What is inter-exchange 2023 cryptocurrency arbitrage and how to make money on it, how the opexflow.com screener works in practice, working links and the largest crypto spreads between exchanges.

Cryptocurrency arbitrage inter-exchange

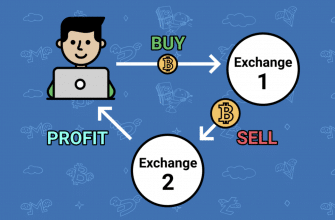

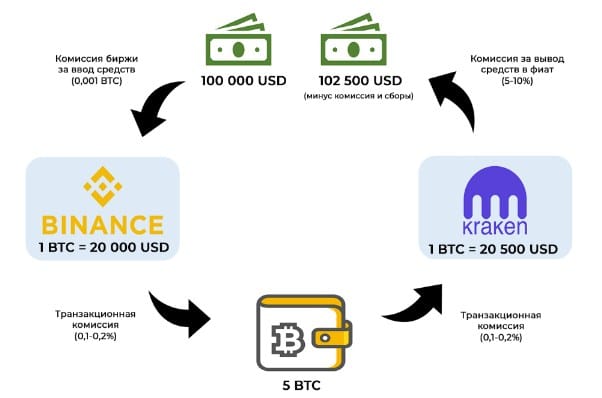

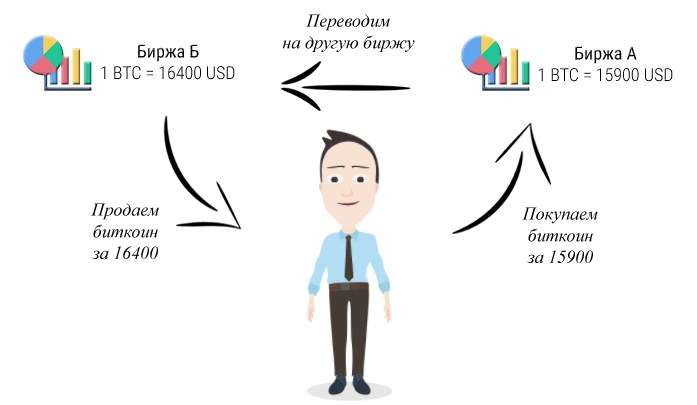

Cross-exchange arbitrage is the main form of p2p arbitrage trading in which a trader tries to make a profit by buying cryptocurrency on one exchange and selling it on another exchange. Inter-exchange cryptocurrency arbitrage combines a chain of operations that help to make a profit on the difference in the price of assets located within several trading platforms. The method of trading one or more assets on different exchanges is used. It is easier to find working links for arbitration on different exchanges than on one. This is what makes inter-exchange arbitrage so relevant.

