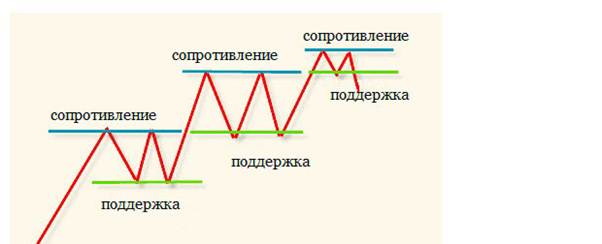

Yadda za a ƙayyade da abin da goyon baya da matakan juriya ke nufi a cikin ciniki – yin makirci a kan ginshiƙi da kuma amfani da ciniki, ciniki ta matakan. Farashin yana motsawa a cikin hanyar zigzag, lokaci-lokaci yana tsayawa akan wasu maki – matakan daga abin da juyawa ya faru kuma motsi baya ya fara. Wadannan maki ana kiran su matakan tallafi (lokacin da farashin ya ragu) da matakan juriya (lokacin da farashin ya tashi), waɗanda sune mahimman ra’ayoyi a cikin bincike na fasaha. https://articles.opexflow.com/analysis-methods-and-tools/osnovy-i-methody-texnicheskogo-trajdinga.htm Farashin yana motsawa tsakanin matakan tallafi da juriya. Sama da farashin akwai matakan juriya na ƙarfi daban-daban, a ƙasa – tallafi. Lokacin da matakin fasaha ya karye kuma farashin gyare-gyare, yan kasuwa sun hango ƙarin motsin farashin zuwa matakin gaba.

- Hanyoyi don ƙayyade matakan tallafi da juriya

- Matakan kwance

- Matakan masu ƙarfi ( karkatar da hankali).

- Matakan gini ta amfani da alamomi

- Matsakaicin motsi, ƙungiyoyin Bollinger

- Matakan Fibonacci

- Murray matakan

- Ciniki algorithm ta hanyar tallafi da matakan juriya a cikin ciniki

- Yadda ake kasuwanci a aikace – dabaru

- A kan sake dawowa

- Don lalacewa

- Tasha

- Fa’idodi da rashin amfani

- Kurakurai a amfani, kasada

- Dabarun gwaji

- Gwajin hannu

- Gwajin atomatik a cikin Metatrader

- Gwaji a TSLAB

- Abin da za a karanta a kan batun

- Jack Schwager. “Nazarin fasaha. Cikakken karatun.

- tsarin ciniki. Timofey Martynov

- Thomas Demark. “Binciken fasaha sabon kimiyya ne”.

- John J. Murphy. “Binciken Fasaha na Kasuwannin Gaba: Ka’idar da Aiki”.

- Larry Williams “Asirin Dogon Lokaci na Kasuwancin Gajere”.

- Bollinger akan Bollinger Bands. John Bollinger.

- “Sabbin Hanyoyin Ciniki na Fibonacci”. Robert Fisher

- “The Complete Encyclopedia of Chart Price Patterns”. Thomas N. Bulkovsky

- “Ciniki tare da Dr. Dattijo: Encyclopedia of the Stock Game” Dattijo Alexander

Hanyoyi don ƙayyade matakan tallafi da juriya

A cikin tsari, ana iya kwatanta halayen ƙididdiga kamar haka: farashin yana motsawa, a wani lokaci ya yi karo da maɓalli mai mahimmanci wanda ke juyawa farashin. Motsi na sama yana iyakance ta matakin juriya. A wani matakin, farashin yana samun tallafi kuma ya sake komawa. Waɗannan motsin zigzag suna faruwa koyaushe. Ayyukan mai ciniki shine gano mahimman matakan juyawa, shigar da ciniki ta hanyar da ta dace kuma kusa da lokacin da yake gabatowa mai ƙarfi tare da babban yiwuwar juyawa, ko kuma nan da nan bayan canji a yanayin kasuwa. Ba ze zama wani abu mai rikitarwa ba, amma kowane mawallafi yana da hanyarsa ta hanyar gina matakan, wasu maki (layi), wasu wurare, wasu suna amfani da matakan tsauri ko amfani da alamomi. Ba shi yiwuwa a ce wane hanyar “daidai”, da kuma ƙayyade ainihin abin da zai faru lokacin da yake gabatowa matakin – raguwa ko sake dawowa. Ayyukan mai ciniki ba shine “yi tsammani”, amma don fahimtar abin da za a yi a kowane hali da kuma yadda za a iyakance asarar idan akwai kuskuren kuskure. Bari mu yi la’akari da manyan hanyoyin gina matakan.

