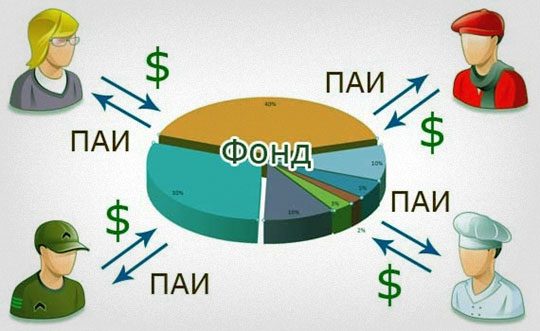

Mutual fund (PIF) nye gaxɔgbalẽvi siwo dɔdzikpɔla aɖe ƒoa ƒu na ame siwo di be yewoade ga eme. Nya lae nye be mehiã be nàƒo gaxɔgbalẽvi nu ƒu le ɖokuiwò si o, ga si wotsɔna ƒoa ƒui la nye asitsalawo ƒe gomekpɔla bibiwo (

asitsalawo , gadzraɖoƒewo ƒe mamãwo, dɔdzikpɔhawo) tso gaŋutiɖoɖo ƒomevi vovovowo me eye wonaa asisiwo be woaƒle ga si wotsɔna ƒoa ƒui la ƒe akpa aɖe.

- Ga si wotsɔna ƒoa ƒui ƒe akpa aɖe

- Mutual Fund ƒe Aƒetɔwo

- Ga si wotsɔna ƒoa ƒui kawoe li eye tiatia kae ate ŋu asɔ na amesi

- Aleke gbegbee gomekpɔkpɔ ɖeka nye

- Vovototo kae le ga si wotsɔ kpena ɖe ame ŋu kple ETF dome?

- ETF-wo ƒe ƒuƒoƒo

- Nɔnɔme ka mee ga si wotsɔna ƒoa ƒui ate ŋu anye viɖenu le?

- Aleke woawɔ ade ga gakpekpeɖeŋunadɔwo me?

- mutual fund ƒe kutsetse ƒe dzidzedzekpɔkpɔ

- Mutual funds of Sberbank – nukae nye gomekpɔkpɔ le Sberbank me?

- Ga Siwo Wozãna Ðe Ame Ŋu Tinkoff

- Ga Siwo Wotsɔ Wɔa Nui Alfa Capital

- Gadede asi ƒe ɣeyiɣi

- Ŋɔdzi

Ga si wotsɔna ƒoa ƒui ƒe akpa aɖe

Ne asisi aɖe ge ɖe eya ŋutɔ ƒe gakɔnta me be yeaƒle ga si woatsɔ awɔ dɔ ɖekae la, wotsɔa gaxɔgbalẽvi siwo me gaxɔgbalẽviwo kple gaxɔgbalẽviwo le le dɔwɔƒe vovovowo ƒe tiatiawɔblɔɖe la naae: ami kple gas, gaŋutinunya, nu xoxowo, IT kple bubuawo. Ga si woƒlena le gaxɔgbalẽvi aɖe me nye ga si wotsɔ blaa gae alo gomekpɔkpɔ le gaxɔgbalẽviwo me ƒe gomekpɔkpɔ. Woate ŋu aƒlee, adzrae, eye woatsɔe ade aƒe me gɔ̃ hã ɖe edzi. Wosusu be gome aɖe ƒe asi adzi ɖe edzi le ɣeyiɣi aɖe megbe, nenye be gaxɔ sia ƒe aɖaŋua va dze nyuie, le ɣeyiɣi aɖe megbe la, gadelawo ate ŋu adzra eƒe gome la ɖe ga si wu esi wòƒle nu eye wòakpɔ viɖe, ne mede ɖeke o la, esiae nye ema alesi wò katã le le xexe si sɔ nyuie me.

