Transactions that investors and traders make with assets are held on official platforms – stock exchanges. The most famous of them are NASDAQ, New York, London, Frankfurt. There are two main sites for investors in Russia – Moscow and St. Petersburg. The Moscow Exchange has its own characteristics, and the functionality of its website will be useful to any investor to obtain both basic knowledge and detailed information necessary for the selection and analysis of securities. Knowledge of how the exchange works also clarifies some of the features of the interaction of an investor with a

broker – more on this in the article.

- What is an exchange and how does it work?

- Moscow Exchange Commission

- Mosbirja today – exchange trading procedure and settlement of transactions

- What assets are represented on the Moscow Exchange – we analyze the market of the Moscow Exchange

- Moscow Exchange opening hours 2021-2022

- Non-working days of the Moscow Exchange in 2021 and 2022

- When stocks, mutual funds / ETFs and bonds are traded on the Moscow Exchange

- When and how futures are traded on the Moscow Exchange

- Moscow Exchange website and online trading

- Demo account “My portfolio”

- Best Private Investor on Moex

- Training on the Mosbirzh website

- Information on assets on the Moscow Exchange website

- Currencies, dollar rate and euro rate online within the Moscow Exchange

- Shares on the Moscow Exchange

- Bonds

- Futures

- Mutual funds and strategies

What is an exchange and how does it work?

Exchanges provide a meeting of orders to buy and sell securities and other assets. They organize tenders according to the rules set by them. If earlier transactions were made live, and 50 years ago brokers shouted out the price or submitted notes with their price, today this process is automated.

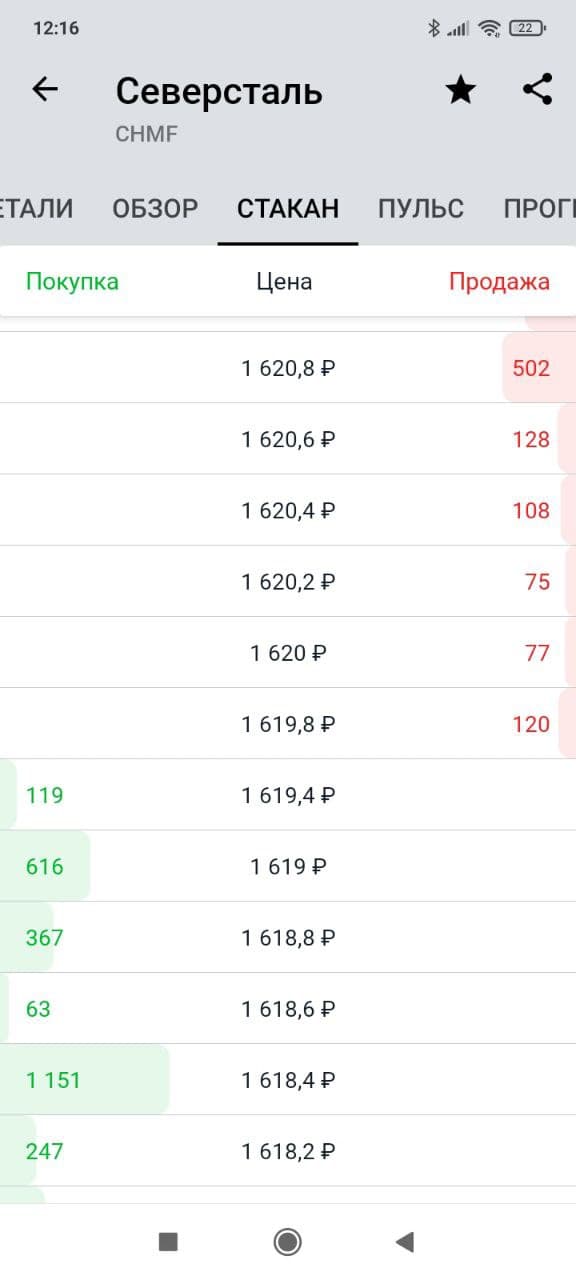

Today the order book is the window through which you can look and see what is happening on the side of the trading organizer.

Individuals place orders, and brokers submit orders to the exchange. That is why in the dialogue between the investor and the broker’s support regarding, for example, an unexecuted, rejected order or suspension of trading, it is the organizers of the trading that often act as “extreme” ones. The course of trading and control over the course of trading really lies in the field of responsibility of the exchange. Trades are organized in accordance with the exchange regulations. Brokers, with whom clients interact most of the time, are intermediaries between the client and the exchange.

