Otkritie Broker is one of the leading structures offering to open brokerage accounts for both beginners and experienced users. In this structure, it is extremely convenient to carry out financial transactions. This opportunity will be offered by a personal account created on the official website of Otkritie Broker, as well as a mobile application that can be downloaded to any device.

- General idea of the structure Opening Broker Investments

- Why use this platform

- Advantages and disadvantages of the company

- Ways to open an account with Opening Broker

- How to open IIS and billing conditions in 2022

- How to download, install and register in the Otkritie Broker application

- Login to your personal account Otkritie Broker

- Setting, resource interface

- How to trade and invest

- Procedure for applying tariffs

- Pros and cons of investing in Discovery

- Demo account opening broker – opening and features

General idea of the structure Opening Broker Investments

Otkritie Broker is currently one of the largest backbone credit structures of the state. The foundation of the company dates back to 1995. At the moment, it is part of the FC Otkritie bank group. Today, Otkritie Broker is recognized as one of the leading trading operators on the

Moscow Exchange. He was repeatedly recognized as a laureate of various nominations of the “Stock Market Elite” contest. The intermediary in the purchase of shares and securities is Otkritie Investments. The leading offer is investing in securities. The prospect of using a mobile application allows you to invest in the world’s largest companies at any convenient time. At Otkritie Broker, your personal account is open for entry from any device with Internet access. The company occupies a leading position in terms of the number of officially registered customers. At the moment, the network of branches is successfully operating throughout the territory of the Russian Federation, as well as in other states.

Why use this platform

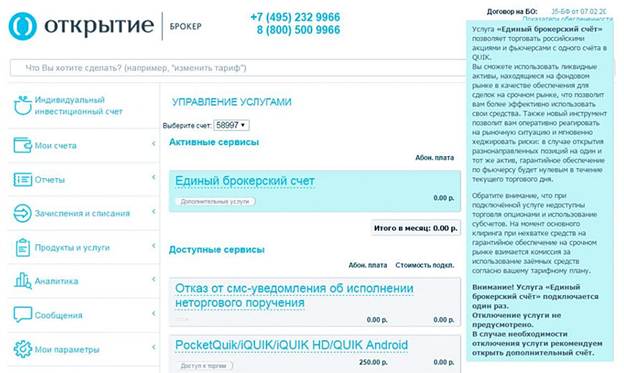

Using the offers of the Otkritie Broker platform provides clients with a convenient and easy access to trading floors in Russia and abroad through the use of trading prospects and investment opportunities. This makes it possible:

- use a single account for all markets and trading systems from the Moscow Exchange to foreign resources;

- use the main trading mode, including REPO transactions, repurchase and placement of securities, and other opportunities;

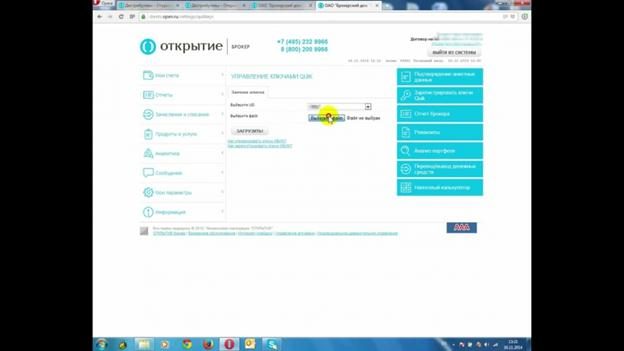

- in the context of markets, receive up-to-date information on the reflection of all QUIK limits ;

- have maximum access to official reporting in the context of trading portfolios, markets, trading systems;

- send a broker report in XML format and more.

It also provides for the provision of the following types of assistance:

- implementation of prompt transfer of funds from a settlement account to a brokerage account and vice versa;

- execution of withdrawal and crediting from a brokerage account;

- trade consulting on the principle of advisory.

As a result, assistance is provided on the maximum range of issues related to the choice of investment decisions, brokerage services, and trading on the stock exchange. It’s all possible to do it in LK Opening Broker.

