Menene tasha mai bin diddigi, ra’ayoyi gabaɗaya game da Tasha Trailing, me yasa ake buƙata da kuma inda za a sanya shi, yadda za a zaɓi madaidaiciyar tasha, abubuwan da za a yi la’akari da su lokacin tantance inda za a sanya tasha. Oda mai bibiyar tasha na iya taimakawa ƴan kasuwan hannun jari waɗanda ke son yuwuwar bin

yanayin yayin gudanar da dabarun ficewar su.

- Menene tasha

- Me yasa kuke buƙatar tasha

- Me yasa kuke buƙatar amfani da tasha a cikin ciniki mai amfani akan musayar hannun jari

- Trailing Dakatar da Siyar

- Lokacin Amfani da Tasha Tasha

- Menene haɗarin sanya odar tsayawa ba tare da tunani ba

- Me yasa tasha bin diddigin yana da mahimmanci da kuma yadda yake aiki

- Inda za a duba da yadda za a saita tasha?

- Yaushe tasha tasha zata fara/ daina aiki?

- Shari’ar amfani mai amfani a cikin kasuwa mai tasowa

- Siffofin amfani da tasha mai biyo baya

- Ribobi da rashin lafiyar tasha

Menene tasha

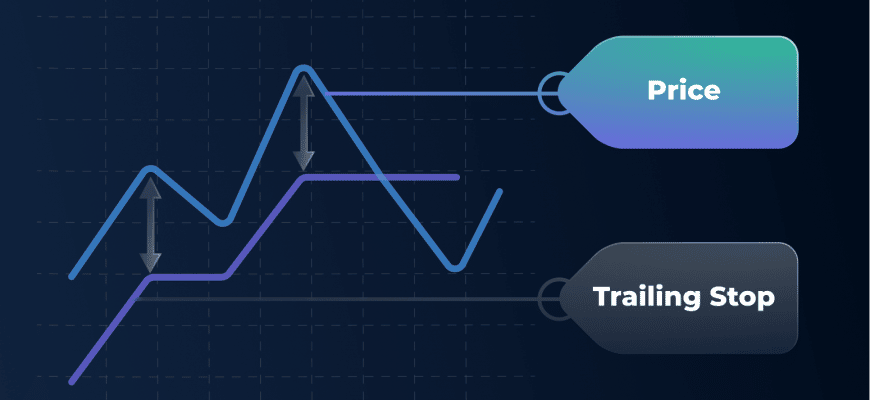

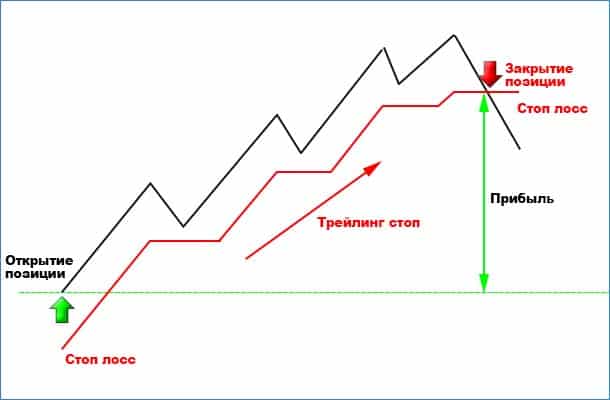

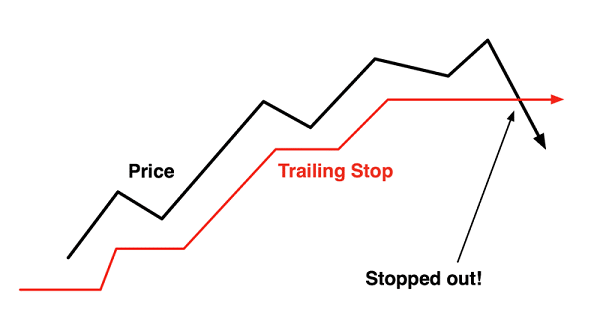

Tasha mai biyo baya umarni ne da aka sanya akan kadara wanda zai sa ta siyar ta atomatik idan darajarta ta motsa sama ko ƙasa da ƙayyadaddun kaso. Ya fi sassauƙa fiye da

asarar tasha , saboda yana ba da damar ƙimar kadari ta ƙaru kafin duk wani raguwa na gaba ya haifar da siyarwa. Tsayawar bin diddigi yana ba da damar matsayi ya kasance a buɗe yayin da farashin ke tafiya a hanya madaidaiciya. Tashawar tasha tana da kariya daga saurin hawa-hawa.

