Baara kɛli lakana sugu la, o ye baara ye min farati ka bon kosɛbɛ, wa a ka gɛlɛn kosɛbɛ. O de kama, mɔgɔ minnu b’u ka sen fɔlɔw kɛ sugu la, a nafa ka bon kosɛbɛ u kana fili. Ko jugu min bɛ sɔrɔ nafolo bilalenw bɔnɛni na, tuma caman na waati jan kɔnɔ, ni o tɛ fo abada, o bɛ wari bilali nege fari faga. O la, ka baara daminɛ sugu la, jagokɛlaw ka kan ka wari bila lakanafɛnw na minnu farati ka dɔgɔn.

- Mun ye blue chips ye stock market la

- Fɛn jumɛnw ka kan ka kɛ walasa tɔnw ka se ka blue chip jɔyɔrɔ sɔrɔ?

- Mun de bɛ jatebɔ sanni ni feereli hakɛ jira bolomafara sugu la

- Kapitali (nafa) ka ɲɛsin sosiyete ma.

- Lakanalifɛnw hakɛ min bɛ baara la (free-float) .

- Nafa minnu bɛ sɔrɔ blue chip stockw la ka tɛmɛ stock tɔw kan

- “Blue chips” ka liquidité sanfɛ.

- Sosiyetew ka muɲuliba

- Dividendew ka bon

- Sosiyete minnu ye “blue chips” jɔyɔrɔ sɔrɔ lakana suguya caman na

- Risi jamana ka bolomafara sugu kan

- Blue chips bɛ Ameriki ka bolomafara sugu la

- Aksidan sugu wɛrɛw kan

- Cogo min na ka blue chip shares san jamana kɔnɔ waritigi dɔ ye

- Blue chips ye sugandili ɲuman ye wariko fɔlɔ la

Mun ye blue chips ye stock market la

Puce buluw – o tɔgɔ yɛrɛ bɔra puce minnu nafa ka bon kosɛbɛ, minnu tun bɛ tulon kɛ kasinow la san kɛmɛ tɛmɛnen kɔnɔ. A ka c’a la, o pucew tun bɛ baara kɛ ni nafolotigiw ye minnu tun bɛ tabali kan. Wa dɔɔnin dɔɔnin, ka Bɔ tulonkɛ-kumasen na, o hakilina in Bɔra tulonkɛ-tabali la ka Taa wariko sugu la.

