Alamar MACD (Matsakaicin Matsakaici / Bambance-bambance) a cikin ciniki – bayanin da aikace-aikacen, yadda ake amfani da, dabarun ciniki. Alamar MACD (Makdi) sanannen oscillator ne, wanda a cikin 2022 an haɗa shi cikin daidaitattun fakitin alamun kowane tasha. Mai nuna alama, kamar yadda sunan ke nunawa, ya dogara ne akan haɗuwa da bambance-bambancen Matsakaicin Motsawa, shahararren ɗan kasuwa Gerald Appel ne ya ƙirƙira shi.

- Bayanan MACD

- Alamun ciniki

- Bambance-bambance

- Ketare layin MACD

- Aikace-aikacen alamar MACD a aikace

- Nau’in MACD mai nuna alama

- MACD a cikin shahararrun tashoshi

- MACD a cikin tashar ciniki ta QUIK

- MACD a cikin tashar Metatrader

- Yadda ake saita alamar MACD

- Dabarun ciniki dangane da alamar MACD

- Haɗuwa da alamomi

- Dabarun Trend

- Bambance-bambance da Haɗuwa

- Yi aiki akan ɓangarorin lokaci da yawa

- Abũbuwan amfãni da rashin amfani na MACD mai nuna alama

Bayanan MACD

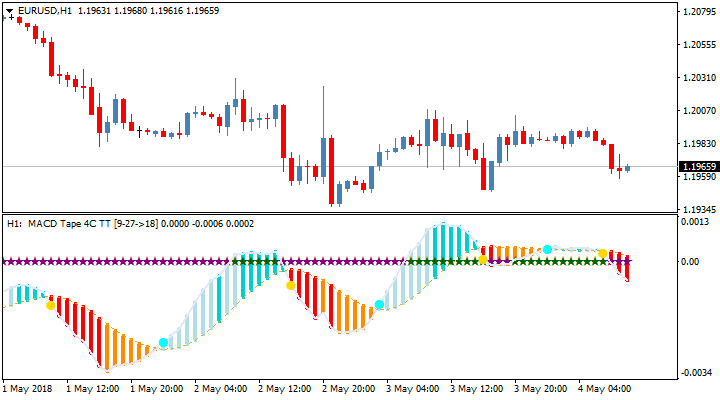

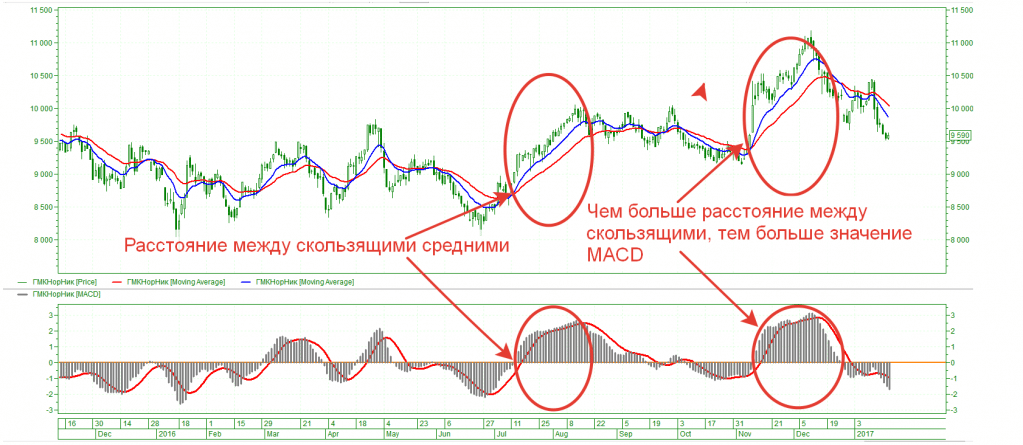

Ka’idar mai nuna alama mai sauƙi ne – yana nuna rabon ɗan gajeren lokaci dangane da na dogon lokaci. Tare da shi, zaku iya ƙayyade ƙarfin yanayin. Idan yanayin ya fara haɓakawa, mai nuna alama yana zana manyan sanduna mafi girma, layin nuna alama ya bambanta daga layin siginar. An yi la’akari da yanayin kwanciyar hankali idan histograms suna da girma kuma na launi ɗaya. Idan launuka na histogram da sauri canza juna, akwai rashin tabbas a kasuwa. Lokacin da yanayin ya ragu, sanduna sun fara raguwa, kuma layukan Macdi suna haɗuwa. Wannan yana nuna lokacin ƙarfafawa ko yuwuwar komawa baya. Ta hanyar tsoho, lokutan matsakaicin motsi shine 12-26, kuma layin siginar yana da tsawon lokacin 9.

