What is a passive and active approach to investing, where to start active and passive investing, the pros and cons of each method. In a market economy, there are several options that help individuals preserve and increase capital. In addition to receiving a salary for hired labor, or profit from running your business, you can increase your income by passive or active investment. What is it, what financial instruments should be used and what are the advantages of passive and active investing, we will tell in this article.

- What is passive investing

- What is active investment

- What financial instruments create passive income

- Deposits

- Real estate

- Bonds

- Exchange-traded funds

- Dividend shares

- Tools for active investment

- Pros and cons of each type of investment

- Active investment

- Passive Investing

- Which investment option is right for you: active or passive

What is passive investing

Passive investing is the formation of a portfolio of various securities for a long period of time. Passive investing differs from other types of financial investments in that it takes less time and effort to make a profit with this type of investment. If we compare passive investment with active investment, then in the second case, a fundamental analysis of the market is required, and in the first case, such work is not a prerequisite. Here, the investor only has to choose the right instrument, perform the distribution of securities according to various parameters and wait for the earnings to be received. With passive investment, the investor receives income, which will bear the same name – passive. The whole point of the strategy of such earnings lies in the formation by the investor of a block of shares, which in the future will bring considerable monetary profit. If the portfolio is formed correctly, the risks of losses will be minimized. Over a long period, the stocks that have grown will be able to cover the drawdown of other securities. Choosing passive investment – pros and cons: https://youtu.be/N7iOSQG4hz0

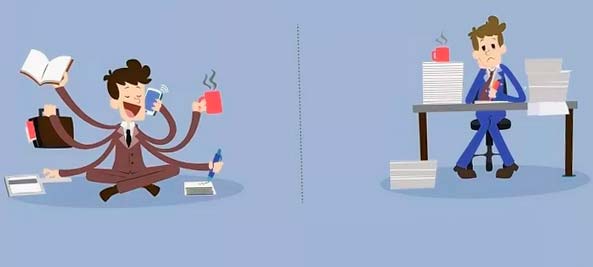

What is active investment

Active investment is a way of investing money, in which the responsibility for exploring investment options and making decisions on managing their own investment portfolio lies with the investor himself. As a rule, active investment is accompanied by certain risks. But with this type of investment, profit can be obtained much faster than in the case of passive income. An active investor can make a profit only with the help of his own knowledge, skills, efforts and time. For example, when acquiring shares in a particular business, it is important to carefully study the market and economics of the organization in order to understand the opportunities for the prospects for increasing the value of the shares.

What financial instruments create passive income

Investments that have a fixed income are investments in assets where the amount of income will be known in advance. It is this passive investment that allows you to receive passive income.

Deposits

Deposits in banking institutions bring investors passive income, which is calculated as a percentage. The payment of the amount of interest occurs at the expense of the profit received by the bank for providing loans, selling currencies, securities, etc. Most often, deposit rates are slightly higher when compared with official inflation. Therefore, this type of deposit is suitable for those investors who wish to keep their funds from depreciation.

Real estate

Investing in real estate is another option for saving money and getting a permanent passive income. Real estate is constantly increasing in value. Among other things, it can be rented out. You can invest in both residential and commercial properties. The amount of income from such investments directly depends on the attractiveness of the property for buyers and tenants. To make an investment, you need to purchase an apartment, house or commercial facility, and then rent it out and receive income. There is another method of investing in real estate: the purchase of shares of closed-end funds.

Bonds

A bond is a security, an IOU of a company or government. When buying a bond, an investor lends his funds for a specific period, and then receives a fixed percentage for this – a coupon income. After the expiration of the term, the invested funds are returned back to the investor. Bonds with minimized risks and constant income are federal loan bonds. With this type of investment, the depositor is guaranteed to receive a loan repayment, since the guarantees are given by the state. Corporate bonds include bonds of developers, car manufacturers, etc. As a rule, they offer profits of up to nine percent. But it is important to understand that with this type of investment there are certain risks – the company may simply go bankrupt and not pay the debt.

