The article was created based on a series of posts from the OpexBot Telegram channel , supplemented by the author’s vision and the opinion of the AI. Today we will discuss the most important topic: “psychologists of trading and the trader”, about emotions, passion and greed, different approaches, real practical examples and historical parallels. A little theory and a lot of interesting facts about how psychology affects the (un)success of a trader on the stock exchange. So, about the psychology of trading, how to get rid of emotions in trading, fear, greed, passion and other weaknesses of a trader.

- Psychology of trading and the emotional component of trading in the markets

- A gambler will not become a good trader, as passion kills the chances of success

- The market is like a casino, the trader is like a player: the road to nowhere

- Algotrader and gambling trader: two approaches, two destinies

- Emotions are the enemy of a trader

- Three quotes about a trader’s cool head from Charles Munger that are important for a trader to know

- Remember trader – emotional crisis and recovery is not the time for trading!

- If you don’t manage your emotions, you don’t manage your money, or why you shouldn’t be fooled by the crowd’s opinions

Psychology of trading and the emotional component of trading in the markets

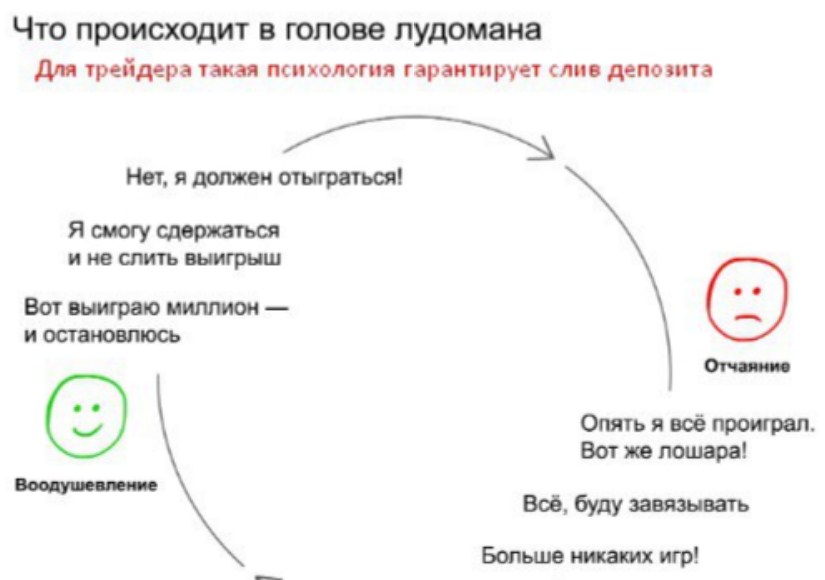

Trading psychology plays a huge role in the world of financial markets. When it comes to trading, it is not only about knowledge of skills and market analysis, but also the ability to control your emotions. One of the most common psychological aspects of trading is the gambling trader . A gambling trader is a person who, instead of a rational and analytical approach, is based on emotions and excitement. He seeks quick gains and the excitement of rapid changes in the market. For a gambling trader, emotions often become the main driver of his decisions. He may feel euphoric from success, which can lead to overconfidence and uncontrollable risks. At the same time, he may experience fear, panic and disappointment in the event of failures and losses. The main problem of a gambling trader is his unpredictability and inconsistency in decision making. Instead of following a strategy and a sound plan, a gambling trader will react to various emotional impulses, which can lead to losses and dissatisfaction. However, overcoming gambling behavior and emotional influences is a key factor in trading success. This requires developing skills of self-reflection and self-discipline. A trader must understand what emotions influence his decisions and learn to control them. This can be achieved in various ways, such as planning trading operations with clear rules, using stop losses, regular meditation practices, or consulting a psychologist. Trading is a process that requires the ability to think rationally and make informed decisions. Trading psychology and managing emotions play a key role in achieving success in the market. A gambling trader can overcome his negative emotions and become a more aware and successful trader if he is willing to invest time and effort in developing his psychological skills.

For a gambling trader, emotions often become the main driver of his decisions. He may feel euphoric from success, which can lead to overconfidence and uncontrollable risks. At the same time, he may experience fear, panic and disappointment in the event of failures and losses. The main problem of a gambling trader is his unpredictability and inconsistency in decision making. Instead of following a strategy and a sound plan, a gambling trader will react to various emotional impulses, which can lead to losses and dissatisfaction. However, overcoming gambling behavior and emotional influences is a key factor in trading success. This requires developing skills of self-reflection and self-discipline. A trader must understand what emotions influence his decisions and learn to control them. This can be achieved in various ways, such as planning trading operations with clear rules, using stop losses, regular meditation practices, or consulting a psychologist. Trading is a process that requires the ability to think rationally and make informed decisions. Trading psychology and managing emotions play a key role in achieving success in the market. A gambling trader can overcome his negative emotions and become a more aware and successful trader if he is willing to invest time and effort in developing his psychological skills.