Mai ciniki zai iya yin gwaji tare da waɗannan dabi’u, daidaita su zuwa kayan aiki da lokaci, amma ka tuna cewa lokacin matsakaicin matsakaicin sauri ya kamata ya zama rabin na jinkirin.

[taken magana id = “abin da aka makala_14795” align = “aligncenter” nisa = “800”]

Alamun ciniki

Alamar MACD tana ba da nau’ikan sigina da yawa, ɗan kasuwa na iya hasashen motsin farashin ta amfani da histogram ko layin nuna alama:

- Histogram ƙetare sifili . Wannan sigina yana nuna haɗuwar matsakaicin motsi na gajeren lokaci da na dogon lokaci. Idan alamar ta haye sifili daga sama zuwa ƙasa, ana buɗe tallace-tallace, kuma idan daga ƙasa zuwa sama, ana buɗe sayayya. An saita asarar tasha mai tsaro don mafi kusa ko kamar 0.2-0.5% na motsin kadari.

- MACD histogram a saman da kasan kasuwa . Yan kasuwa lura da hali na mai nuna alama ta histogram a farashin matuƙar. Idan farashin ya yi tsalle mai karfi zuwa yanayin, kuma histograms ya zama karami, mai ciniki ya kammala cewa yanayin yana gab da kammalawa. A cikin irin wannan yanayi, mai amfani yana neman kasuwancin countertrend, ana sanya umarnin dakatar da kariya sama da matsananciyar. Dole ne a shigar da su, a kan yanayi mai karfi, ta hanyar inertia, kafin a sake dawowa, farashin zai iya sake rubuta matsakaicin ko ƙarami sau biyu ko sau uku. Histogram a cikin irin waɗannan yanayi yana nuna wuraren da aka yi fiye da kima.

Bambance-bambance

Mafi ƙarfi siginar histogram na MACD shine bambance-bambancen da ke faruwa a ƙarshen yanayin lokacin da kasuwa ke shirin juyawa. Wannan siginar ba ta da sauƙin lura ga masu farawa; ƙwararrun yan kasuwa ne ke amfani da ita. Farashin ya ci gaba da yin sabon matsananci, amma histogram na mai nuna alama baya. Akwai yanayi lokacin da bambance-bambancen ya rushe. Na gaba farashin extremum ya zo daidai da histogram extremums, ko da yake kafin wannan mai nuna alama ba zai iya saita wani sabon kololuwa. Sabili da haka, yana da matukar muhimmanci a saita asarar tasha mai karewa. Bambance-bambancen bearish yana faruwa a kan haɓakawa kuma ɓacin rai yana faruwa akan raguwa.

Ketare layin MACD

Lokacin da siginar siginar ta ketare babba daga sama zuwa ƙasa, ƴan kasuwa suna hasashen raguwar abubuwan da ke kusa. Kuma akasin haka, suna siya lokacin hayewa daga ƙasa zuwa sama. A kan ƙananan lokutan lokaci, zaku iya samun sigina da yawa don mahaɗar layukan nuni, amma yawancinsu ƙarya ne. Yana da kyau a kula da sigina akan jadawalin yau da kullun da na mako-mako. Ana amfani da histogram na mai nuna alama azaman tacewa – ana yin sayayya ne kawai lokacin da yake sama da sifili, kuma ana yin tallace-tallace lokacin da yake ƙasa da sifili. Kuna buƙatar daidaituwa na yanayi biyu – tsaka-tsakin layi da histogram a cikin matsayi da ake bukata.

Aikace-aikacen alamar MACD a aikace

Mai nuna alama yana aiki da kyau lokacin aiki a cikin tashoshi, zaku iya kama motsi daga juriya zuwa tallafi da baya a wuraren da aka yi yawa da siyayya. Amma kar ka manta cewa tare da haɓaka mai ƙarfi, farashin baya lura da matakan da sake siyan / sake siyarwa. Macdi yana nuna farkon da ƙarshen yanayin. Yana nuna maki na hanzari da raguwar yanayin. Mai tasiri a cikin kasuwa mai sauƙi, a lokacin ƙananan farashin farashi, mai ciniki zai sami asarar tasha mai yawa. Da farko, an ƙirƙiri mai nuna alama don kama ƙungiyoyi masu tasowa. A cikin ɗakin kwana mai faɗi akan ginshiƙi na yau da kullun, yana iya ba da sigina masu kyau akan sa’a.

