Blue chips are a common term for stock market participants. It means a large, stable company that has been growing for 5-25 years, showing good financial results and paying dividends. Securities of this type are called first-tier stocks.

Background term

The phrase “blue chips” came to the stock market from the casino world, namely from poker. Each piece in this game has its own meaning depending on the color. Whites are considered the cheapest and cost no more than one dollar. The Reds have a higher price tag of five dollars each. The most expensive are blue chips, they have the highest value among all the others. On the territory of the financial exchange, the concept of blue chips is commonplace. These are special types of companies that have proven themselves to be stable and highly capitalized. Such firms are leading in the industry they occupy, their services and goods are considered predominant, without their goods the normal functioning of the economy is impossible. During a market crash, blue-chip companies exit with the least losses due to their stability. Blue-chip companies often have their own brand,but it is so popular that it becomes a household name. https://articles.opexflow.com/akcii/golubye-fishki-fondovogo-rynka.htm

How do companies get blue-chip status?

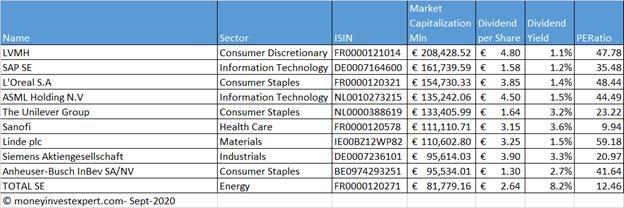

Among the companies that have established themselves as steadily growing companies, there are several that are not yet considered blue chips, but before this title they are not enough. These are often tech-savvy companies like Facebook, which has 1.84 billion daily active users. This indicator makes the social network one of the most famous in the world. In addition, the corporation has achieved a capitalization of 1.05 trillion dollars. All that does not give the company the title of “blue chips” is relative youth and refusal to pay dividends. Facebook did not exist until 2004, so many investors who have gone through fire, water and crises do not recognize the company as a leading and stable company, and Mark Zuckerberg refused to pay dividends out of a desire to develop the company. Top 10 blue-chip Europe from the MSCI Europe Index:

EURO Stoxx 50 – Eurozone Blue Chip Index

To find reliable companies, there is a list with the best companies:

- High market capitalization (selection is automatic).

- Located in the European Union.

The index is rebalanced annually in early September The largest companies of the index:

- ASML Holding NV is a Dutch semiconductor equipment company. It is the largest manufacturer of equipment for the micro electrical industry. The company’s products are used in many countries around the world. The company’s capitalization is more than $ 350 billion.

- LVMH Moët Hennessy Louis Vuitton is a transnational French company that owns well-known brands for the production of wealth and luxury items: clothing, accessories, perfume and classics of elite alcohol. It has several divisions around the world. Among the brands of the company are such brands as: Dior, Louis Vuitton, Givenchy, Guerlain, Moet e Chandon and Hennessy.

- Linde plc is an international chemical corporation based in Germany, moved to Ireland in 2018 and established headquarters in the UK. It is the largest producer of both industrial and medical gases. The company has over 4,000 completed projects and 1,000 registered patents. Liquid hydrogen cylinders from this company are in many industrial workshops.

- SAP SE is a German company that supplies software to organizations. They create automated systems for such activities as: trade, finance, accounting, manufacturing, personnel management and much more.

- Sanofi SA is a French pharmaceutical company operating around the world, a leader among similar companies. Among their work, the following units can be distinguished: the development of vaccines against various viruses and other diseases, drugs for the treatment of diabetes and the cardiovascular system, veterinary products and general medicines.

- Siemens AG is a German corporation working in the field of electronics and electrical engineering. It is not just a single company, but a conglomerate of different enterprises. Their services include: electrical engineering, energy equipment, transport, medical equipment, lighting and electronics.

- Total SE is a French international company engaged in the production and sale of oil, ranked 4th in the list of the largest oil companies. This corporation has branches in many countries of the world. One of the key ones is the branch in Russia. They mine black gold on the territory of the country thanks to a production sharing agreement. In addition, the company sponsors many sporting events.

