I-ETF Finex – sithetha ngantoni, inzuzo yeemali ze-2022, yintoni ebandakanyiweyo kunye nendlela yokwenza iphothifoliyo kwaye ungalahleki.

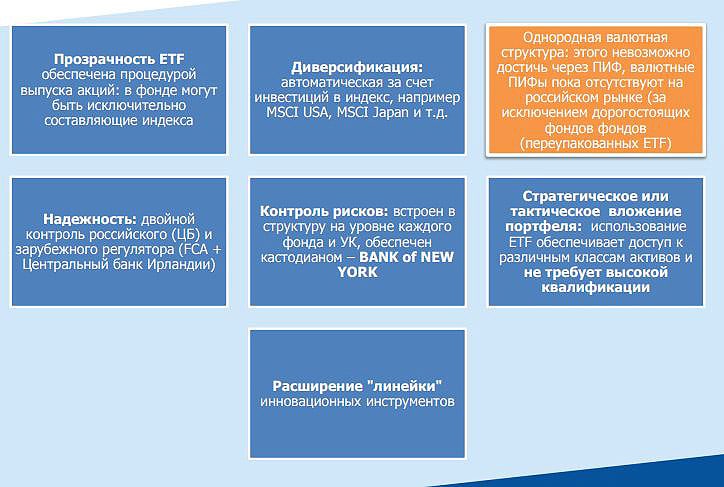

I- ETF (i-Exchange-traded fund) yingxowa-mali ethengisiweyo apho izitokhwe, iimpahla okanye iibhondi zikhethwa ngokusekelwe kwisicwangciso sokulandela uhlobo oluthile lwesalathisi okanye kwisicwangciso esithile.

ipotifoliyo eyohlukeneyo . Ixabiso elincinci lesabelo se-ETF kwi-MICEX yi-ruble eyi-1. Ukuthenga isitokhwe kwi-ETF kufana nokutyala imali kuzo zonke ii-asethi ezenza ingxowa-mali. Ukuze uqokelele iphothifoliyo enjalo ngokuzimeleyo kunye nemilinganiselo ethile, i-capital ubuncinane ye-500-2000 eyiwaka le-ruble iyadingeka.

Isifaniso esiqhelekileyo sokuchaza iimali zotshintshiselwano-zohwebo yisuphu. Udinga isitya sesobho, kodwa ukupheka ngokwakho kubiza kakhulu – udinga izithako ezininzi kwimilinganiselo ethile. Iyabiza kwaye inzima. Endaweni yoko, i-ETF ipheka isuphu kwaye ithengise enye ekhonza kumtyali-mali.

I-ETF Finex – ukubunjwa kunye nesivuno ngo-2022

Utyalo-mali kwiibhondi

- I-FXRB – i-Eurobonds ye-ruble yaseRashiya;

- I-FXIP – imali yengxowa-mali i-ruble, batyala imali kwiibhondi zikarhulumente wase-US;

- IFXRU – idola ye-Eurobonds yeRussian Federation;

- I-FXFA – utyalo-mali kwiibhondi eziphezulu zemveliso yamazwe aphuhlileyo, imali yengxowa-mali i-ruble okanye iidola;

- I-FXRD – iibhondi ze-dollar eziphezulu zesivuno;

- I-FXTP – iibhondi zikarhulumente wase-US, ukhuseleko olwakhelwe ngaphakathi lokunyuka kwamaxabiso;

- I-FXTB – iibhondi zaseMelika zexesha elifutshane;

- I-FXMM – izixhobo zothango lweemarike zemali yase-US;

