For 90% of people in the modern world, the factor of preserving or increasing free financial resources is an important and significant factor. There are various ways to make profitable investments, but only one of the most popular ways is to create a portfolio of investments. Before starting its formation, you need to know the features of the procedure. The best option is the selection of the most profitable securities from the financial point of view. You also need to know what schemes, methods and ways of creating it exist.

- What is an investment portfolio – educational program for beginners

- Investment portfolio for beginners

- Opening a brokerage account

- Further formation of the investment portfolio

- Blue chips in an investment portfolio

- Adding second-tier shares to the investment portfolio

- The principles of forming an investment portfolio – how to compose an investment portfolio correctly?

- What can be included in an investment portfolio?

- Types of investment portfolios

- Portfolio collection options based on timing, goals and other metrics

- An example of an investment portfolio for a year

- An example of an investment portfolio for 3-5 years

- Questions and answers

What is an investment portfolio – educational program for beginners

According to the results of research on the topic of investment, for many it becomes known that the modern theory appeared back in 1952 and since then has only developed and improved, adjusting to the realities of requirements and the economic situation. Before starting the selection, you need to understand all the details of what an investment portfolio is, what are its features. An investment portfolio should be considered as a set of convenient and high-quality financial instruments that bring a stable and guaranteed income to its owner. When choosing a suitable option, it is recommended to take into account one important feature: investment portfolios can differ in terms of the level of risk. You also need to take into account what profit forecasts they have, what investment terms they offer. Having chosen a suitable set of assets,the investor (may be an ordinary individual) will be able to successfully implement the developed portfolio strategy in order to receive a certain amount of funds.

Investment portfolio for beginners

The first investment portfolio requires the investor to pay attention to various details during the collection process. Newbies who want to make the most profitable investments need to know how to create an investment portfolio and what points to pay special attention to. Investment and finance professionals recommend choosing the following approach to building your first investment portfolio.

Opening a brokerage account

Between the exchange and the person (investor) there will be an intermediary – a

broker . Firstly, without a brokerage company, you will not be able to invest in securities. Secondly, the broker will help you choose a safe investment option, make it possible to use the necessary financial instruments for investment and / or trading. It should be borne in mind that in most cases brokers do not charge a fee for opening an account, or the fee is purely symbolic. It is recommended to check the license to carry out activities at the first stage of interaction.

Further formation of the investment portfolio

The structure of the investment portfolio can be supplemented with various bonds or shares.

Here the recommendations are as follows: you need to choose the proportions 20/20/60 currency-bonds-stocks. If bonds are purchased, then the company must return the value of the securities in the amount that it will have at the end of the established period.

Blue chips in an investment portfolio

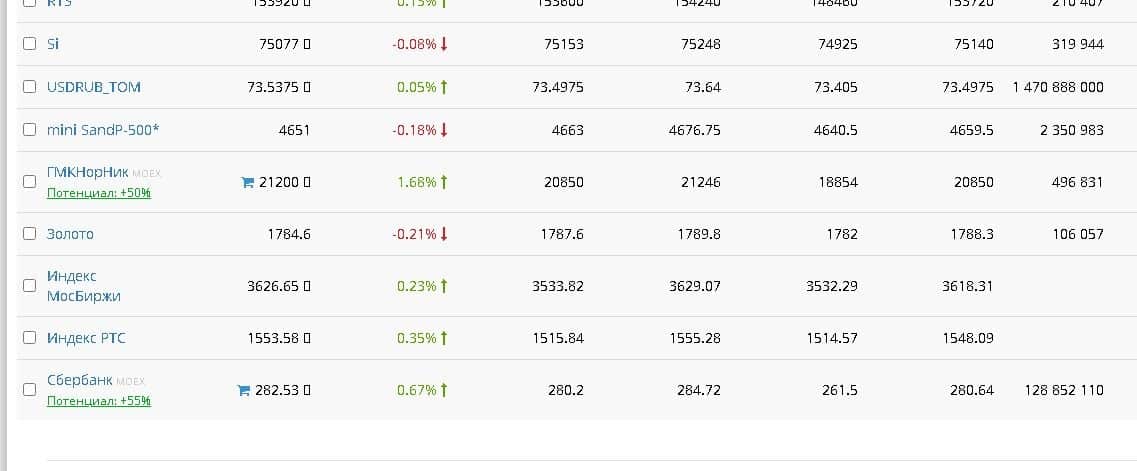

An investment portfolio for beginners should contain

blue chips – shares owned by the largest companies that have proven themselves well in the stock market. Such shares are the most reliable financial instrument. Here you need to take into account that the starting price of the share is at least 3000 rubles.

