Menene stablecoins, menene su, yaya suke aiki da kuma yadda ake amintar da su, kuma yana da daraja siyan su a cikin 2022, menene haɗarin mai saka jari. Kaddarorin Cryptocurrency suna samun karbuwa a kowace shekara. Sabbin alamu suna ƙara bayyana, gami da stablecoins. Sun riga sun yi nasarar cinye babban ɓangare na kasuwar cryptocurrency, tun da suna da fa’idodi da yawa, babban abu shine kariyar kuɗi daga rashin daidaituwa da duk wani kadarorin crypto ke ƙarƙashinsa. Wannan labarin zai mayar da hankali kan stablecoins.

- Menene stablecoin a cikin sauki kalmomi

- Menene stablecoins don?

- Menene mashahurin stablecoins a cikin 2022 – jerin shahararrun

- Abin da kadarorin da aka daure

- Menene hanyoyin tallafin farashi

- Menene centralized stablecoins

- Menene abũbuwan amfãni da rashin amfani na Karkasa Stablecoins

- Menene algorithmic stablecoins

- Menene algorithmic stablecoins

- Yadda barga za su ci gaba

Menene stablecoin a cikin sauki kalmomi

Babban matsalar kadarorin cryptocurrency ga waɗanda ke amfani da alamun a matsayin kuɗi shine rashin

ƙarfi mara ƙarfi . Sauye-sauyen da darajar tsabar kudin farko a duniya ta yi ta zarce dubun dubatan daloli kuma ta fadi kasa da dozin guda bayan kololuwar dala 67,000. A stablecoin yana magance matsalar rashin daidaituwa, tun lokacin da adadin irin wannan tsabar kudin yana ɗaure kai tsaye zuwa kudin fiat ko dukiya ta jiki. A cikin akwati na farko, yana iya zama dalar Amurka, kuma a cikin na biyu, zinariya. Koyaya, akwai stablecoins, adadin wanda aka tabbatar da wani bangare ko gaba ɗaya ta darajar wani kadari na cryptocurrency.

Menene stablecoins don?

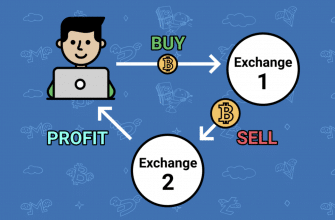

Ana iya amfani da Stablecoins azaman kudin fiat na yau da kullun don siyan kayan abinci, alal misali. Koyaya, wannan ba shine kawai yanki na aikace-aikacen irin waɗannan tsabar kudi ba. Yawanci, ana amfani da stablecoins don adana kuɗi akan musayar cryptocurrency.

- aiwatar da ma’amaloli na yau da kullun;

- canja wurin zuwa wasu mutane ba tare da hukumar ba – ciki har da zuwa wasu ƙasashe;

- kare kudin gida daga hauhawar farashin kayayyaki;

- rage dogaro da musayar cryptocurrency akan farashin bitcoin;

- inganta yawan canja wuri daga wannan asusun banki zuwa wani.

Wannan jeri yana ci gaba da fadadawa. Wannan shi ne saboda fadada iyakokin stablecoins. Misali, ana iya ba su hannun jari don karɓar kudin shiga na yau da kullun, amma wannan yanki bai fi shahara ba.

Menene mashahurin stablecoins a cikin 2022 – jerin shahararrun

A cikin duka, zaku iya ƙidaya adadi mai yawa na stablecoins, amma ba kowane tsabar kuɗi ba ne za a iya la’akari da abin dogaro. Da farko, wannan ya faru ne saboda jujjuyawar kadarorin da ke samar da babban tafkin alamar, da kuma amincewar masu saka jari. Yi la’akari da TOP 10 mafi mashahuri barga apps na Yuli 2022.

| Suna | Babban kasuwa ($) |

| USDT | 3.9 tiriliyan |

| USDC | 3.3 tiriliyan |

| BUSD | 1.07 tiriliyan |

| DAI | biliyan 440 |

| FRAX | biliyan 84 |

| TUSD | biliyan 71 |

| USDP | biliyan 56 |

| USDN | biliyan 44 |

| USDD | biliyan 43 |

| FEI | biliyan 25 |

Bayanan da aka karɓa daga dandalin nazari CoinMarketCap. An kafa TOP bisa ga ka’idar kasuwancin kasuwa. Wato, mafi girma da jari-hujja, mafi girman wuri a cikin ƙimar da aka ba.