Advantages and disadvantages of the company

Over the years of successful activity, the company has confidently taken a leading position in its sector of the financial market. Among the poles are noted:

- access to international markets, including the USA, Great Britain, Canada;

- margin loan offer from 6.5%;

- use of convenient trading services on the derivatives market.

Among the disadvantages:

- the presence of the company’s right to unilaterally implement tariff changes after notification directly on the site;

- application of additional commissions if there is less than 50,000 rubles in the portfolio.

Ways to open an account with Opening Broker

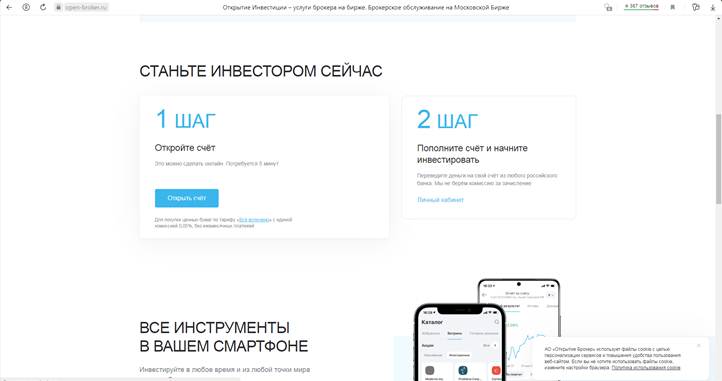

Any potential user can open an account.

- go to the company’s website and click on the “open an account” button;

- make a deposit and start investing.

One of the most attractive for a beginner is the All Inclusive tariff, which is recognized as the most convenient for long-term investments.

Its additional advantage is the absence of monthly and depository fees. The commission on transactions is minimal and amounts to only 0.05% of the total volume of all transactions performed. 0.15% is paid for Eurobonds. To make all operations more profitable will allow the use of the Otkritie bank card to carry out the withdrawal of money through your personal account on the opening broker website. A significant advantage of having a personal account opening a broker for individuals is the connection to the client’s resource of a personal manager.

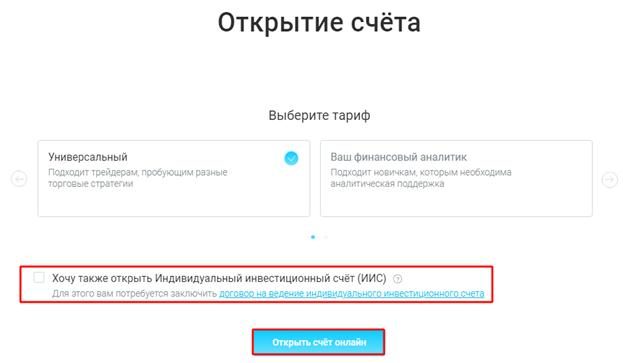

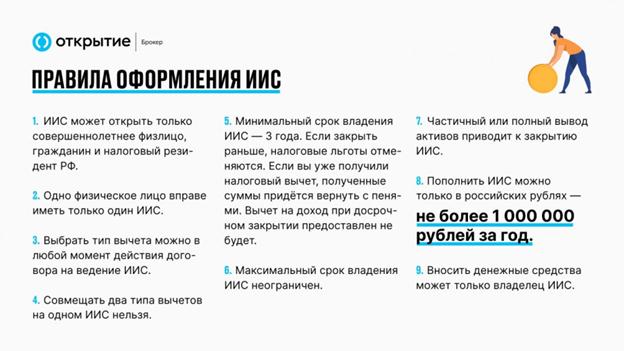

How to open IIS and billing conditions in 2022

Opening an individual investment account (IIA) becomes an attractive and beneficial type of cooperation for clients

. The creation of such a section is also performed on the company’s website. At the moment when the client activates the transition to the account creation section, the system offers to consider the prospect of opening an Individual Investment Account. This option has significant benefits.

