Bullish ani bearish divergence jago la – a bɛ cogo min na charts kan, jago fɛɛrɛ. Sugu jiralanw sɛgɛsɛgɛli kɛlɛbagaw bɛ taamasiyɛnw taamasiyɛnw latɛmɛni jate ka bɔ quotations lamagacogo la, k’o ye sɔsɔliba ye “kɛlɛ” ye. Nka, ni a bɛ fɔ danfara ma, o kɔfɛko in bɛ dɛmɛ don ka dondaw sɔrɔ minnu bɛ nafa sɔrɔ ani minnu bɛ se ka da u kan.

- Mun ye divergence ye jago la

- Divergence suguyaw

- Klasiki danfara

- Divergence dogolen

- Divergence extendue (damatɛmɛnen).

- Convergence (Jɛɲɔgɔnya).

- Fɛn minnu bɛ danfara sigili la taamasiyɛn suguya caman kan

- Oscillateur Stochastique (Oscillateur Stochastique) ye

- RSI – fanga danfaralen jiralan

- MACD ye

- Jagokɛlaw ka sariyaw

- Jagokɛlaw ka danfara: jagokɛlaw dabɔcogo ka ɲɛ

- Jagokɛlaw dabɔli bɛarish divergence waati la

- Jagokɛyɔrɔw dabɔli bullish divergence waati la

- divergence fila-fila

- Divergence ani sɔngɔko wale

- A laban na – tesis

Mun ye divergence ye jago la

“Divergence” daɲɛ in bɔra tubabukan daɲɛ “divergence” la, min kɔrɔ ye ko “divergence, discrepancy”.

Jagokɛcogo danfara ye danfara ye taamasiyɛn kalanniw ni quotations (cikanw) lamagacogo cɛ. Misali la, danfara bɛ kɛ ni sɔngɔ bɛ taa a fɛ ka kɛɲɛ ni taabolo ye ani ka sanfɛla kura kɛ, wa oscillateur bɛ fanga dɔgɔyali taamasiɲɛw di, n’o ye. jatebɔsɛbɛn kan, a kɔfɛta hakɛ kelen-kelen bɛɛ bɛ dɔgɔya ka tɛmɛ tɛmɛnen ta kan. Divergence bɛ stop, correction walima trend reversal laseli kɛ. O kɔrɔ ye ko nin ye ko kɔrɔba ye, min daminɛ na i ka kan ka jago latigɛw kɛ.

Divergence suguyaw

Divergence suguya saba de bɛ yen:

- klasiki la;

- dogolen;

- samanen.

