Nya ɣaɣlawo le asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa ŋu – nusi wònye kple alesi woazã Asixɔxɔ ƒe afɔɖeɖe ƒe ɖoɖoa le asitsatsa me, kpɔɖeŋuwo kple aɖaŋuɖoɖowo. Asixɔxɔ ƒe afɔɖeɖe nye asitsatsa ƒe mɔnu si na asitsalawo te ŋu xlẽa nusiwo le edzi yim le asi me eye wòwɔa asitsatsa ŋuti nyametsotso siwo le eɖokui si le asixɔxɔ ƒe ʋuʋu nyitsɔ laa dzi, tsɔ wu be wòaɖo ŋu ɖe mɔ̃ɖaŋununya ƒe dzesiwo ɖeɖeko ŋu. https://articles.opexflow.com/analysis-methods-and-tools/osnovy-i-methody-texnicheskogo-trajdinga.htm Abe asitsatsa ƒe mɔnu ɖesiaɖe ene la, viɖekpɔkpɔ nɔ te ɖe alesi wozã asixɔxɔ ƒe afɔɖeɖea dzi. Asitsalawo siwo wɔa mɔnua la léa fɔ ɖe ŋutinya me nɔnɔmewo kple esiwo li fifia ŋu be woawɔ afisi asixɔxɔ ate ŋu aʋu le emegbe la ŋudɔ nyuie.

- Price action system – nukae nye ema, gɔmeɖoanyi na novice asitsalawo

- Asi gɔmesese kple asixɔxɔ ƒe afɔɖeɖe

- Candlestick numekuku nye nusi dzi wotu Price Action ɖo

- Asixɔxɔ ƒe afɔɖeɖe ƒe ɖoɖowo

- Nukatae asixɔxɔ ƒe afɔɖeɖea wɔa dɔ?

- Alesi woawɔ Asitsatsa ƒe Asixɔxɔ ƒe Afɔɖeɖe – Gɔmesese kple Aɖaŋuwo

- Scalping kple asixɔxɔ ƒe afɔɖeɖe

- Dɔwɔɖoɖowo ƒe ƒoƒo ɖekae ƒe nuwɔna kple asixɔxɔ ƒe afɔɖeɖe

- Dɔwɔwɔ ƒe aɖaŋu ƒe asixɔxɔ ƒe afɔɖeɖe

- Alesi woazã asixɔxɔ ƒe afɔɖeɖe le nuwɔna me

- Asitsatsa le breakout ƒe chart ƒe nɔnɔme aɖe dzi

- Horizontal breakout/gbugbɔ dodokpɔ ƒe asitsatsa

- Asitsatsa le Breakout le Trendline aɖe dzi

- Hehe ɖe megbe ƒe asitsatsa

- Asitsatsa aɖe me yiyi kple nɔnɔme aɖe

- Price Action Trading: Nusiwo Ŋu Wòle Be Woabu

Price action system – nukae nye ema, gɔmeɖoanyi na novice asitsalawo

Abe alesi ŋkɔa fia ene la, le aɖaŋu sia me la, nu vevitɔ kekeakee nye gaŋutiɖoɖo aɖe ƒe asi. Wotu asixɔxɔ ƒe afɔɖeɖe ɖe asixɔxɔ ƒe ʋuʋu ƒe ŋkuléle ɖe eŋu kple egɔmeɖeɖe dzi. Wodzroa eme zi geɖe le asi ƒe tɔtrɔ siwo dzɔ va yi ŋu. Nu vevitɔ si dea vovototo asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa kple mɔnu bubuwo domee nye be aɖaŋua zãa “dzadzɛ” alo “amama” nɔnɔmetata siwo me dzesi aɖeke mele o, kple numeɖeɖe be dzesiawo ŋutɔ nye gɔmesese siwo le asixɔxɔ ƒe ʋuʋu le ŋutinya me ŋu (siwo me nyagblɔɖiŋusẽ aɖeke mele o, eye manɔ nɔnɔmetataawo ŋutɔ me o). Gake esia mefia be asixɔxɔ ƒe afɔɖeɖe ƒe asitsalawo mezãa mɔ̃ɖaŋudɔwɔnuwo o. Esi wònye be asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa fia asi ƒe ʋuʋu nyitsɔ laa kple esi va yi ta la, mɔ̃ɖaŋununya me numekuku dɔwɔnuwo katã (trendlines, Fibonacci retracements, .

support and resistance lines , etc.) ɖea vi na asixɔxɔ ƒe nuwɔna me dzodzro le ɖekawɔwɔ me kple aɖaŋu si sɔ na asitsalawo wu. https://articles.opexflow.com/analysis-methods-and-tools/fibonacci-channel.htm Zi geɖe la, woɖea asi ƒe tɔtrɔ ŋuti nyatakakawo fiana le

Japantɔwo ƒe akaɖitiwo alo histogram siwo xexlẽ le bɔbɔe ƒe nɔnɔme me. Èkpɔa nusianu si asitsalawo wɔ hena ɣeyiɣi aɖe la tso nɔnɔmetataawo me. Ganyawo ŋuti nyatakakawo katã kple xexeame katã ƒe nyadzɔdzɔ siwo akpɔ ŋusẽ ɖe asixɔxɔa dzi le mɔ aɖe nu la adze le asixɔxɔ ƒe nɔnɔmetata la me.

Asi gɔmesese kple asixɔxɔ ƒe afɔɖeɖe

Nu vevitɔ si wòle be asixɔxɔ ƒe afɔɖeɖe ƒe aɖaŋu asitsala nase gɔme hafi ate ŋu awɔ asitsatsa ŋuti nyametsotso siwo ŋu wonya nu tsoe enye asitsatsa ƒe ɖoɖo si li fifia. Afɔɖeɖe gbãtɔ le gɔmesese sia me enye be woadi mɔ̃ɖaŋununya ƒe dzidzenu veviwo ahade dzesi wo le asixɔxɔ ƒe nɔnɔmetata dzi. Esiawo nye kpekpeɖeŋunana kple tsitretsitsi ƒe seƒe veviwo, siwo me zi geɖe la, nuƒle kple nudzadzra ƒe nudɔdɔ gbogbo aɖewo nɔa wo me, eye le esia ta woate ŋu aɖɔ wo be wonye nuto siwo me nudidi alo nuzazãwo dzi ɖe edzi le. Kpekpeɖeŋu veviwo kple tsitretsitsi ƒe agbɔsɔsɔmewo nyanya nyo wu le ɣeyiɣi didiwo me (gbesiagbe alo kwasiɖa sia kwasiɖa). Di ʋuʋudedi ƒe kɔkɔme kple bɔbɔe siwo dze ƒã siwo wode dzesii enuenu va yi eye nàtsɔ fli siwo le tsia dzi ade dzesi wo. Dzidzenu siawoe nye kpekpeɖeŋu kple tsitretsitsi ƒe dzidzenu vevi siwo me asixɔxɔa ate ŋu ahe ɖe megbe le.

