Bambance-bambancen ra’ayi da bearish a cikin ciniki – yadda yake kallon jadawalin, dabarun ciniki. Masu adawa da nazarin nuna alama na kasuwa sunyi la’akari da jinkirin sigina masu nuna alama daga motsi na ƙididdiga a matsayin babbar hujja “da”. Koyaya, idan aka zo batun rarrabuwar kawuna, wannan sifa mai lalacewa tana taimakawa wajen samun riba kuma amintattun wuraren shiga.

- Menene bambancin ciniki

- Nau’in bambance-bambance

- Bambance-bambancen gargajiya

- Bambamcin boye

- Bambance-bambancen da aka ƙara (ƙananan).

- Haɗuwa

- Features na samuwar rarrabuwa a kan daban-daban Manuniya

- Stochastic Oscillator

- RSI – alamar ƙarfin dangi

- MACD

- Dokokin ciniki

- Bambance-bambance a cikin ciniki: yadda ake buɗe kasuwancin daidai

- Bude cinikai yayin rarrabuwar kawuna

- Bude cinikai yayin rarrabuwar kawuna

- bambance-bambancen biyu

- Bambance-bambance da aikin farashi

- A karshen – theses

Menene bambancin ciniki

Kalmar “bambamci” ta fito ne daga kalmar Ingilishi “banbanci”, wanda ke fassara a matsayin “banbanci, rashin daidaituwa”.

Bambance-bambance a cikin ciniki shine rashin daidaituwa tsakanin karatun masu nuna alama da motsi na ƙididdiga. Misali, bambance-bambance yana faruwa lokacin da farashin ya ci gaba da tafiya daidai da yanayin kuma ya yi sabon girma, kuma oscillator yana ba da sigina na yanayin rauni, watau. akan ginshiƙi, kowane matsakaicin matsakaicin yana ƙasa da na baya. Bambance-bambance yana ba da sanarwar tsayawa, gyara ko juyewar yanayi. A wasu kalmomi, wannan batu ne mai mahimmanci, a farkon abin da kuke buƙatar yanke shawarar ciniki.

Nau’in bambance-bambance

Akwai manyan nau’ikan bambance-bambancen guda uku:

- na gargajiya;

- boye;

- mika.