Abin da kadarorin da aka daure

A yau, mafi yawan na kowa shine stablecoins, wanda aka danganta da darajar kudin fiat – dalar Amurka. Alamar da ta fi dacewa a yau ita ce USDT, inda ƙimar ko da yaushe ya kasance 1 zuwa 1. Bambance-bambancen zai yiwu, amma sun kasance kadan kuma, a matsayin mai mulkin, yana faruwa a lokacin canjin kudin fiat.

Menene hanyoyin tallafin farashi

Kusan kowane kadari na cryptocurrency yana da kayan aikin da ke tallafawa da tabbatar da farashin sa. Duk da haka, akwai manyan hanyoyi guda uku waɗanda za a iya raba su zuwa iri:

- adadin tsabar kudi da tsarin ya tanada:

- dokoki don amfani da kadarorin daga ajiyar;

- sauran hanyoyin da za a riƙe darajar – kowane kadari yana da nasa tsarin.

Menene centralized stablecoins

Kusan kowane barga token ana sarrafa shi ta hanyar masu ba da izini. Suna ƙirƙira da kula da kuɗi waɗanda ke riƙe da kadarorin da aka keɓance ko kuma kuɗaɗen kuɗi kamar dalar Amurka. Ana bincika su don tabbatar da adadin kadarorin da aka ayyana lokaci-lokaci. Mafi shahararren bargacoin shine USDT, mallakar Tether. Yana sabunta bayanai akai-akai kan adadin kadarorin da aka adana a cikin asusun, kuma yana ba da tabbacin biyan diyya ga masu zuba jari don asarar idan wani abu ya faru da USDT. Saboda haka, wannan alamar ita ce mafi mashahuri tsakanin stablecoins. A cikin Yuli 2022, asusun ya wuce kashi 80 cikin ɗari cike da fiat kawai.

Menene abũbuwan amfãni da rashin amfani na Karkasa Stablecoins

Alamu masu tsattsauran ra’ayi waɗanda ƙungiyoyin tsakiya ke gudanarwa suna da kyakkyawan dorewa. Ƙimar su tana da garanti ta hanyar kadarorin da rashin ƙarfi ya yi kadan. Irin waɗannan stablecoins suna da ƙima mai yawa kuma ana samun su don ciniki akan manyan musanya na cryptocurrency da yawa. Hakanan yana da daraja nuna yuwuwar ƙididdigewa, adana kuɗi da ciniki kai tsaye a cikin musayar crypto. Koyaya, duk wani matsala akan musayar tsaka-tsaki shine yuwuwar matsala ga kowane mai riƙe tsabar kudin. Suna iya faruwa saboda kurakurai na kamfanin gudanarwa, rahoton da ba daidai ba, gami da hanyar magudi ko wasu abubuwan da suka faru.

Ɗaya daga cikin mafi kyawun misalai ya faru a cikin 2019. Yana da alaƙa da Tether da stablecoin, kazalika da musayar crypto Bitfinex. An zargi na karshen da yin amfani da babban birnin na Tether don dalilai na kashin kai – don biyan kudaden da masu amfani da shi suka yi asara saboda dalilai na uku. Adadin ya haura dala miliyan 800.