- Zi geɖe la, susuŋutinunya ƒe kpekpeɖeŋu kple tsitretsitsi ƒe seƒewo dzɔna ƒo xlã xexlẽdzesi goglo ƒe asitɔtrɔ ƒe asiwo (1.00, 1.10, 1.20, kple bubuawo). Asitsalawo dometɔ geɖe tsɔa nuƒle kple nudzadzra ƒe nudɔdɔwo ƒoa xlã xexlẽdzesi goglowo, eyata asi ate ŋu asɔ kple dzidzenu siawo alo agbã wo kple asitsatsa ƒe ŋusẽ si kɔkɔ si mebɔ o.

- Wozãa Fibonacci retracement ƒe dzidzenuwo tsɔ dia dzidzenu siwo ate ŋu adzɔ le afisi asi ate ŋu agbugbɔ aɖo eye wòayi nɔnɔme vevitɔa dzi. Ne wozãe le ɣeyiɣi siwo kɔkɔ wu me la, Fibonacci ƒe dzidzenu veviwo abe 61.8% ƒe retracement ƒe dzidzenu ene ate ŋu ava zu mɔ̃ɖaŋununya ƒe dzidzenu vevi siwo me wowɔa nudɔdɔ geɖe siwo le lalam le.

- Pivot points ateŋu anye mɔ̃ɖaŋununya ƒe dzidzenu veviwo hã afisi asixɔxɔ ate ŋu ado go kpekpeɖeŋu alo tsitretsitsi le. Asitsalawo dometɔ geɖe kplɔa gbesiagbe pivot points kple woƒe kpekpeɖeŋu kple tsitretsitsi ƒe dzidzenuwo ɖo le woƒe asitsatsa me.

- Dynamic kpekpeɖeŋu kple tsitretsitsi ƒe dzidzenuwo . Mehiã be mɔ̃ɖaŋununya ƒe ɖoƒe veviwo nanɔ teƒe ɖeka o. Wozãa mamã dedie siwo le ʋuʋum zi geɖe tsɔ dea dzesi mɔ̃ɖaŋununya ƒe dzidzenu vevi siwo trɔna siwo dzɔna le ŋkeke 50 ƒe EMA, ŋkeke 100 ƒe EMA, ŋkeke 200 ƒe EMA, alo le Fibonacci EMA ƒe dzidzenuwo ŋu abe ŋkeke 144 ƒe EMA ene.

- Nusiwo wotsɔna ƒoa ƒui nye nuto siwo me mɔ̃ɖaŋununya ƒe dzidzenuwo doa go le, si gaɖe woƒe vevienyenye dzi.

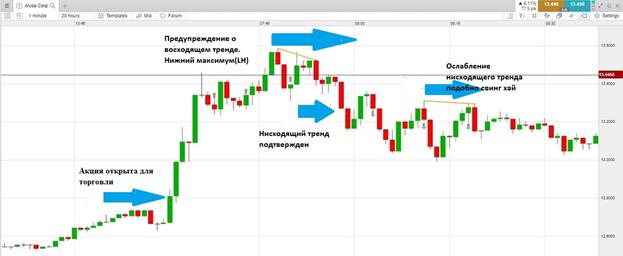

Esi míeɖe mɔ̃ɖaŋununya ƒe dzidzenu veviwo gɔme le nɔnɔmetata la dzi vɔ la, ɣeyiɣia de be míadzro asitsatsa ƒe mɔfiame si li fifia me – alesi wòle fifia. Ðeko asixɔxɔ ƒe afɔɖeɖe asitsalawo dometɔ geɖe dzraa asitsalawo le mɔ si nu nɔnɔme bliboa le la nu, elabena asitsatsa ƒe ɖoɖo siawo dina be yewoakpɔ dzidzedze ƒe kakaɖedzi gãtɔ kekeake. Asiwo ateŋu aʋuʋu le mɔ etɔ̃ nu – dzi, anyi kple axadzi. Asi si le dzi yim la le dzi yim. Eƒe dzesi enye be kɔkɔƒe siwo kɔ wu kple esiwo bɔbɔ ɖe anyi wu le nɔnɔmetata la dzi. Wowɔa nusiwo bɔbɔ ɖe anyi wu le asixɔxɔ ƒe tɔtrɔwo me, si nye asixɔxɔ ƒe ʋuʋu le ɣeyiɣi kpui aɖe me le mɔ si to vovo na nɔnɔme aɖe si woɖo anyi. Zi geɖe la, asitsala siwo le dziyiyi ƒe nɔnɔme me xoxo ƒe viɖekpɔkpɔ tae wowɔa wo ɖo. Ne asixɔxɔa ɖiɖi ko la, nuƒlela yeyewo gena ɖe asi me, . elabena wobua asi si wozãna fifia le asi me be ebɔbɔ vie. Esia wɔa anyigba si kɔ wu. Asi siwo wɔa nusiwo bɔbɔ ɖe anyi wu kple esiwo bɔbɔ ɖe anyi wu la le ɖiɖim. Mlɔeba la, woyɔa asi siwo meɖea HH kple HL ƒe dziyiyi kple LL kple LH ƒe ɖiɖi si ɖe dzesi la fiana o, gake woʋuna yia axadzi evɔ mɔfiame aɖeke si dze ƒã o la, woyɔna be asi siwo le didiƒe. Le asi siwo me wodzraa nu le ƒe asiwo me la, zi geɖe la, asixɔxɔ ƒe afɔɖeɖe ƒe asitsalawo ƒlea nu ne asi ɖo dometsotsoa ƒe nuwuwu si le anyime eye wodzraa nu ne asixɔxɔ ɖo dometsotsoa ƒe nuwuwu si le etame. siwo meɖea HH kple HL ƒe dziyiyi kple LL kple LH ƒe ɖiɖi si ɖe dzesi fiana o, gake woʋuna yia axadzi evɔ mɔfiame aɖeke medze ƒã o la, woyɔna be asi siwo le didiƒe. Le asi siwo me wodzraa nu le ƒe asiwo me la, zi geɖe la, asixɔxɔ ƒe afɔɖeɖe ƒe asitsalawo ƒlea nu ne asi ɖo dometsotsoa ƒe nuwuwu si le anyime eye wodzraa nu ne asixɔxɔ ɖo dometsotsoa ƒe nuwuwu si le etame. siwo meɖea HH kple HL ƒe dziyiyi kple LL kple LH ƒe ɖiɖi si ɖe dzesi fiana o, gake woʋuna yia axadzi evɔ mɔfiame aɖeke medze ƒã o la, woyɔna be asi siwo le didiƒe. Le asi siwo me wodzraa nu le ƒe asiwo me la, zi geɖe la, asixɔxɔ ƒe afɔɖeɖe ƒe asitsalawo ƒlea nu ne asi ɖo dometsotsoa ƒe nuwuwu si le anyime eye wodzraa nu ne asixɔxɔ ɖo dometsotsoa ƒe nuwuwu si le etame.