- Obtaining tax benefits from the state in the form of a tax deduction of up to 52,000 rubles or exemption from income taxes.

- The use of IIS is equally beneficial for beginners and experienced market players.

- The prospect of receiving passive income that helps in achieving long-term goals.

The client has the right to open only one IIS for up to three years with an unlimited validity period. The annual maximum amount of the contribution is set. It is 1,000,000 rubles. For a quick start, the best option is to open an All Inclusive account. The success of the start guarantees a personal account for the client in opening an investment broker. After creating a personal account in the opening of the broker, the entrance is performed using a single login and password. The security of the user’s personal data is confirmed by reviews on opening a broker. In lx opening a broker, the entrance is performed using a single password.

Every adult citizen of the Russian Federation can open a personal account. You just need to open the resource and download the application.

How to download, install and register in the Otkritie Broker application

A convenient resource is the use of an application available for download at the link https://open-broker.ru/invest/promo/mobile/. A simple procedure will allow even a beginner to start investing. It is enough to use a phone with access to the network. Using the application helps to master the rules of successful investment even when there is only 30 minutes for such an activity.

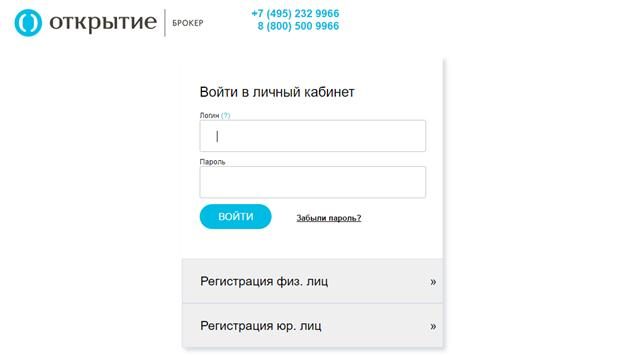

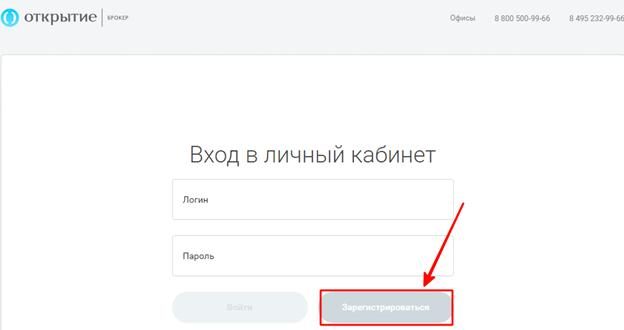

Login to your personal account Otkritie Broker

To successfully use the prospects for using the company’s offers, it is enough to create a personal account on the resource. It is important that there is no need to personally visit the branch of the company. All stages of creating a personal account are performed remotely. There is even no need to simply leave your favorite armchair or office chair. It is enough to enter the opening of the broker through the phone.

Setting, resource interface

To successfully use the company’s offers, it is enough to take just two steps. The first of these is the creation of a personal account and opening an account. Further, funds are transferred to the created account from the client’s account in any Russian bank. An attractive advantage of the company is the absence of charging a commission for the translation. After installing the mobile application, there is a prospect of successful financial transactions from anywhere in the world. It is enough just to go from a device with access to the network to your personal account.

How to trade and invest

An attractive feature for a client of a joint-stock company opening a broker is the prospect of using profits through trading and investing, even for a beginner. Promotions and loyalty programs help you start making a profit. Such as the 30 cashback promotion, which allows virtually every new client, upon creating a personal account, to receive actually start-up capital to the account in order to receive the first lessons for the successful use of investment investments. The site offers a separate offer for a novice investor. Such as the online marathon of immersion in investments “Easy Start”. In the opening of the investment, favorable rates are used, focused on new customers and those regular players who plan to develop their own knowledge and skills.

- nine-day course of study;

- lectures by 4 authoritative experts

- checking the acquired skills in a test mode.

