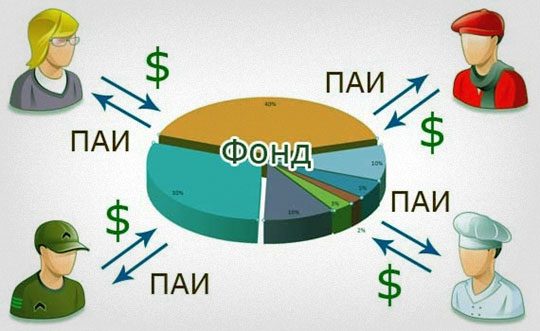

A mutual investment fund (MIF) is a portfolio of securities collected by a manager for people who want to invest. The point is that there is no need to collect a portfolio on your own, mutual funds are made up of professional market participants (

brokers , banking divisions, management companies) from several types of financial instruments and offer clients to buy a share of the mutual fund.

- Share of mutual fund

- Owners of mutual funds

- What mutual funds are there and who may suit which option

- How much is one share

- What is the difference between a PIF and an ETF?

- ETF funds

- In what situation can mutual funds be interesting?

- How to invest in mutual funds?

- Mutual fund profitability rating

- Sberbank mutual funds – what is a share in Sberbank?

- PIFs Tinkoff

- PIFs Alfa-Capital

- Investment term

- Risk

Share of mutual fund

When a client enters his personal account to buy a mutual fund, he is offered a choice of portfolios consisting of bonds and shares of different sectors: oil and gas, metalworking, raw materials, IT and others. The purchase price of the portfolio is a share of Pif or a share. It can be bought, sold, and even pledged, respectively. It is assumed that the price of a share will grow over time, if the strategy of this fund turns out to be competent, after some time the investor can sell his share at a higher price than he bought it and makes a profit, at least this is how it all looks in an ideal world.

Owners of mutual funds

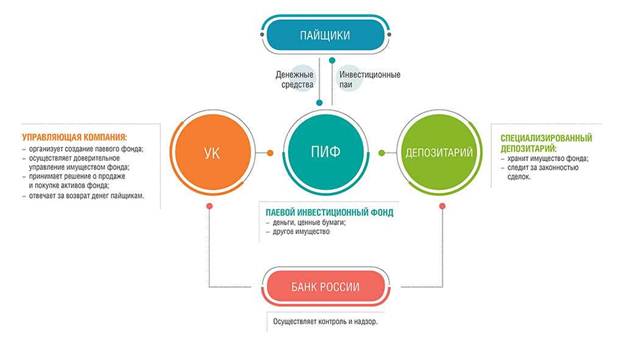

The funds of the mutual fund are managed by the management company; it is the employees of the management company who decide which instruments to buy with the money of the shareholders in order to bring them financial benefits. A management company is a financial institution. There are about 50 large management companies in Russia, the best of which are part of a major financial group. For example, the Sberbank financial group, which includes a bank, a brokerage company and a management company – Sberbank Asset Management.

What mutual funds are there and who may suit which option

If an investor is thinking of investing in solders, there are several factors to consider:

- Mutual funds vary in the direction of investment , that is, there are mutual funds that invest in stocks, bonds, currency, real estate, precious metals and art. But you need to understand that stock mutual funds do not always send one hundred percent of all money to stocks, as a rule, there are certain fixed restrictions, for example, if this is a stock fund, then 80% of the money should be invested in stocks, 20% can fall on bonds.

- There are mixed mutual funds that invest 50 to 50%. Half of it goes to stocks, the rest to bonds. In Russia, they are divided into PIFs for qualified investors who invest in any assets, even the most risky ones, as well as PIFs available to a wide audience: unqualified investors, or retail. Their range of available assets is limited by the least risky financial instruments.

. Therefore, when an investor understands where the unit investment fund will invest his money, it is worthwhile to get acquainted with the investment declaration of each unit investment fund, because it clearly states what share of funds and what management companies have the right to invest in. In addition to the instruments where depositors’ money goes, mutual funds differ in terms of their ability to buy and sell shares in terms of terms. There are 3 main categories here:

- open PIFs, shares of which can be bought and redeemed literally every day. Such PIFs, in view of the fact that money can be quickly withdrawn from them, invests in liquid assets, for example, in blue-chip stocks , for which there is always a demand;

- interval funds – units that can be bought or sold at specific intervals. Typically, this can be done several times a year;

- The third category is closed-end funds, the shares of which can be bought in general only at the moment when the fund is formed and sold when the fund is closed.