Esi wode dzesi mɔ̃ɖaŋununya ƒe dzidzenu veviwo le nɔnɔmetata la dzi, eye wokpɔ asitsatsa ƒe mɔfiame bliboa vɔ la, akpa vevi ɖeka bu be woatsɔ akpɔ asitsatsa ƒe nɔnɔmetata si de blibo wu eye woase asitsatsa ƒe ɖoɖo si li fifia gɔme. Nu siae nye asitsalawo ƒe susuŋutinunya, abe alesi nɔnɔmetatawo kple akaɖiti ƒe nɔnɔmewo ɖo kpe edzii ene.

Asixɔxɔ ƒe afɔɖeɖe ƒe ɖoɖowo ɖea dadasɔ si le nusi wotsɔ na be woadzrae kple gaŋutiɖoɖo aɖe si wona ƒe didi dome fiana le ɣeyiɣi ŋutɔŋutɔ me. Tɔtrɔ ɖesiaɖe si ava asi me fia be woatrɔ asi le nuƒlelawo kple nudzralawo dome dadasɔ ŋu – nusiwo woatsɔ ana ƒe dzidziɖedzi ana asixɔxɔa naɖiɖi, esime nudidi ƒe dzidziɖedzi ana asixɔxɔa nayi dzi. Asixɔxɔ ƒe afɔɖeɖe ƒe asitsalawo tua eƒe asitsatsawo ɖe susu si nye be ne nuƒlelawo ƒe didi wu nudzralawo ƒe nuzazãwo dzi la, asixɔxɔa adzi ɖe edzi wu godoo alo awɔe nenema ke.

Candlestick numekuku nye nusi dzi wotu Price Action ɖo

Ɣeyiɣi ka kee ɖale eme o, ɣeyiɣi ɖesiaɖe sɔ kple akaɖiti alo ʋuƒo. Boklotsuwo ƒoa nu tso asixɔxɔ ƒe afɔɖeɖe ŋu kpuie le ɣeyiɣi aɖe si woɖo ɖi me, eyata le miniti 5 ƒe nɔnɔmetata dzi la, bosomikaɖi ɖesiaɖe tsi tre ɖi na aɖabaƒoƒo 5 ƒe asixɔxɔ ƒe afɔɖeɖe, evɔ le gbesiagbe nɔnɔmetata dzi la, bosomikaɖi ɖeka koe wowɔa gbesiagbe.

Akaɖitiwoe nye nu vevitɔ si wotsɔ dea dzesi asi ƒe dɔwɔwɔ ƒe nɔnɔmetata si wokpɔna. Wo gɔmesese le vevie ŋutɔ be asitsalawo nate ŋu aʋu ɖoƒewo alo axe wo le ɣeyiɣi nyuitɔ dzi.

Asixɔxɔ ƒe ɖoɖo ene le bosomikaɖia me – ʋuʋu (Ʋu), nuwuwu (Tsɔ), suetɔ (Bɔbɔ), gãtɔ (Kɔkɔ). Boklotsua ƒe ŋutilã fiaa didime si le ɣeyiɣia ƒe asi si woaʋu kple ga si woaxe ɖe enu dome. Le akaɖiti si ƒe amadede nye aŋutiɖiɖi dzi (si fia be asi dzi ɖe edzi le ɣeyiɣi si ŋu míele nu ƒom tsoe me) la, wotsɔa ŋutilã ƒe akpa si le ete la ɖea alesi woʋui fiana, eye wotsɔa akpa si le etame la fiaa alesi wowu enui. Eye, vice versa, na bearish bosomikaɖi (si fia be asi ɖiɖi). Wicks (vɔvɔliwo alo asikewo) ɖea afisi asixɔxɔ ƒe ʋuʋu le le ɣeyiɣia me fiana. Ɣesiaɣi si nuwo ƒe asiwo ɖo dzidzenu siwo mele didime si wobla kple esiwo wotu ɖe wo nɔewo ŋu la godo la, wokpɔa vɔvɔliwo kple woƒe kekeme (kɔkɔ alo bɔbɔ). Wozãa amadedewo tsɔ nyaa asi ƒe ʋuʋu si wotsɔ akaɖiti tsi tre ɖi na. Zi geɖe la, bosomikaɖi siwo ƒe amadede nye aŋutiɖiɖi nɔa ɣie, blɔ alo amadede dzẽ me, gake bosomikaɖi siwo ƒe amadede nye bearish ya nyea yevu alo dzĩ.

- Akaɖitiwo ƒe ŋutilã didiwo ɖea ŋusẽ sesẽ kple asitsatsa ƒe nuwɔna si nye nyametsotsowɔwɔ fiana le ʋuʋu yi ʋuʋu me, ke hã, woɖea tɔtrɔ si dzina ɖe edzi fiana esi woɖoa asi aɖewo gbɔ le ɣeyiɣi aɖe me gake woɖea wo ɖa mlɔeba le ʋuʋu yi ʋuʋu ƒe domedome.

- Habɔbɔ suewo ate ŋu afia asitsatsa ƒe nyametsotsomawɔmawɔ alo dadasɔ le ŋusẽ siwo le dzi yim kple esiwo le dzi yim dome.

Mɔ si bɔ si dzi woato aɖɔ asixɔxɔ ƒe nuwɔna le ɣeyiɣi aɖe megbee nye nusi yia edzi. Esiae nye mɔfiame vevitɔ si dzi asixɔxɔ ƒe ʋuʋu le le ɣeyiɣi ƒe fesre si sɔ me.

- Titina ƒe nɔnɔme ƒe fli nye fli si le axadzi si dzi asitsaƒea ƒua du tsoe zi eve. Nɔnɔme ƒe fli sia fia nɔnɔme aɖe si ate ŋu adzɔ gake womeɖo kpe edzi haɖe o.

- Confirmed trendline – Asi la do tso trendline sia dzi zi etɔ̃. Dekɔnu numekuku tsɔa esia be enye dzesi be nusiwo le edzi yim ƒe fli la nye nu ŋutɔŋutɔ eye be asitsalawo awɔ nu ɖe eŋu.

Zi geɖe la, kpekpeɖeŋu kple tsitretsitsi ƒe fliwo nɔa tsia dzi, gake ne wole axadzi le nɔnɔme aɖe nu la, woyɔa wo be fli siwo le tsia dzi.

Nufiafia si le fli siawo zazã ŋu enye be ŋkuɖodzinu ƒomevi aɖe le asitsaƒea si – asixɔxɔa wɔa nu le mɔ aɖe nu le dzidzenu aɖewo gome, siwo nye tɔtrɔ veviwo tsã. Ne dzidzenuwo le asi si li fifia te la, wowɔa “kpekpeɖeŋu”, si ate ŋu anye buffer ɖe bearish ʋuʋu ŋu. Ne dzidzenuawo le dzi wu asi si li fifia la, wodzena abe “tsitretsitsi” ene, si ate ŋu axe mɔ na bullish ʋuʋu. Ne asixɔxɔa gogo dzidzenu siawo ko la, zi geɖe la, asitsalawo kpɔa mɔ be woado dzidzenu siawo kpɔ, agbã wo, alo akpɔ wo ta hafi woaka ɖe asixɔxɔ ƒe mɔfiame si dzi woato age ɖe asitsatsa aɖe me dzi. Ne asixɔxɔa to dzidzenu siawo dometɔ ɖeka me la, wowɔa akpa si to vovo na ema. Ne wogbã dziyiyi ƒe nɔnɔme aɖe la, “tsitretsitsi” zua “kpekpeɖeŋu”, si fiaa dzidzenu ɖedzesi aɖe, .

