If a trader is just starting his way in the securities market, it will not be easy for him to understand the new specifics of work. To help quickly screen out securities according to specified parameters, special programs have been developed – Stock Screeners. They allow you to select securities in the background according to specified criteria. Such programs will be useful not only for beginners, but also for professional brokers and traders.

What is a stock screener, what is the purpose of the application

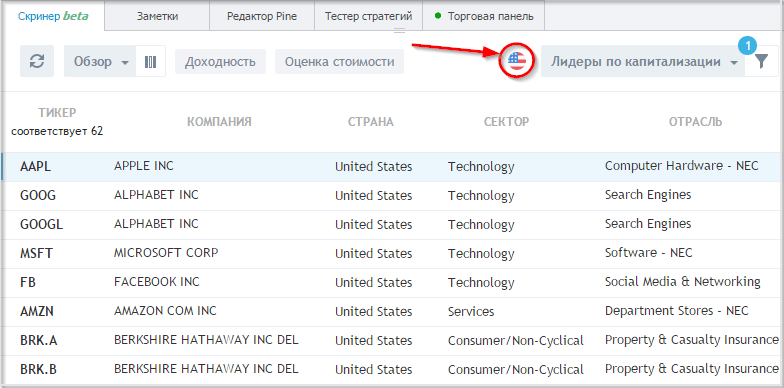

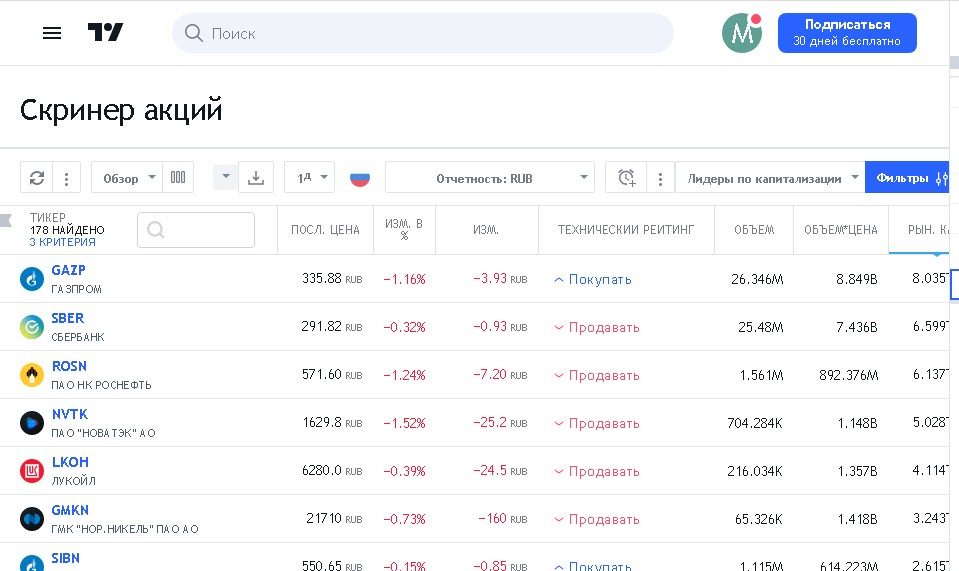

In order to better understand what a stock screener is, an ordinary store can be used as an example. Let’s say a person comes to a sales outlet to buy a cookie. He walks into a store and sees 50 different types of cookies on the shelves. Each of them has its own characteristics, advantages and disadvantages. However, you need to buy exactly creamy cookies with a filling, and no more than 70 rubles per kilogram. If you start manually sorting through all the products in the store, the buyer will spend a lot of time that can be spent on more useful things. As a result, the buyer approaches the seller. He tells him the criteria for the right product and asks for help with the choice. The seller knows the products of his store very well, so in half a minute he can easily find the necessary cookies. If a trader had looked for it on his own, he would have spent 20-30 minutes on the same operation.Screeners work on the same principle. In fact, this is not even a program, but a service with dozens of filters built into it. The investor / trader is required here to tell the screener the parameters of the securities that he wants to view. The program analyzes the request, in the database it goes through the shares that meet the specified requirements and displays them through the interface Screener of shares of the St. Petersburg Stock Exchange at the link https://finbull.ru/stock/:which meet the specified requirements and displays them through the interface Screener of St. Petersburg Stock Exchange shares at the link https://finbull.ru/stock/:which meet the specified requirements and displays them through the interface Screener of St. Petersburg Stock Exchange shares at the link https://finbull.ru/stock/:

The screener does not relieve the investor or trader from the need to understand the securities market and the affairs of a particular company, this tool only filters out shares according to certain parameters, and whether they are set correctly based on the real state of affairs is the responsibility of the protein mind.

