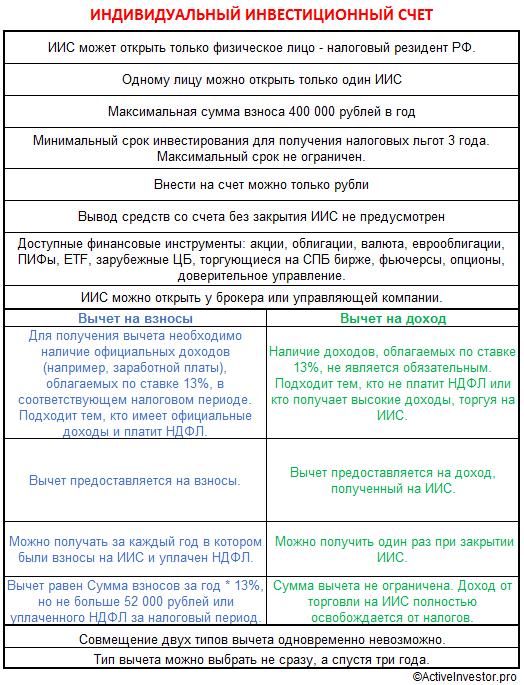

An Individual Investment Account (IIA) is a brokerage account through which you can invest in the securities market. But, unlike a regular brokerage account, IIS entitles you to receive a tax benefit / deduction from the state.

- What is an individual investment account for, what are its main pros and cons and how does it work

- Types of tax deductions

- Tax deduction type A

- Tax deduction type B

- How can I open an individual investment account – what is needed and how much should an IIS be opened

- How to close IIS

- IIS investment strategy

- What to do for beginners

- For experienced investors

- Trust management of IIS

What is an individual investment account for, what are its main pros and cons and how does it work

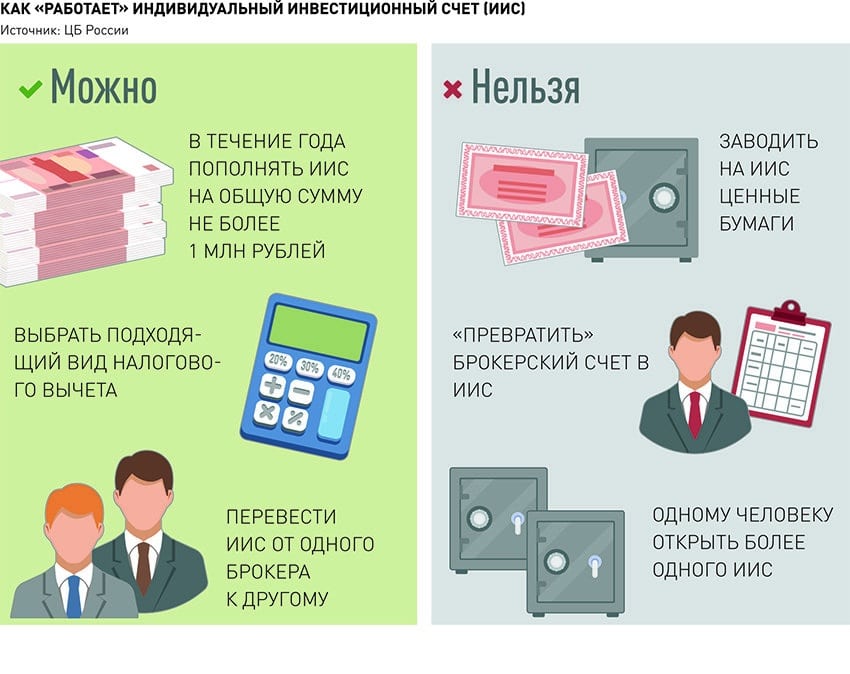

There can be only one brokerage account with tax benefits. The law allows a citizen to have 2 IIS at the same time for no more than a month. When opening an account with one broker and not yet closed an account with another

broker . At the same time, the law does not provide for a limit on the number of ordinary (non-investment) brokerage accounts. A regular brokerage account cannot be made into an investment account. IIS needs to be opened additionally.

It is impossible to withdraw part of the funds from the IIS. Any withdrawal of funds leads to automatic closure of the account. But it will not work to close the IIS automatically, rather, the broker will simply block the withdrawal operations.

Not every employee can close the IIS even if there are no assets on the individual brokerage account. Also:

- Only rubles can be deposited into the IIS account.