Asitsatsa siwo me wowɔa nu ɖe ɖoɖo nu alo esiwo ŋu kakaɖedzi le wue nye esiwo dzɔna ne asitsatsa le tɔtrɔm le kpekpeɖeŋu si woate ŋu ade dzesii kple tsitretsitsi ƒe agbɔsɔsɔ dome. Esia na be nàte ŋu aƒle nu le dziyiyi ƒe nɔnɔme me ne bearish afɔ hehe ɖe megbe na asiwo ɖiɖi va ɖo kpekpeɖeŋu ƒe seƒe, eye emegbe nàdzra ne asi trɔ gbɔ va tsitretsitsi ƒe seƒe, alo, le ɖiɖi ƒe nɔnɔme me la, dzra ne asi la to dzi le esi ŋu kakaɖedzi le tsitretsitsi ƒe seƒe.

Asixɔxɔ ƒe afɔɖeɖe ƒe ɖoɖowo

Akaɖiti ƒe nɔnɔme nye bar ƒe asi ƒe afɔɖeɖe ɖeka alo ɣeaɖewoɣi geɖe si woɖena fiana le nɔnɔmetata me le akaɖiti ƒe nɔnɔmetata dzi si asixɔxɔ ƒe afɔɖeɖe ƒe asitsalawo zãna tsɔ gblɔa asi ƒe ʋuʋu ɖi. Zi geɖe la, kpɔɖeŋuwoe nyea nusi ɖea nuƒle kple nudzadzra ƒe didi dome dadasɔ fiana le ɣeyiɣi nyuitɔ dzi wu. Gake kpɔɖeŋuwo nyanya nye nusi ku ɖe ame ŋutɔ ƒe susu ŋu vie eye ebia hehexɔxɔ kpakple ame ŋutɔ ƒe nuteƒekpɔkpɔ be woatu aɖaŋu siwo woatsɔ ade dzesi bosomikaɖiwo ƒe nɔnɔmewo ahadzra wo ɖo la ɖo. Kpɔɖeŋu vovovowo li, eye wo dometɔ geɖe nye tɔtrɔ sue aɖewo ko le gɔmeɖose vevi ɖeka ma ke dzi. Eyata susu le eme be woalé fɔ ɖe kpɔɖeŋuwo ƒe “ƒuƒoƒo” sue aɖe si naa asitsalawo ƒe dzesi siwo ŋu kakaɖedzi le be wòawɔ dɔ kplii la ŋu.

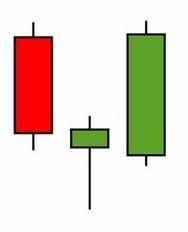

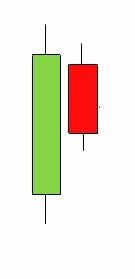

Same High Lower Close Bars (DBHLC) kple Same Low Higher Close Bars (DBLHC) – ŋkɔa ateŋu aɖi nusi sesẽ, gake kpɔɖeŋua gɔmesese le bɔbɔe ale gbegbe. Wotu kpɔɖeŋua ɖe kpekpeɖeŋu kple tsitretsitsi ƒe nukpɔsusu dzi.

DBLHC nye DBHLC ƒe nɔnɔmetata ƒe megbenya. Bosomikaɖi eveawo siaa ƒe kɔkɔme sɔ, eye bosomikaɖi evelia ƒe nuwuwu kɔ wu bosomikaɖi gbãtɔ ƒe kɔkɔme.

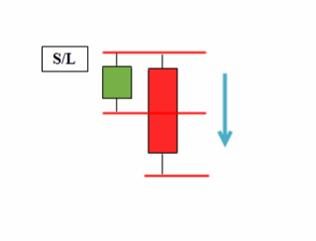

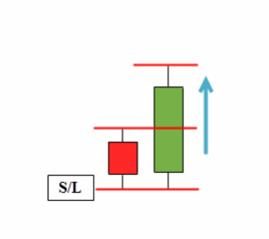

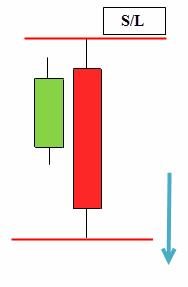

Bearish ɖoɖo ƒe kpɔɖeŋu aɖe

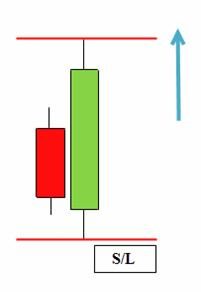

Kpɔɖeŋu si nye bullish setup

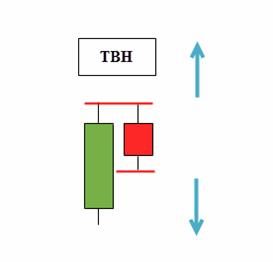

Ati eve siwo ƒe kɔkɔme sɔ (TBH) kple ati eve siwo ƒe kɔkɔme sɔ (TBL) nye asixɔxɔ ƒe ɖoɖo eve siwo wɔa dɔ le mɔ eveawo siaa nu metsɔ le mɔ ka kee nɔnɔmea le o. Asitsatsa katã kple kpɔɖeŋu mawo sɔ kple asitsatsa kple ememe bar. Nusitae nye be ʋuƒo mamlɛtɔa nye ʋuƒo si le eme na ʋuƒo si do ŋgɔ. Price Action ƒe aɖaŋuɖoɖoa ƒe kpɔɖeŋuwo katã kloe nye akpa eve, si wɔnɛ be nàte ŋu aƒle nu ahadzrae siaa. TBH – bar kɔkɔwo le ɖoƒe ɖeka ma ke. Ne asi la wu bosomikaɖi evelia ƒe kɔkɔƒe la, ekema esia nye dzesi be nɔnɔmea yi edzi, esi bɔbɔ wu la nye nɔnɔmea ƒe tɔtrɔ. Kpɔɖeŋu si nye asitsatsa to TBH zazã me:

ketekemɔwonye tɔtrɔ ƒe ɖoɖo bɔbɔe aɖe si dzɔna zi geɖe le nusiwo le edzi yim alo tɔtrɔ gãwo ƒe nuwuwu.

