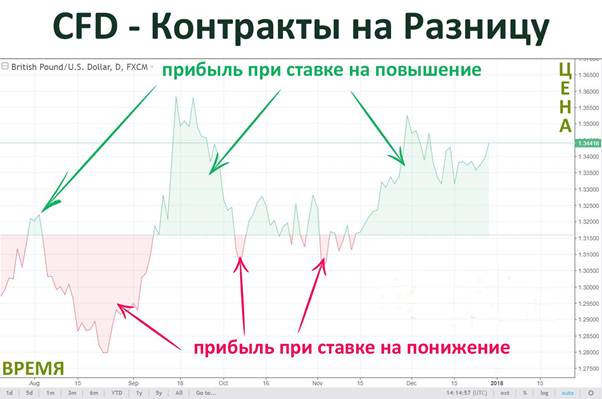

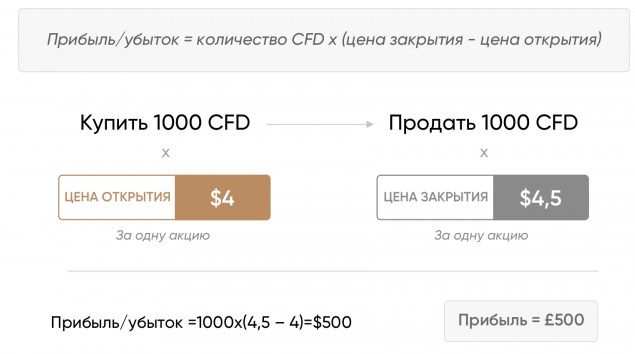

Contract for Difference (CFD) – nkyerɛkyerɛmu a ɛfa adwinnade no ho. Nsonsonoeɛ ho apam (CFD) yɛ sikasɛm adwinnadeɛ a ɛfiri mu ba a ɛne agyapadeɛ ankasa boɔ hyia koraa, nanso berɛ korɔ no ara mu no, adetɔfoɔ no nni hokwan sɛ ɔyɛ ne wura, na mmom hokwan a ɔwɔ sɛ ɔnya mfasoɔ (anaasɛ ɔhwere) firi nsakraeɛ a ɛba wɔ nsɛm a wɔafa aka mu no mu nko ara . Ne titiriw no, CFD yɛ apam a ɛda

aguadifo ne adetɔfo ntam, a nea ɛho hia ne nsonsonoe a ɛda agyapade a ɛwɔ ase no bo a wɔtɔ ne nea wɔtɔn ntam no sesa. Sɛ wopɛ sɛ wode wo ho hyɛ atɔn no mu a, enhia sɛ wotɔ agyapade no ankasa, wubetumi atɔ kyɛfa, sika, crypto agyapade wɔ akontaabu biako so.

- agyapade no ho wura biara nni hɔ;