- L’Oréal SA is a French corporation engaged in the production and sale of cosmetics. The company has united under its wing several small but well-known brands: Loreal, Maybelin New York, Garnier, Giorgio Armani and Lankom.

- Unilever NV is an English company engaged in the production of food products and household chemicals. In Russia, the most popular hygiene products under this brand.

- Allianz SE is the largest German insurance corporation providing services around the world and is included in the list of systemically important ones in the world economy. The company’s areas of activity include banking and insurance. The number of customers is growing every day; by 2021, Allianz SE serves over 88 million people.

How to find blue chips in Europe?

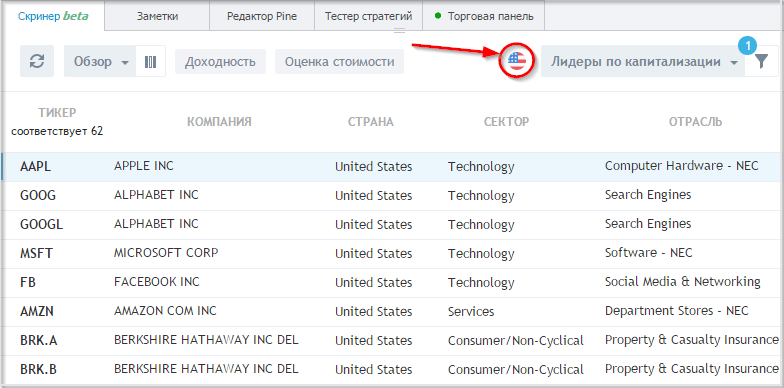

An alternative way to find European blue chips is by using special stock screeners:

- https://ru.tradingview.com/screener/ – there is a setting in the screener – capitalization leaders, it remains to choose the country of interest.

- https://finviz.com/screener.ashx – there are many settings in the screener: dividend payments, country, exchange, etc.

- https://finance.yahoo.com/screener/new/ -simple screener in which you need to specify high capitalization and country.

How to buy the popular blue chips of the European stock market

The principle of buying European blue chips is the same for all brokers. The difference lies in the design of personal accounts and mobile applications. Before buying shares, you will need to exchange rubles for euros in the broker’s personal account.

Important: The number of European stocks available for purchase depends on the specific broker.

After receiving the currency, you can go to the stocks tab and specify the currency for buying the euro or European stocks in the filters. You can also buy shares in Europe with the help of funds from brokers and managers. For example: FinEx-offers clients German shares of leading companies, the price of a share is 29 rubles. Or an exchange-traded fund from the management company “Otkritie-Shares of Europe” offers to buy shares of leading European corporations from 1 euro. The shares of the fund are bought for rubles or euros, if you buy the fund on an

IIS account , then after three years you can get a tax deduction.

Should you buy Eurozone blue chips?

The classic (Conservative) investment strategy involves investing money in stocks and bonds of reliable companies. With bonds, it is clear that these are government loans – OFZ, for shares the highest criterion of reliability is the status of a blue chip. Investing in blue-chip stocks is ideal for newcomers to the stock exchange, as it provides for minimal investment risks, as well as constant dividend payments. Due to these factors and compound interest, in the long term, the investor can receive an amount that is several times higher than the initial one. The stability of the companies will allow a beginner not to worry about his own money. If it happens. crisis, you can not worry about the invested funds, because after the recession, there will be growth, possibly more rapid and profitable than before. All due to the fact that the company is a recognized blue chip,use a robust business model, proprietary products people need. The profitability of investments determines what is happening in the world economy, if there is a recession, there can be no talk of any income, during this period the shares decrease by 10-30%, while recovering the company resumes growth and increases income, depending on the situation, it can be 5-30 % per annum. European blue chips are stocks of large and stable companies, which for many years in reports and in real life have shown growth in revenue, growth in product sales and other parameters. Investing in such stocks is suitable for beginners, as well as for conservative investors who want to save and increase their money. The annual profitability of European blue chips is comparable and sometimes even higher than the rates on bank deposits and savings accounts. For,To see the current list of European blue-chip dividend payers, there is a table listing the companies with the highest dividends: