MACD jiralan (Moving Average Convergence/Divergence) jago la – ɲɛfɔli ni waleyali, baara kɛcogo, jagokɛcogo. MACD jiralan (Makdi) ye oscillator dɔ ye min bɛ fɔ kosɛbɛ, min bɛ don san 2022 la, o bɛ sɔrɔ terminal o terminal jiralanw ka pake jɔnjɔn kɔnɔ. O jiralan in, i n’a fɔ a tɔgɔ b’a jira cogo min na, o sinsinnen bɛ Moving Averages (Moving Averages) ka ɲɔgɔn sɔrɔli n’u ka danfara kan, a dabɔra jagokɛla tɔgɔba Gerald Appel fɛ.

- MACD ka logique

- Jagokɛlaw ka taamasiyɛnw

- Divergence (ka faranfasiyali).

- MACD layiniw tigɛli

- MACD jiralan waleyali waleyali la

- MACD jiralan suguyaw

- MACD bɛ terminali minnu bɛ fɔ kosɛbɛ

- MACD bɛ QUIK jagokɛyɔrɔ la

- MACD bɛ Metatrader ka terminali kɔnɔ

- MACD jiralan sigicogo

- Jagokɛcogo minnu sinsinnen bɛ MACD jiralan kan

- Taamaʃyɛnw faralen ɲɔgɔn kan

- Trend ka fɛɛrɛ

- Divergence ani Convergence (Jɛɲɔgɔnya).

