Ukurhweba kwiiklasi ezahlukeneyo ze-asethi, abahwebi bahlala befuna izikhombisi ezichonga ukuthenga okanye ukuthengisa iimpawu. Ngokukodwa xa uthengisa ngamaxesha amafutshane, ukubeka esweni iindaba kunye nemeko yezoqoqosho akwanelanga, udinga izibonakaliso ezahlukeneyo ze-forex (i-stochastics phakathi kwabo), eya kubonisa kwitshathi ukuba kufuneka uthengise njani kwaye nini. Eli nqaku liza kugxininisa kwisalathisi se-Stochastic Oscillator – isicelo kunye nento enokusetyenziswa.

- Isalathisi seStochastic: inkcazo kunye nesicelo

- Isalathisi seStochastic: indlela yokuyisebenzisa kwaye ngubani oya kuzuza kuyo?

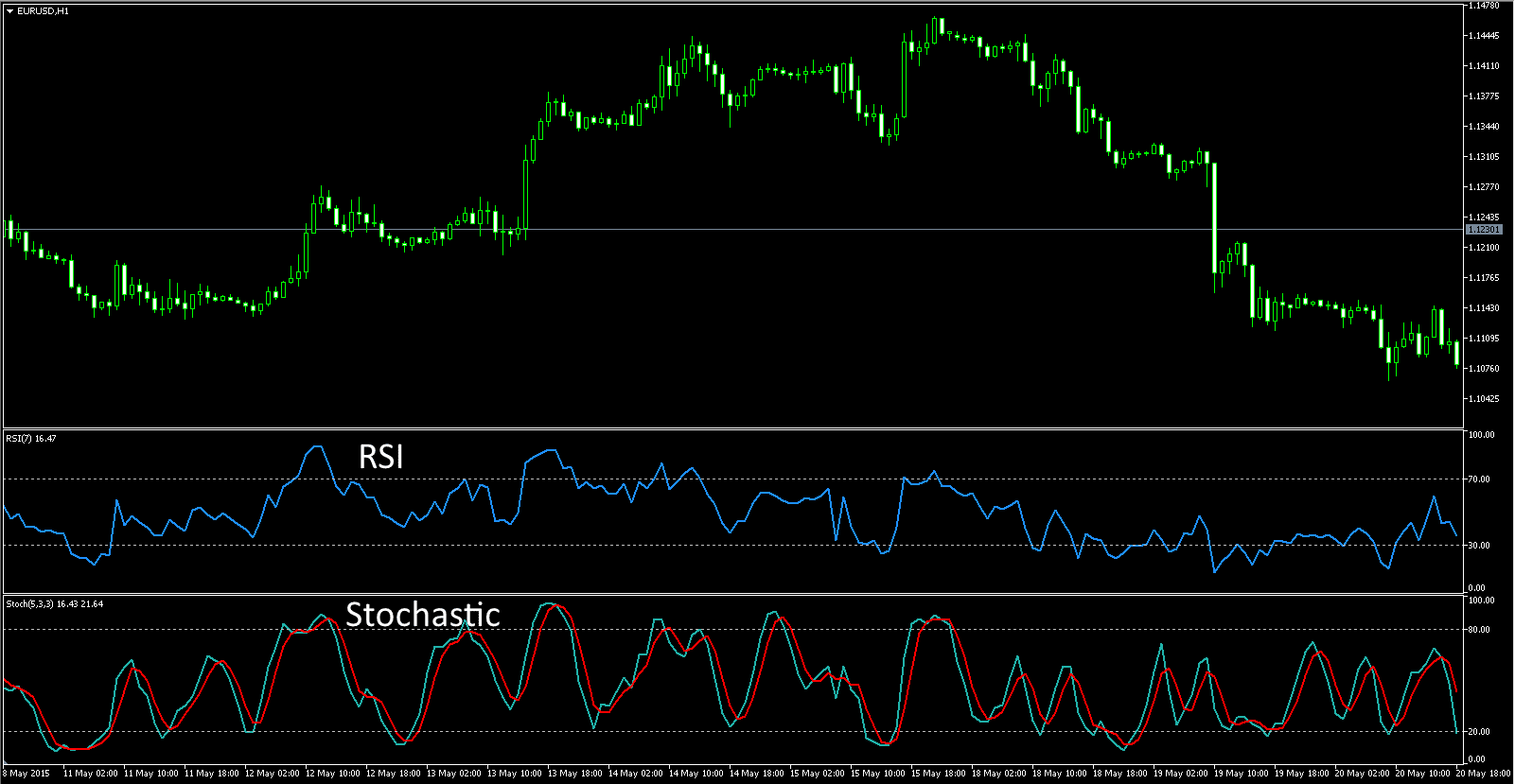

- Isalathisi seStochastic sorhwebo lwe-Forex

- Ukuseta iStochastic Oscillator

- Ukubalwa kwezalathi

- Isalathisi seStochastic sibonisa ntoni?

- Izicwangciso zokusetyenziswa

- Isalathisi sesilumkiso seStochastic

Isalathisi seStochastic: inkcazo kunye nesicelo

I-stochastic oscillator, edla ngokubizwa ngokuba yi-stochastic indicator, yaphuhliswa ngo-1950 nguGeorge Lane njengesalathisi kwi-

countertrend system yakhe.. Ngokuchasene noko igama lithetha ntoni, ingcamango emva kwayo ayinanto yokwenza ne-stochastics, esetyenziswa kwizibalo ukubhekisela kwiinkqubo ezingahleliwe. Kunoko, le oscillator isekelwe ekuqapheliseni ukuba ngexesha le-uptrend, ixabiso lokuvala le-asethi phantsi kwesifundo livame ukuguquguquka phezulu kuluhlu lokurhweba. Kwi-downtrend, into echaseneyo