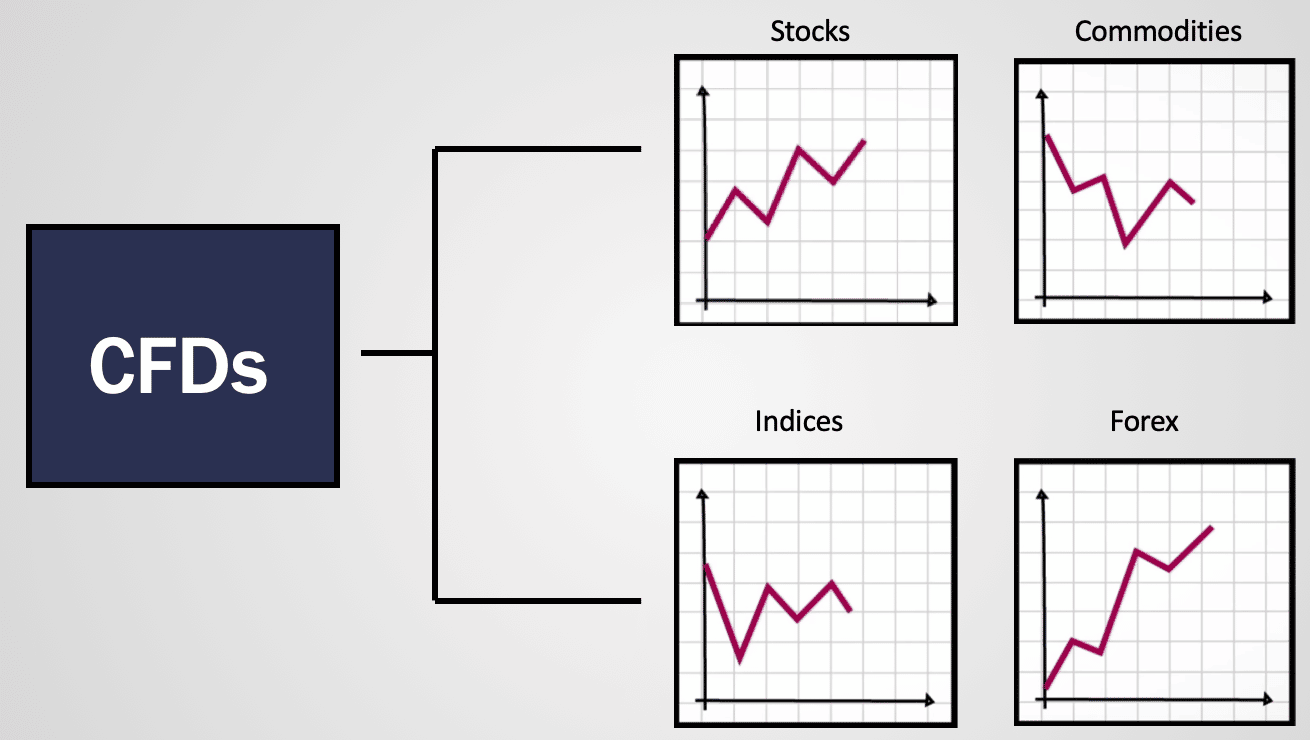

- apam ahorow wɔ hɔ a ɛfa agyapade ahorow ho (stocks, sika, indices, dade, cryptocurrencies);

- wubetumi abue apam tenten ne tiawa nyinaa;

- margin lending a wɔde di dwuma – ma adetɔ no, broker no nhwehwɛ agyapade no nyinaa, na mmom ɔha biara mu nkyem pɔtee bi (mpɛn pii no 5-10%);

- apam no yɛ nea enni ano.

Nneɛma a ɛwɔ CFD aguadi mu

Broker no de leverage ma bere a ɔredi CFD apam ahorow ho gua no. Agyapade bo no fã ketewaa bi pɛ na wosiw ano wɔ akontaabu no so, na ɛma aguadifo a wɔwɔ sika ketewaa bi tumi de wɔn ho hyɛ aguadi mu.

Dɛn ne sika a wɔde bɛto hɔ a wɔhwehwɛ bere a woredi gua wɔ CFD so no

Mfaso a ɛwɔ CFD ahorow so ne sɛ ɛho nhia sɛ wɔtɔ agyapade no wɔ bo a edi mũ so. Sɛ nhwɛso no, sɛ wobɛtɔ wti ngo lot 1 (1000 barrels) a ne bo yɛ $95 wɔ toa biara mu a, ɛho hia sɛ wogye $95,000. Nanso aguadifo no hwehwɛ $950 pɛ sɛ wɔde bɛbɔ bosea. Lot a ɛba fam koraa ma oil CFD brokers a agye din no yɛ wti 0.01, a ɛkyerɛ sɛ ɛho hia sɛ wonya margin a ɛyɛ $9.5. Afei, ɛsɛ sɛ aguadifo no hwɛ sɛnea aguadi nhyehyɛe no fa so, bere tenten a ɛtoatoa so a wɔhweree no kyɛe ne sɛnea sɛ wɔkyekyem pɛpɛɛpɛ a, gyinabea kɛse no yɛ. Sɛ nhwɛso no, sɛ wɔkyekyem pɛpɛɛpɛ a, gyinabea no yɛ 40 sts, adehwere a ɛtoatoa so a ɛyɛ aguadi 10 = 40 * 0.1 * 10 + 9.5 = $49.5. Eyi kyerɛ sɛ sɛ wode nhyehyɛe a ɛte saa di gua 0.01 a, wuhia $50. Sɛ ɛho hia sɛ wode nnwinnade pii di gua anaasɛ wofa nneɛma akɛse a, ɛsɛ sɛ woyɛ nhwehwɛmu a ɛte saa ara ma agyapade biara. Sɛ wɔkyekyem pɛpɛɛpɛ a, $50-200 dɔɔso sɛ wobefi ase adi gua.