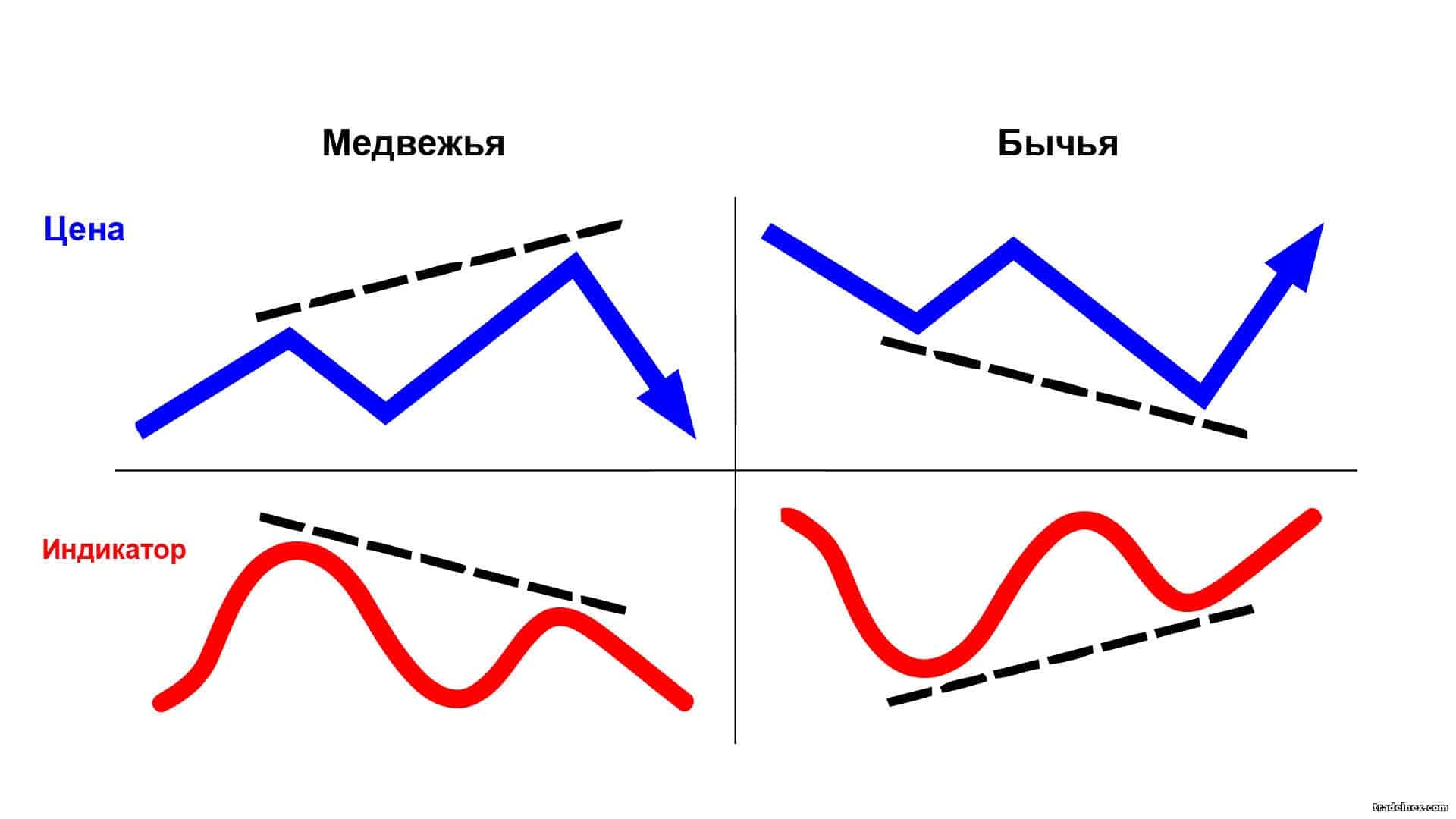

O sugu kelen-kelen bɛɛ, u bɛ tila ka Kɛ suguya fla ye:

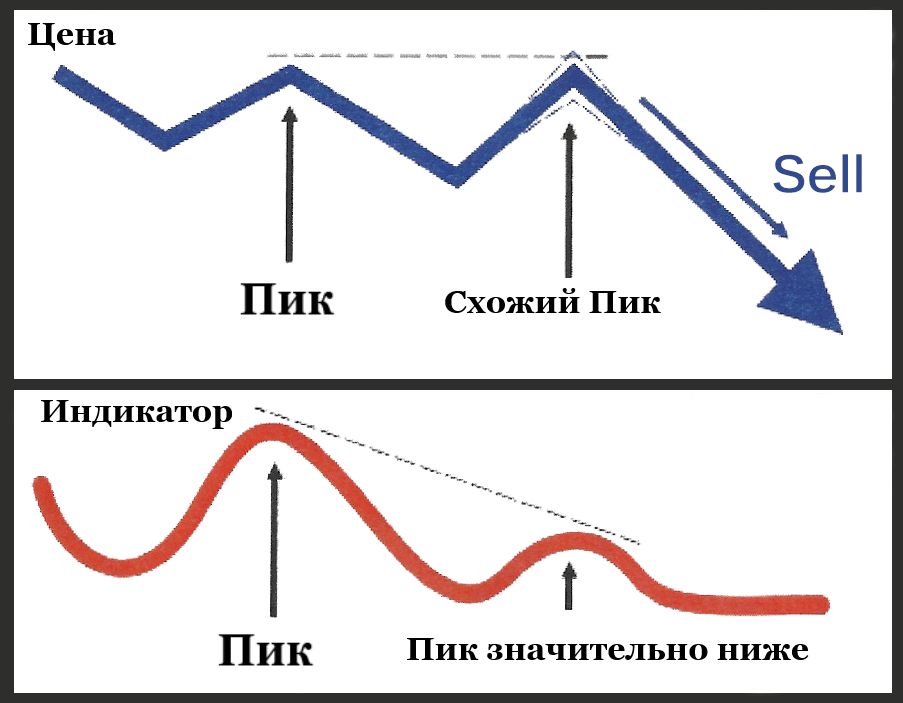

- bearish – min bɛ dilan jatebɔsɛbɛn kan min bɛ wuli ka taa sanfɛ ani min b’a jira ko sɔngɔ bɛna jigin waati nataw la ;

- bullish – bɛ kɛ jigincogo kan ani a bɛ sɔngɔ bonya jira.