yinyani, kwaye ixabiso lithande ukuya ezantsi kuluhlu. Nangona kunjalo, ekusebenzeni, isalathisi sokwahlukana kwestochastic siye sabonakala singasebenzi kakhulu njengesalathisi esicacileyo sokutshintsha kwendlela, kuba i-stochasticity iyodwa, ngakumbi namhlanje, ayisanele ukumisela ukuguqulwa kwendlela okanye utshintsho lwamaxabiso. Kunoko, isalathisi se-oscillator ye-stochastic sakwazi ukuzimisa njengenxalenye yendlela yokuhlalutya,

I-Stochastic isetyenziswe kwifom eyenziwe lula ukubala uluhlu phakathi kwezinto eziphakamileyo kunye nezisezantsi kwixesha elithile. Ngaloo ndlela, umrhwebi, xa esebenza kunye nesalathisi, kufuneka abeke ixesha elithile lexesha.

Isalathisi seStochastic: indlela yokuyisebenzisa kwaye ngubani oya kuzuza kuyo?

Impumelelo ekurhwebeni kuxhomekeke kwisicwangciso semali kunye nomngcipheko wokulawula umngcipheko, kunye nokuchonga iindawo zokungena kunye nokuphuma. I-Stochastic isalathisi esiguquguqukayo kakhulu kwaye siguquguqukayo esikuvumela ukuba unqume ubukho okanye ukungabikho kwemeko yotyalo-mali oluhle kwimizuzwana embalwa. Ngokungafaniyo nezinye izikhombisi ezininzi, isalathisi sestochastic asenzelwanga ukulandela umkhwa, kodwa ukuchonga amanqaku okubuyisela umva. Ke ngoko, ukuba amaxabiso abonisa ukuba ukulungiswa okanye ukuphinda kwenzeke kwakhona kwikamva elingekude, kuyavakala ukusebenzisa isalathiso sestochastic ukuvavanya ukuba ukubuyiselwa umva kunokwenzeka kwikamva elingekude.