CFD ahorow a Agye Din Sen Biara

Wubetumi de cfd apam ahorow adi gua de agye agyapade ahorow pii:

- nkyerɛkyerɛmu ahorow (UK100, GER40, FRA40, ESP35);

- kyɛfa a wɔde ma (HSBA.L, BRBY.L, NWG.L, LLDY.L);

- sika a wɔde di dwuma (EURUSD, GBPUSD, EURGBP, GBPJPJ);

- aguade (wti ngo, sika kɔkɔɔ, dwetɛ, kɔbere).

Nneɛma a ɛwɔ aguadi apam ahorow mu ma nsonsonoe

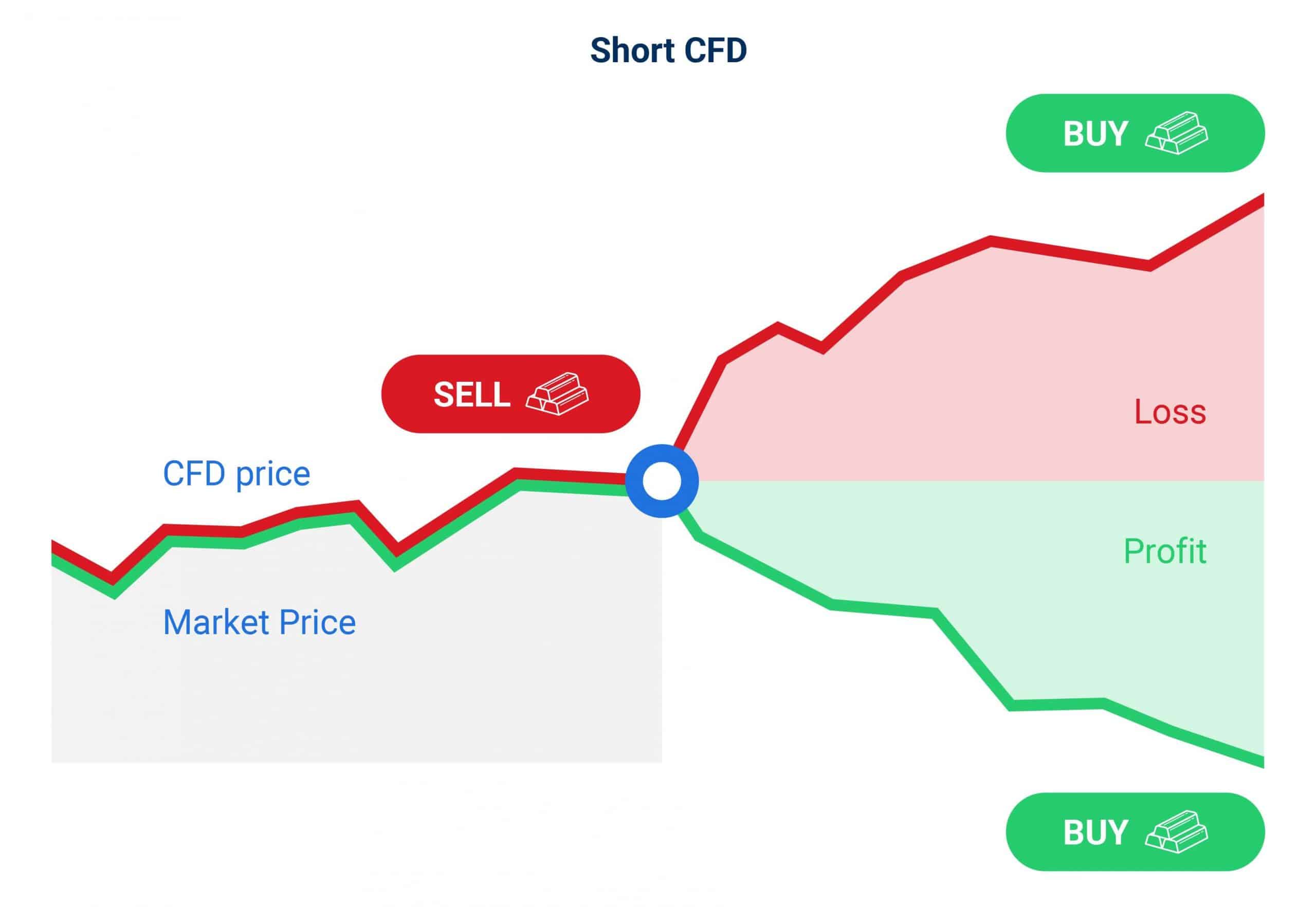

Oguadifo betumi de CFD apam ahorow ayɛ aguadi tenten ne tiawa, a egyina nkɔmhyɛ a ɛfa agyapade no gua so nkɔso ho no so. Sɛ wopɛ sɛ wuwie asɛm bi a, wuhia sɛ:

- Yɛ nkɔmhyɛ bi sɛ nneɛma bo bɛkɔ fam anaasɛ ɛbɛkɔ soro.