Nau’in MACD mai nuna alama

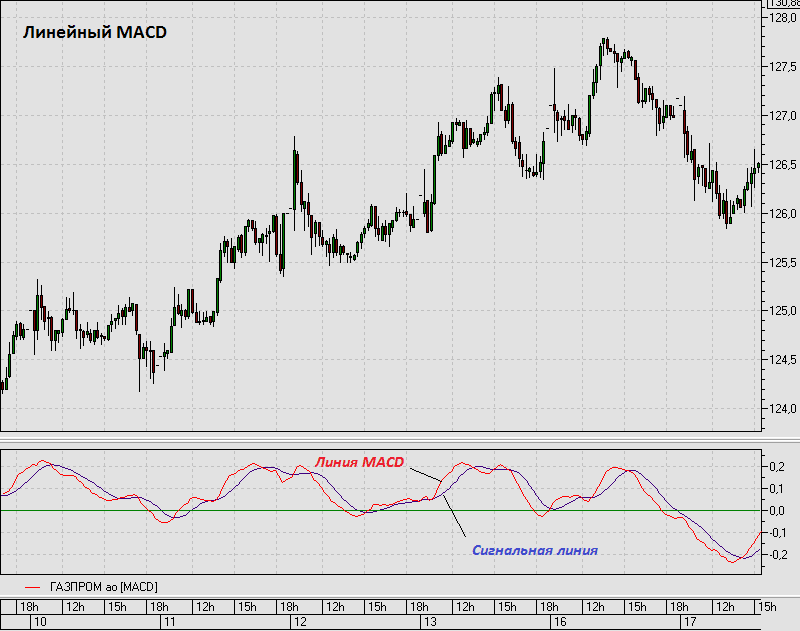

Mai nuna alama ya ƙunshi layi da kuma histogram. Wasu yan kasuwa ba su kula da layin MACD ba, suna haɗa mahimmanci kawai ga histogram. Don cire wuce haddi, mun zo da wani irin MACD histogram nuna alama. Ya ƙunshi histogram kawai. A cikin sigar gargajiya, histogram da MACD suna cikin taga iri ɗaya (misali, a cikin tashar Metatrader). A wasu tashoshi (kamar

Quik ), ana raba histogram da layukan cikin tagogi daban-daban. Ana iya gina mai nuna alama ta amfani da madaidaicin maɗaukaki, mai sauƙi, mai ɗaukar nauyi. A wasu tashoshi ana aiwatar da wannan azaman siga (Metatrader), a cikin wasu akwai suna na musamman ga kowane nau’in (MACD Simple, MACD Weighed, MACD). misali, a cikin tashar FinamTrade. Yadda ake kasuwanci tare da alamar MACD: https://youtu.be/0nihqQyGvOo

MACD a cikin shahararrun tashoshi

An haɗa alamar a cikin ainihin saitin kowane tashar zamani. Yana nan har ma a cikin aikace-aikacen hannu na dillali. Don kunna shi, kuna buƙatar zuwa menu na masu nuna alama kuma sami MACD ko MACD-Histogram.

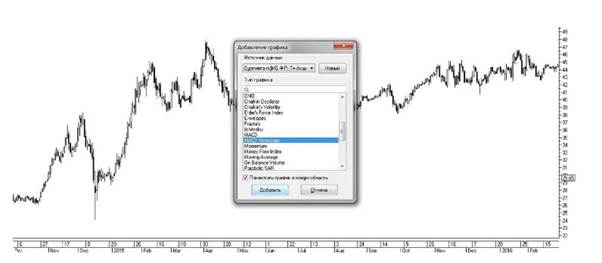

MACD a cikin tashar ciniki ta QUIK

Don nuna alamar a kan ginshiƙi a cikin Saurin tasha, kuna buƙatar danna Manna. Za a nuna akwatin maganganu na Ƙara Graph. A ciki, zaɓi MACD ko MACD histogram kuma danna maɓallin Ƙara. Don canza sigogi masu nuna alama, je zuwa Properties shafin.