Me yasa kuke buƙatar tasha

Tsayawar bin hanya hanya ce don kare kuɗin shiga daga kasuwancin kasuwanci ta hanyar sanya odar siyarwa ta atomatik idan ƙimar su ta faɗi da ƙayyadaddun kaso. Duk da haka, za a yi amfani da wannan darajar ga farashin kasuwa, yana barin damar samun riba a bude.

Me yasa kuke buƙatar amfani da tasha a cikin ciniki mai amfani akan musayar hannun jari

Tsayawar bin diddigi na iya ba da ingantattun hanyoyi don sarrafa haɗari. ‘Yan kasuwa galibi suna amfani da su azaman ɓangare na dabarun ficewa ciniki.

Trailing Dakatar da Siyar

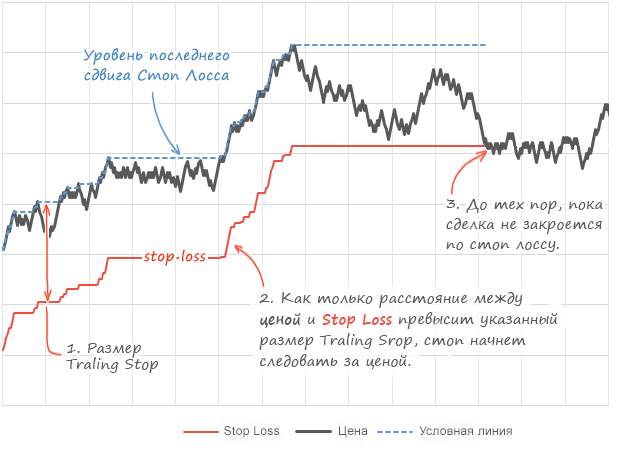

Yayin da ƙimar ciki ta ƙaru zuwa sabon haɓaka, ana sake ƙididdige farashin faɗakarwa bisa sabon babban ƙimar. Babban “high” na farko shine ƙimar ciki lokacin da aka fara kunna tasha, don haka babban “sabon” zai zama mafi girman farashin hannun jari ya kai sama da ƙimar farko. Yayin da farashin ya zarce fare na farko, farashin faɗakarwa yana sake saitawa zuwa sabon matsayi. Idan farashin ya tsaya iri ɗaya, ko ya faɗo daga farkon tayin, ko mafi girman matsayi na gaba, tasha mai bin diddigin tana kiyaye farashin faɗakar sa na yanzu. Idan yanke farashin fare ya kai ko ketare farashin faɗakarwa, tasha ta haifar da odar kasuwa don siyarwa.

Lokacin Amfani da Tasha Tasha

Za a iya kunna tasha tasha a daidaitaccen zaman kasuwa daga karfe 9:30 na safe zuwa 4:00 na yamma. Ba za a yi ƙaddamarwa a lokacin tsawaita zaman sa’o’i ba, kamar kafin kasuwa ko zaman sa’o’i, ko lokacin da hannun jari ba ya ciniki (misali, lokacin tsayawa hannun jari, ko a ƙarshen mako ko hutun kasuwa).

Menene haɗarin sanya odar tsayawa ba tare da tunani ba

Gudanar da matsayi yana da mahimmanci a cikin ciniki kuma yana da mahimmanci don fahimtar haɗarin da za a iya fuskanta yayin amfani da tasha:

- Tashoshi na bin diddigi suna da rauni ga gibin farashin , wanda wani lokaci na iya faruwa tsakanin zaman ciniki ko lokacin dakata. Farashin yajin na iya zama sama ko ƙasa da tasha.

- Rufe kasuwa . Za a iya jawo tasha tasha a yayin zaman kasuwa na yau da kullun. Idan an rufe kasuwa saboda kowane dalili, ba za a aiwatar da tasha ba har sai kasuwar ta sake buɗewa.

- Lokacin da kasuwa ke canzawa , musamman a lokutan babban kasuwancin ciniki, farashin da aka cika oda bazai zama daidai da farashin da aka ƙaddamar da odar don aiwatarwa ba .

- Ruwan ruwa . Kuna iya samun farashi daban-daban don sassan oda, musamman don umarni waɗanda suka haɗa da babban adadin hannun jari.

