Dɛn ne trailing stop, adwene a ɛwɔ hɔ nyinaa fa Trailing Stop ho, dɛn nti na ɛho hia ne baabi a wɔde besi, sɛnea wɔpaw trailing stop a ɛfata, nneɛma a ɛsɛ sɛ wususuw ho bere a worekyerɛ baabi a wode trailing stop besi. A trailing stop order betumi aboa stock aguadifo a wɔpɛ sɛ wobetumi adi

su no akyi bere a wɔrehwɛ wɔn exit strategy so no.

- Nea ɛyɛ trailing stop

- Nea enti a wuhia trailing stop

- Nea enti a ɛsɛ sɛ wode trailing stop di dwuma wɔ aguadi a mfaso wɔ so wɔ stock exchange no mu

- Trailing Gyae Tɔn

- Bere a Ɛsɛ sɛ Wɔde Trailing Stop Di Dwuma

- Dɛn ne asiane ahorow a ɛwɔ nneɛma a wɔde gyae nneɛma a wɔkra a wonsusuw ho no mu

- Nea enti a trailing stop no ho hia saa ne sɛnea ɛyɛ adwuma

- Ɛhe na wobɛhwɛ ne ɔkwan a wobɛfa so de gyinabea a edi akyi asi hɔ?

- Bere bɛn na trailing stop no fi ase/gyae adwumayɛ?

- Practical use case wɔ gua a ɛrekɔ so mu

- Nneɛma a ɛwɔ sɛnea wɔde trailing stop di dwuma mu

- Mfaso ne ɔhaw ahorow a ɛwɔ trailing stops so

Nea ɛyɛ trailing stop

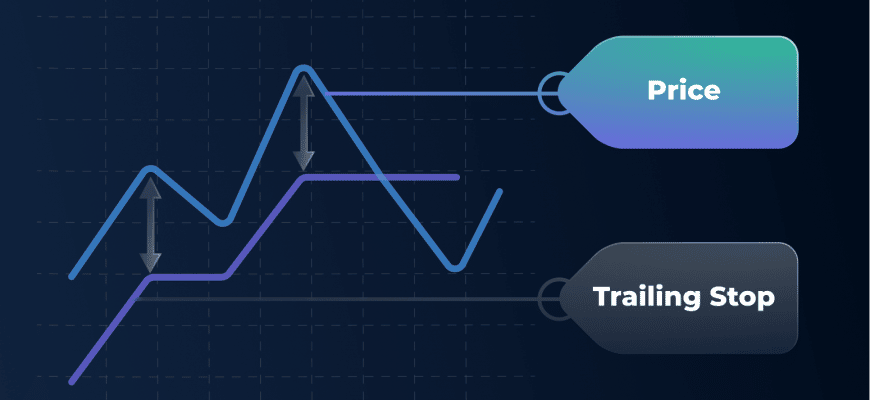

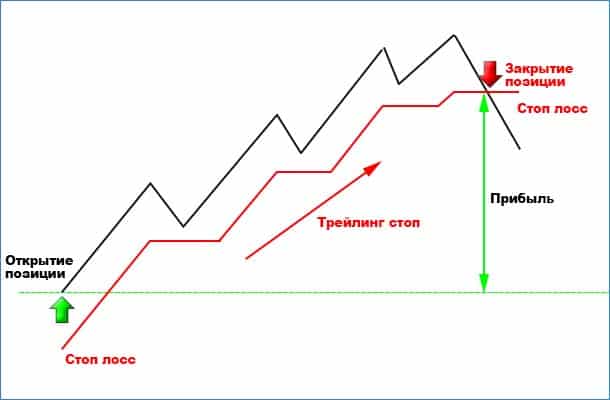

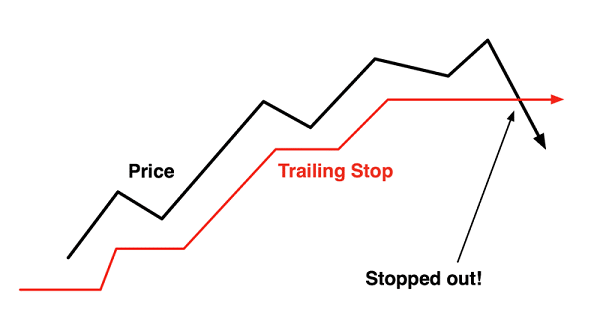

Trailing stop yɛ ahyɛde a wɔde ma agyapade bi a ɛbɛma atɔn ne ho sɛ ne bo kɔ soro anaasɛ ɛkɔ fam ɔha biara mu nkyem a wɔahyɛ ato hɔ a. Ɛyɛ nea wotumi sesa mu sen