Adding second-tier shares to the investment portfolio

Shares of companies from the “second tier” – they can be added to the existing set of securities. Feature: they allow you to earn more, but financial risks in this case also increase. How to build an investment portfolio for a beginner, from which stocks and other securities to compose: https://youtu.be/qiwFndRDDCM Beginners should know that there is a concept of “pay for risk” in the stock market. The essence of the phenomenon is as follows: in the case, for example, of purchasing a bond showing a yield of 10%, the probability of making a profit is about 90%. Brokers will help you calculate the return on your investment portfolio. In order to collect the most optimal option, you must first pass a risk test. Brokers also provide high-quality analytics and courses. Another recommendation is to revise the portfolio for the year.The correct creation of an investment portfolio today is not a guarantee that after a while it will not turn out to be less profitable. Timely verification will help to avoid problems. Example: A compiled portfolio consists of 20% bonds, 20% funds and 60% stocks. Over the year, the shares have shown growth – they have risen in price and their share in the portfolio, respectively, increased. In order to maintain profitability, it is required, first, to sell part of the shares, and then to buy other assets with the funds received. In this way, it will be possible to restore the balance of the investment portfolio.Over the year, the shares have shown growth – they have risen in price and their share in the portfolio, respectively, increased. In order to maintain profitability, it is required, first, to sell part of the shares, and then to buy other assets with the funds received. In this way, it will be possible to restore the balance of the investment portfolio.Over the year, the shares have shown growth – they have risen in price and their share in the portfolio, respectively, increased. In order to maintain profitability, it is required, first, to sell part of the shares, and then to buy other assets with the funds received. In this way, it will be possible to restore the balance of the investment portfolio.

