Working in the securities market is a rather risky and difficult type of activity. Therefore, for those who are taking their first steps in the market, it is very important not to make a mistake. The negative experience associated with the loss of invested funds, often for a long time, if not forever, discourages the desire to invest. Therefore, when starting to work on the market, traders should invest their funds in the least risky securities.

- What are blue chips in the stock market

- What are the requirements for companies to obtain blue-chip status?

- What determines the volume of purchase and sale of shares in the stock market

- Capitalization (value) of the company.

- The volume of securities in circulation (free-float)

- Advantages of blue-chip stocks over other securities

- High level of blue chip liquidity

- High resilience of companies

- High dividends

- Companies that have the status of “blue chips” in various securities markets

- On the Russian stock market

- Blue Chips in the US Stock Market

- In other stock markets

- How to Buy Blue Chips Shares for a Domestic Investor

- Blue Chips are the Best Choice for Initial Investments

What are blue chips in the stock market

Blue chips – the name itself comes from the largest denomination chips that were played in casinos in the last century. These chips were usually used by the richest players at the table. And gradually this concept moved from the gaming slang from behind the gaming table to the investment market.

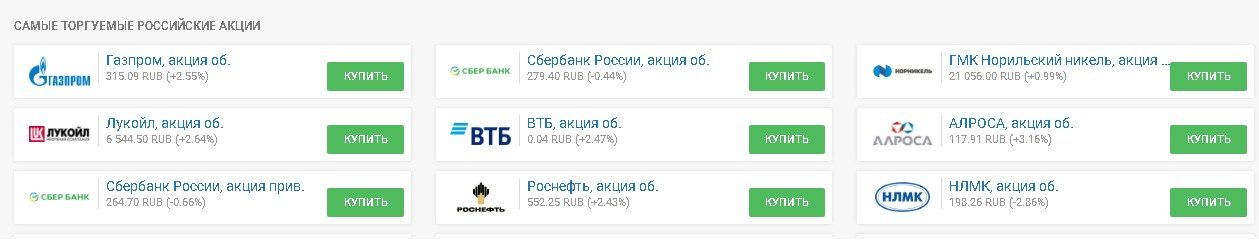

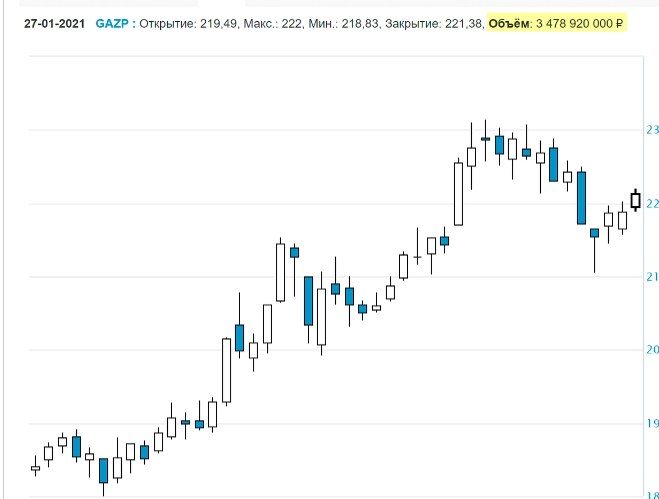

Blue chips are the shares of the largest financially reliable companies with high liquidity of assets, which are the most bought and sold on the market. As a rule, the payment of dividends on the shares of such companies remains practically unchanged, and the owners of the shares can receive a stable, albeit small, income for several decades. Only the world crisis, war or other circumstances equal to them in strength can affect the value of such shares. As an example for the Russian Federation, the daily turnover of Gazprom or SbeBank shares on the market is tens of billions, and they can rightfully be called “blue chips”.

After all, the volume of trade, even among the closest competitors, is an order of magnitude less. Real-time quotes on the blue-chip market are presented on the website https://investfunds.ru/stocks/

What are the requirements for companies to obtain blue-chip status?

In order for the company’s shares to acquire the status of blue chips, the company must meet the following requirements:

- her shares were popular in the stock market and she received a steadily growing income for a number of years;

- had a high level of capitalization;

- its shares must be highly liquid;

- the value of the company’s shares should not undergo major changes over time (low volatility);

- the company must be represented on the stock market for a long enough period;

- payment of dividends on shares by the company must be made regularly without interruption;

- for at least 10 years, the company should not get into situations of internal crisis that can significantly affect the value of its shares.

What determines the volume of purchase and sale of shares in the stock market

The volume of purchase and sale of shares in the stock markets depends on two main parameters:

Capitalization (value) of the company.