stop loss , efisɛ ɛma agyapade bi bo kɔ soro ansa na biribiara a ɛbɛkɔ fam akyiri yi no ama wɔatɔn no. Trailing stops ma gyinabea bi kɔ so bue bere a bo no rekɔ ɔkwan pa so no. Trailing stop no wɔ ahobammɔ fi nsakrae a ɛba ntɛmntɛm yiye ho.

Nea enti a wuhia trailing stop

Trailing stops yɛ ɔkwan a wobɛfa so abɔ wo sika ho ban afi securities ho aguadi ho denam sell order a wode bɛma ankasa sɛ wɔn bo so tew ɔha biara mu nkyem a wɔahyɛ ato hɔ a. Nanso, wɔde saa bo yi bedi dwuma wɔ gua so bo no so, na ama mfaso hokwan no abue.

Nea enti a ɛsɛ sɛ wode trailing stop di dwuma wɔ aguadi a mfaso wɔ so wɔ stock exchange no mu

Nneɛma a wɔde gyina akyi no betumi ama wɔanya akwan a etu mpɔn a wɔbɛfa so adi asiane ho dwuma. Aguadifo taa de di dwuma sɛ aguadi kwan a wɔfa so fi mu no fã.

Trailing Gyae Tɔn

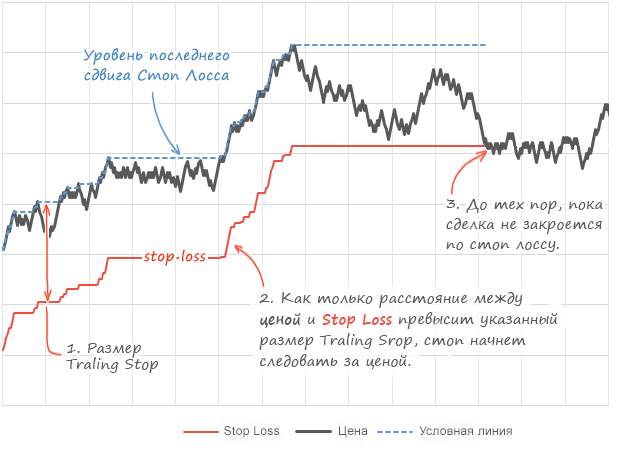

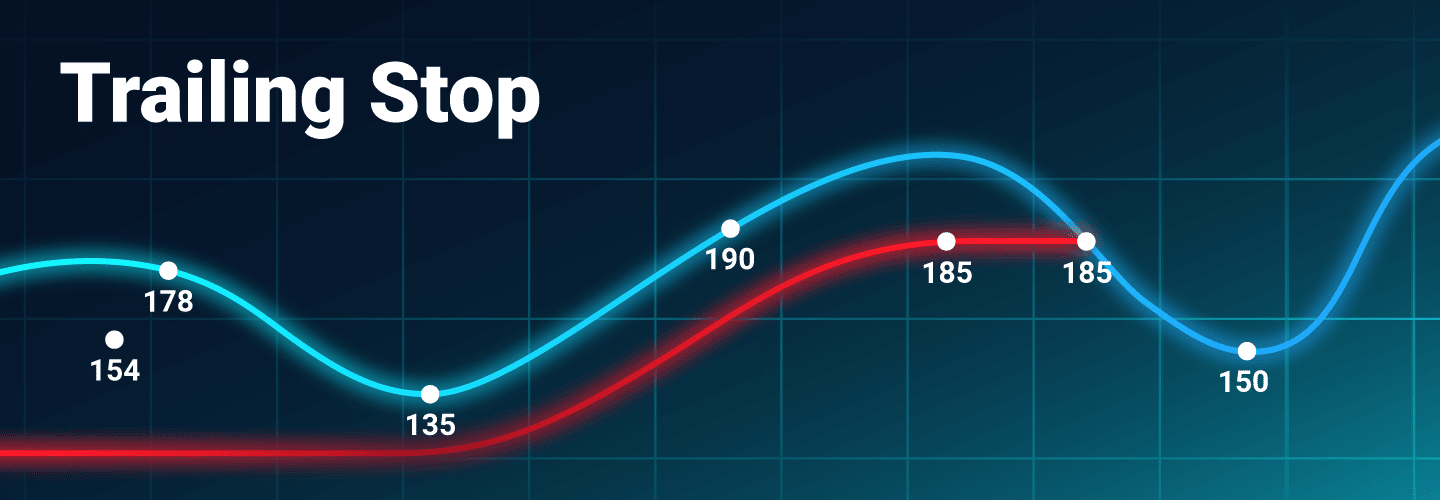

Bere a emu dodow no kɔ soro kodu soro foforo no, wɔsan bu bo a ɛkanyan no no ho akontaa gyina dodow a ɛkorɔn foforo no so. Mfiase “a ɛkorɔn” no yɛ emu dodow bere a edi kan a wɔde gyinabea a edi akyi no yɛ adwuma, enti “foforo” a ɛkorɔn no bɛyɛ bo a ɛkorɔn sen biara a stock no bedu ho a ɛboro saa bo a edi kan no so. Bere a bo no boro kyakyatow a edi kan no so no, bo a ɛkanyan no no san kɔ soro foforo. Sɛ bo no kɔ so yɛ nea ɛte saa ara, anaasɛ ɛba fam fi nea wɔde too gua mfiase no so, anaasɛ nea ɛkorɔn sen biara a edi hɔ a ɛkɔ soro no a, gyinabea a edi akyi no kura ne mprempren bo a ɛkanyan no no mu. Sɛ bet no bo a wɔatwa no du anaasɛ ɛtwa trigger price no a, trailing stop no kanyan gua so ahyɛde sɛ wɔntɔn.

