In order to understand what

blue chips are, and in particular those that are present on the MICEX, it is necessary to consistently consider everything related to this concept. Blue chips of the Moscow Exchange – this is the name given to the shares of Russian companies that have demonstrated a high level of liquidity and a stable credit rating and are included in the MOEX list.

Interesting! The promotion is named after the color of the poker chips used to place the largest bet.

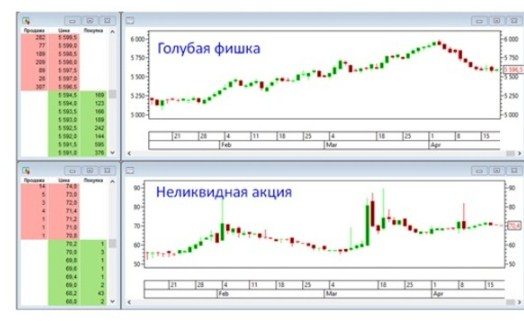

What is the difference between blue chips and other securities

In order to make a profit, you need to know what are the main differences between the shares of large companies from other securities. Before purchasing blue chips on the Moscow Exchange, it is recommended to study their characteristics. There are 3 main points:

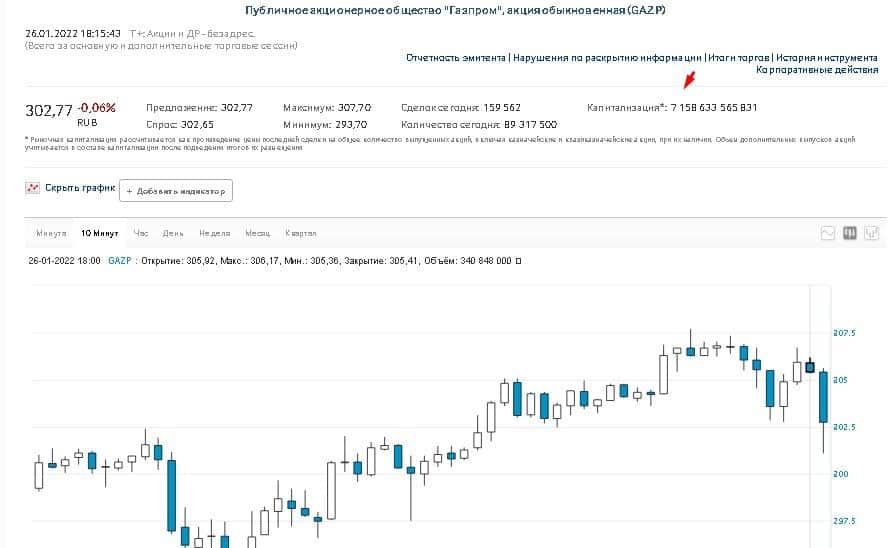

- Large capitalization – the number of all the company’s shares outstanding, multiplied by their price. This item determines the market value of the company. Using the example of Gazprom, one can see that with 23.5 billion shares in circulation, the price of each is at least 226 rubles, which makes it possible to count on good income indicators in the future (data as of 01/10/2022). Capitalization, respectively, for the company as a whole is about 5 trillion rubles.

- Liquidity . Blue chips are also the most visible and significant (interesting and reliable) securities. Due to their stability, they are of great interest to traders and investors. That is why there is a large volume of trades on such securities.

- Dividends – holders of blue chip securities can expect stable payments. This is due to the fact that companies have proven themselves in the market, as they have been on the market for a very long time (on average, the value is about 20 years or more).

Foreign companies: an example of becoming a successful shareholder

Also, for comparison, you need to consider the capitalization indicators for companies that are considered

blue chips in the US.. To qualify as a blue-chip company, capitalization must exceed $10 billion. Small businesses can also become blue chips. To do this, you must comply with the main condition – to be the flagship in its segment of work. Stable dividend performance guarantees the reliability of the company. It is actively developing and generating income, which, in turn, allows you to increase payout rates or not interrupt them for existing or new shareholders. That is why the value of blue chips in most cases is determined taking into account the indicators of the stability of the payment of additional income funds for shareholders.

S&P 500.. For leading organizations, the value of capitalization is set at no less than $3 billion. The assessment also takes into account the average trading volume – at least $5 billion. The data are given for the enterprises of the USA. The list of dividend aristocrats (mainly well-known enterprises) is tracked by specialists. Among enterprises with a similar status, one can observe world-famous names: Coca-Cola, Colgate-Palmolive, or a no less famous brand in the world – Johnson & Johnson.

