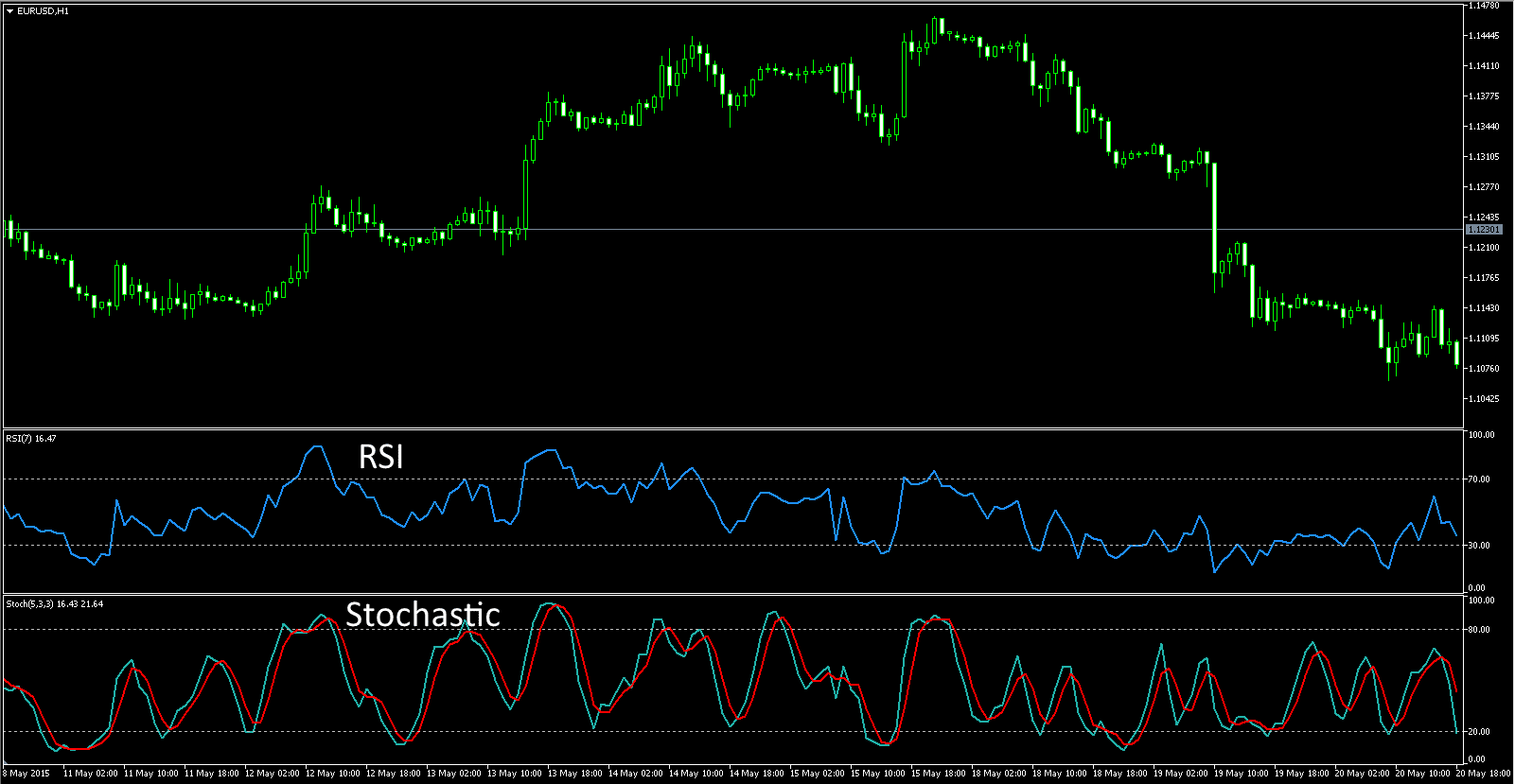

Don kasuwanci azuzuwan kadari daban-daban, yan kasuwa koyaushe suna buƙatar alamomi waɗanda ke gano sigina ko siyarwa. Musamman lokacin ciniki akan gajeren lokaci, saka idanu akan labarai da yanayin tattalin arziki bai isa ba, kuna buƙatar alamomin forex daban-daban (stochastics tsakanin su), wanda zai nuna akan ginshiƙi yadda kuma lokacin da kuke buƙatar kasuwanci. Wannan labarin zai mayar da hankali kan alamar Oscillator Stochastic – aikace-aikacen da abin da za a iya amfani dashi don.

