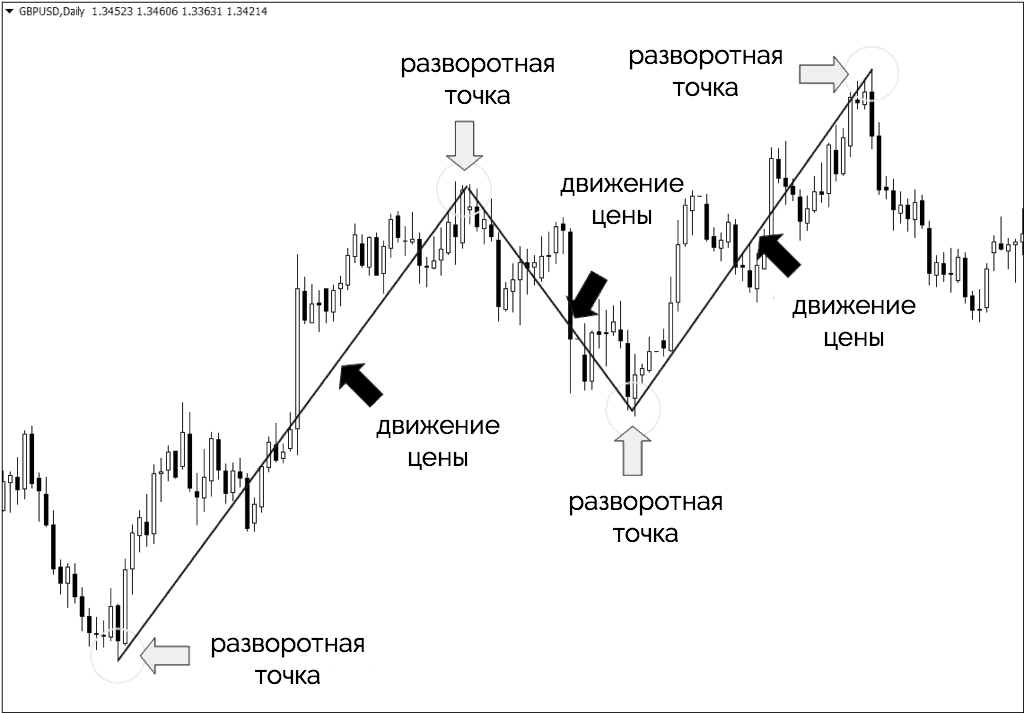

Mene ne yanayin ciniki, yadda za a gane shi a kan ginshiƙi, da kuma yadda ake kasuwanci da haɓakawa da raguwa. Ikon gane yanayin ciniki yana taimakawa wajen samun nasarar cinikin kadarorin. Trend a cikin ma’ana mai faɗi shine yanayin motsin farashin kadari. An gabatar da kalmar ta Charles Dow, wanda ya kafa ka’idar

nazarin fasaha . Halin, a cikin kalmomi masu sauƙi, hanya ce ta bin diddigin haɓakar haɓaka da faɗuwar farashin kadari. Dangane da waɗannan maki, zaku iya ƙayyade ƙarshen yanayin. Dow Theory ba shine kawai kayan aikin hasashen farashi mara ma’ana ba. Daga wannan ra’ayi, ana iya bambanta nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i nau’i) wanda za a iya bambanta: uptrend, downtrend da kuma gefe. Yanayin gefe shine rashin girma ko raguwa. Wani suna na wannan al’amari shine “lebur”.

- Yadda za a gane wani Trend?

- Nau’in abubuwan da ke faruwa a cikin ciniki

- Matakan samuwar

- Halayen Trend

- Matakan masu ƙarfi

- Yadda ake shiga da fita kasuwanci a cikin ciniki na Trend?

- Yadda za a sami matsayi da kuma sanya tasha a Trend ciniki?

- Ma’anar counter-trend, bayanin ‘yan kasuwa akan yanayin

- Yadda za a gano da kama abubuwan da ke faruwa a ciniki?

