Compared to 2020, the number of investors on the Moscow Exchange has more than tripled. Many clients are beginners who are poorly versed in the stock market and working with brokers.

Who is a broker and how does he earn

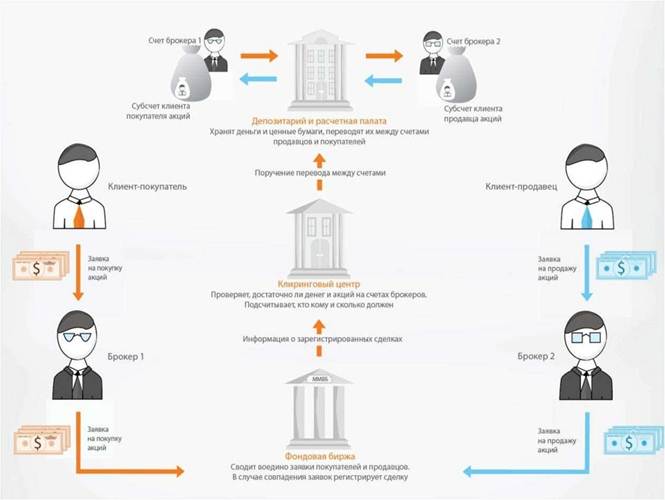

A broker is a legal or natural person who carries out financial transactions on behalf of and at the expense of a client. For the services provided, he receives a commission, the amount of which is established in the contract concluded with the client. The broker, in accordance with the legislation of the Russian Federation, must have a license from the Central Bank. In addition to the basic brokerage work permit, there may be licenses for dealer and depositary activities, asset management, etc. The list of specialists accredited by the Central Bank can be found on the website of the regulator. The activity (work) of a broker is strictly regulated by law. Some beginners confuse the concepts of broker and trader. A trader is a private person who, at the expense of his capital, is engaged in the sale, purchase of assets. But since individuals (without a license) cannot bid, to carry out transactions on the stock exchange, they also need an official intermediary – preferably a profitable broker.

- stock, exchange – a specialist who acquires and sells assets on behalf of a client, on the most favorable terms;

- credit – selects a loan product on the most favorable terms;

- leasing (similar to credit ) – works mainly with legal entities;

- forex broker – work on the Forex exchange, currency transactions can only be carried out by accredited persons, that is, brokers;

- binary (similar to forex) – an intermediary between clients in conducting binary options transactions;

- commercial (business) – selects tenants, buyers in the field of commercial real estate, start-up or ready-made business.

How and on what does a broker earn

The main goal of any business is to make a profit, the work of a broker is no exception. Professional market participants receive income on commission, margin operations, the introduction of personal assets into the work. A financial broker sells or acquires securities on the stock exchange on the initiative, application of the client. This is the main obligation, but not the only one, the broker also carries out and provides the following services:

- opening and maintaining an account;

- preparation of reports on turnover and balance of assets;

- financial advice on trading;

- stock market analytics;

- acquisition, sale of shares at the request of the client;

- payment of taxes;

- submits tax returns.

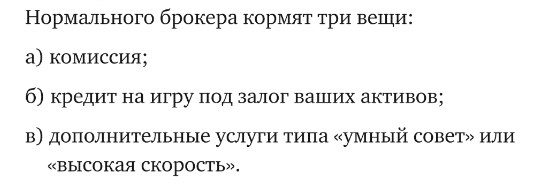

[caption id="attachment_296" align="aligncenter" width="624"]The motto of any broker is commission! After all, it is from the commission that he receives his main income. And in order to earn your commissions, you need to attract as many clients as possible who are actively trading.

Brokerage commission

Commissions for a transaction are different for different brokers, in addition, a fee may be charged for account maintenance, depositary services (storage of securities). The stock exchange takes an additional commission, which is not included in the commission fee of the manager. When compared with foreign countries, in particular the United States, there are fixed commissions, paid on a separate paper. In the Russian Federation, the situation is different, for each transaction the client will pay a commission fee.

The more trades you make, the more commission the broker receives – this is important for understanding why it is beneficial for the broker that you trade a lot.