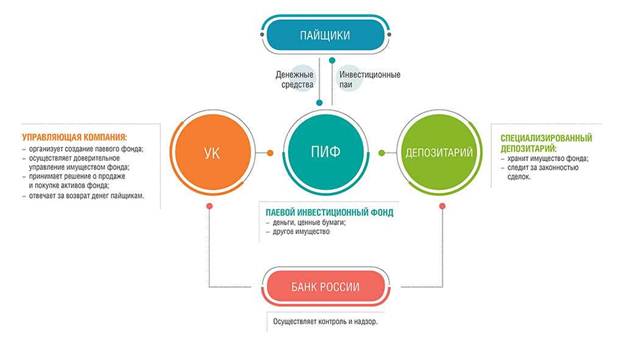

Mutual Fund ƒe Aƒetɔwo

Ga si le ga si woatsɔ awɔ dɔ ɖekae me lae kpɔa dɔwɔƒea dzi, dɔwɔƒe si kpɔa ga la ƒe dɔwɔlawoe tsoa nya me le dɔwɔnu siwo woatsɔ gomenɔlawo ƒe ga aƒle ŋu be woatsɔ ahe ganyawo ƒe viɖewo vɛ na wo. Dɔwɔƒe si kpɔa dɔa dzi nye gadzikpɔƒe. Dɔwɔƒe gã siwo kpɔa dɔa dzi abe 50 ene ye le Russia, eye wo dometɔ nyuitɔwo kekeake le ganyawo ƒe ƒuƒoƒo gã aɖe me. Le kpɔɖeŋu me, ganyawo ƒe ƒuƒoƒo si nye Sberbank, si me gadzraɖoƒe, asitsahabɔbɔ kple dɔdzikpɔha le – Sberbank Asset Management.

Ga si wotsɔna ƒoa ƒui kawoe li eye tiatia kae ate ŋu asɔ na amesi

Ne gadelawo le tame bum be yeade ga gomenɔamesiwo me la, nu geɖe li siwo ŋu wòle be woabu:

- Mutual funds va toa vovo le mɔ si dzi woade gae nu , si fia be mutual funds li siwo dea ga asi ɖe gaxɔgbalẽviwo, gagbalẽwo, gawo, anyigba kple xɔwo, ga xɔasiwo kple aɖaŋudɔwo me. Gake ele be nàse egɔme be gomekpɔkpɔ ƒe ga si wotsɔna ƒoa ƒui meɖoa ga katã ƒe alafa memama alafa ɖeka ɖe gomekpɔkpɔ me ɣesiaɣi o, abe se ene la, mɔxexeɖenu aɖewo li siwo woɖo ɖi, le kpɔɖeŋu me, nenye be enye gomekpɔkpɔ ƒe ga si wotsɔna ƒoa ƒui la, ekema 80% le ele be woade ga gomekpɔkpɔ me, 20% ate ŋu adze ɖe gagbalẽwo dzi.

- Mutual funds vovovowo li siwo dea ga 50% va ɖo 50%. Wotsɔa afã naa gaxɔgbalẽviwo, eye wotsɔa susɔea naa gaxɔgbalẽviwo. Le Russia la, woma wo ɖe gadodo ɖekae me na gadelawo siwo dze siwo dea ga nunɔamesi ɖesiaɖe me, esiwo me afɔku le wu gɔ̃ hã, kpakple gadede asi na ame gbogbo aɖewo: gadelawo siwo medze o, alo gadelawo le asitsaƒewo. Woƒe nunɔamesi vovovo siwo li la nye gaŋutiɖoɖo siwo me afɔku mele boo o ko.

. Eyata ne gadelawo se afisi gaxɔgbalẽvia ade eƒe ga le gɔme la, anyo be wòanya gadodo ƒe gaxɔ ɖesiaɖe ƒe gadede asi ƒe gbeƒãɖeɖea nyuie, elabena egblɔa ga la ƒe akpa si me ga la ƒe akpa kae kple gomenɔamesi si le dɔdzikpɔhawo si be woade ga eme la eme kɔ nyuie. Tsɔ kpe ɖe dɔwɔnu siwo me gadelawo ƒe ga yina ŋu la, ga si wotsɔna ɖoa gae ƒe ga to vovo le ga ƒle kple edzadzra gome le ɣeyiɣi gome. Wole hatsotso vevi 3 me le afisia:

- ʋu ga si wotsɔna ƒoa ƒui, siwo ƒe akpawo woate ŋu aƒle ahaxɔ wo ŋutɔŋutɔ gbesiagbe. Gadzɔdzɔdɔwɔƒe mawo tɔgbe, le nyateƒe si wònye be woate ŋu axɔ ga le wo si kaba ta la, wodea ga nunɔamesi siwo me woate ŋu azã nu le me, le kpɔɖeŋu me, blue chips ƒe gomekpɔkpɔwo me , siwo wobiaa amewo ɣesiaɣi;

- interval funds – unit siwo woateŋu aƒle alo adzra le ɣeyiɣi aɖewo koŋ me. Abe se ene la, woate ŋu awɔ esia zi geɖe le ƒea me;

- Ha etɔ̃liae nye ga siwo wotu , siwo ƒe akpawo zi geɖe la, ɣeyiɣi si me wole gaxɔa ɖom koe woate ŋu aƒle, eye woadzra ne wotu gaxɔa.