Klasiki danfara

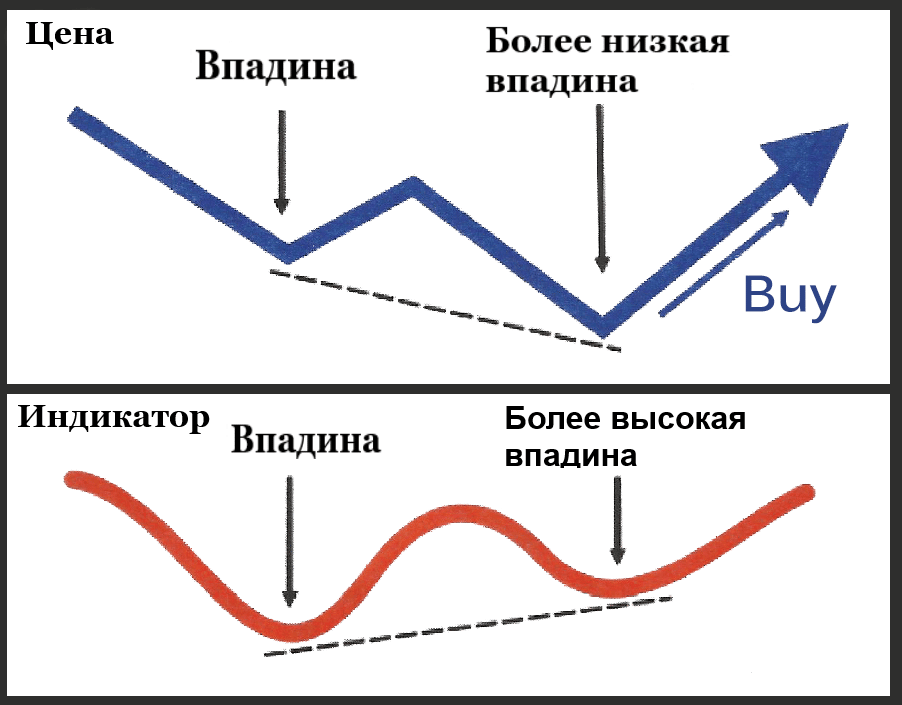

Nin danfara suguya min ka ca kosɛbɛ, o bɛ kɛ ka kɔn ŋaniya caman ɲɛ. Misali la, walasa ka klasiki bullish divergence dɔ dɔn jatebɔ kan, i ka kan ka dɔgɔyalenw kɔlɔsi ani ka waati sigi sen kan, taamasiyɛn jatebɔlan bɛna kɛ dɔgɔmannin ye min ka bon ani sɔngɔ bɛna dɔgɔmanninw kuraya.