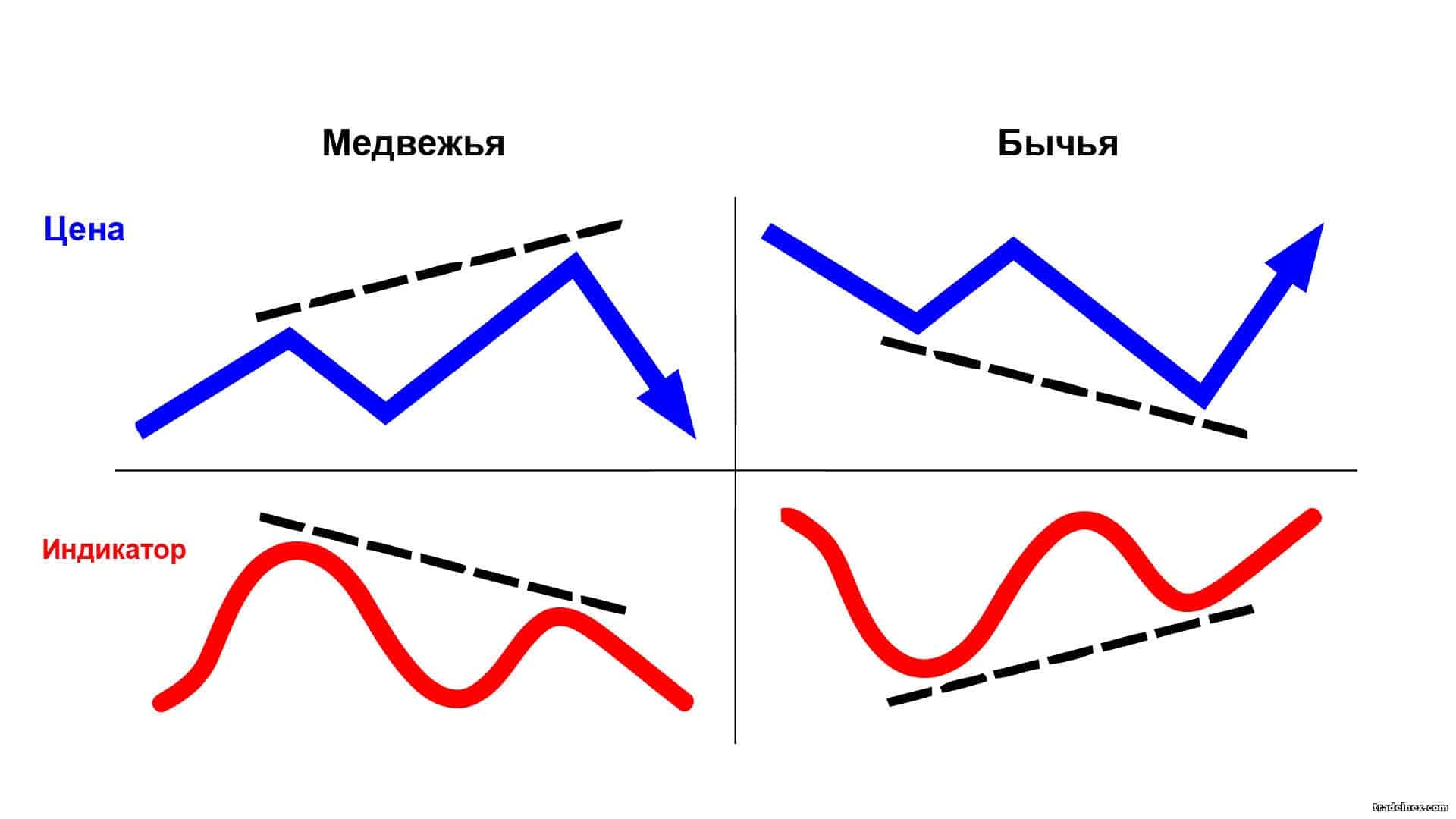

Kowanne daga cikin ire-iren wadannan, bi da bi, ya kasu kashi biyu:

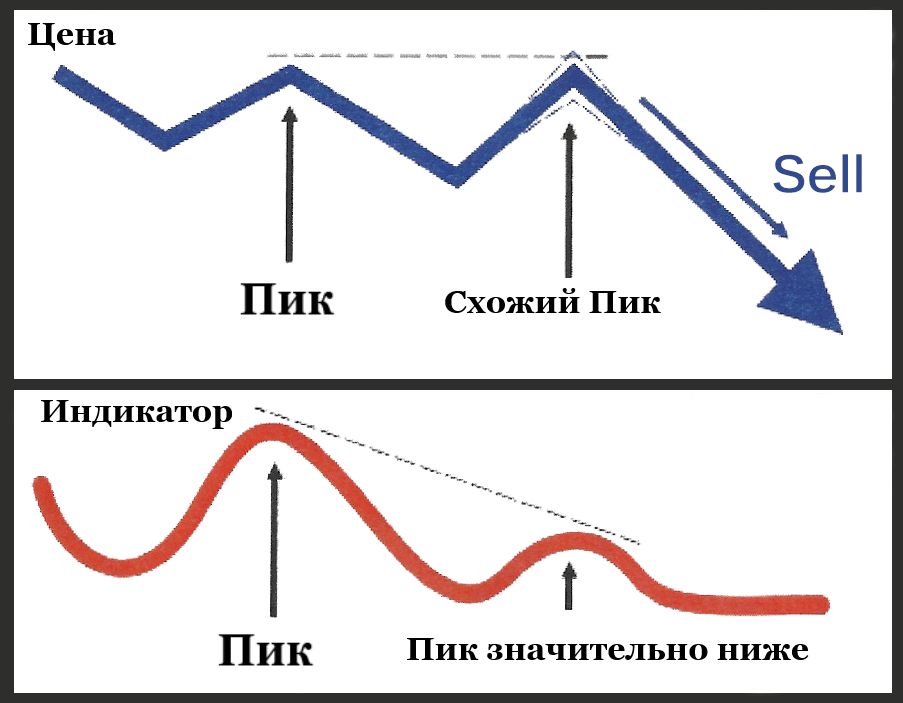

- bearish – kafa akan ginshiƙi mai hawa kuma yana nuna raguwar farashin nan gaba;

- bullish – yana faruwa a kan raguwa kuma yana nuna haɓakar farashi.

