Mutual fund (PIF) yɛ sikakorabea ahorow a ɔpanyin bi boaboa ano ma nnipa a wɔpɛ sɛ wɔde wɔn sika hyɛ mu. Asɛm no ne sɛ enhia sɛ w’ankasa woboaboa portfolio ano, mutual funds no yɛ adwumayɛfo a wɔde wɔn ho hyɛ gua so (

brokers , banking divisions, management companies) a wofi sikasɛm mu nnwinnade ahorow pii mu na wɔde ma adetɔfo sɛ wɔntɔ mutual fund no mu kyɛfa.

- Mutual fund no mu kyɛfa

- Mutual Fund Nwuranom

- Mutual funds bɛn na ɛwɔ hɔ ne ɔkwan bɛn na ebia ɛbɛfata hena

- Kyɛfa biako yɛ ahe

- Nsonsonoe bɛn na ɛwɔ mutual fund ne ETF ntam?

- ETF ahorow

- Tebea bɛn mu na sika a wɔde boa wɔn ho wɔn ho betumi ayɛ nea mfaso wɔ so?

- Ɔkwan bɛn so na wɔde wɔn sika bɛto mutual funds mu?

- mutual fund yield ho nkyerɛkyerɛmu

- Mutual funds a ɛwɔ Sberbank mu – dɛn ne kyɛfa wɔ Sberbank mu?

- Sika a Wɔde Yɛ Adwuma Tinkoff

- Sika a Wɔde Yɛ Adwuma Alfa Capital

- Sikasɛm mu asɛmfua

- Ahudeɛ

Mutual fund no mu kyɛfa

Sɛ obi a ɔregye nneɛma no hyɛn n’ankasa akontaabu mu sɛ ɔrekɔtɔ sikakorabea a, wɔma no sika a ɔpaw a ɛyɛ bonds ne stock ahorow a ɛwɔ nnwuma ahorow mu: ngo ne gas, dade adwumayɛ, nneɛma a wɔde yɛ adwuma, IT ne afoforo. Bo a wɔde tɔ portfolio no yɛ mutual fund anaa kyɛfa mu kyɛfa. Wobetumi atɔ, atɔn, na mpo wɔde ahyɛ dan mu sɛnea ɛfata. Wɔfa no sɛ kyɛfa bi bo bɛkɔ soro bere kɔ so, sɛ sikakorabea yi nhyehyɛe no danee sɛ ɛfata a, bere bi akyi no nea ɔde ne sika hyɛ mu no betumi atɔn ne kyɛfa no de agye nea ɛboro nea ɔtɔɔ no na wanya mfaso a, anyɛ yiye koraa no eyi te saa sɛnea ne nyinaa te wɔ wiase a eye sen biara mu.

Mutual Fund Nwuranom

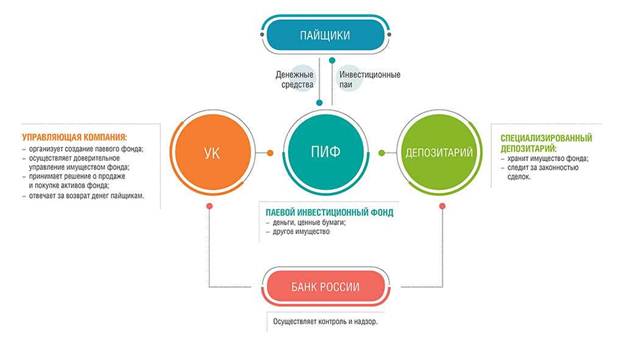

Sika a ɛwɔ mutual fund no mu no, adwumakuw a ɛhwɛ so no na ɛhwɛ so, ɛyɛ adwumakuw a ɛhwɛ so no adwumayɛfo na wosi nnwinnade a wɔde kyɛfafo no sika bɛtɔ ho gyinae sɛnea ɛbɛyɛ a wɔde sikasɛm mu mfaso bɛbrɛ wɔn. Adwumakuw a ɛhwɛ nneɛma so no yɛ sikasɛm ahyehyɛde. Nnwumakuw akɛse a wɔhwɛ so no bɛyɛ 50 na ɛwɔ Russia, na emu nea eye sen biara no ka sikasɛm kuw kɛse bi ho. Sɛ nhwɛso no, sikasɛm kuw Sberbank, a sikakorabea, brokerage adwumakuw ne adwumakuw a ɛhwɛ so ka ho – Sberbank Asset Management.

