In 1971, the NASDAQ transformed the mismanagement of financial markets by introducing the world’s first electronic stock exchange. After 50 years, it has become one of the largest trading floors in the world. Today, the NASDAQ symbolizes innovation and growth.

- What is the NASDAQ exchange – a platform specializing in shares of high-tech companies

- History of the NASDAQ

- The mechanism of the exchange

- What are the NASDAQ Composite, index 100

- What affects the NASDAQ index

- How many companies are included in the index

- How to invest in an index

- Can you trade on the NASDAQ

- How and when does the NASDAQ exchange work?

What is the NASDAQ exchange – a platform specializing in shares of high-tech companies

The NASDAQ is a global electronic trading platform where securities are bought and sold. Link to the official NASDAQ website https://www.nasdaq.com/.

The name is an acronym that stands for National Association of Securities Dealers Automated Quotation.

The exchange does not have its own trading floor, but functions as a website where investors can make transactions. In addition to the stock market, as of 2021, NASDAQ also owns and operates several stock exchanges in Europe, including exchanges in Copenhagen, Helsinki, Reykjavik, Stockholm, Riga, Vilnius and Tallinn.

History of the NASDAQ

The NASDAQ computerized trading platform was originally developed as an alternative to the inefficient “specialist” system that had prevailed for nearly a century. The rapid development of technology has made the new e-commerce model the standard for markets around the world. Having been a leader in trading technology since its inception, the world’s tech giants chose to list their shares on the NASDAQ in its early days. As the technology sector grew in popularity in the 1980s and 1990s, the exchange became the sector’s most popular platform for holdings. Dot-com crisis in the late 1990s illustrated by the ups and downs of the Nasdaq Composite, an index not to be confused with the Nasdaq trading platform. According to the American Institute of Corporate Finance, it first crossed the 1,000 point mark in July 1995,

The mechanism of the exchange

The Nasdaq National Market was one of the 2 levels that make up the exchange. Each of these included companies that met certain listing and regulatory requirements. The Nasdaq-NM consisted of the liquid assets of approximately 3,000 mid-cap and large-cap holdings. The second level was called the Nasdaq SmallCap market. As the name suggests, it consisted of small cap companies or companies with growth potential. On June 23, 2006, the exchange announced that it had split the Nasdaq-NM into 2 different tiers, creating 3 new ones. The change was made to bring the exchange in line with its international reputation. Each level has a new name:

- Nasdaq Capital Market, formerly known as Nasdaq SmallCap Market for small cap companies.

- The Nasdaq Global Market, which was formerly part of the Nasdaq National Market for approximately 1,450 mid-cap stocks.

- The Nasdaq Global Select Market is the newest tier that was part of the Nasdaq National Market and includes approximately 1,200 large cap companies.

NASDAQ Global Select Market Composite (NQGS):

- significant net tangible assets or operating income

- minimum public circulation 1,100,000 shares

- at least 400 shareholders

- offer price of at least $4.