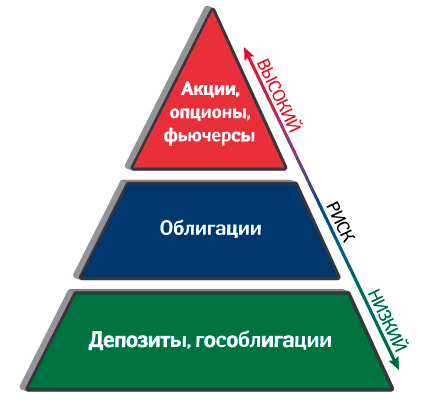

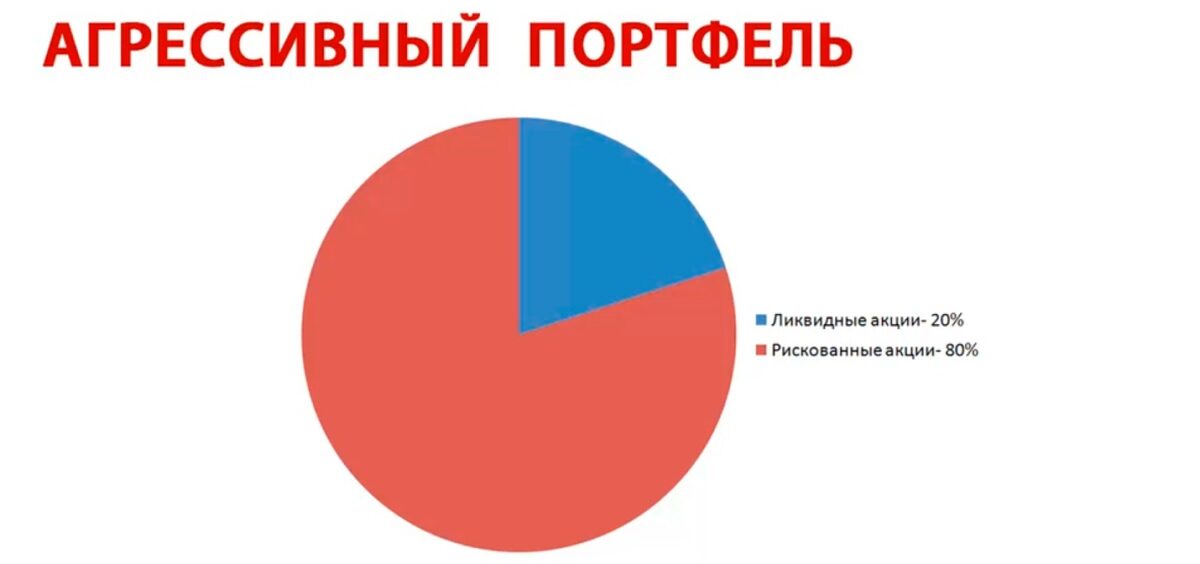

The risk of an investment portfolio directly depends on the division of deposits into aggressive and conservative components.

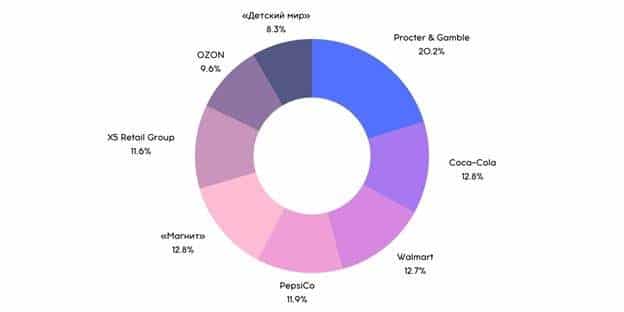

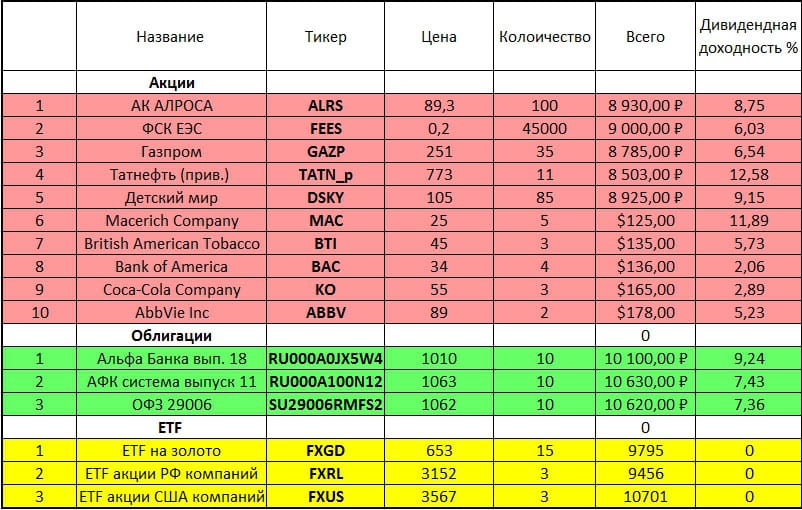

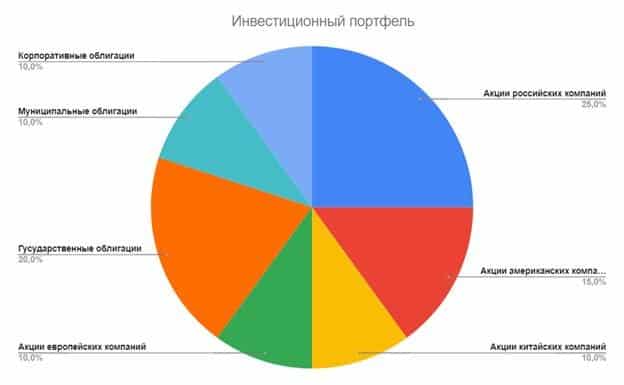

An example of collecting shares of well-known companies and manufacturers. It is not necessary to focus on domestic companies, it is better to separate:

- Pension account . It opens with the aim of generating additional income after retirement. In this case, it is recommended to form it on the basis of stocks and bonds of large companies that are able to show high returns even after 15-20 years. Example: investment portfolio of VTB or Sberbank.