Mutual funds bɛn na ɛwɔ hɔ ne ɔkwan bɛn na ebia ɛbɛfata hena

Sɛ obi a ɔde ne sika hyɛ mu resusuw ho sɛ ɔde ne sika bɛto kyɛfa mu a, nneɛma pii wɔ hɔ a ɛsɛ sɛ wususuw ho:

- Mutual funds gu ahorow wɔ ɔkwan a wɔfa so de sika hyɛ mu no mu , kyerɛ sɛ, mutual funds wɔ hɔ a wɔde wɔn sika hyɛ stocks, bonds, sika, adan ne afie, dade a ɛsom bo ne adwinni mu. Nanso ɛsɛ sɛ wote ase sɛ ɛnyɛ bere nyinaa na mutual funds of shares no de sika nyinaa mu ɔha biara mu ɔha kɔ shares mu, sɛnea mmara kyerɛ no, anohyeto ahorow bi a wɔahyɛ da ahyɛ da wɔ hɔ, sɛ nhwɛso no, sɛ ɛyɛ mutual fund of shares a, ɛnde 80% wɔ ɛsɛ sɛ wɔde sika gu kyɛfa mu, 20% betumi ahwe ase wɔ bonds so.

- Mutual funds a wɔadi afra wɔ hɔ a wɔde wɔn sika hyɛ mu 50% kɔsi 50%. Wɔde fã ma stocks, na wɔde nea aka no ma bonds. Wɔ Russia no, wɔakyekyɛ mu ayɛ no sika a wɔde boa wɔn ho wɔn ho ma wɔn a wɔfata a wɔde wɔn sika hyɛ agyapade biara mu, nea asiane wom sen biara mpo mu, ne sika a wɔde boa wɔn ho wɔn ho a atiefo pii betumi anya: wɔn a wɔde wɔn sika hyɛ mu a wɔmfata, anaasɛ wɔn a wɔde wɔn sika hyɛ aguadidan mu. Wɔn agyapade ahorow a ɛwɔ hɔ no yɛ sikasɛm mu nnwinnade a asiane nnim koraa nkutoo.

. Enti, sɛ obi a ɔde ne sika hyɛ mu te baabi a mutual fund no de ne sika bɛto mu ase a, ɛfata sɛ ohu mutual fund biara sikasɛm ho mpaemuka no yiye, efisɛ ɛkyerɛ pefee sɛ sika no mu kyɛfa bɛn ne nnwumakuw a wɔhwɛ so no wɔ hokwan sɛ wɔde wɔn sika hyɛ mu. Wɔ nnwinnade a wɔn a wɔde sika gu mu no sika kɔ mu akyi no, ɛsono sika a wɔde boa wɔn ho wɔn ho no wɔ kyɛfa a wɔtɔ ne nea wɔtɔn mu wɔ bere ho. Nneɛma atitiriw 3 na ɛwɔ ha:

- open mutual funds, a wobetumi atɔ ne kyɛfa na wɔagye no da biara da ankasa. Sikakorabea ahorow a ɛte saa a wɔde boa wɔn ho wɔn ho no, esiane nokwasɛm a ɛyɛ sɛ wobetumi agye sika afi wɔn nsam ntɛmntɛm nti, wɔde wɔn sika hyɛ agyapade a ɛyɛ nsu mu, sɛ nhwɛso no, wɔ blue chips mu kyɛfa mu , a wɔhwehwɛ bere nyinaa;

- interval funds – units a wobetumi atɔ anaa wɔatɔn wɔ bere pɔtee bi mu. Sɛnea mmara kyerɛ no, wobetumi ayɛ eyi mpɛn pii afe biara;

- Ɔfã a ɛtɔ so mmiɛnsa ne sikakorabea a wɔato mu , a mpɛn pii no wobetumi atɔ ne kyɛfa wɔ bere a wɔrehyehyɛ sikakorabea no nkutoo, na wɔatɔn bere a wɔato sikakorabea no mu.

