What is a trailing stop, general concepts about Trailing Stop, why is it needed and where to place it, how to choose the right trailing stop, factors to consider when determining where to place a trailing stop. A trailing stop order can help stock traders who want to potentially follow the

trend while managing their exit strategy.

- What is trailing stop

- Why you need a trailing stop

- Why you need to use a trailing stop in practical trading on the stock exchange

- Trailing Stop Sell

- When to Use a Trailing Stop

- What are the risks of thoughtlessly placing stop orders

- Why the trailing stop is so important and how it works

- Where to look and how to set a trailing stop?

- When does the trailing stop start/stop working?

- Practical use case in a trending market

- Features of using a trailing stop

- Pros and cons of trailing stops

What is trailing stop

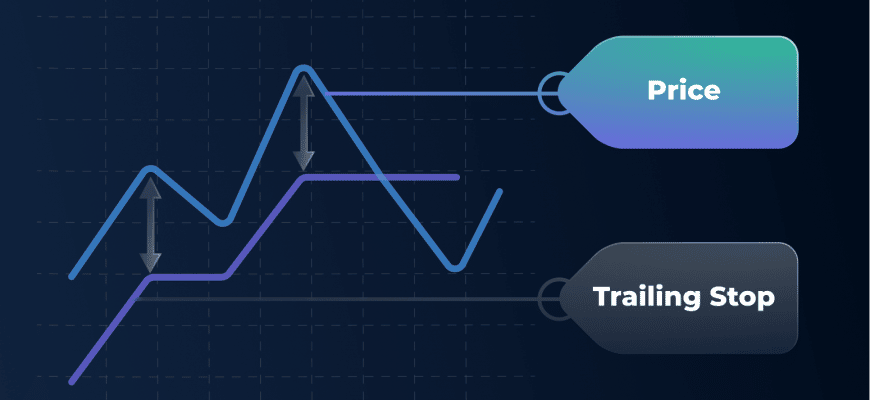

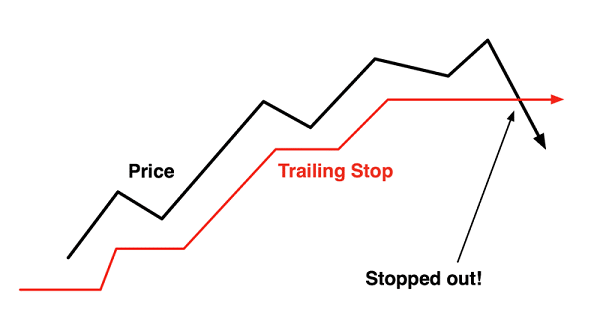

A trailing stop is an order placed on an asset that will cause it to sell automatically if its value moves up or down by a set percentage. It is more flexible than a

stop loss , as it allows the value of an asset to increase before any subsequent decline triggers a sale. Trailing stops allow a position to remain open while the price is moving in the right direction. The trailing stop has protection against very fast fluctuations.

Why you need a trailing stop

Trailing stops are a way to protect your income from trading securities by automatically placing a sell order if their value falls by a fixed percentage. However, this value will be applied to the market price, leaving the profit opportunity open.

Why you need to use a trailing stop in practical trading on the stock exchange

Trailing stops can provide effective ways to manage risk. Traders most often use them as part of a trade exit strategy.