What are the NASDAQ Composite, index 100

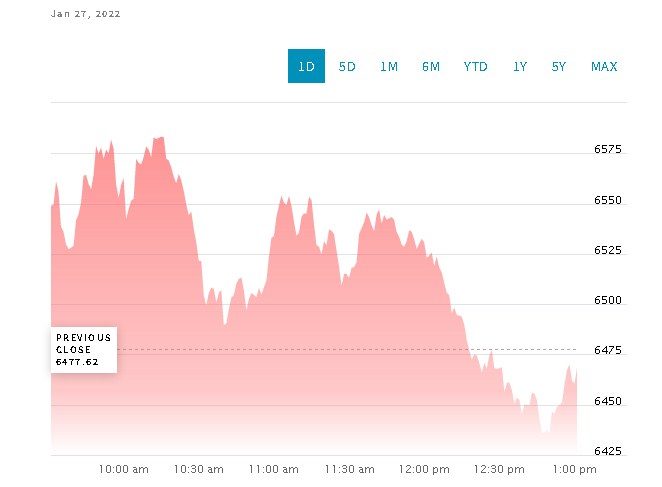

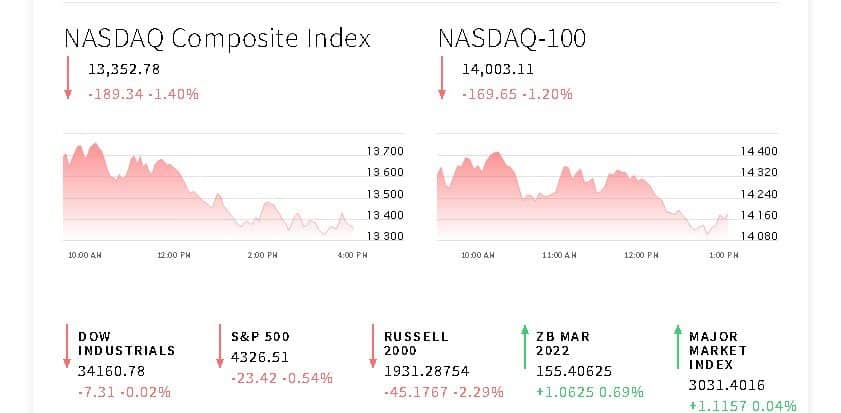

The term “NASDAQ” is also used to refer to the Nasdaq Composite Index, which includes more than 3,000 stocks of major technology and biotech companies. When calculating the values of the indicator, the method of weighting by market capitalization is used. To do this, find the value of the assets of each company by multiplying the number and the current value of securities in circulation. Index components with large market caps carry more weight and have a stronger effect on the value of the Nasdaq Composite Index. Up-to-date data on the Nasdaq Composite, Nasdaq 100 indices https://www.nasdaq.com/market-activity:

What affects the NASDAQ index

Like most major stock indexes, the Nasdaq Composite is weighted by the market capitalization of its underlying components. This means that when the stocks of large companies change, it has a greater impact on the performance of the index than when the shares of smaller companies change.

How many companies are included in the index

As of December 31, 2021, the index includes securities of 3,417 holdings. At the same time, 46.94% of the portfolio is formed by shares of the following 10 issuers:

- APPLE I.N.C.;

- MICROSOFT CORP;

- COM I.N.C.;

- TESLA I.N.C.;

- ALPHABET INC CL C;

- ALPHABET INC CL A;

- META PLATFORMS INC CL A;

- NVIDIA Corp.;

- BROADCOM INC;

- Adobe Inc.

The Nasdaq Composite includes companies that have long been listed on the exchange since its inception, IPO newcomers, companies that grew out of OTC exchanges or moved from other exchanges. The index includes securities that are registered in the United States and listed only on the NASDAQ stock exchange. The following types of assets are included in the calculations:

- ordinary shares of companies;

- American Depository Receipts (ADRs);

- shares of real estate investment funds (REIT);

- shares of limited liability partnerships;

- shares of beneficial interest (SBI);

- target (tracking) shares.