- Baara kɛ waatibolodacogo caman kan

- MACD jiralan nafa ni a dɛsɛ

MACD ka logique

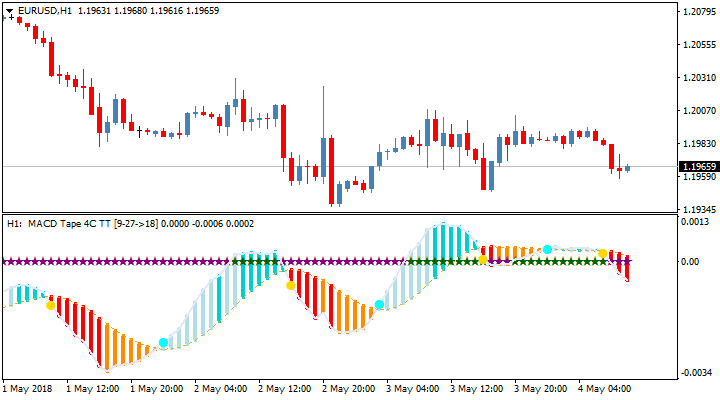

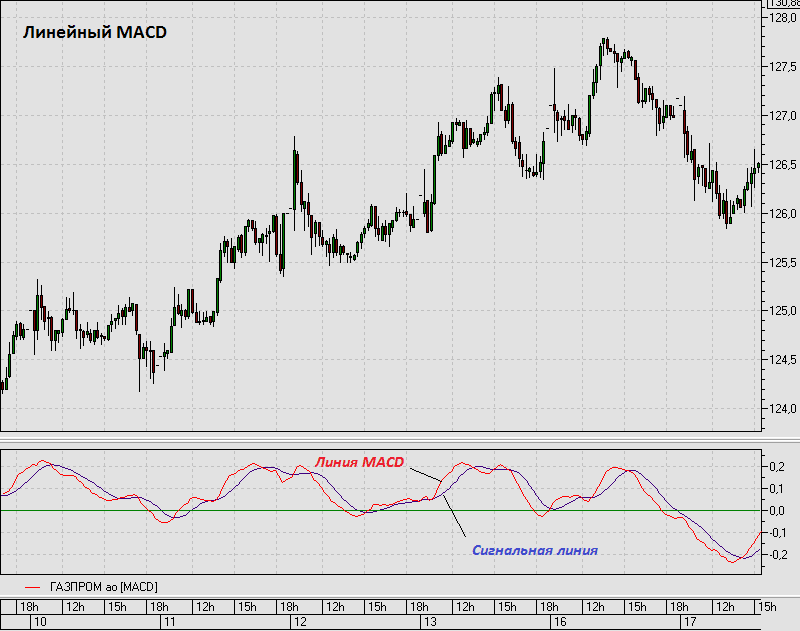

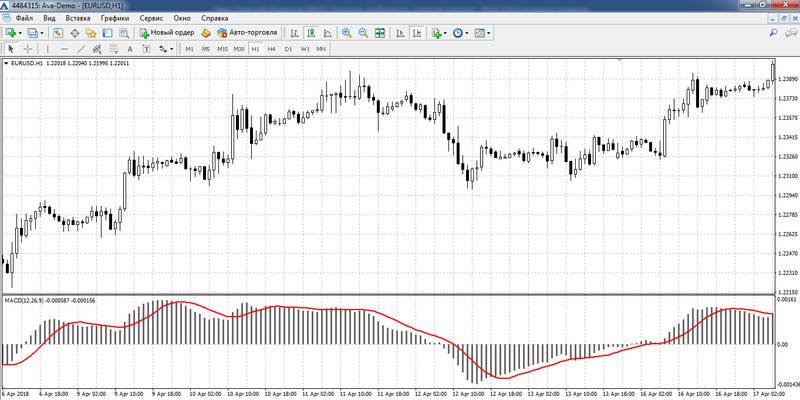

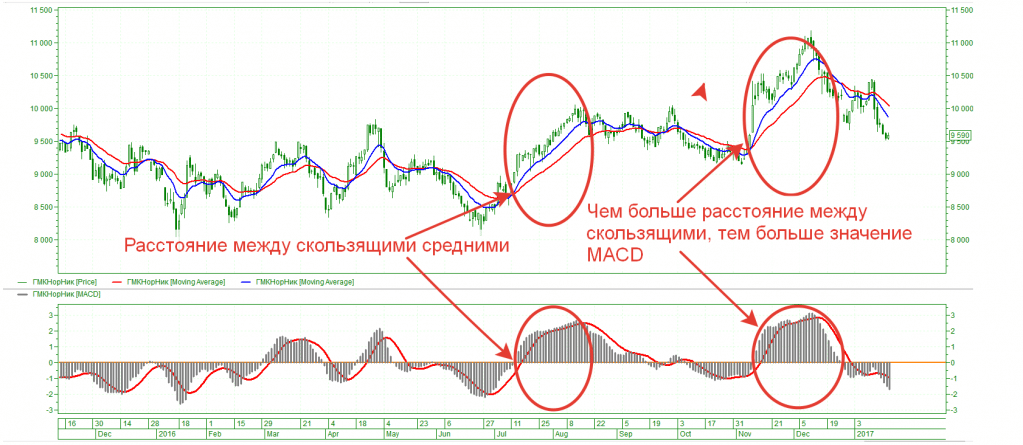

Taamaʃyɛn sariyakolo ka nɔgɔn – a bɛ waati kunkurunnin hakɛ jira ka kɛɲɛ ni waati jan ta ye. Ni o ye, i bɛ se k’a dɔn ko taabolo in fanga ka bon. Ni taabolo in y’a daminɛ ka teliya, taamasiyɛn bɛ barajuru sanfɛtaw ni sanfɛtaw sama, taamasiyɛn layini bɛ bɔ taamasiyɛn layini na ka caya. Taabolo dɔ bɛ jate sabatilen ye ni histogrammes (histogrammes) ka bon ani ni u kulɛri ye kelen ye. Ni histogramme kulɛriw bɛ ɲɔgɔn Changé joona, dannayabaliya bɛ sugu la. Ni taabolo in bɛ sumaya, baraw bɛ daminɛ ka dɔgɔya, Macdi layiniw bɛ ɲɔgɔn sɔrɔ. O b’a jira ko jɛ-ka-baara waati dɔ bɛ yen walima ko a bɛ se ka kɛ ko a bɛ se ka wuli ka bɔ a nɔ na. Ka da a kan, waati minnu bɛ lamaga-lamagali la, olu ye 12-26 ye, wa taamasiyɛn layini waati bɛ kɛ 9 ye.

Jagokɛla bɛ se k’o nafaw kɔlɔsi, k’u ladilan ka kɛɲɛ ni minɛn ni waatibolodacogo ye, nka aw k’a to aw hakili la ko teliya la taama waati ka kan ka kɛ sumaya waati tilancɛ ye.

