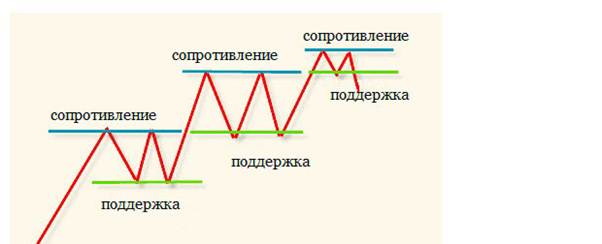

Sɛnea wobehu ne nea mmoa ne ɔsɔretia levels kyerɛ wɔ aguadi mu – plotting wɔ chart so na wɔde di dwuma wɔ aguadi mu, aguadi denam levels so. Bo no tu wɔ zigzag kwan so, bere ne bere mu no gyina nsɛntitiriw bi so – gyinabea ahorow a efi mu ba na ɛdannan no fi ase. Wɔfrɛ saa nsɛm yi mmoa gyinabea (bere a bo no kɔ fam) ne resistance levels (bere a bo no kɔ soro), a ɛyɛ nsusuwii atitiriw wɔ mfiridwuma mu nhwehwɛmu mu. https://articles.opexflow.com/analysis-methods-and-tools/osnovy-i-methody-texnicheskogo-trajdinga.htm Bo no tu kɔ mmoa ne ɔsɔretia dodow ntam. Bo no soro no, wo resistance levels a ewo ahoden ahoroo, ase – mmoa. Sɛ wɔsɛe mfiridwuma mu gyinabea bi na wɔhyehyɛ bo no a, aguadifo hyɛ nkɔm sɛ nneɛma bo bɛkɔ so akɔ ɔfã a edi hɔ no so.

- Akwan a wɔfa so kyerɛ mmoa ne ɔsɔretia dodow

- Nneɛma a ɛwɔ sorosoro

- Dynamic (a ɛkɔ fam) levels

- Ɔdan gyinabea ahorow a wɔde nsɛnkyerɛnnede ahorow di dwuma

- Nneɛma a ɛkɔ so, Bollinger nnwontofo kuw

- Fibonacci dodow a ɛwɔ nipadua no mu

- Murray nsɛm a wɔka kyerɛ

- Trading algorithm nam mmoa ne ɔsɔretia levels wɔ aguadi mu

- Sɛnea wodi gua wɔ nneyɛe mu – akwan horow

- Wɔ rebound no so

- Sɛnea ɛbɛyɛ a ɛbɛpaapae

- Nneɛma a wɔde gyina hɔ

- Mfaso ne ɔhaw ahorow a ɛwɔ so

- Mfomso a ɛba wɔ dwumadie mu, asiane ahorow

- Sɔhwɛ akwan horow

- Nsaano a wɔde sɔ hwɛ

- Nsɔhwɛ a wɔde yɛ adwuma wɔ Metatrader mu

- Sɔhwɛ wɔ TSLAB

- Nea ɛsɛ sɛ wokenkan wɔ asɛmti no ho

- Jack Schwager na ɔkyerɛwee. “Mfiridwuma mu nhwehwɛmu.” Adesua a edi mũ.

- aguadi ho nhyehyɛe. Timofey Martynov na ɔkyerɛwee

- Thomas Demark na ɔkyerɛwee. “Mfiridwuma mu nhwehwɛmu yɛ nyansahu foforo”.

- John J. Murphy na ɔkyerɛwee. “Mfiridwuma mu Nhwehwɛmu a ɛfa Daakye Guadi Ho: Nsusuwii ne Nneyɛe”.

- Larry Williams “Bere Tenten Ahintasɛm a Ɛfa Bere Tiaa Mu Aguadi Ho”.

- Bollinger wɔ Bollinger Nnwontofo Kuw mu.John Bollinger.

- “Fibonacci Aguadi Akwan Foforo”. Robert Fisher na ɔkyerɛwee

- “Encyclopedia a edi mũ a ɛfa Chart Price Patterns ho”. Thomas N. Bulkovsky na ɔkyerɛwee

- “Aguadi ne Oduruyɛfo Ɔpanyin: Encyclopedia a ɛfa Stock Game ho” Ɔpanyin Alexander