Matakan kwance

A cikin ciniki, ana fahimtar matakan tallafi da juriya a matsayin layin kwance waɗanda aka zana ta hanyar nazarin ginshiƙi na tarihi. Don gina matakan juyar da maɓalli, kuna buƙatar:

- bude ginshiƙi na tarihi a kan lokaci ɗaya ko mako;

- zaɓi kayan aikin “zana layin kwance”;

- lura da highs da lows daga inda akwai gagarumin farashin motsi. Yana da kyau a lura da waɗannan tsattsauran ra’ayi wanda aka samu jujjuyawa fiye da sau biyu ko uku;

- je zuwa ginshiƙi na 4h ko 1h kuma kuyi haka. Za a sami wuce gona da iri a nan, waɗanda ba a gani a kullum ko mako;

- je zuwa ginshiƙi m15 kuma buɗe bayanai don zaman ciniki na 3-5 na ƙarshe;

- matakan alamar;

- yana da kyau a yi amfani da launuka daban-daban don kowane lokaci;

- goyon baya a kwance da matakan juriya an gina su (dogon lokaci, matsakaici, gajeren lokaci).

Manazarta suna jayayya game da matakan da za su ɗauka a matsakaicin, ko a kusa. Wasu gina a kan inuwa (bayan duk, idan farashin ya kasance a can, yana nufin cewa wajibi ne don wasu dalilai), wasu a kan jikin (rufe kyandir yana da yanke shawara), kuma har yanzu wasu sun gaskata cewa matakan ba su da wani. aya, amma zone kuma zana rectangular maimakon layi. An kafa shi daga extrema da yawa kusa da juna.

Matakan masu ƙarfi ( karkatar da hankali).

Taimako na kwance da matakan juriya suna aiki da kyau a cikin ɗakin kwana ko akan manyan lokutan lokaci. Lokacin da farashin ke cikin motsi mai tasowa, duk matakan da ke faruwa sun karye, kuma gyare-gyaren ƙanana ne, ba su kai ga tallafi ba. ‘Yan kasuwa suna zana layukan da aka zana tsakanin mafi girma biyu jere ko ƙasa don tantance matakan tallafi ko juriya. An gina tashar tashar tashar daga yanayin jujjuyawar yanayin. Layin ya kamata ya keta ta 2 kusa da extremums (mafi girma ga tashar saukowa, mafi ƙanƙanta ga mai hawan) da kuma matsananciyar tsakani.

Matakan gini ta amfani da alamomi

‘Yan kasuwa sun yi imanin cewa ƙayyade matakan tarihi ko layukan kwance bai isa ba kuma ba koyaushe abin dogara ba ne. Ana amfani da alamomi don ƙayyade matakan tallafi da juriya. Amfani – matakan suna canzawa tare da kasuwa, ana la’akari da rashin daidaituwa.

