What are Depository Receipts and why are they issued?When trading stocks and bonds on the stock exchange, you need to be able to choose the most promising securities. Each exchange offers certain opportunities in this regard. However, sometimes the possibility of buying foreign stocks and bonds is limited. This may be due to the fact that they are not listed on a particular exchange or there are legal restrictions on working with them. Shares are not held by buyers. If, for example, a trader has made investments in securities, then they are not handed over to him. In fact, in the area under consideration, the rules of storage resemble those used in the banking sector. An account is provided for the buyer, in which those shares and bonds to which he has the right of ownership are stored.

- General information, explanations, mechanism of operation

- Difference from shares

- Who issues a depositary receipt

- Varieties of depositary receipts – ADR EDR GDR RDR

- Pros and cons of using investors

- Where to find information about depositary receipts on the Moscow Exchange

- Depositary receipts of Russian companies, global

- When to Invest in Receipts

- How to do it in practice

- Taxation

- Questions and answers

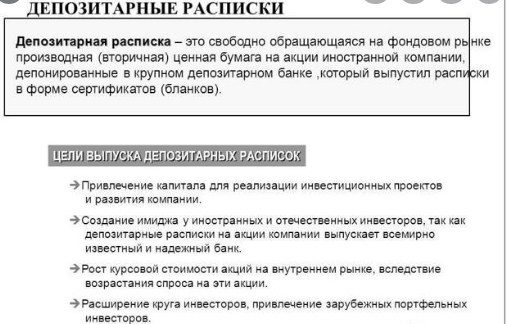

General information, explanations, mechanism of operation

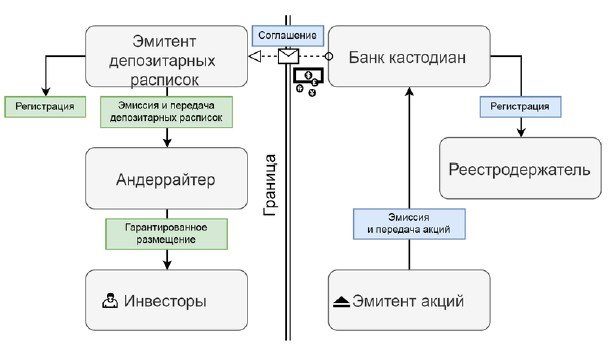

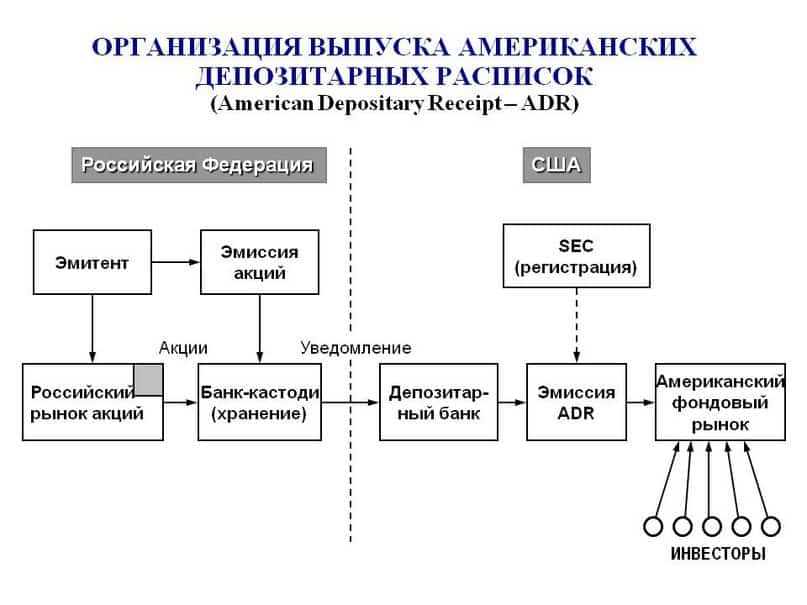

In order to start working on a particular exchange, a company must go through the listing procedure. In order for the result to be successful, it is necessary to comply with the relevant legal requirements, as well as make an initial investment in order to draw attention to your shares. Choosing which exchange to work on, the company takes into account not only its availability, but also the potential benefits from it. However, the use of depository receipts makes it possible to make their securities much more popular. As an example, consider, for example, a Chinese company. It must arrange with its depository bank to issue depository receipts for its shares. In