Akwan a wɔfa so kyerɛ mmoa ne ɔsɔretia dodow

Schematically, wobetumi aka suban a quotes no ho asɛm sɛnea edidi so yi: bo no kɔ fam, wɔ bere pɔtee bi mu no ɛne level titiriw bi a ɛdannan bo no bɔ. Ɔkwan a ɛkɔ soro no yɛ nea anohyeto wom denam ɔsɔretia dodow no so. Wɔ ɔfã pɔtee bi mu no, bo no nya mmoa na ɛdannan. Saa zigzag ahorow yi kɔ so bere nyinaa. Oguadifoɔ no adwuma ne sɛ ɔbɛhunu gyinabea titire a wɔdannan no, ɔhyɛn aguadiɛ bi mu wɔ ɔkwan pa so na wato mu berɛ a ɔrebɛn gyinabea a ɛyɛ den a ɛwɔ tumi kɛseɛ sɛ wɔbɛdan no, anaasɛ wɔ nsakraeɛ bi aba gua so tebea mu akyi pɛɛ. Ɛbɛyɛ te sɛ nea ɛnyɛ biribi a ɛyɛ den, nanso ɔkyerɛwfo biara wɔ n’ankasa kwan a ɔfa so kyekye levels, ebinom hyɛ nsɛntitiriw (ntrɛwmu), mmeae afoforo agyirae, afoforo de levels a ɛyɛ nnam di dwuma anaasɛ wɔde nsɛnkyerɛnne di dwuma. Ɛntumi nyɛ yiye sɛ wobɛka sɛ hena kwan no “teɛ”, ne sɛnea wobɛkyerɛ nea ɛbɛba pɛpɛɛpɛ bere a ɛrebɛn level no – abubu anaasɛ asan aba. Oguadifoɔ no adwuma nyɛ sɛ “ɔbɛsusu ho”, na mmom ɔbɛte deɛ ɛsɛ sɛ ɔyɛ wɔ asɛm biara mu ne sɛdeɛ ɔbɛto nneɛma a wɔhwere ano hyeɛ sɛ ɛba sɛ nkɔmhyɛ a ɛntene ba a. Momma yensusuw akwan atitiriw a wɔfa so yɛ level ahorow no ho.

Nneɛma a ɛwɔ sorosoro

Wɔ aguadi mu no, wɔte mmoa ne ɔsɔretia dodow ase sɛ nsensanee a ɛkɔ soro a wɔtwe denam abakɔsɛm nhyehyɛe no a wosua so. Sɛ wopɛ sɛ wokyekye key reversal levels a, wuhia:

- bue abakɔsɛm nhyehyɛe wɔ da anaa dapɛn bi bere nhyehyɛe mu;

- paw “twe nsensanee a ɛkɔ soro” adwinnade no;

- hyɛ nneɛma a ɛkɔ soro ne nea ɛba fam a efi baabi a nneɛma bo kɔɔ soro kɛse no nsow. Ɛfata sɛ yɛhyɛ saa nneɛma a ɛtra so a wɔdan fii mu bɛboro mprenu anaa mprɛnsa no nsow;

- kɔ 4h anaa 1h chart no so na yɛ saa ara. Nneɛma a ɛtra so bɛba ha, a wonhu wɔ da biara da anaa dapɛn dapɛn no so;

- kɔ m15 chart no so na bue data ma aguadi nhyiam ahorow 3-5 a etwa to no;

- agyiraehyɛde ahorow;

- eye sɛ wode kɔla ahorow bedi dwuma wɔ bere biara mu;

- horizontal support ne resistance levels na wɔkyekye (bere tenten, mfinimfini, bere tiaa mu).

Nhwehwɛmufo regye akyinnye wɔ gyinabea ahorow a ɛsɛ sɛ wɔfa so wɔ dodow a ɛsen biara mu, anaasɛ bere a wɔawie no ho. Ebinom si sunsuma no so (ne nyinaa akyi no, sɛ na bo no wɔ hɔ a, ɛkyerɛ sɛ ɛho hia esiane biribi nti), afoforo nso si nipadua ahorow no so (kyɛnere no a wɔbɛto mu no yɛ gyinaesi), na afoforo nso gye di sɛ level ahorow no nyɛ a twe adwene si so, nanso zone na twetwe ahinanan mmom sen sɛ wobɛtwe nkyerɛwde. Wɔde extrema ahorow pii a ɛwɔ ntam a ɛbɛn na ɛyɛe.

Dynamic (a ɛkɔ fam) levels

Horizontal support ne resistance levels yɛ adwuma yiye wɔ flat anaasɛ wɔ bere akɛse mu. Sɛ bo no wɔ trending movement mu a, wɔbubu levels a ɛrekɔ so nyinaa mu, na nteɛsoɔ no sua, ɛnyɛ mmoa. Aguadifo twetwe nneɛma a ɛrekɔ so a wɔtwe wɔ nneɛma a ɛkorɔn anaa nea ɛba fam abien a ɛtoatoa so ntam de kyerɛ mmoa anaa ɔsɔretia dodow. Wɔkyekye trend channel no fi trend reversal point no so. Ɛsɛ sɛ line no bubu extremums 2 a ɛbɛn ho (maximum ma ɔkwan a ɛsiane no, minimums ma nea ɛforo) ne extremum bi a ɛda wɔn ntam.

Ɔdan gyinabea ahorow a wɔde nsɛnkyerɛnnede ahorow di dwuma

Aguadifo gye di sɛ abakɔsɛm mu nneɛma a ɛkɔ soro anaasɛ nsensanee a ɛkɔ fam a wobehu no nnɔɔso na ɛnyɛ bere nyinaa na wotumi de ho to so. Wɔde nsɛnkyerɛnnede ahorow di dwuma de kyerɛ mmoa ne ɔsɔretia dodow. Advantage – levels sesa ne gua no, wofa volatility ho.