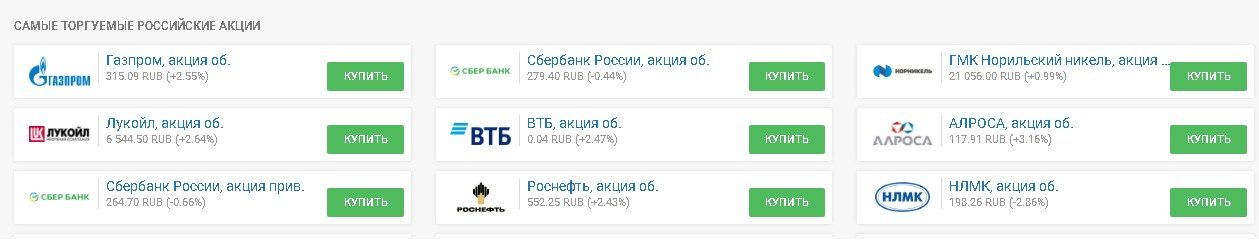

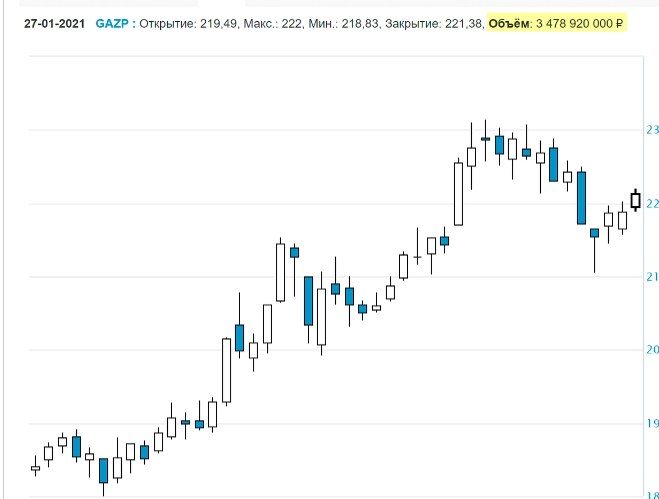

Blue chips ye wariko siratigɛ la tɔnba minnu ka nafolo sɔrɔta ka bon, olu ka jatew ye, minnu bɛ feere kosɛbɛ ani ka san sugu la. Sariya la, jatebɔ sarali o tɔn suguw ka jatebɔw kan, o bɛ ɲini ka Changé, wa jatebɔlaw bɛ se ka sɔrɔ sabatilen sɔrɔ, hali ni a ka dɔgɔ, san tan caman kɔnɔ. Diɲɛ kɔnɔ gɛlɛya, kɛlɛ walima ko wɛrɛ minnu fanga bɛ bɛn ɲɔgɔn ma, olu dɔrɔn de bɛ se ka nɔ bila o jatebɔ suguw nafa la. Misali la, Risi jamana fɛ, Gazprom walima SbeBank ka bolofara minnu bɛ sɔrɔ sugu la don o don, o bɛ se miliyari tan ni tan ma, wa u bɛ se ka wele cogo bɛnnen na ko « chips buluw ».

O bɛɛ kɔfɛ, jago hakɛ hali ɲɔgɔndan minnu ka surun ɲɔgɔn na, o ka dɔgɔ ni hakɛ kelen ye. Waati yɛrɛyɛrɛ quotations bɛ sɔrɔ blue chip sugu kan https://investfunds.ru/stocks/

Fɛn jumɛnw ka kan ka kɛ walasa tɔnw ka se ka blue chip jɔyɔrɔ sɔrɔ?

Walasa ka sosiyete ka jateminεw ka se ka bεn ni bεnkansεbεn ye, sosiyete ka kan ka nin ko ninnu dafa:

- a ka jatew tun ka di aksidan sugu la, wa a ye sɔrɔ sɔrɔ min tun bɛ ka bonya ka taa a fɛ san damadɔ kɔnɔ;

- a tun bɛ ni kapitalisimu hakɛba ye ;

- a ka jatew ka kan ka kɛ ji ye kosɛbɛ;

- sosiyete ka jateminεw nafa man kan ka bεn ni bεnkanba ye waati kɔnɔ (volatility low);

- sosiyete ka kan ka jira bolomafara sugu la waati jan kɔnɔ min bɛ se ka kɛ;

- sosiyete ka jatebɔw sarali ka kan ka kɛ tuma bɛɛ, k’a sɔrɔ a ma dɛsɛ;

- san 10 kɔnɔ, sosiyete man kan ka bin kɔnɔna gɛlɛyaw la minnu bɛ se ka nɔba bila a ka jatew nafa la.

Mun de bɛ jatebɔ sanni ni feereli hakɛ jira bolomafara sugu la

Jatedenw sanni ni feereli hakɛ bɛ bɔ fɛnba fila de la:

Kapitali (nafa) ka ɲɛsin sosiyete ma.