this case, the latter will act as custodian. It can be seen that not only Russian, but also European and American stocks are represented on Russian stock exchanges, however, there are very few opportunities to access Japanese or Chinese. In order to start trading in depository receipts, the custodian buys the required number of securities and becomes their owner in accordance with the issued documents. Note that in the above example, the purchase was made according to Chinese laws and did not take into account any norms of foreign legislation. [caption id="attachment_11790" align="aligncenter" width="608"] that in the above example, the purchase was made according to Chinese laws and did not take into account any norms of foreign legislation. [caption id="attachment_11790" align="aligncenter" width="608"] that in the above example, the purchase was made according to Chinese laws and did not take into account any norms of foreign legislation. [caption id="attachment_11790" align="aligncenter" width="608"]

Difference from shares

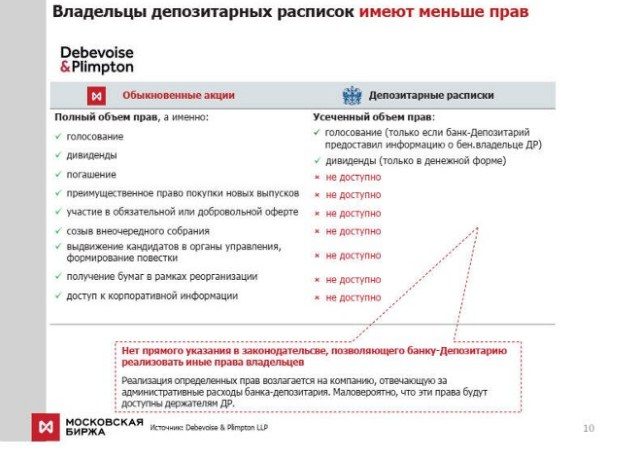

Depositary receipts are largely similar to shares, but they have their own distinctive features. They are as follows:

- They are secondary.

- They provide an opportunity for a trader or investor to trade securities that otherwise may not be available to him.

- In the process of work, there is cooperation between depository banks located in different countries.

[caption id="attachment_11809" align="aligncenter" width="617"]

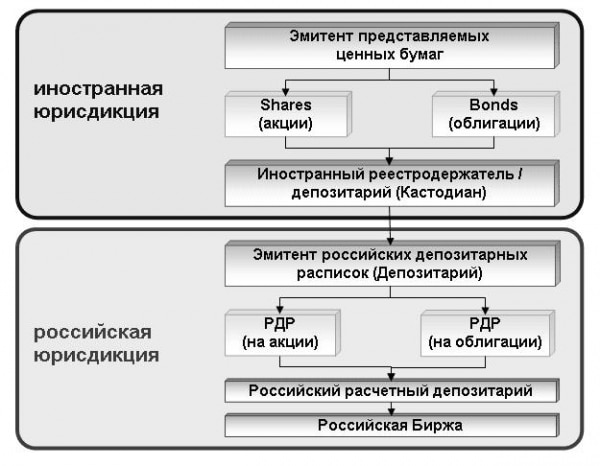

Who issues a depositary receipt

A custodial bank that holds certain securities sells them to a depository bank in another country. The latter issues depositary receipts on them, which are traded on the stock exchange. The investor acquires them, obtaining all the necessary rights and actually becomes the owner of the relevant securities issued in another country. Thus, through the use of depositary receipts, he expands his possibilities, working with securities that would not otherwise be listed on his stock exchange.