Bambance-bambancen gargajiya

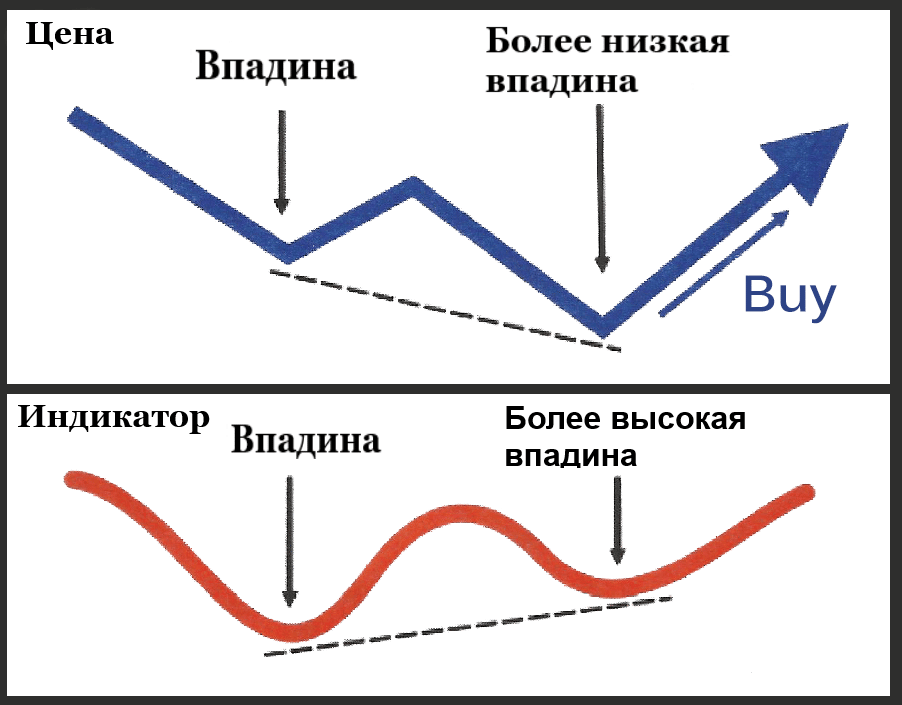

Wannan nau’in rarrabuwar kawuna na yau da kullun yana faruwa ne kafin canjin yanayi. Alal misali, don gane bambancin bullish a kan ginshiƙi, kuna buƙatar kallon lows kuma saita lokacin lokacin da ginshiƙi mai nuna alama zai haifar da ƙananan ƙananan kuma farashin zai sabunta mafi ƙasƙanci.