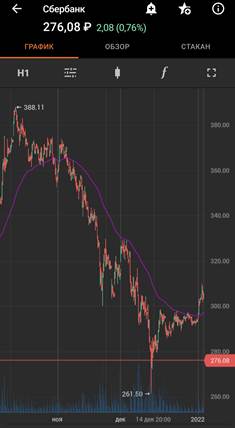

Matsakaicin motsi, ƙungiyoyin Bollinger

Don ƙayyade matakan da farashin zai iya komawa baya, an ba da shawarar yin amfani da masu nuna alama dangane da ma’auni na tarihin tarihi –

ƙungiyoyi masu motsi da

Bollinger bands . Adadin ya nuna akan hannun jari na Sberbank yadda EMA233 akan ginshiƙi na sa’a ke riƙe da yanayin. Ya yi aiki a matsayin tallafi don haɓakawa, bayan raguwa da gwaji, an fara raguwa, wanda ya ƙare ne kawai bayan farashin da aka ƙayyade a sama da motsi. A lokaci guda, ‘yan kasuwa da suka shiga kasuwanci a kan gwaji na matsakaicin motsi na iya motsa tasha ta bin kasuwa ba tare da an ɗaure su da matakan da ba su dace ba. Bayan kowane taɓawa da sake dawo da farashin, yana yiwuwa a buɗe sabbin ma’amaloli bisa ga yanayin.

Matakan Fibonacci

Kayan aiki yana dogara ne akan jerin Fibonacci. Kowace lamba ita ce jimlar biyun da suka gabata, raba kowane lamba da na baya yana ba da 1.61. Don hango ko hasashen maɓalli matakan juyawar farashin ta amfani da matakan Fibonacci, kayan aikin yana da alaƙa da yanayin da ake ciki. Kuna iya hango ko hasashen gyara ko ci gaba na yanayin. A Trend gyara yawanci 23-38%, lokacin da extremum ya karye, farashin yawanci ya kai 128 ko 161%.

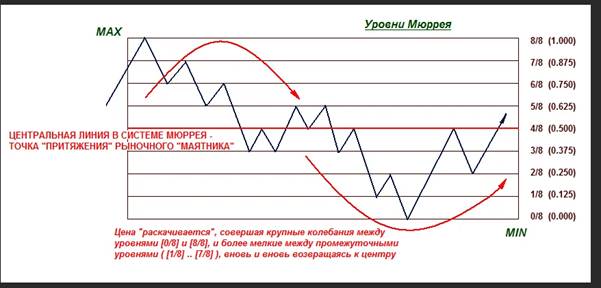

Murray matakan

Don hango hasashen farashin, an haɓaka tsarin da ke haɗa matakan Fibonacci da tsarin murabba’in Gann. Ana gina matakan ta atomatik bisa ga kyandir 64 na ƙarshe na lokacin da aka zaɓa (ana iya canza lokacin). Ana samun alamar a cikin sabis na Tradeview ko tashar Metatrader (Match Murrey). Gindin da aka gina ya ƙunshi matakan 8, ana sake gina su idan rashin daidaituwa ya canza ko farashin ya wuce murabba’in.

Ciniki algorithm ta hanyar tallafi da matakan juriya a cikin ciniki

Matakan goyon baya da juriya suna nuna halin babban adadin mahalarta (“taro”) akan ginshiƙi. Farashin da aka haɓaka a matakin farashin, ƙarfin bijimai da beyar daidai suke idan babu labarai. Mahalarta sun kasu kashi 3 kungiyoyi – wadanda suka yi fare a kan girma, a kan fall da rashin yanke shawara. Idan wasu labarai suka fito kuma farashin ya hauhawa, to wadanda suka sayar sun fahimci kuskurensu kuma su yi mafarkin rufe yarjejeniyar a karya ko da farashin ya dawo. Waɗanda suka saya suna so su sayi ƙarin, kuma waɗanda ba su cikin kasuwa sun yanke shawarar abin da za su sa a haɓaka. Saboda haka, an haɓaka sha’awar farko. Mutane da yawa suna nazarin nazarin fasaha, koyi yin aiki a kan layi na layi, sannan saita alamomi iri ɗaya, sanya umarni na dakatarwa a bayan mahimman bayanai.