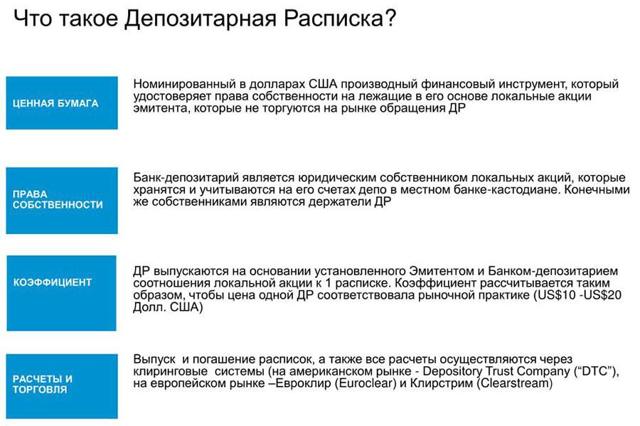

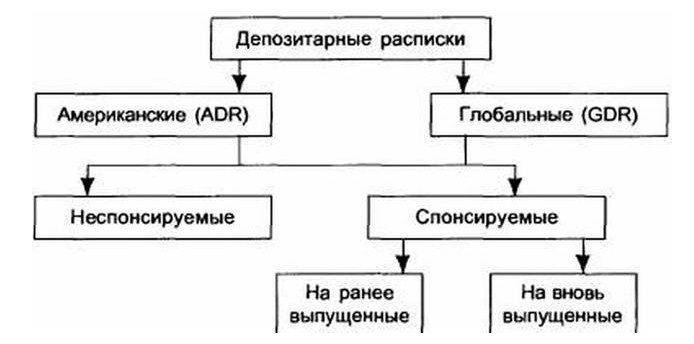

Varieties of depositary receipts – ADR EDR GDR RDR

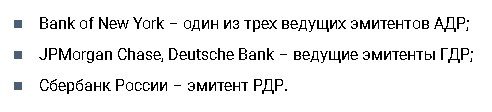

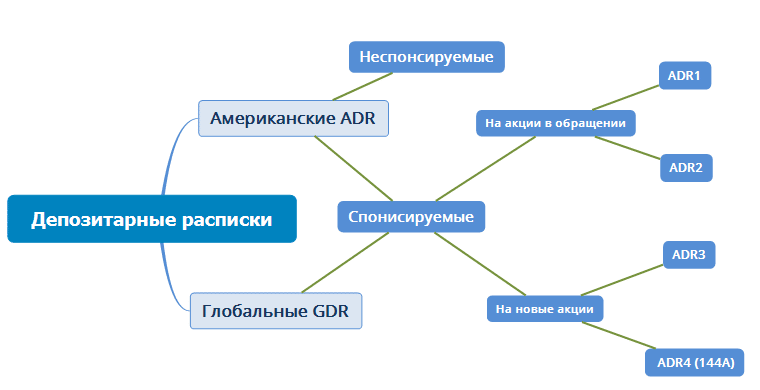

The division into types is based on which banks issue them and where they are traded. Several types of depositary receipts are used:

- ADR (American Depositary Receipt) – receipts issued by American banks. They are designed to work with them on the American exchanges and on the stock market of the world.

ADR and GDR - EDRs are issued by European banks and are traded on European exchanges.

- GDRs are global depositary receipts traded on stock exchanges in several countries.

- The law of the Russian Federation allows the issuance of RDRs intended for the Russian market, but their use is not widespread.

Pros and cons of using investors

The use of depository receipts is similar to how stocks and bonds are handled. However, their use provides additional opportunities for participants in transactions. Issuers can take advantage of the following benefits:

- Usually, he can offer his shares only on certain exchanges. The use of depositary receipts makes them available to others, including abroad.

- By improving accessibility, there are additional opportunities in the search for investors.

- An increase in the supply of shares contributes to the improvement of the company’s reputation.

The investor gets the opportunity to expand the list of instruments with which he can work. This improves the level of asset diversification. With the help of such receipts, it is possible to obtain or expand access to securities from foreign issuers. When working with securities issued abroad, one has to face currency risks. Unpredictable exchange rate changes can sometimes significantly reduce profitability. The use of depositary receipts solves such problems, since the settlements in this case are carried out in the national currency. However, you also need to take into account the presence of certain disadvantages:

- Currency risks remain when the shareholder receives dividends.