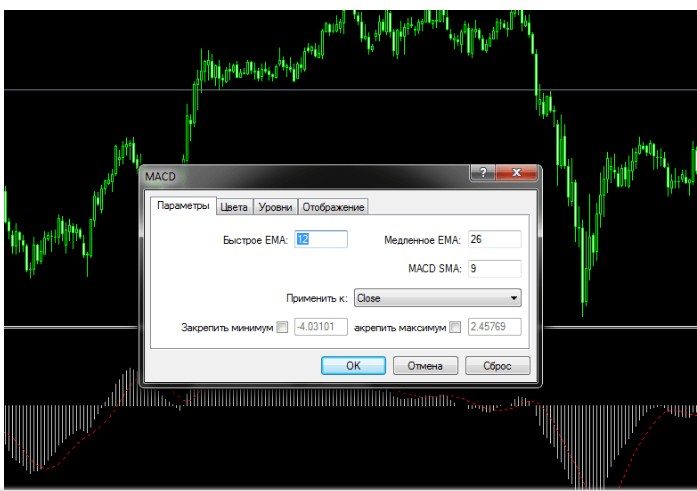

MACD jiralan sigicogo

Ka da a kan, taamasiyɛn in bɛ ni nin sigicogo ninnu ye:

- sɛgɛnlafiɲɛbɔ hakɛ cayalenba ye 26 ye;

- teliya la 12;

- taamasiyɛn -9;

- ka ɲɛsin dadon sɔngɔw ma;

- sɛgɛsɛgɛli suguya.

- baraw kulɛriw ye bilen ni wuluwulu ye .

Ni aw ye sɛgɛsɛgɛli kɛ waatiw la minnu bɛ wuli, aw bɛ se ka taamasiyɛn kɛcogo teliya Changer ni sɔngɔ caman yeli ye. Waati fitininw na, taamasiɲɛ caman bɛna kɛ. Aw bɛ se ka dɔ fara walima ka dɔ bɔ a hakɛ la min bɛ se ka wuli ka bɔ a nɔ na. Ni waati cayara, taamasiyɛnw jogo bɛna bonya, u bɛna dɔgɔya, nka tɔnɔ/nkalon hakɛ bɛna caya. Nka tuma dɔw la, taamasiyɛn tɛna taabolo dɔ daminɛ ye. Ni aw ye paramɛtiriw dɔgɔya, aw bɛ se ka dɔ fara u ka dusukunnataw kan. A nafa ka bon an kana tɛmɛ “sanu cɛmancɛ” waati kan, taamasiyɛn hakɛ n’u jogo cɛ.

Jagokɛcogo minnu sinsinnen bɛ MACD jiralan kan

Ka kɛɲɛ ni fɛɛrɛ ye, Makdi taamasiyɛn bɛ kɛ taamasiyɛnw kulu dɔ ye walima a danma.

- Channel strategy – bɛ baara kɛ sugu la ni ŋaniya jiralen tɛ. Jagokɛla b’a jira ko sɔngɔ bɛna to a dan na waati jan kɔnɔ. Walasa ka “sanfɛ ni duguma” dɔn jagokɛlaw bɛ baara kɛ ni Bollinger Bands ye, Price channel, trend lines, moving averages. O cogo la, sɔngɔ bɛ se ka kɛ jɔyɔrɔ fila la:

- Dugukolo kan . Ni sɔngɔ gɛrɛla dan na – Bollinger duguma, ka taa ni waati jan ye, taabolo layini, jagokɛla bɛ MACD jiralan kɔlɔsi kosɛbɛ. Jago jan dɔ bɛ dabɔ ni histogramme baraw dɔgɔyara, faranfasiyali bɛ kɛ, baraw kulɛri bɛ Changé ka kɛ jiri ye ani taamasiyɛn layiniw cɛtigɛyɔrɔ bɛ yen (sarati kelen bɛ bɔ ni taamasiyɛn 2 walima ka tɛmɛ o kan – taamasiyɛn barika bonya). A jɔyɔrɔ bɛ sigi ka tɛmɛ dantɛmɛnen kan. A man kan ka tɛmɛ 0,2-0,5% kan nafolomafɛnw jiginni na. Ni a tɛ se ka jɔli surun kɛ, aw ka kan ka dɔ bɔ a jɔyɔrɔ bonya la.