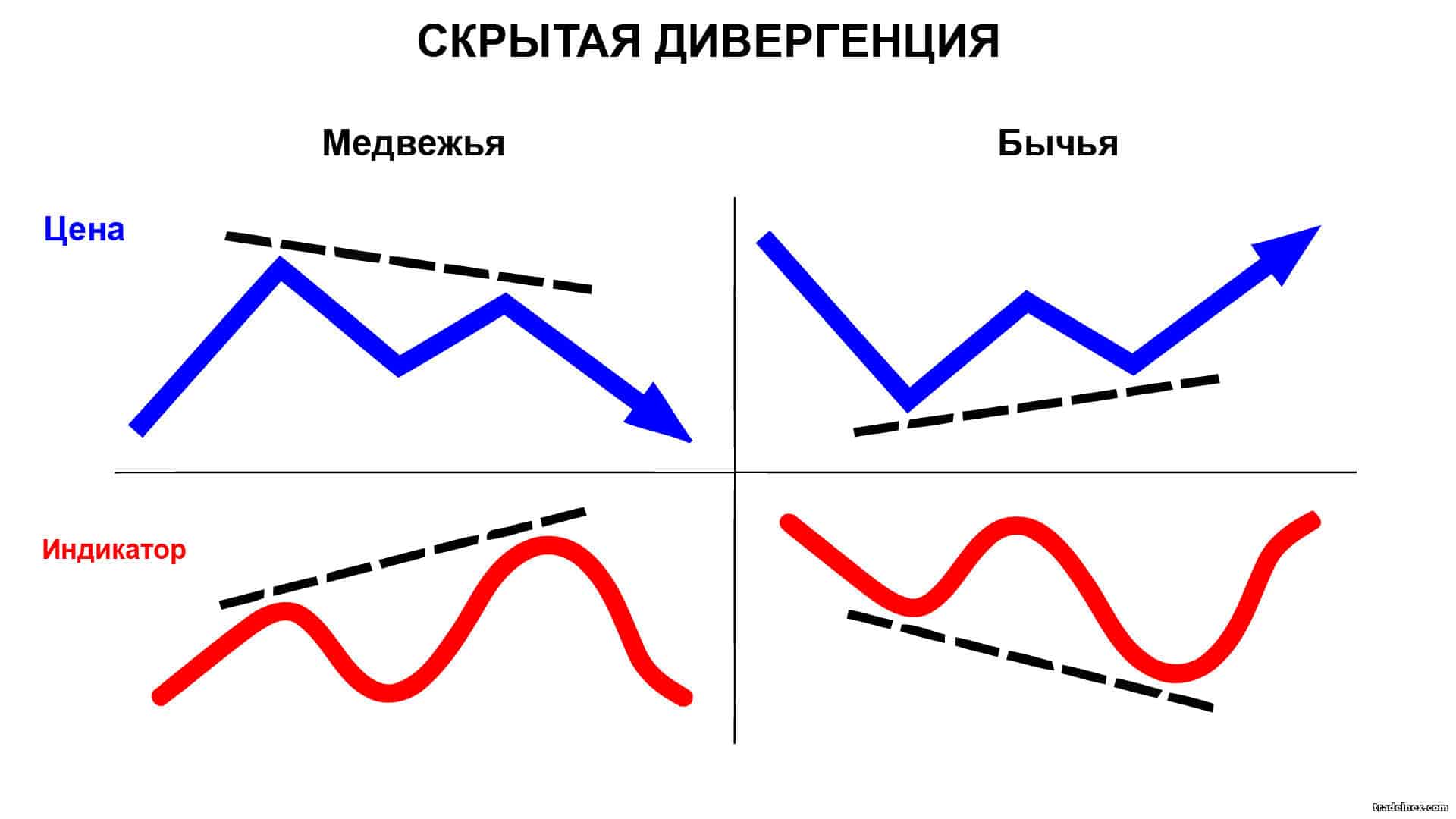

Bambamcin boye

Ba kamar na gargajiya ba, ɓoyayyiyar ɓoyayyiyar tana bayyana lokacin da oscillator yayi sabon girma ko ƙasa, kuma yanayin motsin farashin ya yi rauni, kasuwa ya kasance a matakin gyarawa da haɓakawa. Wannan siginar yana nuna ci gaba da yanayin halin yanzu da yuwuwar haɓakarsa. Bayyanar ɓoyayyen ɓoyayyen ɓoyayyen ɓoyayyen yana nuna cewa farashin zai ci gaba da faɗuwa. Bambance-bambancen da ke ɓoye yana nuna cewa farashin zai ci gaba da hauhawa. Bambance-bambancen da ke ɓoye yana da wahalar ganowa, amma bai kamata a yi sakaci ba. Rashin ja da baya na oscillator kyakkyawar sigina ce don buɗe ko rufe kasuwancin.

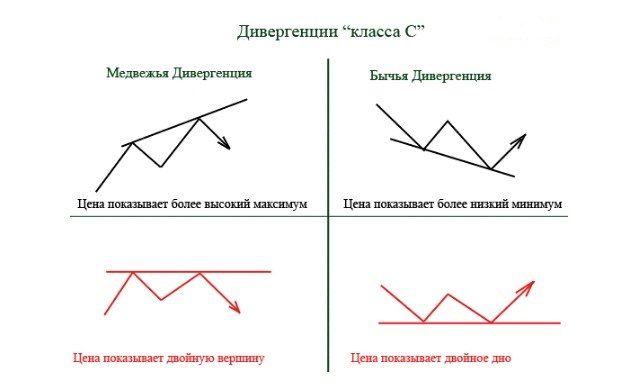

Bambance-bambancen da aka ƙara (ƙananan).

Extended ya bambanta da bambance-bambancen al’ada ta hanyar samar da maɗaukaki biyu kusan iri ɗaya ko ragi akan ginshiƙi farashin. Wannan sigina ce don ci gaba da yanayin halin yanzu. Masu nazarin ciniki sun ƙayyade cewa kololuwar da aka gina (ko ƙananan maki) ba dole ba ne su kasance a wuri ɗaya. Babban nuna alama na tsawaita rarrabuwar kawuna – ginshiƙi mai nuna alama, sabanin ginshiƙi farashin, baya samar da matsananci biyu.