Trailing Stop Sell

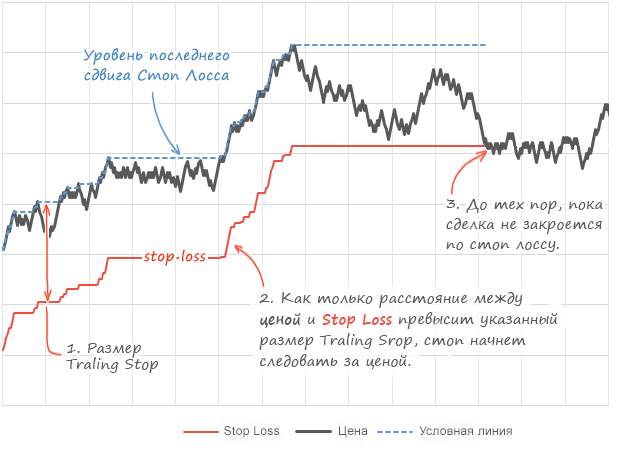

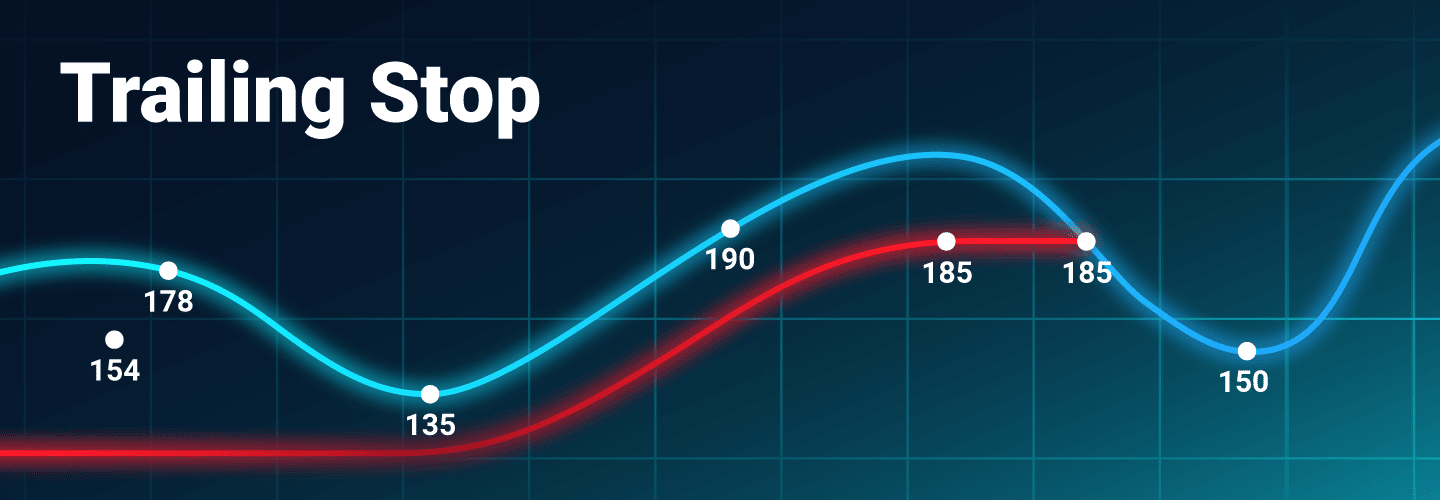

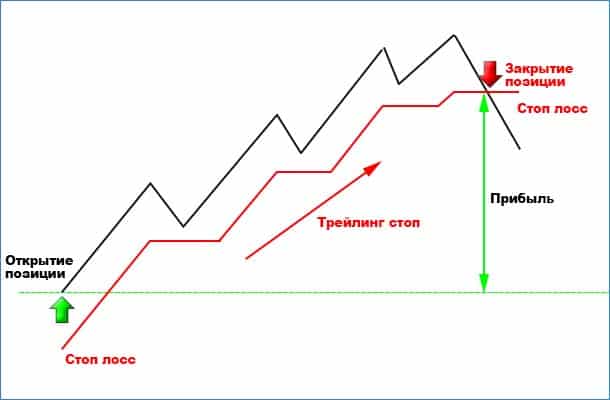

As the inside rate increases to new highs, the trigger price is recalculated based on the new high rate. The initial “high” is the inside rate when the trailing stop is first activated, so the “new” high will be the highest price the stock reaches above that initial value. As the price exceeds the initial bet, the trigger price resets to a new high. If the price stays the same, or falls from the original bid, or the highest subsequent high, the trailing stop maintains its current trigger price. If the cut price of the bet reaches or crosses the trigger price, the trailing stop triggers a market order to sell.

When to Use a Trailing Stop

The trailing stop can only be activated during the standard market session from 9:30 am to 4:00 pm. There will be no launch during extended hourly sessions, such as pre-market or off-hours sessions, or when the stock is not trading (eg, during a stock stop, or on weekends or market holidays).

What are the risks of thoughtlessly placing stop orders

Position management is essential in trading and it is necessary to understand the risks that can be faced when using a trailing stop:

- Trailing stops are vulnerable to price gaps , which can sometimes occur between trading sessions or during pauses. The strike price can be higher or lower than the trailing stop.

- Market closing . Trailing stops can only be triggered during a regular market session. If the market is closed for any reason, trailing stops will not be executed until the market reopens.

- When the market fluctuates , especially during periods of high trading volume, the price at which the order is filled may not be the same as the price at which the order was submitted for execution .

- Liquidity . It is possible to get different prices for parts of an order, especially for orders that include a large number of shares.