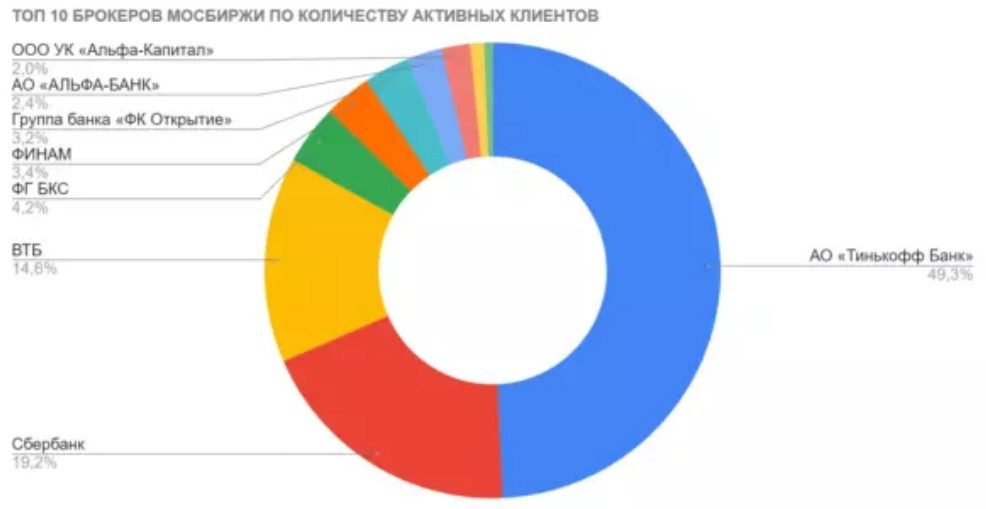

The most popular brokers (read profitable) in Russia as of the end of 2021:

| Popular Brokers | Rate | Transaction fee | Maintenance (month) | Depositary services |

| Tinkoff | “Trader” | 0.025 – 0.05% | 290 rub. | is free |

| Tinkoff | “Investor” | 0.3% | is free | is free |

| VTB | “My online” | 0.05% | is free | is free |

| VTB | “Professional Standard” | 0.015 – 0.0472% | is free | 150 rub. |

| BCS World of Investments | “Trader” | 0.01 – 0.03% | 299 rub. | is free |

| BCS World of Investments | “Investor” | 0.1% | is free | is free |

| Alfa Bank | “Tariff M” | 0.015 – 0.07% | 290 rub. | is free |

| Alfa Bank | “Tariff S” | 0.03% | is free | is free |

| Sberbank | “Investor” | 0.018 – 0.3% | is free | is free |

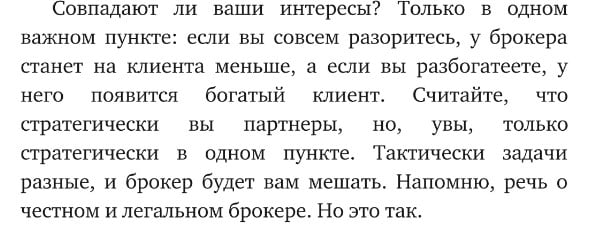

An investor who has invested in shares and is waiting for their value to rise is not profitable and not interesting to the manager. The greater the turnover on transactions, the greater his earnings!

The most profitable broker commissions – fact or fiction?

In fact, profitable commissions for the client simply do not exist. In any case, the investor will pay the manager and not necessarily from the profit. The broker’s income does not consist of the client’s profit, but of the number of operations performed on the account.

The broker is not a friend to the investor, it does not matter to him whether the transaction was profitable. He will receive his guaranteed fee in any case!

Margin lending

Greater competition in the stock markets holds back the growth of tariffs, which means that it is more difficult to make money as a broker. To increase the volume of transactions carried out by investors, brokers offer margin lending. Cash or securities are issued at the expense of the broker’s or other clients’ own investments. Such a loan is secured by the investor’s assets. The amount of margin usually exceeds the amount of collateral. The option of automatically connecting a margin loan is present in many tariff plans. If there are not enough assets to complete the transaction, additional funds are automatically entered. As a result, brokers receive their interest on the loan by introducing their own capital, as well as additional interest for the transaction. If funds for investment are taken from the accounts of other clients, then they are paid a minimum rate of 0, 05% per annum. The double brokerage benefit is obvious. For example, VTB Bank provides a margin (cash) loan in rubles at a rate of 16.8% per annum (LONG – long position), in foreign currency – 4.5%. Bank Opening from 16%, in foreign currency from 3.7% (depending on the tariff plan and security). Securities margin loan (REPO) – VTB Bank (SHORT – short position) – 13% in rubles, in foreign currency – 4.5%. Usually REPO is issued for a short position.

Margin lending is another profitable, commercially profitable brokerage move. It turns out that the manager provides a margin loan, receives his own interest from it, additional interest on the transaction, and all these operations are secured by the client’s assets.

