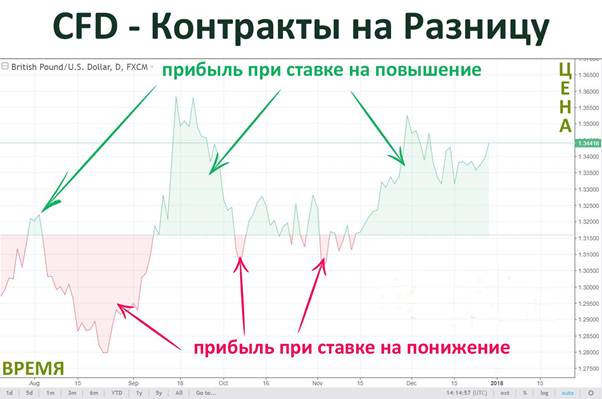

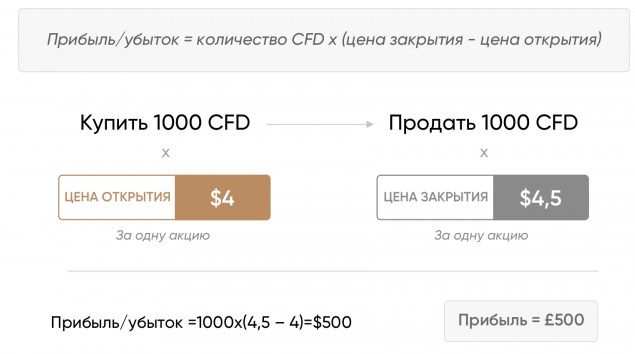

Contract for Difference (CFD) – description of the instrument. A contract for difference (CFD) is a derivative financial instrument that fully corresponds to the value of a real asset, but at the same time, the buyer does not have ownership rights, only the right to profit (or loss) from changes in quotations. In essence, a CFD is an agreement between

a broker and a client, the essence of which is the exchange of the difference between the purchase and sale prices of the underlying asset. To participate in the auction, you do not need to buy the asset itself, you can buy shares, currencies, crypto assets on one account.

- no ownership of the asset;

- there are contracts for different assets (stocks, currencies, indices, metals, cryptocurrencies);

- you can open a deal both long and short;

- the use of margin lending – for the purchase, the broker does not require the entire amount of the asset, but a certain percentage (usually 5-10%);

- the contract is indefinite.

Features of CFD trading

The broker provides leverage when trading CFD contracts. Only a small part of the asset price is blocked on the account, which allows traders with small capital to participate in trading.

What is the deposit required when trading on a CFD

The advantage of CFDs is that there is no need to buy the asset at full price. For example, to buy 1 lot (1000 barrels) of wti oil at the rate of $95 per barrel, $95,000 is required. But the broker only requires $950 in collateral. The minimum lot for popular oil CFD brokers is wti 0.01, which means that a margin of $9.5 is required. Next, the trader should look at the style of the trading system, how long the longest losing series lasted and what is the average stop size. For example, the average stop is 40 sts, a losing series of 10 trades = 40 * 0.1 * 10 + 9.5 = $49.5. This means that to trade 0.01 lots using such a system, you need $50. If you need to trade several instruments or take large volumes, you need to conduct a similar analysis for each asset. On average, $50-200 is enough to start trading.

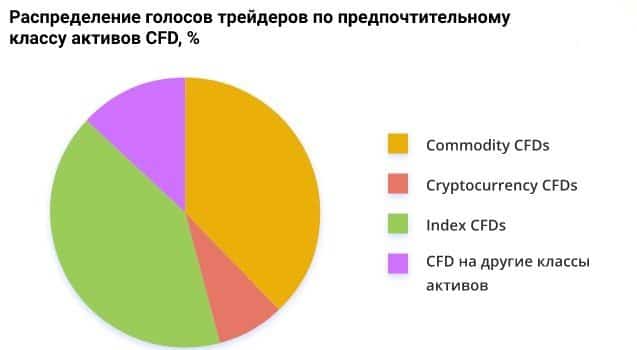

Most Popular CFDs

You can trade cfd contracts for a wide variety of assets:

- indices (UK100, GER40, FRA40, ESP35);

- shares (HSBA.L, BRBY.L, NWG.L, LLDY.L);

- currency (EURUSD, GBPUSD, EURGBP, GBPJPJ);

- commodities (wti oil, gold, silver, copper).