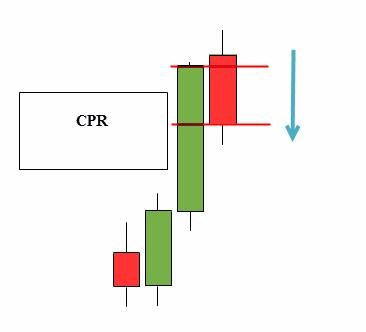

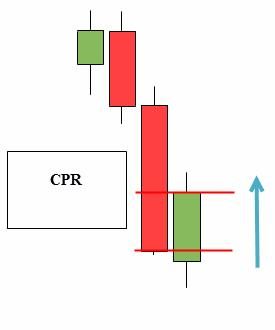

Reversal to close price

(CPR) nye akaɖiti ƒe nɔnɔme si wonya nyuie eye wodzranae enuenu.

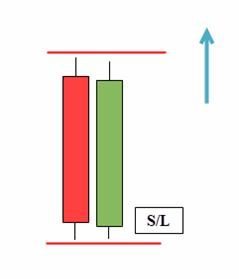

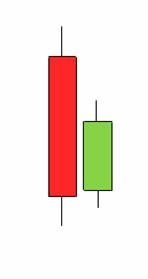

Pin bar , si woyɔna hã be Pinocchio bar, ye nye asixɔxɔ ƒe afɔɖeɖe ƒe kpɔɖeŋu si bɔ wu. Tsi tre ɖi na bosomikaɖi si ƒe ŋutilã le sue eye vɔvɔli didi aɖe le eƒe akpa ɖeka.

pin bar si ƒe vɔvɔli didi aɖe le ete . Ele be woaʋu asitsatsa la kple nuƒle ƒe tɔtrɔ ƒe sedede si le lalam le pin bar la tame, eye woatsɔ stop loss le eteƒe.

Bar ememetɔ ( bar

ememetɔ )

.

nye akaɖiti ƒe nɔnɔme si ame geɖe lɔ̃a zazã si wotsɔna trɔa asi le nu ŋu/yi edzi si hiã be woatsɔ akaɖiti eve ya teti aɖoe. Kpɔɖeŋu sia nye fefe tẽ le ɣeyiɣi kpui aɖe ƒe asitsatsa ƒe seselelãme ŋu le agbagba dzem be yeage ɖe eme hafi “ʋuʋu gãwo” siwo ate ŋu adzɔ le asitsatsa me la nava. Ati si le eme la ɖe alesi asiwo melɔ̃na be yewoayi dzi wu/aɖiɖi wu akaɖitia ƒe kɔkɔ kple bɔbɔ si nɔ anyi tsã la fia, si fia be asitsalawo metso nya me o.

Na bullish ememe bar ƒe nɔnɔme

Bearish ƒe tiatiawɔwɔ

Ati si le eme ƒe vɔvɔliwo ate ŋu agbɔ bosomikaɖi gbãtɔa ŋu, gake le mɔ nyuitɔ nu la, ne bosomikaɖia ƒe ŋutilã kple vɔvɔli siaa le ʋuƒo gbãtɔa me la, kakaɖedzi le dzesi mawo ŋu wu. Azɔ hã, le gbãtɔ bar me mate ŋu anɔ ɖeka o, ke boŋ bosomikaɖi geɖe, nu vevitɔe nye be wowɔa ɖe se siwo katã le asixɔxɔ ƒe afɔɖeɖe asitsatsa ƒe ɖoɖoa me dzi. Le go sia me la, wotsɔa xexlẽdzesi aɖe naa kpɔɖeŋua le fli siwo le eme ƒe xexlẽme nu, abe IB2, IB3, kple bubuawo ene.

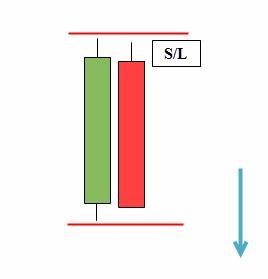

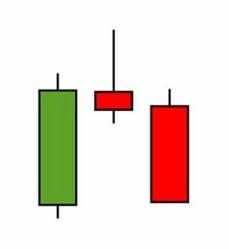

Gotagome ʋuƒo nye akaɖiti eve ƒe nɔnɔme si me bosomikaɖi evelia ƒe kɔkɔme kɔkɔ wu eye eƒe bɔbɔ ɖe anyi wu. Ele be bosomikaɖi evelia ƒe didime nawu gbãtɔa ƒe didime. Esia fia be asixɔxɔ ƒe didime kple eƒe tɔtrɔ le kekem ɖe enu, si ɖe ŋusẽ fia le akpa eveawo siaa. Zi geɖe la, womenya ne nyitsuawo alo dzatawo ɖu dzi o, nusi ŋu kakaɖedzi le koe nye nusiwo trɔna ɖe nɔnɔmewo ŋu ƒe dzidziɖedzi.

BUOVB (bullish gota tsitrenu ʋuƒo) .

BEOVB (bullish gota tsitrenu ʋuƒo) .

Nukatae asixɔxɔ ƒe afɔɖeɖea wɔa dɔ?

Taɖodzinu geɖe siwo gɔme sese sesẽ la yɔ fũ egbea. Gake nusi woate ŋu ana koe nye asixɔxɔ xexlẽ, ƒuƒlu kple ƒuƒlu, si wotsɔ bosomikaɖiwo tsi tre ɖi na. Bosomikaɖiwo koe nèhiã, kpakple kpekpeɖeŋu kple tsitretsiɖeŋu ka bɔbɔewo. To asitsatsa ƒe asixɔxɔ ƒe afɔɖeɖe le nɔnɔmetata dzadzɛwo dzi me la, èɖea susuhenuwo ɖa eye nèléa fɔ ɖe nu vevitɔ kekeake, si nye asixɔxɔ ŋu. Le nyateƒe me la, esia koe nye nusi hiã hafi woate ŋu akpɔ dzidzedze le asiwo me. Asitsalawo dometɔ geɖe xɔe se be asitsaƒea zɔna ɖe ɖoɖo siwo wowɔna le vome dzi eye womekɔ le ɖoɖo nu alesi woawɔ ade dzesi aɖaŋu si wɔa dɔ ɣesiaɣi o. Esi wònye be asixɔxɔ ƒe afɔɖeɖe ƒoa mɔ̃ɖaŋununya me numekuku dɔwɔnuwo kple asixɔxɔ ŋutinya nyitsɔ laa nu ƒu be woatsɔ ade dzesi asitsatsa ƒe mɔnukpɔkpɔ siwo wotu ɖe asitsala ɖekaɖeka ƒe susu me gɔmeɖeɖe dzi ta la, wodoa alɔ asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa ŋutɔ le asitsatsa me.