- yankunan juye-juye akan ginshiƙi na tarihi akan lokaci wanda bai gaza na yau da kullun ba, zai fi dacewa a kowane mako ko kowane wata;

- matakan da aka kafa akan ƙarar ƙira;

- matakan da aka kafa ta kyandirori “labarai”. Misali, Shugaban Amurka yana ba da jawabi kuma kadari yana da sha’awa. Bayan wani lokaci, in babu labarai, farashin yana raguwa, amma ba ya ketare buɗewar kyandir ɗin labarai, yana tashi daga matakin duk lokacin da ya kusanci. Wannan matakin zai iya wuce fiye da shekara guda.

Yadda ake kasuwanci a aikace – dabaru

Lokacin da yake gabatowa matakin, farashin zai iya komawa baya “a kan sake dawowa”) ko ci gaba. (“don gwaji”).

A kan sake dawowa

Mai ciniki yana gina grid na matakan a cikin tashar tashar, tare da kowace hanya zuwa matsayi mai karfi ko matsakaici, an buɗe yarjejeniya a cikin kishiyar shugabanci kuma ana gudanar da shi har zuwa mataki na gaba. Idan farashin ya kusanci matakin juriya, ana buɗe guntun wando, kuma ana buɗe dogayen tsayi akan tallafi. Wannan hanyar ciniki ta zama ruwan dare a cikin kasuwanni masu faɗi, a cikin ciniki na yau da kullun, ko kuma lokacin da aka bayyana a fili cewa kadarar tana cikin kewayo.

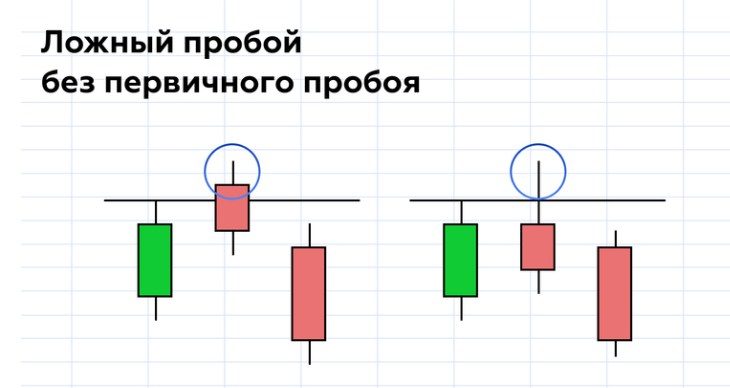

Don lalacewa

Mai ciniki yana jira har sai farashin ya karya ta matakin kuma yana ƙarfafa mafi girma. Ana la’akari da gyarawa don rufe kyandir na lokacin ciniki a sama da matakin. Ana buɗe ciniki ta hanyar motsin farashin. Mai ciniki yana gina tashar mai tasowa, kuma yana buɗe duk sabbin yarjejeniyoyin a cikin hanya ɗaya a kan keta kowane mataki na gaba, muddin yanayin yana aiki.

Tasha

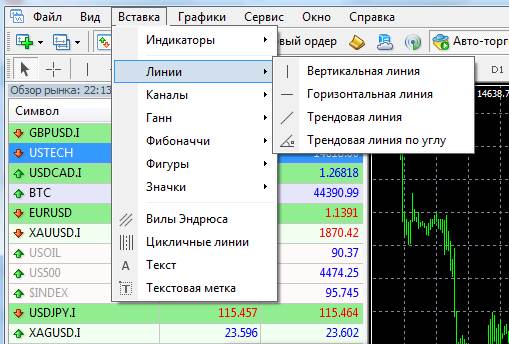

Ko da wane kasuwa (hannun jari, karafa, albarkatun kasa, da dai sauransu) mai ciniki ya yi ciniki a ciki, ilimin halin ɗan adam ba ya canzawa. Don haka matakan suna aiki. Sabili da haka, kowane tashar tashoshi yana da kayan aikin zane na asali – layi na kwance da layi, rectangles, tashoshi, matakan Fibonacci. Matsakaicin motsi, maƙallan Bollinger, da sauransu. an haɗa su cikin daidaitattun fakitin alamun kowane tasha. Idan aikin da ake buƙata ya ɓace, ko kuma da alama bai dace ba don gina grid na matakan, zaku iya amfani da sabis ɗin Tradeview kyauta.