- Hwɛ agyapade no so, kyerɛ sɛnea wɔbɛkɔ mu, tebea horow a ɛbɛma wɔafi asɛm no mu ne apam dodow a wɔbɛyɛ.

- Kɔtɔ cfd a ɛwɔ nkɔmhyɛ a ɛfa agyapadeɛ nkɔsoɔ ho na tɔn a ɛwɔ nkɔmhyɛ a ɛfa ahweaseɛ ho.

- Fa mfaso anaasɛ gyae adehwere no to aguadi no mu.

Asiane a Wɔde Di Dwuma wɔ CFD Aguadi mu

Leverage a wɔde di dwuma no betumi ama mfaso akɔ soro kɛse na ama wɔahwere akontaabu no koraa. Sɛ woredi CFD ahorow ho gua a, ɛsɛ sɛ wofa ɔkwan a asɛyɛde wom so wɔ asiane ho nhyehyɛe mu. Sɛ wode sika kɛse redi gua a, wɔkamfo kyerɛ sɛ ɛnsɛ sɛ wode akontaabu no bɛboro 2% to asiane mu wɔ asɛm biako mu. Ɛsɛ sɛ aguadifo no ankasa bu asiane no ho akontaa anaasɛ ɔde adehwere ho akontaabu no di dwuma. https://articles.opexflow.com/aguadi-ntetee/asiane-a-ho-hwɛ.htm

Ɛsɛ sɛ wɔde ahwɛyiye di agyapade a ɛsakrasakra no ho gua, nneɛma a ɛkɔ so denneennen no betumi ama wɔanya mfaso kɛse ne ɔhweree nyinaa.

Sɛ akontaabu no sua, ɛnyɛ nea ɛboro sika kɛse no nyinaa mu 10% a, aguadifo no betumi ama kwan ma wɔahwere akontaabu no wɔ gua so tebea a enye mu. Wɔ saa tebea yi mu no, asiane ho dwumadie yɛ mfasoɔ a wɔyi fi mu daa, lot korɔ no ara, mfasoɔ a ɛsua koraa a wɔhwehwɛ ne 500-1000%. Ɛnsɛ sɛ wode nea ɛboro nea wɔhwehwɛ ma aguadi wɔ akontaabu no so sie, bere a ɛsakrasakra kɛse no, asiane a ɛne sɛ wobɛkari pɛ no kɔ soro bere a nsonsonoe bi wɔ hɔ no. Sɛ sika pii wɔ akontaabu no so sen nea wɔhwehwɛ na ama wɔakura dibea no a, sika a wɔabu akontaa sɛ wɔbɛhwere no bɛkɔ soro.

Ɛsɛ sɛ wohu sɛ CFD nnwuma nyinaa yɛ nsusuwii hunu, a ɛkyerɛ sɛ wɔde asi wɔn ani so sɛ wobenya mfaso wɔ bere tiaa ne mfinimfini bere mu. Ɛsɛ sɛ aguadifo no to aguadi a wɔahwere wɔ CFD ahorow so no mu. Bere a ɛnsɛ sɛ obi a ɔde ne sika hyɛ adwuma bi mu nkɔso a ebetumi aba mu no to gyinabea ahorow mu a ɔhwere ade kɛse mpo no. Sɛ mfonini titiriw no asesa nkutoo a.