The second and third types – interval and closed-end funds can afford to invest in less liquid instruments, because they predict when depositors can withdraw money from them. Less liquid instruments, on the one hand, have more risks, but on the other hand, they have better potential for profit. Therefore, it is better for conservatives to choose open PIFs. If the investor is ready to take the risk, then interval or closed ones will do.

How much is one share

We remind you that the price of a share changes every day, and accordingly it depends directly on the value of the assets that the fund has acquired. Investors’ income will be determined by how much the share price has risen. You can track the dynamics of the share price on the website of management companies and in other open sources. These funds publish the share price every day at the end of the day, and interval and closed funds at least once a month. When buying a share, the investor pays a premium. It, depending on the amount of invested funds, and the agent through whom the purchase of PIFs is made, can reach 5 percent of the investment amount. When you sell a share, you do it with a so-called discount. It depends on how long the investor has owned the share, on the specific conditions of the agent. As a rule, the discount does not exceed three percent of its cost.

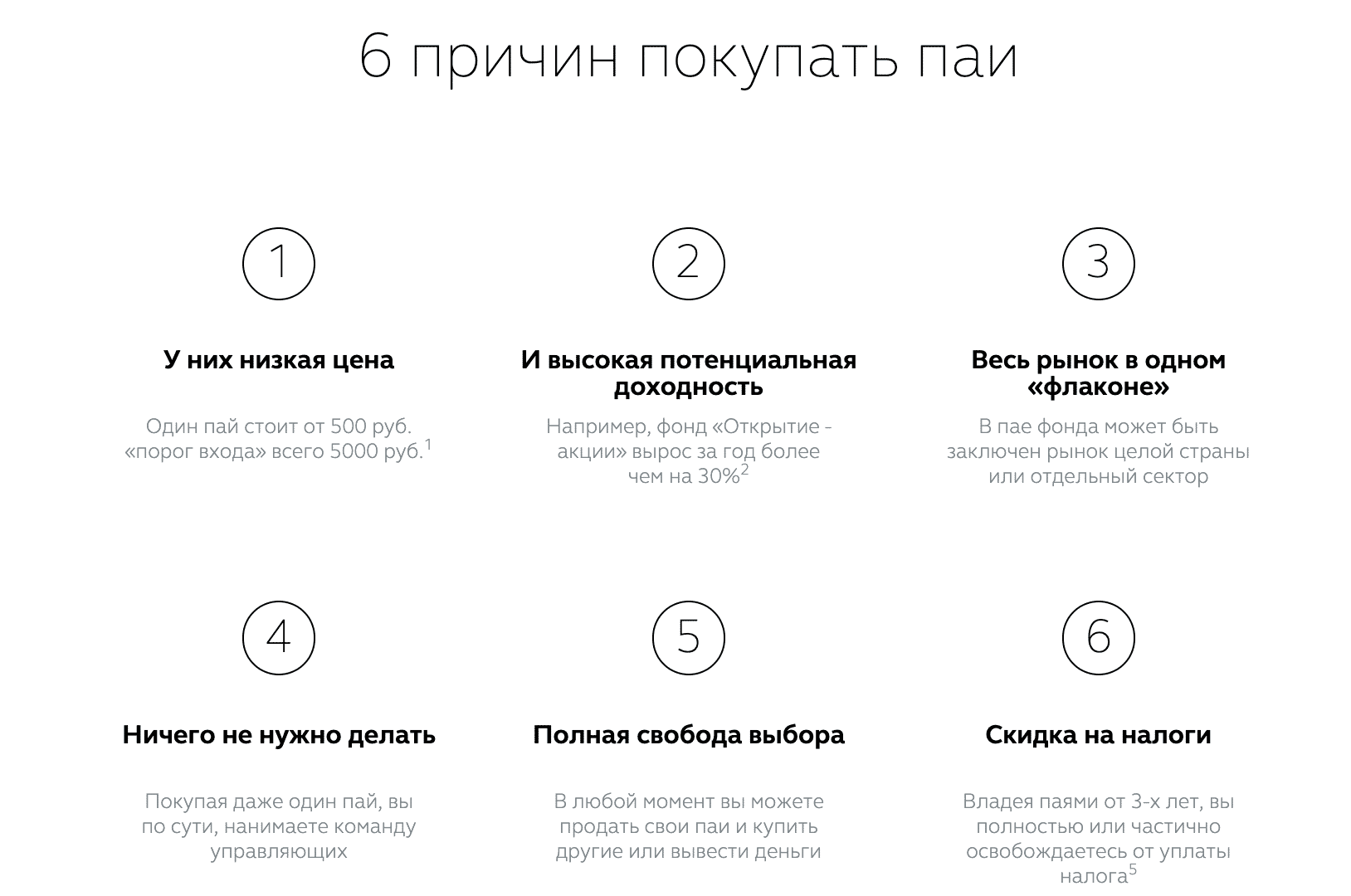

- Availability . Investments in mutual funds have a low entry threshold. You can start from 1000 rubles

- Professionalism in management . Investors’ money is managed by experts. In fact, this argument is controversial, because experts technically know how to invest: open an account, buy financial instruments, set a condition for opening a deal. But experts do not know what to buy in order to become a millionaire tomorrow, because, unfortunately, financial markets are inherently unpredictable. Therefore, sometimes, the octopus Paul can give more accurate stock predictions than an expert with many years of experience.

- High profitability . When mutual funds are sold, the buyer is told about a potentially high income, which will be higher than the income on deposits. Firstly, the income from a mutual investment fund is not guaranteed in any way and the mutual fund invests in some type of assets. If the market does not grow during that period of time while the investor owns the PIF, then the PIF will not show any profitability, while the profitability of the deposit is still fixed. In general, it is fair to compare the profitability of mutual funds not with a deposit, but with an index. Then you can understand how much more profitable active management – just investing in the index.

- They talk about low commissions , but the information is not always true. Pifs are a story quite expensive for the person who buys them and, naturally, it is much more expensive than investing on your own.

- Liquidity . Units of open-ended funds can be sold at any time without additional losses, this is true, but if we talk about shares in liquid instruments, then this can be done at any time without additional losses.

