Mutual fund (PIF) ye warimarayɔrɔ ye min bɛ lajɛ ɲɛmɔgɔ dɔ fɛ mɔgɔw ye minnu b’a fɛ ka wari bila. A kun ye ko i mago t’a la ka portfolio dɔ lajɛ i yɛrɛ ma, mutual funds ye suguya baarakɛlaw ye (

brokers , banking divisions, management companies) ka bɔ wariko minɛn suguya caman na ani ka kiliyanw di u ka mutual fund niyɔrɔ dɔ san.

- Mutuel ka bolofara ka tilayɔrɔba

- Mutuel Fund tigiw

- Mutual fund jumɛnw bɛ yen ani sugandi jumɛn bɛ se ka bɛn jɔn ma

- Jateden kelen ye joli ye

- Danfara jumɛn bɛ mutual fund ni ETF cɛ?

- ETFw ye

- Mutuel funds bɛ se ka nafa sɔrɔ cogo jumɛn na?

- Cogo di ka wari bila mutuel funds la?

- mutual fund sɔrɔta jatebɔ

- Sberbank ka nafolosɔrɔsiraw – Sberbank ka bolofara ye mun ye?

- Fonds mutuels Tinkoff ka baara

- Mutuel ka bolomafaraw Alfa Capital

- Investissement waati

- Farati

Mutuel ka bolofara ka tilayɔrɔba

Ni kiliyan dɔ donna a yɛrɛ ka jatebɔsɛbɛn kɔnɔ walasa ka nafolosɔrɔsiraw san, a bɛ sugandili kɛ portifaliw la minnu bɛ kɛ ni bonw ni aksidanw ye minnu bɛ bɔ seko ni dɔnko suguya caman na: petoroli ni gazi, nɛgɛko, fɛnɲɛnamafagalanw, IT ani fɛn wɛrɛw. Portfolio sanni sɔngɔ ye jɛ-ka-baara walima jɛ-ka-baara dɔ niyɔrɔ ye. A bɛ se ka san, ka feere, ani hali ka juru don a la ka kɛɲɛ n’o ye. A bɛ jate ko jatebɔ dɔ sɔngɔ bɛna bonya waati tɛmɛnen kɔfɛ, ni nin nafolosɔrɔsiraw ka fɛɛrɛ in kɛra seko ye, waati dɔ tɛmɛnen kɔfɛ, waritigi bɛ se k’a ka jatebɔ feere ka tɛmɛ a san kan, ka tɔnɔ sɔrɔ, a dɔgɔyalenba la, nin de bɛ kɛ a bɛɛ bɛ cogo min na diɲɛ ɲuman kɔnɔ.

Mutuel Fund tigiw

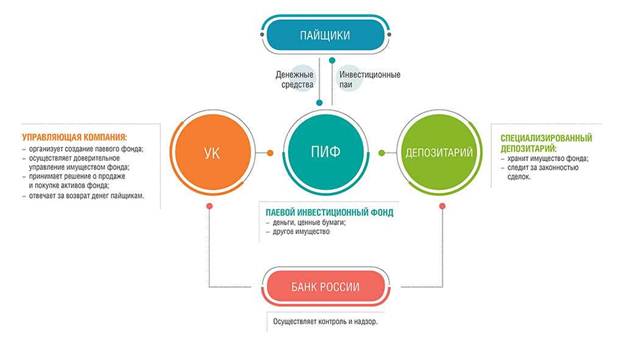

Mutuel nafolo bɛ mara ɲɛmɔgɔyaso fɛ, ɲɛmɔgɔyaso baarakɛlaw de bɛ a latigɛ u bɛna minɛn minnu san ni jatebɔlaw ka wari ye walasa ka wariko nafa lase u ma. Sosiyete min bɛ ɲɛmɔgɔya la, o ye wariko baarada ye. Kunnafoni-falen-falen-tɔnba 50 ɲɔgɔn bɛ Irisi jamana na, minnu bɛɛ la ɲuman ye wariko kuluba dɔ kɔnɔmɔgɔ ye. Misali la, wariko kulu Sberbank, min b b n banki, b nkan ani b nkan s b n – Sberbank Asset Management.