Alesi woawɔ Asitsatsa ƒe Asixɔxɔ ƒe Afɔɖeɖe – Gɔmesese kple Aɖaŋuwo

Gbã la, ele be nànya nɔnɔmetata vovovoawo kple dzesi siwo woate ŋu axlẽ tso wo me. Eyome ele be nàtu asixɔxɔ si woatsɔ ade asixɔxɔ ƒe kpɔɖeŋuwo didi ƒe aɖaŋu ɖo. Efia hã be woasrɔ̃ alesi woata kpekpeɖeŋu kple tsitretsitsi ƒe fliwoe. Le ɣeyiɣi aɖe megbe la, alesi nuwo ƒe asi wɔa nui ne woɖo nɔnɔme aɖewo gbɔ la gɔmesese si woate ŋu akpɔ le susu me ava. Dɔwɔƒe ɖeka kolia si asixɔxɔ ƒe afɔɖeɖe asitsalawo hiãe nye nɔnɔmetata dzadzɛ si me mɔ̃ɖaŋununya ƒe dzesi aɖeke mele o (negbe mamã dedie siwo le ʋuʋum le go aɖewo me koe mele eme o). Asixɔxɔ ƒe nɔnɔmetata dzadzɛ kpena ɖe asitsalawo ŋu be wòalé fɔ ɖe asixɔxɔ ƒe ʋuʋu ŋu ke menye ɖe mɔ̃ɖaŋununya ƒe dzesi siwo tsi megbe ŋu o.

Taɖodzinu vevitɔe nye be woalé nusi le edzi yim le eƒe gɔmedzedze eye woawɔ ɖe edzi vaseɖe esime wòazu nusi mewɔa dɔ o. Ele vevie be míade dzesii be asixɔxɔ ƒe afɔɖeɖe ƒe asitsalawo dzea agbagba be yewoaƒo dɔwɔnu geɖe nu ƒu le yewoƒe numekukua me, si nana asitsatsa ƒe dzidzedzekpɔkpɔ ƒe mɔnukpɔkpɔ dzina ɖe edzi.

Le nyateƒe me la, le asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa ƒe ɖoɖoa me la, wo katã va ɖoa alesi woawɔ asitsatsa ƒe ɖoɖowo alo asixɔxɔ ƒe afɔɖeɖe ƒe ɖoɖowo tso ƒoƒo ɖekae ƒe dzidzenuwo me sɔsrɔ̃ gbɔ. Le asitsalawo ƒe nɔnɔme, woƒe nuwɔna ɖe xexeame katã ƒe ganyawo ƒe tɔtrɔwo ŋu ta la, asixɔxɔ ƒe afɔɖeɖe dina be yeagawɔna le nɔnɔme vovovowo me. Asixɔxɔ ƒe afɔɖeɖe ƒe nɔnɔmetatawo ɖea asitsatsa ƒe seselelãme ƒe tɔtrɔ alo edziyiyi fiana. Eyata esi nèsrɔ̃ alesi nàde dzesi asixɔxɔ ƒe ɖoɖowo vɔ la, àte ŋu akpɔ “aɖaŋuɖoɖowo” tso afisi asixɔxɔa ayi emegbe ŋu. Zi geɖe la, woate ŋu ama wo ɖe hatsotso eve me:

yiyi ƒe ɖoɖowokple nɔnɔmewo ƒe tɔtrɔ ƒe ɖoɖowo. https://articles.opexflow.com/analysis-methods-and-tools/figury-texnicheskogo-analiza-v-trajdinge.htm Togbɔ be yiyi ƒe ɖoɖowo ɖee fia be nɔnɔme vevitɔa le edzi yim hã la, tɔtrɔ ɖe nɔnɔmeawo ŋu fia nusi to vovo na ema, be nɔnɔme vevitɔa le tɔtrɔ ge. Kpɔɖeŋu vevi siwo yia edzi enye

dzogoe ene me ,

aflagawo , ʋuƒo siwo le gegem

(le dziyiyi ƒe nɔnɔme me) kple ʋuƒo siwo le dzi yim (le ɖiɖi ƒe nɔnɔme me). Gbãtɔ Trɔtrɔ ƒe Kpɔɖeŋuwo –

Ta kple Abɔta, ta kple abɔta siwo wogbugbɔ trɔ, etame zi gbɔ zi eve kple ete zi gbɔ zi eve, ʋuƒo siwo le gegem (le ɖiɖi ƒe nɔnɔme me) kple ʋuƒo siwo le dzi yim (le yiyi ƒe nɔnɔme me). Asixɔxɔ ƒe afɔɖeɖe le cryptocurrency dzi – asi gɔmesese, asitsatsa ƒe mɔnuwo, alesi woazã asixɔxɔ ƒe afɔɖeɖe le asi sia me – video mɔfiame: https://youtu.be/BzaS4dgQvxE

Scalping kple asixɔxɔ ƒe afɔɖeɖe

Scalping bia be woage ɖe ɖoƒe aɖe me ahado le eme kaba be woawɔ asixɔxɔ ƒe ʋuʋu suesuesuewo ŋudɔ, eɖanye nusi wobu be enye asixɔxɔ ƒe ʋuʋu sue aɖe na nunɔamesi ma o. Zi geɖe la, taɖawɔla geɖe zãa aɖabaƒoƒo 1 ƒe nɔnɔmetatawo. Taɖodzinua ƒe taɖodzinue nye be yeadzra asitsadɔ le mɔ si dzi nɔnɔmea le la nu eye wòage ɖe eme le ɣeyiɣi si me woahe ɖe megbe ne asixɔxɔa dze egɔme atrɔ ayi megbe le mɔ si dzi nɔnɔmea le la nu. Be woate ŋu awɔ esia la, asitsalawo dia nɔnɔme siwo xɔa aƒe ɖe wo me siwo fiaa dzesi be woage ɖe eme, abe ne bosomikaɖi aɖe si le mɔ si le nɔnɔmea me la tsyɔ bosomikaɖi aɖe dzi le mɔ si dzi wohe ɖe megbe le ene. Esia dzɔna le rollback me.

Dɔwɔɖoɖowo ƒe ƒoƒo ɖekae ƒe nuwɔna kple asixɔxɔ ƒe afɔɖeɖe

Le asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa ƒe nyawo me la, confluence nye teƒe/dzidzenu si me nu eve alo esi wu nenema ƒoa ƒu (alo doa go) ɖekae tsɔ wɔa teƒe dzodzoe (confluence point) si ɖo kpe asitsatsa ƒe dzesi ɖeka dzi. Le kpɔɖeŋu me, asi la ʋuna yia tsitretsitsi ƒe seƒe, ne èlé ŋku ɖe Fibonacci retracement, kloe abe confluence be tsitretsitsi ƒe seƒe hã le 61.8 Fibonacci ƒe seƒe. Gake menye ema koe o, nɔnɔme si le amewo katã dome hã le ɖiɖim. Eyata nu etɔ̃e li siwo le fli me:

- nɔnɔme si le ɖiɖim ɖe anyi le goawo katã me;

- tsitretsitsi ƒe seƒe si asixɔxɔa le gogom;

- asi hã le mɔ dzi yina 61.8 Fibonacci ƒe seƒe, si sɔ kple tsitretsitsi ƒe seƒe.