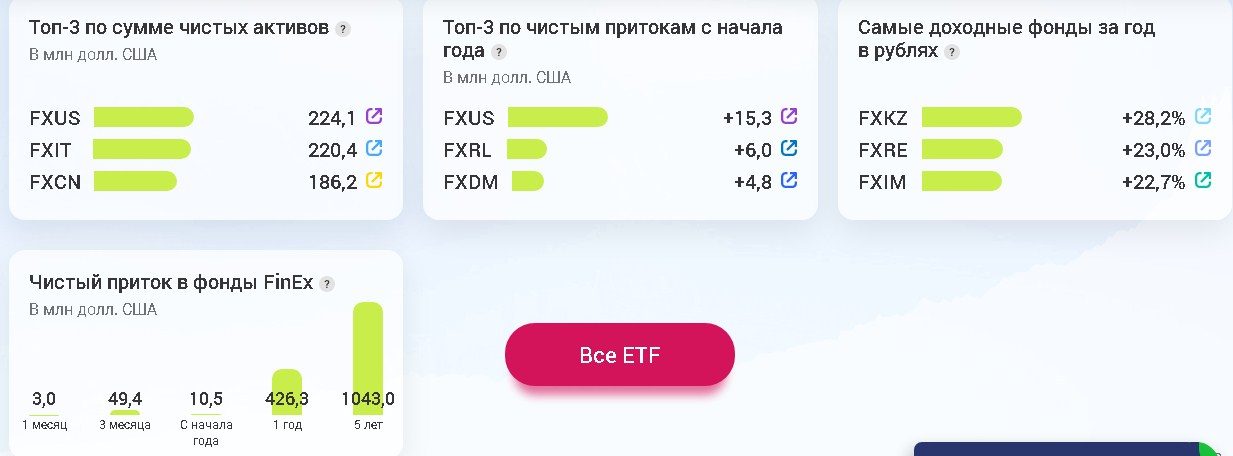

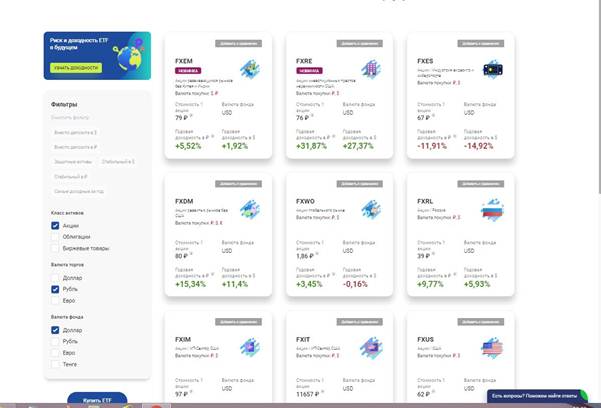

Utyalo-mali kwizabelo

- I-FXKZ – utyalo-mali kwizabelo zaseKazakhstan;

- FXWO – izabelo kwimarike yehlabathi;

- I-FXRL – ilandela i-dynamics ye-RTS;

- FXUS – ilandela SP500 index ;

- I-FXIT – utyalo-mali kwizabelo zecandelo lobuchwephesha base-US;

- I-FXCN – izabelo zaseTshayina;

- FXDE – izabelo zaseJamani;

- I-FXIM – izabelo zecandelo le-IT yase-US;

- I-FXES – izabelo zeenkampani ezibandakanyekayo kuphuhliso lwemidlalo yevidiyo;

- I-FXRE – ingxowa-mali ikuvumela ukuba utyale imali kwi-US real estate;

- I-FXEM – izabelo zamazwe asakhulayo (ngaphandle kweTshayina neIndiya);

- I-FXRW-ityala imali kwi-stocks yase-US enemali eninzi;

Utyalo-mali kwimpahla

- I-FXGD – ingxowa-mali ityala imali kwigolide ebonakalayo.

Yintoni echaphazela imbuyekezo kwiimali?

Imiba ephambili:

- Imbuyekezo yengxowa-mali ixhomekeke kutshintsho kwiingcaphuno zesalathiso okanye impahla elandelwa yi-ETF.

- Kufuneka ubeke ingqalelo kwikhomishini yengxowa-mali. I-ETF Finex inekhomishini ukuya kuthi ga kwi-0.95%. Itsalwa kwixabiso lee-asethi zengxowa-mali, umtyali-mali akayihlawulanga ngakumbi. Kufuneka kwakhona ubeke ingqalelo kwikhomishini ye-brokerage yentengiselwano. Ukuthengiselana ngakumbi umtyali-mali ekwenza, ukuthengisa nokuthenga ii-ETF, isivuno sisezantsi ngenxa yoko.