Oguadifo a ɔwɔ ahotoso wɔ nkɔmhyɛ a ɛteɛ mu, bere a wanya adehwere a ɛho hia no, betumi abue hedshoring gyinabea de abɔ akontaabu no ho ban. Adwinnade koro no ara, nanso ɛne no bɔ abira. Sɛ tebea no sesa a, wɔto asɛm a ɛne no bɔ abira no mu na nea edi kan no nkutoo na aka. Dɛn ne CFD (Contract for Difference) ne sɛnea wɔde di gua: https://youtu.be/sQZFth6e8dg

Baabi a ɛsɛ sɛ wodi gua wɔ CFD ahorow ho

Wɔ afe 2022 mu no, aguadifo pii de wɔn afɛfo ma sɛ wɔmfa CFD apam ahorow nni gua. Ase hɔ no yɛ 10 a agye din sen biara a wɔde di gua no din:

- Avatrade yɛ brokerage nnwumakuw a wɔahyɛ ho mmara sen biara no mu biako. Wɔma atɔfo sɛ wonbue akontaabu ntɛm, anyɛ yiye koraa no, wɔhwehwɛ sɛ wonya nkrataa. Wonnye sika a wɔde bɛto hɔ ne sika a woyi fi mu no ho sika. Cons – commission ma nnwuma a enni hɔ, CFDs no wɔ hɔ ma sika ne cryptocurrencies nkutoo.

- XM yɛ broker kɛse, a ɛfata ma wɔn a wɔrefi ase ne aguadifo a wɔn ho akokwaw nyinaa. Pasport nkutoo na ɛsɛ sɛ wubue akontaabu, commissions biara nni hɔ a wɔde bɛto sikakorabea na wɔayi afi akontaabu no mu, akansi commissions. Wɔ wɔn a wɔrefi ase fam no, nhomasua nhyehyɛe ahorow wɔ hɔ.

- Alpari yɛ brokers a wodi kan no mu biako, ɛde akontaabu ahorow pii ma, mmoa wɔ kasa ahorow 30 mu. Broker no de cfd apam ahorow pii ma, wubetumi afi ase de sika kakraa bi na ɛyɛ. Aguadi mu aguadifo a wɔyɛ adwuma yiye sen biara no mu biako.

- FXTM yɛ broker kɛse ma beginners, papa 24/7 mmoa, pii nhomasua nneɛma. Cons – commission a ewo sika a woyi fi mu ne adee a wonni ho.

- Etero yɛ aguadibea ahorow a agye din sen biara no mu biako. Mfasoɔ – a ɛnyɛ den na ɛyɛ ntɛm a wobɛbue akonta, sika a wɔde bɛto mu a ɛsua koraa, akansiɛ ho ka. Cons – akonta no wo US dollars nkoaa mu, sika a woyi fi mu bere tenten, commissions a ewo soro ma sika a woyi fi mu.

- City index yɛ aguadi kwan a ɛkorɔn, a ɛwɔ dwumadi nhyehyɛe ahorow pii so. Ɛde nnwinnade pa ma gua so nhwehwɛmu, nhomasua nhyehyɛe pii. Broker no de CFD apam pii ma, wubetumi de sika biara afi ase.

- IC gua ahorow yɛ brokers a eye sen biara ma copy trading no mu biako. Broker no de tebea horow a eye sen biara ma wɔn a wɔrefi ase ne aguadifo a wɔn ho akokwaw nyinaa. Good volume discounts, kɛse aguadi platform, wontua sika biara wɔ depositing ne yiyi sika, low minimum deposit, 24/7 mmoa, nnwinnade ahorow pii.

- OANDA yɛ intanɛt so gua a akyɛ sen biara, na wɔne wɔn a wɔkra nneɛma no yɛ adwuma wɔ aman bɛboro 150 so. Mfasoɔ – commissions a ɛba fam, CFD apam ahodoɔ pii, commissions a ɛba fam, sika a wɔde bɛto hɔ a ɛba fam. Disadvantages – bere tenten verification, commission a ɛkorɔn a wɔde yi sika fi akontaabu no mu.

- FXPro yɛ forex broker a wonim no yiye, a wɔde ma sɛ wɔmfa CFD apam ahorow nni gua. Wobetumi abue akonta wɔ mt4 ne mt5 terminals no nyinaa mu, ne browser no mu.

- SaxoBank yɛ aguadi nhyehyɛe a eye sen biara no mu biako, ɛwɔ n’ankasa aguadi nhyehyɛe, nnwinnade ahorow pii, commission biara nni hɔ a wɔde beyi sika afi mu. Nea enye wɔ ho ne sika a wɔde bɛto hɔ a ɛba fam koraa no.