Nneɛma a ɛkɔ so, Bollinger nnwontofo kuw

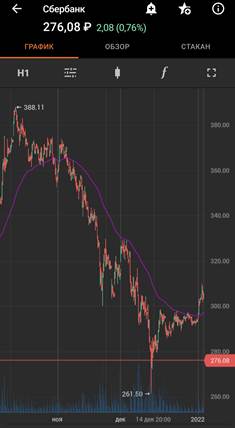

Sɛnea ɛbɛyɛ na wɔahu dodow a ɛda adi sɛ bo no bɛdan akɔ no, wɔahyɛ nyansa sɛ wɔmfa nsɛnkyerɛnnede ahorow a egyina abakɔsɛm mu nsɛm a wɔde bɛkyɛ so –

nkyekyem a ɛkɔ so ne

Bollinger bands . Akontaabu no kyerɛ wɔ Sberbank kyɛfa no so sɛnea EMA233 a ɛwɔ dɔnhwerew biara nhyehyɛe no so kura su no. Ɛyɛɛ adwuma sɛ mmoa ma uptrend, wɔ asɛe ne sɔhwɛ akyi no, downtrend fii ase, a ɛbaa awiei bere a wɔahyɛ bo a wɔahyɛ asen nea ɛrekɔ no akyi nkutoo. Bere koro no ara mu no, aguadifo a wɔhyɛn aguadi bi mu wɔ sɔhwɛ a ɛfa sɛnea wɔkyekyem pɛpɛɛpɛ a ɛkɔ so no ho no betumi atu gyinabea a edi gua no akyi a wɔrenkyekyere wɔn ho wɔ nsɛm a ɛho nhia bio no ho. Bere biara a wɔde wɔn nsa ka na ɛsan ba bio akyi no, na wobetumi abue nnwuma foforo sɛnea ɛrekɔ so no.

Fibonacci dodow a ɛwɔ nipadua no mu

Adwinnade no gyina Fibonacci ntoatoaso no so. Nnɔmba biara yɛ abien a atwam no nyinaa bom, sɛ wokyekyɛ akontaahyɛde biara mu ma nea edi kan no a, wunya 1.61. Sɛnea ɛbɛyɛ a wɔbɛkyerɛ bo a wɔbɛdannan no dodow titiriw denam Fibonacci dodow a wɔde bedi dwuma so no, wɔde adwinnade no bata su bi a ɛwɔ hɔ dedaw ho. Wubetumi ahyɛ nkɔm sɛ wɔbɛyɛ nteɛso anaasɛ nkɔso foforo a ɛbɛba wɔ su no mu. Trend correction no taa yɛ 23-38%, sɛ extremum no bubu a, ɛbo no taa du 128 anaa 161%.

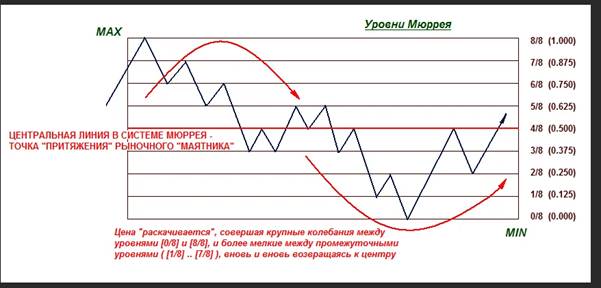

Murray nsɛm a wɔka kyerɛ

Nea ɛbɛyɛ na wɔahu bo no, wɔyɛɛ nhyehyɛe bi a ɛka Fibonacci dodow ne Gann ahinanan nhyehyɛe no bom. Wɔkyekye levels no ankasa gyina kyɛnere 64 a etwa to wɔ bere nhyehyɛe a wɔapaw no mu (wobetumi asesa bere no). Nsɛnkyerɛnne no wɔ Tradeview som anaa Metatrader terminal (Match Murrey) no mu. Grid a wɔasisi no yɛ 8 levels, wɔsan si sɛ volatility no sesa anaasɛ bo no kɔ akyiri sen square no a.

Trading algorithm nam mmoa ne ɔsɔretia levels wɔ aguadi mu

Mmoa ne ɔsɔretia dodow kyerɛ nnipa dodow bi a wɔde wɔn ho hyɛɛ mu (“nnipadɔm”) suban wɔ nhyehyɛe no so. Bo a wɔaka abom wɔ bo gyinabea no, anantwinini ne asono tumi ahorow no yɛ pɛ bere a amanneɛbɔ biara nni hɔ no. Wɔkyekyɛ wɔn a wɔde wɔn ho hyɛ mu no mu akuo 3 – wɔn a wɔto kyakya wɔ nkɔsoɔ no so, wɔ asehweɛ no so ne wɔn a wɔansi gyinaeɛ. Sɛ nsɛm bi ba na ne bo kɔ soro kɛse a, ɛnde wɔn a wɔtɔn no te wɔn mfomso no ase na wɔda dae sɛ wɔbɛto apam no mu wɔ breakeven mu sɛ bo no san ba a. Wɔn a wɔtɔɔ no pɛ sɛ wɔtɔ pii, na wɔn a na wonni gua so no na wosi nea wɔde bɛto nkɔso so ho gyinae. Enti, wonya nkate a edi kan no. Nnipa pii sua mfiridwuma mu nhwehwɛmu, sua sɛnea wɔbɛyɛ adwuma wɔ nneɛma a ɛrekɔ so no ho, afei wɔde nsɛnkyerɛnne koro no ara si hɔ, de ahyɛde ahorow a wɔde gyina hɔ ma nneɛma a ɛtra so a ɛho hia no akyi.