- Kuskuren ciniki na Trend

- Shigar da latti

- Ciniki a kasuwa mai girma

- Yadda za a fahimci kusurwar motsi tare da yanayin?

Yadda za a gane wani Trend?

Don amsa wannan tambaya, wajibi ne a fahimci rawar da wannan al’amari ke da shi a cikin ciniki. Binciken vector motsi farashin shine tushen yanke shawarar saka hannun jari. Idan farashin yana tasowa, to cinikin zai fi samun riba. A duk kasuwanni na kudi, farashin yana motsawa a cikin hanyar zigzag. Wannan zigzag yana taimakawa gina bincike da hasashen farashin. Don wannan dalili, ana amfani da hanyoyi daban-daban. Waɗannan su ne:

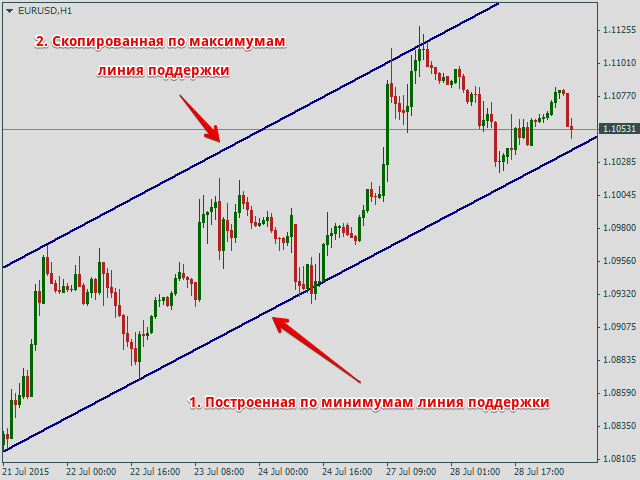

- Nazarin Zane . Hanyar ita ce gina layin haɓaka farashin. Muddin farashin yana sama ko ƙasa da wannan layin, ‘yan kasuwa sun ce farashin ya ci gaba da tafiya.

- Binciken Fasaha . Ana amfani da masu nuni a cikin bincike na fasaha. Binciken fasaha yana taimakawa wajen waƙa ba kawai farashin farashi ba, har ma da ƙarfin yanayin. A wannan yanayin, ana amfani da matsakaicin motsi don cimma burin.

- Mahimman Bincike . Ya ƙunshi nazarin bayanai, daga fasaha zuwa tattalin arziki. Game da cryptocurrency, wannan yana nufin yin nazarin bayanai game da aikin cryptocurrency, ontology, abubuwan da ke da alaƙa, tsare-tsaren ayyuka, da sauransu. Wannan hanya ta dace don gina tsinkaya na dogon lokaci.

- Binciken girma . An kwatanta adadin girma da raguwa. Idan adadin girma yana da kyau, yana da kyau a yi imani cewa vector yana motsawa zuwa ga kololuwar kuma za a sami koma baya nan da nan. Idan faɗuwar ta kasance mai ban mamaki, ana tsammanin girma.

- Trend shine abokin ku mafi kyau: yanayin shine abokin ciniki mafi kyawun abokin ciniki. Matsayin shigar ciniki dole ne ya kasance cikin haɓakawa.

- Yana da amfani a yi amfani da mahara shigarwar maki a cikin shugabanci na Trend. A wani lokaci, yi amfani da wani ɓangare na kudaden, a ɗayan – ɗayan. Wato kar a zuba dukkan kudaden a lokaci guda.

- Yi amfani da umarnin tsayawa don hana asara. Yana da kyau a sanya oda tasha a bayan layin girma kuma ya kamata a daidaita shi yayin da farashin ya canza.

- Kar a manta fita cinikin akan lokaci. Wannan yana iya kasancewa bayan isa matakin riba da aka tsara. Ko lokacin daidaita odar tsayawa, wannan yana faruwa ta atomatik.