- Preferential taxation . Some financial companies say that with the growth of mutual fund assets, investors can be exempted from income tax if they earned less than three million rubles a year on shares, if they hold shares for more than three years. This is the same as with the conventional market and the stock market. Accordingly, income tax on an increase in the value of assets is not paid.

What is the difference between a PIF and an ETF?

Today ETF is gaining popularity

, that is, funds traded on the exchange, they are more popular than the good old retro Grad Pifs. If we compare PIFs and ETFs, then the advantages of the second lie on the surface.

- Firstly, they are more liquid, easier to buy, they are purchased through a brokerage account or we can also buy it on other platforms, and tax incentives are provided.

- Mutual funds are purchased at the office of the management company, on their website. It is impossible to buy unit investment funds through a brokerage account and other platforms. This is a negative point.

- The mutual funds are actively managed. Managers are always trying to overtake the index, while ETFs almost always follow the stock index.

- For a mutual fund, if the commission is in the range of 3.5 percent, excluding markups and discounts, then the ETF has a lower commission. In Russia it is less than one percent and no additional surprises should be expected here.

ETF funds

Investment funds are gradually becoming obsolete when it comes to mutual funds that offer to invest in exchange-traded instruments. There are two alternatives on the surface here:

- Investing in ETFs is usually a more profitable alternative for the investor than a mutual fund.

- The second alternative is the independent purchase of stocks, bonds, and other financial instruments : to an individual investment account for a long-term investment, and then the subsequent receipt of a tax deduction.

no worse than professional managers can do it for him. Another thing is that for this you need to have certain skills, if the investor does not have such skills, then it is better to buy ETF funds.

In what situation can mutual funds be interesting?

For example, if a person is looking at real estate, then real estate mutual funds can become a unique tool for him. This is actually the Russian analogue of American rates. Or mutual funds that invest in art, because it is quite difficult for an investor without specific skills to invest in the IT industry, then mutual funds here help everyone who wants to try in this area to do it.

How to invest in mutual funds?

In order to invest in a mutual investment fund, you will need to open an account with a broker, if the account is open, then it remains to find a tab with a list of mutual funds and select the appropriate one. The opinion of professionals is good, but it is advisable for an investor to understand the basics of economics and have an idea of the stock market, if possible, consult with a broker. This makes it easier to choose a suitable mutual fund.