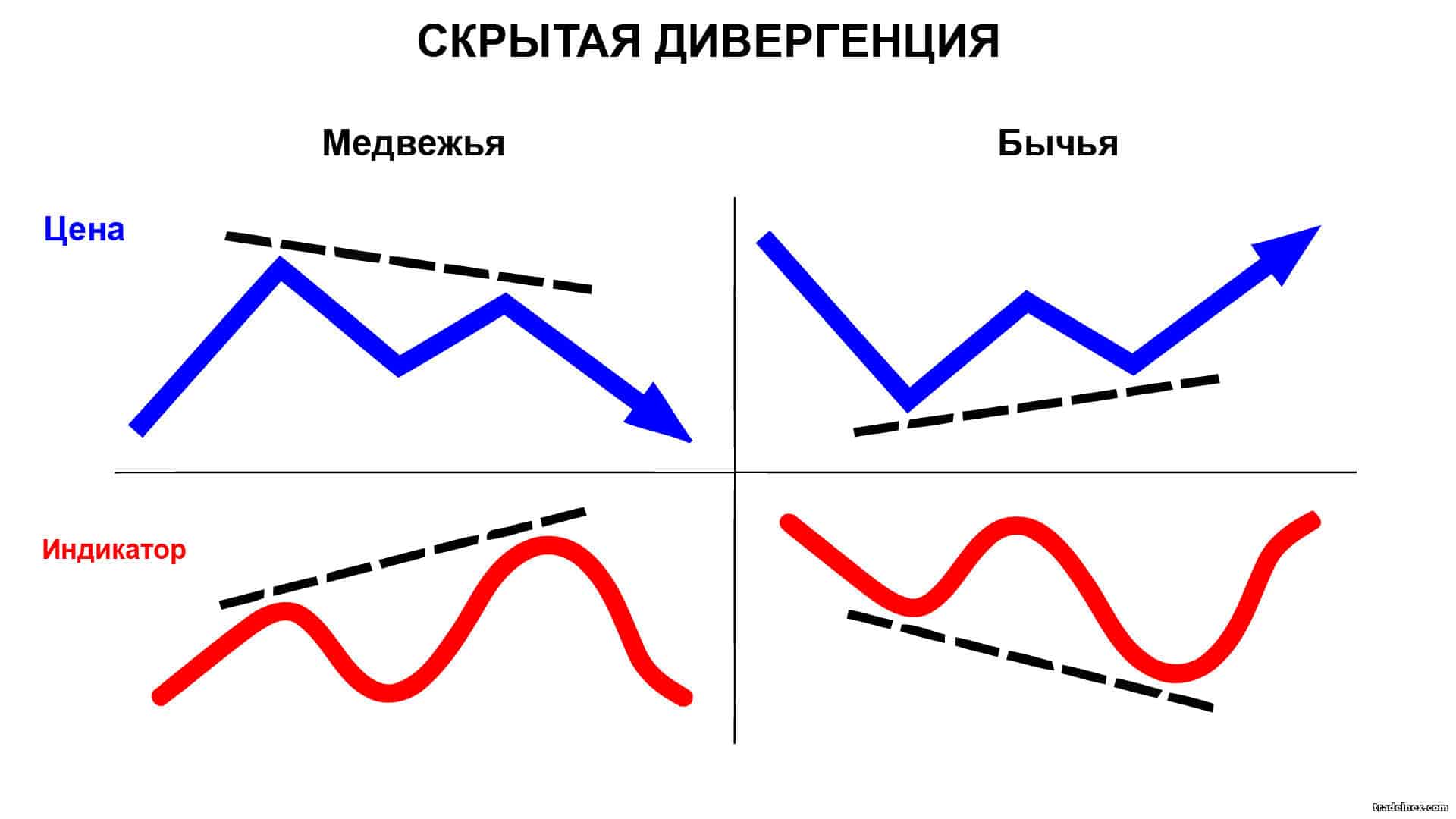

Divergence dogolen

A tɛ i n’a fɔ klasiki ta, danfara dogolen dɔ bɛ bɔ ni oscillateur ye sanfɛ walima duguma kura kɛ, wa sɔngɔ jiginni ka jaabi barika ka dɔgɔ, sugu bɛ to latilenni ni sabatili taabolo la. O taamasiyɛn in b’a jira ko sisan taabolo bɛ taa ɲɛ ani a bɛ se ka sabati. Bearish divergence dogolen dɔ jirali b’a jira ko sɔngɔ bɛna to ka jigin. Hidden bullish divergence b’a jira ko sɔngɔ bɛna taa a fɛ ka wuli. Danfara dogolenw dɔnni ka gɛlɛn, nka u man kan ka ɲinɛ u kɔ. Oscillator ka pullback barikama ye taamasiyɛn ɲumanba ye walasa ka jagokɛlaw da wuli walima ka u datugu.

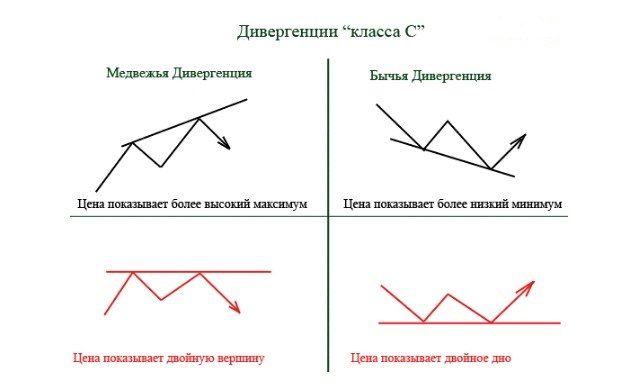

Divergence extendue (damatɛmɛnen).

Extended bɛ danfara don ni klasiki danfara ye ni sanfɛla walima dɔgɔya fila ye minnu bɛ ɲini ka kɛ kelen ye sɔngɔ jatebɔsɛbɛn kan. Nin ye taamasyɛn ye walasa ka t’a fɛ sisan ko in na. Jagokɛlaw-sɛgɛsɛgɛlikɛlaw b’a jira ko kuncɛw jɔlenw (walima yɔrɔ dɔgɔmanninw) man kan ka sigi sanfɛyɔrɔ kelen na. Divergence extendue jiralanba – jiralan jatebɔ, a tɛ i n’a fɔ sɔngɔ jatebɔ, o tɛ kɛ sababu ye ka fɛn fila kɛ minnu bɛ se ka kɛ.

Convergence (Jɛɲɔgɔnya).

“Jɛɲɔgɔnya” daɲɛ bɛ bamanankan na ko “jɛɲɔgɔnya”. Jɛɲɔgɔnya jiralen bɛ jatew kan ni zana fila ye minnu bɛ ɲɔgɔn sɔrɔ (sɔngɔ ni taamasiyɛn). Angilɛkan daɲɛw bamanankan na ani fɛn kɛrɛnkɛrɛnnenw ɲɔgɔn falen-falen daɲɛw bɛ se ka mɔgɔ lafili daminɛbaga fɛ. O la, an ka daɲɛw ɲɛfɔ : danfara ye taamasiyɛn ni sɔngɔ jatebɔlanw lamagacogo danfara (divergence) ye ; Wa fana danfara min bɛ jatebɔsen kan, o bɛ se ka jira ni zana minnu bɛ ɲɔgɔn sɔrɔ ani minnu bɛ ɲɔgɔn bɔ (bullish walima bearish). O la, ɲɔgɔndan bɛ Weele ko bullish divergence.