- Sanfɛla la . Ni sɔngɔ gɛrɛla dan na – Bollinger sanfɛ, ka taa ni waati jan ye, taabolo layini, jagokɛla bɛ MACD jiralan kɔlɔsi kosɛbɛ. Jago surun dɔ bɛ dabɔ ni histogramme baraw dɔgɔyara, faranfasiyali bɛ kɛ, baraw kulɛri bɛ Changé ka kɛ jiri ye ani taamasiyɛn layiniw cɛtigɛyɔrɔ bɛ yen (sarati kelen bɛ bɔ ni taamasiyɛn 2 walima ka tɛmɛ o kan – taamasiyɛn barika bonya). A jɔyɔrɔ bɛ sigi ka tɛmɛ dantɛmɛnen kan. A man kan ka tɛmɛ 0,2-0,5% kan nafolomafɛnw jiginni na. Ni a tɛ se ka jɔli surun kɛ, aw ka kan ka dɔ bɔ a jɔyɔrɔ bonya la.

N’i ye sɔngɔ minɛcogo lajɛ koɲuman danyɔrɔ la, a ka c’a la, ko dɔ bɛ kɛ ni jatebɔ dancɛw bɛ tigɛ, nka kɔfɛ sɔngɔ bɛ segin sɔngɔ dancɛ la. Sanfɛla ni duguma dancɛw bɛ ka bonya. Jagokɛla ka kan ka MACD jiralan kalantaw lajɛ koɲuman walasa a kana tɛmɛ ŋaniyajira waati kan. A bɛ se ka na sanni sɔngɔ ka maga a dan na walima o kɔfɛ.

A cɛmancɛ la, bɛnkan kuraw tɛ dabɔ. Jagokɛla bɛ se ka jɔyɔrɔw barika bonya ni sɔngɔ ye Bollinger cɛmancɛ kari walima moving average waati fitinin dɔ la (9-21 D1 kan).

Taamaʃyɛnw faralen ɲɔgɔn kan

Jagokɛla dɔw bɛ baara Kɛ ni oscillateur damadɔ ye waati kelen na. Jagokɛlaw bɛ kuncɛ ni taabolo fɔlen ye (taamaʃyɛnw bɛɛ bɛ taamasiyɛn kelenw di) walima sannifeere kɔrɔlen walima feereli tɛmɛnen yɔrɔ la walasa ka seginkanni sɔrɔ. Jagokɛlaw bɛ baara kɛ

ni RSI jiralan ye , stochastics, Bill Williams ka oscillateur kabakoma (AO),

moving averages together with Macd . Ka fara o kan, a bɛ taamasiyɛn barika bonya ni Sannifeere kɛcogo dɔ kɛra sanni walima feereli yɔrɔ la.

Trend ka fɛɛrɛ

Jagokɛlaw bɛ dabɔ dɔrɔn ni MACD bɛ zeru duguma walima a sanfɛ (ka feere walima ka san, o cogo kelen na). Ka fara o kan, u bɛ baara Kɛ ni filɛriw ye – trend, oscillateurs wɛrɛw, moving averages. Jago surun bɛ kuncɛ dɔrɔn ni taabolo in dafara – dɛmɛ / kɛlɛli tununna, jatebɔcogo dɔw bɛ yen walasa ka dantigɛli kɛ, taamasiyɛn kalanniw bɛ feereli / sanni barikamaw jira. Ni nivow tiɲɛna, ni taamasiyɛn ma a jira ko taabolo bɛ ka sumaya, jagokɛla bɛ jɔyɔrɔw barika bonya ani ka jɔyɔrɔ lamaga sugu kɔfɛ.

Divergence ani Convergence (Jɛɲɔgɔnya).

Taamaʃyɛn barikama ye danfara ye sɔngɔ ni jiralan cɛ. O bɛ se k’a jira ko fɛn dɔ bɛ senna min bɛ senna waati jan kɔnɔ, o labanna. O taamasiɲɛ suguw ka kan ka lajɛ waatibaw kɔnɔ – don o don walima dɔgɔkun o dɔgɔkun. Sannifeere kɔsegin man teli ka kɛ tile kelen kɔnɔ, a ka ca a la u bɛ sababu di i ma ka don ni jɔli jɛlen ye, a tɛ tɛmɛ 5% kan nafolo lamagacogo la.

