Gundo minnu bɛ sɔngɔko wale jago la – a ye min ye ani baara kɛcogo ni sɔngɔko wale kɛcogo ye jago la, misaliw ani laadilikanw. Sannifeere wale ye jagokɛcogo ye min b’a to jagokɛla bɛ se ka fɛn minnu bɛ kɛ sugu la, olu kalan ani ka jago latigɛw kɛ ka da sɔngɔ jiginni kɔsa in na, sanni a ka a jigi da fɛɛrɛko jiralanw dɔrɔn kan. https://articles.opexflow.com/analysis-methods-and-tools/osnovy-i-methody-texnicheskogo-trajdinga.htm I n’a fɔ jagokɛcogo bɛɛ, nafa sɔrɔli bɛ bɔ sɔngɔko wale kɛcogo la. Jagokɛlaw minnu bɛ fɛɛrɛ in dege, olu bɛ u sinsin tariku ni sisan cogoyaw kan walasa ka nafa sɔrɔ sɔngɔ bɛ se ka taa yɔrɔ min na kɔfɛ.

- Prix action system – o ye mun ye, basigi ye jagokɛlaw daminɛbagaw ye

- Sugu faamuyali ni sɔngɔ wale ye

- Kandili sɛgɛsɛgɛli ye Prix Action jusigilan ye

- Sannifeere kɛcogo misaliw

- Mun na sɔngɔko wale bɛ baara kɛ?

- Jago sɔngɔko wale kɛcogo – Faamuyali ni fɛɛrɛw

- Scalping ani sɔngɔko wale

- Structural merger factors ani sɔngɔko walew

- Baarakɛcogo fɛɛrɛ sɔngɔ wale

- Baara kɛ ni sɔngɔko wale ye cogo min na waleyali la

- Jago kɛli kan breakout dɔ kan chart pattern dɔ kan

- Horizontal breakout/retest jagokɛcogo

- Jago kɛli Breakout dɔ kan Trendline dɔ kan

- Jagokɛyɔrɔ min bɛ bɔ kɔfɛ

- Ka don jago dɔ la ni ŋaniya ye

- Sannifeere wale jago: Fɛn minnu ka kan ka jateminɛ

Prix action system – o ye mun ye, basigi ye jagokɛlaw daminɛbagaw ye

I n’a fɔ a tɔgɔ b’a jira cogo min na, nin fɛɛrɛ in na, fɛn min nafa ka bon kosɛbɛ, o ye wariko minɛn dɔ sɔngɔ ye. Sannifeere wale sinsinnen bɛ sɔngɔ jiginni kɔlɔsili n’a faamuyali kan. Tuma caman na, a bɛ sɛgɛsɛgɛ ka ɲɛsin sɔngɔ caman yeli ma minnu kɛra ka tɛmɛ. Fɛnba min bɛ sɔngɔko wale jago danfara bɔ fɛɛrɛ wɛrɛw la, o ye ko fɛɛrɛ in bɛ baara kɛ ni jatebɔlan “saniyalenw” walima “farilankolonw” ye, ni taamasiyɛnw tɛ, ni ɲɛfɔli ye ko taamasiyɛnw yɛrɛ ye tariku sɔngɔ jiginniw faamuyaliw ye (minnu tɛ ni fanga ye min bɛ se ka fɔ ka ɲɛ, ani tun tɛna sɔrɔ jaaw yɛrɛ la). Nka, o kɔrɔ tɛ ko sɔngɔko wale jagokɛlaw tɛ baara kɛ ni fɛɛrɛbɔminɛnw ye. Ni an y’a jateminɛ ko sɔngɔko wale jago bɛ tali kɛ sɔngɔ jiginni kɔsa in na ani tɛmɛnenw na, fɛɛrɛko sɛgɛsɛgɛli baarakɛminɛnw bɛɛ (trendlines, Fibonacci retracements,

dɛmɛni ni kɛlɛli siraw , a ɲɔgɔnnaw) nafa ka bon sɔngɔko kɛcogo sɛgɛsɛgɛli la ka kɛɲɛ ni fɛɛrɛ ye min bɛ bɛn jagokɛla ma kosɛbɛ. https://articles.opexflow.com/analysis-methods-and-tools/fibonacci-channel.htm A ka c’a la, sɔngɔ yeli kunnafoniw bɛ jira

Zapɔn kandili walima histogramuw cogo la minnu kalanni ka nɔgɔn. Sugu ye min kɛ waati dɔ kɔnɔ, i bɛ o bɛɛ sɔrɔ jatebɔw la. Sɔrɔko kunnafoniw bɛɛ ani diɲɛ kibaruyaw minnu bɛ nɔ bila sɔngɔ la cogo dɔ la, olu bɛna jira sɔngɔko jatebɔsɛbɛn kɔnɔ.

Sugu faamuyali ni sɔngɔ wale ye

Fɛnba min ka kan ka faamuya sɔngɔko walekɛcogo jagokɛla fɛ walasa ka jago latigɛw kɛ ni kunnafoni ye, o ye suguya sigicogo ye min bɛ sen na sisan. Nin ɲɛfɔli in senfɛ fɔlɔ ye ka fɛɛrɛko hakɛ jɔnjɔnw sɔrɔ ani ka taamasiyɛn kɛ sɔngɔko jatebɔsɛbɛn kan. Olu ye dɛmɛ ni kɛlɛli hakɛ jɔnjɔnw ye, a ka c’a la, sanni ni feereli yamaruya caman bɛ sɔrɔ minnu na, o de kama, u bɛ se ka ɲɛfɔ iko yɔrɔw la, ɲinini walima sɔrɔ bɛ caya yɔrɔ minnu na. Dɛmɛ ni farikolo tangalanw hakɛ jɔnjɔnw dɔnni ka fisa waati jan kɔnɔ (don o don walima dɔgɔkun o dɔgɔkun). Aw bɛ swing highs ni lows jɛlenw ɲini minnu kɔlɔsira siɲɛ caman ka tɛmɛ, ka u taamasiyɛn ni zana tilennenw ye. O hakɛw ye dɛmɛ ni kɛlɛli hakɛ jɔnjɔnw ye yɔrɔ minnu na sɔngɔ bɛ se ka segin kɔ.

