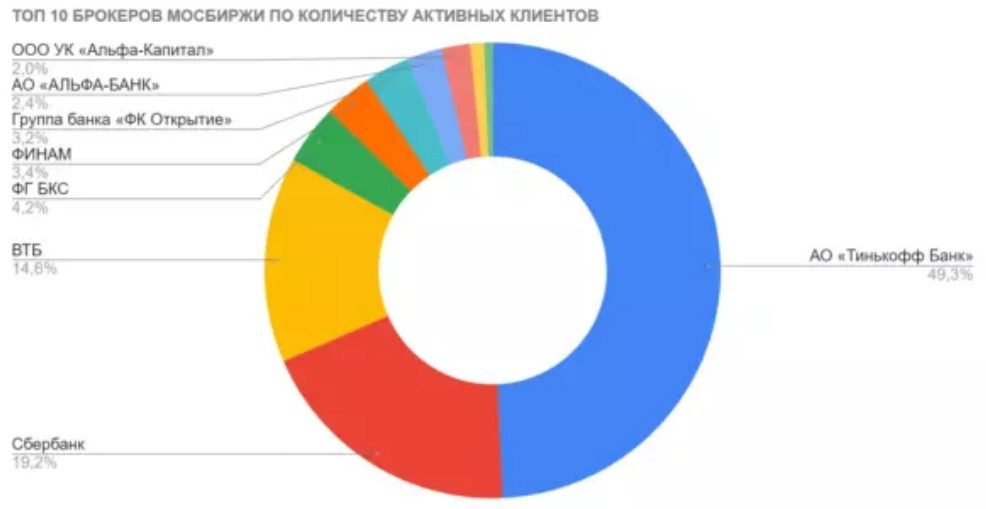

Idan aka kwatanta da 2020, adadin masu saka hannun jari a Canjin Moscow ya ninka fiye da sau uku. Yawancin abokan ciniki sune mafari waɗanda ba su da masaniya a kasuwar hannun jari kuma suna aiki tare da dillalai.

Wanene dillali kuma ta yaya yake samun

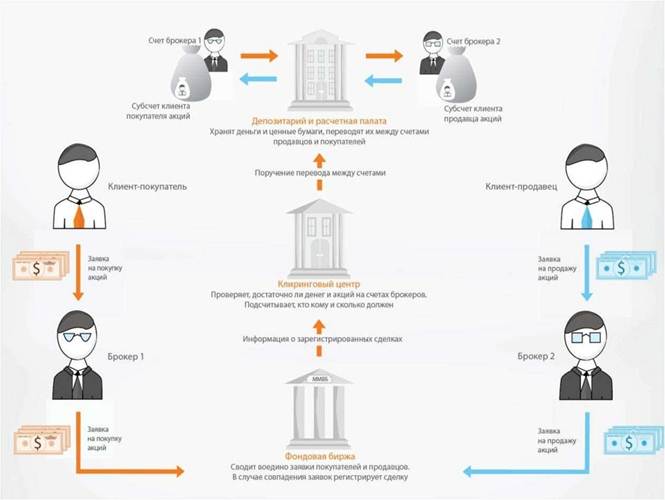

Dillali mutum ne na doka ko na halitta wanda ke gudanar da hada-hadar kudi a madadin abokin ciniki da kuma kashe shi. Don ayyukan da aka bayar, yana karɓar kwamiti, adadin wanda aka kafa a cikin kwangilar da aka kammala tare da abokin ciniki. Dillali, bisa ga dokokin Tarayyar Rasha, dole ne ya sami lasisi daga Babban Bankin. Baya ga ainihin izinin aikin dillali, ana iya samun lasisi don ayyukan dila da ajiyar kuɗi, sarrafa kadara, da sauransu. Ana iya samun jerin ƙwararrun ƙwararrun da Babban Bankin Ƙasa ya amince da su akan gidan yanar gizon mai gudanarwa. Aiki (aiki) na dillali doka ce ta tsara shi sosai. Wasu masu farawa suna rikitar da ra’ayoyin dillali da mai ciniki. Dan kasuwa mutum ne mai zaman kansa wanda, a cikin kudin jarinsa, ya tsunduma cikin siyarwa, siyan kadarori. Amma tunda daidaikun mutane (ba tare da lasisi ba) ba za su iya bayarwa ba, don aiwatar da ma’amaloli a kan musayar hannun jari, suna kuma buƙatar mai shiga tsakani na hukuma – zai fi dacewa dillali mai riba. [taken magana id = “abin da aka makala_287” align = “aligncenter” nisa = “582”]