Moscow Exchange Commission

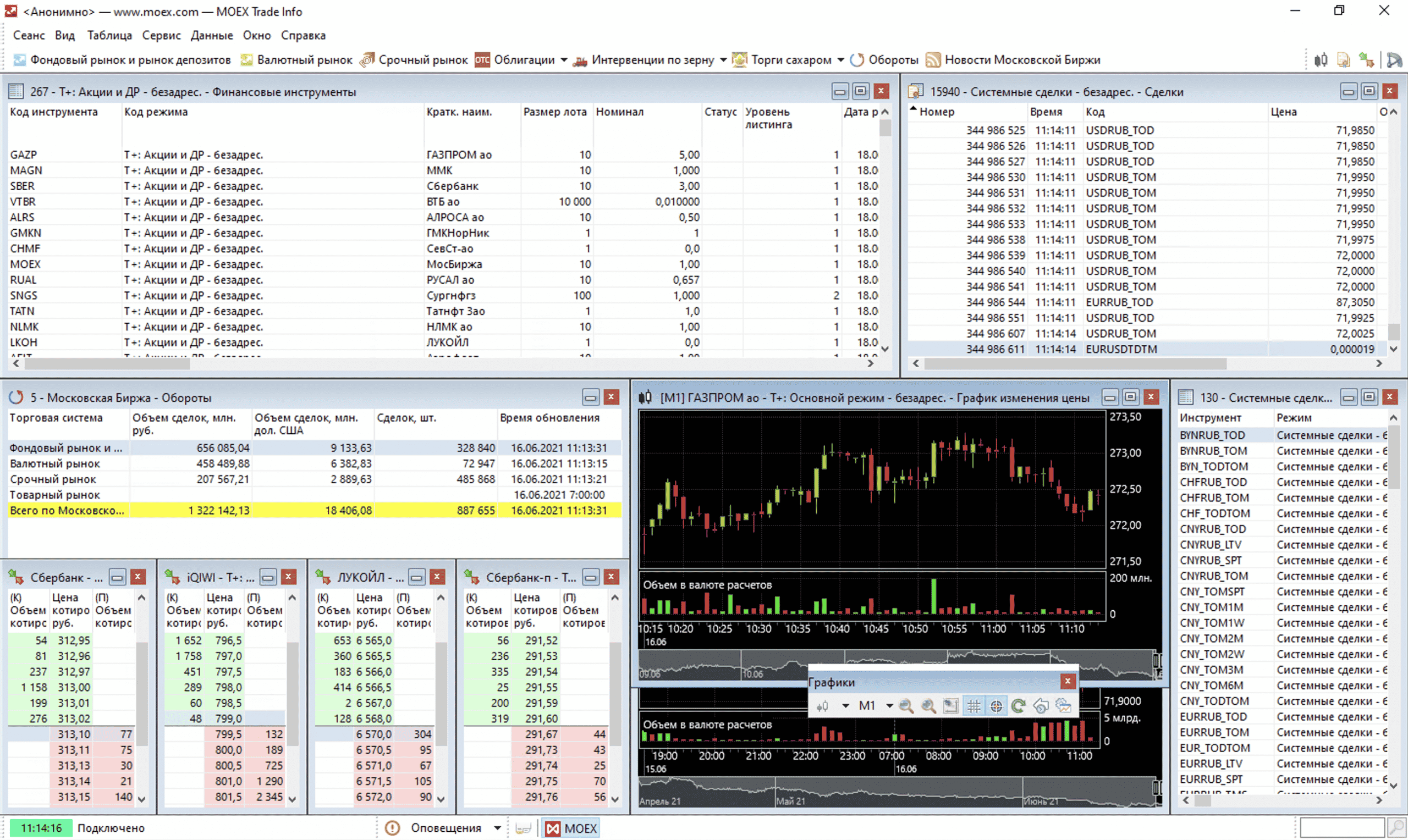

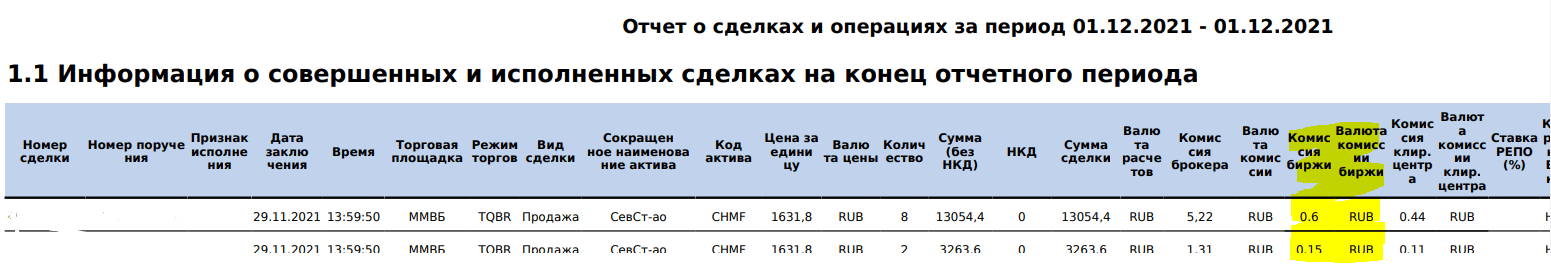

Any transaction made on the exchange market is charged a commission. The end user may not know about it if it is included in the single commission at the broker’s tariff (together with the commission of the clearing center and the brokerage). For individual brokers, you can see exactly the exchange fee in the brokerage report. For example, in the Tinkoff brokerage report, it is located in the section with information about transactions opposite the transaction in the “Exchange Commission” column. At Tinkoff, the exchange commission is included in the general tariff commission, so a brokerage report is the only way to find out exactly how much of the amount is taken by the organizer of the auction. [caption id = "attachment_1862" align = "aligncenter" width = "1551"]

Displaying the exchange commission from the transaction in the brokerage report of the broker Tinkoff [/ caption] Also, the organizers of trading conduct initial offerings (IPO) – the process by which the company (issuer) itself places its securities. Future holders of securities buy them directly from the company, and not through trading between investors, as is usually the case. The Moscow Exchange provides listing of shares of securities issuers, i.e. includes certain shares in the list of traded securities. Conversely, excluding securities from listing will make the paper unavailable for orders to buy or sell that security.

Displaying the exchange commission from the transaction in the brokerage report of the broker Tinkoff [/ caption] Also, the organizers of trading conduct initial offerings (IPO) – the process by which the company (issuer) itself places its securities. Future holders of securities buy them directly from the company, and not through trading between investors, as is usually the case. The Moscow Exchange provides listing of shares of securities issuers, i.e. includes certain shares in the list of traded securities. Conversely, excluding securities from listing will make the paper unavailable for orders to buy or sell that security.

Mosbirja today – exchange trading procedure and settlement of transactions

Although the clearing center is a separate organization, the National Clearing Center (NCC MSE), which settles transactions, is wholly owned by the Moscow Stock Exchange. Settlements for transactions in shares are carried out on the second business day (trading mode T + 2), for transactions in bonds on the next (T + 1) or on the same day. Clearing for

futurestakes place every day twice a day. Calculations by currency depend on the TOD (current day) or TOM (next day) mode. The countdown is carried out from the date of the conclusion of the transaction, it is the working days of the Moscow Stock Exchange that are taken into account. The deferred nature of settlements means that the delivery of money and securities does not actually occur immediately, but within a specified time frame. The clearing center does not settle directly between the buyer and the seller. The Central Counterparty is located between the buyer and the seller. It is he who pays first with one side, then with the other – this is how the security of settlements is ensured. The Moscow Exchange interacts with NCC, and not directly with investors, whose consistency may be questionable, which would call into question the transaction itself. Otherwise, a situation would be possible when the buyer no longer has funds at the time of settlements, and the seller no longer has securities.The central counterparty guarantees: everything will be done. The deferred settlement of T + 2 deals is not an abstraction for an ordinary investor. Each holder of securities deals with the trading mode established by the exchange in one way or another:

- the mechanism for withdrawing funds from brokers depends on the trading mode – connecting an overdraft during withdrawal or the very possibility of an urgent withdrawal (after all, after the sale of shares, the broker receives money on the second working day, and not immediately),

- the trading mode is associated with the conclusion of REPO and overnight transactions (as investors, we use the money from transactions immediately for new transactions, but in fact we do not have this money yet, and we also sell shares, the owners of which, due to the trading regime, are not yet).

The trading mode is of particular importance when receiving dividends or other corporate actions, for example, spin-offs. If you buy securities without taking into account the trading mode, then there is every chance to miss the dividend payment or the accrual of new securities. To get into the list of holders on the date of the register fixation, it is important to buy securities two business days before the set date.

What assets are represented on the Moscow Exchange – we analyze the market of the Moscow Exchange