- Hakilila dɛmɛni ni kɛlɛli hakɛw ka teli ka kɛ jatebɔlanw falenfalen hakɛw lamini na (1,00, 1,10, 1,20, a ɲɔgɔnnaw). Sugutigi caman bɛ sanni ni feereli komandiw kɛ nimɔrɔw lamini na, o la sɔngɔ bɛ se ka bɛn nin hakɛw ma walima k’u kari ni jagokɛcogo caman ye min tɛ deli ka kɛ.

- Fibonacci retracement hakɛw bɛ kɛ ka hakɛw ɲini minnu bɛ se ka kɛ, sɔngɔ bɛ se ka segin yɔrɔ minnu na ani ka taa ɲɛ ni taabolo kunba ye. Ni a kɛra waati kuntaalajanw kan, Fibonacci hakɛ nafamaw i n’a fɔ 61,8% kɔsegin hakɛ bɛ se ka kɛ fɛɛrɛko hakɛ jɔnjɔnw ye, komandi caman bɛ kɛ yɔrɔ minnu na.

- Pivot points fana bɛ se ka kɛ fɛɛrɛko nivo nafamaw ye yɔrɔ minnu na sɔngɔ bɛ se ka dɛmɛ walima kɛlɛ sɔrɔ. Jagokɛla caman bɛ tugu don o don pivot points n’u ka dɛmɛ ni u ka kɛlɛli hakɛw kɔ u ka jago la.

- Dɛmɛn ni muɲuli hakɛw . Fɛɛrɛko nivo jɔnjɔnw man kan ka kɛ fɛn kelenw ye. Moving averages bɛ kɛ ka caya walasa ka dynamique key technique niveaux dɔn minnu bɛ kɛ tile 50 EMA lamini na, tile 100 EMA lamini na, tile 200 EMA lamini na, walima Fibonacci EMA hakɛ lamini na i n’a fɔ tile 144 EMA.

- Fɛn minnu bɛ ɲɔgɔn sɔrɔ, olu ye yɔrɔw ye, fɛɛrɛko hakɛw bɛ ɲɔgɔn sɔrɔ yɔrɔ minnu na, o b’u nafa jira ka taa a fɛ.