- reversal zones wɔ abakɔsɛm nhyehyɛe no so wɔ bere a ɛnnsua da biara da mu, sɛ ɛbɛyɛ yiye a, dapɛn biara anaa ɔsram biara;

- levels a wɔhyehyɛ wɔ volumes a ɛkɔ soro so;

- level ahorow a “asɛmpa” kyɛnere na ɛyɛ. Sɛ nhwɛso no, United States Ɔmampanyin no rema ɔkasa na agyapade bi yɛ nea wɔde wɔn ho hyɛ mu. Bere bi akyi, sɛ amanneɛbɔ biara nni hɔ a, ne bo so tew, nanso ɛntwa nsɛm ho amanneɛbɔ kyɛnere no ano, na ɛbɔ fi soro bere biara a ɛbɛn no. Saa level yi betumi atra hɔ bɛboro afe biako.

Sɛnea wodi gua wɔ nneyɛe mu – akwan horow

Sɛ ɛrebɛn level no a, bo no betumi asan aba bio “wɔ rebound so”) anaasɛ ɛbɛkɔ akyiri. (“ma sɔhwɛ”).

Wɔ rebound no so

Oguadifo no si grid a levels wɔ terminal no mu, a ɔkwan biara a wɔfa so kɔ ahoɔden level a ɛyɛ den anaa mfinimfini no, wobue apam bi wɔ ɔkwan a ɛne no bɔ abira so na wɔkura mu kosi level a edi hɔ no. Sɛ bo no bɛn resistance level no a, wobue shorts, na wobue longs wɔ supports so. Saa kwan a wɔfa so di gua yi abu so wɔ gua a ɛyɛ tratraa so, wɔ da no mu aguadi mu, anaasɛ bere a ɛda adi pefee sɛ agyapade no wɔ ɔkwan bi so no.

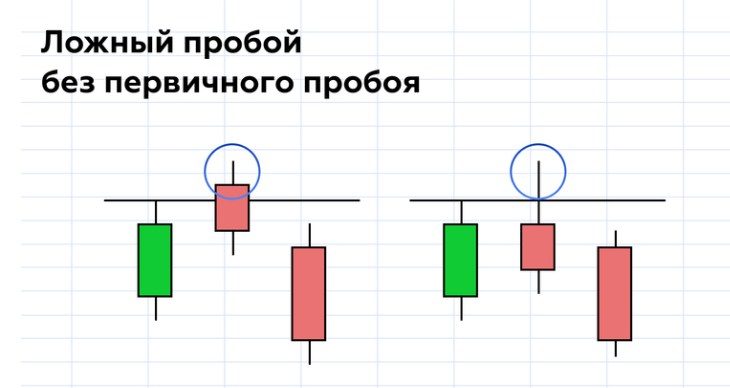

Sɛnea ɛbɛyɛ a ɛbɛpaapae

Oguadifo no twɛn kosi sɛ bo no bebubu level no mu na ayɛ den kɛse. Wobu fixing sɛ ɛyɛ kyɛnere a wɔde to gua wɔ bere a wɔde di gua no so sen level no. Wobue aguadi bi wɔ baabi a nneɛma bo kɔ so. Oguadifo no si su kwan, na obue nkitahodi foforo nyinaa wɔ ɔkwan biako so bere a wabu ɔfã biara a edi hɔ no mu, bere tenten a su no yɛ adwuma no.

Nneɛma a wɔde gyina hɔ

Ɛmfa ho gua a aguadifo bi de di gua (stocks, dade, nneɛma a wɔde yɛ nneɛma, ne nea ɛkeka ho) no, wɔn a wɔde wɔn ho hyɛ mu no adwene nsakra. Enti levels no yɛ adwuma. Enti, terminal biara wɔ mfitiaseɛ mfoniniyɛ nnwinnadeɛ – horizontal ne trend lines, rectangles, channels, Fibonacci levels. Moving averages, Bollinger nnwontofo kuw, ne nea ɛkeka ho. wɔde ka standard package a ɛkyerɛ terminal biara ho no ho. Sɛ dwumadie a wɔhwehwɛ no nni hɔ, anaasɛ ɛte sɛ nea ɛnyɛ mmerɛw sɛ wobɛkyekyere grid a ɛwɔ levels a, wobɛtumi de Tradeview dwumadie a wontua hwee no adi dwuma.