Short

Short (short positions or sales) is another service provided by brokers for additional income. When the trend (expectation) of the fall of certain shares, the investor decides to sell them. The manager can give advice, borrow shares, sell them, and when their price drops further, buy them again. The difference from such a transaction will be the investor’s earnings. The broker will receive his shares as a loan repayment + interest for the transaction. If the shares grow in price, then the client will have to buy more expensive, the security of such a transaction is his assets. Who is a broker and what does he do on the exchange: https://youtu.be/9-MfgQCTxJo

Investment products

Finished products are intermediate investments between independent or trusted ones. The client can choose which assets to invest in, the level of profitability and risk, and the terms.

Trust management is an instruction to a broker to fully manage assets. Typically, the term of trust management is 3 years. It is clear that the receipt of income depends entirely on the manager and it is not guaranteed to the investor.

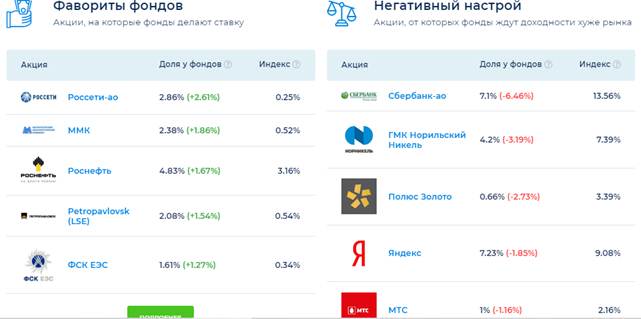

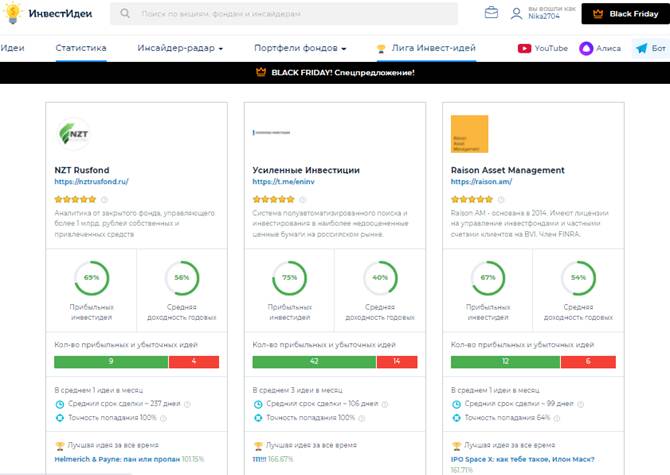

Unlike a broker, the guaranteed commission fee for asset management and for each transaction made by the investor, without receiving income, will be paid to the manager. In order to attract more customers, and hence increase the turnover of funds, brokers are developing new investment products. As you can see, % of investment ideas is much higher than % of their profitability:

How to minimize losses when trading through a broker – is it possible

Before investing assets to work on the stock exchange, you need to study the financial market. To work on the stock market, first of all, you need not the most profitable, but a reliable broker for investment. For proper interaction with the manager, you need to decide:

- what assets to invest in (bonds, stocks, etc.), currency;

- the desired profitability of the product;

- investment terms (perpetual, fixed).

Carefully study the documents:

- before signing the contract, be sure to read the risk declaration;

- study the contract, find out how and when, the conditions for actually withdrawing all or part of the funds (investments are not insured!).

If the investor is satisfied with all the conditions, the contract is signed and funds are deposited into the account. The signing of the contract can take place remotely. It is necessary to periodically check the report, the state of the account, take into account how much brokers on the stock exchange earn on your financial transactions. If the client considers that the manager’s strategy is not justified, the option of switching to a more favorable tariff should be discussed.

Conclusion: brokers are interested in investors trading more and more often. Their earnings depend entirely on the number of deals made.

On the Russian market, the most popular brokerage companies take fractions of a percentage of transactions that are rarely carried out. But if the client is actively trading, and transactions are concluded for large amounts, then the commission can be significant. The development of new products increases the client base, and hence the turnover of funds. Even the most profitable broker in Russia works to obtain, first of all, its own benefit, and secondarily for the benefit of the investor. Although it is precisely because of the number of clients and transactions carried out by him that his total income is formed. The main task of the broker is to find a “golden mean”, attract more actively trading clients, providing them with a stable income, if possible, and receive their legitimate fee.

On the Russian market, the most popular brokerage companies take fractions of a percentage of transactions that are rarely carried out. But if the client is actively trading, and transactions are concluded for large amounts, then the commission can be significant. The development of new products increases the client base, and hence the turnover of funds. Even the most profitable broker in Russia works to obtain, first of all, its own benefit, and secondarily for the benefit of the investor. Although it is precisely because of the number of clients and transactions carried out by him that his total income is formed. The main task of the broker is to find a “golden mean”, attract more actively trading clients, providing them with a stable income, if possible, and receive their legitimate fee.