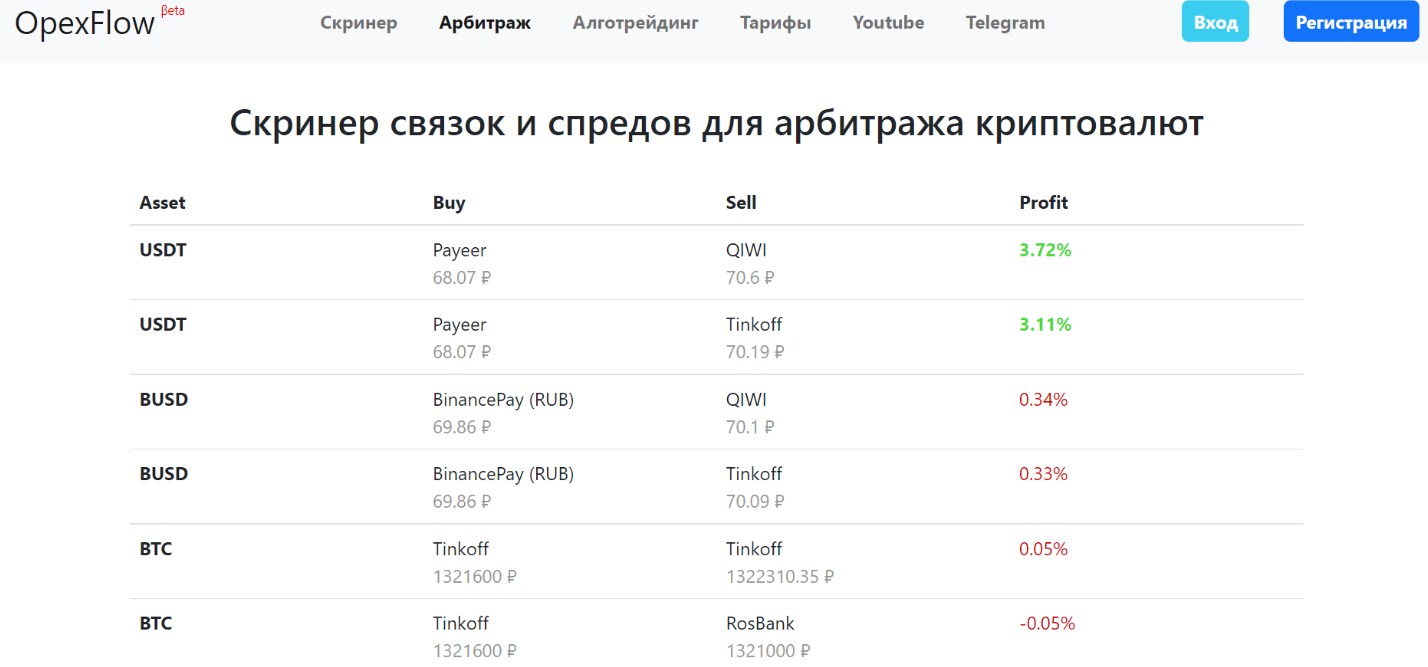

Interface opexflow

Interface opexflow

Why do cryptocurrency prices differ on different exchanges?

The first thing to know is that the price of assets on centralized exchanges depends on the most recent matching Bid-Ask order in the exchange’s order book. In other words, the most recent price at which a trader buys or sells a digital asset on an exchange is considered the real-time price of that asset on the exchange. For example, if an order to buy Bitcoin for $60,000 is the last matched order on the exchange, that price becomes the last price of Bitcoin on the platform. The next matching order after that will also determine the next price of the digital asset. Thus, pricing on exchanges is an ongoing process of determining the market price of a digital asset based on its most recent selling price.

Is Crypto Arbitrage a Low-Risk Strategy?

You may have noticed that, unlike investors or day traders, crypto arbitrage traders do not have to predict future prices for cryptocurrencies, or enter into trades that can take hours or days before they start to turn a profit. By identifying and capitalizing on arbitrage opportunities, traders base their decisions on the expectation of a fixed profit, without necessarily analyzing market sentiment or relying on other pricing forecasting strategies. In addition, depending on the resources available to traders, it is possible to enter and exit an arbitrage trade in seconds or minutes. Thus, taking this into account, we can draw the following conclusions:

- The risk associated with crypto arbitrage trading is somewhat lower than other trading strategies because it usually does not require predictive analysis.

- Arbitrage traders are required to make trades that last no more than a few minutes, so exposure to trading risk is greatly reduced.

- To increase the efficiency of crypto-arbitrage, it is desirable to have a working screener at hand.

About the risks of crypto-arbitrage and ways to minimize them However, this does not necessarily mean that crypto-arbitrageurs are completely risk-free. Opexflow increases the chance of profit and has all the necessary tools to use both inter-exchange and intra-exchange trading methods.

What you should pay attention to when choosing a service for cryptocurrency arbitrage

When choosing a service for working with cryptocurrency arbitrage, users should pay attention to the following factors:

- The program must be reliable . Opexflow does not require users to access wallets and profiles. And therefore completely safe.

- The program must interact with different exchanges . Quality software should work with at least five leading trading platforms. However, there are also systems that are able to interact with twenty sites at once. Such a service significantly increases the opportunities for earning.

- Service cost . In order for trading to be profitable, it is necessary to calculate the service fee and commission, evaluate the amount received and compare with other offers from leading services. If the difference is insignificant, then such a platform can be trusted. As part of beta testing, the cost of working in the opexflow service is minimal.

- Interface with. Each service is distinguished by a set of tools and the complexity of their application. There are programs designed for more experienced users, and there are those that are best suited for beginners. Therefore, when choosing a system, you should focus on your own skills.

- Speed . As practice shows, the speed of obtaining information and performing operations is extremely important for successful arbitrage trading. The faster the program runs, the more efficient it is.

- Possibility of updating . Given the fact that the cryptocurrency market is often changing, it is important that the service can be updated in a timely manner, and thereby become better and better.

International arbitration with opexflowOpexflow offers favorable conditions for cooperation and work for its members. This is an advanced spread and link screener for arbitrage. At the moment, all the criteria described above meet the new service for arbitrage trading opexflow, which can be used by clicking on the link https://opexflow.com/. To use cryptocurrency arbitrage between exchanges in practice, you need to register with the service and proceed to testing the main features of the service.