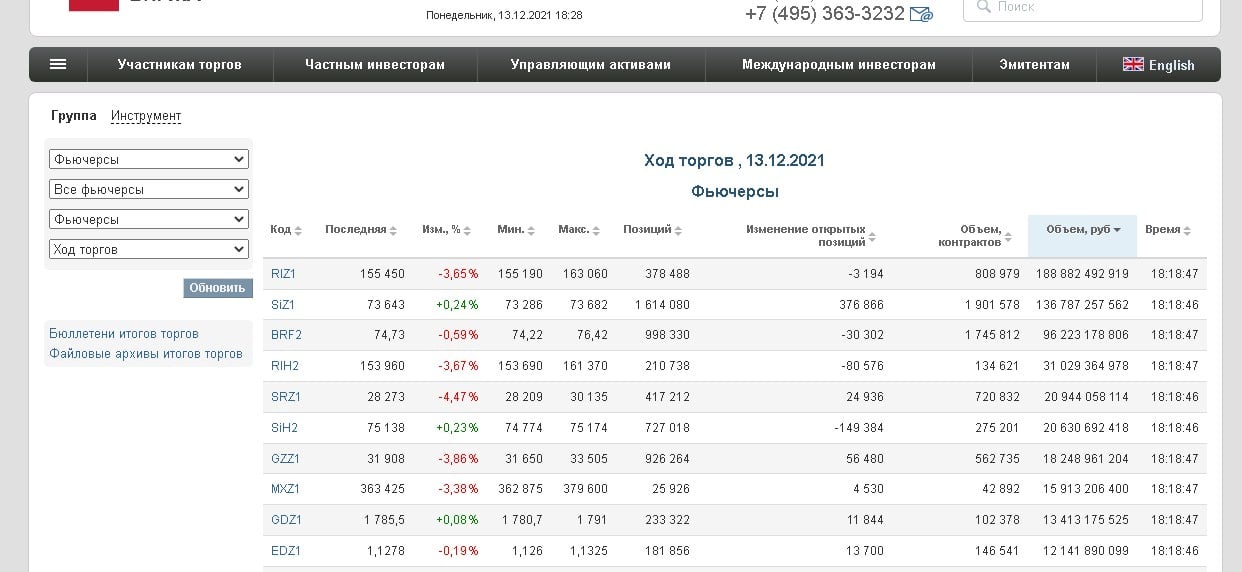

Most domestic investors deal with the Moscow floor when buying securities of Russian companies: Gazprom, Sberbank, Yandex, Severstal, VTB, etc. when buying OFZ and other bonds; when dealing with any futures, including gold and oil futures. And, of course, when buying and selling dollars and euros at a bargain price. Mosbirzh futures at https://www.moex.com/ru/marketdata/#/group=10&collection=227&boardgroup=45&data_type=current&mode=groups&sort=VALTODAY&order=desc

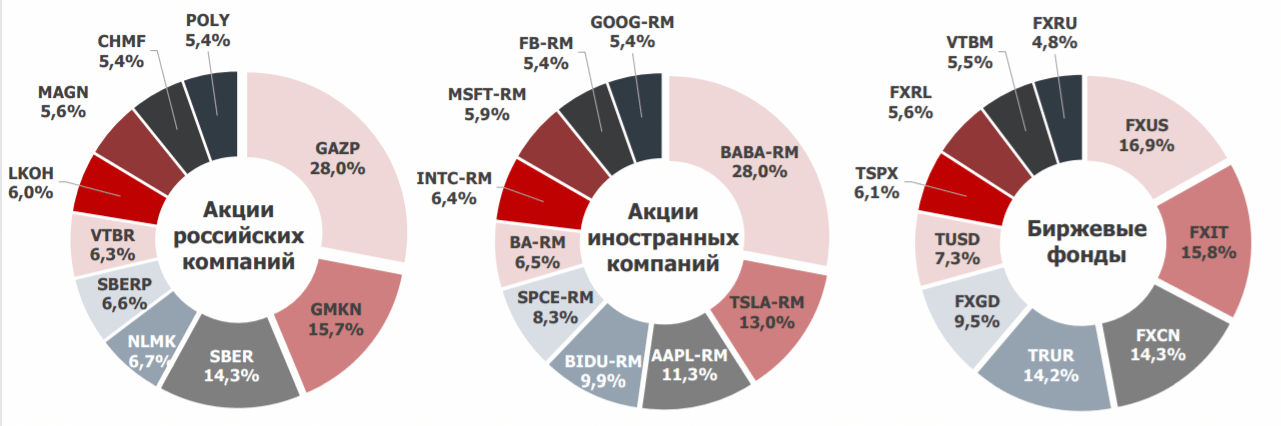

People’s portfolio for November 2021 from the “Infographics” section of the Moscow Exchange (https://www.moex.com/s2184) The following sections are presented on the site:

People’s portfolio for November 2021 from the “Infographics” section of the Moscow Exchange (https://www.moex.com/s2184) The following sections are presented on the site:

- currencies (foreign exchange market),

- stocks and bonds (stock market),

- futures and options (derivatives market),

- commodity market,

- money market (REPO, lending rates, etc.).

The last two markets are mainly used by legal entities. These are trading sections, each of which has its own rules, mode and trading schedule.

Access to such a wide range of instruments through one site is a distinctive feature of the Moscow Exchange. Other world exchanges most often specialize in individual instruments.

Moscow Exchange opening hours 2021-2022

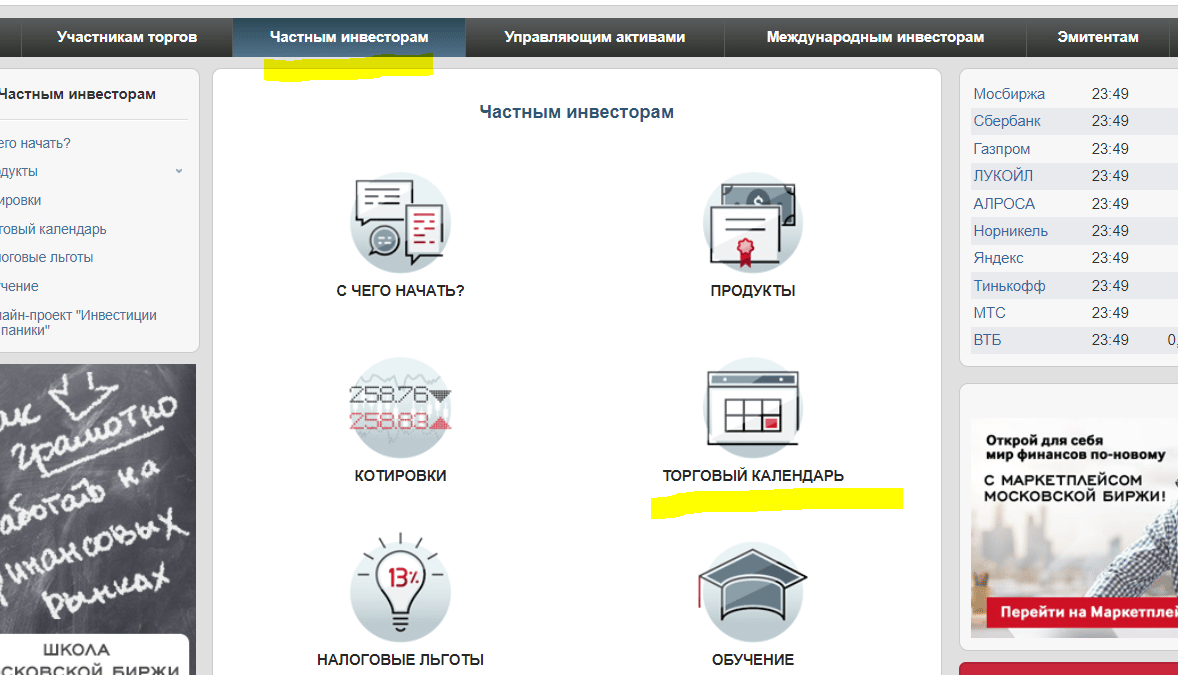

Working days of the Moscow Exchange – the days on which trades and settlements are held – usually coincide with the working days of the Russian Federation: Mon-Fri, with the exception of public holidays. Business hours depend on the sales section. As for the holidays, the site always publishes its schedule, taking into account the holidays. The trading calendar of the Moscow Exchange can be found in the Private Investors section (

https://www.moex.com/msn/investor). In this section, you can select the stock, foreign exchange or derivatives market. Weekends are marked in red. When you hover the cursor over dates with an asterisk, you can see the details. On some holidays, there are auctions but no settlement. This information can be important when urgently withdrawing funds or closing accounts, as it will affect the available closing or withdrawal date.