Evelia kple etɔ̃lia ƒomevi – dometsotso kple ga siwo wotu ɖe nuwuwu ate ŋu akpɔ ga atsɔ ade ga dɔwɔnu siwo me tsi mele o me, elabena wogblɔa ɣeyiɣi si me gadelawo ateŋu aɖe ga le wo me ɖi. Le go ɖeka me la, afɔku geɖe le dɔwɔnu siwo me tsi mele o me, gake le go bubu me la, viɖekpɔkpɔ ƒe ŋutete nyo wu le wo ŋu. Eyata anyo wu be blemakɔnuléɖeasilawo natia ga si woatsɔ awɔ dɔ ɖekae le mɔ gbadza nu. Ne gadelawo le klalo be yeatsɔ afɔkua la, ekema dometsotso alo esiwo wotu la awɔ dɔ.

Aleke gbegbee gomekpɔkpɔ ɖeka nye

Míele ŋku ɖom edzi na mi be gome aɖe ƒe asi trɔna gbesiagbe, eye le esia nu la, enɔ te ɖe nunɔamesi siwo gaxɔa xɔ ƒe asixɔxɔ dzi tẽ. Woakpɔ ga si gadelawo akpɔ to alesi gbegbe gomekpɔkpɔa ƒe asi dzi ɖe edzii dzi. Àte ŋu akpɔ gome aɖe ƒe asi ƒe tɔtrɔ le dɔwɔƒe siwo kpɔa dɔa dzi ƒe nyatakakadzraɖoƒea kple le teƒe bubu siwo woʋu ɖi. Ga siawo taa gomekpɔkpɔ ƒe asi gbesiagbe le ŋkekea ƒe nuwuwu, kple dometsotso kple esiwo wotu zi ɖeka ya teti le ɣletia me. Ne gadelawo le gome ƒlem la, exea ga home aɖe. Eya, le ga home si wodo ɖe eme nu, kple dɔwɔƒe si dzi woto ƒlea ga si wotsɔ dzraa gae nu la, ate ŋu aɖo ga home si wode eme la ƒe alafa memama 5 gbɔ. Ne èle gome aɖe dzram la, èwɔa esia kple nusi woyɔna be asiɖeɖe le eŋu. Enɔ te ɖe ɣeyiɣi didi si gome la le gadelawo si dzi, le nɔnɔme tɔxɛ siwo me dɔwɔƒea le dzi. Abe se ene la, asiɖeɖe le eŋu mewu eƒe asixɔxɔ ƒe alafa memama etɔ̃ o.

- Nusiwo Li . Gadede asi na ga si wotsɔ blaa gae me la ƒe gege ɖe eme ƒe seɖoƒe le sue. Àte ŋu adze egɔme tso 1000 rubles dzi

- Dɔwɔwɔ nyuie le dɔdzikpɔkpɔ me . Eŋutinunyalawo kpɔa gadelawo ƒe ga dzi. Le nyateƒe me la, nyaʋiʋli sia nye nyaʋiʋli, elabena eŋutinunyalawo nya alesi woade gae le mɔ̃ɖaŋununya gome: ʋu gakɔnta, aƒle gaŋutiɖoɖowo, aɖo nɔnɔme aɖe ɖi na asitsadɔ aɖe ʋuʋu. Gake eŋutinunyalawo menya nusi woaƒle be woazu gatɔ etsɔ o elabena nublanuitɔe la, ganyawo ƒe asiwo nye esiwo womate ŋu agblɔ ɖi le dzɔdzɔme nu o. Eyata ɣeaɖewoɣi la, Paul the octopus ate ŋu agblɔ adzɔnuwo ƒe nyagblɔɖi siwo sɔ pɛpɛpɛ wu eŋutinunyala si si ƒe geɖe ƒe nuteƒekpɔkpɔ le.