Mfaso ne ɔhaw ahorow a ɛwɔ so

Ɔsɔretia ne mmoa dodow a wɔde di dwuma wɔ aguadi a mfaso wɔ so mu no wɔ ne mfaso ne ɔhaw ahorow. Mfaso a ɛwɔ so:

- nhyehyeɛ no yɛ adwuma wɔ gua no fã biara mu – nsonsonoeɛ biara nni trend anaa flat ntam, sɛ wɔde di dwuma yie a, levels no bɛboa ma wɔahyɛ boɔ suban foforɔ ho nkɔm;

- asiane a emu da hɔ – bere a woredi gua denam levels so no, ntease biara nni mu se wobeye apam bi mu wo abubu akyi na woasiesie bo a wode level no akyi. Wubetumi de gyinabea a emu da hɔ asi hɔ na woadi kan ahyɛ dodow a wobɛhwere no;

- a well-defined take profit – a wofiri adi gua no mu no nnye nea ehia kakraa bi. Sɛ woredi gua fi level kɔ level a, ɛda adi ntɛm ara baabi a ɛsɛ sɛ wufi asɛm no mu. Fa mfaso no di kan bu akontaa.

Mfomso ahorow:

- aguadifo betumi afi ase asusuw ho sɛ “na nkaribo ɔha bo bɛsan akɔ soro”, “wiɛ, akyinnye biara nni ho sɛ yɛbɛbubu mu”. Wɔde level ahorow no gyina nnipadɔm no nneyɛe so, na wɔ nsaano aguadi mu no, aguadifo no ka nnipadɔm yi ho;

- efficiency of work out the levels gyina phase of the market – a trend anaa flat, levels no mma mmuaeɛ mma asɛmmisa yi, eyi nti ɛsɛ sɛ wode nnwinnadeɛ foforɔ di dwuma.

Mfomso a ɛba wɔ dwumadie mu, asiane ahorow

Mfomso a ɛtaa di ma wɔn a wɔrefi ase ne akwan dodow bi a wɔfa so kyekye reversal levels a wɔaka abom. Nea efi mu ba ne sɛ, nhyehyɛe no te sɛ grid a ɛkɔ so yɛ levels, nanso eyi mfa mfaso biara a mfaso wɔ so mma. Oguadifo no nnim sɛnea ɔbɛyɛ n’ade sɛ levels no bɛn saa a, ɛwɔ 100% hokwan sɛ ɛbɛba sɛ ɛbɛdannan afi line bi mu. Nkrabea biara nni eyi mu. Oguadifo no si gyinae sɛ line a efi saa kwan yi so no ne nea ano yɛ den sen biara, na bere foforo no, wɔrensan nsan. Esiane ahotoso a ɛboro so wɔ asɛm no mu ne stop loss a enni hɔ a ɛto adehwere ano hye nti, aguadi a ɛte saa no ma sika a wɔde asie no so tew ntɛmntɛm.

Sɔhwɛ akwan horow

Pullback ne breakout aguadi akwan no kyerɛkyerɛ nnyinasosɛm a ɛwɔ hɔ nyinaa nkutoo mu. Ɛsɛ sɛ aguadi ho nhyehyɛe no ka ho:

- mmara a emu da hɔ a ɛkyerɛ mmoa ne ɔsɔretia gyinabea ahorow. Ɛsɛ sɛ wopaw ɔkwan biako anaa 2 a wobɛfa so akyekye levels na woadi akyi;

- mmara a emu da hɔ a wɔde hyɛn aguadi mu – hyɛn mu ma breakout anaasɛ rebound, wɔ tebea bɛn mu;

- filter – wo hia indicator foforo, mfiridwuma anaa fapem, a ebetumi akyere wo se efata se wobebue deals. Aguadi nhyehyɛe biara nni hɔ a ɛyɛ adwuma yiye pɛpɛɛpɛ wɔ gua no fã ahorow nyinaa mu. Sɛ trend trading wɔ hɔ ma breakdown a, flat market no bɛma wɔahwere ade;

- asiane ho dwumadie – ehia se wokyerekyere gyinabea no kɛseɛ anaa tebea a wɔbɛto mu pefee;

- fa mfaso – kyekyere mmara a wode wiee mu no mu pefee.

Sɛ wode mmara no nyinaa hyɛ mmara ase wie a, wubetumi ahwehwɛ mfaso a ɛwɔ ɔkwan a wɔfa so yɛ no so wɔ abakɔsɛm mu nsɛm so. Ɛyɛ papa sɛ wobɛhwɛ mfe 5-20, gua ahorow no yɛ kyinhyia, sɛ nhyehyɛe no kyerɛ aba pa mprempren a, ɛsɛ sɛ wuhu sɛ ebia mmere a mfaso nni so wɔ abakɔsɛm mu ne bere tenten a ɛkɔɔ so. Ɛsɛ sɛ wugyina nea efi mu ba no so ba awiei wɔ sɛnea aguadi tu mpɔn no ho. Ebia wubetumi asesa parameters binom na ama aguadi ayɛ mfaso kɛse. Ɛtɔ da bi a ɛdɔɔso sɛ wobɛsesa bere a ɛkɔ so no anaasɛ wobɛma gyinabea no akɔ soro na ama mfaso a ɛwɔ aguadi nhyehyɛe no mu no akɔ soro kɛse.