- Children’s account – here you need to set a specific goal for yourself: education, buying real estate in 10-15 years. Feature: the formation takes place using a high-risk stock (technology companies).

- Unforeseen expenses are another account option. Purpose of opening: small or medium-sized acquisitions, renovation, travel. It is best to choose bonds with a short maturity. The yield and value of these securities must be known in advance.

An example of the formation of an investment portfolio that can immediately start working for its owner:

- Bonds – 5 types.

- Funds – 5 types.

- Shares of companies – 10 types

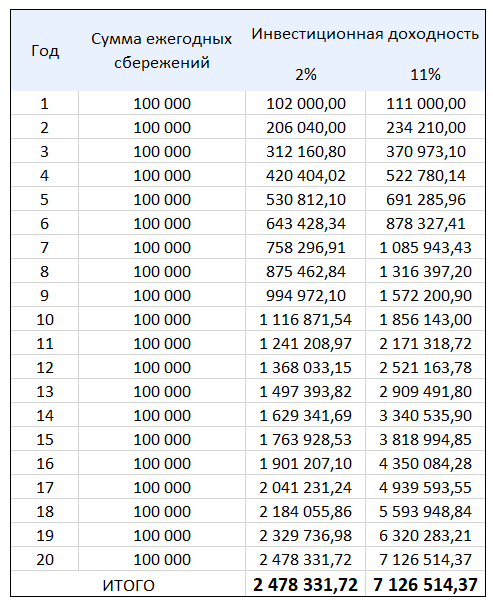

Compiling an investment portfolio from stocks and bonds – portfolio from ETFs on the Moscow Exchange: https://youtu.be/HRwdC8eDAqA You should not give preference to stocks only, especially without a thorough study of the dynamics and a preliminary understanding of what is happening in the market now. If we approach the issue of portfolio formation incorrectly, then the risks of significant financial losses increase by 2-3 times. Trading with a broker’s money is also not recommended for beginners. Margin trading is the process of buying assets with money received directly from a broker. Without experience, the investor runs the risk, because in the event that the transaction is unsuccessful, the broker has the right to close the positions. An example when you need to accumulate a significant amount (for retirement or a large purchase):

The principles of forming an investment portfolio – how to compose an investment portfolio correctly?

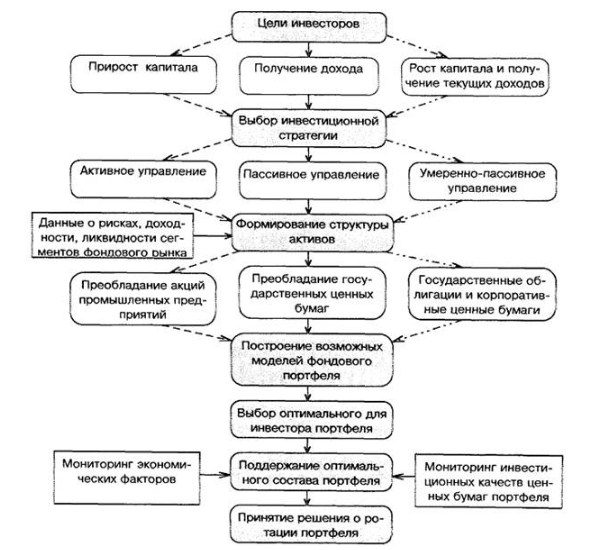

It is also necessary to take into account the general principles of forming an investment portfolio. Here it is important to be able to correctly set the main financial goal for yourself. The formation principle consists of several stages:

- Indicate the amount and terms of accumulation. For example, 4,500,000 rubles for 2.5 years for the subsequent purchase of a country house.

- Decide what amount will be deducted for investments every month. For example, 5% of the salary of each spouse. Much depends on the goal set earlier. Your best bet is to use a calculator to calculate how much to save by dividing the total by the number of months.

- Pass the text at risk. It will help determine how high this indicator is. As a result, it will be possible to calculate the optimal structure. The composition of the portfolio depends not only on the information received, but also on the economic situation and a number of other factors that need to be taken into account.