- Kutsetse geɖe . Ne wodzra ga si wotsɔ blaa gae la, wogblɔa ga gbogbo si wòate ŋu akpɔ, si asɔ gbɔ wu ga si woakpɔ tso ga si wotsɔ de gadzraɖoƒea me la na nuƒlelaa. Gbã la, womeɖo kpe ga si woakpɔ tso gaxɔ si wotsɔ blaa gae me dzi le mɔ aɖeke nu o eye ga si woatsɔ akpe ɖe ame ŋu la dea ga nunɔamesi ƒomevi aɖe me. Ne asitsaƒea medzi ɖe edzi le ɣeyiɣi ma me esime gadelawo tɔe nye ga si wotsɔ blaa gae la o la, ekema ga si woatsɔ akpe ɖe eŋu la maɖe viɖe aɖeke afia o, evɔ viɖe si woakpɔ tso ga si wotsɔ de gadzraɖoƒea me ya gakpɔtɔ li. Le goawo katã me la, esɔ be woatsɔ ga si wokpɔna tso ga si wotsɔ kpe ɖe wo nɔewo ŋu me asɔ kple ga si wotsɔ de gadzraɖoƒea o, ke boŋ wotsɔ ga si wotsɔ de gadzraɖoƒea ƒe dzesidenu. Emegbe àteŋu ase alesi dɔdzikpɔkpɔ veviedodotɔe kpɔa viɖe geɖe wu gɔme – gadede index la me ko.

- Woƒoa nu tso dɔdasi suewo ŋu , gake nyatakakaawo menyea nyateƒe ɣesiaɣi o. Mutual funds nye ŋutinya xɔasi aɖe ŋutɔ na amesi ƒlea wo, eye le nyateƒe me la, exɔ asi sãsãsã wu gadede asi le ɖokuiwò si.

- Tsi si woate ŋu atsɔ awɔ dɔe . Woateŋu adzra ga si le ʋuʋu ɖi ƒe akpawo ɣesiaɣi evɔ womabu nu bubu aɖeke kpee o, esia nye nyateƒe, gake ne míeƒo nu tso gome siwo le liquid instruments me ŋu la, ekema woateŋu awɔ esia ɣesiaɣi evɔ womabu nu bubuwo kpee o.

- Adzɔxexe si wowɔna le mɔ nyuitɔ nu . Ganyawo ŋuti dɔwɔƒe aɖewo gblɔ be esi ga si wotsɔ kpena ɖe ga ŋu ƒe nunɔamesiwo le dzidzim ɖe edzi la, woate ŋu aɖe ga si gadelawo ƒe adzɔxexe le ga si wokpɔna ta me ne wokpɔ ga si mede ruble miliɔn etɔ̃ o ƒe sia ƒe le gomenɔamesiwo ta, ne gome le wo si wu ƒe etɔ̃. Esia sɔ kple esi le asitsaƒe siwo wodzrana edziedzi kple esiwo wodzrana le asitsaƒewo me. Le esia nu la, womexea ga si wokpɔna ƒe adzɔ ɖe nunɔamesiwo ƒe asixɔxɔ ƒe dzidziɖedzi ta o.

Vovototo kae le ga si wotsɔ kpena ɖe ame ŋu kple ETF dome?

Today, the ETF instrument is gaining popularity

, si fia be, ga siwo wodzrana le asitsaƒea, woxɔ ŋkɔ wu nyui xoxo retro-grad mutual ga. Ne míetsɔ ga si wotsɔna ƒoa ƒui kple ETF sɔ kple wo nɔewo la, ekema viɖe siwo le evelia ŋu la le gotagome.

- Gbã la, wole tsi me wu, wo ƒle le bɔbɔe wu, woƒlea wo to asitsahabɔbɔ ƒe akɔnta dzi alo míate ŋu aƒlee le mɔ̃ bubuwo hã dzi, adzɔxexe ƒe viɖe hã li.

- Woƒlea ga si woatsɔ awɔ dɔ ɖekae le dɔwɔƒe si kpɔa dɔa dzi ƒe dɔwɔƒe, le woƒe nyatakakadzraɖoƒea. Manya wɔ be woaƒle ga si woatsɔ awɔ dɔ ɖekae to asitsahabɔbɔ ƒe gakɔnta kple mɔ̃ bubuwo dzi o. Esia nye nya manyomanyo aɖe.

- Wokpɔa ga si wotsɔna ƒoa ƒui dzi vevie. Dɔdzikpɔlawo dzea agbagba ɣesiaɣi be yewoawɔ dɔ wu index la, evɔ ETF-wo ya kplɔa stock index la ɖo ɣesiaɣi kloe.