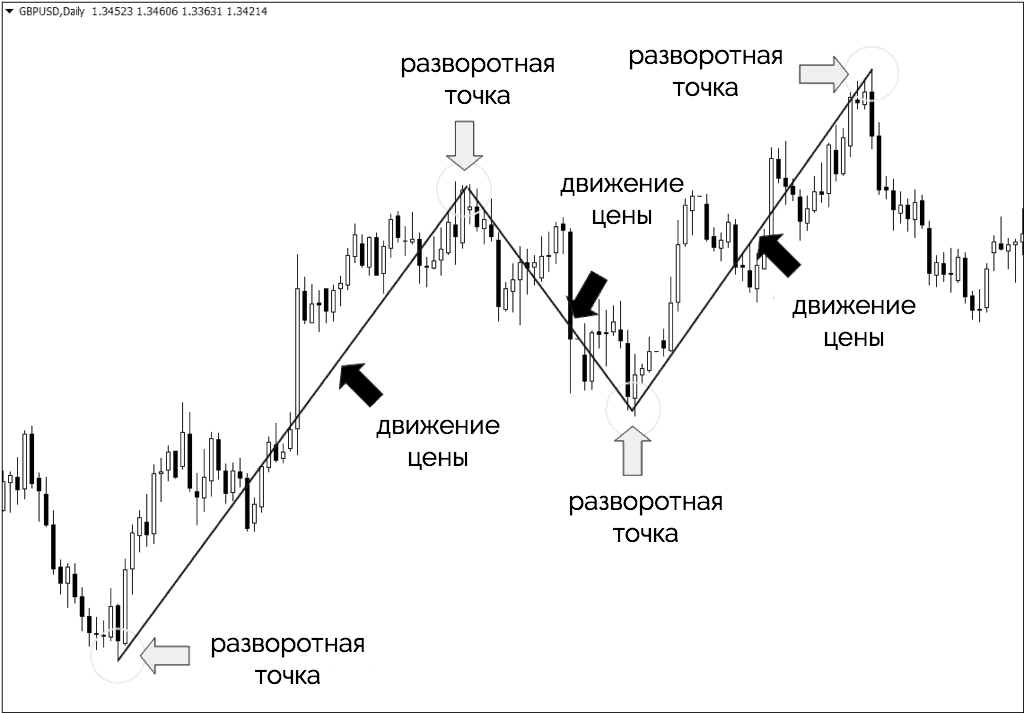

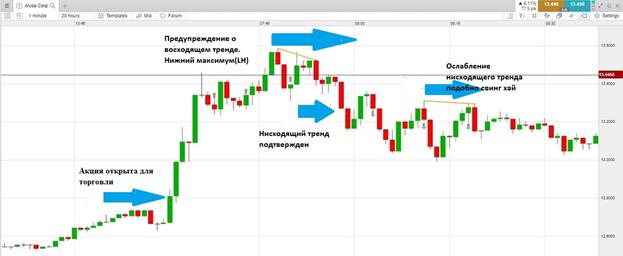

Ka da a kan, an ye fɛɛrɛko hakɛ jɔnjɔnw ɲɛfɔ jatebɔsen kan, waati sera ka sugu taabolo sɛgɛsɛgɛ sisan – sisan taabolo. Sɔngɔ wale jagokɛla caman bɛ jago dɔrɔn de kɛ cogoya bɛɛ lajɛlen sira fɛ, bawo o jago sigicogo ninnu ka teli ka ɲɛtaa sɔrɔ kosɛbɛ. Suguw bɛ se ka taa cogo saba la – sanfɛ, duguma ani kɛrɛfɛ. Sugu min bɛ ka wuli, o bɛ ka wuli. A bɛ dɔn ni sanfɛla caman ye ani minnu ka dɔgɔn tablo kan. Dɔgɔya sanfɛtaw bɛ sɔrɔ sɔngɔko seginni waatiw la, minnu ye sɔngɔko jiginni ye waati kunkurunnin kɔnɔ, min bɛ kɛ cogoya sigilen dɔ sira wɛrɛ fɛ. A ka c’a la, u bɛ Sɔrɔ tɔnɔ sɔrɔli fɛ jagokɛlaw fɛ minnu bɛ wulicogo la kaban. Ni sɔngɔ jiginna dɔrɔn, sannikɛla kuraw bɛ don sugu la, bawo u b’a jate ko sisan suguya sɔngɔ ka dɔgɔ kosɛbɛ. O bɛ kɛ sababu ye ka dɔgɔya sanfɛla dɔ Kɛ. Sugu minnu bɛ jiginɛw kɛ ka dɔgɔya ani ka jiginɛw kɛ, olu bɛ jigincogo la. A laban na, sugu minnu tɛ HH ni HL wulicogo ni LL ni LH jigincogo jira, nka u bɛ taa kɛrɛfɛ ni sira jɛlen tɛ, olu bɛ wele ko suguya minnu bɛ bɔ yɔrɔjan. Range suguw la, sɔngɔ wale jagokɛlaw ka teli ka sanni kɛ ni sɔngɔ sera range duguma dakun na ani ka feere ni sɔngɔ sera range sanfɛla laban na. minnu tɛ HH ni HL jiginni cogoya jira ani LL ni LH jigincogo, nka u bɛ taa kɛrɛfɛ ni sira jɛlen tɛ, olu bɛ wele ko ranging markets. Range suguw la, sɔngɔ wale jagokɛlaw ka teli ka sanni kɛ ni sɔngɔ sera range duguma dakun na ani ka feere ni sɔngɔ sera range sanfɛla laban na. minnu tɛ HH ni HL jiginni cogoya jira ani LL ni LH jigincogo, nka u bɛ taa kɛrɛfɛ ni sira jɛlen tɛ, olu bɛ wele ko ranging markets. Range suguw la, sɔngɔ wale jagokɛlaw ka teli ka sanni kɛ ni sɔngɔ sera range duguma dakun na ani ka feere ni sɔngɔ sera range sanfɛla laban na.

Ni an ye taamasiyɛn kɛ fɛɛrɛko hakɛ jɔnjɔnw kan jatebɔsɛbɛn kan, ani ka sugu ɲɛminɛcogo bɛɛ lajɛlen dɔn, yɔrɔ koloma kelen tɛ yen walasa ka sugu ja dafalen sɔrɔ ani ka sugu sigicogo faamuya sisan. O fɛn in ye sugu lajɛbagaw hakililata ye, i n’a fɔ a jiralen bɛ cogo min na jatebɔ ni kandili cogoyaw fɛ.

Sannifeere kɛcogo misaliw bɛ balansi jira waati yɛrɛ la, min bɛ feereli dicogo ni wariko minɛn dilen dɔ ɲinini cɛ. Yɛlɛma o sɔngɔ bɛ wuli, o b’a jira ko sannikɛlaw ni feerekɛlaw ka balansi bɛna Changer – ni dɔ farala fɛnw sɔrɔli kan, o bɛna sɔngɔ jigin, ka sɔrɔ ni dɔ farala ɲininiw kan, o bɛna sɔngɔ wuli. Sannifeere jagokɛla b’a ka jagokow sinsin a kan ko ni sannikɛlaw ka ɲinini tɛmɛna feerekɛlaw ka sɔrɔ kan, wajibi don sɔngɔ bɛna wuli ka caya walima a kɔfɛ.

Kandili sɛgɛsɛgɛli ye Prix Action jusigilan ye

Waatibolodacogo mana kɛ min o min ye, waati kelen-kelen bɛɛ bɛ bɛn kandili walima bara dɔ ma. Bugunw bɛ sɔngɔko walew lajɛ waati latigɛlen dɔ kɔnɔ, o la miniti 5 jatebɔ kan, buji kelen-kelen bɛɛ bɛ sɔngɔ wale miniti 5 jira, k’a sɔrɔ don o don jatebɔ kan, kandili kelen dɔrɔn de bɛ da tile kɔnɔ.

Kandili ye sɔngɔ wale jatebɔsɛbɛn dɔ jiracogo ɲɛnamaba ye. U faamuyali nafa ka bon kosɛbɛ jagokɛla ka se ka jɔyɔrɔw da wuli walima ka u datugu waati bɛnnen na.

Kandili in kɔnɔ, sɔngɔ hakɛ naani bɛ yen – dabɔli (Da wuli), dadon (Da), dɔgɔmannin (Jiginni), camanba (Kɔrɔ). Kandili farikolo bɛ waati daminɛ sɔngɔ ni dakun daminɛ sɔngɔ cɛ hakɛ jira. Kandili wulilen kan (o b’a jira ko sɔngɔ bɛ bonya waati min bɛ jateminɛ na), da bɛ jira ni farikolo duguma yɔrɔ ye, ani dakun bɛ jira ni sanfɛla yɔrɔ ye. Ani, a kɔfɛ, ka ɲɛsin kandili bearish (min b’a jira ko sɔngɔ jiginna). Wikɛw (biɲɛw walima kɔw) bɛ sɔngɔ jiginni hakɛ jira waati kɔnɔ. Tuma o tuma ni sɔngɔw sera hakɛw ma minnu bɛ danyɔrɔ kɔkan min sirilen don ni dakun dafalenw ni dakunw ye, biɲɛw bɛ ye n’u bonya ye (kɔrɔ walima duguma). Kulɛriw bɛ kɛ ka sɔngɔ lamagacogo dɔn min jiralen bɛ ni kandili ye. A ka c’a la, bullish kandiliw bɛ kɛ fin, bulu walima wuluwulu ye, ka sɔrɔ bearish kandili bɛ kɛ nɛrɛ walima bilen ye.

- Kandili farikolo janw bɛ fanga barikama jira ani sugu kɛcogo latigɛlen da wulilen na, nka, u b’a jira ko fɛn dɔ bɛ wuli ka wuli ka bɔ a nɔ na bawo sɔngɔ dɔw bɛ se waati dɔ kɔnɔ nka u laban bɛ bɔ da wulilen na.

- Farikolo misɛnninw bɛ se ka suguya latigɛbaliya jira walima balansi bɛ fanga wulilenw ni fanga dɔgɔyalenw cɛ.