Yana da mahimmanci a kula da batu na ƙarshe. Kwararru sun yi gargadin cewa ba ikon tsayawa akan lokaci ne ke kasa masu farawa ba. Yanayin yakan ƙare ba zato ba tsammani, ko canza yanayin motsi. Sannan ribar na iya rikidewa zuwa asara.

Nau’in abubuwan da ke faruwa a cikin ciniki

Bisa ga ka’idar, abubuwan da ke faruwa a duk kasuwanni sun kasu kashi kamar haka:

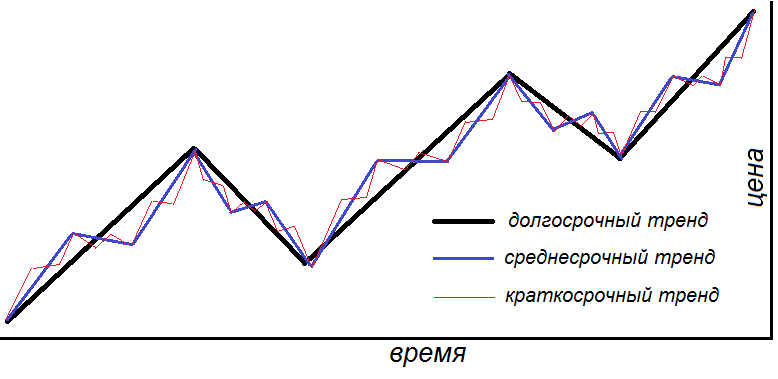

- Abubuwan da ke faruwa a duniya suna komawa baya shekaru . Suna nuna jagororin motsi gaba ɗaya.

- Ana auna yanayin tsaka-tsaki daga watanni da yawa zuwa shekaru da yawa.

- Hanyoyin gajeren lokaci suna nuna canje-canjen kasuwa na yanzu. Wannan kuma ya haɗa da ƙungiyoyin hasashe da abubuwan da ba su da mahimmanci.

Duk nau’ikan nau’ikan nau’ikan nau’ikan guda uku suna wanzuwa lokaci guda a duk kasuwanni. Ga yan kasuwa, mafi ƙanƙanta da matsakaicin maki suna da mahimmanci. Uptrend:

Matakan samuwar

Samuwar yanayin yana faruwa a matakai uku. Bari mu yi la’akari da kowannensu.

- lokacin tarawa. Yawancin lokaci yana gaba da lokacin koma bayan tattalin arziki. An yi la’akari da wannan lokacin a cikin dabarun ‘yan kasuwa a matsayin farawa don buɗe matsayi mai tsawo. An yi imanin cewa farashin ya kai matsayin da sayan kadarori zai iya samun riba sosai. Lokacin tarawa yana ƙoƙarin fara haɓaka ƙimar kadari.

- Halin taro . Yawan masu zuba jari a wannan mataki yana karuwa. Ana sa ran isowar “taron” din. Wannan tsari yana faruwa a hankali. A wannan mataki, ana lura da matsakaicin girma a cikin ƙimar kadarorin. Dangane da lokaci, wannan lokacin ya fi tsayi fiye da lokacin tarawa da mataki na gaba.

- Matakin rarrabawa . A wannan mataki, ƙimar girma ba ta da mahimmanci ko tsayawa. Wannan shi ne inda mafi yawan masu zuba jari ke la’akari da manufar samun riba. Sun fara sayar da kadarorin ga waɗanda har yanzu suna cikin yanayin. Adadin tallace-tallace an daidaita shi ta sabon kundin sayayya. Bayan haka, layin farashin yana shiga cikin ɗakin kwana ko ya faɗi.