Features of trading contracts for difference

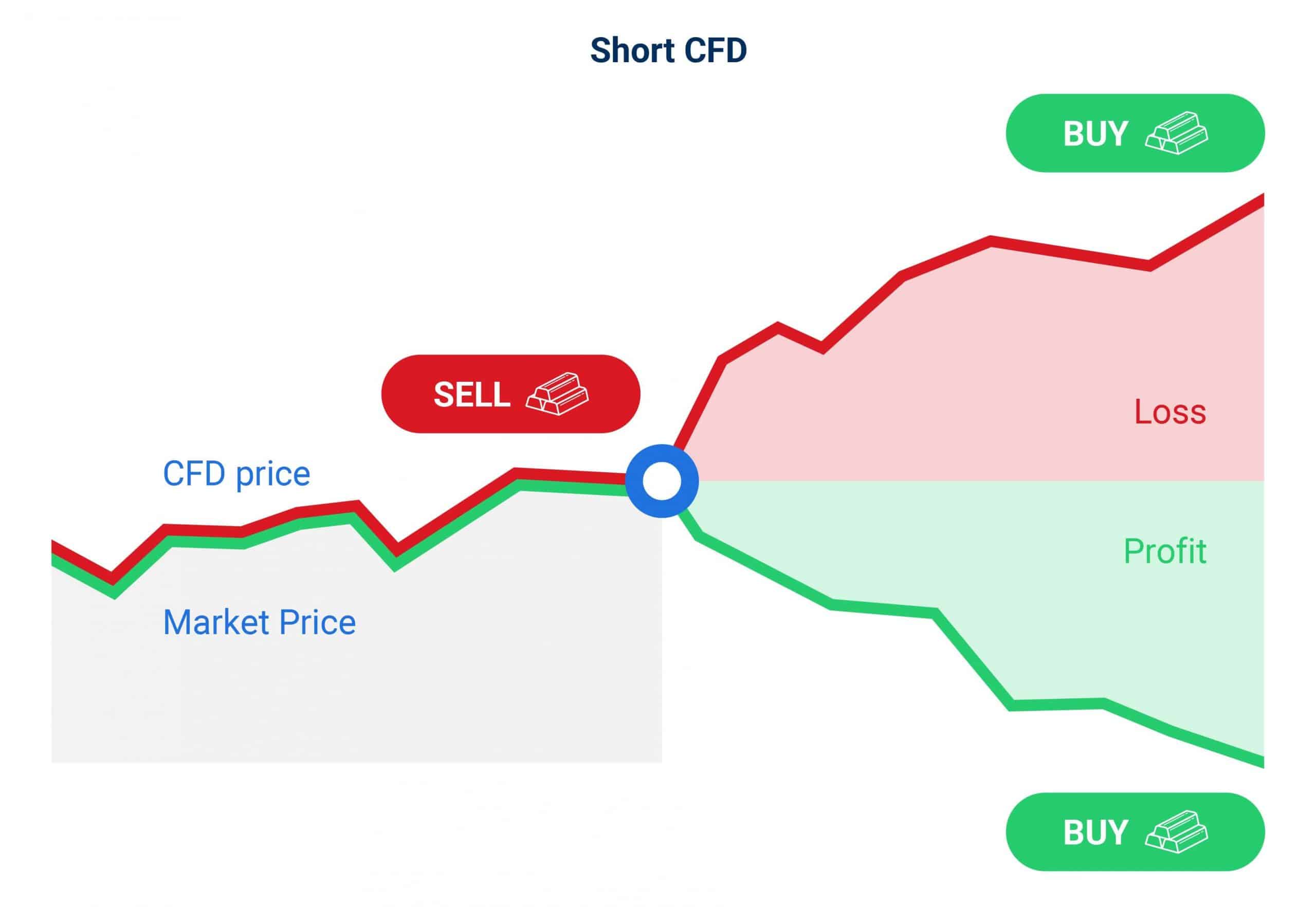

A trader can make trades with CFD contracts both long and short, depending on the forecast of the asset’s market dynamics. To complete a transaction, you need:

- Make a forecast for a fall or rise in prices.

- Monitor the asset, determine the entry level, the conditions for exiting the transaction and the number of contracts.

- Buy cfd with a forecast for an asset growth and sell with a forecast for a fall.

- Close the trade by take profit or stop loss.

Risk Management in CFD Trading

The use of leverage can both significantly increase profits and lead to a complete loss of the account. When trading CFDs, you need to take a responsible approach to risk management. When trading with large capital, it is recommended not to risk more than 2% of the account in one transaction. The trader must calculate the risk himself or use the loss calculator. https://articles.opexflow.com/trading-training/risk-management.htm

Volatile assets should be traded with caution, strong movements can lead to both large profits and losses.

If the account is small, no more than 10% of the total capital, the trader may allow the loss of the account in an unfavorable market situation. In this case, risk management is a regular profit withdrawal, the same lot, the minimum required profit is 500-1000%. You should not keep more than what is required for trading on the account, with high volatility, the risk of a negative balance increases with a gap. If there is more money on the account than is required to hold the position, the amount of the calculated loss will increase.