Stochastic nuna alama: bayanin da aikace-aikace

The stochastic oscillator, sau da yawa aka sani da stochastic nuna alama, an ɓullo da a cikin 1950s ta George Lane a matsayin mai nuna alama ga

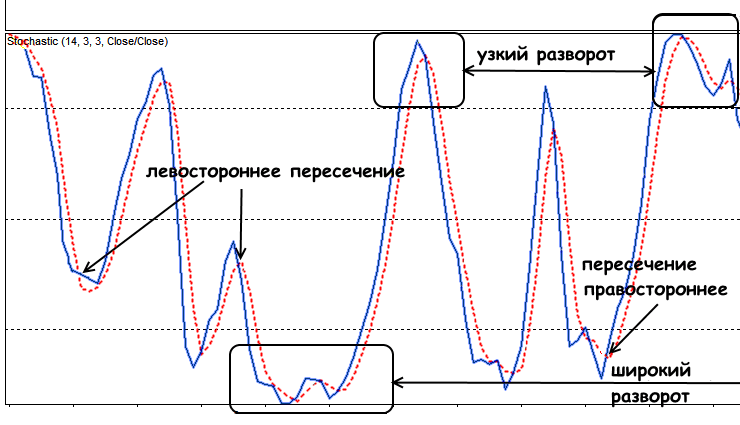

countertrend tsarin.. Sabanin abin da sunan ke nufi, manufar da ke bayanta ba ta da alaƙa da stochastics, wanda ake amfani da shi a cikin ƙididdiga don komawa ga tsarin bazuwar. Maimakon haka, wannan oscillator ya dogara ne akan lura cewa yayin haɓakawa, farashin rufewar kadarar da ke ƙarƙashin binciken yana canzawa a saman kewayon ciniki. A cikin raguwa, akasin haka gaskiya ne, kuma ƙimar tana ƙoƙarin matsawa zuwa ƙasan kewayon. Duk da haka, a aikace, alamar rarrabuwa ta stochastic ta juya ba ta da tasiri sosai a matsayin mai nuna alama mai tsabta na canje-canjen yanayi, saboda stochasticity kadai, musamman a yau, bai isa ya ƙayyade canjin yanayin ko canje-canjen farashin ba. Maimakon haka, alamar oscillator stochastic ya sami damar kafa kanta a matsayin wani ɓangare na hanyar bincike.

Ana amfani da Stochastic a cikin sassauƙan tsari don ƙididdige kewayon tsakanin manyan sama da ƙasa a kan wani lokacin da aka ba. Don haka, mai ciniki, lokacin aiki tare da mai nuna alama, yana buƙatar saita takamaiman lokaci.

Alamar Stochastic: yadda ake amfani da shi kuma wa zai amfana da shi?

Nasara a cikin ciniki ya dogara da kuɗi da dabarun sarrafa haɗari, da kuma gano wuraren shiga da fita. Stochastic alama ce mai sassauƙa da ƙima wacce ke ba ku damar tantance kasancewar ko rashin ingantaccen yanayin saka hannun jari a cikin ‘yan daƙiƙa kaɗan. Ba kamar sauran alamomi da yawa ba, alamar stochastic ba a tsara shi don bin yanayin ba, amma don gano wuraren juyawa. Don haka, idan ƙimar ta nuna cewa gyara ko sake dawowa na iya faruwa a nan gaba, yana da ma’ana a yi amfani da alamar stochastic don tantance ko akwai yuwuwar sake faruwa a nan gaba.

Stochastic nuna alama ga Forex ciniki

Ba komai ajin kadara da kuke shirin yin kasuwanci ba. Ko kuna cikin kasuwancin crypto, kasuwanci na gargajiya kamar hannun jari, ko aiki a cikin kasuwar Forex, ba komai. Koyaya, dabarun ku dole ne ya dace da kasuwar da ta dace kuma dole ne ku kware sosai kan halayen wannan kasuwa. Da farko, masu zuba jari masu aiki da masu cin kasuwa suna amfana daga yin amfani da alamar stochastic, wanda yake da mahimmanci cewa nazarin fasaha na canje-canjen farashin ya faru da sauri. Koyaya, yayin da alamar stochastic ya dace da duk azuzuwan kadari, ya shahara musamman tare da yan kasuwa. Idan kuna son koyon ciniki na yau da kullun, alamar stochastic yana da kayan aikin da yawa don ba ku. Da farko, tun da hannun jari ba su da ƙarfi sosai.