Mun yi la’akari da wani uptrend. A downtrend shi ne lokacin da sake zagayowar da aka ba wuce a kasa da classic line. Mahimman canje-canje a cikin motsi na motsi na dukiya da kuma canzawa daga wani lokaci zuwa wani, manyan masu zuba jari suna taka muhimmiyar rawa. Ɗayan mai ciniki, ko da tare da ƙaƙƙarfan fayil, ba zai iya rinjayar motsin yanayin ba. Manufar mai ciniki a cikin wannan tsari shine gane matakai a cikin lokaci don ƙayyade mafi kyawun shigarwa. Kusa da ƙarshen mataki, yuwuwar shigar da ba daidai ba yana ƙaruwa. A wannan yanayin, maimakon riba, mai ciniki zai iya samun asara. Yadda ake kasuwanci trendlines: https://youtu.be/JLXt4SzGcwQ

Halayen Trend

Yanayin yana da kaddarorin da yawa. Ana iya taƙaita shi bisa ga halaye masu zuwa:

- Gabatar da shugabanci : downtrend da uptrend.

- tsawon lokaci . Akwai nau’i uku: gajere, matsakaici da kuma na dogon lokaci.

- Ƙarfi . Yana nuna adadin ƴan kasuwa da abin ya shafa. Da yawan ‘yan kasuwa suna cikin yanayin, yawan tasirin da suke da shi akan alkibla da vector. Har ila yau, yawan ‘yan kasuwan da abin ya shafa yana shafar ma’auni na masu sayarwa da masu siyan kadarori. Farashin kadarorin sun tashi daidai da adadin ’yan kasuwar da abin ya shafa.

Har ila yau, a cikin ka’idar Dow, an nuna alamun manyan halaye na yanayin. A cikin wannan ka’idar, ana iya bambanta halaye masu zuwa:

- yanayin girma yana ƙoƙarin ci gaba da ci gaba tare da vector, wanda zai haifar da koma baya ko ƙarewa;

- yadda yanayin ya fi karfi, yana dadewa;

- girma ko faɗuwa yakan ƙare a kowane lokaci;

- idan a baya, a ƙarƙashin wasu sharuɗɗa, motsi na motsi ya yi biyayya ga wani tsari, wannan ba yana nufin cewa sake wannan doka zai yi aiki a karkashin yanayi guda.

Wadannan halayen ana iya bin su a fili ta hanyar kuzari a cikin kasuwar cryptocurrency.