Ɛfata sɛ yɛhyɛ no nsow sɛ broker biara a ɔwɔ akontaabu tariffs no mu no kyerɛ dodow a margin a wɔde begyae gyinabea no. Ebetumi ayɛ 50-20% anaa 0% (sɛ akraman no ahwere sika nyinaa nkutoo a, wɔbɛto gyinabea ahorow no mu). Ɛsɛ sɛ wosusuw eyi ho bere a worepaw aguadifo no, ne nneɛma afoforo. Afei nso, brokers de leverage soronko ma, brokers binom nnye swap ho ka sɛ wɔde dibea bi bɛkɔ da foforo. Ɛsɛ sɛ wɔhwehwɛ nneɛma pii mu. Sɛ nhwɛso no, broker Fibogroup hwehwɛ $10 margin na wɔabue 0.01 lots of cfd wɔ Nasdaq 100 index no so, commissions anaa swaps biara nni hɔ, margin call level no yɛ 50%. Broker Roboforex hwehwɛ $30, margin frɛ level 20%, swap 5 p da biara. Broker a odi kan no wɔ sika ketewaa bi a wɔhwehwɛ sɛ ɔde to hɔ, nanso bere koro no ara mu no, ɛho nhia sɛ wɔde agyapade no kɔ baabi foforo pii na ama gyinabea no aba. Ɛfata ma aguadi wɔ da biara da ne dapɛn dapɛn charts so.

Mfaso ne ɔhaw ahorow a ɛwɔ CFD aguadi mu.

Momma yɛnhwɛ mfaso ne ɔhaw ahorow a ɛwɔ CFD ahorow a wɔde di gua so yiye. Mfaso a ɛwɔ so:

- wubetumi afi ase adi gua denam sika a ɛba fam koraa a wode bɛto hɔ so;

- akonta baako – wobɛtumi de stocks, indices, commodities, sika ne cryptoassets asie wɔ portfolio baako mu.

- nsiesiei a ɛfa margin boseabɔ ho.

Mfomso ahorow:

- Cfd ntetee no mfata mma sika a wɔde bɛto mu esiane swap charges a brokers pii tua nti;

- CFD – nnye agyapadee, worentumi mfa bosea ntia ahobanbo anaase wode bedi dwuma de asiesie wo ho;

- aguadifo pii gye sika kɛse fi CDF ho;

- Stock CFD pii wɔ spreads a ɛkorɔn sen stocks. Wɔnnyɛ nea ɛfata ma scalping ne intraday aguadi ;

- ɛho hia sɛ wobu nnwuma dodow a wɔde di dwuma no ho akontaa pɛpɛɛpɛ sɛnea ɛbɛyɛ a aguadifo no rensɛe gyinabea ahorow no wɔ ahoɔden so.

CFD anaa apam ahorow ma nsonsonoe: dɛn ne no, aguadi nsɛmfua: https://youtu.be/0QMRySZLKRU

FAQ

So ebetumi aba sɛ wobenya adwinnade biako a ɛware ne tiawa nyinaa ho nkitahodi bere koro mu? Egyina akontaabu no su so. Wɔ akontaabu a wɔabɔ ho ban so no, hokwan a ɛte saa wɔ hɔ.

So mewɔ hokwan sɛ wonya kyɛfa bere a meretɔ kyɛfa CFD ahorow no? Dabi, nanso broker pii tua “dividend adjustment”.

So ebetumi aba sɛ wobɛkwati sɛ wubetua commission bere a woredi CFD ahorow ho gua no? Broker no sika a wonya no yɛ spread a wɔatrɛw mu anaasɛ commissions. Ɔdetɔfo no betumi apaw aguadifo a ɔwɔ tebea horow a ɛfata, sɛ ɔreyɛ scalping a, mfaso wɔ so kɛse sɛ obetua commission a ɛkɔ soro.

Dɛn na ɛba cfd so bere a wɔakyekyɛ kyɛfa mu no? Sɛ wopaapae mu a, wɔbɛpopa ahyɛde ahorow a wɔabue no nyinaa, wɔde ahoɔden to nkitahodi ahorow a wɔabue mu no mu denam nsɛm a ɛne “Mpaapaemu” no so.

So CFD ahorow no wɔ da a ɛbɛba awiei?Ɔdetɔfo no betumi akura dibea ahorow bere tenten biara a ɔpɛ. Broker no nso de gluing di dwuma da a daakye a ɛne no hyia no bɛba awiei no