Dɔwɔwɔ ƒe aɖaŋu ƒe asixɔxɔ ƒe afɔɖeɖe

Asitsalawo siwo si nuteƒekpɔkpɔ geɖe wu le la léa tiatia vovovowo ɖe asi hena dzesidede nɔnɔmewo, gege ɖe eme kple dodo le eme ƒe seƒewo, nutsitsi ƒe nusiwo bu kple nyatakaka siwo sɔ xɔxɔ. Ðewohĩ aɖaŋu ɖeka ko zazã makpɔ asitsatsa ƒe mɔnukpɔkpɔ siwo sɔ o. Price action asitsatsa mɔnu siwo ate ŋu ana kakaɖedzi be nu nyuiwo do tso eme ne wozãe nyuie:

- Breakout (breakout) – aɖaŋua ƒoa bosomikaɖi si keke ta ƒe anyinɔnɔ (si kɔkɔ wu le ɣeyiɣi 9 mamlɛawo me) kple ɣleti 2 ƒe kɔkɔƒe yeye nu ƒu. Esia na be installation la nye “kakaɖedzi” wu eye wòvivina be woawɔ dɔ kplii.

- Woate ŋu azã pin bar la le asitsatsa ƒe nɔnɔme ɖesiaɖe me, eɖanye be woadi be woagadze nɔnɔme aɖe gɔme ake le megbedede megbe alo be woatsɔ ade dzesi tɔtrɔ siwo tso kɔkɔ alo bɔbɔ veviwo gbɔ o. Ezɔna nyuie kple alakpa breakouts of key levels.

- Ati siwo le eme la sɔ nyuie na nusiwo le edzi yim fifia yometiti, vevietɔ ne wo dometɔ eve, etɔ̃ alo esi wu nenema le tsia dzi (woƒe ŋutete be woawó la lolo ŋutɔ).

Alesi woazã asixɔxɔ ƒe afɔɖeɖe le nuwɔna me

Asitsatsa le breakout ƒe chart ƒe nɔnɔme aɖe dzi

Zi geɖe la, wotua asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa me yiyi ɖe kpeɖodzi ƒomevi aɖe si ʋãa ɖoɖowo dzi. Le go vevi me la, esiawo nye mɔ̃ɖaŋununya ƒe dzidzenuwo ƒe gbagbã, siwo ŋu woɖo kpee to akaɖiti ƒe nɔnɔmewo dzi.

- 1 – miame abɔta.

- 2 – ta la ƒe kpɔɖeŋu.

- 3 – ɖusime abɔta.

- 4 – kɔ ƒe fli si do ƒome kple abɔta eveawo ƒe akpa siwo le ete.

Ta kple Abɔta ƒe nɔnɔme nye tɔtrɔ ƒe nɔnɔme vevi aɖe si dzɔna le dziyiyi ƒe kɔkɔƒe. Asitsalawo lalana be woaʋu ɖoƒe kpui aɖe vaseɖe esime asixɔxɔa nagbã kɔme. Ne gbagbã nya dzɔ ko la, viɖe si woakpɔ tso asitsatsa la mee nye kpɔɖeŋu ƒe kɔkɔme (5) si wobu tso teƒe si wogbã (6). Zi geɖe la, wotsɔa nusiwo bu la dana ɖe kɔ ƒe fli la tame (mɔnu si me wowɔa adã le) alo nɔa ɖusibɔta tame (mɔ si wozãna tsã).

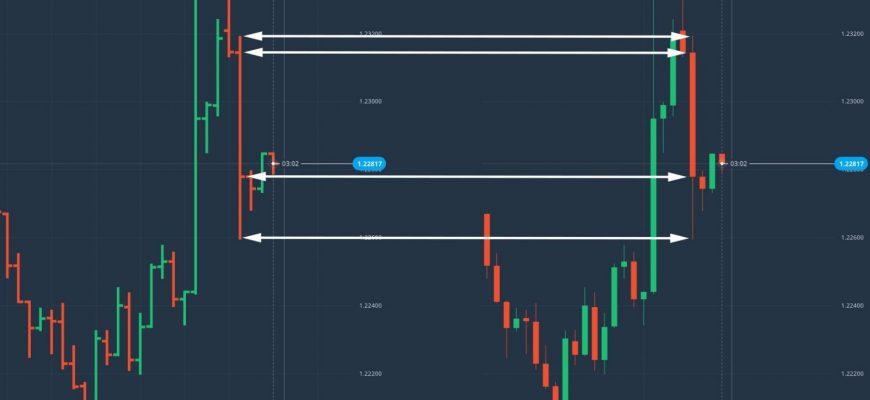

Horizontal breakout/gbugbɔ dodokpɔ ƒe asitsatsa

Asitsalawo dometɔ aɖewo lɔ̃a asitsatsa siwo wotu ɖe breakouts tso horizontal ranges dzi. Mɔnu sia abia be woawɔ asi si woɖo ɖe ɖoƒe si woɖo seɖoƒe siwo le etame kple esiwo le ete la me kɔ nyuie.