Nneɛma ahorow a ɛto so abien ne nea ɛto so abiɛsa – interval ne closed-end sikakorabea betumi atua sika de ahyɛ nnwinnade a ɛnyɛ nsu pii mu, efisɛ ɛhyɛ bere a sikasɛm mu asisifo betumi ayi sika afi wɔn mu ho nkɔm. Ɔkwan biako so no, nnwinnade a nsu pii nnim no wɔ asiane pii, nanso ɔkwan foforo so no, ɛwɔ mfaso a eye. Enti, eye sɛ wɔn a wɔpɛ abrabɔ pa no bɛpaw sika a wɔde boa wɔn ho wɔn ho a wɔabue ano. Sɛ nea ɔde ne sika hyɛ mu no ayɛ krado sɛ ɔde ne ho bɛto asiane mu a, ɛnde interval anaa nea wɔato mu no bɛyɛ yiye.

Kyɛfa biako yɛ ahe

Yɛkae wo sɛ kyɛfa bi bo sesa da biara, na sɛnea ɛte no, egyina agyapade a sikakorabea no anya no bo so tẽẽ. Wɔnam sɛnea kyɛfa no bo akɔ soro no so na ɛbɛkyerɛ sika a wɔn a wɔde wɔn sika bɛto mu no benya. Wubetumi adi kyɛfa bi bo a ɛkɔ so no akyi wɔ nnwumakuw a wɔhwɛ so no wɛbsaet ne mmeae afoforo a wɔabue mu. Saa sikakorabea ahorow yi tintim kyɛfa bo da biara da wɔ da no awiei, ne ntamgyinafo ne nea wɔato mu anyɛ yiye koraa no pɛnkoro ɔsram biara. Sɛ obi a ɔde ne sika hyɛ mu no retɔ kyɛfa a, otua sika bi. Ɛgyina sika dodow a wɔde ahyɛ mu, ne ɔnanmusifo a wɔnam so tɔ sika a wɔde bɛbom ayɛ adwuma no so no betumi adu sika a wɔde ahyɛ mu no ɔha biara mu nkyem 5 ho. Sɛ woretɔn kyɛfa bi a, wode nea wɔfrɛ no sika a wɔatew so na ɛyɛ saa. Egyina bere tenten a sikakorafo no anya kyɛfa no so, wɔ tebea pɔtee a ɔnanmusifo no wɔ so. Sɛnea mmara kyerɛ no, sika a wɔatew so no ntra ne bo no ɔha biara mu nkyem abiɛsa.