- Depository receipts are less active than stocks and bonds.

Where to find information about depositary receipts on the Moscow Exchange

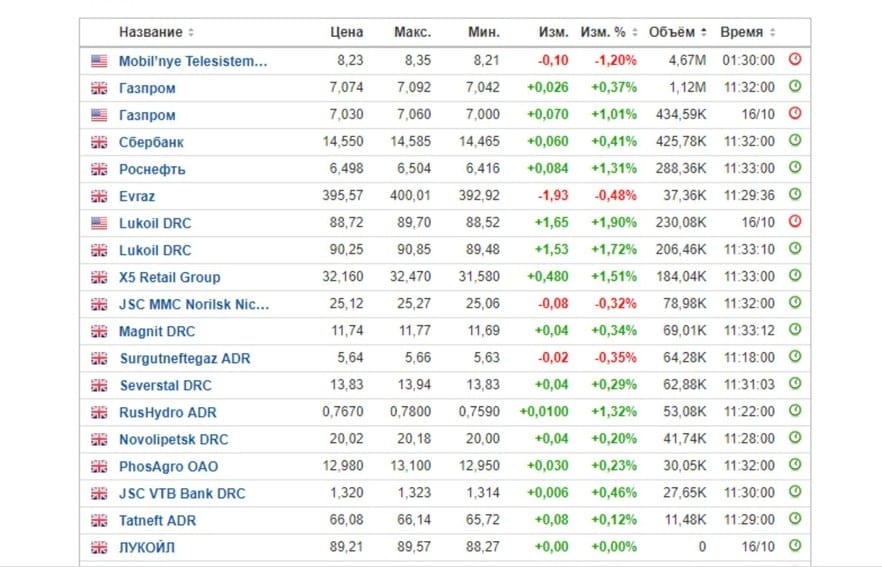

If a stock and a corresponding depository receipt are traded on the exchange at the same time, then it is more profitable to trade the primary asset. However, most often only one species is represented. In this case, there is no opportunity to choose between these types of securities. To understand which asset is traded on the stock exchange, you need to look at the list of instruments. The title will indicate what it is about. The presence of “JSC” means that we are talking about shares. If, for example, ADR or GDR is mentioned, then depositary receipts are traded.

