For 90% of people in the modern world, an important and significant factor is the preservation or increase of free financial resources. There are various ways to make profitable investments, but only one of the most popular ways is to create an investment portfolio. Before starting its formation, it is necessary to know the features of the procedure. The best option is to select the most financially advantageous securities. You also need to know what schemes, methods and ways to create it exist.

- What is an investment portfolio – educational program for beginners

- Investment portfolio for beginners

- Opening a brokerage account

- Further formation of the investment portfolio

- Blue chips in an investment portfolio

- Adding second-tier stocks to the investment portfolio

- Principles of forming an investment portfolio – how to make an investment portfolio?

- What can be included in an investment portfolio?

- Types of investment portfolios

- Portfolio collection options depending on the timing, goals and other indicators

- An example of an investment portfolio for a year

- An example of an investment portfolio for 3-5 years

- Questions and answers

What is an investment portfolio – educational program for beginners

According to the results of research on the topic of investment, it becomes known to many that the modern theory appeared back in 1952 and since then has only developed and improved, adjusting to the realities of the requirements and the economic situation. Before starting the selection, it is necessary to understand all the details of what an investment portfolio is, what are its features. An investment portfolio should be considered as a set of convenient and high-quality financial instruments that bring a stable and guaranteed income to their owner. When choosing a suitable option, it is recommended to take into account one important feature: investment portfolios may differ in terms of the level of risk. You also need to consider what profit forecasts they have, what investment terms they offer. By choosing the right set of assets, the investor (may be an ordinary individual) will be able to successfully implement the developed portfolio strategy in order to receive a certain amount of money.

Investment portfolio for beginners

The first investment portfolio requires the investor to pay attention to various details during the collection process. Beginners who want to make investments with the greatest return need to know how to create an investment portfolio and what points to pay special attention to. Specialists in the field of investment and finance recommend choosing the following approach to the formation of the first investment portfolio.

Opening a brokerage account

Between the exchange and the person (investor) there will be an intermediary – a

broker . Firstly, without a brokerage company, it will not work to invest in securities. Secondly, the broker will help you choose a safe investment option, will give you the opportunity to use the necessary financial instruments for investment and / or trading. It should be borne in mind that in most cases brokers do not charge a fee for opening an account, or the fee is purely symbolic. It is recommended to check the license for activities at the first stage of interaction.

Further formation of the investment portfolio

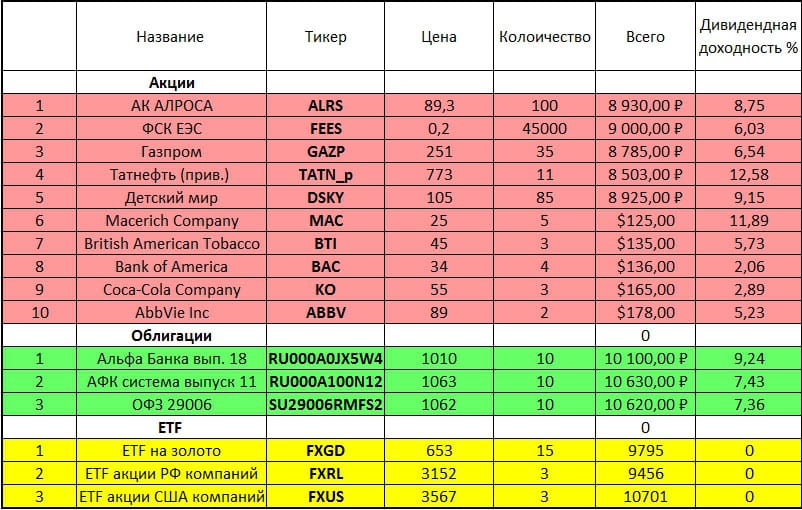

The structure of the investment portfolio can be supplemented by various bonds or stocks.