Mutual fund jumɛnw bɛ yen ani sugandi jumɛn bɛ se ka bɛn jɔn ma

Ni waridonna dɔ bɛ ka miiri ka wari bila aksidanw na, fɛn caman bɛ yen minnu ka kan ka jateminɛ:

- Mutual funds bɛ danfara don wariko siratigɛ la , o kɔrɔ ye ko mutual funds bɛ yen minnu bɛ wari bila aksidanw na, bonw na, wariw la, dugukolow, nɛgɛ nafamaw ani seko ni dɔnko la. Nka i ka kan k’a faamu ko ɲɔgɔndan nafolosɔrɔsiraw tɛ wari bɛɛ kɛmɛsarada la ci tuma bɛɛ jatebɔsɛbɛnw kɔnɔ, sariya la, dantigɛli jɔnjɔn dɔw bɛ yen, misali la, n’o ye jatebɔsɛbɛnw ka ɲɔgɔnfaamu ye, o tuma na, 80% bɛ sɔrɔ wari ka kan ka don jatebɔsɛbɛnw kɔnɔ, 20% bɛ se ka bin bonw kan.

- Mutuel fund ɲagaminenw bɛ yen minnu bɛ wari bila 50% fo 50% la. Tila bɛ di aksidanw ma, tɔ bɛ di bonw ma. Irisi jamana na, u tilalen don ɲɔgɔndɛmɛ nafolo la, waridonna ŋanaw ye minnu bɛ wari bila nafolo suguya o suguya la, hali faratiba bɛ minnu na, ka fara ɲɔgɔndɛmɛ nafolo kan minnu bɛ sɔrɔ jamaba fɛ: waridonnaw minnu tɛ se, walima feerekɛlaw. U ka nafolo sɔrɔta hakɛ dan ye wariko minɛnw ye minnu farati ka dɔgɔn.

. O la, ni waridonna dɔ y’a faamu ko tɔnba bɛna a ka wari bila yɔrɔ min na, a nafa ka bon ka bolomafara kelen-kelen bɛɛ ka wariko jiracogo dɔn, bawo a b’a jira ka jɛya ko nafolosɔrɔsiraw niyɔrɔ jumɛn ani ɲɛmɔgɔyasow ka kan ka wari bila yɔrɔ jumɛn na. Ka fara minɛnw kan, wari bilabagaw ka wari bɛ taa yɔrɔ minnu na, ɲɔgɔndɛmɛ nafolo tɛ kelen ye jatebɔ sanni ni feereli siratigɛ la waati siratigɛ la. Dakunba 3 de bɛ yan:

- da wulilen ɲɔgɔndɛmɛ nafolo, minnu ka jatew bɛ se ka san ani ka kunmabɔ cogo kɔrɔ la don o don. O ɲɔgɔnna nafolosɔrɔsiraw, k’a da a kan wari bɛ se ka bɔ u la joona, u bɛ wari bila nafolo jilamaw la, misali la, buluw ka jatew la , ɲinini bɛ kɛ minnu na tuma bɛɛ

- interval funds – unit minnu bɛ se ka san walima ka feere waati kɛrɛnkɛrɛnnenw na. A ka c’a la, o bɛ se ka kɛ siɲɛ caman san kɔnɔ;

- Jateden sabanan ye nafolo dagalenw ye, minnu ka jatew bɛ se ka san caman na dɔrɔn waati min na nafolosɔrɔsiraw bɛ ka sigi sen kan, ka feere ni nafolosɔrɔsiraw datugulen don.