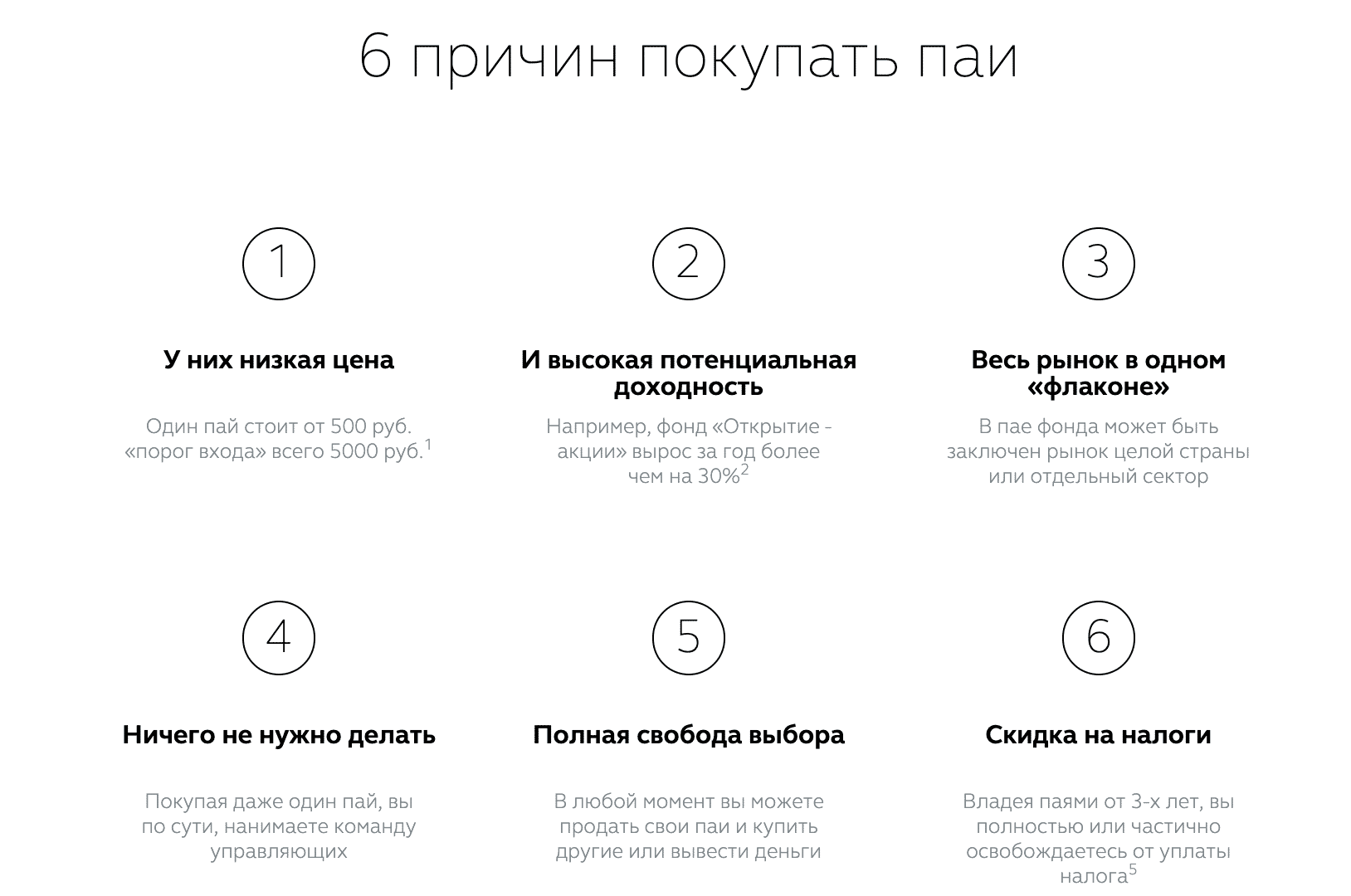

- Nneɛma a ɛwɔ hɔ . Sika a wɔde hyɛ mutual funds mu no wɔ anohyeto a ɛba fam a wɔde hyɛn mu. Wubetumi afi ase afi 1000 rubles

- Adwumayɛfo a wɔyɛ adwumaden wɔ adwumayɛ mu . Abenfo na wɔhwɛ wɔn a wɔde wɔn sika hyɛ mu no sika so. Nokwarem no, saa akyinnyegye yi yɛ nea wontumi nsusuw ho, efisɛ abenfo nim sɛnea wɔde wɔn sika hyɛ mu wɔ mfiridwuma mu: bue akontaabu, tɔ sikasɛm ho nnwinnade, hyehyɛ tebea bi a wɔde bebue aguadi. Nanso abenfo nnim nea wɔbɛtɔ na wɔabɛyɛ ɔpepepemfo ɔkyena efisɛ, awerɛhosɛm ne sɛ, sikasɛm mu gua ahorow no fi awosu mu no, wontumi nhu nea ɛbɛba daakye. Enti, ɛtɔ mmere bi a, Paul the octopus betumi de stock ho nkɔmhyɛ a edi mu ama sen onimdefo a ɔwɔ mfe pii osuahu.