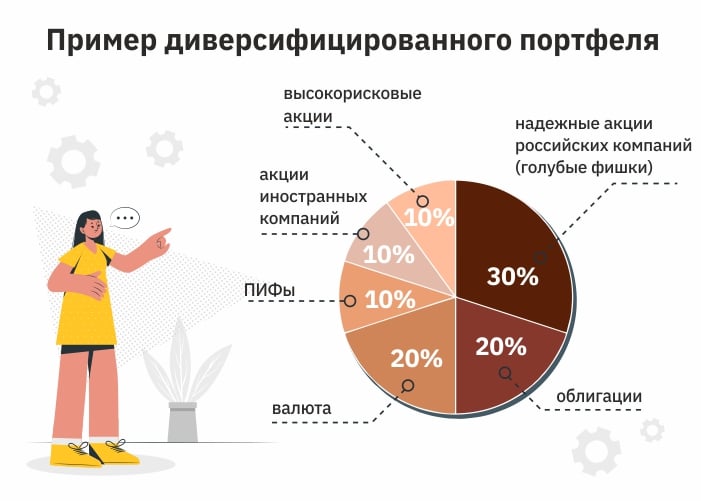

Here the recommendations are as follows: you need to choose the proportions 20/20/60 currency-bonds-stocks. If bonds are purchased, the company must return the value of the securities in the amount that it will have at the end of the specified period. [caption id="attachment_12002" align="aligncenter" width="701"]

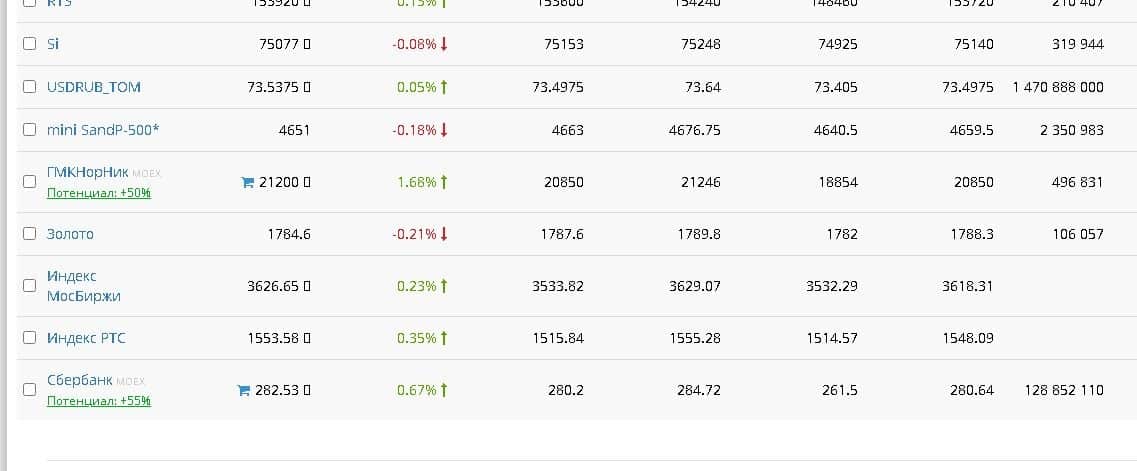

Blue chips in an investment portfolio

An investment portfolio for beginners should contain

blue chips – stocks owned by the largest companies that have performed well in the stock market. Such shares are the most reliable financial instrument. Here you need to take into account that the starting price of the share is at least 3000 rubles. [caption id="attachment_3454" align="aligncenter" width="1137"]