Fa’idodi da rashin amfani

Amfani da juriya da matakan tallafi a cikin ciniki mai amfani yana da fa’ida da rashin amfani. Amfani:

- tsarin yana aiki a kowane lokaci na kasuwa – babu bambanci tsakanin yanayi ko ɗakin kwana, idan an yi amfani da shi daidai, matakan zasu taimaka wajen hango ko hasashen ƙarin halin farashin;

- bayyanannen haɗari – lokacin ciniki ta matakan, ba shi da ma’ana mai amfani don kasancewa cikin ma’amala bayan raguwa da daidaita farashin bayan matakin. Kuna iya sanya tsayayyen tsayawa kuma saita adadin asarar a gaba;

- riba mai ma’ana mai kyau – fita kasuwancin ba shi da mahimmanci. Lokacin ciniki daga matakin zuwa matakin, nan da nan ya bayyana inda za a fita ciniki. Ana lissafin riba a gaba.

Laifi:

- mai ciniki zai iya fara fantasizing “kuma farashin fam ɗari zai sake dawowa”, “da kyau, tabbas za mu karya”. Matakan sun dogara ne akan halayen taron, kuma a cikin cinikin hannu, mai ciniki yana cikin wannan taron;

- yadda ya dace na yin aiki da matakan ya dogara da yanayin kasuwa – wani yanayi ko ɗakin kwana, matakan ba su ba da amsa ga wannan tambaya ba, don wannan kana buƙatar amfani da ƙarin kayan aiki.

Kurakurai a amfani, kasada

Kuskure na yau da kullun ga masu farawa shine haɗuwa da babban adadin hanyoyin don gina matakan juyawa. Sakamakon haka, ginshiƙi yayi kama da grid na matakan ci gaba, amma wannan baya kawo fa’ida mai amfani. Mai ciniki bai san yadda za a mayar da martani ba idan matakan sun kasance kusa da juna, akwai damar 100% cewa za a sami juyawa daga wasu layi. Babu sihiri a cikin wannan. Mai ciniki ya yanke shawarar cewa layin daga wannan hanya shine mafi karfi, kuma lokaci na gaba babu wani juyawa. Tare da amincewa da yawa a cikin ma’amala da kuma rashin asarar tasha ta iyakance asarar, irin wannan ciniki da sauri yana haifar da magudana a kan ajiya.

Dabarun gwaji

Hannun kasuwancin ja da baya da breakout suna bayyana ka’ida ta gaba ɗaya kawai. Ya kamata dabarun ciniki ya haɗa da:

- bayyanannen ƙa’idar ma’anar tallafi da matakan juriya. Kuna buƙatar zaɓar hanyoyi ɗaya ko 2 don gina matakan kuma bi su;

- ƙayyadaddun ƙa’idodi don shigar da ciniki – shigarwa don fashewa ko sake dawowa, a ƙarƙashin wane yanayi;

- tace – kuna buƙatar ƙarin nuni, fasaha ko mahimmanci, wanda zai iya gaya muku ko yana da daraja buɗe ma’amala. Babu tsarin ciniki da ke aiki daidai da kyau a duk matakan kasuwa. Idan akwai yanayin ciniki don raguwa, kasuwa mai laushi zai haifar da asara;

- gudanar da haɗari – kana buƙatar bayyana a fili girman tasha ko yanayin da za a rufe ma’amala;

- ci riba – bayyana ƙa’idodin rufewa a fili.

Bayan tsara duk ka’idoji, zaku iya bincikar riba na dabarun akan bayanan tarihi. Zai fi kyau a duba shekaru 5-20, kasuwanni suna zagaye, idan tsarin ya nuna sakamako mai kyau a yanzu, kana buƙatar sanin ko akwai lokuta marasa amfani a cikin tarihin da kuma tsawon lokacin da suka kasance. Dangane da sakamakon, kuna buƙatar zana ƙarshe game da tasirin ciniki. Wataƙila za ku iya canza wasu sigogi don yin ciniki mafi riba. Wani lokaci ya isa ya canza lokacin matsakaicin motsi ko haɓaka tasha don ƙara yawan riba na tsarin ciniki.