Trade calendar [/ caption]

Trade calendar [/ caption]

Non-working days of the Moscow Exchange in 2021 and 2022

In the outgoing year 2021, according to the schedule of the Moscow Exchange, December 31 will be a non-trading day. According to the schedule of the Moscow Exchange in 2022, the days on the stock section will be non-trading:

- for Russian securities : January 7, February 23, March 8, May 2 and 9, November 4;

- for American shares and depositary receipts (-RM): January 17 (Martin Luther King, Jr. Day), February 21 (Washington’s Birthday), March 5 (this is Saturday, but trading in Russian securities will be held, since this is an all-Russian working Saturday) April 15 (Good Friday), May 2 and 30 (Memorial Day), July 4 (Independence Day), September 5 (Labor Day), November 24 (Thanksgiving Day), December 26 (Christmas Day).

You can print the trading calendar of the Moscow Exchange from its official website from the presentation: https://fs.moex.com/f/15368/2022-01-01-torgovyy-kalendar-akcii-rus.pdf.

When stocks, mutual funds / ETFs and bonds are traded on the Moscow Exchange

At the moment, there are three trading sessions: morning, main and evening. All stocks, funds and bonds are traded on the main trading session from 10:00 to 18:45. The morning additional session runs from 06:50 am to 9:50 am Moscow time. The evening optional session runs from 19:00 to 23:50. In the intervals from 9:50 to 10:00, as well as from 18:45 to 19:00, the exchange goes on a break. When trading through the applications of some brokers, due to these breaks, previously placed limit orders fly off. During these additional sessions, the most liquid stocks on special lists and some bonds and funds are traded. List of securities admitted to trading in additional sessions:

- In the morning: https://fs.moex.com/f/15590/spisok-bumag-k-dopusku-v-uds.xlsx.

- In the evening: https://www.moex.com/msn/stock-instruments#/?evening=’1 ‘.

The Moscow Exchange launched trading in the morning session on the stock market only in December 2021. In honor of this, she also held a competition for the first participants in the morning session.

When and how futures are traded on the Moscow Exchange

Trading on the derivatives market takes place from 7:00 to 23:50. There are two breaks for settlements: from 14:00 to 14:05, intermediate clearing takes place, and from 18:45 to 19: 00/19:05, the main clearing takes place. Clearing is a break for settlement and summing up. Unlike the stock market, according to the exchange rules, futures are settled daily, twice a day. The period before the first clearing is called the morning session, after which it is called the day session. Together they make up the main session. After the evening clearing, the evening session begins. It is part of the next trading day. The result of trades executed in the evening will be taken into account during the daytime clearing of the next trading day. The exchange credits or writes off the variation margin (financial result) to clearing, depending on the settlement price of the futures at the time of clearing or the transaction.Main clearing may take place until 19:05 if futures are settled on that day.

Such a wide interval of access to trading allows traders to catch the trading activity of the Asian, European and American markets. This is also one of the specific features of the Moscow Exchange.

Moscow Exchange website and online trading

The Moscow Exchange has its own official website with wide functionality: moex.com (Moscow Exchange). Trading directly through the website of the Moscow Exchange itself will not work – only through a broker.

Exchanges do not provide direct access to trading for private investors. They cooperate only with professional market participants (brokers, management companies, dealers, etc.). Thanks to this, the exchange can control the safety of transactions – it knows “by sight” each of its partners. And he knows that he is able to provide obligations on his part.

You can be sure that with any offer to invest directly on the exchange, without intermediaries, with any calls to an ordinary person supposedly from the exchange – we are talking about scammers.

The exchange publishes a list of those brokers who act as its partners. It is in the section with these professional participants that the user will get if he clicks on the button “Open an account on the exchange” on any page of the site. But access to trading on the Moscow Exchange is provided by all brokers recognized by the Central Bank of the Russian Federation and licensed to conduct brokerage activities – not only partners.

The exchange publishes a list of those brokers who act as its partners. It is in the section with these professional participants that the user will get if he clicks on the button “Open an account on the exchange” on any page of the site. But access to trading on the Moscow Exchange is provided by all brokers recognized by the Central Bank of the Russian Federation and licensed to conduct brokerage activities – not only partners.

In the “Marketplace” section (https://place.moex.com/) you can apply to open a real brokerage account online. In this case, an account will be opened with the broker “Opening Broker”. You will need a passport photo (a photo on your phone is suitable), TIN and SNILS numbers.

In the “Marketplace” section (https://place.moex.com/) you can apply to open a real brokerage account online. In this case, an account will be opened with the broker “Opening Broker”. You will need a passport photo (a photo on your phone is suitable), TIN and SNILS numbers.

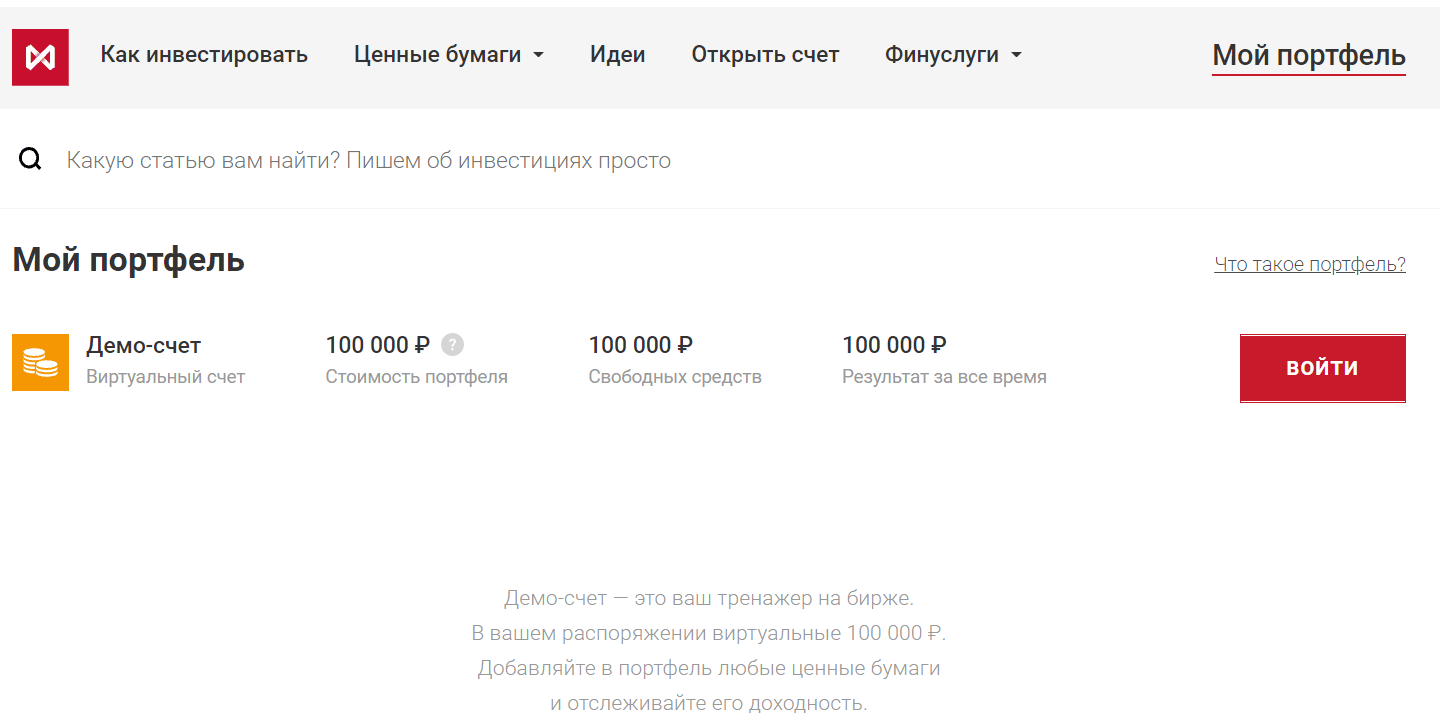

Demo account “My portfolio”

By clicking the “My portfolio” button through the Moscow Exchange website, you can try investing using a virtual demo account.