A suguya filanan ni sabanan – interval ani closed-end nafolo bɛ se ka wari bila minɛnw na minnu tɛ ji caman bɔ, bawo u bɛ a fɔ waati min na waridonnaw bɛ se ka wari bɔ u la. Faan dɔ fɛ, minɛn minnu ji ka dɔgɔn, farati caman bɛ olu la, nka fan wɛrɛ fɛ, tɔnɔ sɔrɔcogo ɲuman bɛ u la. O la, a ka fisa conservateurw ka mutuel fund dafalenw sugandi. Ni waridonna labɛnnen don ka farati ta, o tuma na, interval walima closed ones bɛna kɛ.

Jateden kelen ye joli ye

An b’aw hakili jigin ko jatebɔ sɔngɔ bɛ Changé don o don, wa o hukumu kɔnɔ, a bɛ bɔ nafolomafɛnw nafa la, nafolosɔrɔsiraw ye minnu sɔrɔ. Investisseurs ka sɔrɔ bɛna latigɛ ni jatebɔ sɔngɔ cayara cogo min na. Aw bɛ se ka jatebɔ kɛ jatebɔ sɔngɔ jiginni kan ɲɛmɔgɔyasow ka siti kan ani da wulilen wɛrɛw la. O nafolo ninnu bɛ jatebɔ sɔngɔ bɔ don o don tile laban na, ani cɛmancɛ ni datugulenw siɲɛ kelen kalo kɔnɔ a dɔgɔyalenba la. Ni a bɛ jatebɔ san, waridonna bɛ fɛn dɔ sara. A, ka da wari bilalen hakɛ kan, ani ciden min sababu fɛ, ɲɔgɔndan nafolo sanni bɛ kɛ, o bɛ se ka se wari bilalen hakɛ kɛmɛsarada la 5 ma. Ni i bɛ jatebɔ dɔ feere, i b’o kɛ ni fɛn ye min bɛ wele ko discount. A bɛ bɔ waridonna ka jatebɔ la kabini waati jumɛn, ka kɛɲɛ ni ciden ka cogoya kɛrɛnkɛrɛnnenw ye. Sariya la, jigitigɛ tɛ tɛmɛ a nafa kɛmɛsarada la saba kan.