What else to consider when choosing stocks

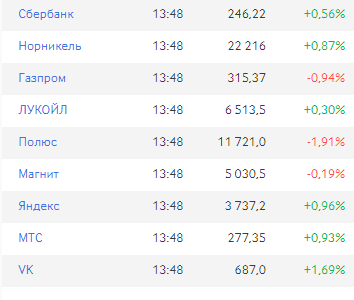

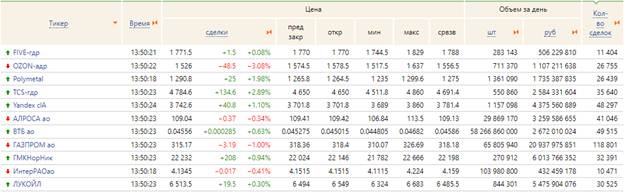

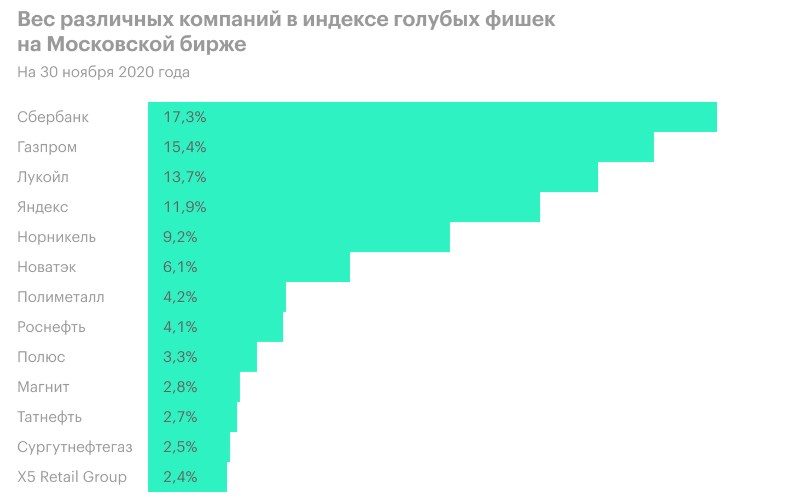

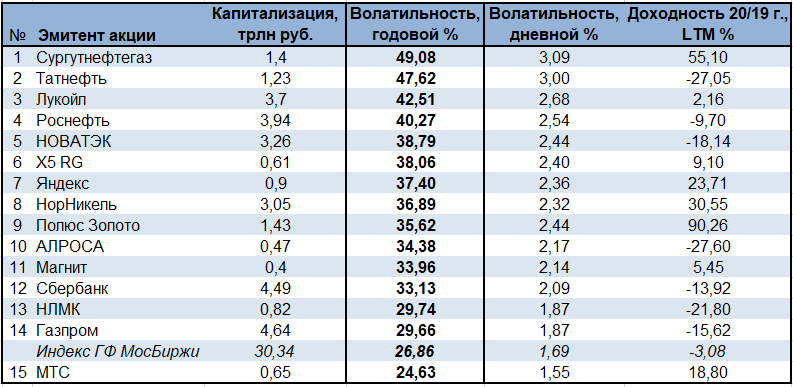

Additionally, a potential buyer can set a number of criteria, including the date of a certain company’s listing (IPO) or dividend yields for a particular period of time. In the case of Russian companies, the index is presented directly on the MICEX website. It is formed on the basis of liquidity. At the same time, such an indicator as the coefficient of stability of dividend payments is not taken into account. The capitalization of the company is also not taken into account. That is why the list may not include organizations with indicators of more than 500 billion rubles. Value (weight) of companies in the blue chip index (as of the end of 2021):

What are the pros and cons of owning blue chip stocks?

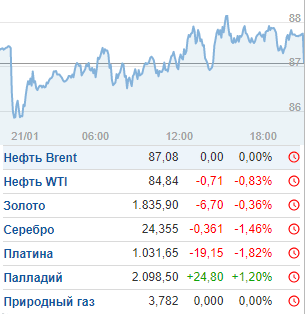

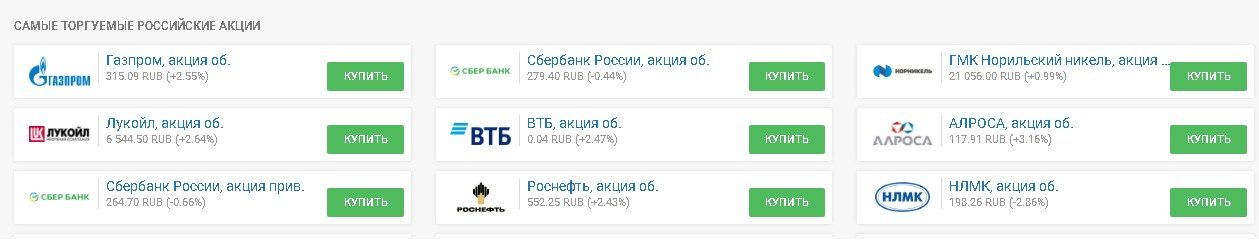

The Moscow Exchange Blue Chip Index 2022 also consists of leading organizations, among which Sberbank, Rosneft, and Gazprom hold the lead. Before purchasing shares or other securities, it is recommended to consider all the advantages and disadvantages that have. Reliability will be an advantage for the investor. This is due to the fact that the risk of bankruptcy of a company on the list of blue chips is minimal. They have a high credit rating, which allows them to easily refinance emerging debts. The updated list of blue chips of the Moscow Exchange is presented on the official website https://www.moex.com/ru/index/MOEXBC, which allows investors to track performance and quickly make a decision to buy or sell securities. The example of Gazprom shows that the capitalization at the end of January 2022 is 7 trillion rubles.

How to invest in blue chips correctly and with maximum profit

Before investing in this segment, you need to take into account that such a phenomenon as rapid growth is not typical for blue chips. The positive here is that the decline also does not occur unexpectedly and for no apparent reason. Reliability is guaranteed by the fact that a business included in this category belongs to a proven and positively proven one. Blue chips grow slowly. The first indicators of profitability can be estimated in 3-5 years. Choosing in their favor is a good way to protect finances from inflation. The Moscow Exchange allows you to track the quotes of blue chips online at the link https://www.moex.com/ru/index/MOEXBC: Blue chips of the Russian stock market – overview, pros and cons: https://youtu.be/XItRNWGcXLE Buy blue chips chips are available online on the official MICEX website.