When you hear the phrase “trading robot”, what do you think about? Probably about a rectangular or square machine that sells various goods.

Main types of trading robots

All programs are divided by type of activity and profitability. In the first case, these are automatic and semi-automatic options. What is their difference is clear from the name. Automatic do everything – from finding deals to closing – on their own for a person. Semi-automatic act as an assistant – they analyze, offer options and make recommendations. By profitability, trading robots are divided into low-frequency, medium-frequency and high-frequency ones. The difference between them lies in the number of trades over a period of time, profitability and risk. For low-frequency, the normal indicator is ten transactions per month with a yield of no more than fifty percent per year. For medium-frequency ones, there are already several dozen a day, and the yield varies from fifty-one to two hundred percent. We need to talk about high-frequency trading robots in more detail, because they are so unique and special that a separate investment direction was created for them – high-frequency trading or HFT.

An interesting fact is that semi-automatic high-frequency trading robots do not exist, since a person is not able to process all the information coming from them.

I think if you are familiar with investing, you have already understood about the risks of each type. At low frequencies, they will be minimal. In the mid-range, respectively, the average. And the high frequencies are huge. Here is a brief explanatory tablet, for greater clarity:

| Bot type for trading | What is he doing | Deals per day | Risk | Annual return |

| Semi-automatic low frequency | Analyzes the market once a week and gives general recommendations | <10 | Minimum | <50% |

| Automatic low frequency | Buys or sells only low-risk stocks several times a month | |||

| Semi-automatic midrange | Analyzes the market several times a day | >10 | Medium, but may be affected by high-risk stocks | From 51% to 200% |

| Auto midrange | Buys or sells both low-risk and high-risk stocks several times a day | |||

| Automatic high frequency | Makes dozens of trades per minute only with high-risk stocks | >1000 | Extremely high | >201% |

Important! The table shows approximate values only for correctly configured and working trading robots without taking into account unique options. For example, a medium-frequency trading robot may have a return of more than 200%, but most fit into this framework. And many high-frequency ones often have negative returns, but only because they did not initially work in the right direction.

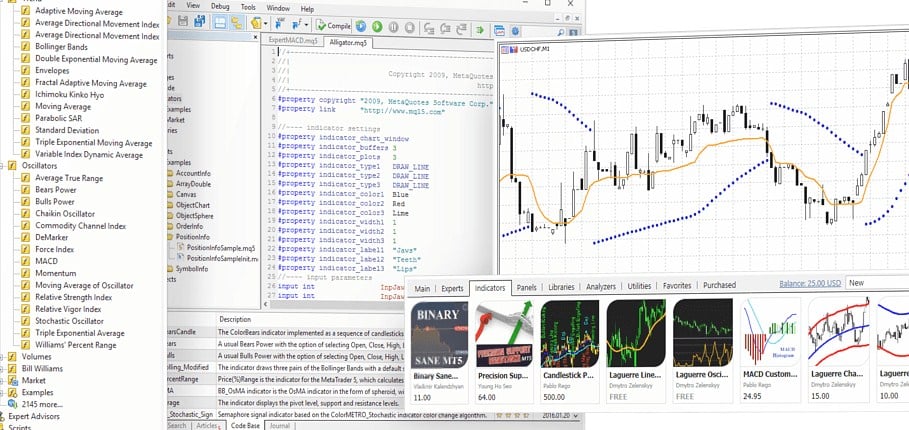

How the trading bot works

For greater clarity, hereinafter the trading robot will be called not a program, but an algorithm. This is important, since at the present time they are almost never written from scratch, but created on the basis of existing solutions. Therefore, we will not analyze a specific program, but the principle of operation itself. So, the algorithm of the trading robot operates according to a clearly written trading strategy – the rules for opening, maintaining and closing transactions are set. Thanks to this, the human factor and emotions are completely excluded. True, one critical minus follows from this, but more on that later. It is very easy to define a trading robot – it makes a huge number of transactions in a minimum period of time. Let’s take the data from the “Best Private Investor” contest for the fall of 2021. In second place we see a contestant under the nickname “Flomaster” with 222 transactions, but in the first place “perfection” with 10491 transactions.

Reasons Why Public Trading Robots Will Never Make You a Millionaire

At this point, we will not touch on offers from large companies and banks (Sberbank, Alfa-Bank, and so on). Most likely, with the help of their trading robots, you can really earn money, but you can open a regular deposit with the same profitability. But various high-frequency Forex trading robots are another matter.

What’s good in theory is bad in practice.

It’s great when you were offered to buy a trading bot with a 1000% return. It’s great when you have proven its performance on a test account. Impossible when with 1000 thousand rubles he made you millions. Why is it impossible? Everything is quite simple and prosaic. When the creators come up with their own trading robots, they do not have the opportunity to test them in practice until the launch itself. That is, in theory, the shares of a company will go down, the algorithm will see this and buy, and then they will go up, and it will sell them. But in practice, will stocks really go up? What if they continue to decline? The robot cannot act outside the program code. Consequently, he cannot navigate in stressful situations. And this means that sooner or later he will lose everything. The solution to the problem exists – private bots customized for themselves.

Is there enough money?

Suppose you have a public bot. How much money should be in the account for a profit of a million rubles per month? A lot. Simple math. You have one hundred shares worth one hundred rubles. If these stocks doubled, then your return is one hundred percent. It sounds great, but instead of ten thousand rubles, you now have twenty thousand rubles. In order for you to make a million from these shares, they must grow a hundred times, that is, by ten thousand percent. As you understand, in the conditions of the real market it is simply impossible. Therefore, in order to make a big profit, you must initially have the funds to invest. If we go back to the “Best Private Investor” list, then even there the first place with a yield of 869% received a million from 143 thousand rubles. And to earn billions, you have to invest tens of millions. Therefore, if you have

Technical faults and correct settings

Trading robots, like any machine, algorithm or program, are not without technical problems. For example, you hosted everything on a virtual private server. But your client crashed and everything immediately stopped working. Another example is that the creator made a critical mistake while programming. For the first ten, one hundred, a thousand or more cycles, it is not detected. But sooner or later it will show itself and, for example, will start buying up all the shares at an inflated price, and selling them at a lower price. There are dozens of similar cases, but the main thing to understand is that the trading robot is not perfect, if you do nothing, it will always break.

In fact, if you are completely unfamiliar with investments and at least partially do not understand the operation of the algorithm, then there is a 99.9% chance that you will lose your money.

Karl Marx Capital. Briefly

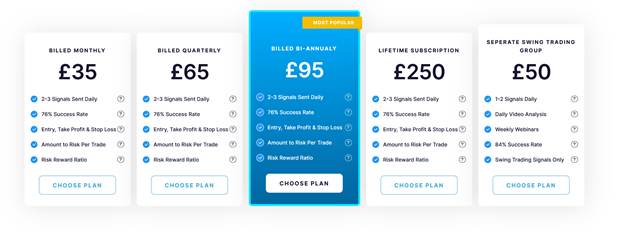

Let’s go to one of the popular sites for the sale of trading bots and look at the price. The most popular offer costs £95 or 9500 rubles. An acceptable price for untold riches.

Publicity

Here we come to the main reason for the failure of all public trading robots. And here everything is quite simple to explain. As long as you know the algorithm of work, the trading bot will function correctly, and the profitability will be really high. But as soon as other people find out about it, everything will go downhill. This is why no public bot will ever make you a millionaire. There is no magic button “Bablo” – behind a million-dollar profit there is always hard work and long education or rich parents.