- Nnɔbae pii a wonya . Sɛ wɔtɔn sika a wɔde boa wɔn ho wɔn ho a, wɔka sika kɛse a ebetumi aba sɛ obenya, a ɛbɛdɔɔso asen sika a wobenya afi sika a wɔde asie mu no ho asɛm kyerɛ nea ɔretɔ no. Nea edi kan no, wɔmfa sika a wobenya afi mutual fund mu no nhyɛ bɔ wɔ ɔkwan biara so na mutual fund no de ne sika hyɛ agyapade bi mu. Sɛ gua no annyin wɔ saa bere no mu bere a ɔdefo no wɔ sikakorabea no a, ɛnde sikakorabea no renkyerɛ mfaso biara, bere a mfaso a wobenya afi sika a wɔde asie no mu no da so ara wɔ hɔ. Mpɛn pii no, ɛfata sɛ wɔde sika a wonya fi mutual sika mu no toto ho a ɛnyɛ sika a wɔde asie, na mmom wɔde toto index ho. Afei wobɛtumi ate sɛdeɛ active management yɛ mfasoɔ kɛseɛ ase – sɛ wode sika bɛto index no mu kɛkɛ.

- Wɔka commissions a ɛba fam ho asɛm , nanso ɛnyɛ bere nyinaa na nsɛm no yɛ nokware. Sika a wɔde boa wɔn ho wɔn ho yɛ asɛm a ne bo yɛ den yiye ma onipa a ɔtɔ no, na nokwarem no, ne bo yɛ den sen sɛ w’ankasa wode sika bɛto mu.

- Nsu a wɔde yɛ adwuma . Wobetumi atɔn sika a wɔabue mu kyɛfa bere biara a wɔrenhwere ade foforo, eyi yɛ nokware, nanso sɛ yɛka kyɛfa a ɛwɔ nnwinnade a ɛyɛ nsu mu ho asɛm a, ɛnde wobetumi ayɛ eyi bere biara a wɔrehwere ade foforo biara.

- Towtua a wɔpɛ . Sikasɛm nnwumakuw binom ka sɛ esiane sɛ mutual fund agyapade renya nkɔanim nti, sɛ wɔn a wɔde wɔn sika hyɛ mu no nya sika a ennu ruble ɔpepem abiɛsa afe biara wɔ kyɛfa ho a, sɛ wokura kyɛfa bɛboro mfe abiɛsa a, wobetumi ayi wɔn afi tow a wɔbɔ wɔ sika a wonya fi mu no ho. Eyi te sɛ nea ɛte wɔ gua a wɔyɛ no daa ne sikakorabea ahorow no ho no ara pɛ. Nea ɛne eyi hyia no, wontua tow a wɔbɔ wɔ sika a wonya fi agyapade bo a ɛkɔ soro no ho.

Nsonsonoe bɛn na ɛwɔ mutual fund ne ETF ntam?

Ɛnnɛ, ETF adwinnade no renya agye din

, kyerɛ sɛ, sika a wɔde di gua wɔ exchange no so, wɔpɛ wɔn asɛm sen retro-grad mutual sika dedaw pa no. Sɛ yɛde mutual funds ne ETFs toto ho a, ɛnde mfaso a ɛwɔ nea ɛto so abien no so no da adi pefee.

- Nea edi kan no, wɔyɛ nsu pii, ɛnyɛ den sɛ wobɛtɔ, wɔnam brokerage akontaabu so tɔ anaasɛ yebetumi nso atɔ wɔ platform afoforo so, towtua mu mfaso nso wɔ hɔ.

- Wɔtɔ sika a wɔde boa wɔn ho wɔn ho wɔ adwumakuw a ɛhwɛ so no adwumayɛbea, wɔ wɔn wɛbsaet so. Ɛrentumi nyɛ yiye sɛ wobɛtɔ mutual fund denam brokerage account ne platform afoforo so. Eyi yɛ asɛm a enye.

- Wɔhwɛ sika a wɔde boa wɔn ho wɔn ho mu no so denneennen. Bere nyinaa adwuma so ahwɛfo bɔ mmɔden sɛ wɔbɛyɛ adwuma asen index no, bere a ɛkame ayɛ sɛ bere nyinaa na ETF ahorow di stock index no akyi.