Isalathisi seStochastic sorhwebo lwe-Forex

Akukhathaliseki ukuba yeyiphi iklasi ye-asethi oceba ukuyirhweba. Nokuba ukurhweba nge-crypto, ukurhweba ngezinto zakudala ezifana nezitokhwe, okanye uyasebenza kwimarike ye-Forex, ayinamsebenzi. Nangona kunjalo, isicwangciso sakho kufuneka silungelelaniswe nemarike efanelekileyo kwaye kufuneka ube nolwazi kakuhle kwindlela yokuziphatha yaloo marike. Okokuqala, abatyali-mali abasebenzayo kunye nabarhwebi baxhamla ekusebenziseni isalathisi se-stochastic, kubani kubalulekile ukuba uhlalutyo lobugcisa lweenguqu zexabiso lwenzeka ngokukhawuleza. Nangona kunjalo, ngelixa isalathisi se-stochastic sifanelekile kuzo zonke iiklasi ze-asethi, ithandwa kakhulu ngabahwebi bempahla. Ukuba ufuna ukufunda ukurhweba nge-intraday, isalathisi sestochastic sinezixhobo ezininzi zokukunika. Okokuqala, kuba izitokhwe ziguquguquka kakhulu,

Ukuseta iStochastic Oscillator

Ngokuqinisekileyo, ukuba ufuna ukusebenzisa isalathisi sestochastic, kufuneka uqale ukuseta ngokufanelekileyo. Isalathisi siphunyezwa kwiinkcukacha ezininzi ezinkulu kunye neeplatifti zokurhweba, ezifana ne-MetaTrader 4, apho kukho ukusetha okungagqibekanga kwisalathisi se-stochastic. Ukuyisebenzisa, kufuneka ubeke kuphela ixesha lexesha, kunye nexabiso eliphezulu elihambelanayo, oko kukuthi “H”, kunye nexabiso eliphantsi, oko kukuthi “L”. Ukufakela iStochastic kwifestile yetshati, kufuneka uvule ithebhu ethi “Uluhlu lwezibonakaliso” kwibar yesixhobo. Emva koko khetha udidi lwe “Oscillators”, kwaye kuyo – “Oscillator Stochastic”. Ukuhlohla kwi-terminal window:

Ukubalwa kwezalathi

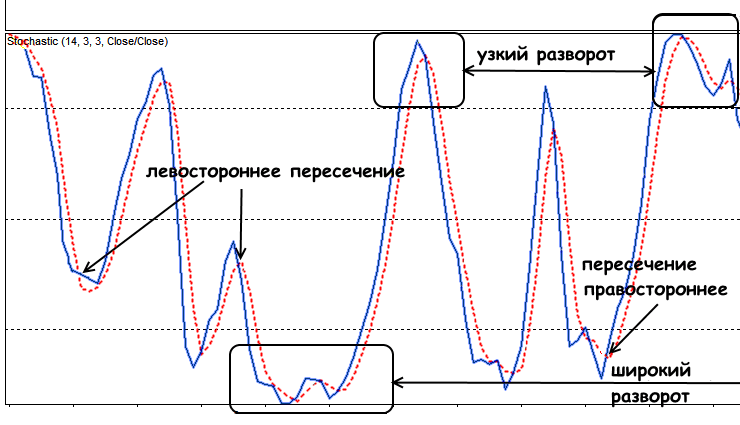

Ngokungagqibekanga, umgca we-%K ubalwa kwisithuba seentsuku ezi-5, kwaye umgca we-%D ubalwa kwiintsuku ezi-3. “Istochastic esicothayo” okanye “istochastic esicothayo” sinegama elifanayo kunye nokutolika, kodwa okuthe kwanciphisa ubuntununtunu. “Slow” kunye “Fast” bahlala bebhidekile, ngakumbi kuba imigca ephakathi esetyenziswayo ihlala inegama elifanayo. Nangona kunjalo, xa ukhankanya isalathisi seStochastic, ngokuqhelekileyo yinguqulelo “ecothayo” ekuthethwa ngayo. Stochastic kwiterminal yeQUIK:

Isalathisi seStochastic sibonisa ntoni?