- Le ga si wotsɔ blaa gae gome la, ne dɔdzikpɔhaa le alafa memama 3.5 dome, ne womexlẽ dzesidewo kple asiɖeɖe le ga ŋu o la, ekema le ETF-wo gome la, dɔdzikpɔhaawo le ʋɛ wu. Le Russia la, esia mede alafa memama ɖeka o, eye mele be woakpɔ mɔ na nu bubu aɖeke si awɔ nuku le afisia o.

ETF-wo ƒe ƒuƒoƒo

Vivivi la, ga si wotsɔna dea gae me va le zazãm ne wole ga si wotsɔna dea gae me siwo gblɔna be yewoade ga dɔwɔnu siwo wotsɔna dzraa gae me. Mɔnu eve li siwo woate ŋu azã ɖe eteƒe le afisia:

- Zi geɖe la, gadede ETF me nyea mɔnu bubu si me viɖe le wu na gadelawo wu ga si woatsɔ awɔ dɔ ɖekae.

- Mɔnu eveliae nye gomenɔamesiwo, gagbalẽwo, gaŋutiɖoɖo bubuwo ƒeƒle le wo ɖokui si : na ame ɖekaɖeka ƒe gadede akɔnta hena gadede asi ɣeyiɣi didi aɖe, eye emegbe woaxɔ adzɔ si woɖe le eme emegbe.

gaxɔgbalẽvi aɖe na eɖokui si mevɔ̃ɖi wu alesi dɔdzikpɔla bibiwo wɔnɛ nɛ o. Nu bubu enye be le esia ta ele be aɖaŋu aɖewo nanɔ asiwò, ne aɖaŋu mawo mele gadelawo si o la, ekema anyo wu be nàƒle ETF ga.

Nɔnɔme ka mee ga si wotsɔna ƒoa ƒui ate ŋu anye viɖenu le?

Le kpɔɖeŋu me, ne ame aɖe le aƒewo kple anyigbawo kpɔm la, ekema aƒewo kple anyigbawo ƒe ga si wotsɔna ƒoa ƒui ate ŋu ava zu dɔwɔnu tɔxɛ aɖe nɛ. Le nyateƒe me la, esiae nye Russiatɔwo ƒe Amerikatɔwo ƒe agbɔsɔsɔme si sɔ kple wo nɔewo. Alo mutual funds siwo dea ga aɖaŋudɔwo me, elabena esesẽna ŋutɔ na gadelawo si si aɖaŋu tɔxɛ aɖeke mele o be wòade ga IT dɔwɔƒea, ekema mutual funds le afisia kpena ɖe amesiame si di be yeate kpɔ le nuto sia me ŋu be wòawɔ esia.

Aleke woawɔ ade ga gakpekpeɖeŋunadɔwo me?

Be nàte ŋu ade ga asi na gaxɔgbalẽviwo me la, ahiã be nàʋu akɔnta le asitsaha aɖe gbɔ, ne gakɔntaa le ʋuʋu ɖi la, ekema esusɔ be nàdi tab si me gadodowo ƒe ŋkɔwo le eye nàtia esi sɔ. Eŋutinunyalawo ƒe nukpɔsusu nyo, gake anyo be gadelawo nase ganyawo ƒe gɔmedzenufiafiawo gɔme eye susu aɖe nanɔ esi ku ɖe gaxɔmenuawo ƒe asitsatsa ŋu, ne anya wɔ la, ekema wòaƒo nu kple asitsaha aɖe. Esia wɔnɛ be wònɔa bɔbɔe be woatia PIF nyuitɔ.

Vevietɔ: kpɔe ɖa be mɔɖegbalẽ le nyatakakadzraɖoƒea hã: https://www.cbr.ru/registries/RSCI/activity_uk_if/

mutual fund ƒe kutsetse ƒe dzidzedzekpɔkpɔ

| ga si wotsɔna ƒoa ƒui | Tse | Nyatakakadzraɖoƒea |

| System Capital – Asitelefon | 14.88% ƒe xexlẽme. | https://sistema-fiagã.com/catalog/ . |

| URALSIB Sika | 3.66% ƒe xexlẽme. | https://www.uralsib.ru/gadede asi-kple-nugblẽfexeɖoɖo/ivestitsii/paevye-gadede-fe-fondy-pif-/ |