Gwajin hannu

Dabaru tare da ginin hoto akan manyan lokutan lokaci ana iya duba su da hannu. Wajibi ne a duba akalla shekara guda, zai fi dacewa shekaru 5-10. Don yin wannan, kuna buƙatar saita alamun da ake buƙata kuma gungurawa ginshiƙi zuwa dama don neman sigina da rikodin sakamakon ciniki na kama-da-wane. Domin kada ku leka “zuwa gaba”, kuna iya amfani da na’urar kwaikwayo ta ciniki, misali, a cikin sabis na Tradeview. Don yin wannan, buɗe ginshiƙi kuma danna maɓallin “Kasuwa Simulator” a saman allon. Kuna iya zaɓar lokacin farawa na simintin (layi mai shuɗi a tsaye) da saurin da sabbin kyandir za su bayyana akan ginshiƙi.

Gwajin atomatik a cikin Metatrader

Don gwada dabarun a cikin shirin Metatrader, kuna buƙatar rubuta mai ba da shawara. Idan babu basirar shirye-shirye, za ku iya juya zuwa ayyuka na musamman, don mai ba da shawara mai sauƙi za su biya $ 50-200. Na gaba, muna so mu shigar da shirin kuma danna “Tsarin Gwajin”.

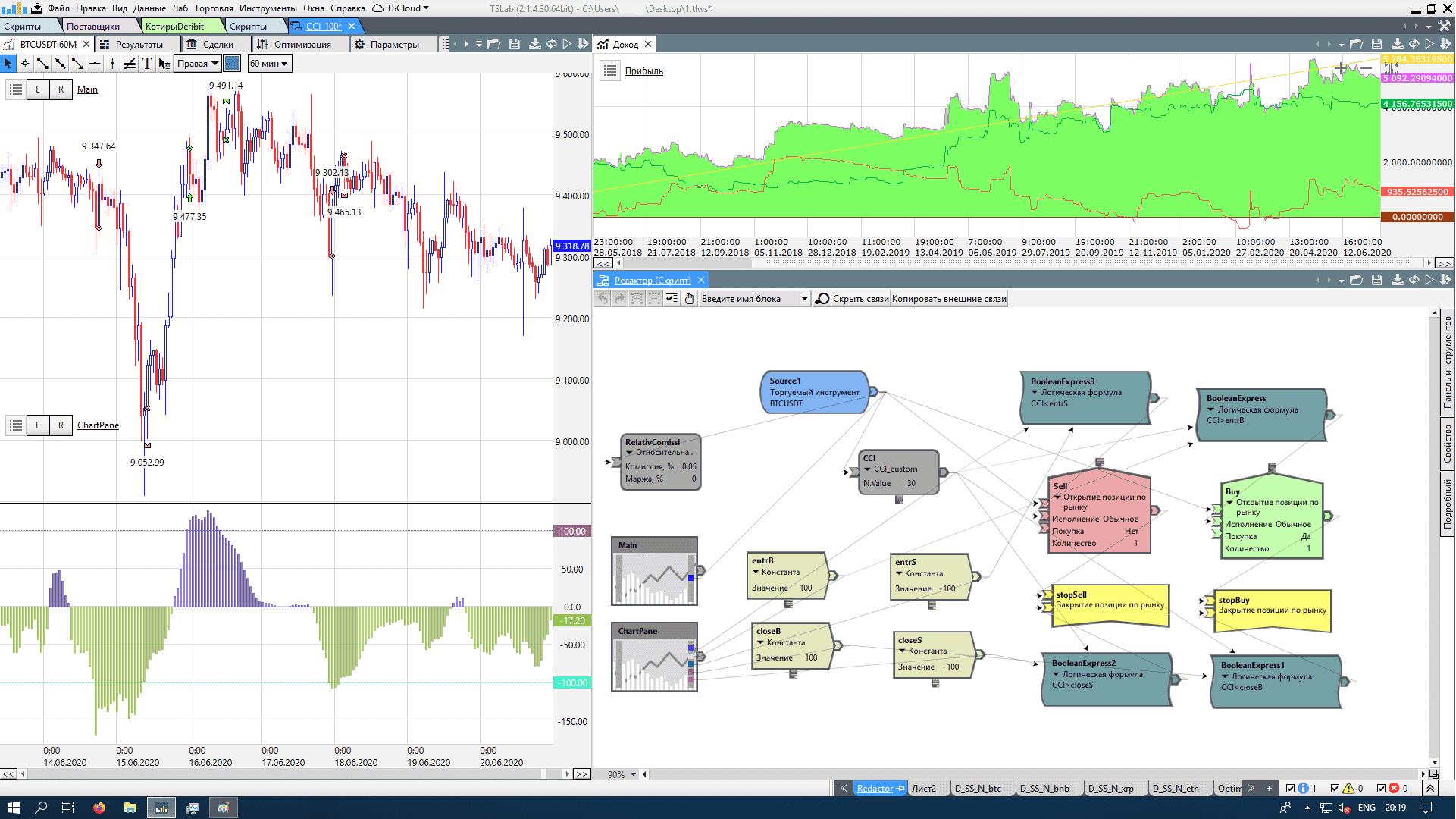

Gwaji a TSLAB

Idan ba ku da gogewa a cikin shirye-shirye, zaku iya gwada dabarun kyauta a cikin shirin TSLAB.

Har yanzu kuna da gano shi, amma ba kwa buƙatar ƙwarewa na musamman don yin aiki tare da cubes na aikace-aikacen, isasshen ilimin ga makarantar sakandare da juriya. Don gwada dabarun kuna buƙatar:

Har yanzu kuna da gano shi, amma ba kwa buƙatar ƙwarewa na musamman don yin aiki tare da cubes na aikace-aikacen, isasshen ilimin ga makarantar sakandare da juriya. Don gwada dabarun kuna buƙatar:

- Zazzage kuma shigar da shirin TSLAB.

- Zazzage maganganun tarihi a cikin tsarin .txt, alal misali, daga gidan yanar gizon Finam https://www.finam.ru/profile/moex-akcii/gazprom/export/ .

- Ƙirƙiri algorithm a cikin shirin TSLAB kuma gwada dabarun.

Abin da za a karanta a kan batun

A lokacin samuwar dan kasuwa, yana da amfani don karanta kwarewar wani, yawancin shahararrun ‘yan kasuwa sun raba kwarewar su. Shahararrun yan kasuwa suna magana game da tafiya, bincike da hanyoyin bincike na fasaha. Wasu daga cikin mafi kyawun littattafai akan nazarin fasaha daga sanannun marubuta – yan kasuwa, manazarta da masu zuba jari:

Jack Schwager. “Nazarin fasaha. Cikakken karatun.

Littafin gargajiya na nazarin fasaha, sanannen dan kasuwa yayi magana game da nazarin sigogi, hanyoyin fahimtar motsin farashin. Raba kwarewarsa, yayi nazarin takamaiman yanayi. An bayyana ginin layukan yanayi, jeri, tallafi da matakan juriya da masu nuni. Marubucin ya ba da shawara da maganganu masu amfani game da ciniki da gudanar da haɗari.

tsarin ciniki. Timofey Martynov

Marubucin shine mahaliccin shahararren shafin don yan kasuwa da masu zuba jari smart-lab.ru. Fiye da shekaru 10, yana bin halayen kasuwa, kuma ya kasance mai gabatarwa a tashar RBC. Ba kamar sauran marubuta ba, ana ba da misalai na ainihi na asarar kasuwancin. Martynov ya bayyana kwarewarsa na yin hasarar kasuwanci don shekaru 5. Ya ba da sirrin yadda ya sami damar canza tsarin kasuwanci kuma ya fara samun kuɗi mai kyau. Nasihar karatu don novice yan kasuwa.