Adding second-tier stocks to the investment portfolio

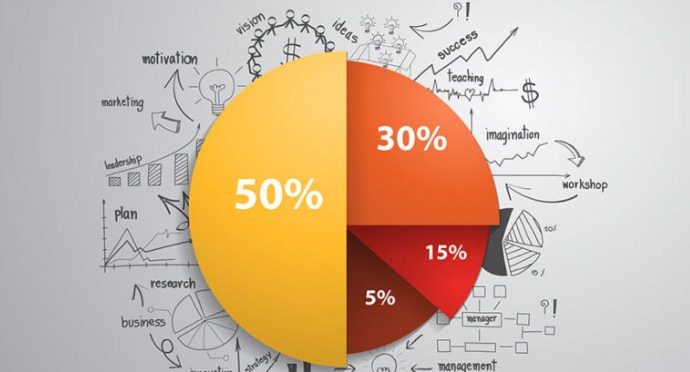

Shares of companies from the “second tier” – they can supplement the already existing set of securities. Feature: they allow you to earn more, but the financial risks in this case increase. How to assemble an investment portfolio for a beginner, what stocks and other securities to make up: https://youtu.be/qiwFndRDDCM Beginners should know that there is a concept of “salary for risk” in the stock market. The essence of the phenomenon is as follows: in the case, for example, of purchasing a bond that shows a yield of 10%, then the probability of making a profit is about 90%. Brokers will help you calculate the return on your investment portfolio. In order to collect the most optimal option, you must first pass a risk test. Brokers also provide high-quality analytics and courses. Another recommendation is to review the portfolio for the year. The correct creation of an investment portfolio today is not a guarantee that after a while it will not turn out to be less profitable. Timely verification will help to avoid problems. Example: A compiled portfolio consists of 20% bonds, 20% funds and 60% stocks. During the year, the shares showed growth – they rose in price and their share in the portfolio, respectively, increased. In order to maintain profitability, it is required to first sell part of the shares, and then buy additional assets with the received funds. In this way, it will be possible to restore the balance of the investment portfolio. During the year, the shares showed growth – they rose in price and their share in the portfolio, respectively, increased. In order to maintain profitability, it is required to first sell part of the shares, and then buy additional assets with the received funds. In this way, it will be possible to restore the balance of the investment portfolio. During the year, the shares showed growth – they rose in price and their share in the portfolio, respectively, increased. In order to maintain profitability, it is required to first sell part of the shares, and then buy additional assets with the received funds. In this way, it will be possible to restore the balance of the investment portfolio.

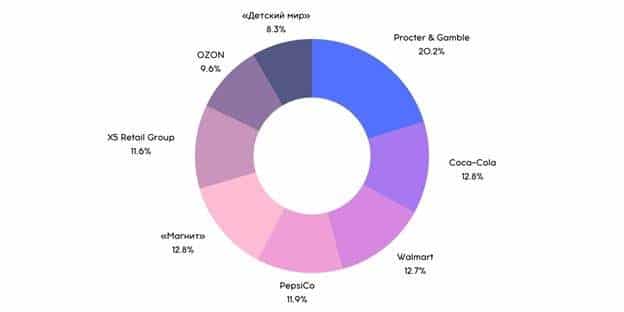

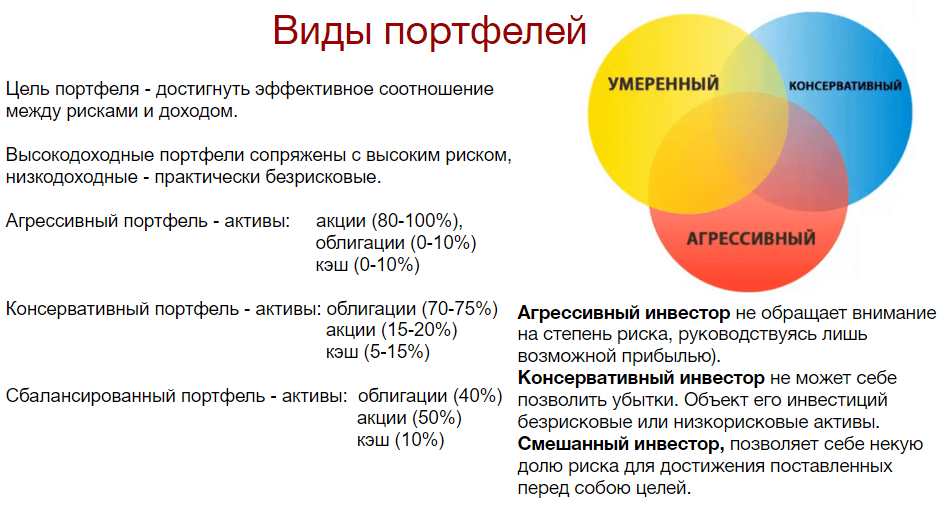

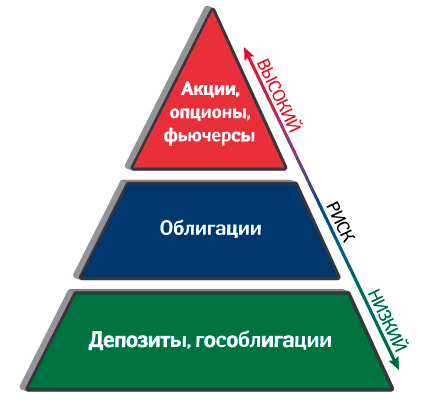

The risk of an investment portfolio directly depends on the division of deposits into aggressive and conservative components.