Haɗuwa

An fassara kalmar “convergence” a matsayin “haɗuwa”. Ana nuna haɗuwa a kan ginshiƙi ta hanyar layi biyu masu haɗuwa (farashi da mai nuna alama). Fassarar kalmomin Ingilishi da ƙayyadaddun musanyar musanya na iya zama yaudara ga mafari. Don haka, bari mu ayyana ma’anar kalmomi: rarrabuwa ita ce rashin daidaituwa (bambamcin) motsi na ma’auni da jadawalin farashin; Hakanan ana iya kwatanta bambance-bambancen da ke kan ginshiƙi ta hanyar haɗuwa da layukan da suka bambanta (bullish ko bearish). Don haka, haɗuwa ana kiranta rarrabuwar kawuna.

Features na samuwar rarrabuwa a kan daban-daban Manuniya

An kafa bambance-bambance akan kowane nau’in alamomi, amma akwai nau’ikan nau’ikan daban-daban waɗanda bambance-bambancen ya fi sauƙi don tantancewa. Ana iya amfani da kowane ɗayan waɗannan kayan aikin yadda ya kamata a cikin dabarun tunani.

Stochastic Oscillator

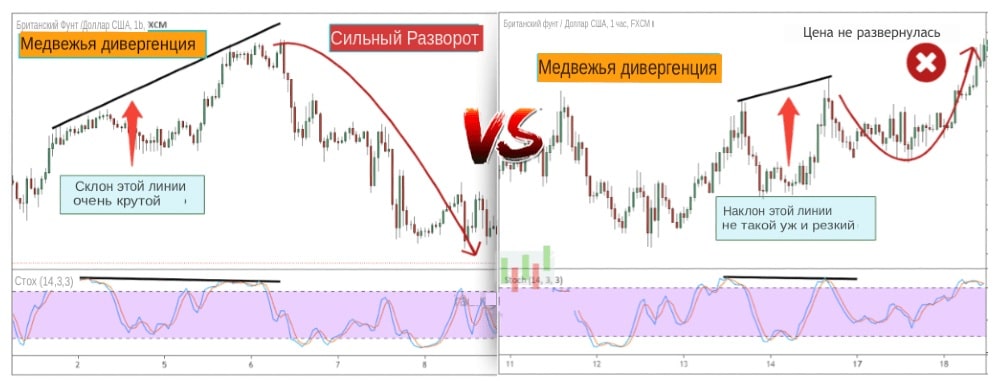

Stochastic wani lokaci yana ba da siginar ƙarya, don haka kawai mafi ƙarfi daga cikinsu ya kamata a la’akari. Ɗayan irin wannan sigina mai ƙarfi mai ƙarfi shine bambancin farashi da sigogi masu nuna alama. Ƙarin tabbaci shine mahadar layin stochastic. Babban fa’idar Stochastic Oscillator shine cewa yana nuna a sarari kowane nau’in rarrabuwa. Don ƙayyade bambance-bambance, ana bada shawara don ƙara raguwa a cikin saitunan. Wannan zai santsi layin, sigina za su yi ƙasa da ƙasa, amma za su kasance mafi aminci.

RSI – alamar ƙarfin dangi

Alamar siginar ciniki ta RSI tana da mahimmanci lokacin da aka kafa ɗaya daga cikin matsananciyar a cikin yankin da aka wuce gona da iri (a cikin kewayon 70 da sama) ko oversold (a cikin kewayon 30 da ƙasa). Yawancin lokaci wannan alamar ta juya baya fiye da farashin. https://articles.opexflow.com/analysis-methods-and-tools/indikator-rsi.htm A kan tushen RSI, an ƙirƙiri mafi aminci da dacewa kibiya oscillator RSI_div., mai da hankali kan ƙayyade ƙungiyoyin farashi mai tsayi. Koren kibiyar tana nuna shigarwar siye, kibiyar ja tana nuna siyar da shigarwar. RSI_div yana da tasiri musamman akan mafi girman lokutan lokaci (daga D1).