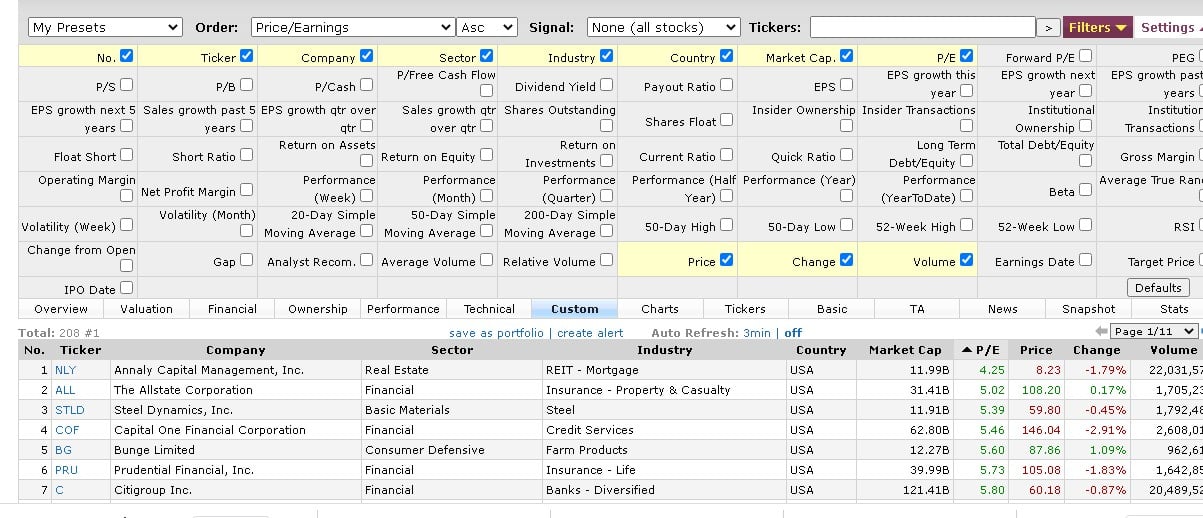

Ni sosiyete ka kapitalize ka bon, a ka jateminεw bε feere ani ka san don o don. Ka kɛɲɛ ni kapitalisimu hakɛ ye, Irisi jamana ka tɔnw bɛ se ka tila ka kɛ echelonw ye:

- Echelon fɔlɔ kɔnɔ, tɔnw bɛ yen minnu bɛ se ka kɛ ni kapitalize hakɛ ye min bɛ suman ni ruble miliyari caman ye.

- Sariyasen filanan ye tɔnw ye minnu ka waribonba bɛ se ka kɛ miliyari kɛmɛ caman ye.

- Wa, dakun sabanan ye tɔn fitininw ye, minnu nafa tɛ tɛmɛ rubɛ miliyari tan caman kan.

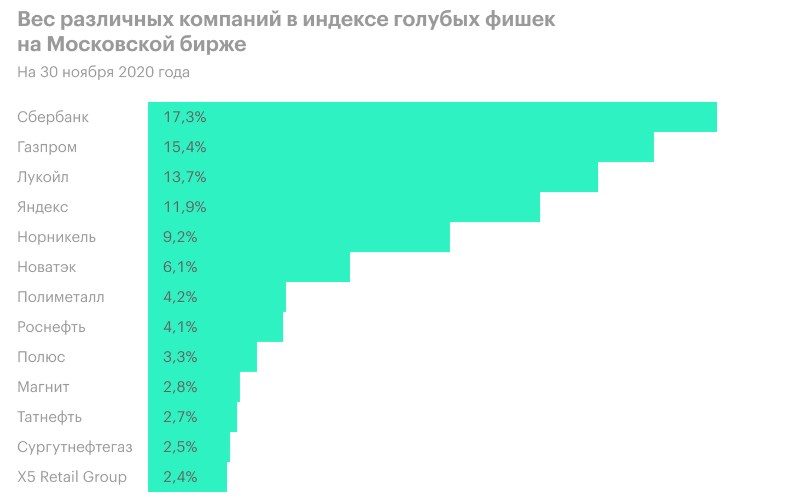

Kunnafoni bɛ se ka sɔrɔ baarakɛda suguya caman ka kapitalizasiyɔn kan Moskow Exchange la. [caption id="attachment_3452" align="aligncenter" width="1203"]

Lakanalifɛnw hakɛ min bɛ baara la (free-float) .