Fɛɛrɛ min bɛ kɛ ka sɔngɔ kɛcogo ɲɛfɔ waati kɔnɔ, o ye fɛn ye min bɛ kɛ. O de ye sɔngɔ jiginni siraba ye waatibolodacogo bɛnnen na.

- Cɛmancɛ-taama-sira ye tigɛli-sira ye sugu bɛ Bɔ min na siɲɛ fila. Nin ŋaniyasira in bɛ taabolo dɔ jira min bɛ se ka kɛ nka a ma dafa fɔlɔ.

- Confirmé trendline – Sugu ye wuli ka bɔ nin trendline in na siɲɛ saba. Laadalata sɛgɛsɛgɛli bɛ nin ta k’a kɛ taamasyɛn ye min b’a jira ko taabolo sinsinni ye tiɲɛ ye, wa ko sugu bɛna jaabi di a lamini na.

A ka c’a la, dɛmɛ ni rezisti layiniw bɛ kɛ jɛgɛma, nka n’u bɛ jɛgɛncogo dɔ kan, u bɛ wele ko jirisunw.

Baara kɛli ni nin zana ninnu ye, o ye ko hakilijagabɔ sugu dɔ bɛ sugu la – sɔngɔ bɛ a yɛrɛ minɛ cogo dɔ la ka ɲɛsin hakɛ dɔw ma, minnu tun ye fɛn nafamaw ye fɔlɔ. Ni nivow bɛ sisan sɔngɔ jukɔrɔ, u bɛ kɛ “dɛmɛ” ye, min bɛ se ka kɛ buffer ye ka ɲɛsin bearish move ma. Ni hakɛw bɛ sanfɛ sisan sɔngɔ kan, u bɛ ye i n’a fɔ “resistance”, min bɛ se ka kɛ sababu ye ka wuli ka taa wuli. Ni sɔngɔ gɛrɛla o hakɛw la dɔrɔn, jagokɛlaw ka teli k’a jira ko nin hakɛw bɛna kɔrɔbɔ, ka kari, walima ka lakana sanni u ka dannaya sɔrɔ sɔngɔ siratigɛ la walasa ka don jago dɔ la. Ni sɔngɔ tɛmɛna o hakɛw dɔ la kelen fɛ, u bɛ jɔyɔrɔ wɛrɛ ta. Ni wulicogo dɔ tiɲɛna, “resistance” bɛ kɛ “support” ye, o bɛ hakɛba jira,

Jago minnu bɛ mara kosɛbɛ walima minnu bɛ se ka da u kan, olu ye minnu bɛ kɛ ni sugu bɛ wuli ka wuli dɛmɛni ni kɛlɛli hakɛw cɛ minnu bɛ se ka dɔn. O b’a to i bɛ se ka sanni kɛ wulicogo la ni sennasanbara bɛrɛbɛrɛ dɔ ye sɔngɔw jigin ka se dɛmɛ hakɛ ma, ka sɔrɔ ka feere ni sɔngɔ seginna ka se kɛlɛli hakɛ ma, walima, jigincogo la, ka feere ni sɔngɔ tɛmɛna sanfɛ cogo la min bɛ se ka da a kan resistance niveau (kɛlɛli hakɛ).

Sannifeere kɛcogo misaliw

Kandili misali ye bara sɔngɔ wale kelen walima tuma dɔw la caman ye min bɛ jira ja la kandili jatebɔsɛbɛn kan, sɔngɔ wale jagokɛlaw bɛ baara kɛ ni min ye walasa ka sugu lamagacogo fɔ. A ka c’a la, misaliw de ye sanni ni feereli ɲininiw bɛnkan jiralan ye min bɛ waati bɛnnen na kosɛbɛ. Nka, misali dɔnni ye fɛn ye min bɛ kɛ ni hakili ye dɔɔnin, wa a bɛ kalan de wajibiya ka fara mɔgɔ yɛrɛ ka dɔnniya kan walasa ka sekow yiriwa ka ɲɛsin kandili misaliw dɔnni n’u feereli ma. Patɔrɔn suguya caman bɛ yen, minnu caman ye fɛn fitininw dɔrɔn ye minnu bɛ ɲɔgɔn falen-falen sariyakolo jɔnjɔn kelen kan. O la, a bɛ nafa sɔrɔ ka sinsin “kulu” fitinin dɔ kan min bɛ kɛ ni misaliw ye minnu bɛ jagokɛla dɛmɛ ni taamasiyɛnw ye minnu bɛ se ka da a kan a ka baara kɛ ni minnu ye.

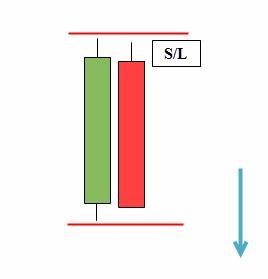

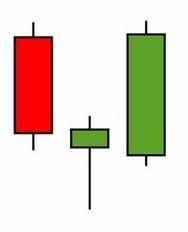

Same High Lower Close Bars (DBHLC) ani Same Low Higher Close Bars (DBLHC) – tɔgɔ in bɛ se ka fɔ ko a ka gɛlɛn, nka a cogoya faamuyali ka nɔgɔn. Modeli in sinsinnen bɛ dɛmɛ ni kɛlɛli hakilina kan.

DBLHC ye DBHLC jatebɔlan inversé ye. Kandili fila bɛɛ ka dɔgɔn kelen ye, wa kandili filanan dadon ka bon ka tɛmɛ kandili fɔlɔ sanfɛla kan.

