What are stablecoins, what are they for, how do they work and how are they secured, and is it worth buying them in 2022, what are the risks for an investor. Cryptocurrency assets are gaining popularity every year. More and more new tokens appear, including stablecoins. They have already managed to conquer a large part of the cryptocurrency market, since they have many advantages, the main thing is the protection of funds from the volatility that any crypto assets are subject to. This article will focus on stablecoins.

- What is a stablecoin in simple terms

- What are stablecoins for?

- What are the popular stablecoins in 2022 – list of popular

- What assets are tied to

- What are the price support mechanisms

- What are centralized stablecoins

- What are the advantages and disadvantages of centralized stablecoins

- What are algorithmic stablecoins

- What are algorithmic stablecoins

- How stables will develop

What is a stablecoin in simple terms

The main problem of cryptocurrency assets for those who use tokens as a currency is uncontrolled

volatility . The fluctuations in the value of the first coin in the world repeatedly exceeded tens of thousands of dollars and fell below one dozen after a peak of $67,000. A stablecoin solves the problem of volatility, since the rate of such a coin is tied directly to fiat currency or physical assets. In the first case, it can be the US dollar, and in the second, gold. However, there are stablecoins, the rate of which is partially or completely confirmed by the value of another cryptocurrency asset.

What are stablecoins for?

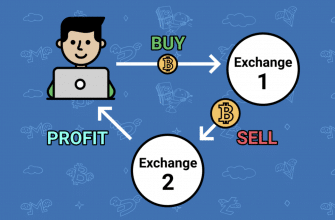

Stablecoins can be used as a regular fiat currency to buy groceries, for example. However, this is not the only area of application of such coins. Typically, stablecoins are used to store funds on a cryptocurrency exchange.

- carrying out daily transactions;

- transfers to other people without commission – including to other countries;

- protecting the local currency from inflation;

- reducing the dependence of cryptocurrency exchanges on the cost of bitcoin;

- optimization of recurrent transfers from one bank account to another.

This list is constantly expanding. This is due to the expansion of the scope of stablecoins. For example, they can be staked to receive passive income, but this area is less popular.

What are the popular stablecoins in 2022 – list of popular

In total, you can count a huge number of stablecoins, but not every coin can be considered reliable. First of all, this is due to the rotation of assets that form the general pool of the token, as well as investor confidence. Consider the TOP 10 most popular stable apps for July 2022.

| Name | Market capitalization ($) |

| USDT | 3.9 trillion |

| USDC | 3.3 trillion |

| BUSD | 1.07 trillion |

| DAI | 440 billion |

| FRAX | 84 billion |

| TUSD | 71 billion |

| USDP | 56 billion |

| USDN | 44 billion |

| USDD | 43 billion |

| FEI | 25 billion |

Information taken from the analytical platform CoinMarketCap. TOP is formed according to the principle of market capitalization. That is, the greater the capitalization, the higher the place in the given rating.

What assets are tied to

Today, the most common are stablecoins, which are pegged to the value of a fiat currency – the US dollar. The most reliable token today is USDT, where the rate always remains 1 to 1. Deviations are possible, but they are minimal and, as a rule, occur during fiat currency volatility.

What are the price support mechanisms

Almost every cryptocurrency asset has tools that support and justify its price. However, there are three main ways that can be divided into types:

- number of coins reserved by the system:

- rules for the use of assets from the reserve;

- other ways to retain value – each asset has its own approach.

What are centralized stablecoins

Virtually every stable token is controlled by centralized issuers. They create and maintain funds that hold reserved assets or fiat currencies such as the US dollar. They are subject to audits to periodically confirm the declared amount of assets. The most popular stablecoin is USDT, owned by Tether. It constantly updates information on the volume of stored assets within the fund, and also guarantees investors compensation for losses if something happens to USDT. Therefore, this token is the most popular among stablecoins. In July 2022, the fund is over 80 percent filled with fiat only.