Ni sosiyete ka jatebɔw hakɛ bɛ ka caya, o bɛ kɛ sababu ye ka free-float hakɛ caya. O la, misali la, yiriwaliba dɔ ka jatew, n’o ye PIK jɔli tɔn ye, olu tɛ buluw ye. Hali ni waribonba ka bon (rubɛri miliyari 870 ɲɔgɔn), a ka bolofara hakɛ min bɛ bolomafara sugu la, o ye 18% dɔrɔn ye u hakɛ bɛɛ lajɛlen na. Ni an y’a suma, Magnit (kapitalize min ye ruble miliyari 637 ye), ani a ka jateminεw bεε lajɛlen na, o ye 63% ɲɔgɔn ye. [caption id="attachment_3456" align="aligncenter" bonya="659"]

Nafa minnu bɛ sɔrɔ blue chip stockw la ka tɛmɛ stock tɔw kan

Nafa kunbaba minnu bɛ jatebɔw la ni “blue chips” jɔyɔrɔ ye ka tɛmɛ lakanafɛn wɛrɛw kan bourse kan, olu bɛ se ka kɛ sababu ye.

“Blue chips” ka liquidité sanfɛ.

Lakanalifɛnw ka wari sɔrɔta hakɛ ka bon, o b’a to u bɛ se ka feere ni nafa caman ye, wa feereli hakɛw bɛ se ka kɛ fɛn o fɛn ye. Jagokɛla caman bɛ “puce buluw” sanni ni feereli la, o la, baara o baara bɛ kɛ ni nin nafolo ninnu ye, o bɛ kɛ joona kosɛbɛ. O waati kelen na, ni jatedenw ka wariko ka bon, u bɛ se ka san walima ka feere u suguya sɔngɔw la, u bɛ surunya o la.

Sosiyetew ka muɲuliba

Kɔnpɔsi minnu bɛ blue chip list kɔnɔ, olu ye ɲɛmɔgɔw ye u ka iziniw kɔnɔ, wa nafa caman b’u la ni u bɛ ɲɔgɔn sɔrɔ ni suguya wɛrɛw ye. An ka jamana kɔnɔ, a ka c’a la, o ye jamana ka tɔnw ye walima tɔn minnu ka jamana niyɔrɔba bɛ u bolo. kapitali min bɛ jate fɛɛrɛko ye. Olu bɛ se ka kɛ ka bɛn ni tɔnw ye i n’a fɔ Gazprom, Rosneft, Sberbank, a ɲɔgɔnnaw. O tɔn suguw de ye baarakɛnafolo sarabagabaw ye, wa u bɛ se ka jate jamana ka dɛmɛ na tuma bɛɛ ni gɛlɛya dɔ kɛra. O tɔn suguw ka teli ka baara kɛ suguw la minnu sigilen don. Sɔrɔdasi nafama si ka bɔli tɛ se ka kɛ. Komin tɔn kuraw dabɔli o yɔrɔw la, o bɛ wariba de wajibiya tiɲɛ na. O kow bɛ kɛ sababu ye ka buluw ka baarakɛcogo sabati kosɛbɛ ka tɛmɛ tulonkɛla misɛnninw ka baarakɛcogo kan sugu la. U ka wariko sabatili hakɛ ka bon kosɛbɛ, wa, o hukumu kɔnɔ, u ka juruko hakɛ ka bon kosɛbɛ, wa o b’a to u bɛ se ka juruko nafolo sama ni tɔnɔ dɔgɔman ye.

Aksidan sugu wɛrɛw kan

EU jamanaw n’u ka index ye “blue chips” dɔnni ye EURO STOXX 50. Ka da a kan, sosiyete minnu bɛ nin kulu in kɔnɔ EU jamanaw kɔnɔ, olu tɔgɔw bɛ yen, o ye fɛnba dɔw ye i n’a fɔ:

- Volkswagen ye;

- Siemens ye;

- Telefɔnika ani caman wɛrɛw.

Angletɛri bɛ baara kɛ n’a ka FTSE 100 index ye, ani tubabukan lisi ɲɛmaaw ye Vodafone, Tobacco, Burberry ye. Japon ni Azi Saheli-Kɔrɔn jamanaw n’u ka indices ani, o hukumu kɔnɔ, u yɛrɛ ka “blue chips”. Aksidanw sɔngɔw bɛ se ka lajɛ ɛntɛrinɛti kan https://investfunds.ru/stocks/ .