MACD

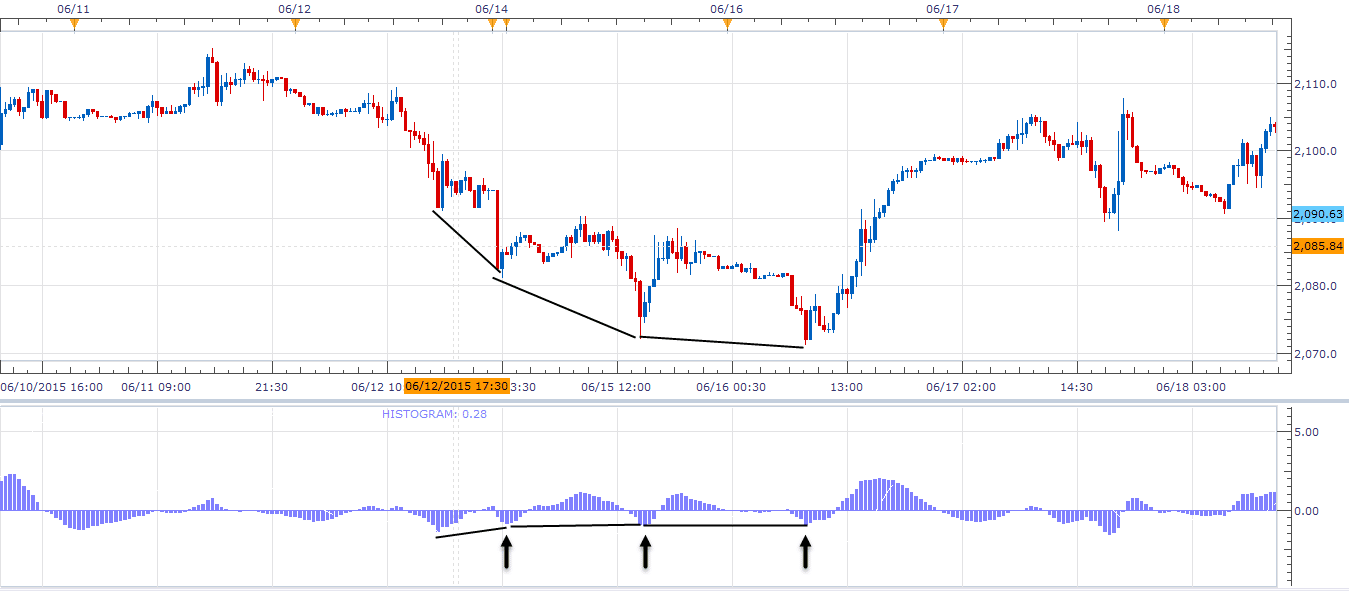

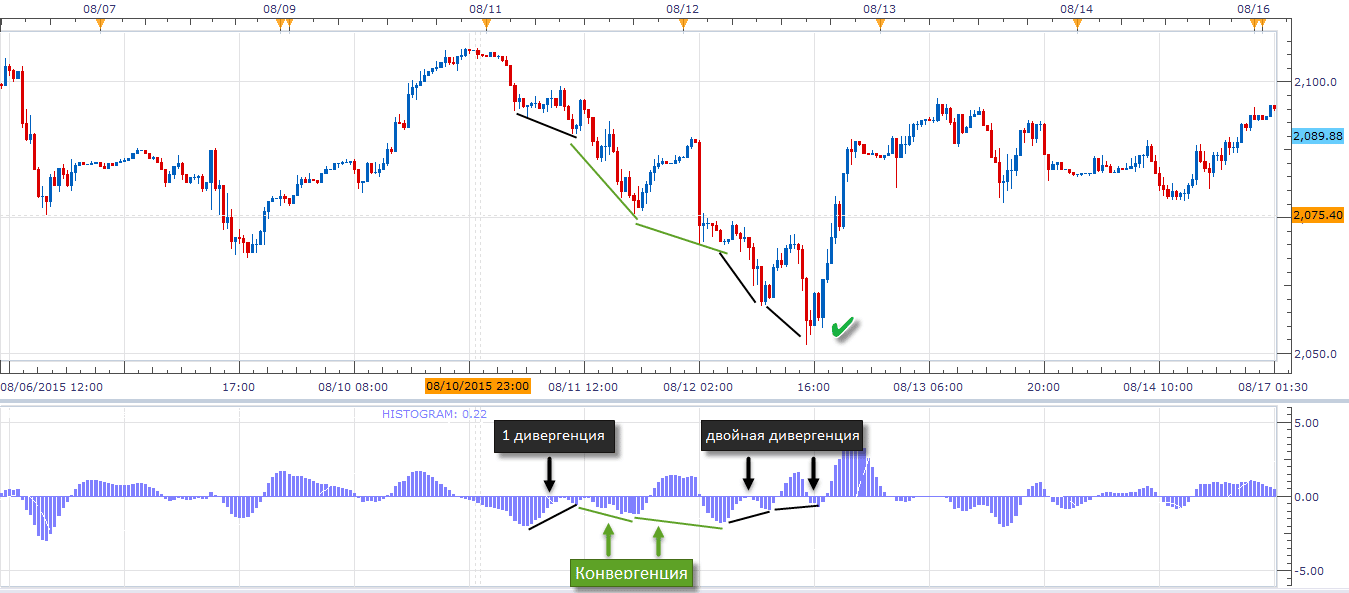

MACD, azaman mai nuna alama, a hankali yana bin ƙimar halin yanzu ba tare da dogon lokaci na saƙon kuskure ba. Don gano bambance-bambance, yawanci ana amfani da MACD na layi, amma ga wasu dabarun, amfani da histogram zai zama zaɓi mai dacewa.