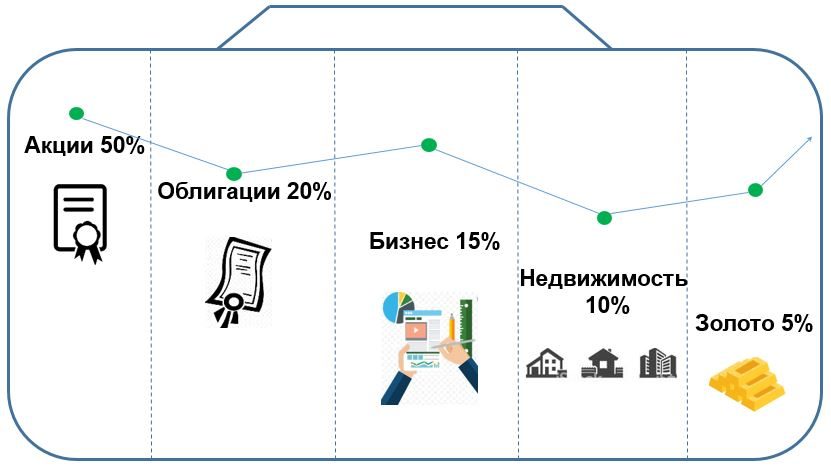

What can be included in an investment portfolio?

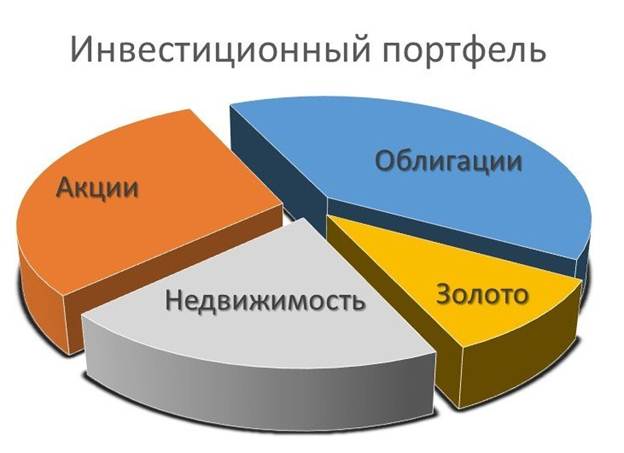

Since portfolio investment is a well-designed investment element, it can consist of various parts that can bring a certain income to its owner. The possible options from which they can be formed include:

- Various securities (stocks, bonds).

- Investment fund shares.

- Currency (US dollar, pounds, euros, also yuan).

- Precious metals (gold, silver and platinum).

futures . If funds allow, then real estate, as well as various deposits, can be included in the investment portfolio. Brokers distinguish another special category – exotic assets. These include antiques, collection wine. Risky – investing in startups and various innovations. Depending on the chosen strategy, the composition of the portfolio will change. How to draw up an investment portfolio for 2022, which securities to buy: https://youtu.be/qYWOBxXHUlI

Types of investment portfolios

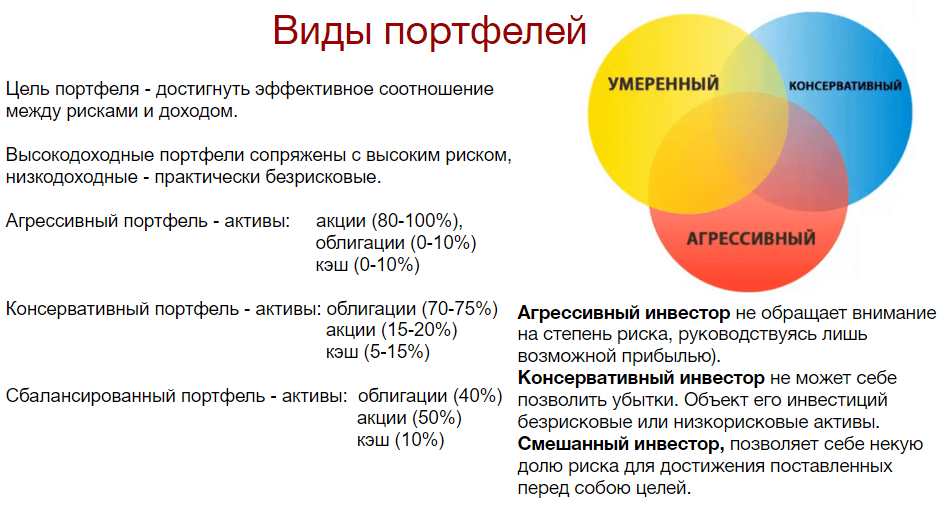

A profitable and competent investment portfolio can be of different types, depending on the investment goals and the internal state and temperament of the investor. Allocate:

- Profitable or aggressive portfolio . Its main goal is high potential profitability. Feature: it is very volatile. In this case, the composition is completely formed from stocks with a large indicator of future growth potential. The challenge is to overtake the Moscow Exchange Index.

- A versatile or balanced portfolio . Its composition is aimed at providing a moderate growth rate. It has high resistance to the market volatility indicator. This is due to wide diversification by asset class and currency used.

- A conservative portfolio is aimed at minimal income, but with minimal risks.

- Simple – the structure includes various securities. If they grow, so does the value of the portfolio itself.

- High growth – is made up of securities of those companies that demonstrate fast and steady growth.

- Moderate growth – the structure includes securities of organizations with indicators of sustainable growth.

- Medium growth – may consist of different securities.

Portfolio collection options based on timing, goals and other metrics

If you need to receive a guaranteed additional income, then you need to know in advance how to create an investment portfolio with minimal risks from scratch and avoid mistakes. Among the options, there is no single and universal for all potential investors. Each person chooses the composition on an individual basis, since it is impossible to predict in advance what the situation will be in the economy and financial sector. Collection options depend on timing. When choosing securities, one should take into account that the longer the investment period, the less investment in shares depends on short-term price changes in the market. At the same time, the indicator of potential income depends on the indicators of the timing. If you choose the option of filling with bonds, then the situation will be as follows: the longer the period for which they are issued,therefore, the rate of return is less predictable. Brokers recommend choosing this option if you want to solve short-term problems and have less complex goals.

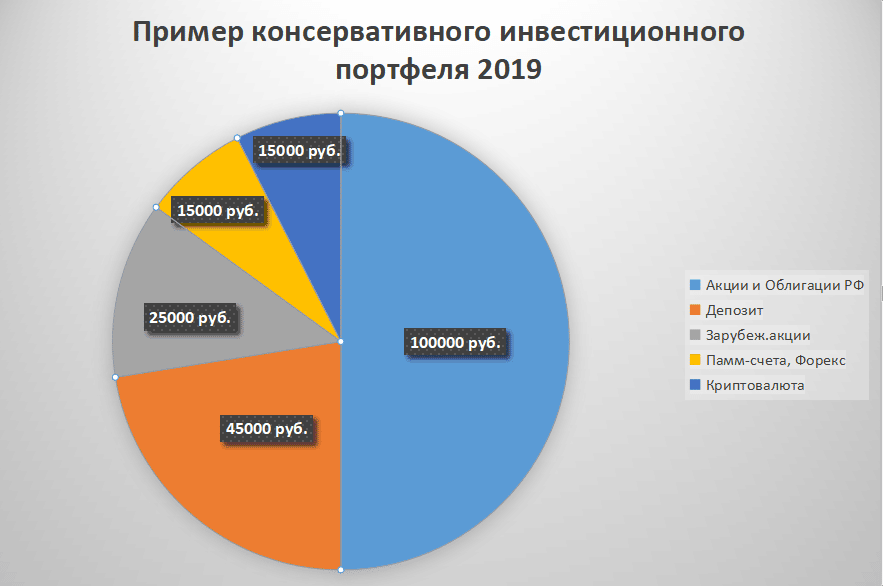

An example of an investment portfolio for a year

An example of a collection (term – 1 year, yield – about 50,000 rubles): ruble bonds. For short-term purposes (for example, traveling, buying household appliances), it is better to collect the portfolio mainly from bonds with a maturity of about a year. This is important, since the person will know in advance the exact (up to hundreds of rubles) amount that can be received in the end. It is risky to buy stocks for a short time, because in the event of a fall, it will be almost impossible to recover quickly. In extreme cases, you can purchase shares in the amount of no more than 10% of the value and the total volume of the investment portfolio. With the help of a broker, you can purchase a ready-made investment portfolio. You can also compose it online.