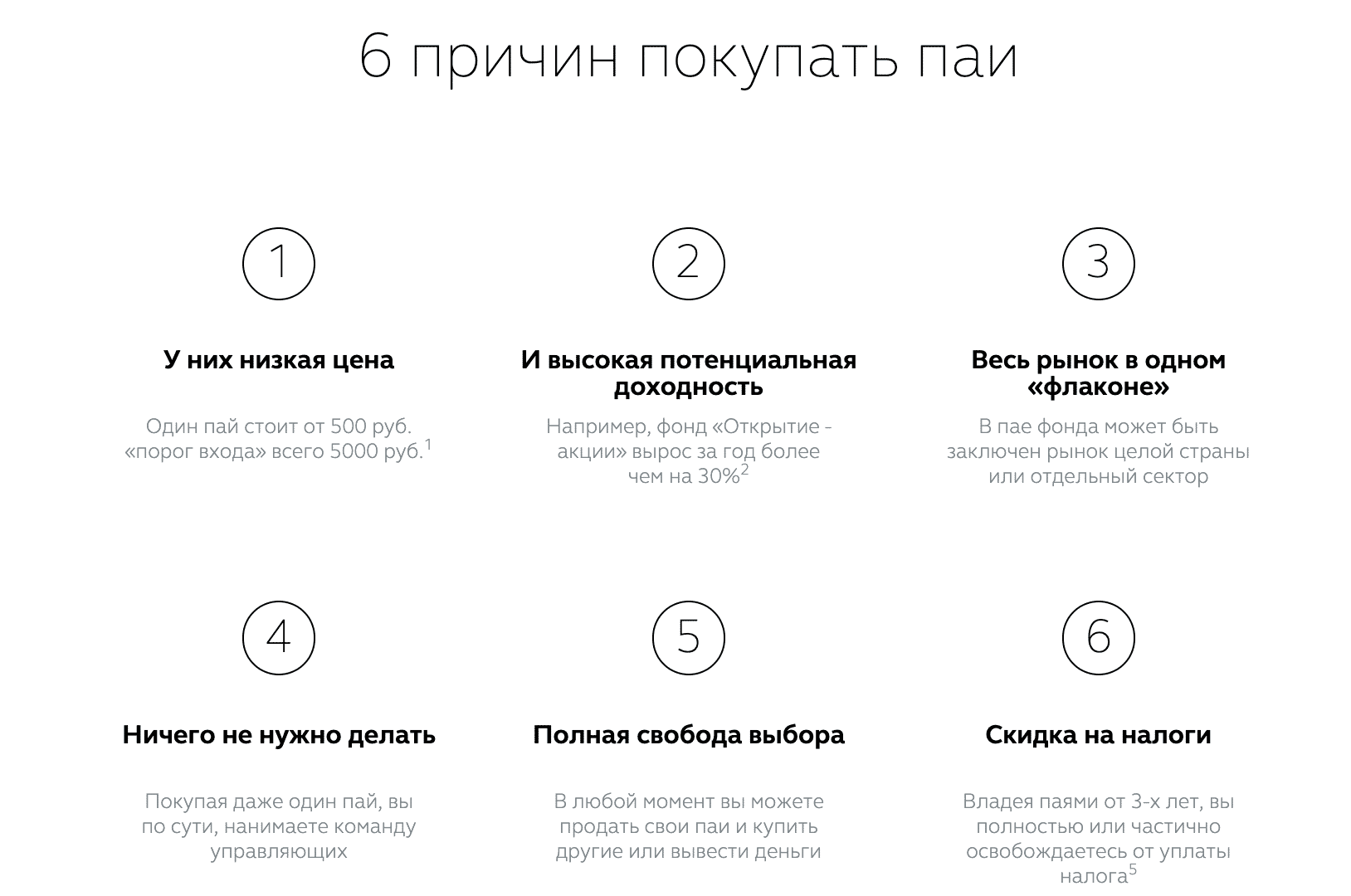

- Sɔrɔli . Nafolodonni minnu bɛ kɛ ɲɔgɔndɛmɛ nafolo la, olu doncogo ka dɔgɔn. Aw bɛ se ka daminɛ ni 1000 rubles ye

- Baarakɛlaw ka baarakɛcogo ɲɛnabɔli la . Fɛn dɔnbagaw bɛ waridonnaw ka wari ɲɛnabɔ. Tiɲɛ na, nin sɔsɔli in ye sɔsɔli ye, bawo dɔnnikɛlaw bɛ wari bilacogo dɔn fɛɛrɛko siratigɛ la : ka jatebɔsɛbɛn da wuli, ka wariko minɛnw san, ka sarati dɔ sigi jago daminɛ na. Nka dɔnnikɛlaw t’a dɔn u bɛ se ka min san walasa ka kɛ miliyɔnɛrɛ ye sini bawo, bɔnɛ ye a sɔrɔ, wariko suguyaw tɛ se ka fɔ ka ɲɛ. O la, tuma dɔw la, Paul the octopus bɛ se ka stock forecasts tigitigiw di ka tɛmɛ dɔnnikɛla dɔ kan min ka san caman dɔnniya bɛ a la.