Bere a Ɛsɛ sɛ Wɔde Trailing Stop Di Dwuma

Wobetumi de gyinabea a edi akyi no ayɛ adwuma wɔ gua so nhyiam a wɔtaa yɛ no mu nkutoo fi anɔpa 9:30 kosi anwummere 4:00. Wɔrenhyɛ aseɛ wɔ dɔnhwerew biara nhyiamu a wɔatrɛ mu, te sɛ pre-market anaa off-hours sessions, anaa berɛ a stock no nnyɛ adwuma (sɛ nhwɛsoɔ no, wɔ stock gyinabea, anaa dapɛn awiei anaa gua so nnapɔnna mu).

Dɛn ne asiane ahorow a ɛwɔ nneɛma a wɔde gyae nneɛma a wɔkra a wonsusuw ho no mu

Position management ho hia wɔ aguadi mu na ɛho hia sɛ wote asiane ahorow a wobetumi ahyia bere a wode trailing stop redi dwuma no ase:

- Trailing stops are vulnerable to price gaps , a ɛtɔ mmere bi a ebetumi aba wɔ aguadi nhyiam ahorow ntam anaasɛ bere a wogyina hɔ ahome no. Strike bo no betumi akɔ soro anaasɛ ɛba fam asen trailing stop no.

- Guadidan a wɔbɛto mu . Wobetumi ahyɛ akyigyina gyinabea ahorow ase wɔ gua so nhyiam a wɔyɛ no daa mu nkutoo. Sɛ wɔto gua no mu esiane biribi nti a, wɔrenyɛ trailing stops no kosi sɛ wobebue gua no bio.

- Sɛ gua no sesa , titiriw wɔ mmere a aguadi dɔɔso wom mu a, ebia bo a wɔde hyɛ ahyɛde no ma no ne bo a wɔde ahyɛde no kɔe sɛ wɔmfa nni dwuma no rennyɛ pɛ .

- Nsu a wɔde yɛ adwuma . Wubetumi anya bo ahorow ama nneɛma a wɔkra no afã horow, titiriw wɔ nneɛma a wɔkra a kyɛfa dodow bi ka ho no ho.