Important: check for a license on the website: https://www.cbr.ru/registries/RSCI/activity_uk_if/

Mutual fund profitability rating

| Mutual fund | Profitability | Site |

| Capital System – Mobile | 14.88% | https://sistema-capital.com/catalog/ |

| URALSIB Gold | 3.66% | https://www.uralsib.ru/investments-and-insurance/ivestitsii/paevye-investitsionnye-fondy-pif-/ |

| Sberbank – Global debt market | 2.58% | https://www.sber-am.ru/individuals/fund/ |

| RGS-Gold | 2.09% | https://www.rgsbank.ru/personal/investment/pif/open/ |

| Raiffeisen – Gold | 2.02% | https://www.raiffeisen.ru/retail/deposit_investing/funds/ |

| Gazprombank – Gold | 1.75% | https://www.gpb-am.ru/individual/pif |

| New construction | 1.72% | http://pif.naufor.ru/pif.asp?act=view&id=3164 |

| Capital-gold | 1.69% | http://www.kapital-pif.ru/ru/about/ |

Mutual investment funds (mutual funds): what is and how a mutual fund works, a rating of the best mutual funds in terms of profitability: https://youtu.be/GB_UJvUDy_s

Sberbank mutual funds – what is a share in Sberbank?

Sberbank is a recognizable and reliable bank that has existed for over 100 years. It is reasonable to invest in such a bank, and for this there are many types of mutual funds, we will highlight the main ones:

- Bond Fund – Ilya Muromets ( https://www.sberbank.ru/ru/person/investments/pifs/fund_bond_im ). Consists of government, municipal, corporate bonds of reliable Russian issuers. Receives income from coupon payments and growth in the value of the asset. Unit investment fund with a low risk percentage of 0-5%, income above inflation 8-10% and moderate liquidity.

- Equity and Bond Fund – Balanced ( https://www.sberbank.ru/ru/person/investments/pifs/fund_balanced ). A mixed mutual fund combines two types of securities. Profits from capital gains, bond income. Invests mainly in Russian financial instruments, yield 10-20%, high risk and moderate liquidity.

- The Dobrynya Nikitich Fund ( https://www.sberbank.ru/ru/person/investments/pifs/fund_equity_dn- ) consists of shares of Russian companies. That makes the fund highly risky, profitable 15-20% and maintains moderate liquidity.

Exchange-traded mutual funds of Sberbank: is it worth investing – BPIFs SBMX, SBSP, SBRB, SBCB and SBGB: https://youtu.be/DBRrF-z-1do

PIFs Tinkoff

It occupies a leading position among popular brokers, ranks first in the number of active clients and investments in bank mutual funds, is considered a reliable and profitable business.

- The eternal RUB portfolio ( https://www.tinkoff.ru/invest/etfs/TRUR/ ) – The fund invests money in three instruments, Russian stocks and bonds, and gold. Investing in various financial instruments allows you to admit minimal risk when investing, but at the same time makes it a low profitable 5-10%. Entrance price 6, 04 rubles.

- Perpetual income USD ( https://www.tinkoff.ru/invest/etfs/TUSD/ ) – provides for investments in American stocks, bonds and gold in three equal shares. Return in dollars 5-10%, with a low level of risk. The share price is $ 0.2.

- Eternal income EU R ( https://www.tinkoff.ru/invest/etfs/TEUR/ ) – provides for investments in European stocks, bonds and gold in three equal shares. Profitability in EUR 3-5%, low risk. The investment cost is 0.10 euros.

PIFs Alfa-Capital

The management company offers an interesting type of investment in various international and Russian companies. Professionals analyze each company and then invest.

- Resource ( https://www.alfacapital.ru/individual/pifs/opifa_akn/ ) – the manager is looking for and analyzing promising shares in the oil and gas and petrochemical, mining sectors. The yield is 15-30%.

- Liquid shares ( https://www.alfacapital.ru/individual/pifs/opifa_akliq/ ) – the largest Russian and foreign issuers with the best financial performance and growth prospects are selected. The yield is 15-25%.

- Balance ( https://www.alfacapital.ru/individual/pifs/opif_aks/ ) – investments in the best Russian stocks and bonds. Moderate risk and 15-20% return.

Investment term

An investor can buy and sell a share in one day, but you need to understand that then funds are lost on commissions. The longer you hold a share, the more profitable is the investment, luring with beautiful numbers with high profitability mean a period of 3 or 5 years, a month of investment may not add to the value of the share.

Risk

There are different shares with a low level of risk, but then the yield will be lower. The higher the yield, the higher the risk. Since financial instruments are not insured against market fluctuations and if the market falls, the value of the fund may fall.

i would like to invested.