| Sberbank – Xexeame katã ƒe fenyinyi ƒe asi | 2.58% ƒe xexlẽme. | https://www.sber-am.ru/ame ɖekaɖekawo/gawo/ |

| RGS-Zoloto ƒe agbalẽa | 2.09% ƒe xexlẽme. | https://www.rgsbank.ru/ame ŋutɔ ƒe gadede/pif/ʋu/ |

| Raiffeisen – Sika ƒe ƒuƒoƒo | 2.02% ƒe xexlẽme. | https://www.raiffeisen.ru/retail/gadede_deme/gadede asi me/ |

| Gazprombank – Sika ƒe ƒuƒoƒo | 1.75% ƒe xexlẽme. | https://www.gpb-am.ru/ame ɖekaɖeka/pif |

| Xɔ yeye tutu | 1.72% ƒe xexlẽme. | http://pif.naufor.ru/pif.asp?act=kpɔ&id=3164. Ƒe 1999 me ƒe ɣleti gbãtɔ |

| Kapital-sika | 1.69% ƒe xexlẽme. | http://www.kapital-pif.ru/ru/ku ɖe/ ŋu. |

Mutual funds (mutual funds): nukae wònye kple aleke mutual fund wɔa dɔe, dzidzedzekpɔkpɔ na mutual funds nyuitɔwo le viɖekpɔkpɔ nu: https://youtu.be/GB_UJvUDy_s

Mutual funds of Sberbank – nukae nye gomekpɔkpɔ le Sberbank me?

Sberbank nye gadzraɖoƒe si woate ŋu ade dzesii eye woate ŋu aka ɖe edzi, si li ƒe 100 kple edzivɔe nye sia. Susu le eme be woade ga gadzraɖoƒe sia tɔgbe me, eye le esia ta la, ga si wotsɔna ƒoa ƒui ƒe mɔnu vovovowo li, míahe susu ayi esiwo koŋ dzi:

- Gaxɔgbalẽviwo ƒe gaxɔ – Ilya Muromets ( https://www.sberbank.ru/ru/ame/gadede dɔwɔƒewo/pifs/gaxɔgbalẽvi_im ). Dukɔa, dudzikpɔƒe, dɔwɔƒewo ƒe gagbalẽ siwo ŋu kakaɖedzi le ƒe Russiatɔwo ƒe agbalẽviwoe le eme. Exɔa gakpɔkpɔ tso coupon ƒe fexexe kple nunɔamesi la ƒe asixɔxɔ ƒe dzidziɖedzi me. Mutual investment fund si me afɔku ƒe alafa memamã si le sue le 0-5%, gakpɔkpɔ si wu ga ƒe asixɔxɔ si nye 8-10% kple gazazã si sɔ gbɔ.

- Ga si woatsɔ akpɔ gomewo kple gagbalẽwo gbɔ – Woda sɔ ( https://www.sberbank.ru/ru/person/investments/pifs/fund_balanced ). Ga si wotsɔ blaa gae la ƒoa gaxɔgbalẽvi ƒomevi eve nu ƒu ɖekae. Viɖe siwo wokpɔna tso ga si wokpɔna le ga me me, ga si wokpɔna tso gagbalẽwo me. Dea ga koŋ Russia ƒe gaŋutiɖoɖowo me, 10-20% ƒe kutsetse, afɔku gã kple gazazã si sɔ gbɔ.

- Dobrynya Nikitich Gaxɔa ( https://www.sberbank.ru/ru/person/investments/pifs/fund_equity_dn- ) nye Russia dɔwɔƒewo ƒe akpa aɖewo. Nusi na gaxɔa nye afɔku gã aɖe, viɖekpɔkpɔ 15-20% eye wòléa gazazã si sɔ gbɔ me ɖe asi.

Sberbank ƒe ga si wodzrana le asitɔtrɔ me: ɖe wòdze be woade ga eme – SBMX, SBSP, SBRB, SBCB kple SBGB ƒe ga si wotsɔna ƒoa ƒui: https://youtu.be/DBRrF-z-1do

Ga Siwo Wozãna Ðe Ame Ŋu Tinkoff

Exɔ nɔƒe gbãtɔ le asitsaha xɔŋkɔwo dome, exɔ nɔƒe gbãtɔ le asisi siwo le dɔ dzi vevie ƒe xexlẽme gome kple gadede gadzraɖoƒea ƒe ga si wotsɔ wɔa dɔ ɖekae me, wobunɛ be enye asitsaha si ŋu kakaɖedzi le eye wòɖea vi.