Nea enti a trailing stop no ho hia saa ne sɛnea ɛyɛ adwuma

Ansa na wobɛkɔ gua so no, ɛho hia sɛ wohwɛ hu sɛ wowɔ ɔkwan a ɛfata a wobɛfa so afi mu. Ɛnyɛ den sɛ wubenya mfaso kɛse na woatew adehwere so wɔ adeyɛ biako mu. Nnipa pii dodo nya nkate ahorow fi wɔn sika a wɔde ahyɛ mu no mu. Eyinom yɛ mfomso ahorow a ɛma wogye sika pii. Sikasɛm mu anansesɛm ahorow te sɛ Warren Buffett mpo nyɛ nea ɛteɛ bere nyinaa. Trailing stop ma wutumi tew asiane ahorow so. Sɛnea ɛyɛ adwuma ni. Fa no sɛ stock aguadi bi wɔ hɔ a ne bo yɛ dɔla 100. Sɛ wɔde trailing stop no si 25% a, ɛnde investor no trailing stop no bɛyɛ 25% a ennu $100 anaa $75. Sɛ kyɛfa no so tew kodu $75 bere biara a, wobetumi atɔn. Nanso, ɛnyɛ ɛno ara ne no. Momma yɛnka sɛ obi a ɔde ne sika ahyɛ mu no kyɛfa kɔɔ soro koduu dɔla 200. Bere a stock no du $125, $150, ne $175 no, nea ɛbɛba akyi no bɛkɔ soro.

Ɛhe na wobɛhwɛ ne ɔkwan a wobɛfa so de gyinabea a edi akyi asi hɔ?

Ɛtɔ da bi a wɔfrɛ trailing stop sɛ “floating stop loss”. Wobetumi nso de adi dwuma sɛ adwinnade a ɛboa anaasɛ ɔfotufo a egyina hɔ ma ne ho. Wɔ nea edi kan no mu no, wɔde ama sɛ script a wɔde ahyɛ client terminal no so. Trailing stop yɛ adwuma wɔ ɔdefo no aguadi terminal so, na ɛnyɛ server no so, te sɛ

stop loss na gye mfaso. Alpari Broker ma adetɔfo nya aguadi hokwan ahorow a ɛkɔ anim. Wɔde adwinnade no ahyɛ MetaTrader 4 terminal no mu dedaw na wobetumi de adi dwuma bere biara.

Ɛhia!

Broker a ɔfata a wobɛpaw no yɛ nneɛma atitiriw a ɛma aguadi di yiye no mu biako.

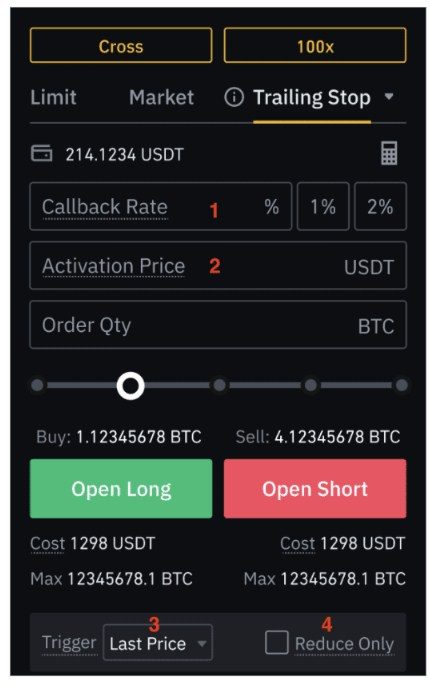

Sɛ wopɛ sɛ wode gyinabea a edi akyi besi hɔ a:

- Fi ase yɛ aguadi foforo. Klik “New order” button no so, hyehyɛ sika pair no na hyehyɛ volume no.

- Fa stop loss si hɔ na hyɛn buy trade mu. Ɛno akyi no, gyinabea foforo bɛda adi wɔ nhyehyɛe no so.

- Wɔ “Trade” tab no so no, klik nifa so na paw “Trailing Stop”.

- Fa kɛse si nsɛntitiriw 15 kosi 715 ntam.

Bere bɛn na trailing stop no fi ase/gyae adwumayɛ?