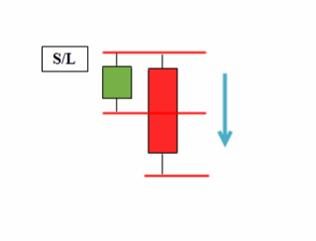

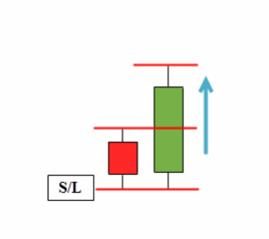

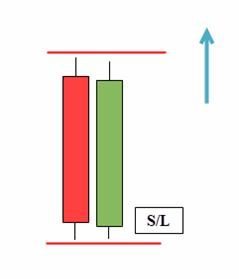

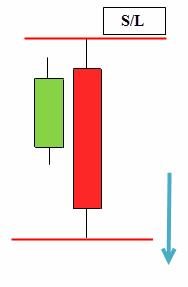

Misali dɔ ye bearish setup ye

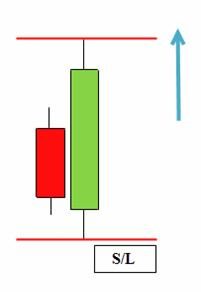

Misali la, bullish sigicogo dɔ

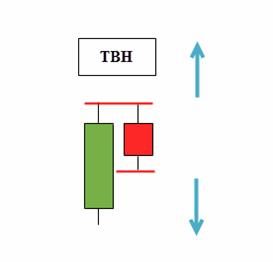

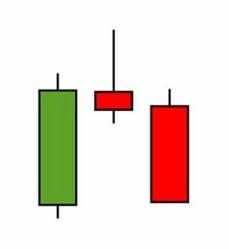

Baro fila minnu ka sanfɛla ye kelen ye (TBH) ani bara fila minnu ka dɔgɔn kelen ye (TBL) olu ye sɔngɔko cogoya fila ye minnu bɛ baara kɛ fan fila bɛɛ la, a kɛcogo mana kɛ min o min ye. Jago bɛɛ ni o cogoyaw ye, o ni jago kɛli ni kɔnɔna bara ye, o bɛ kelen ye. O sababu ye ko bara laban ye kɔnɔna bara ye bara tɛmɛnen na. A bɛ se ka fɔ ko Prix Action fɛɛrɛ misaliw bɛɛ ye fan fila ye, o min b’a to i bɛ se ka sanni kɛ ani ka feere. TBH – bar sanfɛtaw bɛ sɔrɔ hakɛ kelen na. Ni sɔngɔ tɛmɛna kandili filanan sanfɛta kan, o tuma na, o ye taabolo tɛmɛnen taamasyɛn ye, dɔgɔmannin ye taabolo kɔsegin ye. Misali la, jagokɛcogo min bɛ kɛ ni TBH ye:

nɛgɛsirabawye kɔsegincogo nɔgɔman ye min ka teli ka kɛ ŋaniyaw laban na walima jiginnibaw.

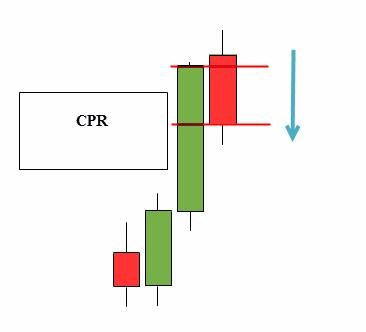

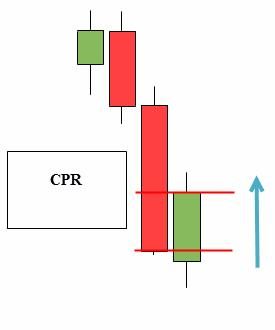

Reversal to close price

(CPR) ye kandili kɛcogo ye min lakodɔnnen don kosɛbɛ ani min bɛ jago kɛ tuma caman.

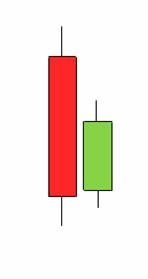

Pin bar , a bɛ fɔ fana ko Pinocchio bar, o ye sɔngɔ wale misali ye min ka ca ni tɔw bɛɛ ye. A bɛ kandili jira ni farikolo fitinin ye ani biɲɛ jan bɛ a fan kelen na.

pinɛ bara ye min duguma dawolo janyalen don . Jago ka kan ka da wuli ni sanni jɔli yamaruya min bɛ sen na, o bɛ pinɛ bara sanfɛ, ani ni jɔli bɔnɛ ye duguma yɔrɔ la.

Kɔnɔna bara (

kɔnɔna

bara

) .ye reversal/continuation candelstick formation ye min bɛ fɔ kosɛbɛ, min bɛ candelstick fila de wajibiya a dɔgɔyalenba la. Nin misali in ye tulonkɛ tilennen ye sugu dusukunnata kuntaala surun kan k’a ɲini ka don ka kɔn “yɔrɔba” ɲɛ minnu bɛ se ka kɛ sugu la. Kɔnɔna bara in b’a jira ko sɔngɔw t’a fɛ ka wuli ka tɛmɛ/jukɔrɔ kan kandili sanfɛla ni duguma tɛmɛnenw kan, o b’a jira ko sugu ma latigɛ.

Baara kɛ ni bullish kɔnɔna bar pattern ye

Bearish sugandicogo

Kɔnɔna bara biɲɛw bɛ se ka tɛmɛ kandili fɔlɔ kan, nka a ka fisa, ni farikolo ni kandili biɲɛ fila bɛɛ bɛ bara fɔlɔ kɔnɔ, o taamasiɲɛ suguw bɛ se ka da u kan kosɛbɛ. Ani fana, bara fɔlɔ kɔnɔ, kelen tɛ Se ka Kɛ, nka kandili damadɔ bɛ yen, a kunba ye k’u bɛ sɔngɔ wale jagokɛcogo sariyaw bɛɛ labato. O cogo la, jate bɛ di patɔrɔn ma ka da kɔnɔna baraw hakɛ kan, i n’a fɔ IB2, IB3, ani a ɲɔgɔnnaw.

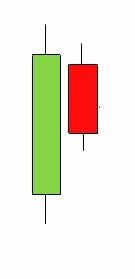

Kɛnɛma bara ye kandili fila ye min kɔnɔ kandili filanan sanfɛla ka bon ani a ka dɔgɔn. Kandili filanan ka yɔrɔ ka kan ka tɛmɛ fɔlɔ ta hakɛ kan. O kɔrɔ ye ko sɔngɔko ni sɔngɔko bɛ ka bonya, ka fanga jira fan fila bɛɛ la. A ka c’a la, a ma jɛya ni misiw walima ursiw ye se sɔrɔ, dannaya kelen min bɛ yen, o ye dɔ farali ye sɛgɛsɛgɛli kan.