Nsaano a wɔde sɔ hwɛ

Wobetumi de nsa ahwɛ akwan horow a wɔde mfonini ayɛ wɔ bere akɛse so. Ɛho hia sɛ wohwɛ anyɛ yiye koraa no afe biako, sɛ ɛbɛyɛ yiye a, mfe 5-10. Sɛ wobɛyɛ eyi a, ɛsɛ sɛ wode nsɛnkyerɛnne a ɛho hia no si hɔ na wotwetwe nhyehyɛe no kɔ nifa so hwehwɛ nsɛnkyerɛnne na wokyerɛw nea efi virtual aguadi mu ba no. Sɛnea ɛbɛyɛ a worenhwɛ “daakye” mu no, wubetumi de aguadi simulator adi dwuma, sɛ nhwɛso no, wɔ Tradeview som no mu. Sɛ wopɛ sɛ woyɛ eyi a, bue chart no na klik “Market Simulator” button a ɛwɔ screen no atifi no so. Wubetumi apaw bere a wobefi ase ayɛ simulation no (vertical blue line) ne ahoɔhare a kyɛnere foforo bɛpue wɔ chart no so.

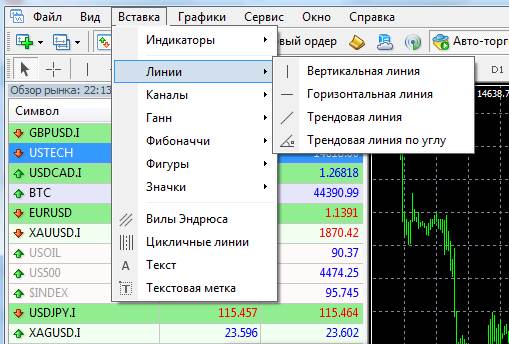

Nsɔhwɛ a wɔde yɛ adwuma wɔ Metatrader mu

Sɛ wopɛ sɛ wosɔ ɔkwan a wɔfa so yɛ adwuma no hwɛ wɔ Metatrader nhyehyɛe no mu a, ɛsɛ sɛ wokyerɛw ɔfotufo. Sɛ nhyehyɛe ho nimdeɛ biara nni hɔ a, wubetumi adan akɔ nnwuma titiriw bi so, ama ɔfotufo a ɔyɛ mmerɛw no wobegye $50-200. Afei, yɛpɛ sɛ yɛhyɛn program no mu na yɛbɔ “Strategy Tester”.