Me yasa tasha bin diddigin yana da mahimmanci da kuma yadda yake aiki

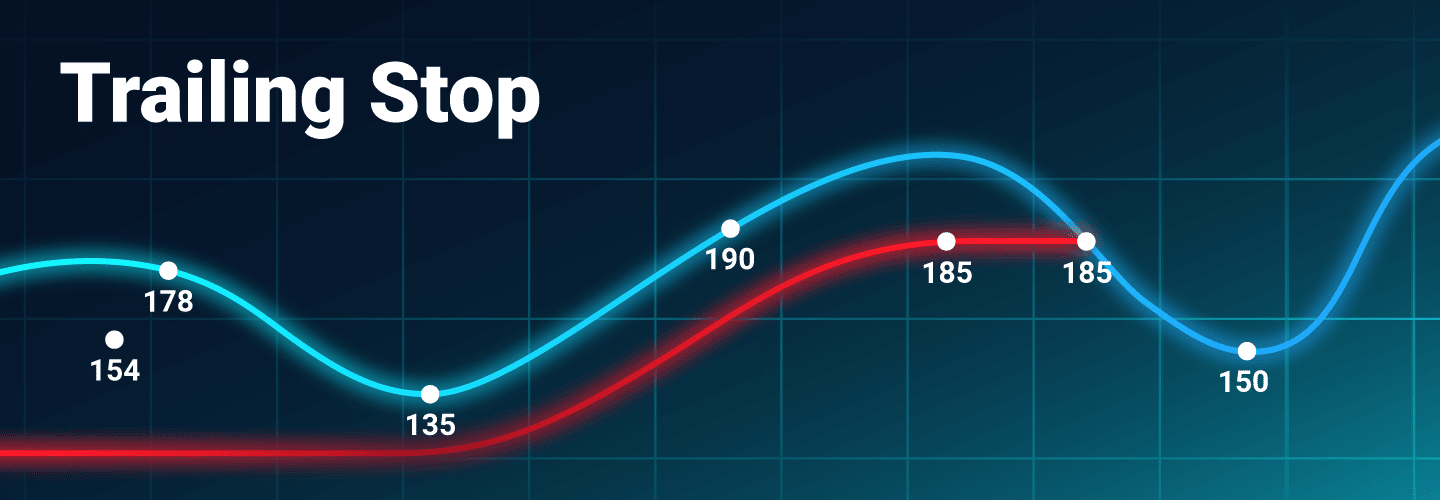

Kafin shiga kasuwa, yana da mahimmanci a tabbatar cewa kuna da dabarun fita daidai a wurin. Yana da sauƙi don haɓaka riba da rage hasara a cikin tafiya ɗaya. Mutane da yawa suna fuskantar motsin rai daga jarin su. Wadannan kurakurai ne da suka kashe makudan kudade. Hatta almara na saka hannun jari kamar Warren Buffett ba koyaushe daidai bane. Tasha bin diddigi yana ba ku damar rage haɗari. Ga yadda yake aiki. A ce akwai cinikin hannun jari akan farashin $100. Idan an saita tasha a 25%, to, tasha mai saka hannun jari zai zama 25% kasa da $100 ko $75. Idan hannun jari ya fadi zuwa $75 a kowane lokaci, ana iya siyar da su. Duk da haka, ba wannan ke nan ba. Bari mu ce hannun jari ya tashi zuwa dala 200. Yayin da hannun jari ya kai $125, $150, da $175, tasha za ta karu.

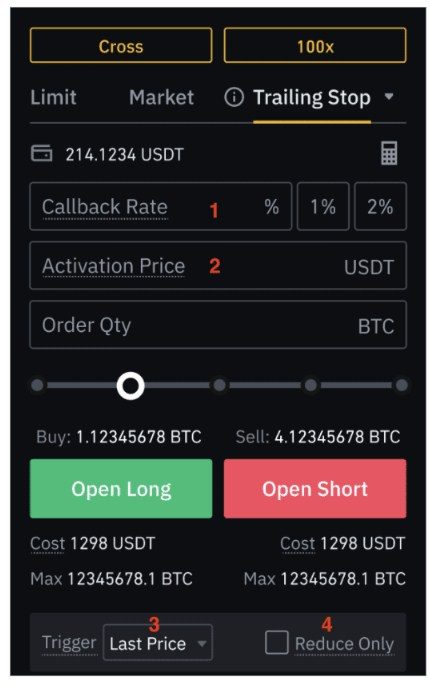

Inda za a duba da yadda za a saita tasha?