- Amaxesha amaninzi, izabelo ziphinda zityalwe, nto leyo eyandisa imbuyekezo iyonke yengxowa-mali. Ukusukela ngoJanuwari ka-2022, yingxowa-mali yeFXRD kuphela-isivuno esikhulu sebhondi yeshishini kunye nokhuseleko ekuguquguqukeni kwemali – ihlawula izabelo.

- Inzuzo evela kwi-ETF irhafiswa ngesantya se-13% njengawo nawuphi na omnye umvuzo. Ukuze ugweme irhafu, kufuneka uthenge ii-ETF kwi- akhawunti ye-brokerage eqhelekileyo kwaye ubambe ubuncinane iminyaka emi-3. Okanye uthenge i-ETF kuhlobo lwe-IIS B.

Indlela yokukhetha i-ETF yotyalo-mali?

Ngaphambi kokuba uqale ukukhetha i-asethi, kufuneka wenze isicwangciso sokurhweba. Qwalasela i-horizon yakho yotyalo-mali kunye nokunyamezela umngcipheko. Ipotfoliyo yeengxowa-mali ze-ETF kufuneka ibandakanye ii-asethi ezahlukeneyo-izabelo zamacandelo ahlukeneyo kunye namazwe, iibhondi kunye notyalo-mali kwii-asethi ezikhuselayo.Igolide ngokuqhelekileyo isetyenziswa njenge-asethi ekhuselayo. Ngokuqhelekileyo iphakama kunye nenqanaba lexabiso kwaye ikhusela imali kwi-inflation. Ngexesha lentlekele, yindawo yokusabela – iyakhula ngelixa isitokhwe siwa. Utyalo-mali kwiintsimbi ezixabisekileyo lubonelelwa ngumboneleli weFinex ngengxowa-mali yotshintshiselwano lweFXGD. Esi sisixhobo sedola yokutyala imali kwigolide ebonakalayo ngaphandle kweVAT. I-Etf FXGD ilandelela ixabiso legolide kwimarike yehlabathi ngokuchanekileyo kangangoko kunokwenzeka.

- uvavanyo lweprofayili yomngcipheko – ucelwe ukuba uphendule imibuzo embalwa ukujonga ukunyamezela komngcipheko;

- I- IIS calculator – ukumiselwa kwengeniso eqikelelweyo xa utyala imali kwi-akhawunti yotyalo-mali yomntu;

- i- calculator pension – iya kunceda ukugqiba inani lokuzaliswa kwakhona ngonyaka ukufumana ukunyuka okwamkelekileyo ngenyanga kwipension.