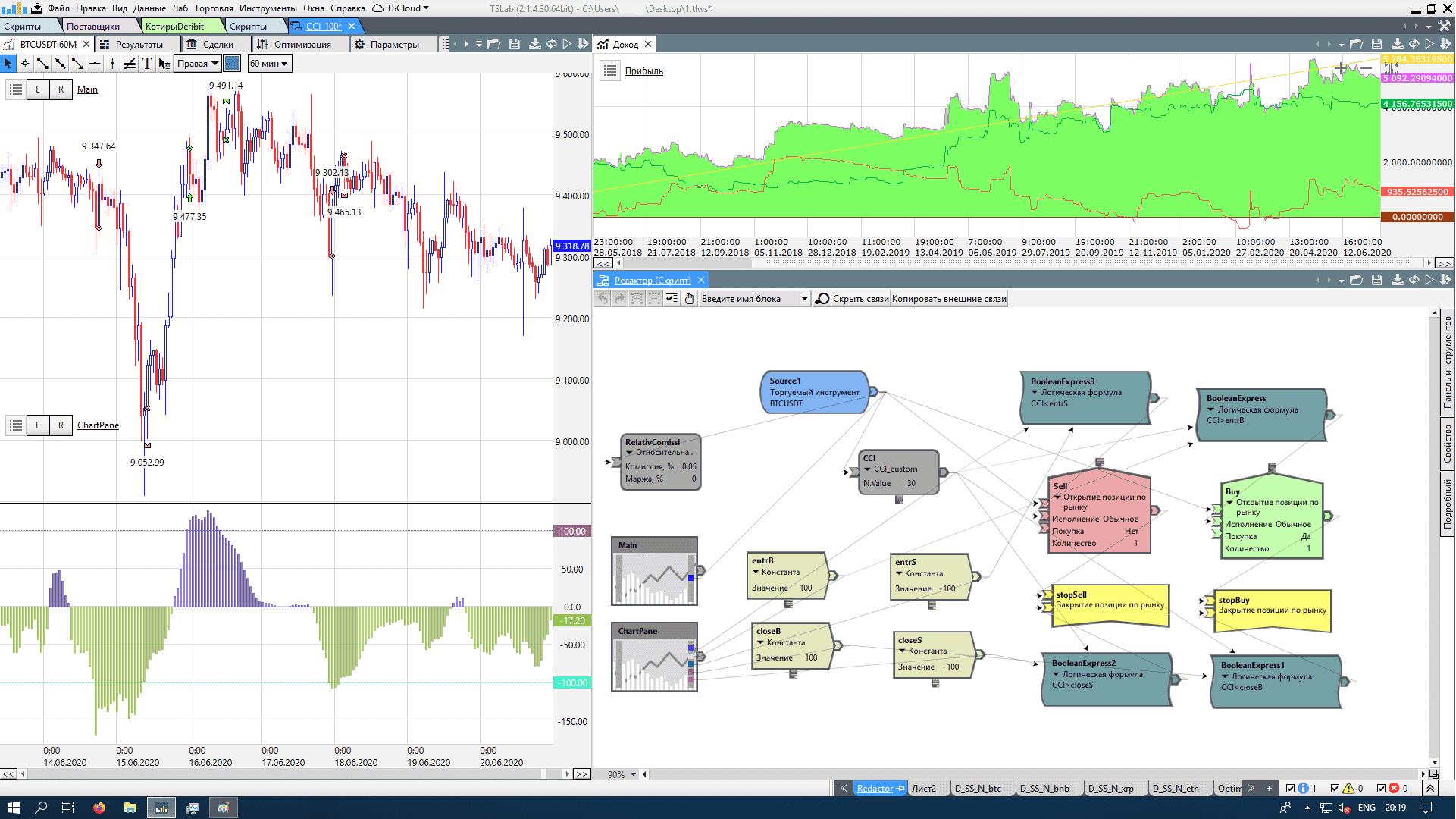

Sɔhwɛ wɔ TSLAB

Sɛ wo nni osuahu biara wɔ nhyehyɛe mu a, wubetumi asɔ akwan horow ahwɛ kwa wɔ TSLAB nhyehyɛe no mu.

Ɛsɛ sɛ woda so ara susuw ho, nanso wunhia ahokokwaw soronko a wode bɛyɛ adwuma wɔ application cubes, nimdeɛ a ɛdɔɔso ma ntoaso sukuu ne boasetɔ. Sɛ wobɛsɔ ɔkwan a wuhia no ahwɛ a:

Ɛsɛ sɛ woda so ara susuw ho, nanso wunhia ahokokwaw soronko a wode bɛyɛ adwuma wɔ application cubes, nimdeɛ a ɛdɔɔso ma ntoaso sukuu ne boasetɔ. Sɛ wobɛsɔ ɔkwan a wuhia no ahwɛ a:

- Twe TSLAB program no na fa gu wo kɔmputa so.

- Twe abakɔsɛm mu nsɛm a wɔafa aka wɔ .txt kwan so, sɛ nhwɛso no, fi Finam wɛbsaet https://www.finam.ru/profile/moex-akcii/gazprom/export/ .

- Yɛ algorithm wɔ TSLAB program no mu na sɔ nhyehyɛe no hwɛ.

Nea ɛsɛ sɛ wokenkan wɔ asɛmti no ho

Bere a wɔhyehyɛɛ aguadifo no, mfaso wɔ so sɛ wobɛkenkan obi foforo suahu, aguadifo a wɔagye din pii kaa wɔn suahu. Aguadifo a wɔagye din ka wɔn akwantu, nhwehwɛmu ne mfiridwuma mu nhwehwɛmu akwan ho asɛm. Nhoma ahorow a eye sen biara a ɛfa mfiridwuma mu nhwehwɛmu ho a efi akyerɛwfo a wonim wɔn yiye hɔ – aguadifo, nhwehwɛmufo ne sikasɛm mu asisifo hɔ no bi:

Jack Schwager na ɔkyerɛwee. “Mfiridwuma mu nhwehwɛmu.” Adesua a edi mũ.

Nhoma a wɔagye din a ɛfa mfiridwuma mu nhwehwɛmu ho no, aguadifo bi a wonim no yiye ka nhyehyɛe ahorow mu nhwehwɛmu ho asɛm, akwan a wɔfa so te nneɛma bo a ɛkɔ so no ase. Ɔka ne suahu, hwehwɛ tebea horow pɔtee bi mu. Wɔakyerɛkyerɛ trend lines, ranges, support ne resistance levels ne indicators a wɔasi no mu. Ɔkyerɛwfo no de afotu ne nsɛm a mfaso wɔ so ma wɔ aguadi ne asiane ho nhyehyɛe ho.

aguadi ho nhyehyɛe. Timofey Martynov na ɔkyerɛwee

Ɔkyerɛwfo no ne ɔbɔadeɛ a ɔyɛɛ wɛbsaet a agye din ma aguadifo ne sikakorafo smart-lab.ru. Bɛboro mfeɛ 10 ni, wadi gua no suban akyi, na na ɔyɛ ɔyɛkyerɛfoɔ wɔ RBC channel. Nea ɛnte sɛ akyerɛwfo afoforo no, wɔde aguadi a wɔhwere ho nhwɛso ankasa ama. Martynov ka ne suahu a ɛfa aguadi a ɛmaa ɔhweree ade mfe 5 ho asɛm. Ɔka sɛnea otumi sesaa ɔkwan a wɔfaa so dii gua no na ofii ase nyaa sika pa ho ahintasɛm ahorow ho asɛm. Akenkan a wɔkamfo kyerɛ ma aguadifo a wonnim hwee.

Thomas Demark na ɔkyerɛwee. “Mfiridwuma mu nhwehwɛmu yɛ nyansahu foforo”.