Asitsatsa le Breakout le Trendline aɖe dzi

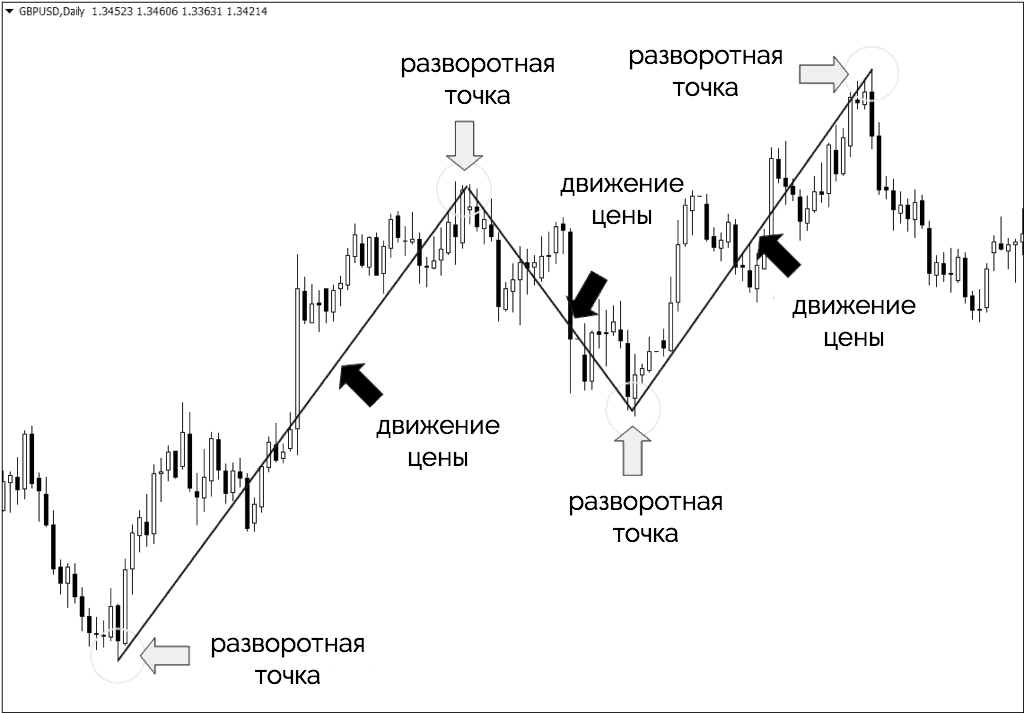

Asiwo dina be yewoagbã asiwo ƒe nɔnɔme siwo le ŋgɔ yim me alo aɖiɖi wo ɖe anyi. Asitsalawo zãa nɔnɔme ƒe fliwo tsɔ doa ka kple kɔkɔƒe siwo kɔkɔ wu le dziyiyi ƒe ɣeyiɣiwo me kple esiwo bɔbɔ ɖe anyi wu le ɖiɖi ƒe ɣeyiɣiwo me, si ƒe gbagbã naa mɔnukpɔkpɔ wo be woawɔ asitsadɔ le mɔ si dzi gbagbãa le. Dziyiyi ƒe fli si wogbã fia vevietɔ be anɔ eme be asixɔxɔa awɔ ɖiɖi yeye si bɔbɔ ɖe anyi, si nye ɖiɖi ƒe nɔnɔme eye wòfia be nɔnɔmea ate ŋu atrɔ. Nenema ke asixɔxɔ ƒe ɖiɖi si me gblẽ fia be anɔ eme be asixɔxɔ nawɔ kɔkɔƒe yeye si kɔ wu, si nye nɔnɔme si le dziyiyi ŋu.

Hehe ɖe megbe ƒe asitsatsa

Asitsalawo siwo hea nu ɖe megbe dzea agbagba be yewoaƒle adzɔnu alo adzɔnu aɖe ne eƒe asi ɖiɖi hena ɣeyiɣi aɖe le dzidziɖedzi si keke ta wu ta. Be asitsatsa la, ele be asitsaƒea nayi mɔ aɖe dzi, ayi dzi alo ayi anyime. Ne nɔnɔme aɖeke mele asitsatsa aɖe me o la, manya wɔ be woakpɔ viɖe le asitɔtrɔ le asitsatsa ŋu me o.

Asitsatsa aɖe me yiyi kple nɔnɔme aɖe

Afɔɖeɖe gbãtɔe nye be woanya asi ƒe mɔfiame si le ete – ɖe eveawo le dzi yim alo le ɖiɖim? Dziyiyi ƒe nɔnɔmewo dzɔna to asi ƒe kɔkɔme si kɔ wu kple asi ƒe ɖiɖi si kɔ wu dzi, gake ɖiɖi ƒe nɔnɔmewo ya dzɔna to asi ƒe ɖiɖi si bɔbɔ ɖe anyi kple kɔkɔƒe si bɔbɔ ɖe anyi me. Ele vevie be míase egɔme be le mɔ dzi yiyi dzi la, asixɔxɔa aʋuʋu le mɔ si to vovo na nɔnɔmea nu ɣeaɖewoɣi. Woyɔa asi ƒe ʋuʋu siawo ɖe nɔnɔmea ŋu be asixɔxɔ ƒe ɖɔɖɔɖowo eye wowɔa zigzag ƒe nɔnɔme si ɖe dzesi le nɔnɔme si le dzi yim me. Be woage ɖe nɔnɔme aɖe si kplɔ asitsatsa ɖo me la, asitsalawo zãa Fibonacci ƒe megbedede ƒe dzidzenuwo tsɔ dzidzea didime si gbugbɔgaɖoanyi aɖe tso tso ʋuʋu ƒe ƒutsotsoe si nɔ anyi va yi gbɔ.

Price Action Trading: Nusiwo Ŋu Wòle Be Woabu

Afɔku dzi kpɔkpɔ le asixɔxɔ ƒe afɔɖeɖe ƒe asitsatsa me sɔ kple afɔku dzi kpɔkpɔ le asitsatsa ƒe atsyã bubu ɖesiaɖe me – se mawo ke sɔ. Le nu ŋutɔŋutɔ siwo wòle be asitsalawo nanɔ susu me na wo gome la:

- Asitsatsa ƒe ɖoɖo si li fifia . Le dziyiyi ƒe nɔnɔme me la, ƒle mɔnukpɔkpɔwo;le dometsotso aɖe me la, ƒle le teƒe si gogo dometsotsoa ƒe anyigbamama siwo le bɔbɔe le kpekpeɖeŋu me, alo dzra le teƒe si gogo kɔkɔƒe le tsitretsiɖeŋu me, le ɖiɖi ƒe nɔnɔme me (dzra mɔnukpɔkpɔwo).

- Nuto siwo ŋu asixɔxɔ le le nɔnɔmetata la dzi . Ŋlɔ kpekpeɖeŋu/tsitretsitsi ƒe dzidzenuwo alo dzidzenu siwo do susu ɖa be pivot points le asi me. Le kpɔɖeŋu me, ne asitsaƒea le dzi yim la, ate ŋu anye kpekpeɖeŋunaƒe, ʋuʋudedi si le bɔbɔe, mamã dedie si le ʋuʋum kple ɣeyiɣi si me nɔnɔme ƒe fli 50 le, si me asitsatsa la tso zi geɖe.

- Da stop loss ɖe dzidzenu mawo dome, alo afisi ŋusẽ ma tɔgbe ƒe dzesi ŋutɔŋutɔ aɖeke meli si ahe mɔfiame ƒe tɔtrɔ sia vɛ le asitsatsa me o.

Le vevietɔ me la, asitsalawo dzea agbagba be yewoage ɖe eme le teƒe siwo wodzraa ga ɖo. Dzidzenu siwo le tɔtrɔƒewo dome nye “nuto ƒuƒluwo” afisi woateŋu aɖo ʋutɔɖoƒewo le. Le kpɔɖeŋu me, ne ège ɖe asitsatsa aɖe me le kpekpeɖeŋu ƒe ɖoɖo aɖe me hele mɔ kpɔm be asixɔxɔa adzi ɖe edzi la, àte ŋu aɖo tɔtrɔ ɖe kpekpeɖeŋu ƒe ɖoɖo si nège ɖe eme la te ŋutɔ, nenye be menye kpekpeɖeŋu ƒe ɖoɖo hãe wònye o. Le go sia me la, ne woƒo nutɔtrɔa la, efia be nyati gbãtɔ si dzi wotu asitsatsa la ɖo la mesɔ o. Nu vevitɔ si ana woakpɔ dzidzedze le asitsatsa mee nye mɔnu si sɔ le susu nu, si sɔ pɛpɛpɛ, si ŋu wowɔ ɖoɖo ɖo nyuie, eye agbagbadzedze aɖeke mele eŋu o la nanɔ ame si. Nuteƒekpɔkpɔ, le asitsatsa dzi kpɔkpɔ kple le gaɖeɖe didi ƒe akpa siwo womate ŋu aƒo asa na o siaa me, ate ŋu ana vovototoa katã nanɔ eme be woanɔ mɔ nyuitɔ dzi ɣesiaɣi evɔ womatra ɖa le eŋu o, gake esia meɖea nyateƒe si wònye be asitsala yeyewo alo ame mawo gɔ̃ hã dzi kpɔtɔna o