The higher the capitalization of a company, the more shares are bought and sold daily. By the level of capitalization, companies in Russia can be divided into echelons:

- The first tier includes companies that can have a capitalization level measured in trillions of rubles.

- The second echelon is made up of companies, the capitalization of which may amount to several hundred billion.

- And the third echelon consists of relatively small companies, the cost of which does not exceed several tens of billions of rubles.

Information about the capitalization of various enterprises can be obtained from the Moscow Exchange. The

The volume of securities in circulation (free-float)

The larger the volume of the company’s shares in circulation, the higher the free-float indicator. So, for example, the shares of a large developer, the construction company PIK, are not blue chips. Despite the high level of capitalization (about 870 billion rubles), the share of its shares on the stock market is only 18% of their total number. For comparison, Magnit (capitalization 637 billion rubles), and the share of shares on the stock market is about 63% of the total.

Advantages of blue-chip stocks over other securities

The main advantages of blue-chip stocks over other securities on the stock exchange include.

High level of blue chip liquidity

The high level of liquidity of securities makes it possible to sell them more profitably, and the volume of sales can be practically any. A lot of traders are engaged in buying and selling blue chips, so any operations with these assets are carried out very quickly. Moreover, the higher the liquidity of the shares, the closer to their market prices they can be bought or sold.

High resilience of companies

The companies included in the blue-chip list are leaders in their industries and have significant advantages in competition with other market players. In our country, these are often state-owned companies or companies with a significant share of state-owned companies. capital that is considered strategic. Such companies as Gazprom, Rosneft, SberBank, etc. can rightfully be referred to them. Such companies are the largest payers to the budget, and can always count on government assistance in the event of a crisis. These companies tend to operate in established markets. The appearance of any significant competitors is unlikely. Since the creation of new companies in these areas requires a truly colossal investment.These factors make blue-chip performance much more stable than that of smaller players in the market. Their financial stability margin is much higher and, accordingly, their credit rating is very high, and this allows them to attract credit resources at lower interest rates.

High dividends

The established business model in large companies allows them to pay fairly high and regular dividends. In accordance with the current legislation of the Russian Federation, state. companies must spend at least 50% of their profits on dividend payments on shares. At the same time, companies belonging to the “blue chips” of the Russian Federation are mainly classified as “raw materials”, which ensures a fairly high level of profit and, accordingly, dividends. This is unusual for most small companies – recent startups. They often do not pay dividends or pay only the minimum amount. Such companies are interested in rapid capitalization and accelerated development, so they try to invest the resulting profit in their growth and promotion in the market. It is important for these companies to gain additional market shares.

Companies that have the status of “blue chips” in various securities markets

In various stock markets, companies whose shares have the status of “blue chips” are determined by:

On the Russian stock market

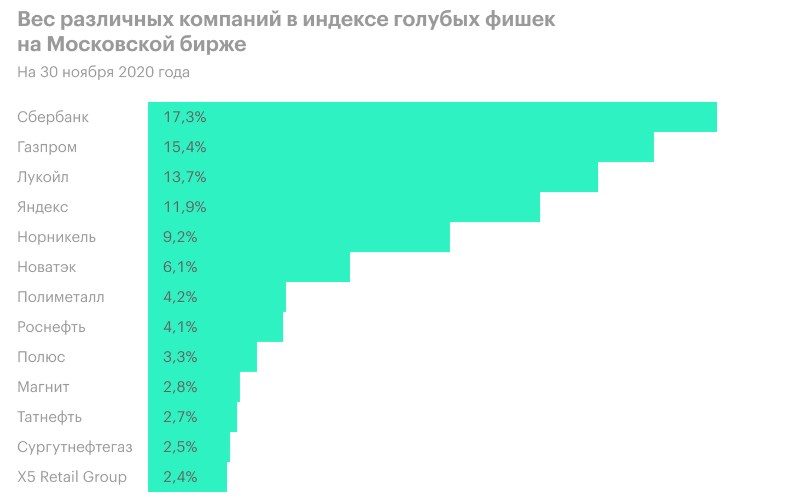

In the Russian Federation, companies acquire blue-chip status based on an index calculated by the Moscow Stock Exchange. Today, the list includes fifteen of the largest companies in the country, namely:

- Gazprom

- Sberbank

- Rosneft

- Lukoil

- Yandex

- Norilsk Nickel

- “Magnet”

- “MTS”

- NLMK

- Novatek

- “Pole”