How does the screener work?

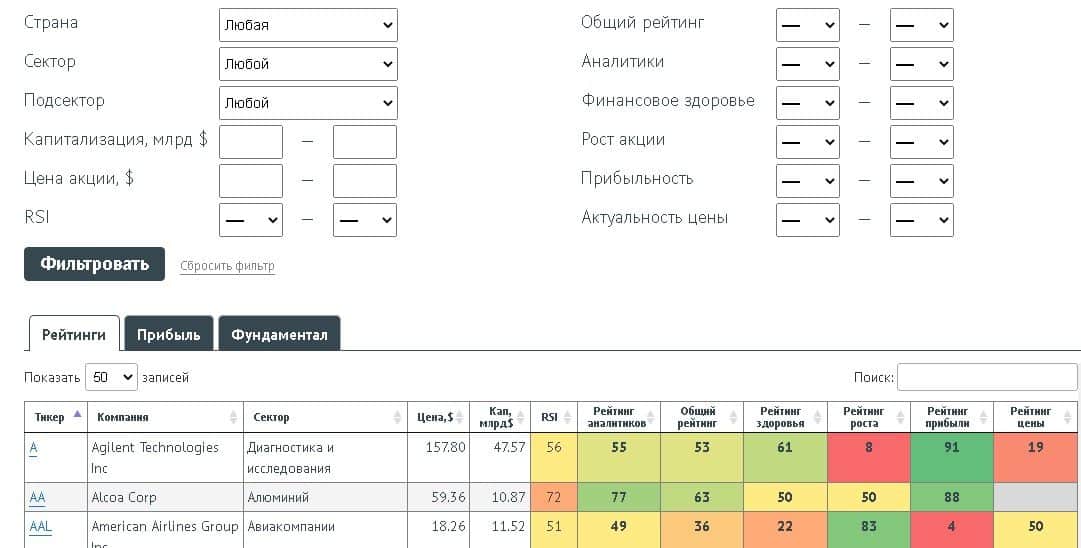

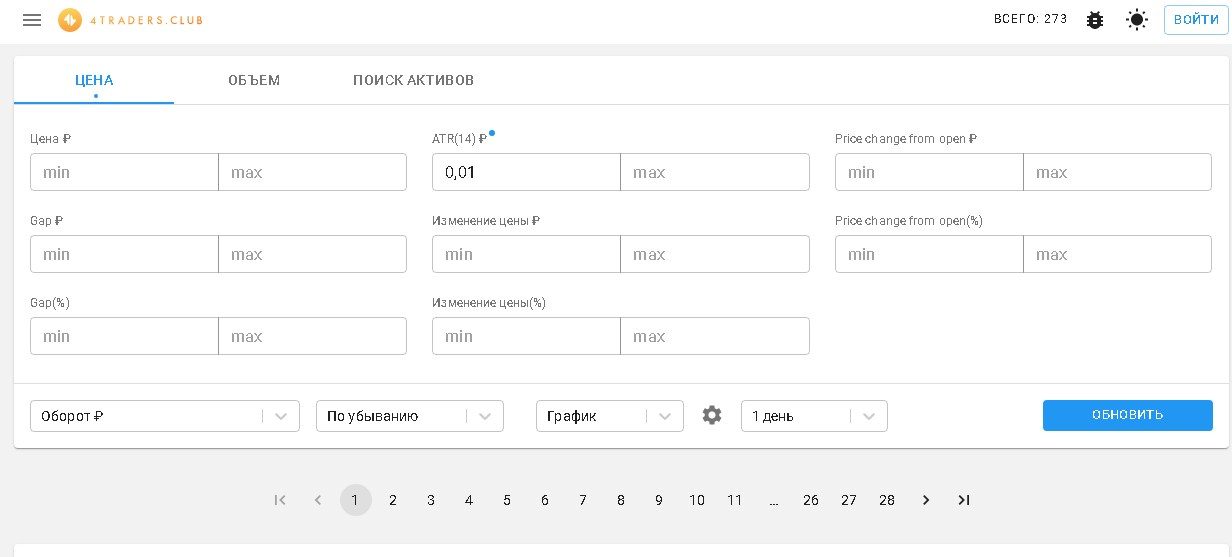

The stock screener allows you to conduct an initial analysis of stocks using multiples and ratios. Each screener has built-in filters in its program shell. The trader fills them in either manually, or selects parameters from the values offered by the service. Analyzing the entered data, the screener makes a selection of securities that meet the specified criteria. The trader can set various parameters here. It can be:

- fundamental characteristics;

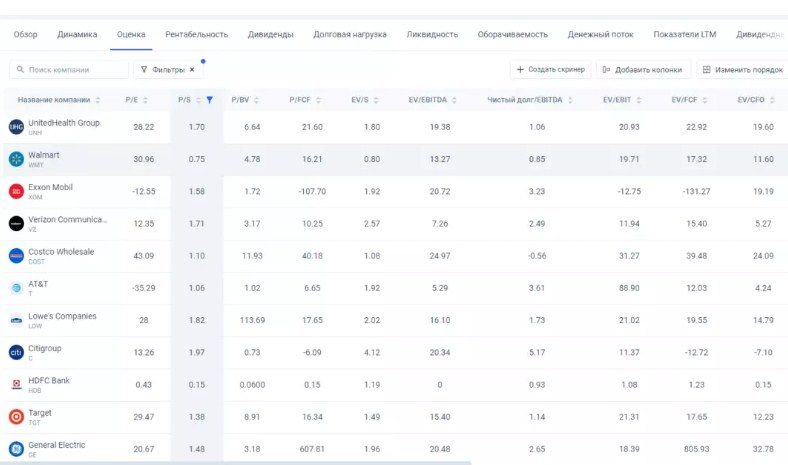

- multiples P / E, P / BV, P / S, P / FCF, EV / EBITDA, E / P, estimates of Graham, Dupont, Altman and others;

- the number of shares outstanding;

- securities with great potential according to analysts’ forecasts;

- different criteria for accounting or financial reporting.

:

However, screeners also have disadvantages. They are not suitable for those people who know nothing about multipliers and financial indicators. And they can even be dangerous if used ineptly.

For the program to be useful, the investor must, at least at an initial level, understand the specifics of the market, and know exactly what he wants to find with the help of the screener. Otherwise, the trader will simply go through options that will not do him any good. Most of the screeners have an English interface. To use the program effectively, you need to understand this language at least on a conversational level. Automatic page translation services are not suitable here. The fact is that during background translation the meaning of the text is often lost or distorted. If this factor is not taken into account, it can lead a trader to sad consequences, up to the loss of his securities and capital.

How to use the screener

Most of the existing screeners have the following sections in the interface:

- description of the company;

- dividends;

- multipliers;

- financial statements;

- financial ratios;

- liquidity.

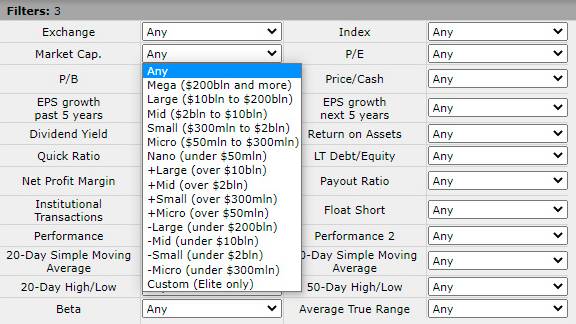

Each section has a number of subsections. For example, in the “Company Profile” you can find information about the stock exchange where the shares are sold, the industry of activity, and information about whether the security is included in the indices. The trader can independently customize the filters for sections and subsections. This can be done either manually or using templates. In the first case, you have to register specific filter values or select them from the proposed options.

since many of them have their own screeners. To set up filters in this case, you will need to select “Euro” as the currency, and “IT industry” in the characteristics of the company.

- First, the shares are selected according to the P / E Ratio criterion. This indicates that the securities are undervalued. By enabling this filter on the skiner, the trader narrows his choice from 3-4 thousand to 100-200 shares.

- Next, the P / BV filter is turned on. It is recommended to set it to a value greater than 1, but less than some other specific digit. Accordingly, the output will be options for securities that are sold above their book value, but, nevertheless, do not exceed this indicator by much.