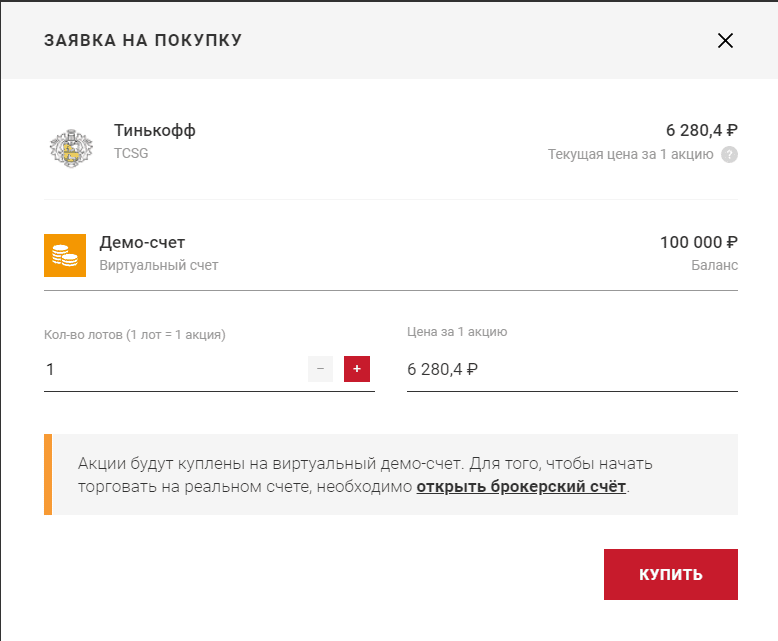

Demo account on the Moscow Exchange website [/ caption] It does not give real ownership of securities, but it will allow you to collect a portfolio of securities and track its performance. This is an opportunity to start somewhere and understand investments from your own experience. And at the same time – without risk. To open a demo account, you need to log into the site – this can be done through authorization on the State Services. The functionality of the virtual account is modest. Only one type of order is available, the order book is not visible, the delay in loading quotes is 15 minutes, only the most popular instruments are available.

Demo account on the Moscow Exchange website [/ caption] It does not give real ownership of securities, but it will allow you to collect a portfolio of securities and track its performance. This is an opportunity to start somewhere and understand investments from your own experience. And at the same time – without risk. To open a demo account, you need to log into the site – this can be done through authorization on the State Services. The functionality of the virtual account is modest. Only one type of order is available, the order book is not visible, the delay in loading quotes is 15 minutes, only the most popular instruments are available.  Order to buy on the Moscow Exchange [/ caption] It is more optimal for educational practice to use demo accounts with brokers, through which you can master real

Order to buy on the Moscow Exchange [/ caption] It is more optimal for educational practice to use demo accounts with brokers, through which you can master real

trading programs and terminals .

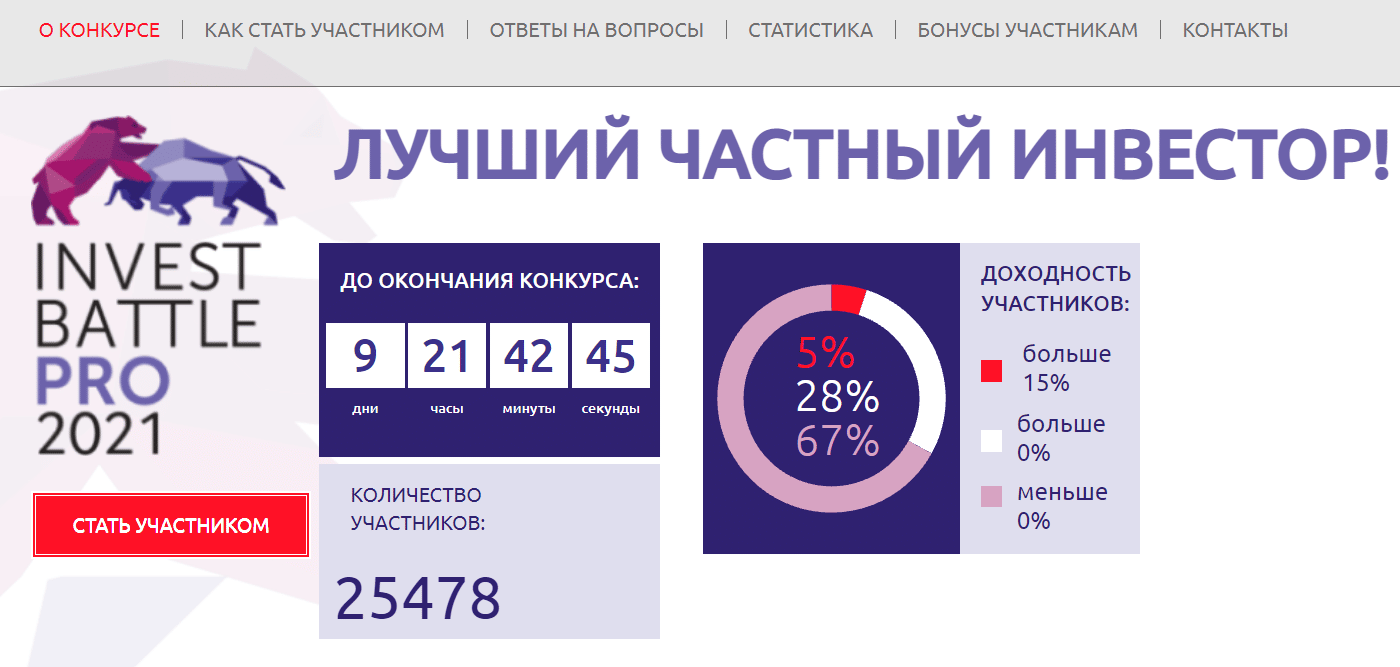

Best Private Investor on Moex

One of the tasks of the Moscow Exchange is to provide liquidity. High liquidity is beneficial for everyone. Traders can capitalize on price movements. The exchange and other organizations participating in trading can earn on commissions. To stimulate liquidity and increase trading activity, annually in September-December, the exchange holds a competition among traders – “The Best Private Investor” (LPI). The

best private investor [/ caption] To participate, you can register your brokerage account through your broker on the competition page – if the broker is a partner of the competition. You can also use a demo account. The main prize is 1,000,000 rubles. The participant wins,

best private investor [/ caption] To participate, you can register your brokerage account through your broker on the competition page – if the broker is a partner of the competition. You can also use a demo account. The main prize is 1,000,000 rubles. The participant wins,

reached the maximum profitability from the moment of joining the competition in comparison with other participants.