- On an individual investment account, you can buy any instruments that are traded on the Moscow Exchange , including ETFs and derivatives of futures and options.

- You can trade on IIS on the Moscow and St. Petersburg stock exchanges.

- The purchase of foreign shares (other than shares traded on the St. Petersburg Stock Exchange) is not permitted. Clients who wish to trade in the US, China or India markets directly will not be able to receive tax deductions for such transactions.

- Some brokers (for example, VTB) allow you to withdraw dividends and bond coupons to a bank account. If you return these funds to a brokerage account, this will be considered as a replenishment and you can get a tax deduction from this money. If coupons and dividends will come to the brokerage account as a replenishment, this is not considered.

- You can specifically buy stocks 1-2 days before the dividend payment, or federal loan bonds a few days before the coupon payment. Daredevils even buy them with financial leverage. To increase coupon payments. Thus, you can withdraw up to 50% of the IIS account per year to a bank account. Everything should be calculated so as not to incur losses. After all, after the dividend cutoff, shares fall by about the amount of dividends. The broker charges a fee for providing leverage, which will not pay off if you hold a losing position for a long time.

- The law does not establish a maximum term for IIS. You can continue to use it after three years, each year receiving deductions. In this case, you can close it at any time.

- Funds on a brokerage account (any) are not subject to DIA insurance. Investments involve the risk of losing investments.

- Assets (stocks and bonds) are not stored with the broker, but in the depository and will remain yours even if the broker goes bankrupt. Cash in a brokerage account does not have this protection.

What is IIS – clear and accessible about an individual investment account: https://youtu.be/zKkgnJLil1s

Types of tax deductions

There are two types of tax deductions that can be received on the IIS.

Tax deduction type A

Return of 13% of the amount deposited to the brokerage account, but not more than 52 thousand per year. To apply for a deduction, you must submit to the tax authority (filled in electronically through the personal account of the Federal Tax Service):

- certificate 2-personal income tax for the tax period;

- an agreement with a brokerage company for maintaining an account;

- confirmation of replenishment of an individual brokerage account – a receipt or payment order from a bank;

- 3-NDFL (filled in the personal account of the Federal Tax Service).

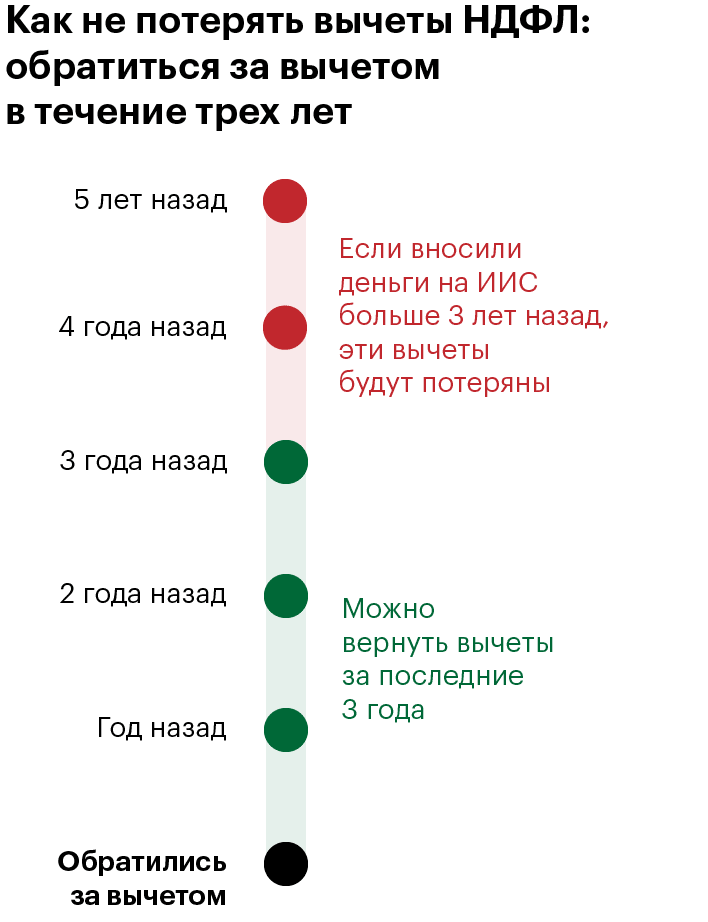

Documents must be submitted within a maximum of three years from the year for which the tax credit is claimed. The tax authorities will transfer funds to the details specified in the application within a maximum of 4 months – 3 months for verification and 1 month for transferring funds. You can get a tax deduction even if there is no official salary – 2-personal income tax can be received, for example, with positive trading on a regular brokerage account. Thus, you can reduce the taxes paid without restrictions on the withdrawal of part of the funds from the brokerage account. Also, through the IIS tax deduction, you can return the tax paid on the sale of real estate, interest on deposits or tax paid on royalties. Self-employed (tax is paid at a rate of 4 or 6%) will not be able to return taxes through IIS.