- Wɔ mutual fund fam no, sɛ commission no wɔ ɔha biara mu nkyem 3.5 mu, a yɛnkan markups ne discounts a, ɛnde wɔ ETFs fam no, commission no sua. Wɔ Russia no, eyi nnu ɔha biara mu biako, na ɛnsɛ sɛ wɔhwɛ nneɛma foforo biara a ɛyɛ nwonwa kwan wɔ ha.

ETF ahorow

Sika a wɔde hyɛ mu no reyɛ nea ne bere atwam nkakrankakra bere a ɛfa sikakorabea ahorow a wɔde wɔn ho hyɛ mu a ɛkyerɛ sɛ wɔde wɔn sika bɛto nnwinnade a wɔde sesa nneɛma mu no ho no. Nneɛma abien na ɛwɔ hɔ a wobetumi de asi ananmu wɔ ha:

- Mpɛn pii no, sika a wɔde bɛto ETF mu no yɛ ɔkwan foforo a mfaso wɔ so kɛse ma obi a ɔde ne sika hyɛ mu sen sikakorabea.

- Ɔkwan a ɛto so abien ne sɛ wɔbɛtɔ kyɛfa, nkrataa, sikasɛm mu nneɛma afoforo a wɔde wɔn ho : akɔ ankorankoro sikasɛm akontaabu mu ama sika a wɔde ahyɛ mu bere tenten, na afei wɔagye tow a wɔatew so akyiri yi.

sikakorabea bi ama ne ho a ɛnyɛ bɔne sen sɛnea adwuma so ahwɛfo a wɔyɛ adwumaden yɛ ma no no. Adeɛ foforɔ ne sɛ yei nti ɛhia sɛ wonya ahokokwaa bi, sɛ investor bi nni nimdeɛ a ɛte saa a, ɛnde ɛyɛ papa sɛ wobɛtɔ ETF sika.

Tebea bɛn mu na sika a wɔde boa wɔn ho wɔn ho betumi ayɛ nea mfaso wɔ so?

Sɛ nhwɛso no, sɛ obi rehwɛ adan ne afie a, ɛnde sika a wɔde boa adan ne afie no betumi abɛyɛ adwinnade soronko ama no. Eyi ne Russiafo a wɔde Amerikafo bo a wɔde di dwuma no di nsɛ ankasa. Anaasɛ mutual funds a ɛde sika hyɛ adwinni nneɛma mu, efisɛ ɛyɛ den yiye ma investor a onni nimdeɛ pɔtee bi sɛ ɔde ne sika bɛto IT adwumayɛ mu, afei mutual funds a ɛwɔ ha boa obiara a ɔpɛ sɛ ɔbɔ mmɔden wɔ saa beae yi ma ɔyɛ eyi.

Ɔkwan bɛn so na wɔde wɔn sika bɛto mutual funds mu?

Sɛnea ɛbɛyɛ a wode wo sika bɛto mutual fund mu no, ɛho behia sɛ wubue akontaabu wɔ broker bi nkyɛn, sɛ akontaabu no abue a, ɛnde aka sɛ wobɛhwehwɛ tab a mutual funds no din wom no na woapaw nea ɛfata. Adwene a adwumayɛfo no wɔ no ye, nanso ɛyɛ papa sɛ obi a ɔde ne sika bɛto sikakorabea no bɛte sikasɛm mu mfitiasesɛm ase na wanya adwene bi afa sikakorabea no ho, sɛ ɛbɛyɛ yiye a, afei ɔne obi a ɔtɔn nneɛma no besusuw ho. Eyi ma ɛyɛ mmerɛw sɛ wobɛpaw PIF a ɛfata.