BUOVB (bullish kɛnɛma bara jɔlen) .

BEOVB (bullish kɛnɛma bara jɔlen) .

Mun na sɔngɔko wale bɛ baara kɛ?

Tablo caman bɛ bi, olu falen bɛ taamasiyɛnw na minnu faamuyali ka gɛlɛn. Nka, u bɛ se ka min di, o ye sɔngɔ kalanni ye, a jɛlen ani a sɔgɔlen, min jiralen bɛ ni kandili ye. Aw mago bɛ kandiliw dɔrɔn de la, ka fara dɛmɛ nɔgɔmanw ni kɛlɛli siraw kan. Ni i bɛ jago kɛ sɔngɔ wale la jatebɔlan saniyalenw kan, i bɛ fɛnw bɔ yen minnu bɛ i hakili ɲagami ani ka i sinsin fɛn nafamaba kan, n’o ye sɔngɔ ye. Tiɲɛ na, o de ye fɛn kelen ye min wajibiyalen don walasa ka ɲɛtaa sɔrɔ suguw la. Jagokɛla caman dalen b’a la ko sugu bɛ tugu cogoya gansanw kɔ wa a ma jɛya cogo labɛnnen na cogo min na ka fɛɛrɛ dɔ dɔn min bɛ baara kɛ tuma bɛɛ. Ikomi sɔngɔko wale bɛ fɛɛrɛko sɛgɛsɛgɛli baarakɛminɛnw fara ɲɔgɔn kan ni sɔngɔko tariku kɔsa in na walasa ka jago siraw dɔn ka da jagokɛla kelen-kelen bɛɛ ka faamuyali kan min bɛ kɛ ni hakilina ye, sɔngɔko wale jago bɛ dɛmɛ kosɛbɛ jago la.

Jago sɔngɔko wale kɛcogo – Faamuyali ni fɛɛrɛw

Fɔlɔ, i ka kan ka jatebɔsɛbɛn suguya wɛrɛw dɔn ani taamasiyɛn minnu bɛ se ka kalan ka bɔ u la. O kɔfɛ, aw ka kan ka seko ni dɔnko yiriwa sɔngɔko misaliw dɔnni na. O kɔrɔ fana ye ka dɛmɛ ni kɛlɛli layiniw jacogo dege. Waati tɛmɛnen kɔfɛ, faamuyali min bɛ se ka faamuya, sɔngɔw bɛ kɛ cogo min na n’u sera fɛn dɔw la minnu bɛ taa ɲɛ, o bɛna na. Baarakɛyɔrɔ kelen min ka kan ni sɔngɔko wale jagokɛla ye, o ye jatebɔlan saniyalen ye min tɛ ni fɛɛrɛko jiralan si ye (n’a ma fɔ fɛnɲɛnɛmaw jiginni dɔw la). Sannifeere jatebɔsɛbɛn saniyalen bɛ jagokɛla dɛmɛ a ka a sinsin sɔngɔ jiginni kan, a kana a sinsin fɛɛrɛko jiralanw kan minnu bɛ kɔfɛ.

Laɲini fɔlɔ ye ka fɛn dɔ minɛ a daminɛ na, ka tugu a kɔ fo a ka kɛ fɛn ye min tɛ se ka kɛ. A nafa ka bon k’a dɔn ko sɔngɔko wale jagokɛlaw b’a ɲini ka baarakɛminɛn damadɔ fara ɲɔgɔn kan u ka sɛgɛsɛgɛli la, o bɛ dɔ fara jagokɛlaw ka ɲɛtaa sɔrɔli kan.

Tiɲɛ na, sɔngɔko wale jago siratigɛ la, a bɛɛ bɛ jigin jago sigicogo walima sɔngɔ wale kɛcogo degecogo la ka bɔ ɲɔgɔndan hakɛw la. K’a sababu kɛ sugu baarakɛlaw cogoya ye, u ka waleyaw diɲɛ sɔrɔko fɛn caman sɛgɛsɛgɛli la, sɔngɔko wale bɛ teli ka segin a yɛrɛ kan cogoya wɛrɛw la. Sannifeere kɛcogo jatebɔsɛbɛnw bɛ sugu dusukunnataw caman yeli walima u tɛmɛnenw jira. O cogo la, i kɛlen kɔ ka sɔngɔko cogoyaw dɔnni dege, i bɛ se ka “ladiliw” sɔrɔ sɔngɔ bɛna taa yɔrɔ min na kɔfɛ. A ka c’a la, u bɛ se ka tila kulu fila ye:

tɛmɛsira kɛcogoani ŋaniyajiracogo kɔsegincogo. https://articles.opexflow.com/analysis-methods-and-tools/figury-texnicheskogo-analiza-v-trajdinge.htm Hali ni tɛmɛsira cogoyaw b’a jira ko taabolo kunba bɛ ka taa ɲɛ, kɔsegincogo misaliw bɛ a kɔkanna jira, ko o taabolo kunba bɛ ka kɔsegin. Tɛmɛsiraba minnu bɛ yen olu ye

rectangles ,

flags ,

wedges bintɔw (jiginni waati) ani wedges wulilenw (jigin waati). Basic Reversal Patterns –

Kunkolo ni senw, kunkolo ni kamankunw bɛ wuli, sanfɛ fila ni duguma fila, jirisunw bintɔ (jigin waati la) ani jirisunw wulilen (jigin waati). Sannifeere wale kriptowari kan – sugu faamuyali, jago fɛɛrɛw, baara kɛcogo sɔngɔ wale sugu in na – wideyow kalan: https://youtu.be/BzaS4dgQvxE

Scalping ani sɔngɔko wale

Scalping ye ka don ani ka bɔ jɔyɔrɔ dɔ la joona walasa ka nafa sɔrɔ sɔngɔ jiginni misɛnninw na, a mana kɛ fɛn o fɛn ye min bɛ jate sɔngɔ jiginni fitinin ye o nafolo la. A ka ca a la, sɔgɔsɔgɔninjɛkɛla caman bɛ baara kɛ ni miniti 1 jatebɔlanw ye. Sɛgɛsɛgɛli fɛɛrɛ in kun ye ka jago kɛ taabolo sira fɛ ani ka don kɔsegin waati la ni sɔngɔ bɛ daminɛ ka segin ka taa taabolo sira fɛ. Walasa k’o kɛ, jagokɛlaw bɛ fɛnw ɲini minnu bɛ fɛnw minɛ minnu bɛ doncogo jira, i n’a fɔ ni kandili min bɛ trend fan fɛ, o bɛ kandili datugu ka ɲɛsin pullback ma. O bɛ kɛ rollback dɔ senfɛ.