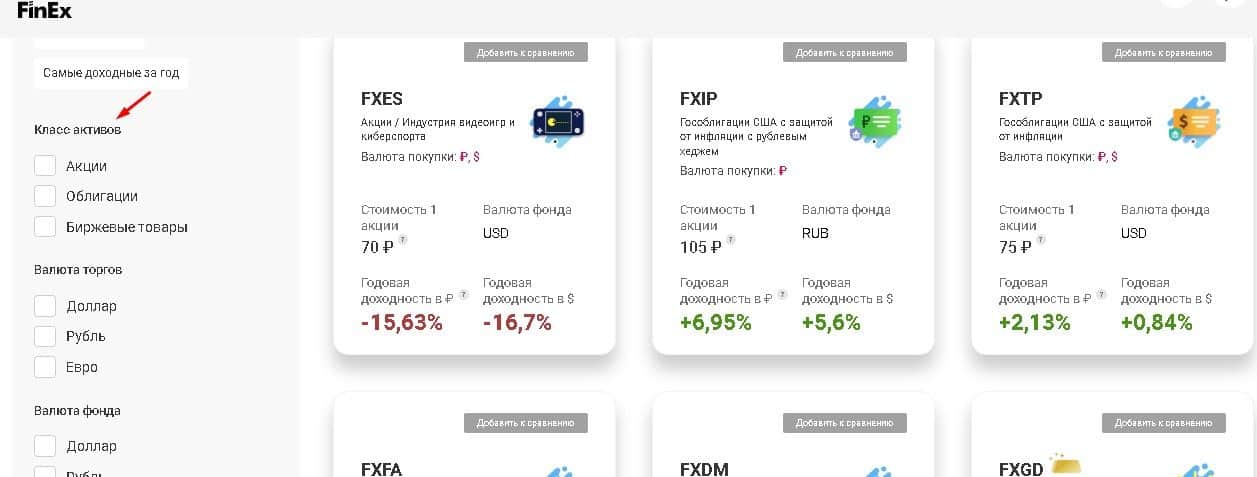

Inkonzo yeFinex iya kukunceda uthelekise imali ngenzuzo. Yiya kuzo zonke ii-ETFs ithebhu kwiwebhusayithi esemthethweni

https://finex-etf.ru/products , ngoko kufuneka ukhethe iimali ezininzi kwaye ucofe iqhosha lokuthelekisa. Isihluzi siya kukunceda ukhethe imali oyifunayo. Unokukhetha imali ngeklasi ye-asethi, ngokurhweba okanye ngemali yemali, kunye nenjongo yotyalo-mali:

- endaweni yediphozithi ngeedola;

- endaweni yediphozithi kwiiruble;

- ii-asethi ezikhuselayo;

- uzinzile kwiidola;

- uzinzile kwii-ruble;

- eyona ngeniso yonyaka.

Uyakha njani ipotifoliyo esuka kwiFinEX ETFs kunye neepotfoliyo zemodeli esele zenziwe

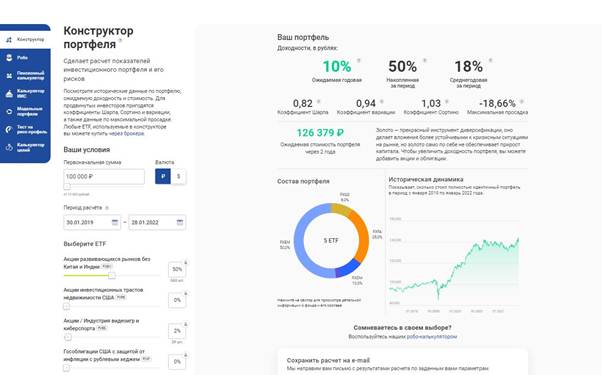

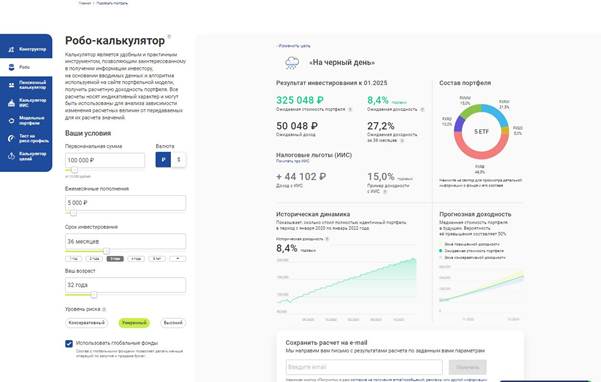

Kungaba nzima kubaqalayo ukwenza isigqibo malunga nesicwangciso sokurhweba kwaye ukhethe iimali ezithile zotyalo-mali. Ukwenza kube lula kumtyali-mali, iFinex iqulunqe iipotfoliyo zemizekelo emininzi. Umtyali-mali unokufaka idatha yokuqala kwithebhu ye-Robo-calculator:

- ubungakanani bemali yokuqala;

- ukugcwaliswa kwenyanga;

- ixesha lotyalo-mali;

- iminyaka yakho;

- inqanaba lomngcipheko – kufuneka kuqondwe ukuba umngcipheko ophezulu, ingeniso ephezulu ingaba;

- ukufumaneka kweemali zawo onke amazwe kwipotfoliyo;

- injongo yotyalo-mali.