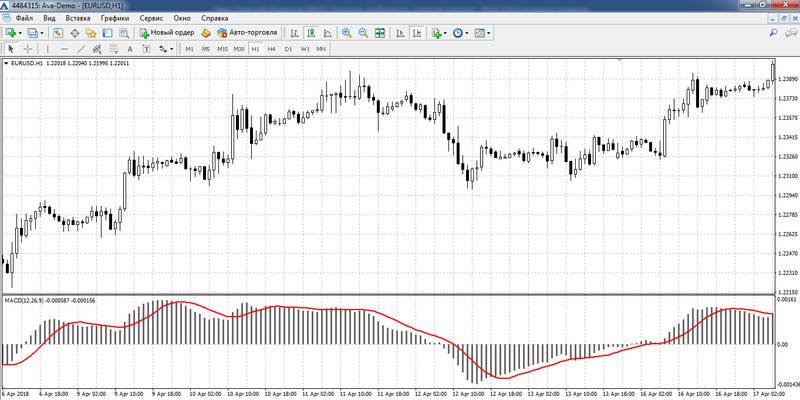

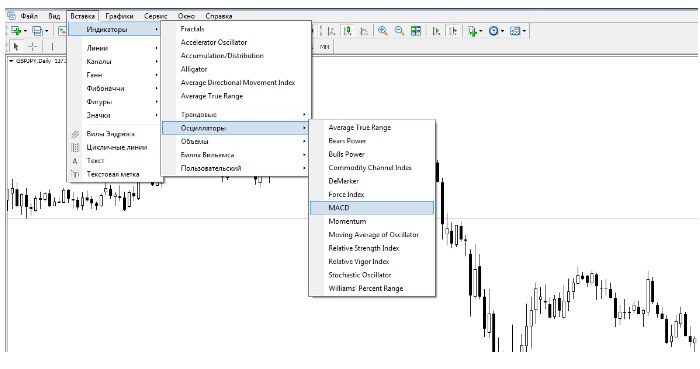

MACD a cikin tashar Metatrader

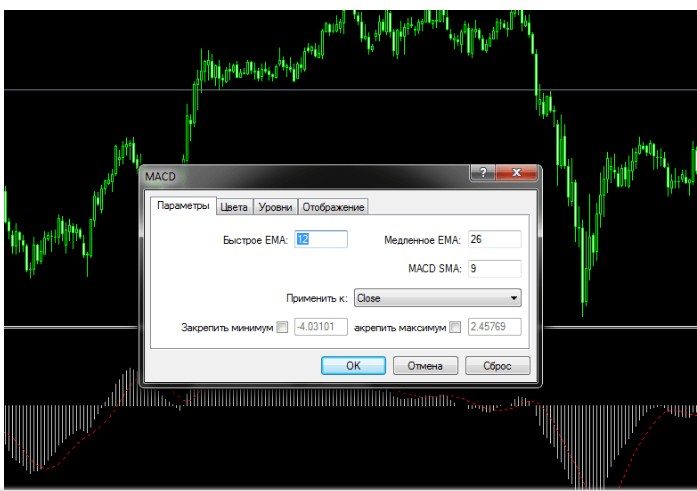

Don ƙara alamar Macdi, kuna buƙatar danna maɓallin Saka – Indicators – Oscillators – MACD. Taga don saitin sigogi zai bayyana, zaku iya zaɓar lokacin matsakaicin motsi, tsarin launi da nau’in matsakaicin motsi. [taken magana id = “abin da aka makala_14800” align = “aligncenter” nisa = “700”]

Yadda ake saita alamar MACD

Ta hanyar tsoho, mai nuna alama yana da saitunan masu zuwa:

- matsakaicin matsakaicin motsi 26;

- saurin motsi 12;

- sigina -9;

- shafi farashin rufewa;

- nau’in ma’ana.

- launukan sanduna ja ne da kore.

Ta hanyar canza lokutan matsakaicin motsi, zaku iya canza saurin martanin mai nuna alama ga canje-canjen farashin. A kan ƙananan lokuta za a sami ƙarin sigina. Kuna iya ƙara ko rage lokacin matsakaicin motsi. Tare da karuwa a cikin lokaci, ingancin siginar zai karu, za a sami ƙananan su, amma riba / arya rabo zai zama mafi girma. Amma wani lokacin mai nuna alama ba zai ga farkon yanayin ba. Ta hanyar rage ma’auni, za ku iya samun karuwa a hankali. Yana da mahimmanci kada ku rasa lokacin “ma’anar zinariya”, tsakanin adadin sigina da ingancin su.