Fɛn minnu bɛ danfara sigili la taamasiyɛn suguya caman kan

Danfara bɛ dilan taamasiyɛn suguya bɛɛ kan, nka misali danfaralenw bɛ yen minnu kan danfara dɔnni ka nɔgɔn. O baarakɛminɛn kelen-kelen bɛɛ bɛ se ka baara kɛ ka ɲɛ fɛɛrɛw la minnu bɛ kɛ ni hakili ye.

Oscillateur Stochastique (Oscillateur Stochastique) ye

Stochastic bɛ taamasiɲɛ nkalonmaw di tuma dɔw la, o la u fanga ka bon dɔrɔn de ka kan ka jate. O taamasiyɛn barikama dɔ min bɛ se ka da a kan, o ye sɔngɔ ni taamasiyɛnw jatebɔw danfara ye. Dafalen wɛrɛ ye stokasti layiniw cɛtigɛ ye. Stochastic Oscillator nafa fɔlɔ ye ko a bɛ danfara suguya bɛɛ jira ka jɛya. Walasa ka danfara dɔn, a ka ɲi ka dɔ fara teliya hakɛ kan sigidaw la. O bɛna layiniw nɔgɔya, taamasiɲɛw bɛna dɔgɔya, nka u bɛna da u kan kosɛbɛ.

RSI – fanga danfaralen jiralan

RSI divergence trading signal nafa ka bon ni dantɛmɛnen dɔ kɛra sannifeere yɔrɔ la (min bɛ 70 ni sanfɛ) walima ni a feerela ka tɛmɛ (a bɛ 30 ni duguma). A ka c’a la, o taamasiyɛn bɛ kɔsegin ka kɔn sɔngɔ ɲɛ. https://articles.opexflow.com/analysis-methods-and-tools/indikator-rsi.htm RSI kan, jirisunba dɔ dabɔra min bɛ se ka da a kan ani min ka nɔgɔn kosɛbɛ, n’o ye RSI_div. Tile bilenman bɛ sanni sɛbɛnw jira, jiri bilenman bɛ feereli sɛbɛnw jira. RSI_div bɛ nɔ bɔ kɛrɛnkɛrɛnnenya la waatibolodacogo caman na (ka bɔ D1 la).