An example of collecting shares of well-known companies and manufacturers. It is not necessary to focus on domestic companies, it is better to separate:

- Retirement account . It is opened with the aim of generating additional income after retirement. In this case, it is recommended to form it on the basis of stocks and bonds of large companies that are able to show high returns even after 15-20 years. Example: investment portfolio of VTB or Sberbank.

- Children’s account – here you need to set a specific goal for yourself: education, buying real estate in 10-15 years. Feature: formation occurs using a high-risk stock (technology companies).

- Contingency expenses are another account option. Opening purposes: small or medium acquisitions, repairs, travel. It is best to choose bonds that have a short maturity. The yield and value of these securities must be known in advance.

An example of the formation of an investment portfolio that can immediately start working for its owner:

- Bonds – 5 types.

- Funds – 5 types.

- Company shares – 10 types

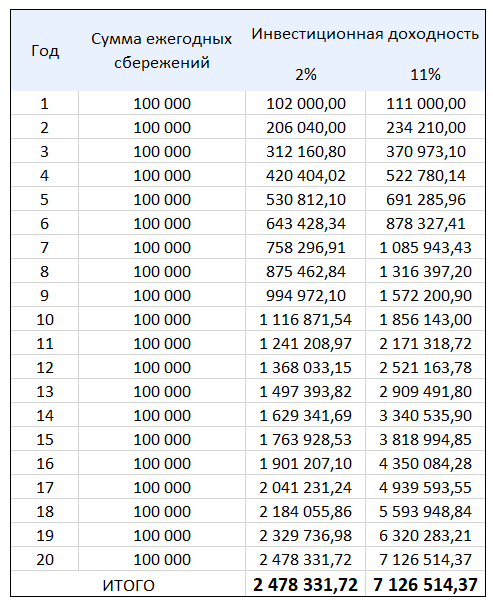

Compiling an investment portfolio of stocks and bonds – a portfolio of ETFs on the Moscow Exchange: https://youtu.be/HRwdC8eDAqA Stocks alone should not be preferred, especially without a thorough study of the dynamics and a preliminary understanding of what is happening on the market now. If you approach the issue of portfolio formation incorrectly, then the risks of significant financial losses increase by 2-3 times. Trading with the broker’s money is also not recommended for beginners. Margin trading is the process of buying assets with money received directly from a broker. Having no experience, the investor takes risks, because in the event that the transaction is unsuccessful, the broker has the right to close positions. An example when you need to save a significant amount (for retirement or a large purchase):

Principles of forming an investment portfolio – how to make an investment portfolio?

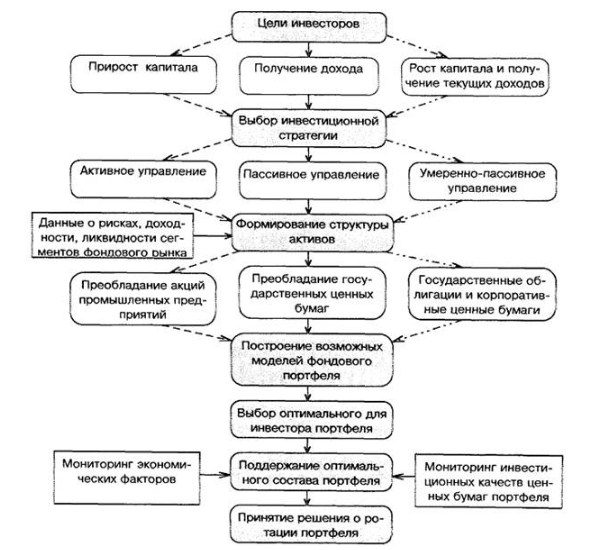

It is also necessary to take into account the general principles of forming an investment portfolio. It is important to be able to correctly set the main financial goal. The principle of formation consists of several stages:

- Specify the amount and terms of accumulation. For example, 4,500,000 rubles for 2.5 years for the subsequent purchase of a country house.

- Decide how much money will be deducted each month for investments. For example, 5% of the salary of each of the spouses. Here much depends on the goal set earlier. The best way is to use a calculator to calculate how much you need to save by dividing the total amount by the number of months.

- Pass the text at risk. It will help determine how high this indicator is. As a result, it will be possible to calculate the optimal structure. The composition of the portfolio depends not only on the information received, but also on the economic situation and a number of other factors that need to be taken into account.