Structural merger factors ani sɔngɔko walew

Sannifeere wale jago siratigɛ la, ɲɔgɔndan ye yɔrɔ/dakun ye, fɛn fila walima caman bɛ ɲɔgɔn sɔrɔ yɔrɔ min na (walima u bɛ ɲɔgɔn cɛ) ka kɛ yɔrɔ funteni ye (jɛɲɔgɔnya yɔrɔ) min bɛ jago taamasiyɛn kelen sinsin. Misali la, sɔngɔ bɛ taa rezisti hakɛ la, n’i ye Fibonacci kɔsegincogo lajɛ, a bɛ se ka kɛ i n’a fɔ ɲɔgɔndan min rezisti hakɛ fana bɛ 61,8 Fibonacci hakɛ la. Nka o dɔrɔn tɛ, jɛrɛn taabolo fana bɛ jigin. O la, fɛn saba bɛ yen minnu bɛ ɲɔgɔn Labɛn:

- jεkuluba ka jigincogo;

- sɔngɔ bɛ ka gɛrɛ resistance hakɛ min na;

- sɔngɔ fana bɛ ka taa fo 61,8 Fibonacci hakɛ la , o bɛ bɛn ni rezisti hakɛ ye .

Baarakɛcogo fɛɛrɛ sɔngɔ wale

Jagokɛlaw minnu bɛ se kosɛbɛ, olu bɛ sugandi suguya caman mara walasa ka cogoyaw dɔn, ka don ni bɔ hakɛw dɔn, ka bɔnɛw jɔ ani ka kunnafoni nafamaw sɔrɔ. Ni aw bɛ baara kɛ ni fɛɛrɛ kelen dɔrɔn ye, a bɛ se ka kɛ ko o tɛna jagokɛcogo bɛrɛ di. Sannifeere wale jagokɛcogo minnu bɛ se ka nɔ ɲumanw garanti ni baara kɛra ni u ye ka ɲɛ:

- Breakout (breakout) – o fɛɛrɛ bɛ kandili caman sɔrɔli fara ɲɔgɔn kan (min ka bon kosɛbɛ kalan 9 labanw na) ani kalo 2 sanfɛla kura. O bɛ kɛ sababu ye ka installation (dadon) kɛ “dafalen” ye ani ka baara kɛ ni diya ye.

- Pini bara bɛ se ka baara kɛ ni suguya o suguya ye, a kɛra ka ŋaniya dɔ daminɛ kokura ɲini kɔsegin kɔfɛ walima ka kɔseginw dɔn ka bɔ sanfɛla walima dɔgɔya nafamaw la. A bɛ taa ɲɛ ni nkalontigɛ breakouts ye key levels.

- Kɔnɔna baraw ka ɲi kosɛbɛ walasa ka sisan kow nɔfɛtaama, kɛrɛnkɛrɛnnenya la n’u fila, saba walima caman bɛ ɲɔgɔn kɔ (u ka se ka bɔn).

Baara kɛ ni sɔngɔko wale ye cogo min na waleyali la

Jago kɛli kan breakout dɔ kan chart pattern dɔ kan

A ka c’a la, donni sɔngɔko wale jagokɛlaw la, o bɛ sinsin dantigɛli sugu dɔ kan min bɛ sigikafɔw daminɛ. A jɔnjɔn na, ninnu ye fɛɛrɛko nivow karilenw ye, minnu bɛ Sɛmɛntiya ni kandili cogoyaw ye.

- 1 – kininbolo kamankun .

- 2 – patɔrɔn kunkolo .

- 3 – kininbolo kamankun .

- 4 – kɔkili min bɛ kamankun fila bɛɛ duguma yɔrɔw siri ɲɔgɔn na .

Kungolo ni kamankunw cogoya ye kɔsegincogo nafama ye min bɛ sɔrɔ wulicogo dɔ sanfɛ. Jagokɛla bɛ jɔyɔrɔ surun dɔ dabɔli makɔnɔ fo sɔngɔ ka kɔkili kari. Ni bεnkansεbεn dɔ Kεra, tɔnɔ laɲini min bε jago la, o ye patɔrɔn janya (5) ye min bε jira ka Bɔ bεnkansεbεn yɔrɔ la (6). A ka ca a la, jɔli bɔnɛw bɛ bila kɔkili sanfɛ (taamacogo jugu) walima kininbolo kamankun sanfɛ (laadalata).

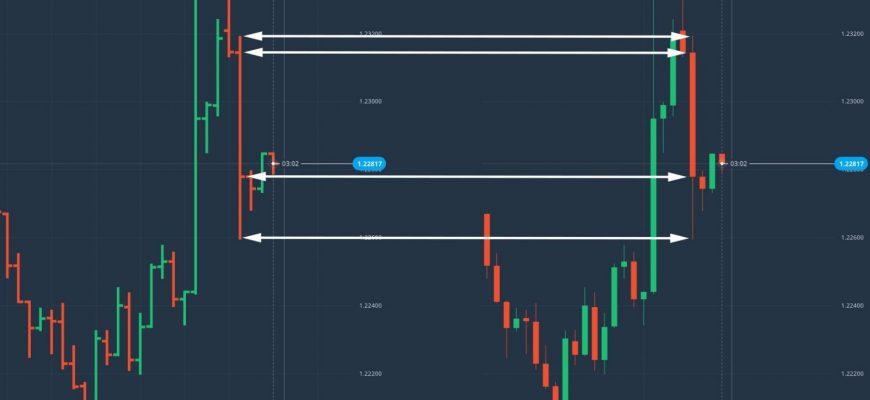

Horizontal breakout/retest jagokɛcogo

Jagokɛla dɔw b’a fɛ ka jago ta ka da breakouts kan ka bɔ horizontal ranges la. O fɛɛrɛ in bɛna kɛ sababu ye ka suguya dɔ sɔrɔ min bɛ sigiyɔrɔmako la, sanfɛla ni duguma dan jɛlenw bɛ min na.