Thomas Demark. “Binciken fasaha sabon kimiyya ne”.

Demark ya sadaukar da shekaru 25 na rayuwarsa don nazarin halayen kasuwannin hannayen jari. Ya zayyana duk kwarewarsa a cikin wannan littafi, ya gaya mahimman al’amura da matsalolin bincike na fasaha. Yana raba nasa hanyar gina layukan da bai dace ba. Marubucin ya yi jayayya daga mahangar kimiyya, a cikin ciniki babu wani wuri don hasashe da kuma hanyar da ta dace. Dukkan dalilan marubucin an tabbatar da su a zahiri.

John J. Murphy. “Binciken Fasaha na Kasuwannin Gaba: Ka’idar da Aiki”.

Wannan littafi na zamani ne na bincike na fasaha. Marubucin sanannen guru ne na bincike na fasaha, ƙwararren ɗan kasuwa da mai saka jari. A cikin wallafe-wallafen, marubucin ya gaya game da bincike na fasaha, ainihin ma’anarsa, hanyoyin da ake amfani da shi a aikace. Murphy yayi magana game da dalilin da yasa waɗannan hanyoyin ke aiki, ana ƙididdige ribar hanyar. .

Larry Williams “Asirin Dogon Lokaci na Kasuwancin Gajere”.

Kasuwancin rana yana ɗaya daga cikin mafi yawan riba da kuma hadaddun hanyoyin. Marubucin, ɗaya daga cikin ƴan kasuwa masu cin nasara na karni na 20, ya ba da labarin kwarewarsa, yana nuna alamu da dabaru ta misali. Ya yi magana game da matakan kasuwa, ya shafi batun kula da haɗari. https://articles.opexflow.com/analysis-methods-and-tools/svechnye-formacii-v-tradinge.htm

Bollinger akan Bollinger Bands. John Bollinger.

Marubucin shine mahaliccin mai nuna alama, wanda ke cikin kowane tasha. Nasihar karatu ga duk wanda ya yanke shawarar amfani da Bollinger Bands. Wanene, idan ba marubucin ba, zai gaya game da nuances na aikace-aikacen da ma’anar mai nuna alama.

“Sabbin Hanyoyin Ciniki na Fibonacci”. Robert Fisher

Marubucin ya ba da shawarar sabuwar hanyar amfani da sanannen kayan aiki. Littafin ya yi nazarin ainihin manufar kuma ya bayyana ma’anarsa mai amfani.

“The Complete Encyclopedia of Chart Price Patterns”. Thomas N. Bulkovsky

Wani al’ada na bincike na fasaha, yawancin shahararrun ‘yan kasuwa na farkon karni na 21st sunyi nazari daga wannan littafi. Ya ƙunshi mafi cikakken cikakkun bayanai na ƙa’idar game da ƙirar hoto. Littafin yana gabatar da kididdigar ciniki, ya bayyana fa’idodi da rashin amfani na samfurin. Littafin zai kasance da amfani don karantawa ga masu zuba jari da masu hasashe. Ba ma a yi amfani da shi ba, amma don ci gaban gaba ɗaya.

“Ciniki tare da Dr. Dattijo: Encyclopedia of the Stock Game” Dattijo Alexander

Marubucin shahararren masanin fasaha ne na duniya. Littafin ya ƙunshi ƙwarewar marubucin, yana ba da nazarin takamaiman yanayi. Yana da mahimmanci cewa marubucin ya gaya yadda za a tsara ciniki da kuma zana yanke shawara daga kuskure. Littattafan ciniki suna nuna tsarin tunanin marubucin kuma yana ba ku damar bin diddigin abubuwan da ke faruwa. A ƙarshen littafin akwai gwaji tare da amsoshi waɗanda zasu taimaka muku fahimtar idan mai karatu ya shirya don ciniki.