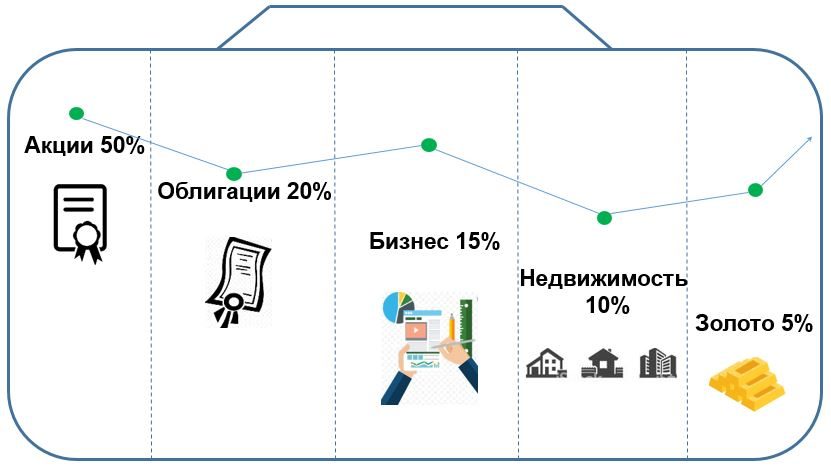

What can be included in an investment portfolio?

Since portfolio investment is a well-composed investment element, it can consist of various parts that can bring a certain income to its owner. Possible options from which they can be formed include:

- Various securities (stocks, bonds).

- Shares of investment funds.

- Currency (US dollar, pounds, euro, also yuan).

- Precious metals (gold, silver and platinum).

futures . If funds allow, then real estate, as well as various deposits, can be included in the investment portfolio. Brokers distinguish another special category – exotic assets. These include antiques, collection wine. Risky – investing in startups and various innovations. Depending on the chosen strategy, the composition of the portfolio will change. How to make an investment portfolio for 2022, what securities to buy: https://youtu.be/qYWOBxXHUlI

Types of investment portfolios

A profitable and competent investment portfolio can be of different types depending on the purpose of the investment and the internal state and temperament of the investor. Allocate:

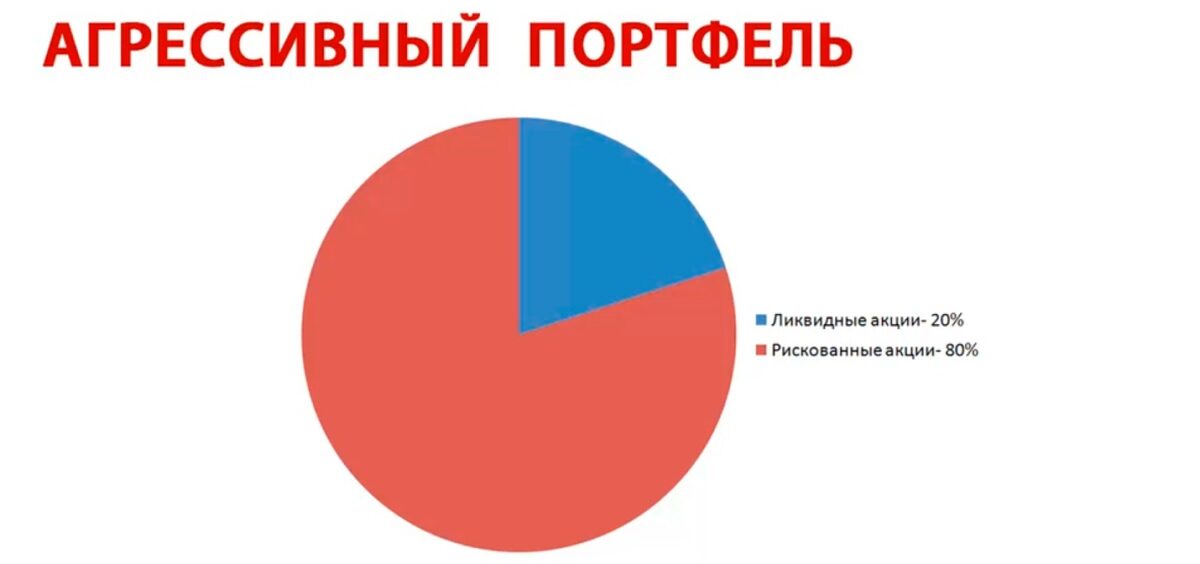

- Profitable or aggressive portfolio . Its main goal is high potential profitability. Feature: it is very volatile. In this case, the composition is completely formed from stocks with a large indicator of growth potential in the future. The challenge is to overtake the Moscow Exchange Index.