Dabarun ciniki dangane da alamar MACD

Dangane da dabarun, ana amfani da alamar Makdi a matsayin wani ɓangare na saitin alamomi ko dabam.

- Hanyar tashar tashar – ana amfani da ita a kasuwa ba tare da bayyana yanayin ba. Mai ciniki yana tsammanin cewa farashin zai kasance a cikin kewayon na dogon lokaci. Don ƙayyade ‘yan kasuwa na “sama da ƙasa” suna amfani da Bollinger Bands, Tashar farashin, layin layi, matsakaicin motsi. A wannan yanayin, farashin zai iya zama a wurare biyu:

- Kasan kewayon . Lokacin da farashin ya kusanci gefen kewayon – kasan Bollinger, yana motsawa tare da dogon lokaci, layin layi, mai ciniki yana kallon alamar MACD a hankali. An buɗe ciniki mai tsayi idan sandunan histogram sun ragu, akwai bambance-bambance, sanduna suna canza launi zuwa kore kuma akwai tsaka-tsaki na layin masu nuna alama (yanayin daya ya isa idan akwai alamun 2 ko fiye – ƙarfafa siginar). An saita tasha fiye da matsananciyar. Kada ya wuce 0.2-0.5% na motsi na kadari. Idan ba zai yiwu a sanya ɗan gajeren lokaci ba, kuna buƙatar rage girman matsayi.

- saman kewayon . Lokacin da farashin ya kusanci gefen kewayon – a saman Bollinger, yana motsawa tare da dogon lokaci, layin Trend, mai ciniki yana kallon alamar MACD a hankali. An buɗe ɗan gajeren ciniki idan sandunan histogram sun ragu, akwai bambance-bambance, sanduna suna canza launi zuwa kore kuma akwai tsaka-tsaki na layukan nuni (yanayi ɗaya ya isa idan akwai alamun 2 ko fiye – ƙarfafa siginar). An saita tasha fiye da matsananciyar. Kada ya wuce 0.2-0.5% na motsi na kadari. Idan ba zai yiwu a sanya ɗan gajeren lokaci ba, kuna buƙatar rage girman matsayi.

Idan kayi la’akari da riko da farashin a cikin kewayon, sau da yawa akwai yanayi lokacin da iyakokin kewayon ke raguwa, amma daga baya farashin ya koma farashin farashi. Iyakoki na sama da kasa suna fadadawa. Ya kamata dan kasuwa ya kalli karatun mai nuna alamar MACD a hankali don kada ya rasa lokacin raguwar yanayin. Yana iya zuwa kafin ko bayan farashin ya taɓa gefen kewayon.

A tsakiyar kewayon, ba a buɗe sabbin yarjejeniyoyin. Mai ciniki na iya ƙarfafa matsayi idan farashin ya karye ta tsakiyar Bollinger ko matsakaita matsakaita akan ƙaramin lokaci (9-21 akan D1).

Haɗuwa da alamomi

Wasu ‘yan kasuwa suna amfani da oscillators da yawa a lokaci guda. Ana kammala ma’amaloli tare da bayyananniyar yanayin (duk masu nuna alama suna ba da sigina iri ɗaya) ko a cikin yanki mai mahimmanci da aka yi fiye da kima ko sayarwa don sake dawowa. ‘ Yan kasuwa suna amfani

da alamar RSI , stochastics, Bill Williams’ ban mamaki oscillator (AO),

matsakaita matsakaita tare da Macd . Bugu da ƙari, yana ƙarfafa siginar idan tsarin Ayyukan Farashi ya faru a wurin siye ko siyarwa.

Dabarun Trend

Ana buɗe kasuwancin ne kawai lokacin da MACD ke ƙasa ko sama da sifili (don siyarwa ko siye, bi da bi). Bugu da ƙari, suna amfani da filtata – Trend, sauran oscillators, matsakaicin motsi. An kammala cinikin ɗan gajeren lokaci ne kawai lokacin da aka tabbatar da yanayin – goyon baya / juriya ya ɓace, akwai alamu masu hoto don tabbatarwa, karatun nuna alama yana nuna tallace-tallace / sayayya mai karfi. Lokacin da matakan suka karya, idan mai nuna alama bai nuna raguwa a cikin yanayin ba, mai ciniki yana ƙarfafa matsayi kuma yana motsa tasha a bayan kasuwa.

