Junk stocks are stocks characterized by low quotations on the stock exchange and insufficient liquidity. Investing in these securities carries high risks, but can also result in high returns, well above the average blue chip return.

What are junk stocks – penny stock (penny-stock)

A penny stock may include shares that are not listed on the stock exchange. However, in the US, traders consider papers worth up to $5 as such, and in Europe up to €1. Sometimes in the category of junk, stocks of highly liquid corporations fall into the category, which temporarily fell in value and received the status of penny stock. This also includes stocks of companies with a small capitalization, the price of which traditionally does not exceed $5.

- issuers do not comply with stock exchange listing regulations , resulting in their IPOs being conducted on OTC platforms;

- shares can be bought from the issuer without involving a broker or using over-the-counter boards;

- a large spread between the sale and purchase price, as well as high volatility within intraday trading , which is about 300%, which makes the paper a speculative instrument;

- high brokerage standards for collateral during the period of registration of short positions when making transactions to sell;

- predominantly for junk stocks, exceptionally long buy deals are allowed , which allows you to make a profit only with a significant increase in their value;

- large participants are not interested in these instruments , so small investors can turn large volumes;

- low level of liquidity – it is easy to manipulate assets, since an insignificant number of transactions are made on them, and this creates a fertile ground for fraudulent activities.

Guided by these features, investors can choose high-yield assets with a high level of risk.

Types of garbage shares

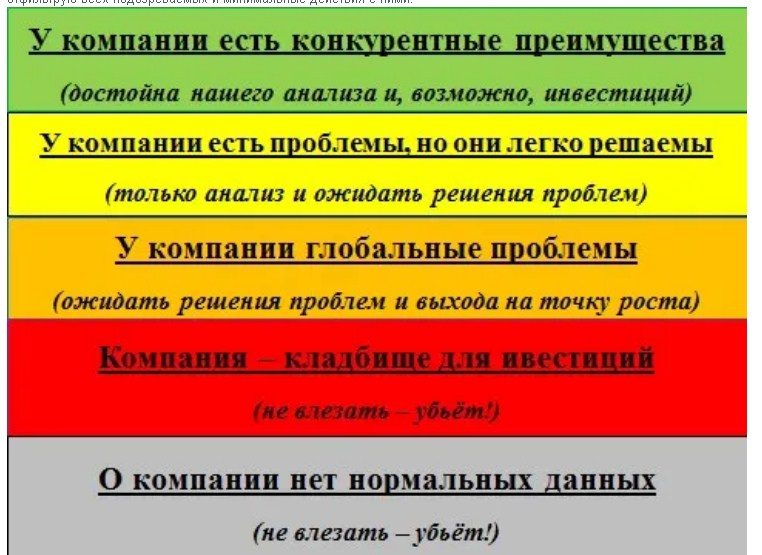

The analysis of the instrument is significantly hampered by the fact that securities are placed outside the exchange. No one obliges the issuer to conduct an independent audit and publish financial statements in an expanded form. Junk stock quotes do not appear on public streaming tables. To analyze securities, you need to determine which of the three groups they belong to:

Rising stars . Little-known firms with no operating history or financial records. They do not have a large capitalization that would allow them to receive a sufficient rating from Moody’s. These shares are considered junk, no matter what their current value is.

Fallen angels. Firms with a sharp drop in financial ratings, which was due to a deterioration in the financial situation or poor management on the part of managers. Such securities are characterized by a high probability of recovery of high value.

High-debt – companies that are on the verge of bankruptcy or are taken over by large corporations. Their shares are considered the most risky for investments.

Capital-intensive – companies with a stable financial position, but wishing to attract additional investments that cannot be secured with bank loans or their own funds. Such securities quickly grow in price and receive a high credit rating.

Analysis of penny stack securities

Stocks belonging to these categories are characterized by low activity on the stock exchanges and are often used for manipulation, which makes classical trading with graphical and technical analysis impossible. It uses fundamental analysis, which consists in studying the following data:

- news published by the company;

- industry news;

- financial report;

- information provided by insiders;

- macroeconomic indicators.

Experts recommend paying attention to junk stocks with dynamics characterized by the presence of a correlation with key stock indices for at least 6 months. When investing in these instruments, you need to analyze the changes regarding blue chips, as they provoke volatility in the sector of junk securities related to the same sector of the economy.

It is not recommended to invest more than 5% of the total portfolio in one instrument.

What you need to know about garbage stocks: https://youtu.be/czGgGYkC5EI

manipulation schemes

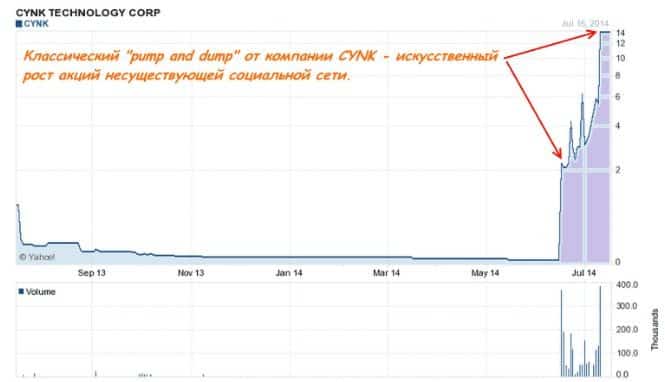

Stocks are manipulated according to several schemes, the most popular of which is pump and dump. Investors artificially provoke the growth of quotations, and then they are brought down sharply. Manipulation of illiquid securities is carried out according to the standard scheme. It consists in disseminating information, under the guise of inside information, about the upcoming major purchase of shares. The goal is to provoke insufficiently informed and inexperienced market participants to pay off. To achieve this goal, the following means can be used:

- false press releases, analytics;

- sending messages under the guise of spam;

- throwing in a controlling block of shares to maintain a stir among investors;

- dissemination of insider information.

[caption id="attachment_3410" align="aligncenter" width="665"]