Dokokin ciniki

Ya kamata a yi la’akari da waɗannan abubuwan:

- Kula da matsananciyar farashi.

Ana bayyana bambance-bambance ne kawai idan farashin ya yi sabon girma (ƙananan) ko ya samar da saman biyu (ƙasa biyu). Idan babu waɗannan maki akan ginshiƙi farashin, zaku iya watsi da ginshiƙi mai nuna alama.

- Haɗa kololuwa.

Tare da bambance-bambancen bearish akan ginshiƙi farashin kuma akan ginshiƙi mai nuna alama, kawai manyan abubuwan da ake buƙatar haɗawa. Tare da bambance-bambance mai ban sha’awa, ƙananan ƙananan kawai ana haɗa su akan ginshiƙi farashin da kuma akan mai nuna alama.

- Zana a tsaye.

Matsakaicin ginshiƙi na ginshiƙi na farashi da ginshiƙi mai nuna alama yakamata suyi daidai. Don duba yarda, ana bada shawarar zana layi na tsaye.

- Kusurwoyin gangaren layin suna nuna ƙarfin bambance-bambancen.

Mafi girman kusurwar layukan layi, mafi ƙarfin bambance-bambancen, wanda ke nufin mafi girma damar samun juzu’i.

- Tabbatar da bambance-bambance.

Mafi kyawun tabbatar da rarrabuwar kawuna shine gano matsananciyar maƙasudi a yankin da aka yi yawa ko siyayya.

- Kar a rasa wani lokaci.

Ba za ku iya rasa wurin shiga cikin ciniki ba. Idan an rasa lokacin, to, ba shi da amfani don cim ma shi, bambancin ya yi aiki kuma ya zama ba shi da mahimmanci. A wannan yanayin, yana da kyau a jira bambance-bambance na gaba.

- Ba tabbata ba – kar a kasuwanci.

Kada ku yi tsammani a kan kofi na kofi kuma ku gina hasashe game da ko rashin daidaituwa ya faru ko a’a. Dole ne sigina na gaske kuma abin dogaro ya zama bayyananne da fahimta.

Bambance-bambance a cikin ciniki: yadda ake buɗe kasuwancin daidai

Akwai dabaru da yawa don ciniki ta amfani da ma’anar rarrabuwar kawuna, amma an haɗa su da ka’idodin buɗe kasuwancin gabaɗaya.

Bude cinikai yayin rarrabuwar kawuna

Lokacin da ginshiƙi farashin ya zana sabon kololuwa mafi girma, kuma oscillator bai tabbatar da hakan ba, siginar buɗe matsayi na siyarwa yana faruwa. A lokaci guda, ana karɓar siginar anti-trend sau da yawa, wanda shine dalilin fita daga ma’amala. Wajibi ne don buɗe sababbin ma’amaloli a kan yanayin a hankali kamar yadda zai yiwu, yana da kyau a yi haka lokacin da bambance-bambancen ya haifar a lokacin ƙarfafawa ko gyarawa.

Bude cinikai yayin rarrabuwar kawuna

Bayyanar akan ginshiƙi na sabon ƙananan ƙananan, wanda ba a tabbatar da shi ta hanyar oscillator ba, alama ce don buɗe yarjejeniyar siya. Idan ana jagorantar siginar akan yanayin, ana bada shawarar rufe tallace-tallace. Bambance-bambance – ta yaya da lokacin amfani da shi: https://youtu.be/kJQu999pt_k