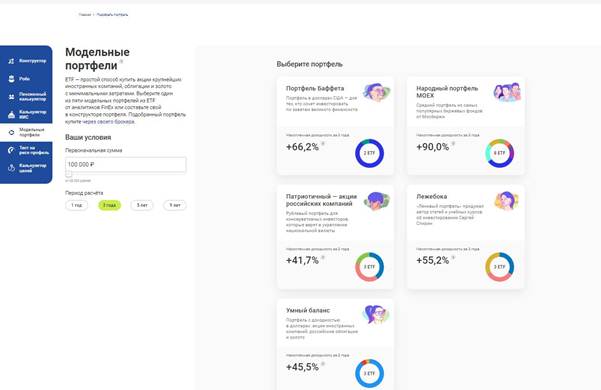

- Ipotfoliyo kaBuffett lutyalo-mali kwimigaqo yomtyali-mali odumileyo, iquka utyalo-mali kwiinkampani zase-US kunye namatyala exeshana elifutshane ase-US. Ifanelekile kumngcipheko ophezulu.

- Iipotfoliyo zabantu be-MOEX – iphothifoliyo yenziwe yimali ethandwa kakhulu yokutshintshiselana, epapashwa ngenyanga yiMoscow Exchange. Ukwakhiwa kwepotfoliyo yomfuziselo kutshintsha kwiwebhusayithi yeFinex qho ngenyanga.

- I- Patriotic – iphothifoliyo yabatyalo-mali abakholelwa kwiinkampani zaseRashiya. Iqukethe iimali zezabelo zeRussian Federation, izibophelelo zeenkampani ezinokwethenjelwa kakhulu kunye nengxowa-mali yemali ye-ruble. Ifanelekile kubatyali-mali abangafuni ukukhetha izabelo ngokwabo.

- I- Lezhebok – ukuphunyezwa kwesicwangciso somtyalo-mali owaziwayo waseRashiya uSergei Spirin. Iqukethe ii-ETF ezi-3 – kwimpahla, iibhondi kunye negolide.

- Ibhalansi ehlakaniphile – ipotifoliyo enesivuno sedola, iqulethe i-ETF kwizabelo zangaphandle zamazwe aphuhlileyo nasakhulayo. Ii-ETF zegolide kunye ne-Russian corporate bonds ziye zongezwa ukunciphisa ukuguquguquka kweepotfoliyo. Ipotifoliyo ifanelekile kwabo bantu bafuna ukutyalomali kwiidola.

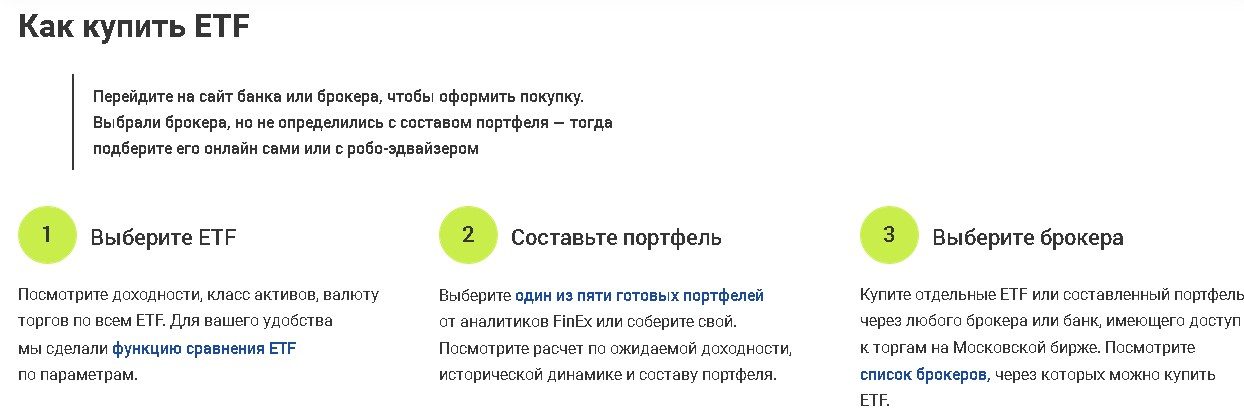

Ukuthenga i-ETF, gcina isibalo kwaye ufumane izixhobo nge-akhawunti yobuqu yomthengisi okanye isicelo esikhethekileyo. Ukuba awunayo i-

akhawunti ye-brokerage okwangoku, unokuvula enye ngokuya kwi-Thenga i-ETF ithebhu.