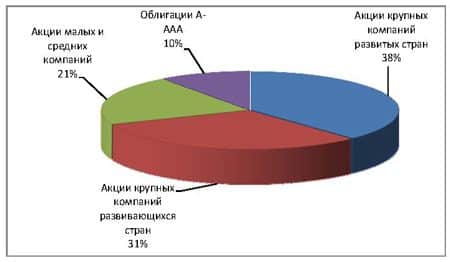

An example of an investment portfolio for 3-5 years

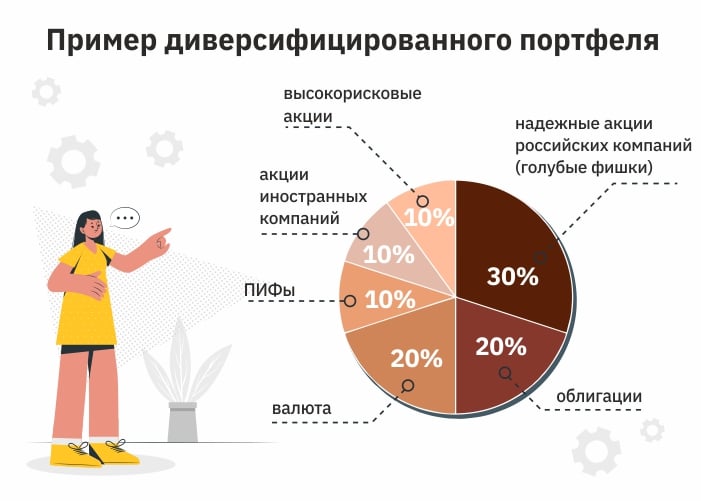

Another option: the established period is in this case 3-5 years. Here you can give preference to both bonds and stocks. Their share in the portfolio is 50/50 or 40/60. Feature: the longer the term, the larger the share of shares in the portfolio can be. Here you need to take into account that you need to increase the number of shares in proportion to the timing. Research in economics indicates that stocks will start to make a profit in a 5-10 year period. Balanced investment portfolio Examples of balanced investment portfolios: Some funds should be invested in real estate, others in art or precious metals. The structure is as follows: 25% each for stocks and bonds, real estate funds make up 15%, alternatives – 20% and precious metals – 15%. Investment portfolio:the correct proportion of stocks and bonds: https://youtu.be/seS4gI3oLqY A 50/50 portfolio is formed quite simply: it consists of an equal number of stocks and bonds. Feature – each type of securities must be divided into Russian and foreign, also in the amount of 50/50. You can additionally secure your investments if you buy securities that differ in the level of risk and profitability.

Questions and answers

What is the best investment portfolio? This is a kind of subjective option that meets the goals, objectives and expectations. The strategy option is selected based on the economic situation, the risk level indicator and the broker’s recommendations. It is necessary to give preference to the securities of large companies and enterprises that can withstand most of the negative manifestations in the market.

What are direct and portfolio investments?In the first case, it is customary to talk about investments that start working immediately. Portfolio investments are also more difficult, since they are designed for a long-term action. In most cases, portfolio investment differs from direct investment in terms of volume. Portfolio investment instruments: debt securities (including not only bonds, but also promissory notes), as well as stocks. Portfolio investments are designed for a shorter period than direct investments. It should be borne in mind that they have more liquidity. Portfolio investments are aimed at making a profit, which is carried out by receiving interest or dividends. You also need to take into account that the investor does not set as his main task the management of an enterprise or a certain project in which his own funds are invested.An investment portfolio is a modern way to increase your investment. An investor who has decided to form a profitable option should tune in to study the economic situation not only in the country, but also in the world. He has to do a thorough and competent work with different market segments. Additionally, you will need to conduct a thoughtful drafting of the strategy. For this purpose, a careful selection of assets is made, consisting of several options. They must meet the set deadlines and goals. If all stages are made in accordance with the rules, then the investment portfolio will be profitable. In this case, there are no risks for the investor. If we do not take into account the real indicators of the economy, then the losses can be significant. Brokers can help with choosing the best option. It is recommended to contact them prior to the purchase of shares,bonds and other components of the investment portfolio.