In order to achieve success in trading and investments and make a profit, develop and improve in modern methods and ways of earning, you need to know what such a concept as money management is. Many novice market players do not take into account the significance and value of this phenomenon, so they cannot choose an effective direction in trading. This term is important in any existing areas of trading and investment, as it allows you to choose the optimal algorithm of actions.

What is money management and why is it necessary for beginners and practicing traders and investors

The concept of money management in trading is one of the main ones, which is recommended to be studied before the first entry into the auction. A careful and thoughtful attitude to this concept will allow you to avoid losses, reduce risks and learn to recognize signals in a timely manner, according to which you should open / close positions. In fact, money management, like risk management, must be studied in order to properly manage funds, thereby increasing profits and minimizing losses.

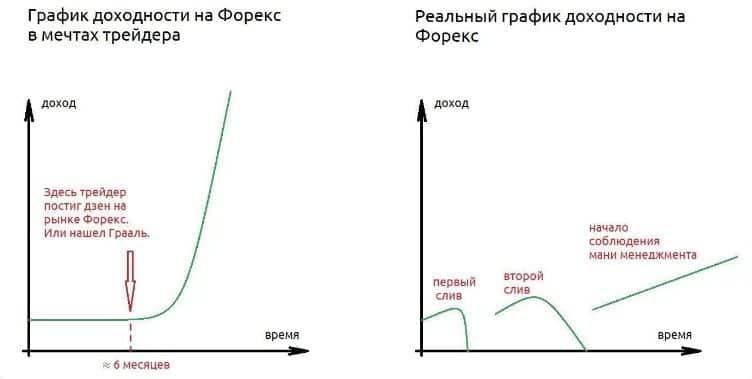

It should be borne in mind that instant profit is an additional element of earnings. But, if it is chosen as the main model, then in 90% of cases the player will fail. That is why it is important to think about how to manage the available personal capital with maximum benefit.

The existing money management rules imply a number of principles and systems for the distribution of funds that are intended for investment. The purpose of this concept is to minimize the risks of losing all the money capital available to the trader. Hence it turns out that money management is a set of actions to manage money. It involves the judicious use of tools and strategies to preserve and grow invested assets. Also, these are financial strategies that help a person not to lose money already invested in trading. Forex money management calculator for MT4: https://youtu.be/J8ill0oHneQ This type of management is needed in order to achieve a smooth increase in investments, without sharp drawdowns, unforeseen risks and unjustified losses. The chosen direction of work will allow to give a guarantee to the trader, that successful transactions will appear and be carried out. Loss-making operations will be minimized. Money management needs to be studied in order to learn how to plan asset management. Up to 90% of traders are working to increase capital in the long term. Here it should be taken into account that the longer a trader trades without a system, the higher the risks of financial losses. At the same time, you can go negative even within one day of trading. Money management will allow you to understand how to deal with losses and how not to increase them in the future. This is the main purpose of money management. that the longer a trader trades without a system, the higher the risk of financial loss. At the same time, you can go negative even within one day of trading. Money management will allow you to understand how to deal with losses and how not to increase them in the future. This is the main purpose of money management. that the longer a trader trades without a system, the higher the risk of financial loss. At the same time, you can go negative even within one day of trading. Money management will allow you to understand how to deal with losses and how not to increase them in the future. This is the main purpose of money management.

Money management rules

When studying money management, you need to carefully study the rules and understand the consequences of its violation. The first, simple and easy to understand the essence of MM rules were developed at the beginning of the 20th century. They already then allowed trading with a profit. The essence of these rules:

- It is forbidden to invest all available capital at once in one transaction.

- It is recommended to open several deals at once, or use the funds to average positions.

- It is best to invest in one transaction no more than 5-10% of the available capital. Then it will be easier to avoid stress in the event of a loss.

- It is possible to give possible profit the opportunity to reach its maximum. This will help it grow within one trading session.

- You need to exit the cache on time. This means that it is required to transfer the received profit directly into money. It is recommended that at least half of the profitable capital available at a particular moment be converted into cash. This should be done with all funds received from any large or significant transaction.

Another rule applies here – each player must independently set his own threshold.

The current rules also point to the fact that any investor uses his capital as a working tool. Proper money management is important in trading, as it allows you to always be in a winning position. Violation of money management entails negative consequences. Beginners in this direction constantly forget that it is dangerous to risk large amounts, as there may be large financial losses. For them, it is recommended to use no more than 5% of the total amount they have available in the transaction. It is necessary to carefully study such a concept as a trader’s deposit, since the resulting indicator directly depends on what the loss will be in the event of an unsuccessful transaction. Accordingly, if you take more than 5% of the amount, then the losses will be significant for the beginner.

Specific money management strategies that can be put into practice

It is known that for money management and risk management in trading, their own strategies have been developed. If you examine the statistics, you can see that beginners in most cases prefer the averaging strategy. It consists in increasing the proportion of shares held by the trader as their price falls. The strategy is remarkable in that it lowers the average purchase price. Also, a similar method is chosen by those investors who use fundamental analysis during trading.

. Calculations and analytics are based on the understanding that the valuation of an asset should be underestimated in relation to expectations. In this case, each subsequent price cut increases the undervaluation. As a result, there is an increase in the attractiveness of the asset for subsequent investments. Here we must take into account that there is a contradiction with the basic principle of reducing losses.

Practical example

For a better understanding of what money management is in trading, you need to give examples and calculate risks. This will help you develop a profitable trading strategy.

Risk calculation

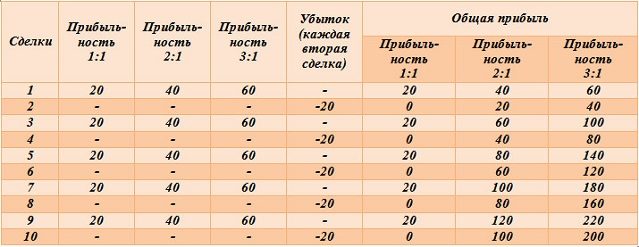

Using money management and risk management, it should be taken into account that in 90% of cases the risk indicators per trade will be in the range of 1-15%. The indicators are calculated based on the trader’s deposit. Normally, the indicators should fit in 1-2%. The risk of 3-5% will be moderate. A high rate is 7-15%. If there is a deposit of 100,000 rubles, then the allowable level of reduction is no more than 5,000 rubles per security. In the event of a decrease in the deposit to 80,000 rubles, the drawdown should no longer be more than 4,000 rubles. At the same time, the profit/risk ratio must be at least 1.5. It is best when it is greater than 3. For example, a risk of loss of 5% (5,000 rubles) is invested in a transaction, the deposit is 100,000 rubles. The expected yield from here should be set at a level of at least 7,500 rubles.

Tips

Additional recommendations:

- You must immediately set the maximum value of the loss per trade.

- No need to open large positions.

- It is necessary to diversify the investment portfolio , taking into account the ratio of positions.

- Emotions should not influence the decisions made.

- The absence of open positions allows you to avoid losses.

- It is important to be able to be out of positions – you need to pay attention to market activity.

- Wait for real trades with high profit potential.

- During times of volatility , you need to trade less.

One of the main tips is to prepare a trading plan in advance, to draw up positive and negative scenarios.

Is it possible to achieve success in trading without following strict money management rules, or is it simply gambling with your capital?”,

“refusal

Akkamitti jalqabuun danda’aamaa?