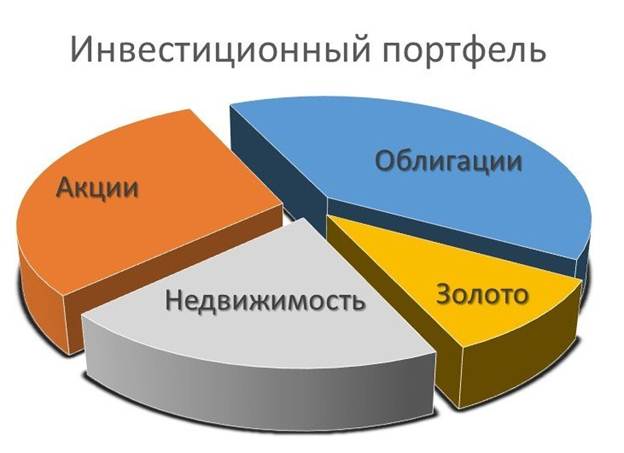

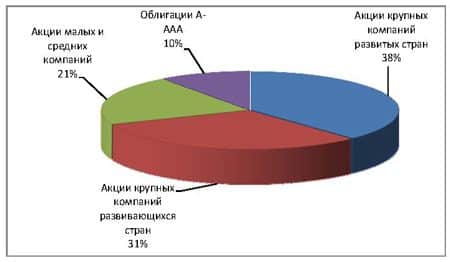

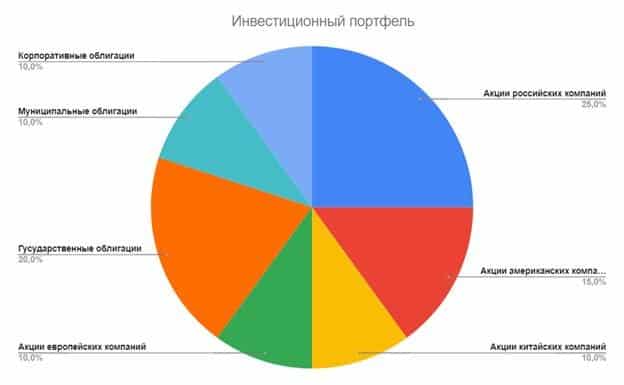

Aggressive investment portfolio - Universal or balanced portfolio . Its composition aims to provide a moderate rate of growth. It has a high resistance to market volatility. This is due to the wide diversification by asset class and currency used.

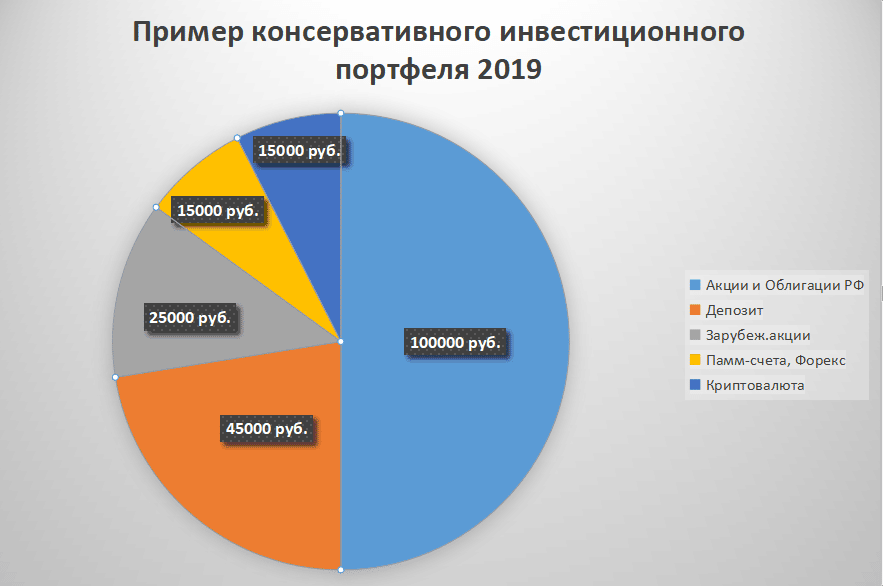

- A conservative portfolio aims for the minimum return, but with the minimum risk.