Baara kɛ waatibolodacogo caman kan

Jagokɛla bɛ waati caman (a ka c’a la saba) lajɛ. Jago kuntaalajan kama o ye 1h ye, don o don ani dɔgɔkun o dɔgɔkun, don kɔnɔna na o ye 15-1h-4h ye, ka ɲɛsin scalping ma o ye 1-m15-1h ye. Waati kɔrɔlenba kan, taabolo kuntaalajan dɔ bɛ tugu o kɔ. Sisan taabolo bɛ latigɛ ni hakɛ danma ye. An bɛ don ɲini waati fitinin kan. Walasa ka don jan kɔnɔ:

- kɔrɔlen waati – janya ;

- cɛmancɛ – janya;

- dɔgɔmannin ka surun, an bɛ sɔngɔ wulicogo ɲini ni layiniw ɲɔgɔndan ye walima ni ɲɔgɔndan ye.

Jiginni bɛ sigi duguma waati de kama, ta bɛ kɛ cɛmancɛ waati de kama. Ni kuma surun ye, a jiracogo bɛ ɲɔgɔn ta. Ni kalan saba bɛɛ ye sira kelen ye, an tɛ jago kɛ.

MACD jiralan nafa ni a dɛsɛ

O jiralan in bɛ jagokɛcogo fanba la minnu sinsinnen bɛ kanal jago (yɔrɔ minnu sanna ka tɛmɛ ani minnu feerela ka tɛmɛ) ani swing jago fila bɛɛ kan. MACD jiralan nafaw:

- taamasiyɛn ɲumanw sugu la min bɛ wuli ka bɔ a nɔ na;

- taamasiyɛn tigitigiw waati belebelew kan ani waati fitininw kan fo ka se m1 ma. O kelen-kelen bɛɛ la, aw ka kan ka taamasiyɛn paramɛtiriw sugandi. Waati misɛnninw kan, m1-m5 bɛ kɛ sɔgɔsɔgɔninjɛ fɛɛrɛ la ;

- universel – i bɛ se ka jago kɛ nafolo suguya bɛɛ kan (stocks, indices, commodities, metals, currencies);

- nafama ni jago bɛ kɛ ni ŋaniya ye.

MACD jiralan nafaw:

- waati misɛnninw kan, filɛri wɛrɛw ka kan ka kɛ;

- taamasiyɛn bɛ kɔfɛ, waati fitininw na a bɛ na ni taamasiyɛn nkalonmaw ye. Waatiba kan, o nafa tɛ ten, bawo waati caman bɛ yen. Waati misɛnninw na, taamasiyɛn bɛ taamasiyɛn dɔ bali ni lamaga banna kaban;

- tɛ baara kɛ ka ɲɛ flati la;

- tɛ baara kɛ ni wulicogo dɔgɔman ye – histogramme bɛ wuli dɔrɔn ka zeru lamini. Siginidenw tɛ barika sɔrɔ, jɔyɔrɔw bɛ to ka gosi ka bɔ.

Baara kɛcogo ni MACD jiralan ye – kalan kalan dɔ jago kan: https://youtu.be/iuFQxnCuz9w San 2022, ɛntɛrinɛti falen bɛ “super profitable” jiralanw dicogo la. O de kosɔn, ja in bɛ i n’a fɔ seli jiri dɔ min bɛ ni taamasiyɛn suguya caman ye. Ni o suguya sugu bɛ yen, dɔw ɲinɛna sariya jiralanw kɔ minnu bɛ kɛ tuma bɛɛ. Wa u ma bɔnɛ u ka nafa la. Osilatɛriw ka sariyakolo yɛrɛ ye kelen ye, i bɛ Se ka na ni fɛn kura dɔɔnin ye. Sisan, MACD ye sɛgɛsɛgɛli kɛcogo ɲɛ, nka taamasiyɛn yɛrɛ fana bɛ baara kɛ ka ɲɛ jago fɛɛrɛw la. A baara kɛcogo faamuyali de ye jagokɛcogo ɲuman kun ye. MACD ye diɲɛ bɛɛ jiralan ye, i bɛ se ka taabolo fanga lajɛ ani ka kɔseginyɔrɔw sɔrɔ sannifeere ni feereli tɛmɛnen yɔrɔw la. A nafa bɛna kɛ daminɛbagaw la, MACD ye taabolo jiralan ye wa a tɛna a to i ka wuli ka taa taabolo barikama dɔ kɛlɛ.