Ngenxa yoko, ufumana isalathisi “% K”, esisuka kwi-0 ukuya kwi-100. Ixabiso le-100 libonisa ukuba i-asethi engaphantsi kophando irhweba ngobuninzi bexesha eliqwalaselwayo. Ixabiso le-0, ngakolunye uhlangothi, libonisa ukuba lithengisa ngexabiso eliphantsi. Emva koko, ukugudisa umlinganiselo kwaye ujike istochastic esikhawulezayo sibe sisicothayo, i-arithmetic ehambayo i-avareji ibalelwa kwisiphumo, esikwachazwa njenge “%K”. Okokugqibela, kongezwa umgca wesignali, othi, emva koko, ube sisiphumo somndilili ohambahambayo we “%K” kwaye uchazwe njenge “%D”. Kuzo zombini ii-avareji ezihambayo, ixabiso lesi-3 okanye lesi-5 lidla ngokusetyenziswa

njengamaxesha .

%D = %K i-avareji kwisithuba sezihlandlo ezithathu.

Izicwangciso zokusetyenziswa

Isikhundla sesalathisi kwisikali sibonisa ukuba ngaba i-asethi ephantsi ehlalutyiweyo ikwimeko yokuthengwa kakhulu okanye i-oversold kwimarike. Amaxabiso angaphezulu kwama-80 ajongwa njengexabiso elithe kratya kwaye, ngokufanelekileyo, ixabiso eliphantsi lixhomekeke ekwehleni kwexabiso. Amaxabiso angaphantsi kwama-20 ajongwa njenge-oversold kwaye ngenxa yoko i-asethi esisiseko isesichengeni sokubuyiswa kwexabiso. Nangona kunjalo, ukuba kukho ukuthambekela okuqinileyo, i-asethi engaphantsi inokuhlala kwelinye loluhlu oluxeliweyo ixesha elide.

Isalathisi sesilumkiso seStochastic

Kubathengisi abaninzi, inkqubo enjalo ibandakanya ukuzenzekelayo kwezikhombisi. Ezinye izicelo zesoftware kunye namaqonga anika i-alam ezenzekelayo ekhupha umyalezo okhethekileyo kwiimeko ezithile kunye nee-alamu. Emva kokufumana isilumkiso esinjalo, ungaqala ukuthengisa ngokukhawuleza, okanye ujonge urhwebo kwakhona usebenzisa ezinye izikhombisi.

Inqaku elinomdla: ukongeza, ezininzi iiplatifomu zokurhweba zinamandla okuphumeza urhwebo oluzenzekelayo. Kule meko, konke okufuneka ukwenze kukusetha isalathisi kwaye usethe ukuphunyezwa kwezenzo ezifanelekileyo kwiimeko ezithile.

I-MT4 Stochastic Strategy Alerts Indicator: https://youtu.be/7unY7xDm25k Ekubeni utyalo-mali lwe-intanethi ngokurhweba lunenani elikhulu lezinto eziguquguqukayo, kuyinqweneleka ukugubungela uninzi lwazo ngangokunokwenzeka ngezalathisi ezahlukeneyo. Ukongeza kwisalathiso sestochastic, esinokuthi sisetyenziswe ukujonga ukuguqulwa kwendlela, ezinye izikhombisi kufuneka zisetyenziswe ezinokubala ukuphakama nokuhla okanye ukuchaza uluhlu. Ngoko ke, ngokudibanisa ne-stochastic, i-

Bollinger Bands kunye nezinye izixhobo eziyaziwayo zihlala zisetyenziswa.