- Simple – the composition includes various securities. If they grow, the value of the portfolio itself also increases.

- High growth – is made up of the securities of those companies that demonstrate rapid and steady growth.

- Moderate growth – the composition includes securities of organizations with indicators of sustainable growth.

- Medium height – may consist of different papers.

Portfolio collection options depending on the timing, goals and other indicators

If you want to receive guaranteed additional income, then you need to know in advance how to create an investment portfolio with minimal risks from scratch and avoid mistakes. Among the options there is no single and universal for all potential investors. Each person chooses the composition on an individual basis, since it is impossible to predict in advance what the situation will be in the economy and the financial sector. Collection options depend on the timing. When choosing securities, it should be taken into account that the longer the investment period, the less investment in shares depends on short-term changes in market prices. At the same time, the indicator of potential income also depends on the timing indicators. If you choose the option of filling with bonds, then the situation will be as follows: the longer the period for which they are issued, the less predictable are the returns. Brokers recommend choosing this option if you want to solve short-term tasks and set less complex goals.

An example of an investment portfolio for a year

Collection example (term – 1 year, yield – about 50,000 rubles): ruble bonds. For short-term purposes (for example, travel, buying household appliances), it is better to build a portfolio mainly from bonds with a maturity of about a year. This is important, since a person will know in advance the exact (up to hundreds of rubles) amount that can be received in the end. It is risky to buy short-term stocks, because in the event of a fall, it will be almost impossible to quickly restore indicators. In extreme cases, you can purchase shares in the amount of not more than 10% of the value and the total volume of the investment portfolio. With the help of a broker, you can purchase a ready-made investment portfolio. It can also be compiled online.

An example of an investment portfolio for 3-5 years

Another option: the established period in this case is 3-5 years. Here you can give preference to both bonds and stocks. The share of their presence in the portfolio is 50/50 or 40/60. Feature: the longer the term, the greater the share of shares in the portfolio can be. Here you need to take into account that you need to increase the indicator of the number of shares in proportion to the timing. Research in the field of economics indicates that stocks will begin to make a profit in a period of 5-10 years. Balanced investment portfolio Examples of balanced investment portfolios: Some of the funds should be invested in real estate, some in art or precious metals. The structure is as follows: 25% each for stocks and bonds, real estate funds 15%, alternatives 20% and precious metals 15%. Investment portfolio: the correct proportion of stocks and bonds: https://youtu.be/seS4gI3oLqY A 50/50 portfolio is formed quite simply: stocks and bonds are included in equal amounts. Feature – each type of securities must be divided into Russian and foreign also in the amount of 50/50. You can additionally secure investments if you purchase securities that differ in terms of risk and return.

Questions and answers

What is the best investment portfolio? This is a kind of subjective option that meets the goals, objectives and expectations. The strategy option is selected based on the economic situation, the risk level indicator and the broker’s recommendations. It is necessary to give preference to the securities of large companies and enterprises that can withstand most of the negative manifestations in the market.

What is direct and portfolio investment?In the first case, it is customary to talk about investments that start working immediately. Portfolio investments are more difficult, as they are designed for a long-term effect. In most cases, portfolio investment differs from direct portfolio investment in terms of volume. Portfolio investment instruments: debt securities (including not only bonds, but also promissory notes), as well as shares. Portfolio investments are calculated for a shorter period than direct ones. It should be borne in mind that they have greater liquidity. Portfolio investments are aimed at making a profit, which is carried out by receiving interest or dividends. It should also be taken into account that the investor does not set as his main task the management of an enterprise or a certain project in which his own funds are invested. An investment portfolio is a modern way of multiplying invested funds. An investor who decides to form a profitable option should tune in to study the economic situation not only in the country, but also in the world. He will have to do a thorough and competent work with different market segments. In addition, it will require thoughtful strategizing. For this purpose, a careful selection of assets is made, consisting of several options. They must meet the set deadlines and goals. If all stages are carried out in accordance with the rules, then the investment portfolio will be profitable. There are no risks for the investor in this case. If we do not take into account the real indicators of the economy, the losses can be significant. Brokers can help you choose the best option. It is recommended to contact them before the purchase of shares,