Nea ɛho hia: hwɛ sɛ tumi krataa bi wɔ hɔ wɔ wɛbsaet no so: https://www.cbr.ru/registries/RSCI/activity_uk_if/ .

mutual fund yield ho nkyerɛkyerɛmu

| sika a wɔde boa wɔn ho wɔn ho | So | Wɛbsaet no |

| Nhyehyɛe Kapital – Mobile | 14.88% na ɛwɔ hɔ. | https://sistema-ahenkurow.com/catalog/ Nsɛmma nhoma no mu nsɛm. |

| URALSIB Sika kɔkɔɔ | 3.66% na ɛwɔ hɔ. | https://www.uralsib.ru/sika-sika-ne-insurance/ivestitsii/paevye-sika-sika-sika-fondy-pif-/ |

| Sberbank – Wiase nyinaa bosea ho gua | 2.58% na ɛwɔ hɔ. | https://www.sber-am.ru/ankorankoro/sika/ |

| RGS-Zoloto a ɔyɛ ɔkyerɛwfo | 2.09% na ɛwɔ hɔ. | https://www.rgsbank.ru/ankorankoro/sikasɛm/pif/bue/ |

| Raiffeisen – Sika kɔkɔɔ | 2.02% na ɛwɔ hɔ. | https://www.raiffeisen.ru/retail/sika_sika_sika/sika/ |

| Gazprombank – Sika kɔkɔɔ | 1.75% na ɛwɔ hɔ. | https://www.gpb-am.ru/ankorankoro/pif |

| Ɔdan foforo a wosisi | 1.72% na ɛwɔ hɔ. | http://pif.naufor.ru/pif.asp?act=hwɛ&id=3164. Ɔkwan a wɔfa so yɛ aduru a ɛma obi nya apɔwmuden |

| Kapital-sika kɔkɔɔ | 1.69% na ɛwɔ hɔ. | http://www.kapital-pif.ru/ru/fa/ Nsɛm a ɛfa asɛm bi ho. |

Mutual funds (mutual funds): dɛn ne no ne ɔkwan bɛn so na mutual fund yɛ adwuma, mutual funds a eye sen biara no dodow denam mfaso a wonya so: https://youtu.be/GB_UJvUDy_s

Mutual funds a ɛwɔ Sberbank mu – dɛn ne kyɛfa wɔ Sberbank mu?

Sberbank yɛ sikakorabea a wotumi hu na wotumi de ho to so a ɛwɔ hɔ bɛboro mfe 100 ni. Ntease wom sɛ wode sika bɛto sikakorabea a ɛte saa mu, na eyi nti mutual fund ahorow pii wɔ hɔ, yɛbɛtwe adwene asi nea ɛho hia titiriw no so:

- Bond sikakorabea – Ilya Muromets ( https://www.sberbank.ru/ru/onipa/sika a wɔde totɔ nneɛma/pifs/sika_bond_im ). Ɛyɛ ɔman, kurow, adwumakuw bonds a ahotoso Russiafo issuers. Ɛnya sika fi coupon a wotua ne agyapade no bo a ɛkɔ soro no mu. Mutual investment fund a asiane a ɛba fam ɔha biara mu nkyem 0-5%, sika a wonya boro nneɛma bo a ɛkɔ soro no yɛ 8-10% ne sika a ɛkɔ fam.

- Sika a wɔde ma kyɛfa ne nkrataa – Ɛkari pɛ ( https://www.sberbank.ru/ru/person/investments/pifs/fund_balanced ). Mutual fund a wɔadi afra no ka ahobammɔ ahorow abien bom. Mfaso a wonya fi sika kɛse a wonya mu, sika a wonya fi bonds mu. Invests titiriw wɔ Russia sikasɛm nnwinnade, 10-20% yield, asiane kɛse ne moderate liquidity.

- Dobrynya Nikitich Foto no ( https://www.sberbank.ru/ru/person/investments/pifs/fund_equity_dn- ) no yɛ Russia nnwumakuw no kyɛfa. Nea ɛma sikakorabea no yɛ asiane kɛse, mfaso wɔ so 15-20% na ɛkura sika a ɛyɛ mmerɛw mu.

Sberbank sika a wɔde sesa sika a wɔde di gua: so ɛfata sɛ wɔde sika hyɛ mu – SBMX, SBSP, SBRB, SBCB ne SBGB sika a wɔde boa wɔn ho wɔn ho: https://youtu.be/DBRrF-z-1do

Sika a Wɔde Yɛ Adwuma Tinkoff

Ɛwɔ dibea a edi kan wɔ aguadifo a wɔagye din mu, edi kan wɔ nnipa dodow a wɔyɛ adwumaden ne sika a wɔde hyɛ sikakorabea no sika a wɔde boa wɔn ho wɔn ho mu no mu, wobu no sɛ ɛyɛ adwuma a wotumi de ho to so na ɛma wonya mfaso.

