A shekara ta 1971, NASDAQ ta canza yadda ake sarrafa kasuwannin hada-hadar kudi ta hanyar gabatar da kasuwar hada-hadar hannayen jari ta farko a duniya. Bayan shekaru 50, ya zama ɗaya daga cikin manyan wuraren kasuwanci a duniya. A yau, NASDAQ tana wakiltar ƙira da haɓaka.

- Menene musayar NASDAQ – dandamali mai ƙwarewa a cikin hannun jari na manyan kamfanoni masu fasaha

- Jadawalin tarihin NASDAQ

- Tsarin musayar

- Menene NASDAQ Composite, index 100

- Abin da ke shafar ma’aunin NASDAQ

- Kamfanoni nawa ne aka haɗa a cikin fihirisar

- Yadda ake saka hannun jari a cikin fihirisa

- Kuna iya kasuwanci akan NASDAQ

- Ta yaya kuma yaushe ne musayar NASDAQ ke aiki?

Menene musayar NASDAQ – dandamali mai ƙwarewa a cikin hannun jari na manyan kamfanoni masu fasaha

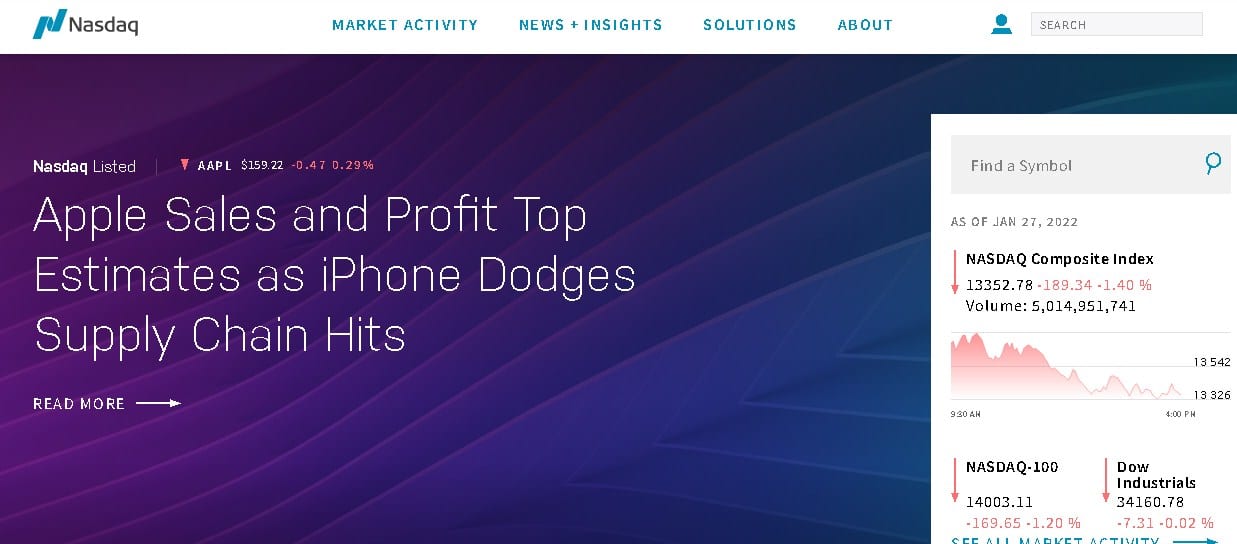

NASDAQ dandamali ne na kasuwanci na lantarki na duniya inda ake siye da siyarwa. Haɗi zuwa gidan yanar gizon NASDAQ na hukuma https://www.nasdaq.com/.

Sunan gajarta ce da ke tsaye ga Ƙungiyar Dillalan Tsaro ta Ƙasa mai sarrafa kansa.

Musanya ba shi da nasa filin ciniki, amma yana aiki azaman gidan yanar gizon inda masu zuba jari zasu iya yin ma’amala. Baya ga kasuwar hada-hadar hannayen jari, tun daga shekarar 2021, NASDAQ ita ma ta mallaki kuma tana gudanar da harkokin hada-hadar hannayen jari da dama a Turai, gami da musayar hannayen jari a Copenhagen, Helsinki, Reykjavik, Stockholm, Riga, Vilnius da Tallinn. [taken magana id = “abin da aka makala_12879” align = “aligncenter” nisa = “1237”]

Jadawalin tarihin NASDAQ

Dandalin ciniki na NASDAQ na kwamfuta an samo asali ne a matsayin madadin tsarin “kwararre” mara inganci wanda ya yi nasara kusan karni guda. Haɓaka haɓakar fasaha cikin sauri ya sanya sabon samfurin e-commerce ya zama ma’auni na kasuwanni a duniya. Kasancewar ta kasance jagora a fasahar ciniki tun farkon ta, manyan kamfanonin fasaha na duniya sun zaɓi jera hannun jarinsu akan NASDAQ a farkon farkon sa. Yayin da fannin fasaha ke samun karbuwa a shekarun 1980 zuwa 1990, musayar ya zama dandalin da ya fi shahara a fannin. Rikicin Dot-com a ƙarshen 1990s wanda aka kwatanta ta sama da ƙasa na Nasdaq Composite, fihirisa ba za a ruɗe da dandalin ciniki na Nasdaq ba. Bisa ga Cibiyar Harkokin Kasuwancin Amirka, ta fara ketare alamar 1,000 a Yuli 1995.

Tsarin musayar

Kasuwar Nasdaq ta ƙasa tana ɗaya daga cikin matakan 2 waɗanda ke yin musayar. Kowanne daga cikin waɗannan ya haɗa da kamfanoni waɗanda suka cika wasu jeri da buƙatun tsari. Nasdaq-NM ya ƙunshi kadarorin ruwa na kusan 3,000 tsakiyar hula da kuma manyan rijiyoyin rijiyoyin. An kira matakin na biyu kasuwar Nasdaq SmallCap. Kamar yadda sunan ya nuna, ya ƙunshi ƙananan kamfanoni ko kamfanoni masu yuwuwar haɓaka. A ranar 23 ga Yuni, 2006, musayar ya sanar da cewa ya raba Nasdaq-NM zuwa matakai 2 daban-daban, ya haifar da 3 sababbi. An yi wannan sauyi ne domin a sa musanyar ta yi daidai da kimarta a duniya. Kowane matakin yana da sabon suna:

- Nasdaq Capital Market, wanda aka fi sani da Nasdaq SmallCap Market don ƙananan kamfanoni.

- Kasuwar Duniya ta Nasdaq, wacce a da ta kasance wani ɓangare na Kasuwar Nasdaq ta ƙasa don kusan hannun jari 1,450 na tsaka-tsaki.

- Kasuwancin Zaɓin Duniya na Nasdaq shine sabon matakin wanda ya kasance wani ɓangare na Kasuwar Nasdaq ta ƙasa kuma ya haɗa da kusan manyan kamfanoni 1,200.

NASDAQ Global Select Market Composite (NQGS): An fara

- mahimman kadarori na zahiri ko kuma samun kudin shiga na aiki

- mafi ƙarancin rarraba hannun jari 1,100,000

- akalla masu hannun jari 400

- farashin tayin akalla $4.

Menene NASDAQ Composite, index 100

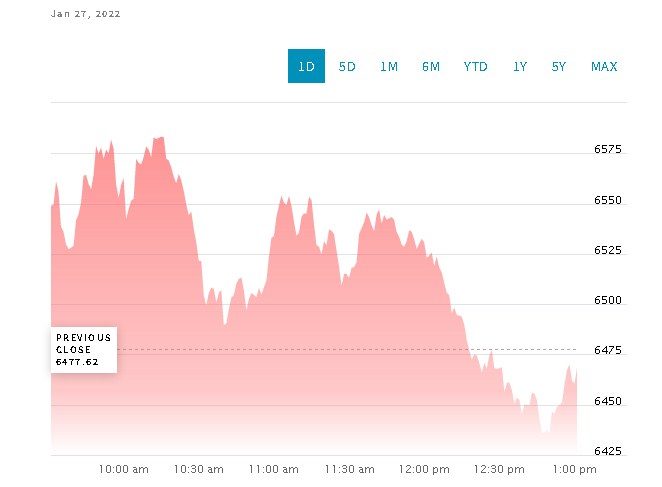

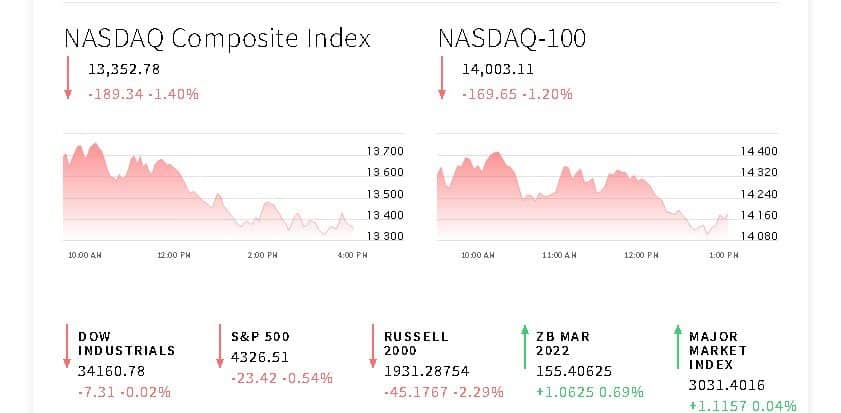

Hakanan ana amfani da kalmar “NASDAQ” don komawa zuwa Nasdaq Composite Index, wanda ya ƙunshi fiye da hannun jari 3,000 na manyan kamfanonin fasaha da fasahar kere kere. Lokacin ƙididdige ƙimar mai nuna alama, ana amfani da hanyar yin nauyi ta hanyar babban kasuwa. Don yin wannan, nemo ƙimar kadarorin kowane kamfani ta hanyar ninka lamba da ƙimar ƙimar tsaro na yanzu a wurare dabam dabam. Abubuwan ƙididdiga tare da manyan iyakoki na kasuwa suna ɗaukar ƙarin nauyi kuma suna da tasiri mai ƙarfi akan ƙimar Nasdaq Composite Index. Bayanan da aka sabunta akan Nasdaq Composite, Nasdaq 100 fihirisa https://www.nasdaq.com/market-activity:

Abin da ke shafar ma’aunin NASDAQ

Kamar yawancin manyan fihirisar hannun jari, Nasdaq Composite yana da nauyi ta hanyar babban kasuwa na abubuwan da ke cikin sa. Wannan yana nufin cewa lokacin da hannun jari na manyan kamfanoni suka canza, yana da tasiri mafi girma akan ayyukan ƙididdiga fiye da lokacin da hannun jari na ƙananan kamfanoni ke canzawa.

Kamfanoni nawa ne aka haɗa a cikin fihirisar

Tun daga ranar 31 ga Disamba, 2021, fihirisar ta ƙunshi bayanan hannun jari 3,417. A lokaci guda, 46.94% na fayil an kafa shi ta hannun hannun jari na masu bayarwa 10 masu zuwa:

- APPLE I.N.C.;

- MICROSOFT CORP;

- COM I.N.C.;

- TESLA I.N.C.;

- ALPHABET INC CL C;

- ALPHABET INC CL A;

- META PLATFORMS INC CL A;

- Kamfanin NVIDIA;

- BROADCOM INC.

- Adobe Inc.

Nasdaq Composite ya haɗa da kamfanonin da aka dade da aka jera a kan musayar tun lokacin da aka fara, IPO sabon shiga, kamfanonin da suka girma daga musayar OTC ko kuma sun tashi daga wasu musayar. Fihirisar ta ƙunshi bayanan sirri waɗanda aka yi rajista a Amurka kuma aka jera su kawai akan musayar hannun jari NASDAQ. Ana haɗa nau’ikan kadarori masu zuwa a cikin lissafin:

- talakawa hannun jari na kamfanoni;

- Rasitun Depository na Amurka (ADRs);

- hannun jari na asusun saka hannun jari na gida (REIT);

- hannun jari na iyakacin haɗin gwiwa;

- hannun jari na riba mai amfani (SBI);

- manufa (bibiya) hannun jari.

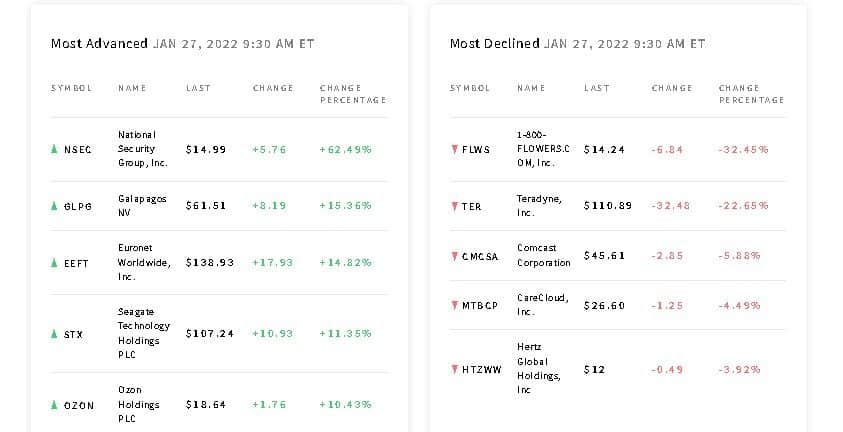

Ayyukan Hannun Kasuwa na Kasuwa: [taken magana id = “abin da aka makala_12878” align = “aligncenter” nisa = “843”]

- fasahar sadarwa (44.55%);

- bangaren mabukaci (16.52%);

- sabis na gida (15.44%);

- kiwon lafiya (8.59%);

- kudi (4.52%);

- masana’antu (4.04%);

- kayan masarufi (3.64%);

- dukiya (1.01%);

- kayan aiki (0.68%);

- makamashi (0.44%).

Saboda Nasdaq yana da tarin kamfanoni masu yawa a fannin fasaha, musamman matasa da masu tasowa cikin sauri, ana ɗaukar Nasdaq Composite Index a matsayin ma’auni mai kyau na yadda kasuwar fasaha ke tafiya.

Rukunin Nasdaq bai iyakance ga kamfanoni masu hedkwatar Amurka ba, wanda ya sa ya bambanta da sauran fihirisa. Lissafin ya haɗa da kadarorin kamfanoni a kasuwanni masu zuwa:

- Amurka (96.67%);

- kasashe masu tasowa (1.25%);

- Turai (1.14%);

- Asiya Pasifik da Japan (0.59%);

- Kanada (0.34%);

- wasu (0.02%).

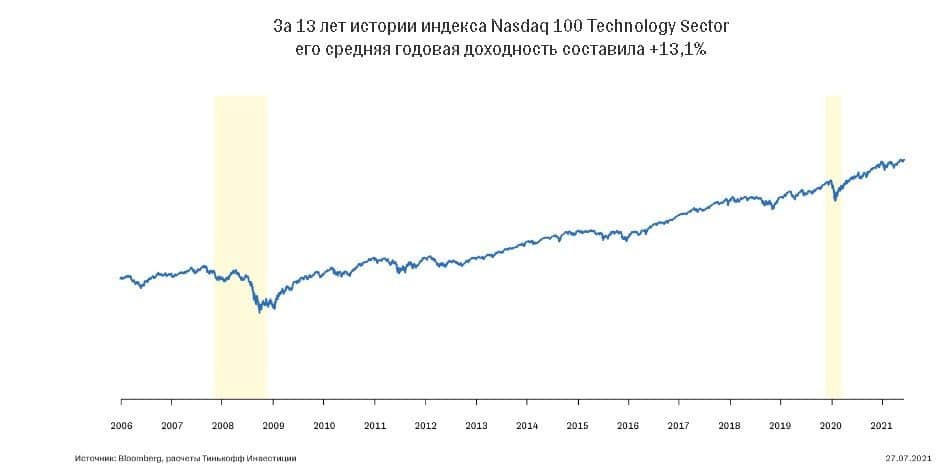

Yadda ake saka hannun jari a cikin fihirisa

Hanya mafi sauƙi don saka hannun jari a cikin Nasdaq Composite Index ita ce siyan kaso na asusun ƙididdiga. Ta hanyar kwatanta sakamakon kasuwannin kuɗi, ETFs suna haɓaka zuba jari sosai a cikin dogon lokaci. A lokaci guda kuma, mai saka hannun jari baya buƙatar zama ƙwararre a cikin kasuwar hannun jari kuma ya tsara dabarunsa. Shiga cikin ETFs yana da fa’idodi da yawa:

- Yana ba ku damar rage lokacin da aka kashe akan nazarin hannun jari ɗaya . Madadin haka, zaku iya dogaro da gaba gaɗi kan shawarar mai sarrafa fayil ɗin asusun.

- Yana rage haɗarin kuɗi . Ƙididdigar Haɗaɗɗen Nasdaq ta ƙunshi fiye da hannun jari 3,500, wanda ke sa ya zama ƙasa da yuwuwar asara babba idan kamfanoni da yawa sun rasa riba mai yawa.

- Ƙananan farashin kuɗi . Zuba jari a cikin ETFs ya fi arha fiye da saka hannun jari a cikin kuɗaɗen da ake sarrafawa. Wannan shi ne saboda gaskiyar cewa manajan yana aiki bisa ga dabarar da aka sani a baya.

- Ƙananan haraji . Kuɗaɗen fihirisa suna da ingantaccen haraji idan aka kwatanta da sauran jarin da yawa.

- Simple zuba jari shirin . Bisa ga makirci ɗaya, za ku iya ci gaba da saka hannun jari a kowane wata, yin watsi da gajeren lokaci sama da ƙasa.

[taken magana id = “abin da aka makala_12884” align = “aligncenter” nisa = “942”]

- daidaiton bin diddigin alamomi;

- farashin masu saka jari;

- ƙuntatawa na yanzu.

Don siyan hannun jari na asusun fihirisar da aka zaɓa, dole ne ka buɗe asusu tare da

ETF ko tare da dillali mai lasisi. Lokacin yanke shawarar hanyar da za a zaɓa, yana da daraja kula da farashi. Wasu dillalai suna cajin abokan cinikinsu ƙarin kuɗi don siyan hannun jari na asusun ƙididdiga, wanda ya sa ya zama mai rahusa buɗe asusun ETF. Koyaya, yawancin masu saka hannun jari sun gwammace su ajiye ajiyar kuɗi a cikin asusu ɗaya. Wannan ya dace idan mai ciniki yana shirin saka hannun jari a cikin ETFs daban-daban.