- hannun jari, musayar – ƙwararren ƙwararren wanda ke siyar da siyar da kadarori a madadin abokin ciniki, akan mafi kyawun sharuɗɗan;

- bashi – ya zaɓi samfurin lamuni akan mafi kyawun sharuddan;

- haya (kama da bashi ) – yana aiki da yawa tare da ƙungiyoyin doka;

- dillali na forex – aiki a kan musayar Forex, ma’amalar kuɗi za a iya aiwatar da su ta hanyar mutane masu izini kawai, wato, dillalai;

- binary (mai kama da forex) – tsaka-tsaki tsakanin abokan ciniki wajen gudanar da ayyukan zaɓuɓɓukan binary;

- kasuwanci (kasuwanci) – ya zaɓi masu haya, masu siye a fagen kasuwancin kasuwanci, farawa ko kasuwancin da aka shirya.

Ta yaya kuma akan me dillali yake samu

Babban burin kowane kasuwanci shine samun riba, aikin dillali ba banda bane. Masu sana’a masu sana’a na kasuwa suna samun kudin shiga a kan kwamiti, ayyuka na gefe, gabatarwar kadarorin sirri a cikin aikin. Dillali na kuɗi yana siyarwa ko samun takaddun shaida akan musayar hannun jari akan yunƙurin, aikace-aikacen abokin ciniki. Wannan shi ne babban hakki, amma ba shi kaɗai ba, dillali kuma yana aiwatar da ayyuka masu zuwa:

- budewa da kula da asusu;

- shirye-shiryen rahotanni game da juyawa da ma’auni na dukiya;

- shawarwarin kudi akan ciniki;

- nazarin kasuwannin hannayen jari;

- saye, sayar da hannun jari a buƙatar abokin ciniki;

- biyan haraji;

- sallama haraji.

Taken kowane dillali shine kwamiti! Bayan haka, daga hukumar ne yake samun babban kudin shigarsa. Kuma don samun kwamitocin ku, kuna buƙatar jawo hankalin abokan ciniki da yawa waɗanda ke yin ciniki sosai.

[taken magana id = “abin da aka makala_296” align = “aligncenter” nisa = “624”]

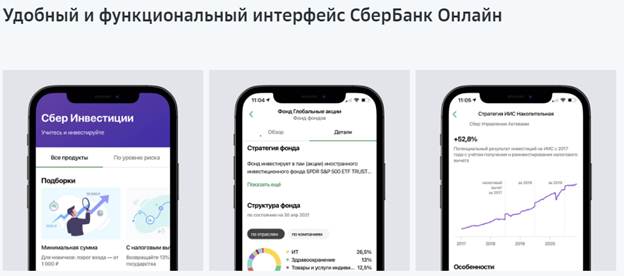

Hukumar dillalai

Kwamitocin don ma’amala sun bambanta ga dillalai daban-daban, ƙari, ana iya cajin kuɗi don kula da asusu, ayyukan ajiya (ajiya na tsaro). Kasuwancin hannun jari yana ɗaukar ƙarin kwamiti, wanda ba a haɗa shi cikin kuɗin hukumar na manajan ba. Idan aka kwatanta da ƙasashen waje, musamman Amurka, akwai ƙayyadaddun kwamitocin, wanda aka biya akan takarda daban. A cikin Tarayyar Rasha, yanayin ya bambanta, ga kowane ma’amala abokin ciniki zai biya kuɗin kwamiti. [taken magana id = “abin da aka makala_288” align = “aligncenter” nisa = “552”]

Yawan cinikai da kuke yi, ƙarin kwamitocin da dillali ke karɓa – wannan yana da mahimmanci don fahimtar dalilin da yasa yake da fa’ida ga dillali kuna kasuwanci da yawa.