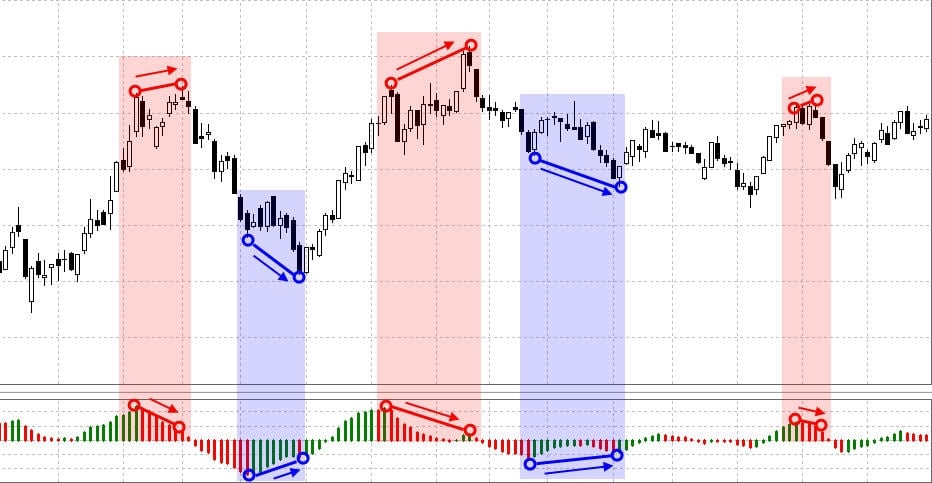

bambance-bambancen biyu

Idan muka yi magana game da ƙarfin sigina, to, bambance-bambancen biyu shine sigina mai ƙarfi fiye da ɗaya. Ana iya bayyana rarrabuwar kawuna a matsayin jerin wuce gona da iri waɗanda ba a tabbatar da oscillator ba. Hoton allo na MACD da ke ƙasa yana nuna bambance-bambancen bullish sau biyu: raƙuman ginshiƙan farashin suna zama ƙarami kowane lokaci kuma a hankali suna raunana. Alamar tana nuna rarrabuwar kawuna da yawa, amma rarrabuwar kawuna ta farko za ta yi asara. A wannan yanayin, kada ku yi sauri, kuna buƙatar jira sabon tsayi, wanda zai nuna juyawar farashin farashin.

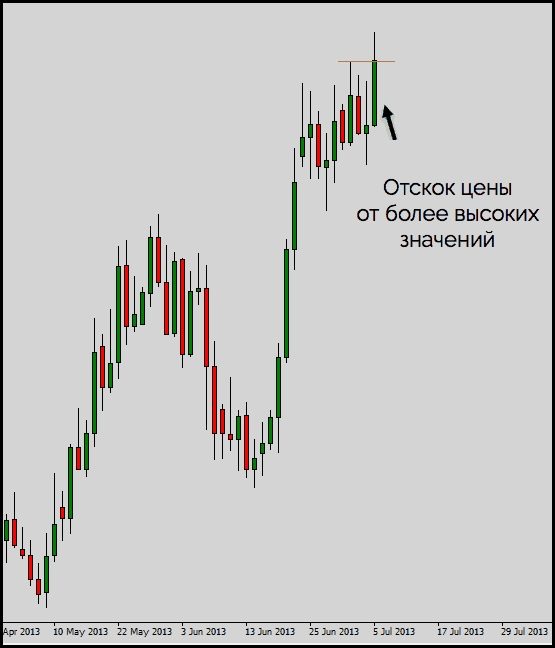

Bambance-bambance da aikin farashi

Dabarar aikin farashin ya ƙunshi ciniki ta amfani da ginshiƙi farashin kawai, ba tare da alamu ba. A wannan yanayin, ana amfani da kalmar bambance-bambance a fakaice. Bari mu kalli misali akan ginshiƙi na fitila. Hoton da ke ƙasa yana nuna lokacin rauni na hauhawar farashin: kyandir ɗin suna rufewa a cikin kewayon ƙimar kyandir ɗin da suka gabata, inuwa suna tsayi. Akwai matakin juriya mai ƙarfi.

A karshen – theses

- Bambance-bambancen sigina ce mai inganci don buɗewa da rufe kasuwancin.

- Bambance-bambancen sigina na ginshiƙi na farashi da ginshiƙi mai nuna alama ba koyaushe yana nuna jujjuyawar yanayin ba.

- Bambance-bambance, kamar kowane sigina, yana buƙatar tabbaci, don haka don amintacce, ana ba da shawarar yin amfani da alamomi da yawa. Tabbatacce tabbataccen siginar shine ficewar ambato fiye da matakan da aka yi fiye da kima.

- Ana iya ƙayyade bambance-bambance ba tare da alamu ba (dabarun aikin farashi).

- Yana da kyau ga masu farawa suyi amfani da manyan lokutan lokaci (daga H1 da sama), suna ba da ƙarin sigina daidai.