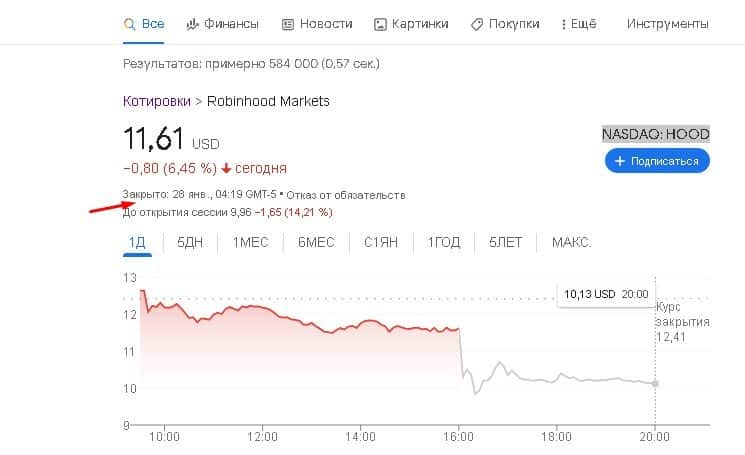

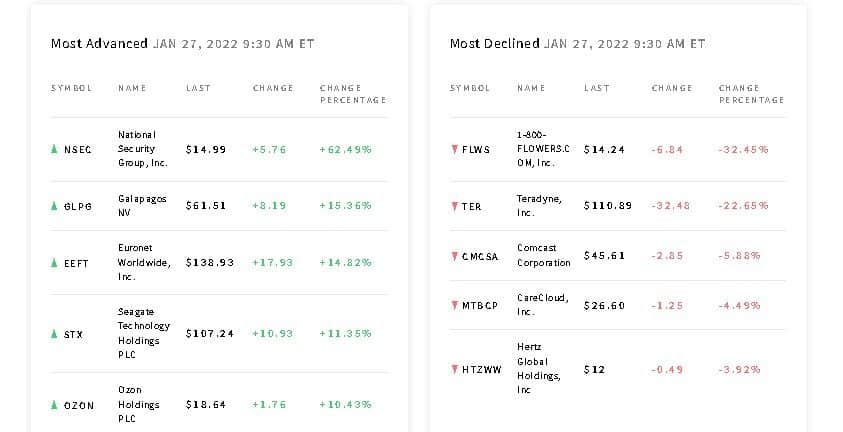

Pre-Market Stock Activity:

- information technology (44.55%);

- consumer discretionary sector (16.52%);

- household services (15.44%);

- healthcare (8.59%);

- finance (4.52%);

- industry (4.04%);

- consumer goods (3.64%);

- real estate (1.01%);

- utilities (0.68%);

- energy (0.44%).

Because the Nasdaq has a high concentration of companies in the tech sector, especially young and fast-growing ones, the Nasdaq Composite Index is often considered a good barometer of how well the tech market is doing.

The Nasdaq Composite is not limited to US-headquartered companies, which makes it different from many other indexes. The calculation includes the assets of companies in the following markets:

- USA (96.67%);

- developing countries (1.25%);

- Europe (1.14%);

- Asia Pacific and Japan (0.59%);

- Canada (0.34%);

- others (0.02%).

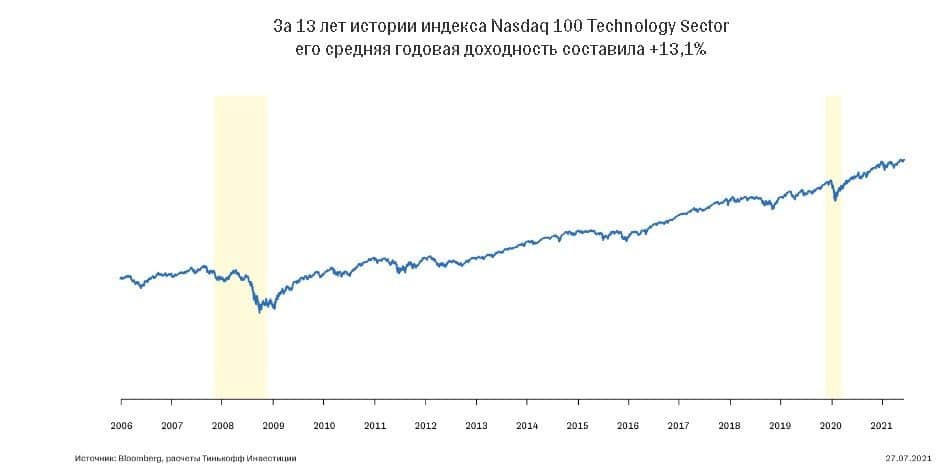

How to invest in an index

The easiest way to invest in the Nasdaq Composite Index is to buy a share of an index fund. By comparing the results of financial markets, ETFs effectively multiply investments in the long run. At the same time, the investor does not need to become an expert in the stock market and design his own strategies. Participating in ETFs has several benefits:

- Allows you to minimize the time spent on studying individual stocks . Instead, you can confidently rely on the decisions of the fund’s portfolio manager.