Exchange-traded funds

ETFs are a great opportunity to start your career for new investors. This method is suitable for those who want to start investing, but do not yet know how to do it and where to start their journey. Transactions on the stock exchanges are carried out by professionals, and investors simply receive income. The creation of exchange-traded funds is carried out by management companies: they collect low-risk investment portfolios, and private investors acquire a stake in a mutual fund (

mutual investment fund ).

Dividend shares

When buying a share, the investor receives ownership of a part of the company’s property and the right to dividends from profits if the issuer pays them. However, it is important to understand that investing in stocks is risky. This is due to the constant change in their value. It is impossible to accurately determine the yield on these securities.

Tools for active investment

To actively invest, you can:

- trade stocks on the market through brokers;

- create your own business;

- buy a franchise business;

- invest in promising startups.

Among other things, an investor can purchase bonds and make a profit from them.

Pros and cons of each type of investment

Consider the positive and negative sides of each of these types of investment.

Active investment

Pros:

- Substantial potential profit . The main goal of active investors is to beat the stock market. The method involves making large amounts when the market is up and losing smaller ones.

- Great flexibility . Whether an investor manages their own money on their own or works with an active managerial capital, there will always be more flexibility with active investing. The depositor has the opportunity to transfer funds to specific sectors of the economy, taking into account the current financial environment;

- A large number of investment opportunities .

Of course, active investing also has its significant drawbacks:

- high potential risks;

- increased costs.

Among other things, active investment requires more effort. Here you need to constantly follow the news of the economy and the market, study investment methods, etc. At the same time, the investor will not receive any guarantees that this will bear fruit.

Passive Investing

Pros of passive investing:

- Making a profit is much easier . Active investors must constantly monitor business and market news, as well as regularly conduct a certain number of transactions in their portfolio on their own. Active investing takes a very long time to trade, while passive investors only spend a couple of hours each year maintaining their investments;

- Minimized risks . Active investors are at great risk of selling their investments at the wrong time or buying them when the market is at its peak. In passive investing, investors acquire investments and hold them for themselves. Passive investors do not have to worry about selling their investments at the wrong time, because they can count on a steady increase in the long term;

- Cheaper form of investment . Passive investors do not pay transaction fees that active investors regularly pay. Passive traders can store their funds in index funds, which typically charge around 0.10%, and sometimes less. Even passive investment traders who do their work with investment managers often pay less commissions than those who do business with active investment managers.

- The profit is much lower compared to active investing . Passive traders most often try to follow the market, not outperform it. Experienced players who make trades regularly can determine the market growth, thanks to which they earn large sums. Passive investing usually earns an average return.

- There is no protection against short – term market drops . In passive investing, traders do not sell positions before the stock falls in value. They are usually glad that they are experiencing the ups and downs of the market.

A passive approach to investing can be especially difficult to maintain when the economic news gets bleaker, the value starts to drop as active traders bail out and the desire to take action grows stronger. Active or passive investments: what is the difference – https://youtu.be/K8kwYb8XYFA

Which investment option is right for you: active or passive

What type of investment to choose – everyone must decide for themselves. On the side of passive investing is that the investor will be able to get a guaranteed market return (of course, minus minor commissions and taxes) and the investment itself will not require a lot of time. If we talk about active investing, in theory a trader has the opportunity to overtake the market, but the chance of making a good profit in the long term is very small. Among other things, active traders need to spend a lot of time studying the analysis of stocks and this will not end there – throughout the process, regular and constant analysis of securities will be required. Of course, not everyone can do this. Most likely, such a strategy is suitable for people who can analyze and strive to learn something new. Until now, you can see a lot of controversy about passive and active investing. But it is important to understand that the ultimate goal of any trader is not to outperform the market, but to achieve a financial goal. At the same time, it is not necessary to compete with the market.