund from the management company “Opening-Europe Shares”, offers to buy shares of leading European corporations from 1 euro. Fund units are bought for rubles or euros, if you buy a fund to an

IIS account , then after three years you can get a tax deduction.

Should You Buy Eurozone Blue Chips?

The classic (Conservative) investment strategy involves investing in stocks and bonds of reliable companies. With bonds, it is clear that these are government loans – OFZ, for shares, the highest reliability criterion is the status of a blue chip. Investing in blue chip stocks is ideal for newcomers to the stock exchange, as it provides for minimal investment risks, as well as constant dividend payments. Due to these factors and compound interest, in the long run, the investor can receive an amount several times higher than the initial one. The stability of companies will allow a beginner not to worry about their own money. If it happens. crisis, you can not worry about the invested funds, because after the recession, there will be growth, perhaps more rapid and profitable than before. All due to the fact that the company is recognized as a blue chip, use a reliable business model, patented products that people need. The profitability of investments determines what is happening in the global economy, if there is a recession, there can be no question of any income, in this period the shares are reduced by 10-30%, recovering the company resumes growth and increases income, depending on the situation, it can be 5-30 % per annum. European blue chips are stocks of large and stable companies that for many years in reports and in real life show revenue growth, product sales growth and other parameters. Investing in such stocks is suitable for beginners, as well as conservative investors who want to save and increase money. The annual yield of European blue chips is comparable and sometimes even higher than the rates on bank deposits and savings accounts. For,