Shahararrun dillalai (karanta riba) a cikin Rasha har zuwa ƙarshen 2021:

| Shahararrun Dillalan | Rate | Kudin ciniki | Kulawa (wata) | Ayyukan ajiya |

| Tinkoff | “Dan kasuwa” | 0.025 – 0.05% | 290 rub. | yana da kyauta |

| Tinkoff | “Mai saka jari” | 0.3% | yana da kyauta | yana da kyauta |

| VTB | “My online” | 0.05% | yana da kyauta | yana da kyauta |

| VTB | “Ma’auni na Ƙwarewa” | 0.015 – 0.0472% | yana da kyauta | 150 rub. |

| BCS Duniya na Zuba Jari | “Dan kasuwa” | 0.01 – 0.03% | 299 rub. | yana da kyauta |

| BCS Duniya na Zuba Jari | “Mai saka jari” | 0.1% | yana da kyauta | yana da kyauta |

| Alfa Bank | “Tariff M” | 0.015 – 0.07% | 290 rub. | yana da kyauta |

| Alfa Bank | “Tariff S” | 0.03% | yana da kyauta | yana da kyauta |

| Sber Bank | “Mai saka jari” | 0.018 – 0.3% | yana da kyauta | yana da kyauta |

[taken magana id = “abin da aka makala_291” align = “aligncenter” nisa = “986”] Rabon

Mai saka hannun jari wanda ya saka hannun jari kuma yana jiran darajar su ta tashi ba ta da fa’ida kuma ba ta da ban sha’awa ga manajan. Mafi girman jujjuyawar ma’amaloli, yawan abin da ya samu!

Kwamitocin dillalai mafi riba – gaskiya ko almara?

A gaskiya ma, kwamitocin riba don abokin ciniki kawai ba su wanzu. A kowane hali, mai saka jari zai biya manajan kuma ba lallai ba ne daga ribar. Kudin dillali bai ƙunshi ribar abokin ciniki ba, amma na yawan ayyukan da aka yi akan asusun.

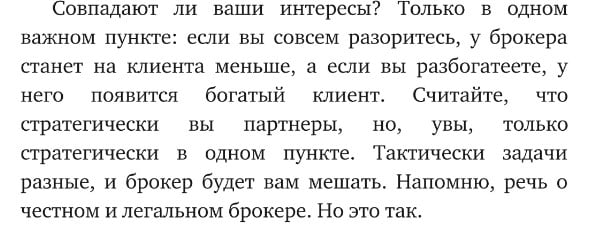

Dillali ba abokin mai saka jari ba ne, ko cinikin ya samu riba ba komai a gare shi. Zai karɓi kuɗin da aka ba shi garanti a kowane hali!

Lamuni mai gefe

Gasa mafi girma a kasuwannin hannun jari yana hana haɓakar kuɗin fito, wanda ke nufin cewa yana da wahala a sami kuɗi a matsayin dillali. Don ƙara yawan ma’amaloli da masu zuba jari ke yi, dillalai suna ba da rancen gefe. Ana bayar da tsabar kuɗi ko takaddun shaida ta hanyar kuɗin dillali ko wasu na hannun jarin abokan ciniki. Irin wannan lamuni yana samuwa ta hanyar kadarorin mai saka hannun jari. Adadin gefe yakan wuce adadin lamuni. Zaɓin haɗa lamunin gefe ta atomatik yana nan a cikin tsare-tsaren jadawalin kuɗin fito da yawa. Idan babu isassun kadarori don kammala ciniki, ana shigar da ƙarin kuɗi ta atomatik. A sakamakon haka, dillalai suna karɓar sha’awar su akan lamuni ta hanyar gabatar da jarin kansu, da kuma ƙarin sha’awar ciniki. Idan an karɓi kuɗi don saka hannun jari daga asusun wasu abokan ciniki, to ana biyan su ƙaramin adadin 0, 05% a kowace shekara. Amfanin dillali biyu a bayyane yake. Misali, Bankin VTB yana ba da lamuni na gefe (tsabar kudi) a cikin rubles a cikin adadin 16.8% a kowace shekara (DOGO – matsayi mai tsayi), a cikin ƙasashen waje – 4.5%. Buɗe Banki daga 16%, a cikin kuɗin waje daga 3.7% (dangane da tsarin jadawalin kuɗin fito da tsaro). Lamuni na Securities (REPO) – Bankin VTB ( GAJEN – gajeriyar matsayi) – 13% a cikin rubles, a cikin kudin waje – 4.5%. Yawancin lokaci ana ba da REPO don ɗan gajeren matsayi.