What are the advantages and disadvantages of centralized stablecoins

Stable tokens managed by centralized organizations have good sustainability. Their value is guaranteed by assets whose volatility is minimal. Such stablecoins have high liquidity and are available for trading on many popular cryptocurrency exchanges. It is also worth highlighting the possibility of calculating, saving funds and trading directly inside the crypto exchange. However, any trouble on a centralized exchange is a potential problem for every stablecoin holder. They can occur due to errors of the management company, incorrect reporting, including in the form of manipulations or other events.

One of the best examples happened in 2019. He is associated with Tether and its stablecoin, as well as the Bitfinex crypto exchange. The latter was accused of using the capital of the Tether company for personal purposes – to compensate for the funds that its users lost for third reasons. The amount was more than 800 million dollars.

What are algorithmic stablecoins

The value of stablecoins is usually pegged to something, such as the value of a fiat currency or another asset. The main advantage of stablecoins is protection from high volatility, which is often used by both investors and traders. Almost every stablecoin strives for full binding to some asset, introducing its own mechanisms. And those that are already in active circulation have enough assets to secure and guarantee their own value. These assets are located in centralized organizations, such as banking. Funds operate without the use of blockchain technology. The most popular stablecoins by market capitalization work exactly like this. However, there are stablecoins that use blockchain technology to form a fund. Some even work with decentralized mechanisms, e.g. DAI. Such stablecoins are called algorithmic. By the name, you can understand that algorithms are used as the basis for their formation. In this case, it is a kind of list of rules, instructions and restrictions that must be followed. Usually everything is formed by computational processes with a certain list of input data. Algorithm optimization has a single goal — to keep the token exchange rate stable relative to pegged assets. Typically, algorithmic stablecoins do not have any funds or other collateral. The cost is not tied to external assets. However, there are also hybrids. Everything you need to know about stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg In this case, it is a kind of list of rules, instructions and restrictions that must be followed. Usually everything is formed by computational processes with a certain list of input data. Algorithm optimization has a single goal — to keep the token exchange rate stable relative to pegged assets. Typically, algorithmic stablecoins do not have any funds or other collateral. The cost is not tied to external assets. However, there are also hybrids. Everything you need to know about stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg In this case, it is a kind of list of rules, instructions and restrictions that must be followed. Usually everything is formed by computational processes with a certain list of input data. Algorithm optimization has a single goal — to keep the token exchange rate stable relative to pegged assets. Typically, algorithmic stablecoins do not have any funds or other collateral. The cost is not tied to external assets. However, there are also hybrids. Everything you need to know about stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg Algorithm optimization has a single goal — to keep the token exchange rate stable relative to pegged assets. Typically, algorithmic stablecoins do not have any funds or other collateral. The cost is not tied to external assets. However, there are also hybrids. Everything you need to know about stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg Algorithm optimization has a single goal — to keep the token exchange rate stable relative to pegged assets. Typically, algorithmic stablecoins do not have any funds or other collateral. The cost is not tied to external assets. However, there are also hybrids. Everything you need to know about stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg

What are algorithmic stablecoins

Today it is difficult to choose a way to regulate the value of a stablecoin. Therefore, new variations of stable tokens are emerging. One way is to create a fund, the volume of which significantly exceeds the issuance of the coin. The most popular token that works in this way is DAI. It has a large initial margin, behaves stably, but the efficiency of the asset is significantly lower than that of centralized counterparts. In May 2022, the leader in terms of market capitalization was an asset, the value of which collapsed to a minimum. We are talking about the Terra project and the UST token. The principle was that the creators did not regulate the emission – anyone could issue tokens. Economic agents were engaged in price adjustment.

How stables will develop

The vast majority of stablecoins have funds with real assets, algorithmic ones, on the contrary. In their arsenal, there is only mathematics and developed mechanisms that help stimulate the stability of the exchange rate relative to a certain coin. Also, stablecoins are associated with risks, since investors cannot be sure of the transparency of the reserves. This may indicate not only the possible regulation of stablecoins by the state, but also the development of algorithmic stable tokens. However, using the example of UST, one can see that at the moment there are no effective mechanisms for the development of the sphere. But at the same time it is inevitable in the near future. Stablecoins are a versatile asset that are already being used in many areas of everyday life. The technology is actively developing, new centralized coins appear, as well as algorithmic tokens.