Demark de n’asetra mu mfe 25 suaa sɛnea sikakorabea ahorow no yɛ wɔn ade no ho ade. Ɔkaa ne suahu nyinaa ho asɛm wɔ nhoma yi mu, ka mfiridwuma mu nhwehwɛmu afã atitiriw ne ɔhaw ahorow ho asɛm. Ɔkyɛ n’ankasa ɔkwan a ɔfa so yɛ nsensanee a ɛyɛ oblique. Ɔkyerɛwfo no fi nyansahu kwan so gye akyinnye sɛ, wɔ aguadi mu no, baabiara nni hɔ a wɔde nsusuwii hunu ne ɔkwan a wɔfa so yɛ ade a wotumi te ase. Wɔde osuahu di ɔkyerɛwfo no nsusuwii nyinaa ho adanse.

John J. Murphy na ɔkyerɛwee. “Mfiridwuma mu Nhwehwɛmu a ɛfa Daakye Guadi Ho: Nsusuwii ne Nneyɛe”.

Saa nhoma yi yɛ mfiridwuma mu nhwehwɛmu a wɔagye din. Ɔkyerɛwfo no yɛ mfiridwuma mu nhwehwɛmu ho ɔbenfo a wogye no tom, aguadifo ne sikakorafo a ɔwɔ nimdeɛ. Wɔ nhoma no mu no, ɔkyerɛwfo no ka mfiridwuma mu nhwehwɛmu, n’adwene mu ade titiriw, akwan a wɔfa so de di dwuma wɔ nneyɛe mu ho asɛm. Murphy ka nea enti a saa akwan yi yɛ adwuma no ho asɛm, wɔbu mfaso a ɛwɔ ɔkwan no so no ho akontaa. .

Larry Williams “Bere Tenten Ahintasɛm a Ɛfa Bere Tiaa Mu Aguadi Ho”.

Daa aguadi yɛ akwan a mfaso wɔ so na ɛyɛ den sen biara no mu biako. Ɔkyerɛwfo no, afeha a ɛto so 20 yi mu aguadifo a wodii yiye sen biara no mu biako, ka n’ankasa osuahu ho asɛm, ɔde nhwɛso kyerɛ nhwɛso ne akwan horow. Ɔka gua no fã ahorow ho asɛm, ɔka asɛmti a ɛfa asiane ho nhyehyɛe ho. https://asɛmti.opexflow.com/nhwehwɛmu-akwan-ne-nnwinnade/svechnye-formacii-v-tradinge.htm

Bollinger wɔ Bollinger Nnwontofo Kuw mu.John Bollinger.

Ɔkyerɛwfo no ne ɔyɛkyerɛfo no bɔfo, a ɛwɔ terminal biara mu. Wɔkamfo akenkan kyerɛ obiara a osi gyinae sɛ ɔde Bollinger Bands bedi dwuma. Hena na sɛ ɛnyɛ ɔkyerɛwfo no a, ɔbɛka nsɛm nketenkete a ɛwɔ application no mu ne nea ɛkyerɛ no kyerɛ ho asɛm.

“Fibonacci Aguadi Akwan Foforo”. Robert Fisher na ɔkyerɛwee

Ɔkyerɛwfo no de ɔkwan foforo a wɔfa so de adwinnade bi a agye din di dwuma ho nyansahyɛ ma. Nhoma no hwehwɛ adwene no mu ade titiriw mu na ɛda ne ntease a mfaso wɔ so adi.

“Encyclopedia a edi mũ a ɛfa Chart Price Patterns ho”. Thomas N. Bulkovsky na ɔkyerɛwee

Mfiridwuma mu nhwehwɛmu a wɔagye din no, afeha a ɛto so 21 mfiase no mu aguadifo a wɔagye din pii suaa ade fii nhoma yi mu. Ɛwɔ nsusuwii ho nsɛm a edi mũ sen biara a ɛfa mfoniniyɛ nhwɛso ahorow ho. Nhoma no de aguadi ho akontaabu kyerɛ, ɛkyerɛkyerɛ mfaso ne ɔhaw ahorow a ɛwɔ nhwɛso no mu. Nhoma no bɛyɛ nea mfaso wɔ so sɛ wɔbɛkenkan akyerɛ ankorankoro a wɔde wɔn sika hyɛ mu ne wɔn a wɔde wɔn sika hyɛ nneɛma mu. Ɛnyɛ sɛ wɔde bedi dwuma mpo, sɛnea ɛfa nkɔso a ɛkɔ akyiri ho no.

“Aguadi ne Oduruyɛfo Ɔpanyin: Encyclopedia a ɛfa Stock Game ho” Ɔpanyin Alexander

Ɔkyerɛwfo no yɛ mfiridwuma mu nhwehwɛmu ho ɔbenfo a wagye din wɔ wiase nyinaa. Nhoma no kura ɔkyerɛwfo no suahu, ɛde tebea pɔtee bi mu nhwehwɛmu ma. Ɛho hia sɛ ɔkyerɛwfo no ka sɛnea wɔhyehyɛ aguadi na wɔde nsɛm fi mfomso ahorow mu ba awiei. Deal diaries kyerɛ sɛnea ɔkyerɛwfo no adwene kɔ so na ɛma wutumi di nea ɛkɔ soro ne nea ɛba fam no akyi. Wɔ nhoma no awiei no sɔhwɛ bi wɔ hɔ a mmuae ahorow wom a ɛbɛboa wo ma woate ase sɛ ɔkenkanfo no ayɛ krado ama aguadi anaa.