Wani lokaci ana kiran tasha tasha a matsayin “asarar tasha mai iyo”. Hakanan za’a iya amfani dashi azaman kayan aiki na taimako ko azaman mai ba da shawara mai zaman kansa. A cikin yanayin farko, an bayar da shi azaman rubutun da aka shigar akan tashar abokin ciniki. Tasha tasha tana aiki akan tashar ciniki ta mai amfani, kuma ba akan uwar garken ba, kamar

tasha asara da cin riba. Alpari Broker yana ba abokan ciniki damar kasuwanci na ci gaba. An riga an haɗa kayan aiki a cikin tashar MetaTrader 4 kuma ana iya amfani dashi a kowane lokaci.

Muhimmanci!

Zaɓin dillali mai kyau yana ɗaya daga cikin manyan maɓallan samun nasara ciniki.

Don saita tasha:

- Fara sabon ciniki. Danna maɓallin “Sabon oda”, saita nau’in kudin kuma saita ƙarar.

- Saita asarar tasha kuma shiga cikin cinikin siye. Bayan haka, sabon matsayi zai bayyana akan ginshiƙi.

- A shafin “Ciniki”, danna-dama kuma zaɓi “Trailing Stop”.

- Saita girman tsakanin maki 15 zuwa 715.

Yaushe tasha tasha zata fara/ daina aiki?

Don kunna tasha mai biyo baya, dole ne tsari ya kasance mai fa’ida don takamaiman adadin maki. Wannan yanayin zai kasance ne kawai bayan an cika wannan yanayin. Idan tashar ciniki ta yi karo, rufe ko kwamfutar ta mutu, ana cire tasha saboda ba a ajiye ta a uwar garken ba. Don guje wa wannan, zaku iya amfani da sabis na Exness VPS kyauta.

Shari’ar amfani mai amfani a cikin kasuwa mai tasowa

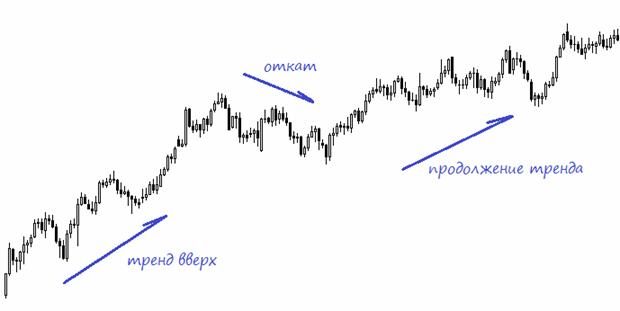

Duk wani yanayi ya ƙunshi hawan hawan sama da ƙasa. Wannan yana nufin cewa zaku iya sanya madaidaicin tasha a ƙasan iyakar kowane ja da baya (ƙananan kafin farashin farashin). Lokacin da aka buga tasha, yana nufin cewa yanayin ya bar tsarin kuma yana iya tsayawa ko baya.

Siffofin amfani da tasha mai biyo baya

Ba tare da shugabanci ba, canje-canjen farashin suna zagaye. Akwai hawa da sauka. A cikin haɓakawa, hawan ya fi tsayi fiye da faɗuwa, kuma a cikin yanayin rashin ƙarfi, faɗuwar ya fi tsayi. Bugu da ƙari, abubuwan da ke faruwa na dogon lokaci ko da yaushe suna da “pullback”. Wannan yana nufin cewa yanayin koyaushe na iya jujjuya na ɗan lokaci kuma ya koma alkiblarsa ta asali.

Ribobi da rashin lafiyar tasha

Babban fa’idodin wannan kayan aikin sune:

- Saita tsayawar bin diddigi na iya rage damuwa ta tunani mai alaƙa da sa ido akai-akai a buɗe wuraren.

- Ta hanyar matsar da odar tasha-asara ta atomatik zuwa yankin riba, ‘yan kasuwa na iya (tare da daidai amfani da wannan kayan aiki) rage asara da haɓaka yuwuwar riba.

Tabbas, akwai kuma rashin amfani, wanda mafi bayyanannen su shine:

- Rashin sassaucin ra’ayi shine kawai saboda gaskiyar cewa an zana asarar tasha sosai a ƙayyadaddun nisa. A gefe ɗaya, wannan baya ƙyale farashin ya motsa cikin yardar kaina kuma yana iya haifar da rufe matsayi da wuri ta hanyar asarar tasha (ƙananan ƙimar tasha). A gefe guda, idan an saita tasha mai tsayi da yawa, zai iya ƙarshe (lokacin da farashin ya koma ya tsaya) ya cinye mafi yawan ribar takarda.

- Kamar yadda aka ambata a sama, tsayawar trailing kusan koyaushe yana buƙatar dandalin ciniki tare da haɗin Intanet mara yankewa.

[taken magana id = “abin da aka makala_16129” align = “aligncenter” nisa = “630”]