- The companies are then compared in terms of ROA and ROE. Thanks to this, the trader can understand how effectively the company is using the investors’ money.

- After completing all these actions, 5-10 options remain on the screen of the screener. They are monitored manually, choosing the most promising from them.

Thus, the screener cannot completely replace the mind and understanding of the investment market. It only helps to filter out unnecessary information. Fundamental analysis of stocks on the Russian market, analysis through 4 screens, how to properly evaluate the data: https://youtu.be/GVzeqKjhTk8

Review of popular stock screeners for the Russian market

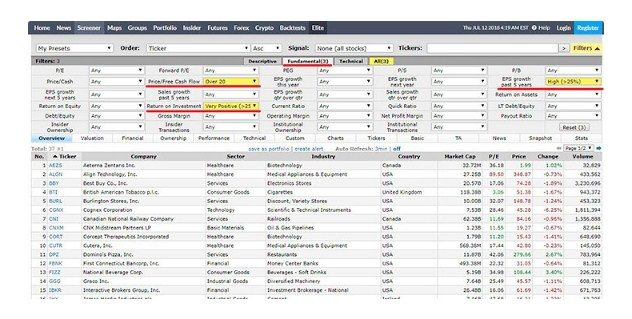

Finviz

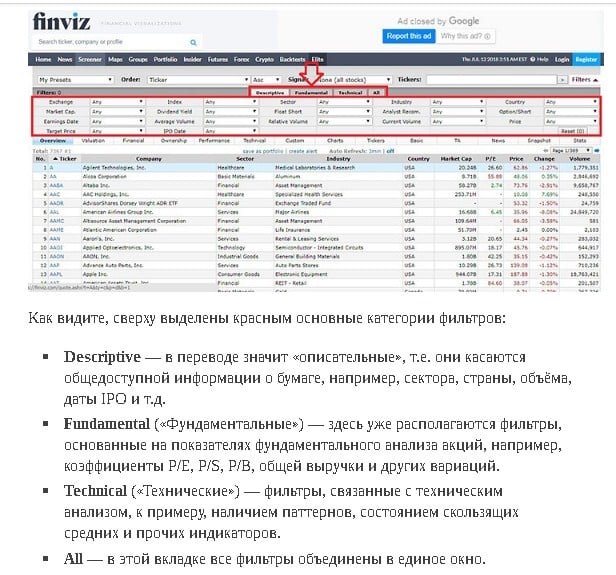

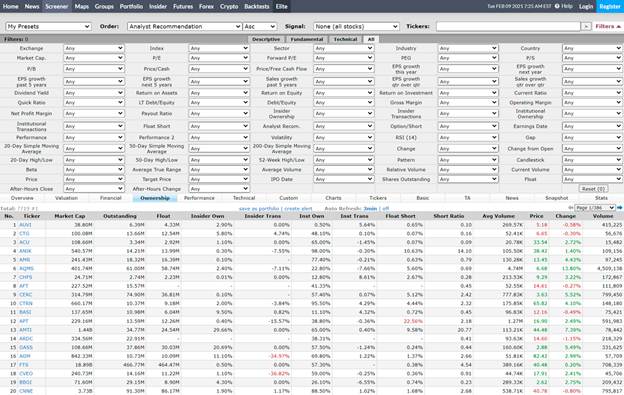

This is one of the simplest and most famous screeners among traders. You do not need to register here. Having entered the service, you can immediately set the filter value and start searching for securities. The sample will be updated automatically. Despite the fact that there is only an English version of the screener, it has a simple and intuitive interface. Even those who do not speak English can understand it. The service has three large filter groups:

- Descriptive – description.

- Fundamental – fundamental characteristics.

- Technical – technical analysis.