- Polymetal

- Surgutneftegaz

- Tatneft

- TCS Group

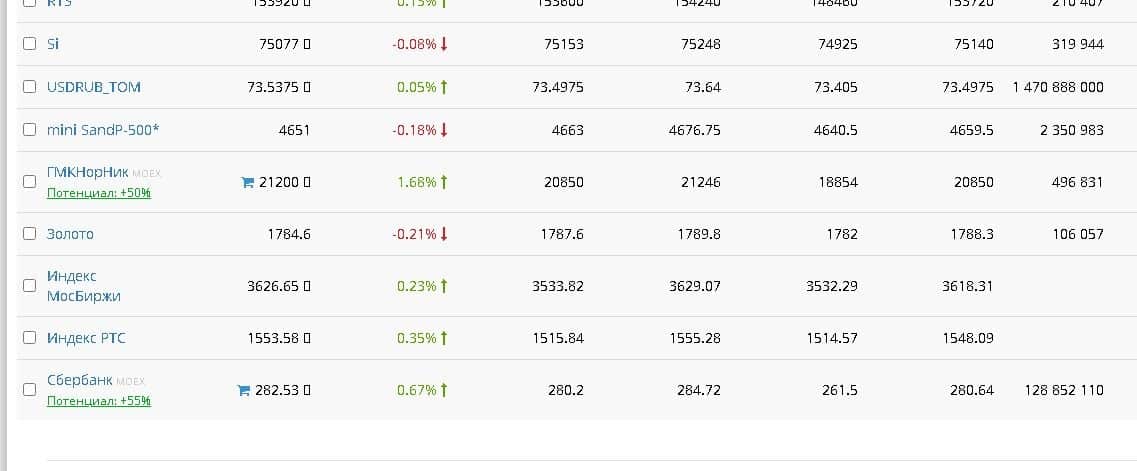

Quotes for blue chips of the Russian Federation, the United States on the securities market in real time can be viewed at https://www.finam.ru/quotes/

Blue Chips in the US Stock Market

In the US, the list of blue-chip companies is based on the Dow Jones Index. To calculate this indicator, they use data on the financial position of the 30 largest companies. Most of them operate in the banking sector, in the sector of large high-tech production, as well as companies that specialize in retail chains. In such companies, the level of capitalization is maximum, and the level of liquidity is very high. The list of such companies includes business flagships, such as:

- Coca-Cola;

- Boeing;

- Nike;

- Walmart;

- Walt Disney and others.

All blue chips of the US stock market that pay dividends are American aristocrats at the link https://www.proshares.com/funds/nobl_daily_holdings.html:

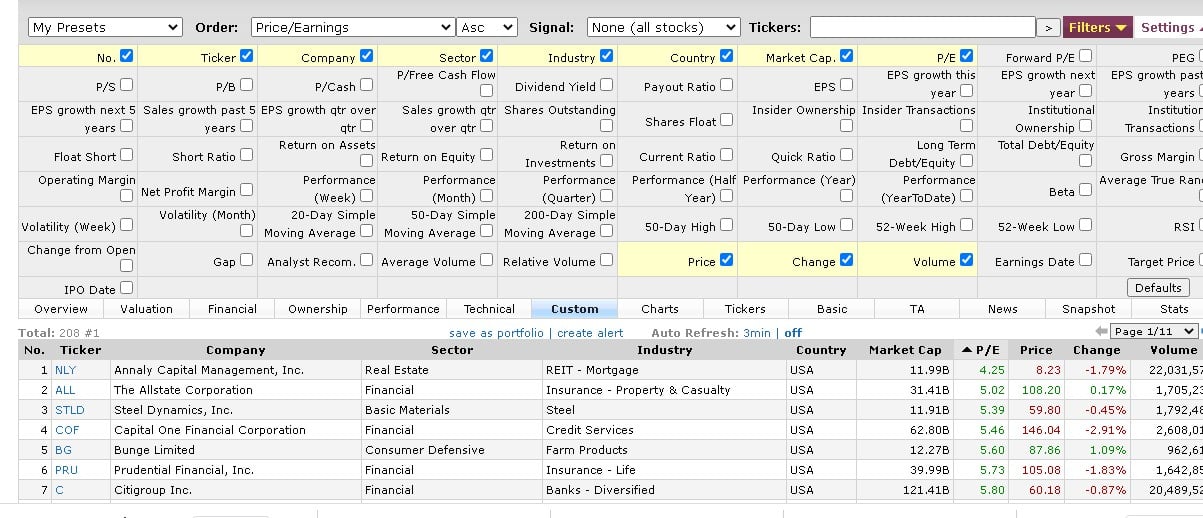

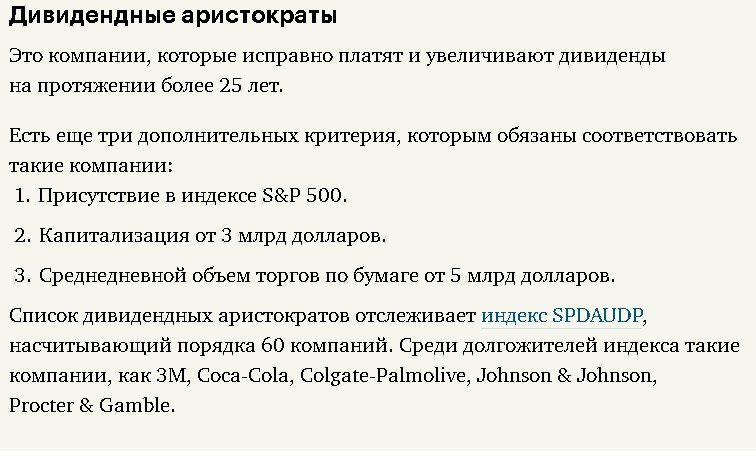

Blue US stock market chips [/ caption] However, in the US, the list of companies whose shares belong to “blue chips” is not limited to those identified by the Dow Johnson index. These include companies that have been increasing their share dividends for at least 20 years. Such companies are called “dividend aristocrats” and they are determined according to the S&P 500 Dividend Aristocrats Index.

In other stock markets

The EU countries have their own index for determining the “blue chips” EURO STOXX 50. On its basis, the list of companies included in this club in the EU countries includes such giants as:

- Volkswagen;

- Siemens;

- Telefonica and many others.

The UK uses its FTSE 100 index, and the leaders of the English blue-chip list are Vodafone, Tobacco, Burberry. Japan and the countries of Southeast Asia have their own indices and, accordingly, their own “blue chips”. Online stock prices on stock exchanges can be seen at https://investfunds.ru/stocks/

How to Buy Blue Chips Shares for a Domestic Investor

There are several ways that investors can buy blue-chip stocks, namely:

- Purchase a portion of a finished ETF investment portfolio . This portfolio is made up of various assets and parts of it are freely traded and bought on the stock market. Therefore, an investor can freely buy on the stock exchange a part of the portfolio, which includes blue-chip stocks.

- Build a portfolio of investments on your own , but this method is quite capital intensive. In addition, this method requires a lot of time, you will need to open your own brokerage account, install specialized programs on your PC and make purchases in accordance with the Profit index.

- It is also possible to open a brokerage account abroad , which immediately gives the investor the opportunity to purchase directly the blue chips of the country in which the account is located. But this method requires a very significant investment, since the cost of such shares is quite high (at the end of October, the value of a Tesla share was $ 909), and is available to wealthy investors.

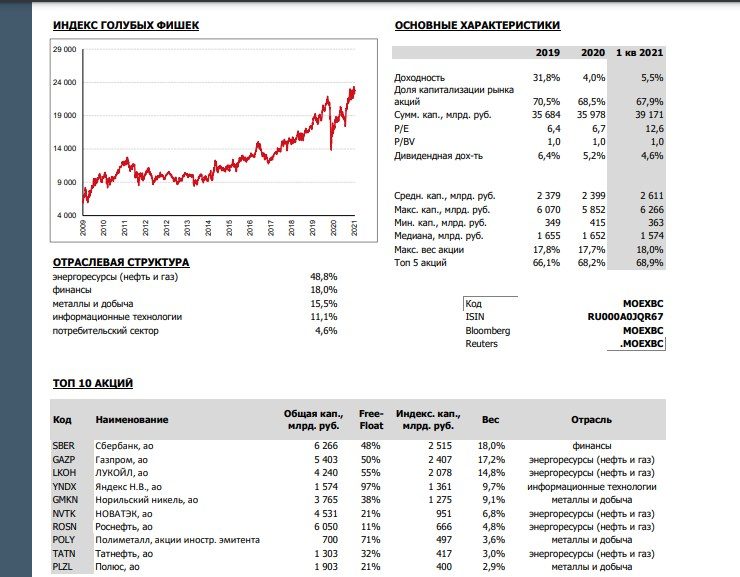

The structure and profitability of the Russian blue-chip index as of 2021 according to MOEX data:

Blue Chips are the Best Choice for Initial Investments

Investing in blue chips allows you to practically not react to significant market fluctuations, and a stable exchange rate allows you to use them as safe long-term investments. And it is clear that blue chips are much less risky compared to other stocks. All data on the status of blue chips can be obtained online at https://investfunds.ru/stocks/?auto=1