Nyse – an overview of the exchange. The New York Stock Exchange (NYSE) is the largest stock exchange in the world. The market capitalization of listed companies is a whopping $24.5 trillion. More than nine million corporate stocks and securities are traded on the New York Stock Exchange every day. Some of the largest technology, healthcare and energy companies have partnered with the NYSE. In fact, 82% of the TNCs included in the core

S&P 500 index are traded on it. NYSE exchange – official website (www.nyse.com).

- Principle of operation

- The scale of development and the pandemic

- Listing Requirements

- What is the difference between NYSE and NASDAQ

- Trade

- NYSE Index

- How to start trading?

- Withdrawals

- Where NYSE shares are traded – information about quotes, indices, etc.

- #1 Stock Tracker

- #2 Trading View

- #3 FreeStockCharts

- How to register directly

- How and when it works

- Interesting Facts

Principle of operation

The NYSE is a virtual stock market system that buys and sells shares of public companies. The NYSE uses an auction based system. Under this system, brokers auction shares at the highest price. They can be obtained either on a physical trading platform or in an electronic system. “Sellers” accept bids on stocks from

brokers representing buyers, whether the purpose of the purchase is to add to a personal investment portfolio or to the reserve of a large financial firm that is strengthening its long-term position. Since stocks are traded “manually”, their prices are updated regularly during the trading day.

The scale of development and the pandemic

The NYSE was founded in 1792. Over the past two centuries, it has grown to such proportions that it has become a household name for the very idea of the stock market. The NYSE headquarters building is located on the corner of Broad and Wall Street in New York City, so the term “Wall Street” is often used to describe the financial system as a whole. Up until the onset of the Covid-19 pandemic, the NYSE conducted its business through electronic trading and directly through the trading floors at its offices located in New York. In March 2020, however, the company had to close trading platforms due to the lockdown and transfer all transactions to a virtual format.

Listing Requirements

For a company to be listed and traded on the NYSE, it must be public and meet strict financial and structural standards. It must have at least 400 shareholders and 1.1 million shares outstanding. The share price must be at least $4.00 and the market value of the public paper must be at least $40 million—or $100 million for transfers and certain other listings. In addition, the company must be profitable, earning at least $10 million over the past three years. A REIT requires a net worth of $60 million. Companies that wish to be listed on the NYSE submit their financial statements, company charter, and information about their executives for review. If the company is approved,

What is the difference between NYSE and NASDAQ

After the NYSE

, the Nasdaq is the second largest stock exchange in the US with a market capitalization of $19 trillion, about $5.5 trillion less than the NYSE. Nasdaq is a much younger exchange than the NYSE. It was founded in 1971. Aside from age and market cap, there are other key differences between the two exchanges:

- exchange systems . Prior to the pandemic, the NYSE supported both e-commerce and full-fledged marketplaces on Wall Street, staffed by experts to help run auctions. Nasdaq has been an electronic exchange since its inception.

- Market types . The NYSE uses the auction market to set prices, while the Nasdaq uses the dealer market. In the NYSE auction market, buyers and sellers simultaneously submit competitive bids. When the buyer’s offer and the seller’s offer match, the transaction is completed. In the Nasdaq dealer market model, all prices are set by dealers who update their bid (ask) and bid (ask) prices throughout the trading day.

- Listing fees . There is a big difference in the cost of listing on the major stock exchanges. Listing fees on the Nasdaq range from $55,000 to $80,000 for the lowest level of the capital market. The NYSE is significantly more expensive, with the lowest listing fee of $150,000.

- Sectors . Investors usually view the NYSE as a stock exchange for older, more established companies. The Nasdaq tends to feature new technology and innovation-driven companies, which is why some investors see Nasdaq listings as riskier.

Trade

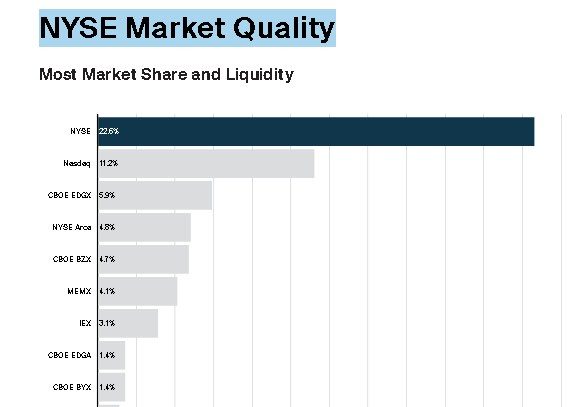

When a company is listed on the NYSE (primarily to raise capital), its shares become available for public trading. Traders who wish to invest in the stock market can buy and sell securities online through exchange platforms. Trading takes place on the trading floor through brokers and designated market makers. The NYSE appoints market makers for each stock to provide liquidity. The NYSE owns five regulated markets, including the New York Stock Exchange, Arca, MKT and Amex Options. Medium and large companies are represented on the NYSE, while smaller ones are on the NYSE MKT. Investors can trade several major asset classes: stocks, options, exchange-traded funds (NYSE Arca), and bonds (NYSE bonds).

Attention! The NYSE broker in most cases provides its users with educational materials for successful trading on the stock exchange. In technical and software aspects, trading on the New York Stock Exchange is very similar to the work of the Forex market. In any case, you can clarify all questions on trading in the support services of the selected company.

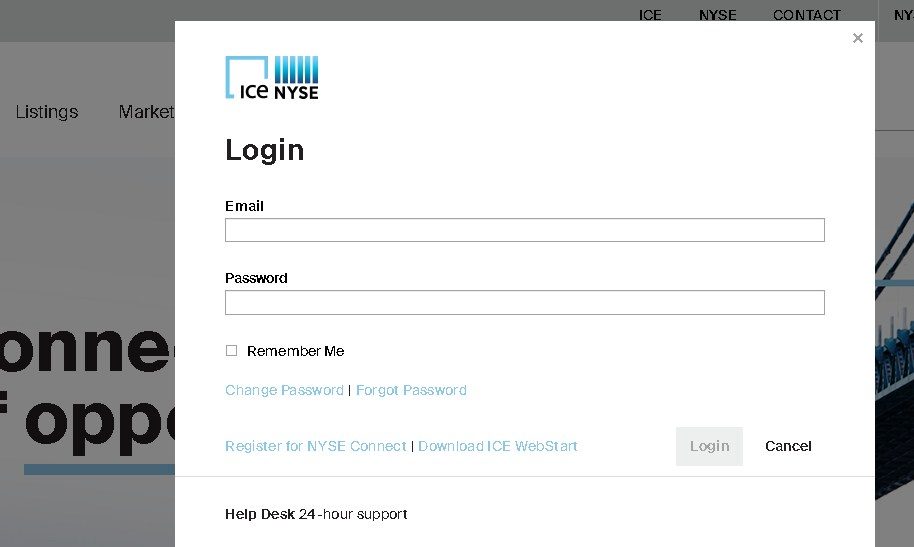

Login to your NYSE account at https://www.nyse.com/index#launch:

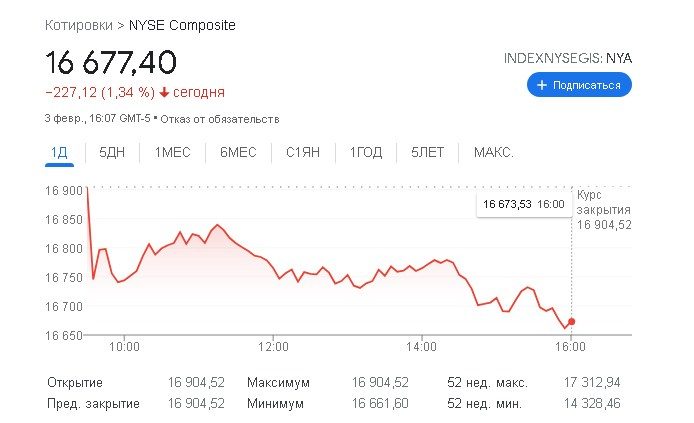

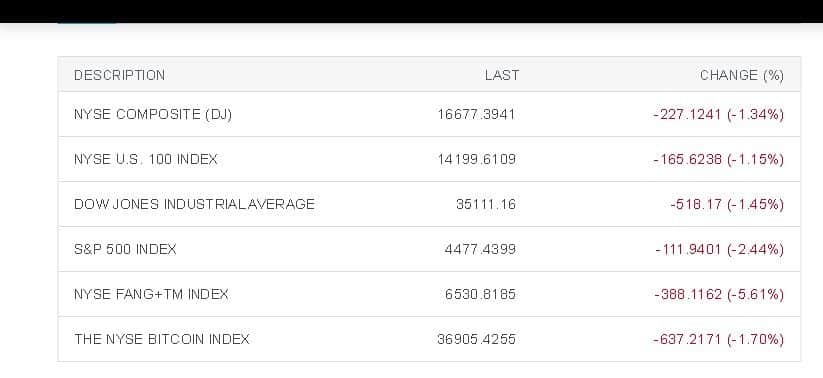

NYSE Index

There are several stock market indices on the New York Stock Exchange: Dow Jones Industrial Average, S&P 500, Nyse Arca, NYSE Composite, NYSE US 100, NASDAQ Composite and others.

- AT&T.

- black rock

- Bank of America.

- BP

- ExxonMobil

- FXCM

- HP Inc.

- HSBC Holdings.

- Goldman Sachs.

- JPMorgan Chase.

- Pfizer Inc.

- Royal Dutch Shell.

- Verizon Communications Inc.

- Twitter.

How to start trading?

In order to start trading on the NYSE platform, you must complete the following steps. Below is the algorithm for starting trading on the exchange:

- Choose a broker or trading platform.

When choosing a platform, make sure it provides market access and allows you to trade specific NYSE stocks. Different brokers also have different fee structures and it is important to find the one that is most cost effective. Specifically for a Russian user, Otkritie.Broker is ideal. The company has an official license obtained from the Central Bank of the Russian Federation to carry out economic activities.

- Open a stock trading account. To do this, follow the link https://open-broker.ru/invest/open-account/ and click on the “Open an account” button.

- Fill in the registration data – phone number, passport data, etc.

- After concluding an agreement with the company, the user gets access to a personal account via a unique link. It is necessary to replenish the balance by bank transfer in the “Credits and transfers” section or using a debit card (a commission of 1% is charged).

- Buy some NYSE shares. To do this, go to the “Trading terminals” section and activate the “Market quotes for American securities” service.

- All papers of interest are in the “Catalogue” section.

- To complete a transaction, you must click on the “Buy” button.

Ready! You bought the first NYSE security.

Withdrawals

Withdrawal of funds is available after filling out a special application in the “Personal Account”. The commission is 0.1%.

Where NYSE shares are traded – information about quotes, indices, etc.

Normal quotes and charts are shown to most Russian users with a 15 minute delay. Below is a list of sites where NYSE statistics are transmitted in real time without delay.

#1 Stock Tracker

https://www.stockstracker.com/ tracks and provides quotes for major US stocks. The interface is similar to exchange trading platforms. The site has a list of stocks on the left side of the screen, price information and news (open, high, low and close prices), and charts on the right side of the screen.

#2 Trading View

TradingView offers users sophisticated charting and quote building tools for hundreds of thousands of stocks worldwide. TradingView is more than just a real-time quote charting website. It is a complete social trading platform where users can share their own trading successes. The link https://ru.tradingview.com/ideas/nyse/ presents the main charts, indices and quotes of the NYSE exchange.

#3 FreeStockCharts

At FreeStockCharts, users can get a full package of services for beginner traders for free. As part of TC2000, FreeStockCharts offers great charting, NYSE stock and options quotes, dozens of the most popular indicators, option chains, and even a free demo account to practice. Unfortunately, real-time stock market quotes and updated channels are only available in the paid version. Free users still receive streaming data with a delay of 10-15 minutes.

How to register directly

At the moment, Russian users cannot do this, because registration is available only to brokers. Work with the exchange does not take place directly, but through market traders who receive special licenses from the company itself.

How and when it works

NYSE hours are Monday through Friday, 9:30 am to 4:00 pm ET. The New York Stock Exchange begins and ends each trading day with the ringing of the bell. The New York Stock Exchange is closed for trading on weekends and the following public holidays:

- New Year’s Day is December 22.

- Martin Luther King Jr Day is January 18th.

- President’s Day – 15 February.

- Good Friday – April 17th.

- Memorial Day is May 30th.

- Independence Day – July 4th.

- Labor Day is September 5th.

- Thanksgiving is November 24th.

- Christmas Day is December 25th.

After hours trading continues after the official close of trading on the New York Stock Exchange. After hours sessions were previously only available to institutional investors, but online brokerage firms have opened up these sessions to the average investor. This means that now ordinary users can make transactions even after the market closes. https://youtu.be/o-7VGqcf20Y

Interesting Facts

- Until 1995, exchange managers rang the bells. But the NYSE began inviting corporate executives to regularly ring the opening and closing bells, which later became a daily event.

- In July 2013, United Nations Secretary Ban Ki-moon rang the closing bell to mark the NYSE’s accession to the United Nations’ Sustainable Stock Exchanges Initiative.

- In the late 1800s, the New York Stock Exchange changed the gavel to the gong. The bell became the official signal for the exchange in 1903 when the NYSE moved to 18 Broad St. 7.