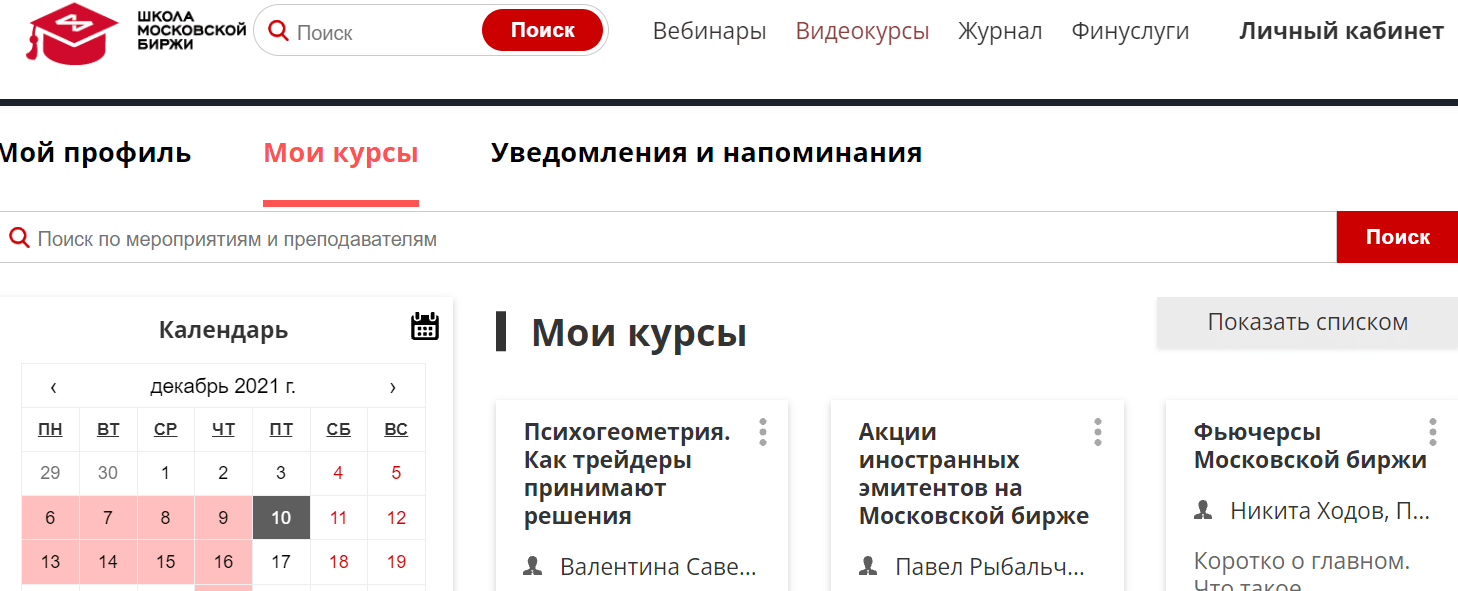

Training on the Mosbirzh website

Mosbirzh School [/ caption] Link for access https://school.moex.com/ webinars. There are both paid and free videos and hands-on webinars. Classes are held on the general principles of investment and portfolio formation, on investment instruments (mutual funds, bonds, options, futures, etc.), on the analysis of companies’ reporting, on the taxation of brokerage accounts.

Mosbirzh School [/ caption] Link for access https://school.moex.com/ webinars. There are both paid and free videos and hands-on webinars. Classes are held on the general principles of investment and portfolio formation, on investment instruments (mutual funds, bonds, options, futures, etc.), on the analysis of companies’ reporting, on the taxation of brokerage accounts.

There are also series of lectures from practicing traders about

There are also series of lectures from practicing traders about

algorithmic trading.by signals with an analysis of the main indicators. At such events, you can ask questions. Classes are held often, the recording is ongoing, so the active audience is not too large, so that the lecturer answers all the questions of the participants. Training is available in the Moscow Stock Exchange School section.

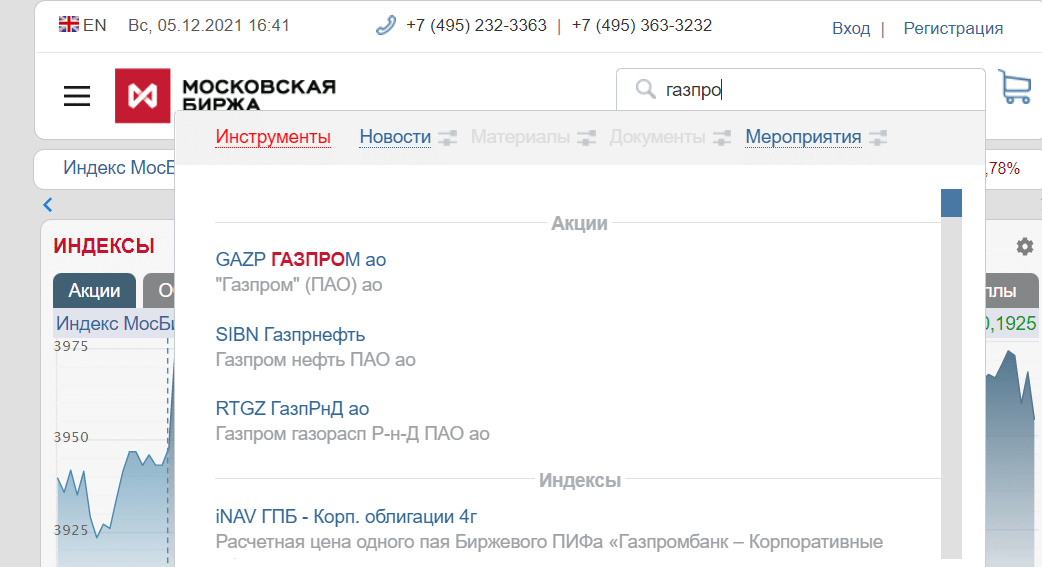

Information on assets on the Moscow Exchange website

Information about events with assets that are traded on the Moscow Exchange first appears on the Mosbirzh website and then broadcasted by brokers on their services. When the broker’s support is silent, the ability to use the exchange website will be useful if you need to make an investment decision quickly. Although brokers usually publish reports on securities and their main parameters on their own resources, they take the data from primary sources. Using the search box in the upper right corner of the site, you can go to any asset if you enter its name. Thus, it is convenient and often faster than with a broker, you can find out:

- the latest news, including the suspension of trading in securities,

- the date of the initial placement, taking into account the latest changes and postponements,

- a complete list of parameters for securities, including such details that are important, but not always available to the broker: the date of closing the register of bondholders, the estimated price of the futures contract at the last clearing.

For example, the broker Tinkoff so far only publishes information about the date of the coupon payment, but not the date of purchase of the bond in order to qualify for this payment (as opposed to the date for dividends). Also, while Tinkoff does not have information about the futures price at the last clearing, it is from this price that the variation margin is charged or written off. Without knowing this figure, it will not be possible to understand exactly why the amount of the variation margin was exactly the same, but the calculated price is calculated according to a special formula of the Moscow Exchange.

On the page with the asset, the MOEX exchange publishes: trading events and parameters of the day, chart, asset parameters, documentation. There is also a paid part of the functionality with more professional information.