Matakan masu ƙarfi

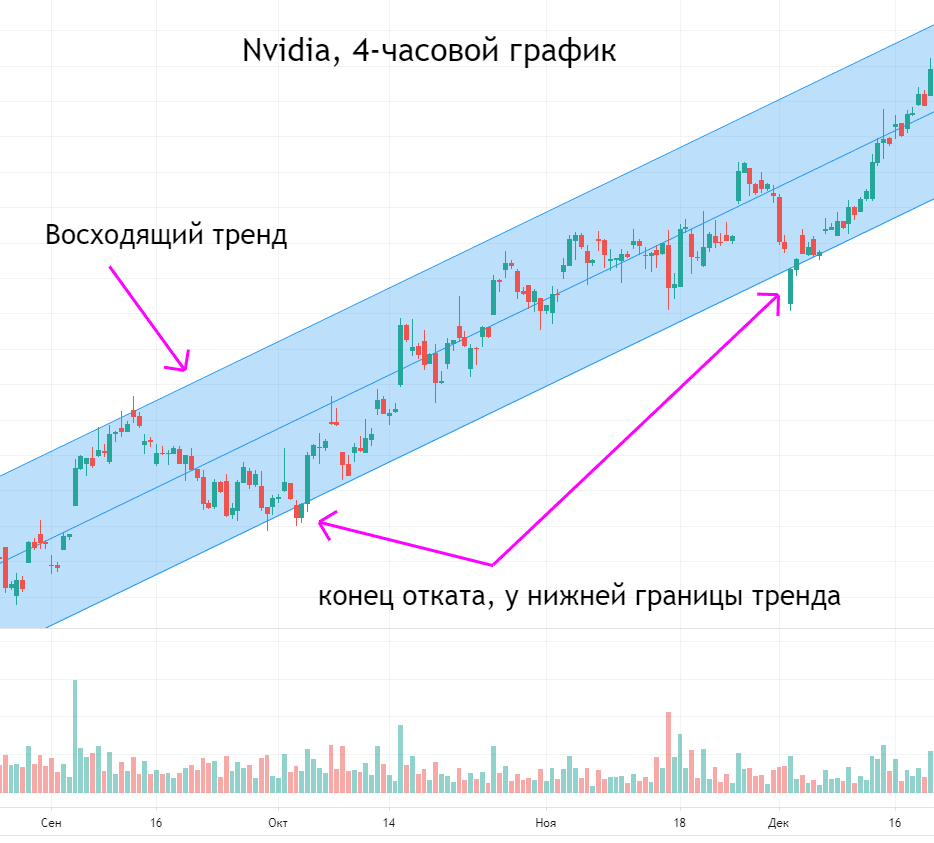

Matakan masu ƙarfi suna matsakaita. Akwai matakin tallafi da matakin juriya. Idan yanayin yanayin ya kasance sama da yanayin yanayin, to an ce juriya ne. Idan yana ƙasa da layi, to wannan yanki ne na tallafi. Matsalolin shiga ciniki suna tsakanin waɗannan nau’ikan.

Yadda ake shiga da fita kasuwanci a cikin ciniki na Trend?

Ga ‘yan kasuwa, dokar matakan tana aiki a nan: idan kullun yana a matakin juriya, kuna buƙatar sayar da kadarorin, idan yana da ƙasa, to saya. Har ila yau, an yi la’akari da shigarwa mai nasara a cikin ma’amala a lokacin ƙetare matsakaicin motsi. Duk da haka, bai kamata ku yi gaggawa ba. ƙwararrun yan kasuwa sun san ilimin halin ɗan adam na masu farawa, cewa tare da irin waɗannan hotuna, nan da nan za su fara buɗe ma’amala. Kuna buƙatar jira har sai an buɗe isassun adadin umarni. Ana kiran wannan tabbaci.

Yadda za a sami matsayi da kuma sanya tasha a Trend ciniki?

Ɗaya daga cikin dabarun mafi sauƙi kuma mafi riba shine cinikin aikin farashi. Ayyukan farashi shine hanyar da mai ciniki ke mayar da hankali kawai akan ginshiƙi, ba kula da alamun ba. Binciken Trend a cikin aikin farashin ana aiwatar da shi ta hanyar matakin tallafi, juriya da ƙirar fitila. Hakanan, azaman ɓangare na aikin farashin, zaku iya sarrafa haɗarin ku yadda yakamata. Tsaya hasara zai taimaka da wannan. Tsaida asara alama ce da aka saita a gaba. Wannan ya zama dole don tabbatar da mai ciniki akan babban hasara yayin ginshiƙi na ƙasa. Akwai dabarun asarar tasha daban-daban. Masu sana’a suna ba da shawarar sanya asarar tasha a bayan wasu shingen kan hanyar da ake bi. Menene shingen? Misali, wadannan:

- matakan tallafi da juriya;

- alamomin tunani;

- highs da lows na latest alkuki alamu.

Sanya tasha a bayan shingen ya dace da gaskiyar cewa farashin sau da yawa yana gwada matakin da aka kai. Breakouts yana faruwa a cikin wannan tsari lokacin da farashin tasha ya faru, sannan ya tafi cikin “daidai”. Lokacin da ciniki na al’ada, saitin yana tsayawa yana da sauƙi: ana ba da shawarar sanya su a wurare uku: a bayan layin matsakaicin motsi, a bayan layin ja baya na baya, da kuma waje da layukan ci gaba.