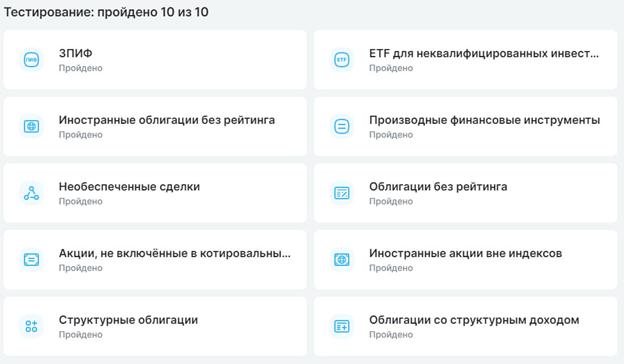

The answers to the broker opening tests, published in the public domain on the company’s website, help to check the knowledge gained.

Procedure for applying tariffs

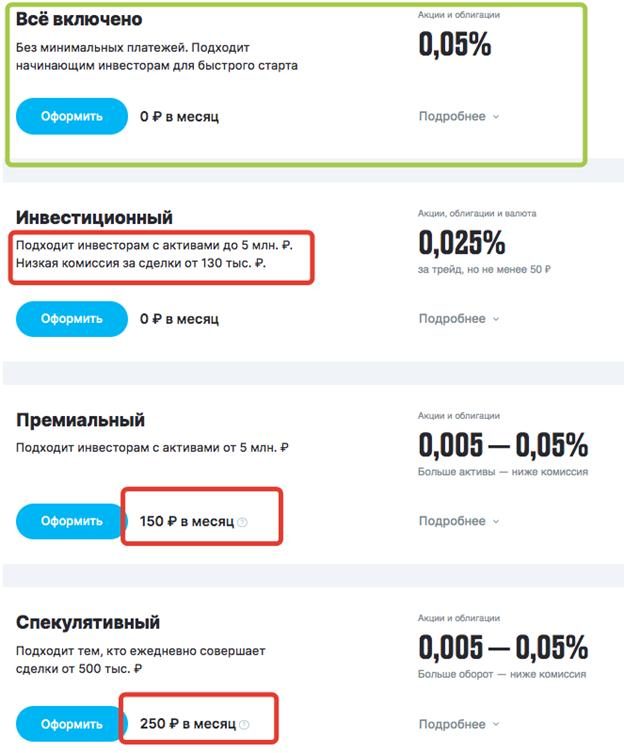

The choice of tariffs for IIS or a brokerage account is available on the official website of the company. At the moment, the opening broker offers the use of the following tariffs:

- offered free of charge at 0% per month ” All Inclusive “, beneficial to all investors, especially beginners;

- developed for investors with assets up to 5 million rubles ” Investment “, maintenance also costs 0% per month;

- customers with assets of more than 5 million rubles are eligible for the Premium tariff , with service of 150 rubles per month;

- customers who make transactions every day from 500 thousand rubles will be comfortable with the “Speculative” tariff with registration from 250 rubles.

Pros and cons of investing in Discovery

The company’s offer is in great demand among customers. Before considering the prospect of creating a personal account and starting investing, it is worth considering the potential advantages and disadvantages of the company. The pluses include:

- easy access to international markets;

- profitable margin loan of 6.5%;

- offer of consulting a client by a personal manager;

- customers can trade on US exchanges.

Among the minuses:

- a tariff scale that can seem confusing to a beginner;

- the depositary commission is fixed, amounting to 175 rubles per month;

- free service only if the amount on the account is more than 50,000 rubles, with a smaller amount, 295 rubles are charged every month;

- charging 1% in the form of a commission when making payments by card, there is no commission for bank transfers;

- technical support is not always ready to promptly provide advice and assistance.

Detailed information is available by calling the broker opening hotline.

Demo account opening broker – opening and features

A significant advantage for every novice investor is the prospect of initially trying out all the shares and functions of the company when using a demo account. When using a demo account, every beginner has the opportunity to use the best practices of the world’s leading investors. The rules of the account help to master the rules of investing and making a profit.

go

goo