- Sɛnɛfɛnw sɔrɔli ka ca . Ni ɲɔgɔndɛmɛ nafolo feerela, a bɛ fɔ sannikɛla ye sɔrɔba min bɛ se ka sɔrɔ, o bɛna caya ka tɛmɛ sɔrɔ kan min bɛ sɔrɔ wari bilalenw kan. A fɔlɔ, sɔrɔ min bɛ bɔ bolomafara dɔ la, o tɛ garanti ye cogo si la wa tɔnba bɛ wari bila nafolo suguya dɔ la. Ni sugu ma bonya o waati kɔnɔna na k’a sɔrɔ waridonna ye ɲɔgɔndan bolofara tigi ye, o tuma na, tɔnba tɛna nafa foyi jira, k’a sɔrɔ wari bilalen nafa bɛ sigi sen kan hali bi. A ka c’a la, a bɛnnen don ka ɲɔgɔndan nafolo sɔrɔta suma ni wari bilalen ye, nka ni index ye. O kɔfɛ, i bɛ se k’a faamu cogo min na ɲɛmɔgɔya waleyali bɛ nafa sɔrɔ kosɛbɛ – ka wari bila dɔrɔn index kɔnɔ.

- U bɛ kuma komisiyɔn dɔgɔmanninw kan , nka kunnafoniw tɛ tiɲɛ ye tuma bɛɛ. Mutual funds ye maana sɔngɔ gɛlɛnba ye kosɛbɛ mɔgɔ min b’a san, wa, tiɲɛ na, a sɔngɔ ka gɛlɛn kosɛbɛ ka tɛmɛ wari bilali kan i yɛrɛ ma.

- Liquidité (Liquidité) . Nafolo dafalenw ka jatebɔw bɛ se ka feere waati o waati k’a sɔrɔ bɔnɛ wɛrɛ ma sɔrɔ, o ye tiɲɛ ye, nka n’an kumana jatebɔw kan minɛn jilamaw kɔnɔ, o tuma na, o bɛ se ka kɛ waati o waati k’a sɔrɔ bɔnɛ wɛrɛ ma sɔrɔ.

- Takisi min bɛ kɛ ka ɲɛ . Nafolosɔrɔko tɔn dɔw b’a fɔ ko ni ɲɔgɔndɛmɛ nafolo bonyalen don, waridonnaw bɛ se ka bɔ sɔrɔta impositi la ni u ka sɔrɔ tɛ se miliyɔn saba ma san kɔnɔ jatebɔw kan, n’u ye jatebɔw minɛ ka tɛmɛ san saba kan. O ye kelen ye ni suguw ye minnu bɛ kɛ tuma bɛɛ ani minnu bɛ kɛ ni bolomafaraw ye. O hukumu kɔnɔ, sɔrɔta impositi min bɛ sɔrɔ nafolo nafa bonya kan, o tɛ sara.

Danfara jumɛn bɛ mutual fund ni ETF cɛ?

Bi, ETF minɛn bɛ ka bonya sɔrɔ

, o kɔrɔ ye ko nafolo minnu bɛ jago kɛ fɛnw falen-falen na, u ka di ka tɛmɛn retro-grad mutual fund kɔrɔ ɲumanw kan. N’an ye ɲɔgɔndɛmɛ ni ETFw suma ɲɔgɔn na, o tuma na, filanan nafa bɛ sɔrɔ kɛnɛ kan.

- A fɔlɔ, u ka jilama ka ca, u sanni ka nɔgɔn, u bɛ san brokerage account fɛ walima an bɛ se k’a san fana plateforme wɛrɛw kan, impositi nafa fana bɛ yen.

- Mutuel funds bɛ san ɲɛmɔgɔyaso ka biro la, u ka siti kan. A tɛ se ka kɛ ka nafolosɔrɔsiraw san brokerage jatebɔsɛbɛn fɛ ani plateforme wɛrɛw fɛ. O ye ko jugu ye.

- Mutuel funds bɛ mara ni timinandiya ye. Kuntigiw b’a ɲini tuma bɛɛ ka tɛmɛ index kan, k’a sɔrɔ ETFw bɛ tugu stock index kɔ tuma bɛɛ.