Ma’anar counter-trend, bayanin ‘yan kasuwa akan yanayin

A counter-trend ne wani ɗan gajeren lokaci farashin motsi a kan halin yanzu shugabanci. Ga mai ciniki, wannan batu yana da ban sha’awa saboda yana ba da damar shiga kasuwa tare da matsakaicin haɗari-da-riba rabo. Koyaya, gano mafi kyawun ma’ana a cikin countertrend ba abu ne mai sauƙi ba. Akwai babban yuwuwar zubar da ajiya. Sabili da haka, wannan dabarun ya dace da ƙwararrun yan kasuwa. A cikin yanke shawara a cikin tsarin counter-trend, ana jagorantar su ta hanyar sigogi masu zuwa:

- ƙayyade hanyar da ta dace na halin yanzu;

- gano yuwuwar farashin koma baya;

- sami amintaccen siginar ciniki.

The countertrend dogara ne a kan sauki dabaru na Trend bayanai. Idan duk masu zuba jari sun ce farashin wannan ko wannan kadari zai girma, to, da yawa sun riga sun sayi waɗannan kadarorin kuma suna jiran girma. Tun da kowa ya saya, to, yanayin yana kusa da juyawa. Idan kowa ya yi iƙirarin cewa wannan ko wannan kayan aiki zai faɗi, to tabbas mafi yawan sun sayar da dukiyoyinsu kuma, mafi mahimmanci, abubuwan da ke faruwa suna kusa da juyawa a cikin hanyar ci gaba.

Yadda za a gano da kama abubuwan da ke faruwa a ciniki?

Hanyar da ta fi dacewa don nemo yanayi da yanayin shine amfani da matsakaita mai motsi a cikin binciken ku. Mafi kyawun dabarun shine don ƙayyade mafi kyawun lokacin da kasuwanci kawai a cikinsa. Ya kamata a yi amfani da ginshiƙi na wasu lokutan lokaci bayan bincike mai zurfi.

Kuskuren ciniki na Trend

Sau da yawa, ‘yan kasuwa na iya yin watsi da shawarwarin game da madaidaicin shigarwa da kuma hanyar fita. Wani kuskuren gama gari shine shigar da juriya ba tare da tabbatar da farashin ba.

Shigar da latti

Lokacin shigar da marigayi, yana da amfani don bin ka’idar “saita asarar tasha kuma ku manta da shi.” In ba haka ba, dan kasuwa ya kamata a shirya don waɗannan abubuwa:

- Faɗin asarar tasha;

- An rage haɗarin haɗari / sakamako daga 1: 4 zuwa 1: 2;

- Akwai damar da za a buga kololuwar yanayin.

Ana iya amfani da waɗannan abubuwan don amfanin ku.

Ciniki a kasuwa mai girma

Anan ka’idojin sune:

- ba za ku iya buɗe ma’amaloli ba a lokacin da farashin ya karye ta hanyar manyan kayayyaki;

- Ana iya shigar da shigarwa kawai bayan gyaran farashin bayan babban fashe;

- kar a dogara kacokan akan oda masu jiran aiki.

Yadda za a fahimci kusurwar motsi tare da yanayin?

Matsakaicin motsi yana nuna adadin wadata da buƙata. Idan kusurwa ya yi tsayi, to akwai masu sayarwa a irin wannan kasuwa fiye da masu saye. Idan kusurwa ya dan kadan, to, wannan yana nuna adadi mai yawa na masu siye da ke shirye don magance, amma tsarin bai riga ya fara ba. Ikon karanta gangara yana buɗe matsayi don nemo saiti masu fa’ida. Don nemo wurin shigarwa mai kyau, yana da amfani a haɗa kusurwoyi masu tasowa tare da alamun aikin farashi. Wannan kalmar tana bayyana abubuwan mamaki ba kawai a cikin ciniki ba, har ma a cikin ilimin kimiyya na asali. A Trend a cikin tattalin arziki ne vector na motsi na Manuniya. Akwai kuma wani yanayi a cikin kididdigar da ke taimakawa wajen gano alkiblar ci gaban wasu al’amuran zamantakewa. Ikon karanta waɗannan alamomi da lura yana taimakawa wajen yanke shawara mai kyau a wasu fagage.