Jago kɛli Breakout dɔ kan Trendline dɔ kan

Suguw ka teli ka fɛnw tigɛcogo tiɲɛ walima ka jigin suguw cogoyaw la minnu bɛ taa ɲɛ. Jagokɛlaw bɛ baara kɛ ni ŋaniyajiralanw ye walasa ka sanfɛyɔrɔw siri ɲɔgɔn na jiginni waatiw la ani duguma jiginni waatiw la, o tiɲɛni bɛ sababu di ka jago kɛ kari sira fɛ. Yɛlɛma sira karilen kɔrɔ jɔnjɔn ye ko sɔngɔ bɛ se ka jigin duguma kura kɛ, o min ye jigincogo taamasiyɛn ye, wa a bɛ taamasiyɛn kɛ ko jiginni bɛ se ka wuli. O cogo kelen na, jigincogo karilen kɔrɔ ye ko a ka c’a la, sɔngɔ bɛ se ka sanfɛla kura kɛ, o ye jiginni taamasiyɛn ye.

Jagokɛyɔrɔ min bɛ bɔ kɔfɛ

Jagokɛlaw minnu bɛ kɔsegin kɔfɛ, olu b’a ɲini ka aksidan walima fɛn dɔ san ni a sɔngɔ jigira waati dɔ kɔnɔ, k’a sɔrɔ a bɛ ka wuli ka taa a fɛ. Walasa ka jago kɛ, sugu ka kan ka taa sira dɔ fɛ, sanfɛ walima duguma. Ni ŋaniya tɛ jago dɔ kɔnɔ, a tɛ se ka tɔnɔ sɔrɔ rollback kan.

Ka don jago dɔ la ni ŋaniya ye

Fɛn fɔlɔ min ka kan ka kɛ, o ye ka sugu ɲɛminɛcogo jugu dɔn – yala o fila bɛ ka wuli walima ka jigin wa? Yɛlɛma bɛ sɔrɔ sɔngɔ jiginni ni sɔngɔ dɔgɔyali fɛ, ka sɔrɔ jigincogo bɛ sɔrɔ sɔngɔ dɔgɔyali ni sɔngɔ dɔgɔyali fɛ. A nafa ka bon k’a faamu ko wuli sira kan, sɔngɔ bɛna taa tuma dɔw la ka taa a cogo kɔrɔ la. O sɔngɔ jiginniw ka ɲɛsin taabolo ma, u bɛ wele ko sɔngɔko ladilanni ani u bɛ kɛ zigzag cogoya ye min bɛ kɛ cogoya la wulicogo dɔ senfɛ. Walasa ka don ŋaniya dɔ la jago kɔfɛ, jagokɛlaw bɛ baara kɛ ni Fibonacci kɔsegin hakɛw ye walasa ka kɔsegin dɔ janya suman ka bɔ wulikan tɛmɛnen na.

Sannifeere wale jago: Fɛn minnu ka kan ka jateminɛ

Farati ɲɛnabɔli sɔngɔ wale jago la, o ni farati ɲɛnabɔli bɛ tali kɛ jago kɛcogo wɛrɛ la – o sariya kelenw de bɛ sirataama. Jagokɛlaw ka kan ka fɛn lakikaw minnu to u hakili la, olu ta fan fɛ:

- Suguda sigicogo min bɛ sen na sisan . Ni wulicogo la, san cogoyaw la;yɔrɔ dɔ la, sanni kɛ danyɔrɔ dɔgɔyalenw kɛrɛfɛ dɛmɛni na, walima ka feere sanfɛyɔrɔw kɛrɛfɛ kɛlɛli la, jigincogo la (feere cogoyaw).

- Nafa bɛ yɔrɔ minnu na jatebɔsɛbɛn kan . Aw bɛ dɛmɛ/kɛlɛli hakɛw walima hakɛw don minnu bɛ pivot points jira sugu la. Misali la, ni sugu bɛ wulicogo la, a bɛ se ka kɛ dɛmɛyɔrɔ ye, wulicogo dɔgɔman, wulicogo wulilen ni wulicogo layini 50 waati ye, sugu bɔra min na siɲɛ caman.

- Aw bɛ stop loss bila o hakɛw ni ɲɔgɔn cɛ, walima yɔrɔ min na o fanga sugu jiracogo lakika tɛ yen min bɛna kɛ sababu ye ka nin sira caman cili sugu la.

A jɔyɔrɔba ye, jagokɛlaw b’a ɲini ka don tipping points (tipping points) la. Nivo minnu bɛ jiginni yɔrɔw ni ɲɔgɔn cɛ olu ye “zon lankolonw” ye jɔyɔrɔw bɛ se ka bila yɔrɔ minnu na. Misali la, n’i donna jago dɔ la dɛmɛ hakɛ dɔ la k’a jira ko sɔngɔ bɛna wuli, i bɛ se ka jɔyɔrɔ dɔ bila i donna dɛmɛ hakɛ min na, o jukɔrɔ kosɛbɛ, n’a sɔrɔla o fana tun tɛ dɛmɛ hakɛ ye. O cogo la, ni jɔli ye gosi, o b’a jira ko jago in jɔyɔrɔ fɔlɔ tesis tun ma jo sɔrɔ. Jagokɛlaw ka ɲɛtaa kunba ye ka kɛ ni fɛɛrɛ ye min bɛ bɛn hakilina ma, min bɛ tiɲɛ, min labɛnna ka ɲɛ, wa min tɛ cɛsiri kɛ. Ko kɛlenw, jagokow ɲɛnabɔli la ani jagokɛlaw ka jatebɔ janw dakunw na minnu tɛ se ka bali, olu bɛ se ka danfara bɛɛ kɛ walasa ka to sira ɲuman kan tuma bɛɛ k’a sɔrɔ i ma bɔ a la, nka o tɛ dɔ bɔ a la ko hali jagokɛla kuraw walima o mɔgɔw