Cogo min na ka blue chip shares san jamana kɔnɔ waritigi dɔ ye

Fɛɛrɛ damadɔ bɛ yen minnu bɛ se ka kɛ sababu ye ka waridonnaw ka bolomafaraw san, olu ye :

- ETF ka wariko bolofara labɛnnen dɔ san . O portfolio in bɛ dilan ni nafolo suguya caman ye, wa a yɔrɔw bɛ feere hɔrɔnya la ani ka san aksidan sugu la. O la, waridonna dɔ hɔrɔnyalen don ka sanni kɛ bourse la portfolio yɔrɔ la, min kɔnɔ “blue chips” ka jatew bɛ sɔrɔ a la.

- Assemble a portfolio of investments on your own , nka nin fɛɛrɛ in bɛ waribonba de ta kosɛbɛ. Ka fara o kan, o fɛɛrɛ in bɛ waati caman de wajibiya, i bɛna a ɲini k’i yɛrɛ ka brokerage compte da wuli, ka porogaramu kɛrɛnkɛrɛnnenw sigi i ka PC kan ani ka sanni kɛ ka kɛɲɛ ni Profit index ye.

- A bɛ se ka kɛ fana ka brokerage jatebɔsɛbɛn da wuli jamana kɔkan , o min bɛ teliya ka sababu di waridonna ma ka “blue chips” san k’a ɲɛsin jamana min ma, o jatebɔsɛbɛn bɛ yɔrɔ min na. Nka nin fɛɛrɛ in bɛ waribonba camanba de wajibiya, bawo o jatebɔ suguw nafa ka bon kosɛbɛ (Ɔkutɔburukalo laban na, Tesla ka jatebɔ musaka tun ye dɔrɔmɛ 909 ye), wa a bɛ sɔrɔ nafolotigiw bolo.

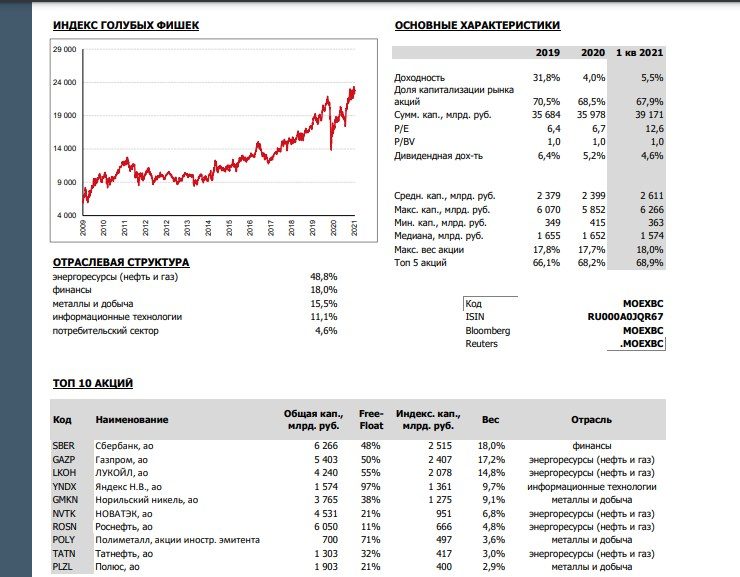

Risi ka blue chip index sigicogo n’a nafa sɔrɔli san 2021 ka kɛɲɛ ni MOEX ye:

Blue chips ye sugandili ɲuman ye wariko fɔlɔ la

Ni i ye wari bila buluw la, o b’a to i tɛ se ka jaabi di suguya caman jiginni na, wa wari falenfalen hakɛ sabatilen b’a to i bɛ se ka baara kɛ n’u ye i n’a fɔ wari bilali kuntaalajan lakananenw. Wa a jɛlen don ko “blue chips” farati ka dɔgɔ kosɛbɛ ni i ye a suma ni stock tɔw ye. Kunnafoni bɛɛ bɛ se ka sɔrɔ blue chips cogoya kan ɛntɛrinɛti kan https://investfunds.ru/stocks/?auto=1