- Reduces financial risks . The Nasdaq Composite Index includes more than 3,500 stocks, making it less likely to lose big if multiple companies lose significant profits.

- Lower financial costs . Investing in ETFs is much cheaper than investing in actively managed funds. This is due to the fact that the manager acts according to a previously known effective strategy.

- Lower taxes . Index funds are quite tax efficient compared to many other investments.

- Simple investment plan . According to a single scheme, you can continue to invest monthly, ignoring short-term ups and downs.

- the accuracy of tracking index indicators;

- investor costs;

- existing restrictions.

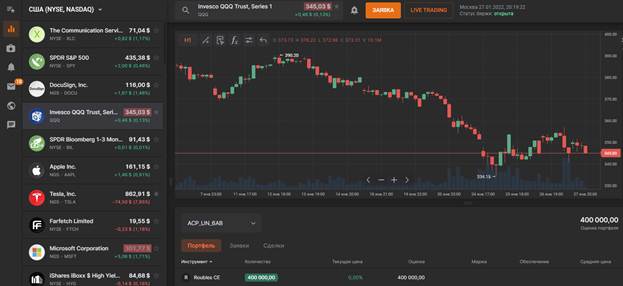

To buy shares of the selected index fund, you must open an account with an

ETF or with a licensed broker. When deciding which method to choose, it is worth paying attention to costs. Some brokers charge their clients extra fees for buying shares of an index fund, which makes it cheaper to open an ETF account. However, many investors prefer to keep their deposits in one account. This is convenient if a trader plans to invest in different ETFs.

Can you trade on the NASDAQ

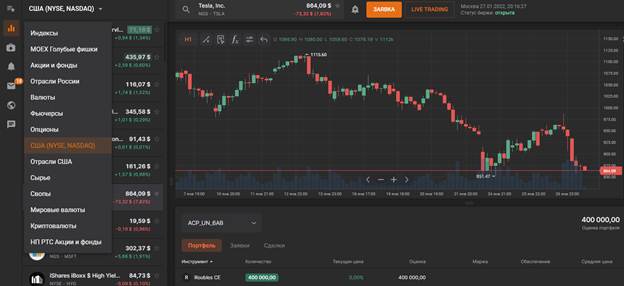

A Russian investor can trade assets of American holdings directly on the NASDAQ electronic platform, which is directly accessible by large licensed brokers. For example, such an opportunity is provided by Finam, Sberbank, VTB, etc.

However, in this case, it is necessary to obtain the status of a qualified investor, to confirm which you must have trading experience and a starting capital of at least 6 million rubles.

Small traders prefer to enter the St. Petersburg Stock Exchange, as it is often cheaper. In this case, assets can be purchased through

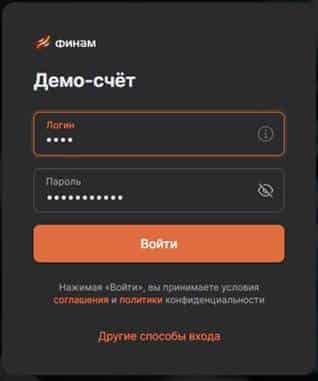

an individual investment account (IIA) with tax deductions. To open an account, you must register on the broker’s website. For example, at Finam, it is enough to follow the link https://trading.finam.ru/ and enter the necessary data in the form. You can open

a demo account in a few minutes, and to get a real IIS, you will have to prepare a small package of documents and conclude an agreement with the organization. After receiving the login and password, you can enter the

trading terminal .

How and when does the NASDAQ exchange work?

The NASDAQ regular trading session starts at 9:30 AM and ends at 4:00 PM Eastern Time sharp. After it ends, auctions can be held until 20:00.