You can find anything on the Mosbirzh website through the search bar in the upper right corner [/ caption]

You can find anything on the Mosbirzh website through the search bar in the upper right corner [/ caption]

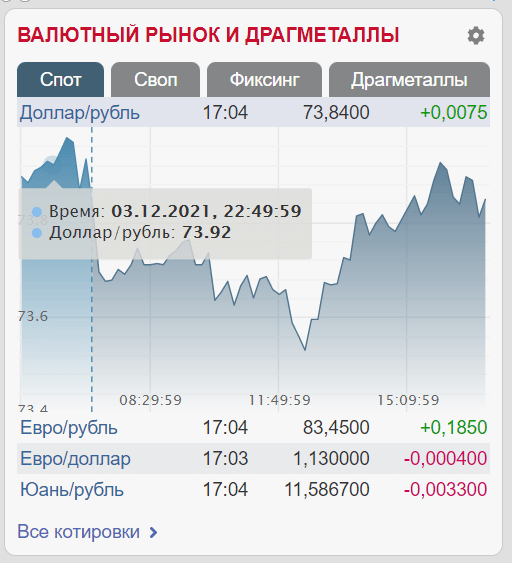

Currencies, dollar rate and euro rate online within the Moscow Exchange

The exchange rate of the Moscow Exchange is the very exchange rate of the currency that brokers boast in their commercials. “Buy currency profitably”, “we are not a bank”. All these are ways to inform that the purchase of dollars, euros and other currencies is available on the services at the exchange rate – at the rate of the Moscow Exchange. The exchange rate of the currency is always more profitable than the bank rate.

Currencies [/ caption]

Currencies [/ caption]

The exchange rate of the dollar and other currencies is determined by the ratio of supply and demand, changes every second. Currencies are very liquid all day long.

You can buy and sell currency on the Moscow Exchange on weekdays from 07:00 to 23:50. Basic information about exchange rates is published by the exchange on the first page of the site in the center. For more details, click on the “All quotes” button. Current exchange rates on the Moscow Exchange charts can be viewed at the link https://www.moex.com/ru/markets/currency/:

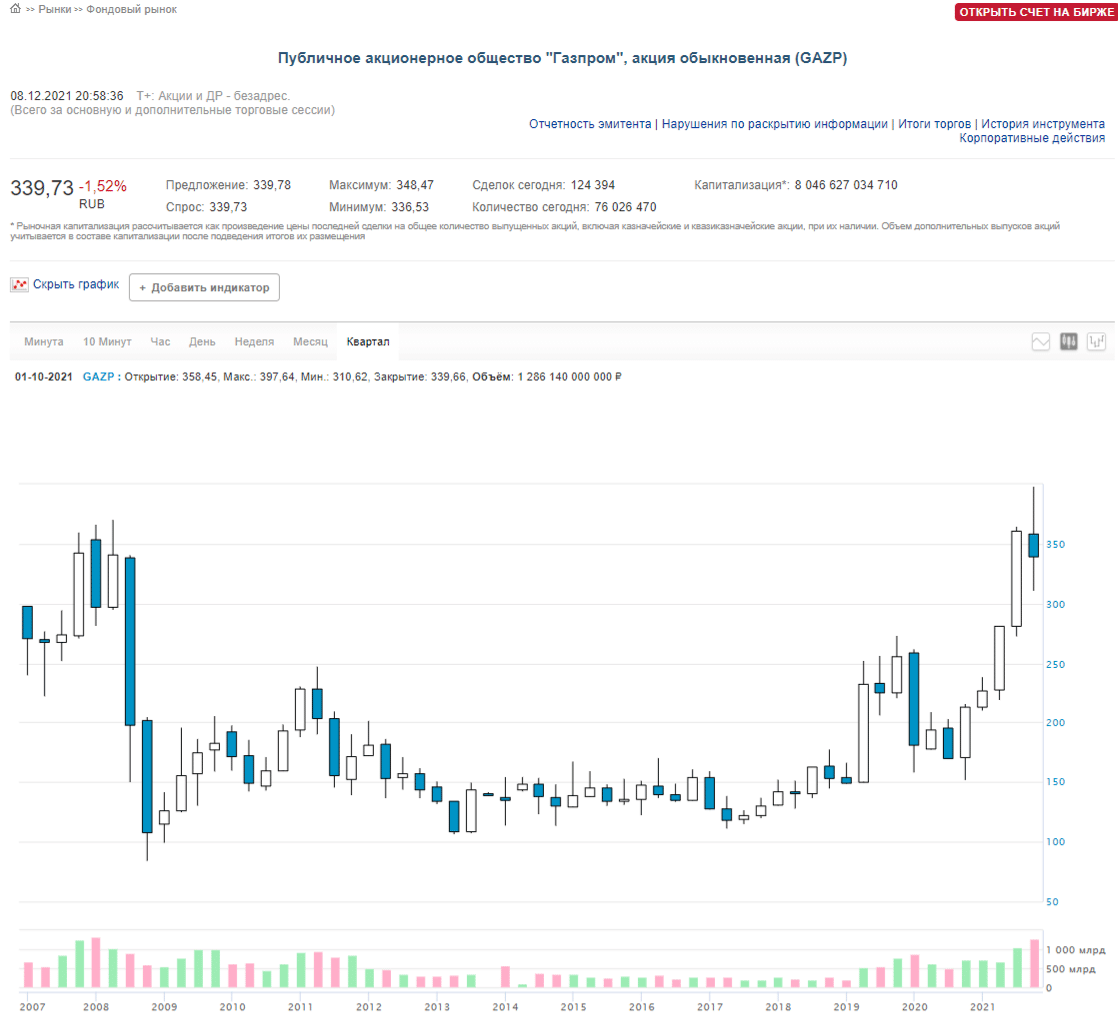

Shares on the Moscow Exchange

On the page of each share, the Moscow Exchange publishes at the top: information on trading today. Slightly below – the asset’s chart is published with the ability to choose the type of chart: candlestick or linear. You can also select intervals: minimum 1 minute, maximum – a quarter.

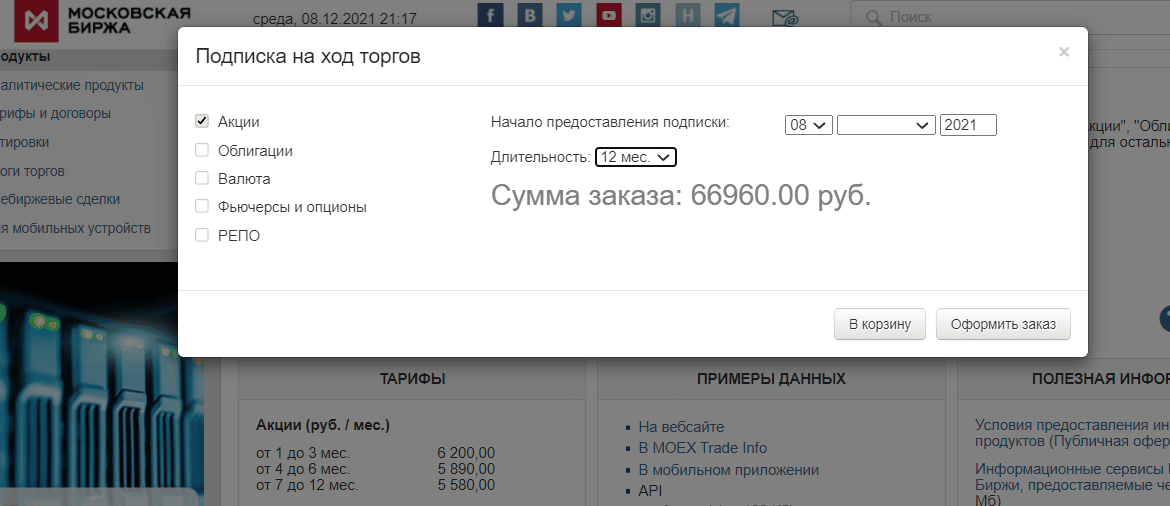

Gazprom [/ caption] The page contains all the basic trade information. The minimum and maximum for the price, the price of the last transaction, and the volumes of transactions are published. In this case, you can select the date for which you want to download the information. All key parameters of the paper, ISIN are displayed below. You can go to the section with the issuer’s documentation. There is a button “Download totals”, but it goes to the registration of a paid subscription.