- Eternal RUB portfolio ( https://www.tinkoff.ru/invest/etfs/TRUR/ ) – Gaxɔa dea ga dɔwɔnu etɔ̃ me, Russiatɔwo ƒe adzɔnuwo kple gagbalẽwo, sika. Gadede gaŋutiɖoɖo vovovowo me nana nète ŋu tsɔa afɔku suetɔ kekeake ne èle ga dem eme, gake le ɣeyiɣi ma ke me la, enaa wòkpɔa viɖe sue 5-10%. Geɖe ƒe asi nye 6.04 rubles.

- Gakpɔkpɔ mavɔ USD ( https://www.tinkoff.ru/invest/etfs/TUSD/ ) – na be woade ga Amerikatɔwo ƒe adzɔnuwo, gagbalẽwo kple sika me le akpa etɔ̃ siwo sɔ me. Kutsetse le dɔlar me 5-10%, kple afɔku ƒe agbɔsɔsɔ si le sue. Ga si wozãna ɖe gome ɖeka ŋu nye dɔlar 0.2.

- Gakpɔkpɔ mavɔ EU R ( https://www.tinkoff.ru/invest/etfs/TEUR/ ) – na be woade ga Europa ƒe adzɔnuwo, gagbalẽwo kple sika me le akpa etɔ̃ siwo sɔ me. Yield le euro 3-5%, afɔku si le sue. Ga si woatsɔ ade gae ƒe home nye euro 0.10.

Ga Siwo Wotsɔ Wɔa Nui Alfa Capital

Dɔwɔƒe si kpɔa dɔa dzi la naa gadede asi ƒomevi dodzidzɔname aɖe le xexeame katã kple Russia dɔwɔƒe vovovowo me. Eŋutinunyalawo bua dɔwɔƒe ɖesiaɖe ŋu eye emegbe wodea gae.

- Dɔwɔnu ( https://www.alfacapital.ru/individual/pifs/opifa_akn/ ) – dɔdzikpɔla le didim, ku nu me le adzɔnu siwo ŋugbe wodo le ami kple gas kple ami, tomenukuƒewo ƒe akpawo ŋu. Nusiwo wokpɔna le eme nye 15-30%.

- Wotiaa gomekpɔkpɔ siwo me tsi le ( https://www.alfacapital.ru/individual/pifs/opifa_akliq/ ) – Russia kple duta dɔwɔƒe gãtɔwo, kple ganyawo ƒe dɔwɔwɔ nyuitɔ kekeake kple dzidziɖedzi ƒe mɔkpɔkpɔwo. Nuku ƒe kutsetse 15-25%.

- Balance ( https://www.alfacapital.ru/individual/pifs/opif_aks/ ) – gadede Russiatɔwo ƒe ga kple gagbalẽ nyuitɔwo kekeake me. Afɔku si sɔ gbɔ kple tɔtrɔgbɔ si nye 15-20%.

Gadede asi ƒe ɣeyiɣi

Gadelawo ate ŋu aƒle gome aɖe ahadzrae le ŋkeke ma ke dzi, gake ele be nàse egɔme be ekema ga buna ɖe dɔdzikpɔfewo dzi. Zi alesi nèlé gome aɖe ɖe asi ɣeyiɣi didi la, zi nenemae ga si nède eme la akpɔ viɖe geɖe wu, eye wòhea ame kple xexlẽdzesi dzeani siwo me viɖe geɖe le, wofia be ƒe 3 alo 5 ƒe ɣeyiɣi aɖe, hena ɣleti ɖeka ƒe gadede asiwo mate ŋu akpe ɖe gomea ƒe asixɔxɔ ŋu o.

Ŋɔdzi

Gome vovovowo li siwo me afɔku mele o, gake emegbe la, ga si woakpɔ tso eme la aɖiɖi. Zi alesi gakpɔkpɔa sɔ gbɔe la, zi nenemae afɔkua hã lolonae. Esi wònye be gaŋutiɖoɖowo mevo tso asitsatsa ƒe tɔtrɔwo me o eye ne asitsaƒea dze anyi la, gaxɔa ƒe asixɔxɔ ate ŋu aɖiɖi.

i would like to invested.