Bambance-bambance da Haɗuwa

Sigina mai ƙarfi shine bambance-bambance tsakanin farashin da mai nuna alama. Wannan na iya nuna ƙarshen yanayin dogon lokaci. Ya kamata a duba irin waɗannan sigina akan manyan lokutan lokaci – kullum ko mako-mako. Juyawa farashin da wuya ya faru a cikin rana ɗaya, sau da yawa suna ba ku damar shiga tare da tsayayyen tsayawa, ba fiye da 5% na motsin kadari ba.

Yi aiki akan ɓangarorin lokaci da yawa

Dan kasuwa yana kallon lokuta da yawa (yawanci uku). Don ciniki na dogon lokaci yana da 1h, yau da kullun da mako-mako, don intraday shine 15-1h-4h, don gashin gashi shine 1-m15-1h. A cikin mafi tsufa lokacin, ana bin yanayin dogon lokaci. An ƙaddara yanayin halin yanzu akan matsakaici. Muna neman shigarwa akan mafi ƙarancin lokaci. Don shiga dogon:

- babban lokaci – dogon lokaci;

- tsakiya – tsawo;

- ƙaramin ɗan gajere ne, muna neman juyawar farashin ta hanyar haɗuwa da layi ko rarrabuwa.

An saita tasha don ƙananan lokaci, kuma ɗaukar shine na tsakiya. A cikin yanayin gajere, alamun sun kasance iri ɗaya. Idan duk karatun ukun ba su kai tsaye ba, ba mu kasuwanci ba.

Abũbuwan amfãni da rashin amfani na MACD mai nuna alama

An haɗa mai nuna alama a cikin mafi yawan dabarun ciniki dangane da kasuwancin tashoshi (yankin da aka yi sama da su) da ciniki na lilo. Amfanin alamar MACD:

- sigina masu inganci a cikin kasuwa maras tabbas;

- ingantattun sigina duka a kan manyan lokutan lokaci da kan ƙananan lokutan lokaci har zuwa m1. A kowane hali, kuna buƙatar zaɓar sigogi masu nuna alama. A kan ƙananan lokutan lokaci, ana amfani da m1-m5 a cikin dabarun ƙwanƙwasa ;

- duniya – zaka iya kasuwanci akan kowace dukiya (hannun jari, fihirisa, kayayyaki, karafa, agogo);

- tasiri lokacin ciniki tare da yanayin.

Rashin hasara na alamar MACD:

- akan ƙananan lokutan lokaci, ana buƙatar ƙarin tacewa;

- mai nuna alama ya makara, a kan ƙananan lokuta yana haifar da siginar ƙarya. A kan manyan lokuta, wannan ba shi da mahimmanci, saboda akwai lokaci mai yawa. A kan ƙananan lokuta, mai nuna alama yana hana sigina lokacin da motsi ya riga ya ƙare;

- ba ya aiki da kyau a cikin lebur;

- ba ya aiki tare da ƙananan rashin ƙarfi – histogram kawai yana juyawa a kusa da sifili. Alamun ba su da ƙarfi, tasha yawanci ana fidda su.

Yadda ake aiki tare da alamar MACD – darasi na koyarwa akan ciniki: https://youtu.be/iuFQxnCuz9w A cikin 2022, Intanet yana cike da tayin “mafi riba” alamomi. A sakamakon haka, ginshiƙi yayi kama da itace mai ban sha’awa na alamomi daban-daban. Tare da irin wannan nau’in, wasu sun manta game da ma’auni na yau da kullum. Kuma ba su rasa abin da ya dace ba. Ka’idar oscillators iri ɗaya ce, zaku iya fito da ɗan sabon abu kaɗan. A halin yanzu, MACD ya inganta juzu’i, amma alamar ita kanta ana samun nasarar amfani da dabarun ciniki. Fahimtar yadda yake aiki shine mabuɗin ciniki mai inganci. MACD alama ce ta duniya, zaku iya bin diddigin ƙarfin halin da ake ciki kuma ku sami juzu’i a wuraren da aka yi fiye da kima. Zai zama da amfani ga masu farawa, MACD alama ce ta Trend kuma ba za ta ƙyale ka ka tashi daga yanayin ƙarfi ba.