Bayar da lamuni mai fa’ida wani riba ce, mai fa’ida ta kasuwanci. Ya bayyana cewa manajan yana ba da rancen gefe, yana karɓar sha’awar kansa daga gare ta, ƙarin sha’awa akan ma’amala, kuma duk waɗannan ayyukan ana kiyaye su ta hanyar kadarorin abokin ciniki.

Gajere

Short (gajeren matsayi ko tallace-tallace) wani sabis ne da dillalai ke bayarwa don ƙarin kudin shiga. Lokacin da yanayin ( tsammanin) faduwar wasu hannun jari, mai saka jari ya yanke shawarar sayar da su. Manajan na iya ba da shawara, aron hannun jari, sayar da su, kuma idan farashin su ya faɗi gaba, sake siyan su. Bambanci daga irin wannan ma’amala zai zama abin da mai saka jari ya samu. Dillali zai karɓi hannun jarinsa a matsayin biyan lamuni + ribar ciniki. Idan hannun jari ya girma a farashin, to abokin ciniki zai sayi mafi tsada, amincin irin wannan ma’amala shine kadarorinsa. Wanene dillali kuma me yake yi akan musayar: https://youtu.be/9-MfgQCTxJo

Kayayyakin zuba jari

Kayayyakin da aka ƙare su ne matsakaicin saka hannun jari tsakanin masu zaman kansu ko amintattu. Abokin ciniki zai iya zaɓar waɗanne kadarorin da zai saka hannun jari, matakin riba da haɗari, da sharuɗɗan.

Gudanar da amana umarni ne ga dillali don sarrafa dukiyoyi. Yawanci, wa’adin gudanar da amana shine shekaru 3. A bayyane yake cewa samun kudin shiga ya dogara ne ga mai sarrafa kuma ba a ba da garantin ga mai saka jari ba.

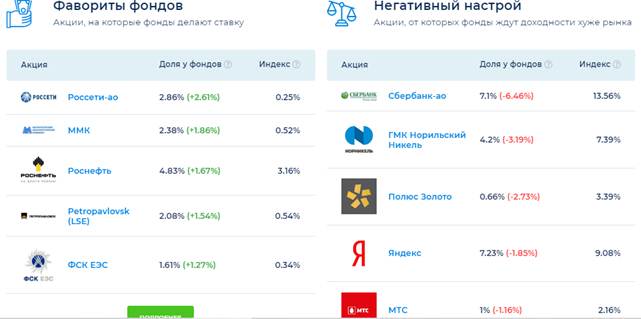

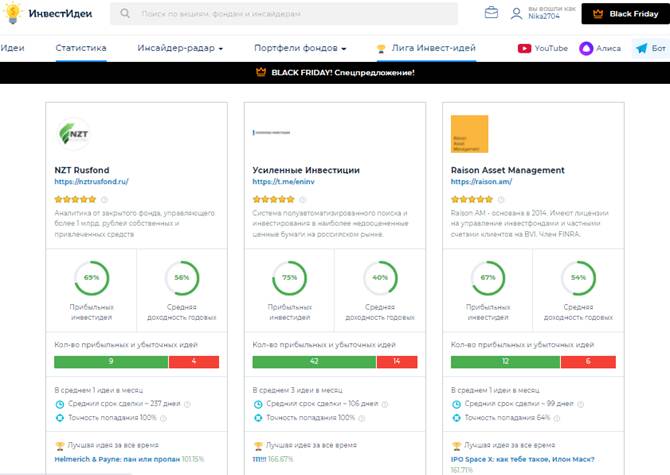

Ba kamar dillali ba, garantin kuɗin hukumar don gudanar da kadara da kowane ma’amala da mai saka jari ya yi, ba tare da samun kuɗin shiga ba, za a biya wa mai sarrafa. Don jawo hankalin abokan ciniki da yawa, don haka ƙara yawan kuɗin kuɗi, dillalai suna haɓaka sabbin samfuran saka hannun jari. Kamar yadda kake gani, % na ra’ayoyin saka hannun jari ya fi % na ribar da suke samu: [taken magana id = “abin da aka makala_298” align = “aligncenter” wide=”670″]