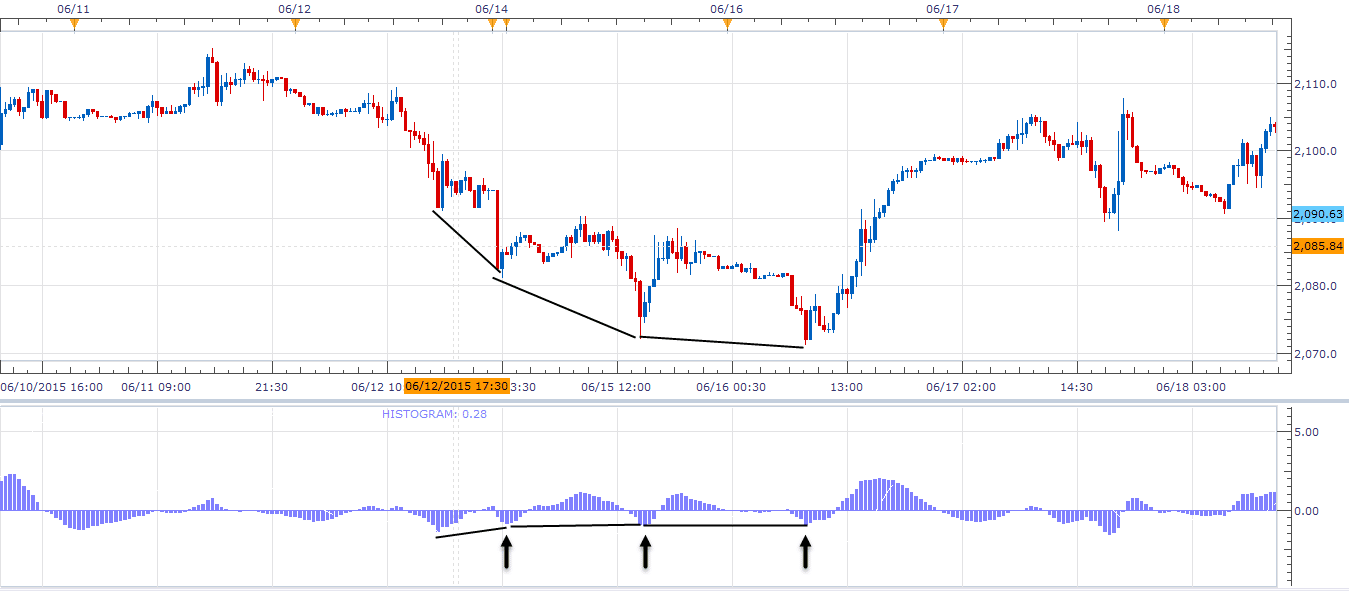

MACD ye

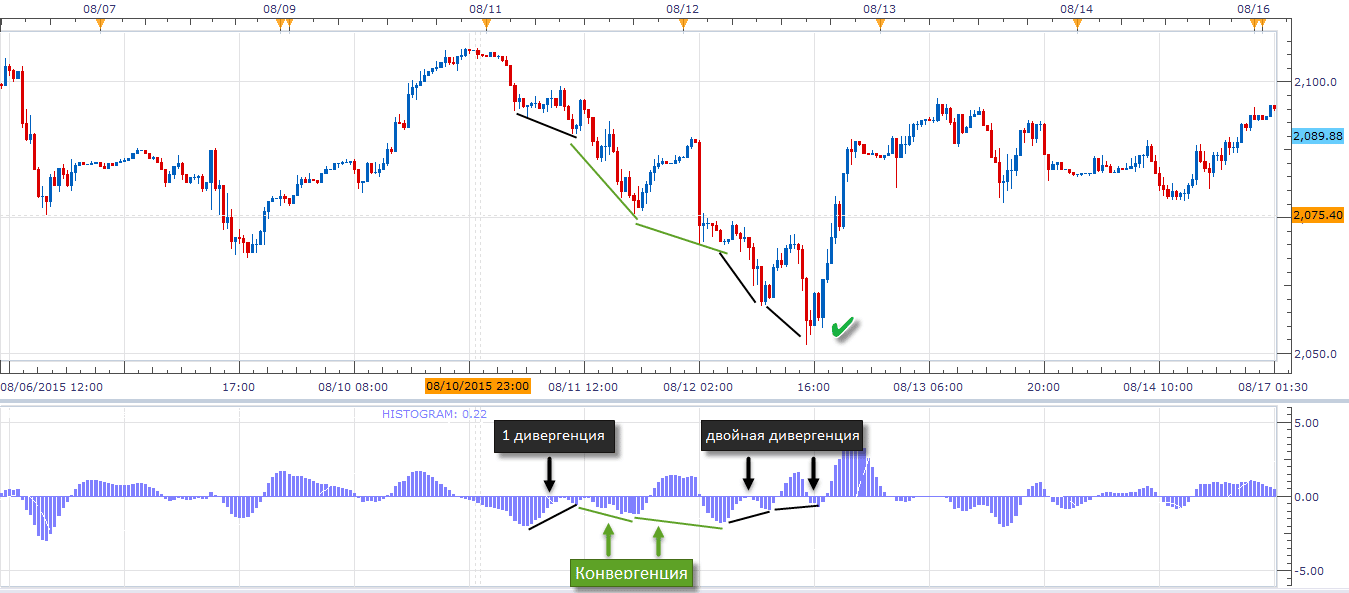

MACD, n’o ye taabolo jiralan ye, a bɛ tugu sisan hakɛ la ka taa a fɛ, k’a sɔrɔ taamasiyɛn fililenw ma waati jan kɛ. Walasa ka danfara dɔn, a ka c’a la, MACD liniyali de bɛ kɛ, nka fɛɛrɛ dɔw la, histogrammes (histogrammes) baara bɛna kɛ sugandi nɔgɔman ye.

Jagokɛlaw ka sariyaw

Nin hakilinaw ka kan ka jateminɛ:

- Aw ye aw janto sɔngɔko dantɛmɛnenw na.

Divergence bɛ ɲɛfɔ dɔrɔn ni sɔngɔ ye sanfɛla kura kɛ (jigin) walima ka sanfɛla fila kɛ (jukɔrɔ fila). Ni nin hakilina ninnu tɛ sɔngɔko jatebɔsɛbɛn kan, i bɛ se ka i ɲɛmajɔ taamasiyɛn jatebɔsɛbɛn kan.

- Aw bɛ kuluw siri ɲɔgɔn na.

Ni bεnkansεbεn bε bεn sɔngɔko jatebɔsɛbɛn kan ani jiralan jatebɔsɛbɛn kan, sanfɛla dɔrɔn de ka kan ka siri ɲɔgɔn na. Ni bullish divergence ye, lows dɔrɔn de bɛ jɛ sɔngɔko jatebɔsɛbɛn kan ani jiralan kan.

- Aw bɛ ja jɔlenw ja.

Sannifeere jatebɔsɛbɛn ni taamasiyɛn jatebɔsɛbɛn ka dantɛmɛyɔrɔw ka kan ka bɛn ɲɔgɔn ma. Walasa ka sariya labatoli lajɛ, a ka fisa aw ka zana jɔlenw ja.