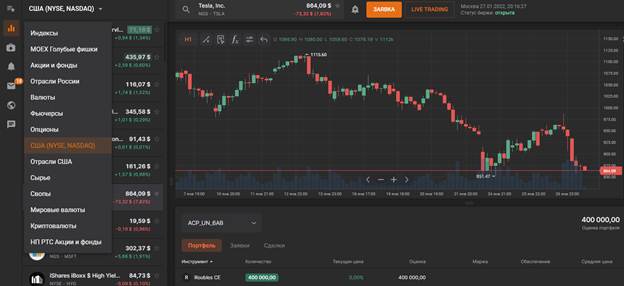

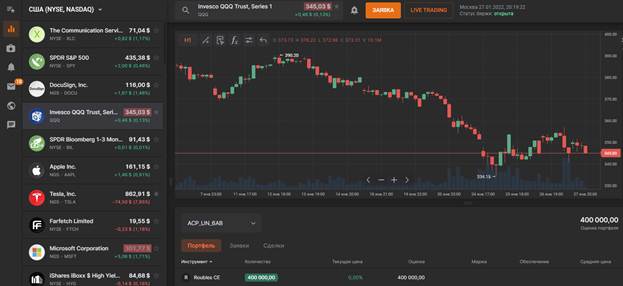

Kuna iya kasuwanci akan NASDAQ

Mai saka hannun jari na Rasha zai iya cinikin kadarorin hannun jarin Amurka kai tsaye akan dandalin lantarki na NASDAQ, wanda manyan dillalai masu lasisi ke samun damar kai tsaye. Alal misali, irin wannan damar yana samuwa ta hanyar Finam, Sberbank, VTB, da dai sauransu.

Duk da haka, a wannan yanayin, wajibi ne a sami matsayi na mai saka hannun jari, don tabbatar da abin da dole ne ku sami kwarewar kasuwanci da babban birnin farawa na akalla 6 miliyan rubles.

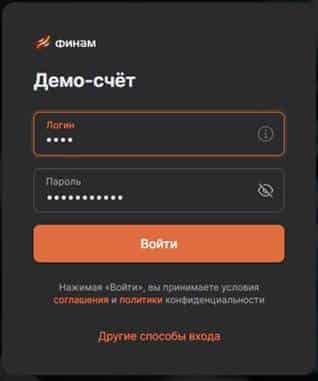

Ƙananan yan kasuwa sun fi son shiga St. Petersburg Stock Exchange, saboda sau da yawa yana da rahusa. A wannan yanayin, ana iya siyan kadara ta hanyar

asusun saka hannun jari na mutum ɗaya (IIA) tare da cire haraji. Don buɗe asusun, dole ne ku yi rajista a gidan yanar gizon dillali. Misali, a Finam, ya isa ya bi hanyar haɗin yanar gizon https://trading.finam.ru/ kuma shigar da bayanan da suka dace a cikin fom. Kuna iya buɗe

asusun demo a cikin ‘yan mintuna kaɗan, kuma don samun ainihin IIS, dole ne ku shirya ƙaramin fakitin takardu kuma ku kammala yarjejeniya tare da ƙungiyar. Bayan karɓar shiga da kalmar wucewa, za ku iya shigar da

tashar ciniki .

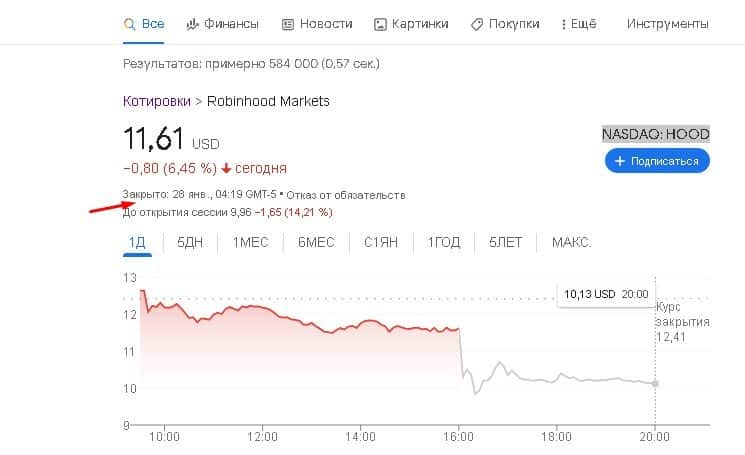

Ta yaya kuma yaushe ne musayar NASDAQ ke aiki?

Zaman ciniki na NASDAQ na yau da kullun yana farawa da karfe 9:30 na safe kuma yana ƙarewa da ƙarfe 4:00 na yamma agogon Gabas mai kaifi. Bayan ya ƙare, ana iya yin gwanjon har zuwa 20:00.