You should be aware that all CFD transactions are speculative, which means they are aimed at making profit in the short and medium term. The trader must close losing trades on CFDs. While an investor who invests in the potential growth of a business should not close positions even with large losses. Only if the fundamental picture has changed.

A trader who is confident in the correct forecast, when receiving a critical loss, can open a hedshoring position to protect the account. The same tool, but in the opposite direction. When the situation changes, the opposite transaction is closed and only the original one remains. What is a CFD (Contract for Difference) and how to trade it: https://youtu.be/sQZFth6e8dg

Where to trade CFDs

In 2022, many brokers offer their clients to trade CFD contracts. Below is a list of the 10 most popular brokers:

- Avatrade is one of the most regulated brokerage companies. Clients are offered a quick opening of an account, a minimum of documents is required. They do not charge commission for deposits and withdrawals. Cons – commission for the lack of transactions, CFDs are available only for currencies and cryptocurrencies.

- XM is the largest broker, suitable for both beginners and experienced traders. Only a passport is required to open an account, there are no commissions for depositing and withdrawing funds from the account, competitive commissions. For beginners, there are educational programs.

- Alpari is one of the leading brokers, offers many types of accounts, support in 30 languages. The broker offers a wide range of cfd contracts, you can start with minimal amounts. One of the best trading brokers.

- FXTM is a great broker for beginners, good 24/7 support, lots of educational material. Cons – commission for withdrawal of funds and inaction.

- Etero is one of the most popular trading platforms. Advantages – easy and fast account opening, no minimum deposit, competitive fees. Cons – the account is only in US dollars, a long withdrawal of funds, high commissions for withdrawing money.

- City index is a high-quality trading platform, available on several operating systems. Offers good tools for market analysis, many educational programs. The broker offers many CFD contracts, you can start with any amount.

- IC markets is one of the best brokers for copy trading. The broker offers the best conditions for both beginners and experienced traders. Good volume discounts, great trading platform, no fees for depositing and withdrawing funds, low minimum deposit, 24/7 support, a wide range of tools.

- OANDA is the oldest online marketplace, working with clients in more than 150 countries. Advantages – low commissions, wide range of CFD contracts, low commissions, low minimum deposit. Disadvantages – long verification, high commission for withdrawing funds from the account.

- FXPro is a well-known forex broker, offered to trade CFD contracts. An account can be opened both in the mt4 and mt5 terminals, and in the browser.

- SaxoBank is one of the best trading platforms, has its own trading programs, a wide range of tools, no commission for withdrawal. The disadvantage is the high minimum deposit.

It is worth noting that each broker in the account tariffs specifies the amount of margin at which the position is liquidated. It can be 50-20% or 0% (positions will be closed only if the client has lost all funds). This should be taken into account when choosing a broker, among other factors. Also, brokers offer different leverage, some brokers do not charge a swap for transferring a position to another day. Many factors need to be evaluated. For example, broker Fibogroup requires $10 margin to open 0.01 lots of cfd on the Nasdaq 100 index, there are no commissions or swaps, the margin call level is 50%. Broker Roboforex requires $30, margin call level 20%, swap 5 p per day. The first broker has a smaller required deposit, but at the same time, it also requires less movement of the asset to stop out. Suitable for trading on daily and weekly charts.

Advantages and disadvantages of CFD trading.

Let’s take a closer look at the pros and cons of trading CFDs. Advantages:

- you can start trading with a minimum deposit;

- single account – you can keep stocks, indices, commodities, currencies and cryptoassets in one portfolio.

- provision of margin lending.

Flaws:

- Cfd training is not suitable for investment due to swap charges by many brokers;

- CFD – is not a property, you cannot take a loan against security or use it for settlements;

- many brokers charge high commissions on CDF;

- Many stock CFDs have higher spreads than stocks. They are not suitable for scalping and intraday trading ;

- it is necessary to accurately calculate the volume of transactions so that the positions are not forcibly liquidated by the broker.

CFD or contracts for difference: what is it, trading terminology: https://youtu.be/0QMRySZLKRU

FAQ

Is it possible to have deals on one instrument both long and short at the same time? Depends on the type of account. On hedged accounts, there is such an opportunity.

Am I entitled to dividends when buying share CFDs? No, but many brokers pay a “dividend adjustment”.

Is it possible to avoid paying commission when trading CFDs? The broker’s income is either an extended spread or commissions. The client can choose a broker with suitable conditions; when scalping, it is more profitable to pay an increased commission.

What happens to cfd when shares are split? When splitting, all open orders will be deleted, open transactions are forcibly closed with the comment “Split”.

Do CFDs have an expiration date?The client can hold positions for as long as he likes. The broker also uses gluing on the day of expiration of the corresponding futures