A gambler will not become a good trader, as passion kills the chances of success

A gambling trader will lose with a high degree of probability – Yes. Why? It’s all about the player’s psychology. A gambler always strives to be in the game, which is suicidal on the stock exchange. Thus, professional traders trade no more than 2-3 hours a day, spending the rest of the time analyzing, observing and studying the market and information field. “One of the best rules that everyone should learn is to do nothing, absolutely nothing, until there is something to do. Most people (not because I consider myself better than most) want to always be in the game, they always want something do”. – Jim RogersFor a gambler, trading is a hunt, where he thinks that he is a hunter, although he is the one being hunted. Ludomaniacs are accustomed to risk, and trading is an activity that directly pushes them towards this. Here, profitability and loss indicators directly depend on the risk taken. The higher the risk, the higher the potential, but miracles do not happen, the higher the risk of losing everything. A gambler is always haunted by vivid emotions – fear, greed, euphoria. A successful trader clearly knows his system and adjusts it consciously, and not based on deal to deal.

Trading should be a boring but profitable activity.

The market is like a casino, the trader is like a player: the road to nowhere

Let’s continue about the excitement in trading. The story of trader Omar Geas. He made $1.5 million trading stocks using high leverage. In parallel with the increase in income, the number of sports bets, casino nights, women and cars increased. Income grew, but expenses grew even faster. The party ended unexpectedly. Money too. The biggest revelation from this story was Geass’s confession: “I really started to treat the market like a casino.” “I’m starting from scratch,” Mr. Geas, 25, said. He has a chance. The trader works with probability, and the player wanks and has fun. For the time being.

Algotrader and gambling trader: two approaches, two destinies

Ed Seykota was one of the first to use the program to test his trading ideas. One of the successes: I increased my deposit from $5,000 to $15 million, thanks to my own computer system for trading on futures markets. When developing my own trading strategy, I relied on a long-term trend, analysis of current graphical models and selection of points for entering/exiting a transaction. Now he spends only a few minutes on trading; the robot does most of the work. Ed Seykota: “Risk an amount that you can afford to lose and that will also be enough to make the gain meaningful to you.”One of these robots is Opexbot, registration is possible right now.

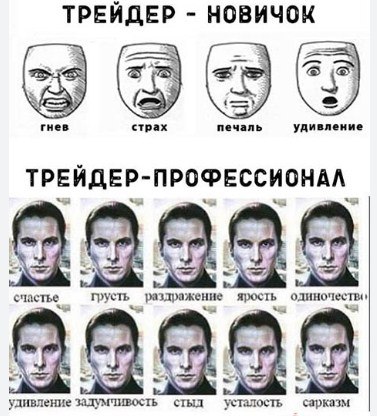

Emotions are the enemy of a trader

Trading decisions that are made on emotions are almost always wrong. This is the main idea that I want to convey to you today. People are always psychology and emotions. This means people can be manipulated. This is what traders who know how to control themselves primarily do. These are, most often, traders who trade strictly according to a strategy, no matter what happens (there are up to 10-15% of them). It’s true that this is already becoming a thing of the past. Many have long used algorithmic trading to reduce the human factor. Unfortunately, it is not yet possible to exclude it completely. But this is for now. What can I advise to those who have not yet switched to trading automation?

STOP! Stop, don’t trade, if thoughts flash through your mind: fear of loss, not enough, I want more, what have I done, I missed a profitable entry point… it’s better to sit on the fence than to miss the moment of going on tilt.

Three quotes about a trader’s cool head from Charles Munger that are important for a trader to know

1. “You have to force yourself to consider opposing arguments. Especially when they challenge your favorite ideas.” This quote from Charles Munger is extremely important for a trader who is on the stock exchange to make money, not to play games. Key factor to consider before making a “100% bid”. It’s about the ability to look at your trading from the outside. About the ability to challenge yourself and break out of the usual paradigm. “Forgetting your mistakes is a terrible mistake if you want to improve your understanding. Applicable to trading – without analyzing and taking into account your successes and failures in the market, without making adjustments to the trading system, you should not expect progress on the exchange. Without doing anything new, you cannot We should expect new results.” “I say that a certain temperament is more important than brains. You need to keep unbridled irrational emotions under control. An emotional trader is a disaster for the family. In a market where chaos rules, only a cool head and a system will help you be profitable. Not emotional decisions on a hot head” .

Remember trader – emotional crisis and recovery is not the time for trading!

As I said above, if you are driven by emotions, it is better not to even launch the terminal. Enter into trades only if you are in a balanced state, your head is clear of thoughts other than work. This applies to both a bad mood and an overly elated one. An ideal trading system, smooth and understandable money management, dozens of books read, all this goes to waste if you have a divorce, the birth of a child, or buying a car. Dr. Van Tharp divided the trading process into three categories that influence traders, the importance in his opinion is as follows: Trading strategy (10%). Capital management (30%). Psychology (60%).

My advice: trade only in the zone of emotional balance, or trust everything to the algorithms and do not interfere!

If you don’t manage your emotions, you don’t manage your money, or why you shouldn’t be fooled by the crowd’s opinions

Be afraid to invest when others are greedy and buying everything, and vice versa. This is the most sensible advice and the hardest for most people to follow. Most people become greedy when others are greedy and fearful when others are fearful. Thus, many investors fell into a depressed investing mode and were unable to buy stocks after Covid-19 began in 2020. During the worst of the panic, stocks fell 10% per day. The market fell 50% before recovering. Few people wanted to enter the market at the bottom, fearing that the market would fall further. And after just three or four months, when the market began to recover, investors returned. Those who dared to play near the bottom won.