Menene algorithmic stablecoins

Darajar stablecoins yawanci ana danganta shi da wani abu, kamar darajar kudin fiat ko wata kadara. Babban amfani da stablecoins shine kariya daga babban rashin daidaituwa, wanda masu zuba jari da ‘yan kasuwa ke amfani da su sau da yawa. Kusan kowane stablecoin yayi ƙoƙari don cikakken ɗaure wani kadara, yana gabatar da nasa hanyoyin. Kuma waɗanda suka riga sun kasance a cikin wurare masu aiki suna da isassun kadarori don amintattu da garantin ƙimar nasu. Waɗannan kadarorin suna cikin ƙungiyoyi masu ƙarfi, kamar banki. Kudade suna aiki ba tare da amfani da fasahar blockchain ba. Mafi mashahuri stablecoins ta hanyar babban kasuwa yana aiki daidai da wannan. Koyaya, akwai stablecoins waɗanda ke amfani da fasahar blockchain don samar da asusu. Wasu ma suna aiki da hanyoyin da ba a daidaita su ba, misali DAI. Irin waɗannan stablecoins ana kiran su algorithmic. Da sunan, zaku iya fahimtar cewa ana amfani da algorithms azaman tushen samuwar su. A wannan yanayin, nau’in jerin dokoki ne, umarni da hani waɗanda dole ne a bi su. Yawancin lokaci komai yana samuwa ta hanyar tsarin lissafi tare da takamaiman jerin bayanan shigarwa. Haɓaka Algorithm yana da manufa guda ɗaya – don kiyaye ƙimar musanya alama ta daidaita dangane da kadarorin da aka ƙulla. Yawanci, algorithmic stablecoins ba su da wani kuɗi ko wasu haɗin gwiwa. Kudin ba a haɗa shi da kadarorin waje ba. Duk da haka, akwai kuma hybrids. Duk abin da kuke buƙatar sani game da stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg A wannan yanayin, nau’in jerin dokoki ne, umarni da hani waɗanda dole ne a bi su. Yawancin lokaci komai yana samuwa ta hanyar tsarin lissafi tare da takamaiman jerin bayanan shigarwa. Haɓaka Algorithm yana da manufa guda ɗaya – don kiyaye ƙimar musanya alama ta daidaita dangane da kadarorin da aka ƙulla. Yawanci, algorithmic stablecoins ba su da wani kuɗi ko wasu haɗin gwiwa. Kudin ba a haɗa shi da kadarorin waje ba. Duk da haka, akwai kuma hybrids. Duk abin da kuke buƙatar sani game da stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg A wannan yanayin, nau’in jerin dokoki ne, umarni da hani waɗanda dole ne a bi su. Yawancin lokaci komai yana samuwa ta hanyar tsarin lissafi tare da takamaiman jerin bayanan shigarwa. Haɓaka Algorithm yana da manufa guda ɗaya – don kiyaye ƙimar musanya alama ta daidaita dangane da kadarorin da aka ƙulla. Yawanci, algorithmic stablecoins ba su da wani kuɗi ko wasu haɗin gwiwa. Kudin ba a haɗa shi da kadarorin waje ba. Duk da haka, akwai kuma hybrids. Duk abin da kuke buƙatar sani game da stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg Haɓaka Algorithm yana da manufa guda ɗaya – don kiyaye ƙimar musanya alama ta daidaita dangane da kadarorin da aka ƙulla. Yawanci, algorithmic stablecoins ba su da wani kuɗi ko wasu haɗin gwiwa. Kudin ba a haɗa shi da kadarorin waje ba. Duk da haka, akwai kuma hybrids. Duk abin da kuke buƙatar sani game da stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg Haɓaka Algorithm yana da manufa guda ɗaya – don kiyaye ƙimar musanya alama ta daidaita dangane da kadarorin da aka ƙulla. Yawanci, algorithmic stablecoins ba su da wani kuɗi ko wasu haɗin gwiwa. Kudin ba a haɗa shi da kadarorin waje ba. Duk da haka, akwai kuma hybrids. Duk abin da kuke buƙatar sani game da stablecoins, USDC, USDT, DAI, BUSD: https://youtu.be/71u4U2eJWGg

Menene algorithmic stablecoins

A yau yana da wuya a zaɓi hanyar da za a daidaita ƙimar stablecoin. Saboda haka, sabbin bambance-bambancen alamun barga suna fitowa. Hanya ɗaya ita ce ƙirƙirar asusu, wanda girmansa ya zarce fitowar tsabar kudin. Shahararriyar alamar da ke aiki ta wannan hanyar ita ce DAI. Yana da babban gefe na farko, yana aiki a tsaye, amma ingancin kadari yana da matukar ƙasa da na takwarorinsa na tsakiya. A cikin Mayu 2022, jagora dangane da babban kasuwa ya kasance kadari, wanda ƙimarsa ta faɗi zuwa ƙarami. Muna magana ne game da aikin Terra da alamar UST. Ka’idar ita ce masu yin halitta ba su tsara fitar da hayaki ba – kowa zai iya ba da alamun. Wakilan tattalin arziki sun tsunduma cikin daidaita farashin.

Yadda barga za su ci gaba

Mafi rinjaye na stablecoins suna da kudade tare da dukiya na ainihi, algorithmic, akasin haka. A cikin arsenal ɗin su, akwai ilimin lissafi kawai da kuma hanyoyin haɓakawa waɗanda ke taimakawa tada kwanciyar hankali na canjin kuɗi dangane da wani tsabar kuɗi. Har ila yau, stablecoins suna da alaƙa da haɗari, tun da masu zuba jari ba za su iya tabbatar da gaskiyar ajiyar kuɗi ba. Wannan na iya nuna ba wai kawai tsarin da zai yiwu na stablecoins ta hanyar jihar ba, amma har ma da ci gaban alamun kwanciyar hankali na algorithmic. Duk da haka, ta amfani da misali na UST, mutum zai iya ganin cewa a halin yanzu babu wani ingantattun ingantattun hanyoyin ci gaban yankin. Amma a lokaci guda kuma babu makawa nan gaba kadan. Stablecoins wata kadara ce da aka riga aka yi amfani da ita a fannoni da yawa na rayuwar yau da kullun. Fasahar tana haɓaka haɓakawa sosai, sabbin tsabar kuɗi na tsakiya sun bayyana, da alamun algorithmic.