Kafa Stochastic Oscillator

Tabbas, idan kuna son amfani da alamar stochastic, da farko kuna buƙatar saita shi daidai. Ana aiwatar da mai nuna alama akan mafi yawan manyan bayanai da dandamali na kasuwanci, kamar MetaTrader 4, inda akwai saitunan tsoho don alamar stochastic. Don amfani da shi, kawai kuna buƙatar saita tsawon lokaci, da madaidaicin madaidaicin ƙimar, watau “H”, da mafi ƙarancin ƙima, i.e. “L”. Don shigar da Stochastic a cikin taga ginshiƙi, kuna buƙatar buɗe shafin “List of Manuniya” akan kayan aiki. Sa’an nan zaɓi “Oscillators” category, kuma a ciki – “Stochastic Oscillator”. Shigarwa a cikin taga tasha:

Lissafin alamomi

Ta hanyar tsoho, ana ƙididdige layin %K a cikin tsawon kwanaki 5, kuma layin %D ana ƙididdige shi a cikin kwanaki 3. “Slow stochastic” ko “slow stochastic” yana da kalmomi iri ɗaya da fassarar, amma da ɗan rage hankali. “Slow” da “Fast” galibi suna rikicewa, musamman saboda layin tsakiya da ake amfani da su koyaushe suna da nadi iri ɗaya. Koyaya, lokacin ambaton alamar Stochastic, yawanci sigar “jinkirin” ake nufi. Stochastic a tashar QUIK:

Menene alamar Stochastic ke nunawa?

A sakamakon haka, kuna samun alamar “% K”, wanda ke fitowa daga 0 zuwa 100. Ƙimar 100 yana nuna cewa kadarar da ke ƙarƙashin binciken ita ce ciniki a iyakar lokacin da ake la’akari. Ƙimar 0, a gefe guda, yana nuna cewa yana ciniki a ƙasa. Sannan, don daidaita ƙimar da juyar da stochastic mai sauri zuwa mai sannu a hankali, ana ƙididdige matsakaicin motsi na lissafi don sakamakon, wanda kuma ana nuna shi da “% K”. A ƙarshe, ana ƙara layin sigina, wanda, bi da bi, sakamakon matsakaicin matsakaicin motsi na “% K” kuma ana nuna shi da “% D”. Domin duka matsakaita motsi, ana amfani da ƙimar 3 ko 5 azaman lokaci.

Ana ƙididdige su ta amfani da dabarar da ke gaba:

% K = (farashin kusa – ƙarancin farashi) / (farashi mai girma – ƙarancin farashi);

%D = %K an daidaita sama da lokuta uku.

Dabarun amfani

Matsayin mai nuna alama akan ma’auni yana nuna ko ƙayyadaddun kadarar da aka bincika tana cikin yanayin da aka fi siyo ko kuma an sayar dashi akan kasuwa. Ana la’akari da ƙimar sama da 80 an cika siyayya kuma, saboda haka, ƙimar da ke ƙasa tana ƙarƙashin raguwar farashin. Ƙimar da ke ƙasa 20 ana la’akari da ta wuce gona da iri don haka kadarar da ke ƙasa tana da rauni ga sake dawo da farashi. Koyaya, idan akwai yanayi mai ƙarfi, ƙayyadaddun kadari na iya kasancewa a cikin ɗayan manyan jeri da aka ambata na dogon lokaci.

Alamar faɗakarwar Stochastic

Ga yawancin yan kasuwa, irin wannan tsarin ya haɗa da sarrafa kansa na masu nuna alama. Wasu aikace-aikacen software da dandamali suna ba da ƙararrawa ta atomatik wanda ke ba da saƙo na musamman don wasu yanayi da ƙararrawa. Bayan karɓar irin wannan faɗakarwa, zaku iya ko dai fara ciniki nan da nan, ko sake duba cinikin ta amfani da wasu alamomi.

Batu mai ban sha’awa: Bugu da ƙari, yawancin dandamali na kasuwanci suna da ikon aiwatar da ciniki ta atomatik. A wannan yanayin, duk abin da kuke buƙata shine saita mai nuna alama kuma shigar da aiwatar da ayyukan da suka dace don wasu al’amura.

MT4 Stochastic Strategy Alert Nuni: https://youtu.be/7unY7xDm25k Tunda saka hannun jari na kan layi ta hanyar ciniki yana da adadi mai yawa na masu canji, yana da kyawawa a rufe yawancin su gwargwadon yiwuwa tare da alamomi daban-daban. Bugu da ƙari ga alamar stochastic, wanda za a iya amfani da shi don tabo yanayin juyawa, ya kamata a yi amfani da wasu alamomi waɗanda za su iya ƙididdige maɗaukaki da ƙasa ko ma’anar kewayo. Sabili da haka, a hade tare da stochastic,

Bollinger Bands da sauran sanannun kayan aiki ana amfani dasu.