- Mutual fund ta la, ni komisiyɔn bɛ kɛmɛsarada la 3,5 cɛ, ni jate tɛ kɛ ni markups ni discounts ye, o tuma na ETFw ta la, komisiyɔnw ka dɔgɔ. Irisi jamana na, o tɛ kɛmɛsarada la kelen bɔ, wa kabako wɛrɛ si man kan ka jira yan.

ETFw ye

Investissement nafolo bɛ ka kɔrɔlen dɔɔnin dɔɔnin ni a bɛ fɔ mutuel funds ma minnu b’a fɔ ka wari bila fɛnw na minnu bɛ jago kɛ ni fɛnw falenfalenni ye. Fɛɛrɛ fila bɛ yen minnu bɛ se ka kɛ:

- A ka c’a la , wari bilali ETF kɔnɔ , o ye fɛɛrɛ wɛrɛ ye min bɛ nafa caman lase waridonna ma ka tɛmɛ bolomafara kan.

- O sira filanan ye sannifeere yɛrɛmahɔrɔnyalen ye, ka bɔ aksidanw na, ka bonw, wariko minɛn wɛrɛw : ka kɛ waridon kelen-kelen bɛɛ ka jatebɔsɛbɛn ye, ka ɲɛsin waridon kuntaalajan ma, o kɔfɛ, ka impositi dɔgɔyali sɔrɔ o kɔfɛ.

portfolio dɔ da a yɛrɛ ye min tɛ juguya ka tɛmɛ ɲɛmɔgɔ ŋanaw b’a kɛ a ye cogo min na. Fɛn wɛrɛ ye ko o kama i ka kan ka seko dɔw sɔrɔ, ni waritigi dɔ tɛ ni o seko suguw ye, o tuma na, a ka fisa ka ETF nafolo san.

Mutuel funds bɛ se ka nafa sɔrɔ cogo jumɛn na?

Misali la, ni mɔgɔ dɔ bɛ ka sow ni dugukolow lajɛ, o tuma na, sow ni dugukolow ka ɲɔgɔnfaamu wari bɛ se ka kɛ baarakɛminɛn ye min ɲɔgɔn tɛ a bolo. Nin ye tiɲɛ na Risi analogue ye Ameriki tarikuw la. Walima mutuel funds minnu bɛ wari bila seko ni dɔnko fɛnw na, bawo a ka gɛlɛn kosɛbɛ investisseur min tɛ ni seko kɛrɛnkɛrɛnnen ye ka wari bila IT baara la, o tuma mutual funds yan bɛ mɔgɔ bɛɛ dɛmɛ min b’a fɛ k’a ɲini nin ko in na, k’o kɛ.

Cogo di ka wari bila mutuel funds la?

Walasa ka wari bila mutual fund kɔnɔ, i bɛna a ɲini ka jatebɔsɛbɛn dɔ da wuli ni broker dɔ ye, ni jatebɔsɛbɛn dabɔra, o tuma na a bɛ to ka tab sɔrɔ ni mutual funds list ye ani ka min bɛnnen sugandi. Baarakɛlaw ka hakilina ka ɲi, nka a ka ɲi waridonna dɔ ka sɔrɔko jɔnjɔnw faamuya ani ka hakilina sɔrɔ aksidan suguya kan, ni a bɛ se ka kɛ, o kɔfɛ, a ka lajɛ ni dilanbaga dɔ ye. O bɛ a to a ka nɔgɔn ka PIF ɲuman sugandi.