Gazprom [/ caption] The page contains all the basic trade information. The minimum and maximum for the price, the price of the last transaction, and the volumes of transactions are published. In this case, you can select the date for which you want to download the information. All key parameters of the paper, ISIN are displayed below. You can go to the section with the issuer’s documentation. There is a button “Download totals”, but it goes to the registration of a paid subscription.  Subscription [/ caption]

Subscription [/ caption]

Bonds

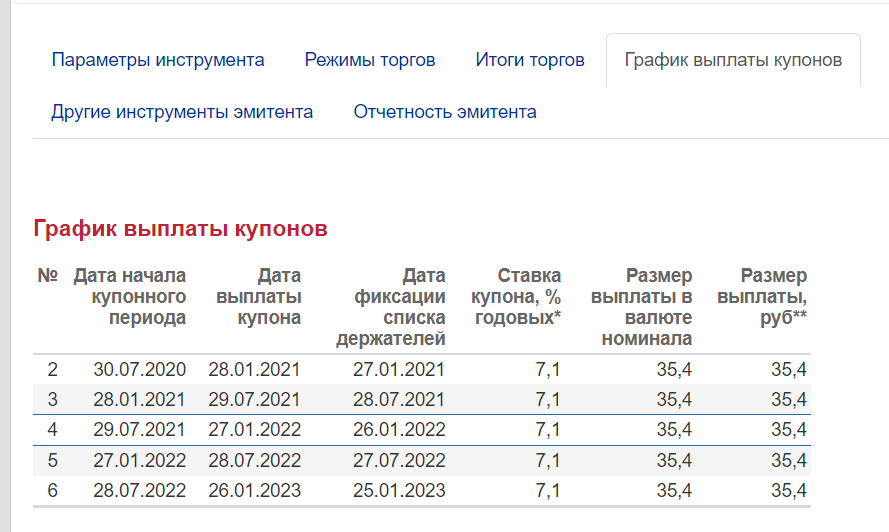

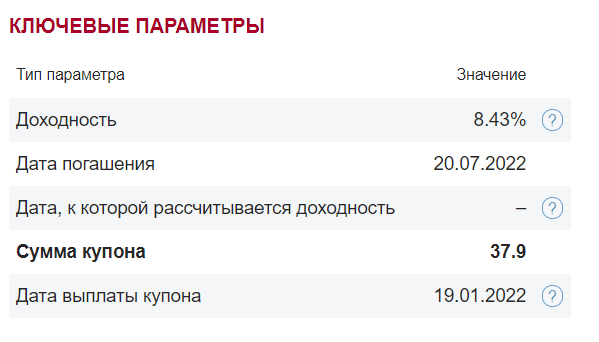

The favorite instrument of a conservative investor – government bonds (OFZ, regional), as well as corporate bonds of Russian companies – are also placed and traded on the Moscow Exchange. In the tab with any bond, you can view the key parameters: yield, maturity date, coupon and coupon payment date.

Coupon payment schedule [/ caption] The bond page also publishes a schedule and data on trading. Below the chart is detailed information, including the security code, short and full name, ISIN, settlement date and other details important for the investor. There you can also go to the tab with the coupon payment schedule, as well as to the section with the documents “Issuer reporting”. You can find the prospectus here.

Coupon payment schedule [/ caption] The bond page also publishes a schedule and data on trading. Below the chart is detailed information, including the security code, short and full name, ISIN, settlement date and other details important for the investor. There you can also go to the tab with the coupon payment schedule, as well as to the section with the documents “Issuer reporting”. You can find the prospectus here.

Key parameters of the bond [/ caption]

Key parameters of the bond [/ caption]

Futures

On the page of any futures, you can view all its main parameters and contract documentation. One of the main conveniences – with the help of the Mosbirzh website, you can check the estimated price of a futures contract at the time of the last clearing. It is convenient to independently clarify why the amount of variation margin received or written off – brokers do not always provide this information or take time to check the situation. Since the calculated price is calculated according to a special formula of the Moscow Exchange, it may not coincide with the market value of the futures at the time of clearing.

Mutual funds and strategies

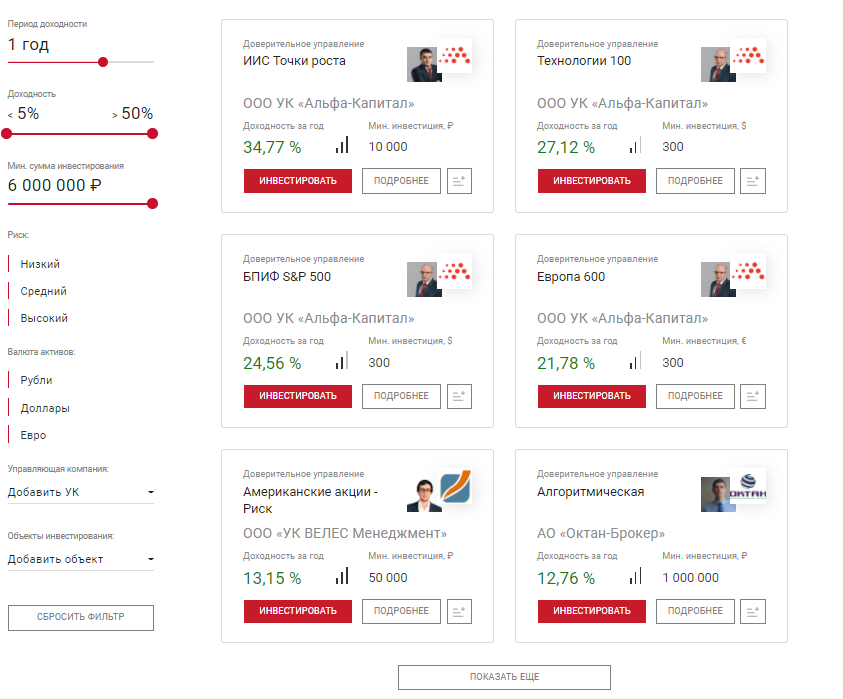

There is a subsection on the Mosbirzhi website that allows you to see all the mutual funds available on the site and the strategies of the Management Companies. For each name, the underlying asset, currency, format (BIF or ETF), and ticker are indicated. For some, an extended presentation of the fund is available. Information is located in the section “Markets” – “Stock Market” – “Instruments” – “Exchange Traded Funds”. A wide range of functions for selecting a trust management strategy is available on the Trust Management section of the website (https://du.moex.com/). On the product showcase, you can sort offers by profitability, investment amount, investment period, risk, currency and investment object.

Trust management strategies [/ caption] Thus, the Moscow Exchange is an organization thanks to which brokers, and through them investors, have access to stable trading and a variety of assets. Its feature is in a wide range of instruments: from conservative OFZs to risky options. The trading schedule allows the Russian investor to participate in the trading activity of Asians, Europeans and Americans. The site has a convenient and functional website, investor-oriented services. And, of course, the contests are interesting.

Trust management strategies [/ caption] Thus, the Moscow Exchange is an organization thanks to which brokers, and through them investors, have access to stable trading and a variety of assets. Its feature is in a wide range of instruments: from conservative OFZs to risky options. The trading schedule allows the Russian investor to participate in the trading activity of Asians, Europeans and Americans. The site has a convenient and functional website, investor-oriented services. And, of course, the contests are interesting.