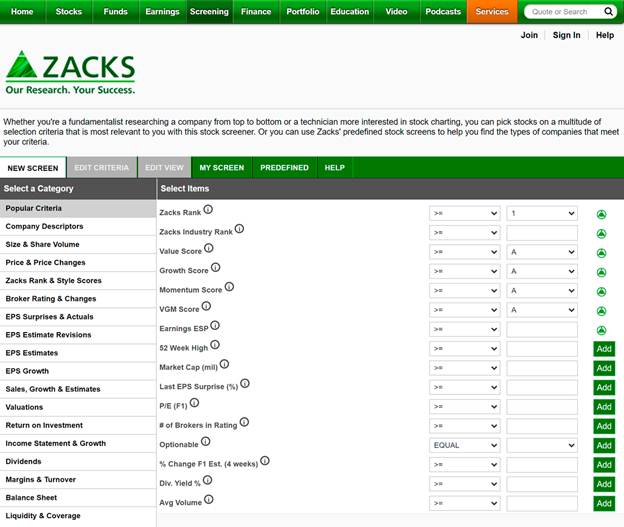

Sachs

There are practically no technical analysis filters here. But there are criteria for accounting. Thanks to the screener, you can collect characteristics from 18 sections. This allows you to build your own program. Each of them has from 5 to 15 subsections. Those. a set of settings here allows you to effectively search for securities according to the specified parameters. Of the minuses, it can be noted that not all filters will be available in the free version. For example, it will not be possible to search for companies by rating or growth potential. However, this can be done manually.

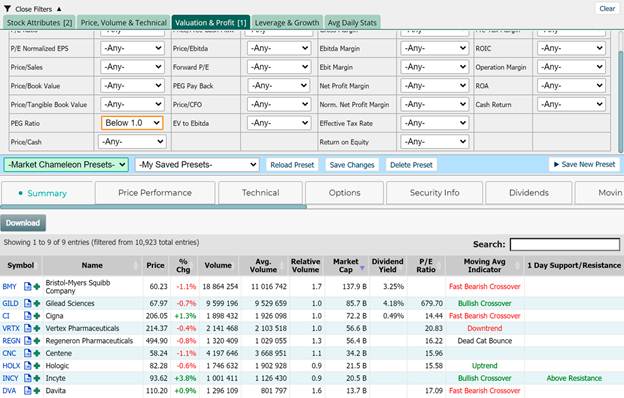

Screener from “Markethameleon”

It is easy and convenient to use. As soon as the trader starts filling in the parameter fields, companies that match the criteria already entered appear at the bottom of the screen. Along with the screener, detailed instructions for its use are supplied, as well as a training video. The only thing is that they are all in English. The free version will not be able to save the search results. It will also not be possible to fill in some of the fields. The latter are mainly related to technical analysis.

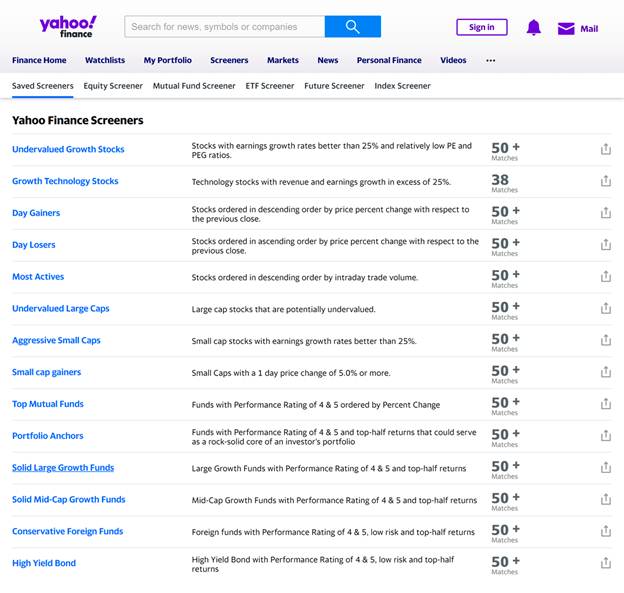

Screener from Yahoo

It comes with ready-made criteria for searching for securities. If desired, it is possible to correct the template at any time. In any case, the trader will have to fill in some of the fields himself. For newbies unfamiliar with the market, this can seem daunting. Correction of some important parameters, for example, the same growth rates and profitability, will be available only after purchasing the paid version.

Comparison of screeners

| Stock Screener Name | Is it suitable for beginners? | Autocomplete fields | Availability of additional input parameters |

| Finviz | + | + | + |

| Sachs | + | – | – |

| Screener from “Markethameleon” | – | + | + |

| Screener from Yahoo | – | + | – |

Stock Screener is a trader’s assistant. But this is precisely the assistant. He will not be able to completely do the work. The program only searches for securities according to the specified parameters. How well the criteria are set depends on the skills of the trader himself.