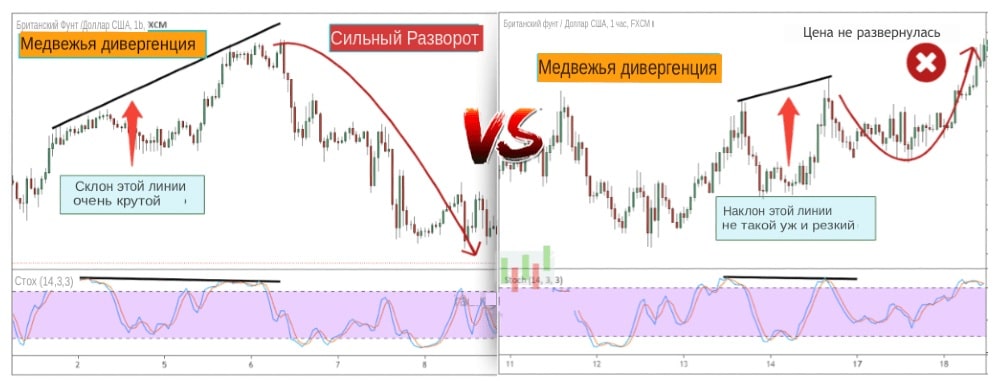

- Zanaw ka sɛrɛkiliw bɛ danfara fanga jira.

Ni zanaw jɛgɛncogo ka bon, danfara bɛ barika sɔrɔ, o kɔrɔ ye ko taabolo kɔsegincogo bɛ bonya.

- Aw bɛ danfara in dafa.

Divergence (dafalen) dantigɛli ɲuman ye ka point extreme (point dantɛmɛnenw) sɔrɔ yɔrɔ la min bɛ san kojugu walima min bɛ feere kojugu yɔrɔ la.

- Aw kana ɲinɛ waati dɔɔnin kɔ.

I tɛ se ka tɛmɛ don yɔrɔ la jago la. Ni waati in Tɛmɛna, o tuma na fɛ, nafa t’a la k’a Sɔrɔ, danfara in ye baara Kɛ, wa a Kɛra fɛn ye min tɛ foyi ɲɛ. O cogo la, a ka fisa ka danfara nata makɔnɔ.

- A ma da a la – kana jago kɛ.

Aw man kan ka jateminɛ kɛ kafeminkutuw kan ani ka hakilinaw jɔ ni bɛnbaliya dɔ kɛra walima ni a ma kɛ. Taamaʃyɛn lakika min bɛ se ka da a kan, o ka kan ka jɛya ani min bɛ se ka faamuya.

Jagokɛlaw ka danfara: jagokɛlaw dabɔcogo ka ɲɛ

Jagokɛcogo caman bɛ yen ni danfara ɲɛfɔli ye, nka u bɛ fara ɲɔgɔn kan ni jago daminɛ sariyakolo caman ye.

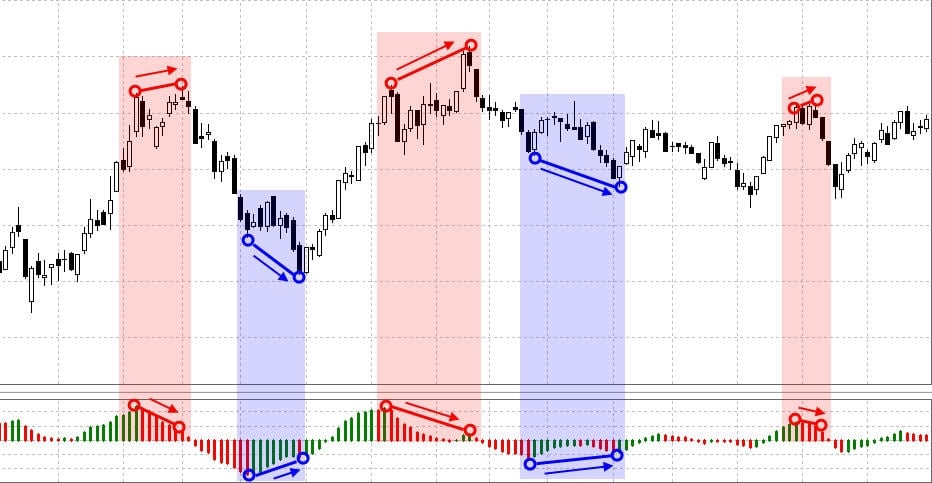

Jagokɛlaw dabɔli bɛarish divergence waati la

Ni sɔngɔko jatebɔ ye sanfɛla kura dɔ ja, ni oscillateur ma o Sɛmɛntiya, taamasiyɛn dɔ bɛ Kɛ ka feereli jɔyɔrɔ dɔ Dabɔ. O waati kelen na, anti-trend taamasiyɛnw bɛ sɔrɔ tuma caman na, o ye sababu ye ka bɔ jago la. A ka kan ka jago kura da wuli ka ɲɛsin taabolo ma ni hakilisigi ye i n’a fɔ a bɛ se ka kɛ cogo min na, a ka fisa k’o kɛ ni danfara dɔ kɛra jɛ-ka-baara walima latilenni waati dɔ la.