Sɛ wobɛma trailing stop ayɛ adwuma a, ɛsɛ sɛ order no yɛ nea mfaso wɔ so ma nsɛntitiriw dodow bi. Saa ade yi bɛba bere a wɔadi saa tebea yi ho dwuma akyi nkutoo. Sɛ aguadi terminal no bɔ, ɛto mu anaasɛ kɔmputa no to mu a, woyi trailing stop no fi hɔ efisɛ wɔmfa nsie wɔ server no so. Sɛnea ɛbɛyɛ a wobɛkwati eyi no, wubetumi de Exness VPS dwumadie a wontua hwee no adi dwuma.

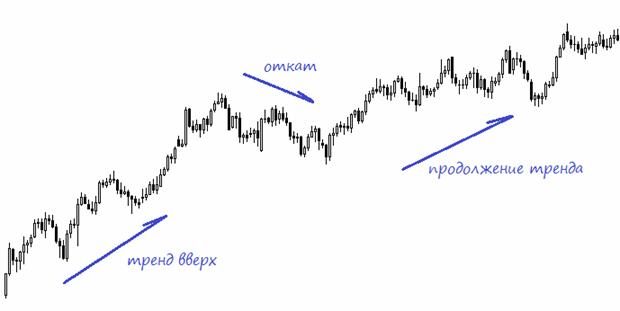

Practical use case wɔ gua a ɛrekɔ so mu

Ade biara a ɛkɔ so no yɛ nea ɛkɔ soro ne nea ɛba fam a ɛkɔ soro. Wei kyerɛ sɛ wobɛtumi de trailing stop ahyɛ pullback biara hyeɛ ase (nea ɛba fam ansa na ɛboɔ no akɔ). Sɛ wɔbɔ gyinabea no a, ɛbɛkyerɛ sɛ su no afi nhyehyɛe no mu na ɛda adi sɛ ebegyae anaasɛ ɛbɛsan akɔ akyi.

Nneɛma a ɛwɔ sɛnea wɔde trailing stop di dwuma mu

Sɛ akwankyerɛ nni hɔ a, nneɛma bo mu nsakrae yɛ nea ɛkɔ so kyinhyia. Nneɛma a ɛkɔ soro ne nea ɛba fam wɔ hɔ. Wɔ nkɔso a ɛkɔ soro mu no, nkɔanim no kyɛ sen asehwe no, na sɛ ɛba fam a, asehwe no kyɛ sen nkɔanim no. Bio nso, nneɛma a ɛkɔ so bere tenten no wɔ “pullback” bere nyinaa. Eyi kyerɛ sɛ bere nyinaa su no betumi asan aba bere tiaa bi na asan akɔ ne mfitiase kwan no so.

Mfaso ne ɔhaw ahorow a ɛwɔ trailing stops so

Mfaso atitiriw a ɛwɔ saa adwinnade yi so ne:

- Sɛ wode gyinabea ahorow a edi akyi besisi hɔ a, ebetumi atew adwene mu nhyɛso a ɛbata gyinabea ahorow a wɔabue a wɔhwɛ so bere nyinaa no so.

- Ɛdenam ahyɛde ahorow a ɛbɛma wɔagyae adehwere no a wɔde bɛkɔ mfaso beae no ara kwa so no, aguadifo betumi (sɛ wɔde adwinnade yi di dwuma yiye a) atew nneɛma a wɔhwere no so na ama mfaso a wobetumi anya no akɔ soro.

Nokwarem no, nneɛma a enye nso wɔ hɔ, a nea ɛda adi kɛse ne:

- Nokwasɛm a ɛyɛ sɛ wɔtwe gyinabea a ɛyera no katee wɔ akyirikyiri a wɔahyɛ ato hɔ no nkutoo na ɛma wontumi nsakra no. Ɔkwan biako so no, eyi mma nneɛma bo nkɔ baabiara a ɛnyɛ den na ebetumi ama wɔato gyinabea ahorow no mu ntɛm denam stop losses (smaller trailing stop values) so. Ɔkwan foforo so no, sɛ wɔde gyinabea a edi akyi no si soro dodo a, awiei koraa no, ebetumi awe (bere a bo no dan ne ho na ɛbɔ gyinabea no) awe krataa so mfaso no fã kɛse no ara.

- Sɛnea yɛaka wɔ atifi hɔ no, ɛkame ayɛ sɛ bere nyinaa na trailing stops hwehwɛ sɛ wonya aguadibea a intanɛt nkitahodi a wontwa mu.