- Daa RUB portfolio ( https://www.tinkoff.ru/invest/etfs/TRUR/ ) – Sikakorabea no de sika hyɛ nnwinnade abiɛsa mu, Russia sikakorabea ne bonds, sika kɔkɔɔ. Sika a wode bɛto sikasɛm nnwinnade ahorow mu no ma wutumi fa asiane ketewaa bi ho bere a wode sika reto mu no, nanso bere koro no ara mu no ɛma ɛyɛ nea ɛba fam 5-10%. Ɔkwan a wɔfa so hyɛn mu no bo yɛ 6.04 rubles.

- Daa sika a wonya USD ( https://www.tinkoff.ru/invest/etfs/TUSD/ ) – ma sika a wɔde bɛto Amerika sikakorabea, bonds ne sika kɔkɔɔ mu wɔ kyɛfa mmiɛnsa a ɛyɛ pɛ mu. Yield wɔ dɔla 5-10%, a asiane a ɛba fam. Kyɛfa bi ho ka yɛ dɔla 0.2.

- Daa sika a wonya EU R ( https://www.tinkoff.ru/invest/etfs/TEUR/ ) – ma sika a wɔde bɛto Europa sikakorabea, bonds ne sika kɔkɔɔ mu wɔ kyɛfa abiɛsa a ɛyɛ pɛ mu. Yield wɔ euro 3-5%, asiane a ɛba fam. Sika a wɔde bɛto mu no ho ka yɛ euro 0.10.

Sika a Wɔde Yɛ Adwuma Alfa Capital

Adwumakuw a ɛhwɛ so no de sika a wɔde bɛto wiase nyinaa ne Russia nnwumakuw ahorow mu a ɛyɛ anigye ma. Nnwumayɛfo hwehwɛ adwumakuw biara mu na afei wɔde wɔn sika hyɛ mu.

- Resource ( https://www.alfacapital.ru/individual/pifs/opifa_akn/ ) – ɔpanyin no rehwehwɛ, hwehwɛ stocks a ɛhyɛ bɔ wɔ petrol ne gas ne petrochemical, mining sectors mu. Aba a wonya no yɛ 15-30%.

- Liquid shares ( https://www.alfacapital.ru/individual/pifs/opifa_akliq/ ) – wɔpaw Russia ne amannɔne a wɔde ma no kɛse, a sikasɛm mu nkɔso a eye sen biara ne nkɔso ho anidaso wom. Aba a wonya no yɛ 15-25%.

- Balance ( https://www.alfacapital.ru/individual/pifs/opif_aks/ ) – sika a wɔde hyɛ Russia sikakorabea ne nkrataa a eye sen biara mu. Asiane a ɛkɔ fam ne sanba a ɛyɛ 15-20%.

Sikasɛm mu asɛmfua

Obi a ɔde ne sika hyɛ mu betumi atɔ na watɔn kyɛfa bi da koro no ara, nanso ɛsɛ sɛ wote ase sɛ afei sika no yera wɔ commissions so. Dodow a wokura kyɛfa no mu kyɛ no, dodow no ara na mfaso wɔ sika a wode bɛto mu no so, a ɛde akontaabu fɛfɛ a mfaso kɛse ba so twetwe wo, kyerɛ sɛ bere tenten yɛ mfe 3 anaa 5, ɔsram biako sika a wode bɛto mu no betumi amfa kyɛfa no bo no renka ho.

Ahudeɛ

Kyɛfa ahorow wɔ hɔ a asiane a ɛba fam wom, nanso afei aba a wobenya no bɛba fam. Dodow a mfaso no kɔ soro no, dodow no ara na asiane no yɛ kɛse. Esiane sɛ sikasɛm mu nnwinnade ntumi nkɔ gua so nsakrae ho na sɛ gua no kɔ fam nti, sikakorabea no bo betumi akɔ fam.

i would like to invested.