Jagokɛyɔrɔw dabɔli bullish divergence waati la

A yecogo min bɛ quotes chart kan, n’o ye low low kura ye, n’o ma dafa ni oscillateur ye, o ye taamasyɛn ye ka sannifeere daminɛ. Ni taamasiyɛnw ɲɛsinnen bɛ taabolo ma, a ka ɲi ka feereli dabila. Divergence – a baara cogo ani waati min na: https://youtu.be/kJQu999pt_k

divergence fila-fila

N’an bɛ kuma taamaʃyɛnw fanga kan, o tuma na, danfara fila-fila ye taamaʃyɛn barikama ye ka Tɛmɛ kelen kan. Divergence fila bɛ se ka ɲɛfɔ i n’a fɔ dantɛmɛnenw sigiyɔrɔma minnu tɛ dafa ni oscillateur ye. MACD ja min bɛ duguma, o bɛ wulicogo fila jira: sɔngɔko jatebɔsɛbɛn ka jikuruw bɛ dɔgɔya tuma o tuma, ka fanga dɔgɔya dɔɔnin dɔɔnin. Taamaʃyɛn bɛ danfara damadɔ jira, nka danfara kelen fɔlɔ tun bɛna kɛ bɔnɛ ye. O cogo la, aw kana kɔrɔtɔ, aw ka kan ka sanfɛla kura makɔnɔ, o bɛna a jira ko sɔngɔ jiginni bɛ wuli.

Divergence ani sɔngɔko wale

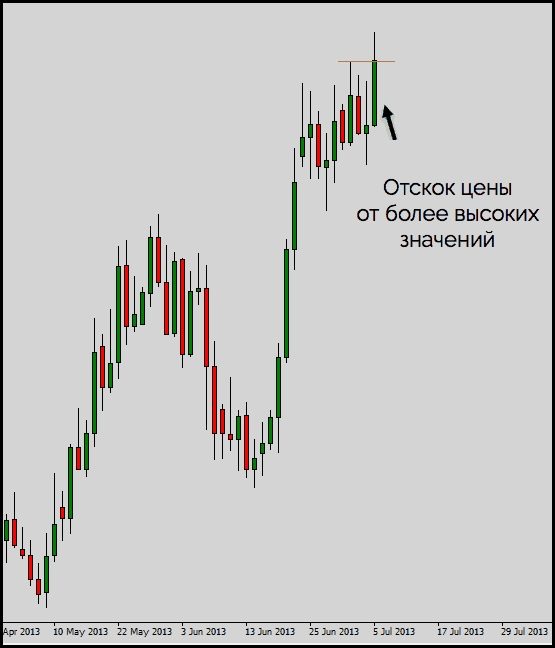

Sannifeere wale fɛɛrɛ bɛ jago kɛ ni sɔngɔko jatebɔ dɔrɔn ye, ni taamasiyɛnw tɛ. O cogo la, daɲɛ min ye implicit divergence ye, o bɛ Fɔ. An ka misali dɔ lajɛ kandili ja kan. Ja min bɛ duguma, o bɛ sɔngɔ jiginni barika dɔgɔya waati jira: kandiliw bɛ ka da tugu kandili tɛmɛnenw nafaw hakɛ la, biɲɛw bɛ ka janya. Kɛlɛli hakɛ barikama bɛ yen.

A laban na – tesis

- Divergence ye taamasiyɛn ye min bɛ se ka da a kan kosɛbɛ walasa ka jagokɛlaw da wuli ani ka u datugu.

- Sannifeere jatebɔ ni taamasiyɛn jatebɔ taamasiyɛnw ka faranfasiyali tɛ taabolo jiginni jira tuma bɛɛ.

- Divergence, i n’a fɔ taamasiɲɛ tɔw bɛɛ, o bɛ sɛgɛsɛgɛli de wajibiya, o la walasa ka dannaya sɔrɔ, a ka ɲi ka baara kɛ ni taamasiyɛn caman ye. Siginidenw ka dantigɛli dafalen ye quotations bɔli ye ka tɛmɛn sanni kɛlenw (feere tɛmɛnenw) hakɛw kan.

- Divergence bɛ se ka dɔn ni taamasiyɛnw tɛ (sɔngɔ wale kɛcogo).

- A ka fisa daminɛbagaw ka baara kɛ ni waatiboloba ye (ka bɔ H1 la ka taa sanfɛ), u bɛ taamasiyɛn tigitigiw di.