Yadda za a rage asara lokacin ciniki ta hanyar dillali – zai yiwu

Kafin saka hannun jari don yin aiki akan musayar hannun jari, kuna buƙatar yin nazarin kasuwar kuɗi. Don yin aiki a kan kasuwar jari, da farko, ba ku buƙatar mafi yawan riba, amma dillali mai dogara don zuba jari. Don kyakkyawar hulɗa tare da manajan, kuna buƙatar yanke shawara:

- wace kadarorin da za a saka hannun jari a ciki (bonds, hannun jari, da sauransu), kudin waje;

- ribar da ake so na samfurin;

- sharuddan zuba jari (har abada, kafaffen).

Yi nazarin takaddun a hankali:

- kafin sanya hannu kan kwangilar, tabbatar da karanta bayanin haɗarin;

- nazarin kwangilar, gano yadda kuma lokacin, yanayin da za a cire duk ko ɓangare na kudaden (ba a sanya hannun jari ba!).

Idan mai saka jari ya gamsu da duk sharuɗɗan, an sanya hannu kan kwangilar kuma an saka kuɗi a cikin asusun. Sa hannu kan kwangilar na iya faruwa daga nesa. Wajibi ne a duba rahoton lokaci-lokaci, yanayin asusun, la’akari da yawan dillalai a kan musayar hannun jari suka samu akan ma’amalolin ku na kuɗi. Idan abokin ciniki ya yi la’akari da cewa dabarar mai sarrafa ba ta dace ba, za a tattauna zaɓin canzawa zuwa jadawalin kuɗin fito mafi dacewa.

Kammalawa: dillalai suna sha’awar masu saka hannun jari suna kasuwanci da yawa. Abubuwan da suke samu ya dogara gaba ɗaya akan adadin yarjejeniyar da aka yi.

A kasuwannin Rasha, shahararrun kamfanonin dillalai suna ɗaukar ɓangarorin kaso na ma’amaloli waɗanda ba a cika yin su ba. Amma idan abokin ciniki yana kasuwanci sosai, kuma an ƙaddamar da ma’amaloli don adadi mai yawa, to hukumar na iya zama mahimmanci. Haɓaka sabbin samfura yana haɓaka tushen abokin ciniki, sabili da haka canjin kuɗi. Ko da mafi yawan riba a Rasha yana aiki don samun, da farko, amfanin kansa, kuma na biyu don amfanin mai saka jari. Ko da yake dai saboda yawan abokan ciniki da mu’amalar da ya yi ne ya sa jimillar kudaden shigar sa ke samuwa. Babban aikin dillali shine nemo “ma’anar zinare”, jawo hankalin abokan ciniki masu himma, samar musu da ingantaccen samun kudin shiga, idan zai yiwu, da karɓar kuɗin da ya dace.

A kasuwannin Rasha, shahararrun kamfanonin dillalai suna ɗaukar ɓangarorin kaso na ma’amaloli waɗanda ba a cika yin su ba. Amma idan abokin ciniki yana kasuwanci sosai, kuma an ƙaddamar da ma’amaloli don adadi mai yawa, to hukumar na iya zama mahimmanci. Haɓaka sabbin samfura yana haɓaka tushen abokin ciniki, sabili da haka canjin kuɗi. Ko da mafi yawan riba a Rasha yana aiki don samun, da farko, amfanin kansa, kuma na biyu don amfanin mai saka jari. Ko da yake dai saboda yawan abokan ciniki da mu’amalar da ya yi ne ya sa jimillar kudaden shigar sa ke samuwa. Babban aikin dillali shine nemo “ma’anar zinare”, jawo hankalin abokan ciniki masu himma, samar musu da ingantaccen samun kudin shiga, idan zai yiwu, da karɓar kuɗin da ya dace.