Nafama: a lajɛ ni lase dɔ bɛ sɔrɔ yɔrɔ in na: https://www.cbr.ru/registries/RSCI/activity_uk_if/ .

mutual fund sɔrɔta jatebɔ

| jɛ-ka-baara bolofara | Nafa sɔrɔli | Site web kan |

| Sistɛmu Kapitali – Mobili | 14,88% ye . | https://sistema-capital.com/catalogue/ Bamako, Mali. |

| URALSIB Sanu | 3,66% ye . | https://www.uralsib.ru/investissement-ani-assurance/ivestitsii/paevye-investissementnye-fondy-pif-/ Bamako, Mali. |

| Sberbank – Duniya juru suguya | 2,58% ye . | https://www.sber-am.ru/mɔgɔ kelen-kelenw/nafolo/ |

| RGS-Zoloto ye | 2,09% ye . | https://www.rgsbank.ru/personnel/investissement/pif/open/ Bamako, Mali. |

| Raiffeisen – Sanu | 2,02% ye . | https://www.raiffeisen.ru/retail/deposit_investissement/nafolo/ |

| Gazprombank – Sanu | 1,75% ye . | https://www.gpb-am.ru/mɔgɔ kelen/pif |

| So kura jɔli | 1,72% ye . | http://pif.naufor.ru/pif.asp?act=lajɛ&id=3164. Bamako, Mali |

| Kapital-sanu | 1,69% ye . | http://www.kapital-pif.ru/ru/about/ Bamako, Mali. |

Mutuel funds (mutual funds): o ye mun ye ani mutual fund bɛ baara kɛ cogo di, mutual funds ɲumanw jatebɔ ka kɛɲɛ ni nafa sɔrɔli ye: https://youtu.be/GB_UJvUDy_s

Sberbank ka nafolosɔrɔsiraw – Sberbank ka bolofara ye mun ye?

Sberbank ye banki ye min bɛ dɔn ani min bɛ se ka da a kan, a bɛ yen kabini san 100 ni kɔ. A bɛnnen don ka wari bila o banki sugu la, wa o kama, ɲɔgɔndan nafolo suguya caman bɛ yen, an bɛna a kunbabaw jira :

- Bond bolofara – Ilya Muromets ( https://www.sberbank.ru/ru/mɔgɔ/nafolodonnaw/pifs/bond_bond_im ). A bɛ kɛ jamana, minisiriso, tɔn ka bonw ye minnu bɛ se ka da u kan Risi bɔbagaw fɛ. A bɛ sɔrɔ sɔrɔ kupon sarali la ani nafolo nafa bonya. Mutuel investissement fund ni farati dɔgɔyalen kɛmɛsarada la 0-5%, sɔrɔ min bɛ sanfɛ inflation 8-10% ani liquidité moyenne.

- Nafolo min bɛ kɛ ka jatebɔw ni bonw kɛ – Balanced ( https://www.sberbank.ru/ru/person/investments/pifs/fund_balanced ). Mutual fund ɲagaminen bɛ lakana suguya fila fara ɲɔgɔn kan. Tɔnɔ minnu bɛ sɔrɔ kapitali tɔnɔw la, sɔrɔ minnu bɛ bɔ bonw la. A bɛ wari bila kɛrɛnkɛrɛnnenya la Risi wariko minɛnw na, 10-20% sɔrɔta, faratiba ani wariko danma.

- Dobrynya Nikitich ka bolofara ( https://www.sberbank.ru/ru/person/investments/pifs/fund_equity_dn- ) ye Risi ka tɔnw ka bolofara ye. Min bɛ kɛ sababu ye ka nafolosɔrɔsiraw kɛ faratiba ye, nafa bɛ sɔrɔ a la 15-20% ani ka wari sɔrɔta hakɛ danmadɔ mara.

Sberbank ka bolomafara minnu bɛ jago kɛ ni fɛnw falenfalenni ye : yala a nafa ka bon ka wari bila – SBMX, SBSP, SBRB, SBCB ani SBGB ka bolomafaraw : https://youtu.be/DBRrF-z-1do

Fonds mutuels Tinkoff ka baara

A bɛ jɔyɔrɔba la dilanbagaw cɛma minnu bɛ fɔ kosɛbɛ, a bɛ jɔyɔrɔ fɔlɔ la a ka kiliyanw hakɛ la minnu bɛ baara kɛ ani ka wari bila banki ka ɲɔgɔndɛmɛ nafolo la, a bɛ jate jagokɛyɔrɔ ye min bɛ se ka da a kan ani min bɛ nafa sɔrɔ.