Why the trailing stop is so important and how it works

Before entering the market, it is important to make sure you have the right exit strategy in place. It is easy to maximize profits and minimize losses in one move. Too many people experience emotions from their investments. These are mistakes that cost a lot of money. Even investment legends like Warren Buffett are not always right. Trailing stop allows you to reduce risks. Here’s how it works. Suppose there is a stock trade at a price of $100. If the trailing stop is set at 25%, then the investor’s trailing stop will be 25% less than $100 or $75. If the shares fall to $75 at any time, they can be sold. However, that’s not all. Let’s say an investor’s shares rose to $200. As the stock reaches $125, $150, and $175, the trailing stop will increase.

Where to look and how to set a trailing stop?

A trailing stop is sometimes referred to as a “floating stop loss”. It can also be used as an auxiliary tool or as a standalone advisor. In the first case, it is provided as a script that is installed on the client terminal. Trailing stop works on the user’s trading terminal, and not on the server, like

stop loss and take profit. Alpari Broker offers clients advanced trading opportunities. The tool is already integrated into the MetaTrader 4 terminal and can be used at any time.

Important!

Choosing the right broker is one of the main keys to successful trading.

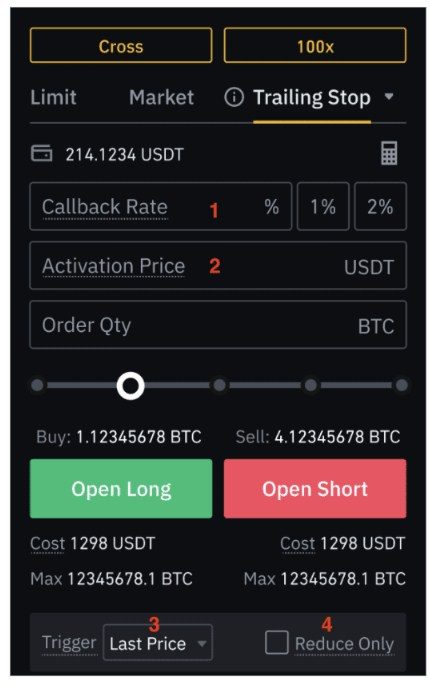

To set a trailing stop:

- Start a new trade. Click the “New order” button, set the currency pair and set the volume.

- Set a stop loss and enter into a buy trade. After that, a new position will appear on the chart.

- On the “Trade” tab, right-click and select “Trailing Stop”.

- Set size between 15 and 715 points.

When does the trailing stop start/stop working?

To activate a trailing stop, the order must be profitable for a certain number of points. This feature will only be available after this condition is met. If the trading terminal crashes, closes or the computer shuts down, the trailing stop is removed because it is not saved on the server. To avoid this, you can use the free Exness VPS service.

Practical use case in a trending market

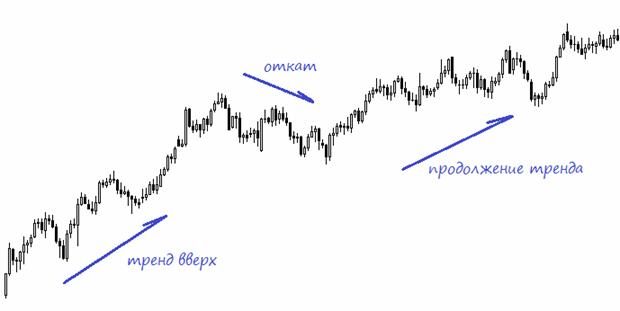

Any trend consists of rising highs and lows. This means that you can place a trailing stop below the boundary of each pullback (the low before the price move). When the stop is hit, it will mean that the trend has left the structure and is likely to stop or reverse.

Features of using a trailing stop

Without direction, price changes are cyclical. There are ups and downs. In an uptrend, the rise is longer than the fall, and in the case of a downtrend, the fall is longer than the rise. Moreover, long-term trends always have a “pullback”. This means that the trend can always reverse temporarily and return to its original direction.

Pros and cons of trailing stops

The main advantages of this tool are:

- Setting trailing stops can reduce the mental stress associated with constantly monitoring open positions.

- By automatically moving stop-loss orders into the profit zone, traders can (with the right use of this tool) minimize losses and increase potential profits.

Of course, there are also disadvantages, the most obvious of which are:

- The inflexibility is due only to the fact that the stop loss is drawn strictly at a fixed distance. On the one hand, this does not allow prices to move freely and may lead to premature closing of positions through stop losses (smaller trailing stop values). On the other hand, if the trailing stop is set too high, it can eventually (when the price reverses and hits the stop) eat up most of the paper profit.

- As mentioned above, trailing stops almost always require a trading platform with an uninterrupted internet connection.