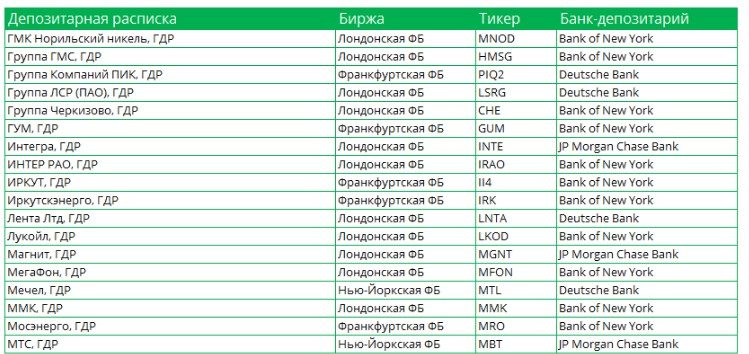

Depositary receipts of Russian companies, global

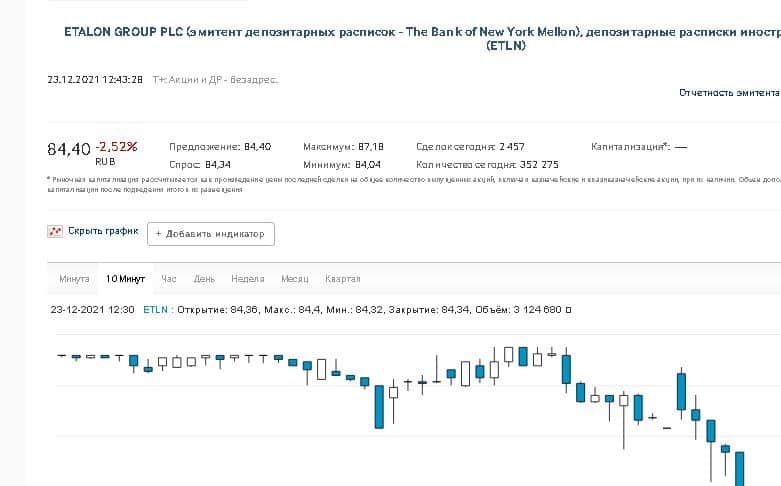

In Russia, work with depository receipts is regulated by Law No. 39-FZ “On the Securities Market”. Their definition is given in Art. 2, and the rules of work are formulated in Art. 27:5-3 of this law. List of securities (including depositary receipts) admitted to trading as of December 22, 2021 on MOEX: https://www.moex.com/en/listing/securities-list.aspx For example, depositary receipts of a foreign issuer on shares (ETLN) on the Moscow Exchange at the link https://www.moex.com/en/issue.aspx?code=ETLN :

Depositary receipts and international shares on MOEX

When to Invest in Receipts

In fact, the greatest benefit from depositary receipts exists in cases where it is possible to gain access with their help to exchanges that were previously closed to an investor or trader. For example, we can talk about companies or industries in certain countries that can be considered attractive to work with. Another benefit of using receipts is that their denomination may differ from that of a share. Moreover, we can talk not only about 10 or 100 shares, but also about shares. This circumstance makes investment more accessible in cases where the share has a relatively large nominal value (for example, if it is several thousand dollars).

- When trading or investing, there is significant risk associated with the uncertainty of future price changes. You can reduce it by making portfolio investments. At the same time, purchases of various types of securities are made in accordance with the planned level of risk.

- In order to more accurately assess the options for the future development of the situation, it is necessary to use the methods of fundamental and technical analysis. At the same time, it is important to study the features of the development of the company that issued the receipts and understand how the economic development of its country is going.

- If necessary, you need to adjust the composition of the portfolio. This may be necessary in cases where the quotes of certain receipts develop in an undesirable direction.

- It must be remembered that the use of high-yield receipts is often associated with significant risk. Therefore, it is impossible to invest all available funds in only one type. Diversification reduces risks and increases the chances of making a profit.

Sometimes it is more profitable to work on the stock exchange not by yourself, but to transfer funds for trust management. In this case, it will be possible to use the services of professionals who are likely to be able to provide a suitable return on investment.

Depository receipts of GDRs, ADRs, RDRs of Russian companies Tinkoff, Mail, Yandex, etc. – taxation, risks, features: https://youtu.be/9p2kxTo9A_U

How to do it in practice

In practical exchange trading, transactions for the purchase and sale of depositary receipts do not differ in their procedure from those carried out with shares. A trader can select a suitable asset by the type and name of the instrument and perform the desired action. Brokers rarely distinguish between these two types of instruments. To clarify whether these are shares or a depositary receipt, you can view the reference information on the exchange website.

Taxation

Individual income tax may be paid on the difference between the purchase and sale prices of receipts. The need for payments and the exact calculation of the amount is carried out by the broker. Usually he himself withdraws the appropriate amount from the account and draws up the payment. Upon receipt of dividends or coupon payments, personal income tax is always paid. It must be displayed in the declaration “3-NDFL” and transferred to the tax independently.

Questions and answers

Question: “Which is more reliable: shares or depositary receipts?” Answer: “Their reliability is almost the same. In the latter case, the custodian and the depository bank are involved in the execution of transactions, but they are almost always reliable and trustworthy organizations.

Question: “Which of these assets is more profitable to invest and trade?” Answer: “Working on the exchange is associated with the presence of significant risks, which are different in nature. There are no tools that are guaranteed to give a profit, regardless of the circumstances. The use of depositary receipts for their risks is largely similar to the use of the corresponding shares.