- RUB portfolio banbali ( https://www.tinkoff.ru/invest/etfs/TRUR/ ) – O bolofara bɛ wari bila minɛn saba la, Risi ka bolomafaraw ni bonw, sanu. Ka wari bila wariko minɛn suguya caman na, o b’a to i bɛ se ka farati fitinin ta ni i bɛ wari bila, nka o waati kelen na, a bɛ kɛ sababu ye ka sɔrɔ dɔgɔya 5-10%. Donda sɔngɔ ye 6,04 rubles ye.

- Sɔrɔ banbali USD ( https://www.tinkoff.ru/invest/etfs/TUSD/ ) – o bɛ wari bila Ameriki ka bolomafaraw, bonw ani sanu na jatebɔ saba la minnu bɛ bɛn ɲɔgɔn ma. A bɛ sɔrɔ dɔrɔmɛ la 5-10%, ni farati hakɛ ka dɔgɔn. Jateden kelen musaka ye dɔrɔmɛ 0,2 ye.

- Sɔrɔ banbali EU R ( https://www.tinkoff.ru/invest/etfs/TEUR/ ) – bɛ wari bila Erɔpu ka bolomafaraw la, bondw ani sanu na jate saba bɛnkanw na. Sɔrɔ bɛ sɔrɔ euro la 3-5%, farati ka dɔgɔ. Nafolodonni musaka ye ɛrɔ 0,10 ye.

Mutuel ka bolomafaraw Alfa Capital

O ɲɛmɔgɔyaso bɛ waridon suguya nafama dɔ di diɲɛ ni Risi tɔn suguya caman na. Baarakɛlaw bɛ sosiyete kelen-kelen bɛɛ sɛgɛsɛgɛ, ka tila ka wari bila.

- Nafolo ( https://www.alfacapital.ru/individual/pifs/opifa_akn/ ) – ɲɛmɔgɔ bɛ ɲini, a bɛ layidu talenw sɛgɛsɛgɛ petoroli ni gazi ani petoroli, minɛnko siratigɛ la. A sɔrɔta ye 15-30% ye.

- Liquid shares ( https://www.alfacapital.ru/individual/pifs/opifa_akliq/ ) – Risi ni jamana wɛrɛw ka jatebɔlaw minnu ka bon kosɛbɛ, olu de bɛ sugandi, ni wariko kɛcogo ɲuman ani yiriwali siraw ye. A bɛ sɔrɔ 15-25%.

- Balance ( https://www.alfacapital.ru/individual/pifs/opif_aks/ ) – wari bilali Risi ka bolomafaraw ni bond ɲumanw na. Farati damadɔ ani kɔsegin 15-20%.

Investissement waati

Investisseur bɛ se ka share san ka feere o don kelen na, nka i ka kan k’a faamu ko o tuma na, nafolo bɛ tunun komisiyɔnw kan. Ni i ye jatebɔ minɛ ka mɛn, waridon bɛ nafa sɔrɔ ka caya, ka mɔgɔw lafili ni jate cɛɲiw ye ni nafa caman ye, u kɔrɔ ye ko san 3 walima san 5 waati, kalo kelen waridonw bɛ se ka dɔ fara jatebɔ nafa kan.

Farati

Jatedenw bɛ yen minnu tɛ kelen ye ni farati hakɛ ka dɔgɔn, nka o kɔfɛ, sɔrɔ bɛna dɔgɔya. Ni nafa bɛ sɔrɔ ka caya, farati bɛ bonya ka taa a fɛ. Ikomi wariko minɛnw tɛ bɔ suguw jiginni na ani ni sugu binna, nafolosɔrɔsiraw nafa bɛ se ka jigin.

i would like to invested.