Tax deduction type B

A citizen is exempt from paying taxes on all income for the period of existence of the account. With the exception of dividends, tax is deducted regardless of the type of account. You will also have to pay tax on the sale of precious metals and currencies. A citizen can decide which type of tax credit to choose up to the date of closing the account. But after receiving tax deductions, it will no longer be possible to change the type of tax benefit. To change the type of deduction, it is required to open a new IIS after a three-year period. On the new account, there will again be a choice of deduction. The law does not provide for a limit on the number of newly opened accounts during the life of a citizen.

[caption id="attachment_12229" align="aligncenter" width="1026"]A draft law is being prepared on the third type of tax deduction – the term of the account is from 10 years, with replenishments above 1 million per year. Officials suggest that in this way citizens will save up for real estate.

How can I open an individual investment account – what is needed and how much should an IIS be opened

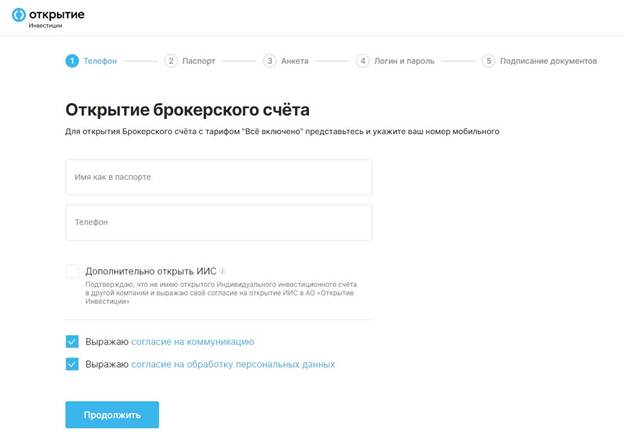

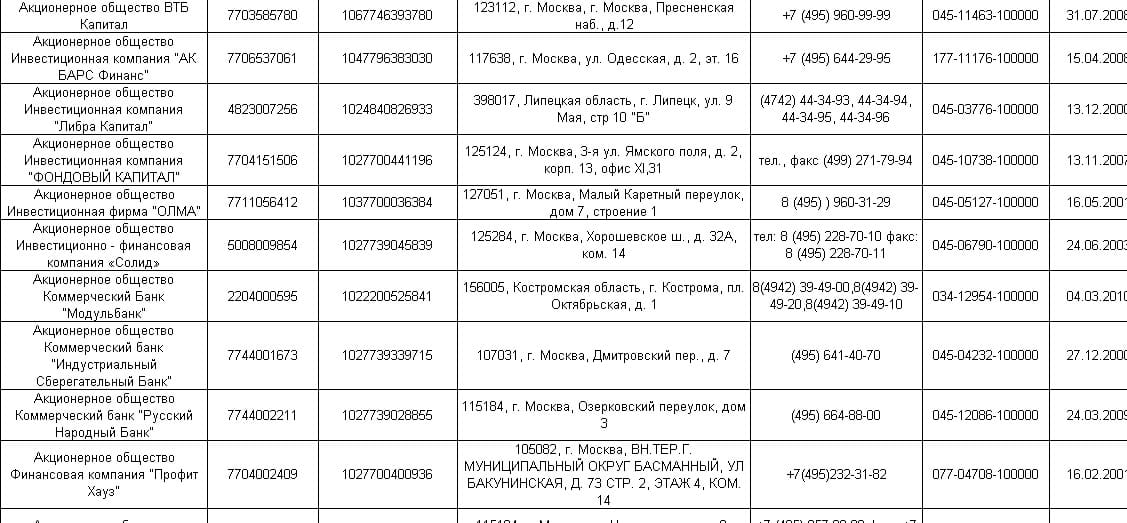

To open an individual investment account, only a passport is required. In some cases, they may ask for SNILS or TIN. Most brokers provide this service remotely. Changing a broker after opening an IIS is a rather costly procedure, so the choice of a broker should be approached responsibly – study the rates on the broker’s website, go through the forums, read customer reviews. IIS Investments Opening https://open-broker.ru/invest/:

It is

How to close IIS

Closing of the IIS is carried out only in the department. It is worth noting that in order to close an account there should not be assets, only cash. It is possible to close the IIS with assets and transfer them to another IIS or a regular brokerage account. Not all brokers inform their clients about this possibility. Closing an IIA with assets is a troublesome procedure, and you will have to pay a commission of about 200-400 rubles for the transfer of each share or bond. When transferring assets from one broker to another, personal income tax is not paid, the citizen retains the right to deductions. A three-year shareholding benefit cannot be used on IIS. To receive such benefits, it is necessary to transfer shares to a brokerage account (if the broker performs such operations). Thus, you can immediately receive 2 types of deduction – for replenishment through a type 1 tax deduction and for income, if the trading strategy involves long-term holding of positions. [caption id="attachment_12227" align="aligncenter" width="603"]

IIS investment strategy

What to do for beginners

If you are new to the financial markets and have a formal job with an income of more than 400,000 a year, the most winning strategy is to deposit 400,000 a year (one-time or monthly), buy federal loan bonds with this money, and receive a Type A tax deduction. With independent management of IIS, for the implementation of trading operations, it is required to install special software on a computer or phone. Up to 5 applications per month can be made free of charge through the operator by phone. Such a simple strategy with almost no risks brings about 15% per annum.

For experienced investors

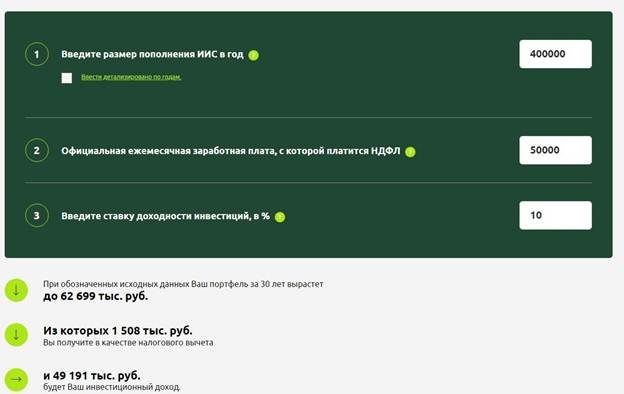

If you are an experienced investor and have a strategy that brings more than 13% per annum, it is more profitable to stick to it on IIA and, after the expiration of the established period, choose a tax benefit of type B. An IIA calculator that offers to calculate the return on investment online can only give an approximate idea of yield. Even if the official salary allows you to get the maximum tax deductions, it is impossible to predict how much you will be able to contribute monthly.

There were cases when citizens did not trade on IIS, using it only to receive a tax deduction. In this case, the tax office may refuse to issue a tax deduction due to the fictitious account. To avoid the risks of such a situation, you should buy federal loan bonds with a short maturity.

Trust management of IIS

If you do not know how to trade and are ready to take risks to get a higher income, you can use the services of a broker for the trust management of IIS. Many large brokers offer ready-made investment solutions with moderate or high risk. In this case, there are no guarantees of income, there may even be a loss. But the annual commission for the management of IIS will still have to be paid. It is necessary to check that the trust management agreement contains a clause on maximum losses, upon reaching which trading stops. Otherwise, instead of profit, you can lose all the money. With independent management of IIS, the client is not limited in the amount of replenishment, you can transfer funds at any time. He can even transfer 100 rubles to start investing. One has only to understand that the smaller the amount of investment, the less ruble profit will be received. When investing through IIS trust management, it is required to replenish the account immediately after signing the contract. The minimum amount of replenishment is 90-100 thousand rubles. Often a broker offers ready-made investment products for working on IIS with different levels of risk:

- Low risk – money is invested in an exchange-traded stock fund. Claimed yield is 0.9-15%. It is expected that even in the most negative scenario, losses will be covered by a tax deduction.

- Medium or low risk level – money is invested in stocks / federal loan bonds / corporate bonds in the proportion of 10% / 30% / 60%. The historical profitability of the strategy is 52% per annum since 2017. During the investment period (the broker recommends investing for at least 3 years), the client may receive a negative return. There is no loss threshold.

- High level of risk – money is invested in the top 10 stocks of the Russian Federation with certain proportions. The historical profitability of the strategy since 2017 is 72%. The threshold of losses is not indicated.

[caption id="attachment_12003" align="aligncenter" width="623"]